Transcription

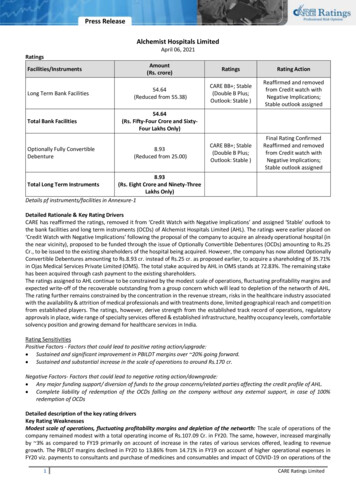

Press ReleaseAlchemist Hospitals LimitedApril 06, 2021RatingsFacilities/InstrumentsLong Term Bank FacilitiesTotal Bank FacilitiesOptionally Fully ConvertibleDebentureAmount(Rs. crore)RatingsRating Action54.64(Reduced from 55.38)CARE BB ; Stable(Double B Plus;Outlook: Stable )Reaffirmed and removedfrom Credit watch withNegative Implications;Stable outlook assignedCARE BB ; Stable(Double B Plus;Outlook: Stable )Final Rating ConfirmedReaffirmed and removedfrom Credit watch withNegative Implications;Stable outlook assigned54.64(Rs. Fifty-Four Crore and SixtyFour Lakhs Only)8.93(Reduced from 25.00)8.93(Rs. Eight Crore and Ninety-ThreeLakhs Only)Details pf instruments/facilities in Annexure-1Total Long Term InstrumentsDetailed Rationale & Key Rating DriversCARE has reaffirmed the ratings, removed it from ‘Credit Watch with Negative Implications’ and assigned ‘Stable’ outlook tothe bank facilities and long term instruments (OCDs) of Alchemist Hospitals Limited (AHL). The ratings were earlier placed on‘Credit Watch with Negative Implications’ following the proposal of the company to acquire an already operational hospital (inthe near vicinity), proposed to be funded through the issue of Optionally Convertible Debentures (OCDs) amounting to Rs.25Cr., to be issued to the existing shareholders of the hospital being acquired. However, the company has now alloted OptionallyConvertible Debentures amounting to Rs.8.93 cr. instead of Rs.25 cr. as proposed earlier, to acquire a shareholding of 35.71%in Ojas Medical Services Private Limited (OMS). The total stake acquired by AHL in OMS stands at 72.83%. The remaining stakehas been acquired through cash payment to the existing shareholders.The ratings assigned to AHL continue to be constrained by the modest scale of operations, fluctuating profitability margins andexpected write-off of the recoverable outstanding from a group concern which will lead to depletion of the networth of AHL.The rating further remains constrained by the concentration in the revenue stream, risks in the healthcare industry associatedwith the availability & attrition of medical professionals and with treatments done, limited geographical reach and competitionfrom established players. The ratings, however, derive strength from the established track record of operations, regulatoryapprovals in place, wide range of specialty services offered & established infrastructure, healthy occupancy levels, comfortablesolvency position and growing demand for healthcare services in India.Rating SensitivitiesPositive Factors - Factors that could lead to positive rating action/upgrade: Sustained and significant improvement in PBILDT margins over 20% going forward. Sustained and substantial increase in the scale of operations to around Rs.170 cr.Negative Factors- Factors that could lead to negative rating action/downgrade: Any major funding support/ diversion of funds to the group concerns/related parties affecting the credit profile of AHL. Complete liability of redemption of the OCDs falling on the company without any external support, in case of 100%redemption of OCDsDetailed description of the key rating driversKey Rating WeaknessesModest scale of operations, fluctuating profitability margins and depletion of the networth: The scale of operations of thecompany remained modest with a total operating income of Rs.107.09 Cr. in FY20. The same, however, increased marginallyby 3% as compared to FY19 primarily on account of increase in the rates of various services offered, leading to revenuegrowth. The PBILDT margins declined in FY20 to 13.86% from 14.71% in FY19 on account of higher operational expenses inFY20 viz. payments to consultants and purchase of medicines and consumables and impact of COVID-19 on operations of the1CARE Ratings Limited

Press Releasehospital towards the end of March, 2020. The PAT margins, however, improved significantly to 4.86% in FY20 from 0.14% inFY19, as there were lower extraordinary expenses in FY20 and no deferred tax liability during the year, as compared to Rs.4.48cr. of extraordinary expenses (pertaining to loss on sale of asset) in FY19.Concentration in the revenue stream: The company derived 57% of its total operating income in FY20 from the top fivedepartments, with the cardiology department alone constituting 16% of the total income in FY20. The revenue stream of thecompany is therefore associated with a concentration risk. The continued availability of professionals in the department andmaintenance of service quality will directly affect the revenue stream of the company from these departments.Risks in the healthcare industry associated with the availability and attrition of medical professionals as-well-as thetreatments done: Presence of qualified medical professionals such as doctors, paramedical staff and support staff is one of theimportant requisites of any hospital to be successful and to get continued patronage from the local population. There is anincreasing level of competition and the scarcity of medical specialists in the domestic healthcare industry. Furthermore,healthcare is a highly sensitive sector where any mishandling of a case or negligence on the part of any doctor and/or staff ofthe unit can damage the reputation of the hospital to a large extent. In such an industry scenario, operations of hospitals likeAHL are also therefore, highly dependent on the availability of qualified medical professionals and its ability to retain its currentpool.Limited geographical reach and competition from established players in the region: The company is operating a single hospitalin Panchkula (Haryana). This limits the ability to tap opportunities and revenue. Further, though the hospital has an establishedoncology and cardiology department, it faces stiff competition from several other private hospital chains. This leads tocompetition not only in acquiring patients, but also in attracting medical professionals.Key Rating StrengthsEstablished track record of operations, regulatory approvals in place and healthy occupancy levels: The company wasoriginally incorporated in 1994 as Kaiser Hospital Limited and operated the single hospital in Panchkula under the name ‘KaiserHospital’. It was subsequently acquired by the current promoters in 2006 and rechristened as Alchemist Hospitals Limited. Theoperations of the company are being looked after by its current director. Mr. Karan Deep Singh (son of Mr. Kanwar Deep Singh,Member of Parliament and the founder promoter of the Alchemist Group). He holds an industry experience of more than tenyears and is supported by an experienced management team. The hospital has been operational for around two and a halfdecades now leading to an established track record in the Panchkula, Haryana region. The occupancy levels in the hospitalremained healthy and stood at 80% in FY20. The hospital holds accreditations from National Accreditation Board for Hospitalsand Healthcare Providers (NABH) as well as National Accreditation Board for Testing and Calibration Laboratories (NABL). Thisleads to an advantage to the company in terms of attracting patients as well as medical professionals. The hospital derivesmost of its income each year from private patient inflow ( 70% in FY20). The hospital also has tie ups with several reputedThird-Party Administrators and private & public institutions. Further, the hospital is also empanelled under the CGHS (CentralGovernment Health Scheme) and ECHS (Ex Servicemen Contributory Health Scheme) schemes of the government. This segmentconstituted 5% of the total income in FY20.Established infrastructure and wide range of services offered: The 186 bedded multi-specialty hospital has medicalprofessionals and associated infrastructure and equipment for various departments like oncology, neurology, cardiology,gynaecology etc. The hospital facilities are equipped with OPD (out-patient department) facilities, operation theatres,pathological lab, catheterization lab etc. along with technologically sound medical equipment and supporting infrastructurelike Intensive Care Units, general wards, luxury rooms, blood bank, pharmacy etc. The hospital is associated with severalreputed doctors as well as consultants who are supported by a qualified and experienced staff. Most of the doctors are workingwith the hospital are working exclusively for it, though on consultancy basis.Comfortable overall solvency position: The capital structure of the company remained comfortable with the debt to equityratio and overall gearing ratio at 0.29x and 0.38x respectively, as on March 31, 2020; as compared to 0.19x and 0.27xrespectively, as on March 31, 2019. The capital structure deteriorated as on March 31, 2020 mainly on account of new termloans availed by the company in FY20 for the capex undertaken during the year. The interest coverage ratio and total debt toGCA ratio also stood comfortable at 6.59x in FY20 and 4.11x as on March 31, 2020, respectively (PY: 5.35x and 4.56x,respectively). The interest coverage ratio deteriorated on account of lower PBILDT in absolute value terms in FY20 and higherinterest costs incurred in FY20. The total debt to GCA ratio deteriorated on account of higher total debt outstanding at the endof the year in FY20.AHL has acquired 72.38% stake in another hospital- OMS (Panchkula), in 2020-2021, which will operate as a subsidiary of AHL.The acquisition has been funded through issuance of OCDs amounting to Rs.8.93 Cr. for 35.71% stake, while the remaining36.67% was acquired through cash payment to the existing shareholders. OMS has reported cash losses in the past (FY18-FY202CARE Ratings Limited

Press Releaseperiod). Any major funding support/ diversion of funds from AHL to the group concerns/related parties, going forward,affecting the credit profile of AHL will remain a key rating sensitivity. For the acquisition, AHL has issues OCDs (Secured) to theexisting shareholders of the target company (carrying coupon rate of 6% for the first 18 months and 12% in the remaining 6months). The ability of AHL to timely service the redemption obligation (if-and-when it falls due) will also be monitored closelyby CARE. The OCDs are redeemable after 24 months, as per the terms of the agreement.Growing demand in the healthcare sector: With the Outbreak of Covid-19, profitability margins of the industry remained underpressure till H1FY21 due to drop in outpatient footfalls and elective surgeries. However, the long-term prospect of the industryremains positive and continue to grow backed by an increase in demand for modern healthcare facilities, a rise in awarenessabout diseases, health consciousness among people, increase in per capita income, changing lifestyle, transition in diseaseprofile etc. Although there is increasing competition in the sector, comfort is drawn from the sizeable presence and establishedposition of AHL. Going forward, AHL’s prospects would depend upon its ability to achieve the revenue and profitability asenvisaged and will remain a key rating sensitivity.Liquidity: Adequate:- The current ratio and quick ratios of the company stood comfortable at 1.95x and 1.83x respectively, ason March 31, 2020, though the same deteriorated on a year-on-year basis (PY: 2.48x and 2.35x respectively). The operatingcycle of the company remained at 25 days as on March 31, 2020. The company had free cash and bank balance of Rs. 3.87 cr.as on March 31, 2020. The company has a total debt repayment obligation of Rs.3.87 Cr. and Rs.10.87 Cr. in FY21 and FY22,respectively, to be met through the internal accruals generated. The average utilization of the working capital borrowings stoodcomfortable at 68% for the last 12 months ending December, 2021. The company has successfully completed the ongoingcapex to increase the total number of operational beds to 186, within the proposed time and cost estimates. The company hadavailed moratorium for its debt obligations due for the period March-20 to Aug-20. Further, the company had availedemergency COVID line of Rs.7.65 cr. in FY21 to manage its working capital requirements.Analytical approach: StandaloneApplicable CriteriaCriteria on assigning Outlook and credit watch to Credit RatingsFinancial ratios – Non-Financial SectorCARE’s policy on default recognitionCriteria for Short Term InstrumentsLiquidity analysis of non-financial sector entitiesRating Methodology – Hospital IndustryRating Methodology - Service Sector CompaniesAbout the CompanyAlchemist Hospitals Limited (AHL) was initially incorporated under the name Kaiser Hospitals Limited in 1994. This companyoperated a single hospital property under the name ‘Kaiser Hospital’ in Panchkula, Haryana. It was subsequently acquired bythe current promoters in 2006 and rechristened as AHL. The hospital was also renamed ‘Alchemist Hospital’. The multi-specialtytertiary hospital has 186 operational beds as on March 30, 2021. The hospital offers a wide range of services in various specialtysegments like: oncology, cardiology, joint replacements, laparoscopic surgery, neurology and neurosurgery, paediatric surgery,endocrinology, plastic surgery etc., along with medicine and general surgery. Subsidiaries/ related parties of the companyinclude various entities of the Alchemist group including Ojas Medical Services Private Limited, Alchemist Limited, AlchemistRealty Limited, etc.Brief Financials (Rs. crore)FY19 (A)FY20 (A)Total operating ll gearing (times)0.270.38Interest coverage (times)8.176.59A: AuditedStatus of non-cooperation with previous CRA: India Ratings has reviewed the ratings on the best available information andclassified AHL as ‘non-cooperating‘ vide PR dated June 19, 2019.Any other information: NARating History for last three years: Please refer Annexure-23CARE Ratings Limited

Press ReleaseCovenants of rated instrument / facility: Detailed explanation of covenants of the rated instruments/facilities is given inAnnexure-3Complexity level of various instruments rated for this company: Annexure 4Annexure-1: Details of Instruments/FacilitiesName of theInstrumentSize of theIssue(Rs. crore)Date ofIssuanceCouponRateMaturityDateFund-based - LT-TermLoan--June-202641.64Fund-based - LT-WorkingCapital Limits---13.00August 21, 20206August 20, 20228.93Debentures-OptionallyFully ConvertibleDebentureAnnexure-2: Rating History of last three yearsCurrent RatingsName of gFacilities(Rs. crore)1.Fund-based - LT-TermLoan2.Fund-based - LTWorking Capital Limits3.Debentures-OptionallyFully ConvertibleDebentureLTLTLT41.6413.008.93CAREBB ;StableCAREBB ;StableCAREBB ;StableRating assignedalong with RatingOutlookCARE BB ; StableCARE BB ; StableCARE BB ; StableRating historyDate(s) &Rating(s)assigned in2020-20211)CARE BB (CWN)(20-Jul-20)2)CARE BB ;Stable(07-Apr-20)1)CARE BB (CWN)(20-Jul-20)2)CARE BB ;Stable(07-Apr-20)Date(s) &Date(s) & Date(s) &Rating(s)Rating(s)Rating(s)assigned in assigned in assigned in2019-2020 2018-2019 2017-20181)CAREBB ; Stable(28-Jun-19)1)CAREBB ; Stable(28-Jun-19)1)ProvisionalCARE BB (CWN)(20-Jul-20)-------Annexure-3: Detailed explanation of covenants of the rated instrument / facilities: NAAnnexure 4: Complexity level of various instruments rated for this companySr.Name of the InstrumentNo.Complexity Level1.Debentures-Optionally Fully Convertible DebentureHighly Complex2.Fund-based - LT-Term LoanSimple3.Fund-based - LT-Working Capital LimitsSimpleNote on complexity levels of the rated instrument: CARE has classified instruments rated by it on the basis of complexity.Investors/market intermediaries/regulators or others are welcome to write to care@careratings.com for any clarifications.4CARE Ratings Limited

Press ReleaseContact usMedia ContactMradul MishraContact no. – 91-22-6837 4424Email ID – mradul.mishra@careratings.comAnalyst ContactGroup Head Name – Mr. Sudeep SanwalGroup Head Contact no.: 91-0172-4904025Group Head Email ID- sudeep.sanwal@careratings.comRelationship ContactName: Mr. Anand JhaContact no. : 91-0172-4904000/1Email ID: anand.jha@careratings.comAbout CARE Ratings:CARE Ratings commenced operations in April 1993 and over two decades, it has established itself as one of the leading creditrating agencies in India. CARE is registered with the Securities and Exchange Board of India (SEBI) and also recognized as anExternal Credit Assessment Institution (ECAI) by the Reserve Bank of India (RBI). CARE Ratings is proud of its rightful place inthe Indian capital market built around investor confidence. CARE Ratings provides the entire spectrum of credit rating thathelps the corporates to raise capital for their various requirements and assists the investors to form an informed investmentdecision based on the credit risk and their own risk-return expectations. Our rating and grading service offerings leverage ourdomain and analytical expertise backed by the methodologies congruent with the international best practices.DisclaimerCARE’s ratings are opinions on the likelihood of timely payment of the obligations under the rated instrument and are notrecommendations to sanction, renew, disburse or recall the concerned bank facilities or to buy, sell or hold any security.CARE’s ratings do not convey suitability or price for the investor. CARE’s ratings do not constitute an audit on the ratedentity. CARE has based its ratings/outlooks on information obtained from sources believed by it to be accurate and reliable.CARE does not, however, guarantee the accuracy, adequacy or completeness of any information and is not responsible forany errors or omissions or for the results obtained from the use of such information. Most entities whose bankfacilities/instruments are rated by CARE have paid a credit rating fee, based on the amount and type of bankfacilities/instruments. CARE or its subsidiaries/associates may also have other commercial transactions with the entity. Incase of partnership/proprietary concerns, the rating /outlook assigned by CARE is, inter-alia, based on the capital deployedby the partners/proprietor and the financial strength of the firm at present. The rating/outlook may undergo change in caseof withdrawal of capital or the unsecured loans brought in by the partners/proprietor in addition to the financialperformance and other relevant factors. CARE is not responsible for any errors and states that it has no financial liabilitywhatsoever to the users of CARE’s rating. Our ratings do not factor in any rating related trigger clauses as per the terms ofthe facility/instrument, which may involve acceleration of payments in case of rating downgrades. However, if any suchclauses are introduced and if triggered, the ratings may see volatility and sharp downgrades.5CARE Ratings Limited

Hospital'. It was subsequently acquired by the current promoters in 2006 and rechristened as Alchemist Hospitals Limited. The operations of the company are being looked after by its current director. Mr. Karan Deep Singh (son of Mr. Kanwar Deep Singh, Member of Parliament and the founder promoter of the Alchemist Group).