Transcription

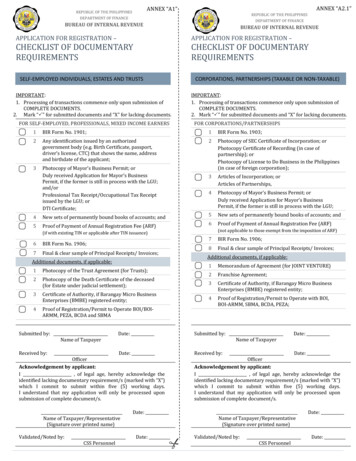

ANNEX “A2.1”ANNEX “A1”REPUBLIC OF THE PHILIPPINESDEPARTMENT OF FINANCEREPUBLIC OF THE PHILIPPINESDEPARTMENT OF FINANCEBUREAU OF INTERNAL REVENUEAPPLICATION FOR REGISTRATION –BUREAU OF INTERNAL REVENUEAPPLICATION FOR REGISTRATION –CHECKLIST OF DOCUMENTARYREQUIREMENTSCHECKLIST OF DOCUMENTARYREQUIREMENTSSELF-EMPLOYED INDIVIDUALS, ESTATES AND TRUSTSIMPORTANT:1. Processing of transactions commence only upon submission ofCOMPLETE DOCUMENTS.2. Mark “ ” for submitted documents and “X” for lacking documents.FOR SELF-EMPLOYED, PROFESSIONALS, MIXED INCOME EARNERSCORPORATIONS, PARTNERSHIPS (TAXABLE OR NON-TAXABLE)IMPORTANT:1. Processing of transactions commence only upon submission ofCOMPLETE DOCUMENTS.2. Mark “ ” for submitted documents and “X” for lacking documents.FOR CORPORATIONS/PARTNERSHIPS1BIR Form No. 1901;1BIR Form No. 1903;2Any identification issued by an authorizedgovernment body (e.g. Birth Certificate, passport,driver’s license, CTC) that shows the name, addressand birthdate of the applicant;23Photocopy of Mayor’s Business Permit; orDuly received Application for Mayor’s BusinessPermit, if the former is still in process with the LGU;and/orProfessional Tax Receipt/Occupational Tax Receiptissued by the LGU; orDTI Certificate;Photocopy of SEC Certificate of Incorporation; orPhotocopy Certificate of Recording (in case ofpartnership); orPhotocopy of License to Do Business in the Philippines(in case of foreign corporation);3Articles of Incorporation; orArticles of Partnerships,4Photocopy of Mayor’s Business Permit; orDuly received Application for Mayor’s BusinessPermit, if the former is still in process with the LGU;New sets of permanently bound books of accounts; and5New sets of permanently bound books of accounts; andProof of Payment of Annual Registration Fee (ARF)6Proof of Payment of Annual Registration Fee (ARF)45(not applicable to those exempt from the imposition of ARF)(if with existing TIN or applicable after TIN issuance)6BIR Form No. 1906;7Final & clear sample of Principal Receipts/ Invoices;Additional documents, if applicable:1Photocopy of the Trust Agreement (for Trusts);2Photocopy of the Death Certificate of the deceased(for Estate under judicial settlement);3Certificate of Authority, if Barangay Micro BusinessEnterprises (BMBE) registered entity;4Proof of Registration/Permit to Operate BOI/BOIARMM, PEZA, BCDA and SBMASubmitted by:Name of TaxpayerDate:Received by:Date:OfficerAcknowledgement by applicant:I , of legal age, hereby acknowledge theidentified lacking documentary requirement/s (marked with “X”)which I commit to submit within five (5) working days.I understand that my application will only be processed uponsubmission of complete document/s.Name of Taxpayer/Representative(Signature over printed name)Validated/Noted by:CSS PersonnelDate:Date:7BIR Form No. 1906;8Final & clear sample of Principal Receipts/ Invoices;Additional documents, if applicable:1Memorandum of Agreement (for JOINT VENTURE)2Franchise Agreement;3Certificate of Authority, if Barangay Micro BusinessEnterprises (BMBE) registered entity;4Proof of Registration/Permit to Operate with BOI,BOI-ARMM, SBMA, BCDA, PEZA;Submitted by:Name of TaxpayerDate:Received by:Date:OfficerAcknowledgement by applicant:I , of legal age, hereby acknowledge theidentified lacking documentary requirement/s (marked with “X”)which I commit to submit within five (5) working days.I understand that my application will only be processed uponsubmission of complete document/s.Name of Taxpayer/Representative(Signature over printed name)Validated/Noted by:CSS PersonnelDate:Date:

ANNEX “A2.2”REPUBLIC OF THE PHILIPPINESDEPARTMENT OF FINANCEBUREAU OF INTERNAL REVENUEAPPLICATION FOR REGISTRATION –ANNEX “A3”REPUBLIC OF THE PHILIPPINESDEPARTMENT OF FINANCEBUREAU OF INTERNAL REVENUEAPPLICATION FOR REGISTRATION –CHECKLIST OF DOCUMENTARYREQUIREMENTSCHECKLIST OF DOCUMENTARYREQUIREMENTSCOOPERATIVES, ASSOCIATIONS (TAXABLE OR NON-TAXABLE)IMPORTANT:1. Processing of transactions commence only upon submission ofCOMPLETE DOCUMENTS.2. Mark “ ” for submitted documents and “X” for lacking documents.FOR GAIs AND LGUsREGISTRATION OF BRANCH AND FACILITY TYPESIMPORTANT:1. Processing of transactions commence only upon submission ofCOMPLETE DOCUMENTS.2. Mark “ ” for submitted documents and “X” for lacking documents.REGISTRATION OF BRANCH/FACILITY TYPE - INDIVIDUAL1BIR Form No. 1903;1BIR Form No. 1901;2Photocopy of Unit or Agency’s Charter;2Photocopy of Mayor’s Business Permit; orDuly received Application for Mayor’s BusinessPermit, if the former is still in process with the LGU;and/orProfessional Tax Receipt/Occupational Tax Receiptissued by the LGU; or DTI Certificate;3New sets of permanently bound books of accounts; andProof of Payment of Annual Registration Fee (ARF)FOR COOPERATIVES1BIR Form No. 1903;2Photocopy of Cooperative Development Authority(CDA) Certificate of Registration; and3Articles of CooperationFOR HOME OWNER’S ASSOCIATION1BIR Form No. 1903;42Photocopy of Certificate of Registration issued byHousing and Land Use Regulatory Board (HLURB); and5BIR Form No. 1906;3Articles of Association6Final & clear sample of Principal Receipts/ Invoices;FOR LABOR ORGANIZATION, ASSOC. OR GROUP OF UNION OR WORKERSREGISTRATION OF BRANCH/FACILITY TYPE – NON-INDIVIDUAL1BIR Form No. 1903;1BIR Form No. 1903;2Photocopy of Certificate of Registration issued by theDepartment of Labor and Employment (DOLE); and23Constitution and by-laws of the applicant unionPhotocopy of Mayor’s Business Permit; orDuly received Application for Mayor’s Business Permit,if the former is still in process with the LGU; and/orBoard Resolution/Secretary Certificate stating theBranch Establishment;3New sets of permanently bound books of accounts; and4Proof of Payment of Annual Registration Fee (ARF)FOR FOREIGN EMBASSIES1BIR Form No. 1903;2Endorsement from Department of Foreign Affairs (DFA)FOR INTERNATIONAL ORGANIZATIONS(not applicable to those exempt from the imposition of ARF)1BIR Form No. 1903;2Host agreement or any international agreement dulycertified by DFASubmitted by:Name of TaxpayerDate:Received by:Date:OfficerAcknowledgement by applicant:I , of legal age, hereby acknowledge theidentified lacking documentary requirement/s (marked with “X”)which I commit to submit within five (5) working days.I understand that my application will only be processed uponsubmission of complete document/s.Name of Taxpayer/Representative(Signature over printed name)Validated/Noted by:CSS PersonnelDate:Date:5BIR Form No. 1906;6Final & clear sample of Principal Receipts/ Invoices;Submitted by:Name of TaxpayerDate:Received by:Date:OfficerAcknowledgement by applicant:I , of legal age, hereby acknowledge theidentified lacking documentary requirement/s (marked with “X”)which I commit to submit within five (5) working days.I understand that my application will only be processed uponsubmission of complete document/s.Name of Taxpayer/Representative(Signature over printed name)Validated/Noted by:CSS PersonnelDate:Date:

ANNEX “A4”REPUBLIC OF THE PHILIPPINESDEPARTMENT OF FINANCEBUREAU OF INTERNAL REVENUEAPPLICATION FOR REGISTRATION –ANNEX “A5.1”REPUBLIC OF THE PHILIPPINESDEPARTMENT OF FINANCEBUREAU OF INTERNAL REVENUEAPPLICATION FOR REGISTRATION –CHECKLIST OF DOCUMENTARYREQUIREMENTSCHECKLIST OF DOCUMENTARYREQUIREMENTSEMPLOYEESPURELY TIN ISSUANCE (NON-BUSINESS)IMPORTANT:1. Processing of transactions commence only upon submission ofCOMPLETE DOCUMENTS.2. Mark “ ” for submitted documents and “X” for lacking documents.FOR LOCAL EMPLOYEEIMPORTANT:1. Processing of transactions commence only upon submission ofCOMPLETE DOCUMENTS.2. Mark “ ” for submitted documents and “X” for lacking documents.FOR E.O. 98 - INDIVIDUAL1BIR Form No. 1902;1BIR Form No. 1904;2Any identification issued by an authorizedgovernment body (e.g. Birth Certificate,passport, driver’s license, CTC) that showsthe name, address and birthdate of theapplicant;2Any identification issued by an authorizedgovernment body (e.g. Birth Certificate,passport, driver’s license, CTC) that showsthe name, address and birthdate of theapplicant; or3Marriage contract, if applicable;3Passport (in case of Non-Resident Alien not Engagedin Trade or Business)FOR ALIEN EMPLOYEE1BIR Form No. 1902;2Passport; and3Working PermitSubmitted by:Name of TaxpayerFOR E.O. 98 – NON-INDIVIDUALDate:Received by:Date:OfficerAcknowledgement by applicant:I , of legal age, hereby acknowledge theidentified lacking documentary requirement/s (marked with “X”)which I commit to submit within five (5) working days.I understand that my application will only be processed uponsubmission of complete document/s.Name of Taxpayer/Representative(Signature over printed name)Validated/Noted by:CSS PersonnelDate:Date:1BIR Form No. 1904;2Any official documentation issued by an authorizedgovernment body (e.g. government agency (taxauthority) thereof, or a municipality) that includes thename of the non-individual and the address of itsprincipal office in the jurisdiction in which the nonindividual was incorporated or organized (e.g. Articlesof Incorporation, certificate of Tax residency)Submitted by:Name of TaxpayerDate:Received by:Date:OfficerAcknowledgement by applicant:I , of legal age, hereby acknowledge theidentified lacking documentary requirement/s (marked with “X”)which I commit to submit within five (5) working days.I understand that my application will only be processed uponsubmission of complete document/s.Name of Taxpayer/Representative(Signature over printed name)Validated/Noted by:CSS PersonnelDate:Date:

ANNEX “A5.2”REPUBLIC OF THE PHILIPPINESDEPARTMENT OF FINANCEANNEX “A6”REPUBLIC OF THE PHILIPPINESDEPARTMENT OF FINANCEBUREAU OF INTERNAL REVENUEBUREAU OF INTERNAL REVENUEAPPLICATION FOR REGISTRATION –APPLICATION FOR AUTHORITY TO PRINT –PURELY TIN ISSUANCE (NON-BUSINESS)AUTHORITY TO PRINT (ATP) RECEIPTS/INVOICESCHECKLIST OF DOCUMENTARYREQUIREMENTSCHECKLIST OF DOCUMENTARYREQUIREMENTSIMPORTANT:1. Processing of transactions commence only upon submission ofCOMPLETE DOCUMENTS.2. Mark “ ” for submitted documents and “X” for lacking documents.FOR ONETT – Transfer Of Properties By Succession (Estate WithNo Proprietary Activities)IMPORTANT:1. Processing of transactions commence only upon submission ofCOMPLETE DOCUMENTS.2. Mark “ ” for submitted documents and “X” for lacking documents.FOR NEW AND SUBSEQUENT APPLICATION OF ATP –MANUAL BOUND RECEIPTS/INVOICES1BIR Form No. 1904;1BIR Form No. 1906;2Photocopy of Death Certificate of decedent; orExtrajudicial Settlement of theEstate/Affidavit of Self Adjudication;2Job order;3Final & clear sample of Principal and SupplementaryReceipts/ Invoices;4Photocopy of last issued ATP or PCD; orAny booklet from the last issued ATP for subsequentapplicationFOR ONETT – Transfer by Gratuitous Title (DONATION)– Sale, Assignment, Exchange, Mortgage, Purchaseand/or Disposal of Shares of Stock and/or RealEstate Properties– Claim of Winnings– Claim of Winnings involving Personal PropertiesSubject to Registration– Sale of Second- hand Vehicle1BIR Form No. 1904;2Any identification issued by an authorizedgovernment body (e.g. Birth Certificate,passport, driver’s license, CTC) that showsthe name, address and birthdate of theapplicant;Submitted by:Name of TaxpayerDate:Received by:Date:OfficerAcknowledgement by applicant:I , of legal age, hereby acknowledge theidentified lacking documentary requirement/s (marked with “X”)which I commit to submit within five (5) working days.I understand that my application will only be processed uponsubmission of complete document/s.Name of Taxpayer/Representative(Signature over printed name)Validated/Noted by:CSS PersonnelDate:Date:FOR NEW AND SUBSEQUENT APPLICATION OF ATP –MANUAL LOOSE LEAF RECEIPTS/INVOICES1BIR Form No. 1906;2Permit to Use Loose-Leaf Official Receipts or SalesInvoices;3Job order;4Final & clear sample of Principal and SupplementaryReceipts/ Invoices;5Photocopy of last issued ATP or PCD; orAny booklet from the last issued ATP for subsequentapplicationSubmitted by:Name of TaxpayerDate:Received by:Date:OfficerAcknowledgement by applicant:I , of legal age, hereby acknowledge theidentified lacking documentary requirement/s (marked with “X”)which I commit to submit within five (5) working days.I understand that my application will only be processed uponsubmission of complete document/s.Name of Taxpayer/Representative(Signature over printed name)Validated/Noted by:CSS PersonnelDate:Date:

ANNEX “A7”REPUBLIC OF THE PHILIPPINESDEPARTMENT OF FINANCEBUREAU OF INTERNAL REVENUEAPPLICATION FOR REGISTRATION –ANNEX “A8”REPUBLIC OF THE PHILIPPINESDEPARTMENT OF FINANCEBUREAU OF INTERNAL REVENUECHECKLIST OF DOCUMENTARYREQUIREMENTSCHECKLIST OF DOCUMENTARYREQUIREMENTSAPPLICATION FOR PERMIT TO USEBOOKS OF ACCOUNTSIMPORTANT:1. Processing of transactions commence only upon submission ofCOMPLETE DOCUMENTS.2. Mark “ ” for submitted documents and “X” for lacking documents.REGISTRATION OF MANUAL BOOKS OF ACCOUNTS (NEW ORSUBSEQUENT)1BIR Form No. 1905;2New sets of permanently bound books of accounts;3Official Appointment Book (for Professionals only);IMPORTANT:1. Processing of transactions commence only upon submission ofCOMPLETE DOCUMENTS.2. Mark “ ” for submitted documents and “X” for lacking documents.PERMIT TO USE MANUAL LOOSE LEAF BOOKS OFACCOUNTS/RECEIPTS AND INVOICES1BIR Form No. 1900;2Job order;3Sample Format and print-out to be used;4Photocopy of last issued ATP or PCD; orAny booklet from the last issued ATP for subsequentapplicationREGISTRATION OF MANUAL LOOSE LEAF BOOKS OF ACCOUNTS1BIR Form No. 1905;2Permit to Use Loose Leaf Books of Accounts;3Permanently bound Loose Leaf Books of Accounts;4Affidavit attesting the completeness, accuracy andcorrectness of entries in Books of Accounts and thenumber of Lo

1 BIR Form No. 1901; 2 Any identification issued by an authorized government body (e.g. Birth Certificate, passport, driver’s license, CTC) that shows the name, address and birthdate of the applicant; 3 Photocopy of Mayor’s Business Permit; or Duly received Application for Mayor’s Business Permit, if the former is still in process with the LGU; and/or Professional Tax Receipt .

![05[2] Strategy competitors, competitive rivalry .](/img/2/052-strategy-competitors-competitive-rivalry-competitive-behavior-and-competitive-dynamics.jpg)