Transcription

FICO Score Open Access Consumer Credit Education – US VersionFrequently Asked QuestionsFREQUENTLY ASKEDQUESTIONS ABOUT FICO SCORES 2013-2018 Fair Isaac Corporation. All rights reserved.i

Frequently Asked Questions about FICO ScoresTable of ContentsIntroduction to Credit Scoring . 1What is in a credit report? . 1How do I check my credit report for free? . 1What if there’s an error on my credit report? . 1What is a credit score? . 1About FICO Scores . 1What is FICO? . 2What are FICO Scores? . 2How are FICO Scores different? . 2What goes into FICO Scores? . 2What is left out of FICO Scores? . 4What is a good FICO Score? . 4What are score factors? . 4What are the minimum requirements to calculate a FICO Score? . 4How can FICO Scores help me? . 5Do I have more than one FICO Score? . 5Why is my FICO Score different than other scores I have seen? . 5Why do FICO Scores fluctuate/change?. 5New Credit. 5Does a FICO Score alone determine whether I get credit? . 5What is a typical FICO Score for someone new to credit? . 6How is a credit history established? . 6What is a credit “inquiry”? . 6Will my FICO Scores drop if I apply for new credit? . 6How can I minimize the effect to my FICO Score when seeking new credit? . 6Credit Cards . 7Should I take advantage of promotional credit card offers? . 7Will closing a credit card account affect a FICO Score? . 7What’s the best way to manage my growing credit card debt? . 7Student Loans . 8What is the effect of paying student loans while in college versus after graduation? . 8How are FICO Scores affected by the combination of interest and principal? . 8 2013-2018 Fair Isaac Corporation. All rights reserved.ii

Frequently Asked Questions about FICO ScoresDoes moving loans into forbearance affect FICO Scores?. 8Mortgages . 8How long will a foreclosure affect a FICO Score? . 8Are the alternatives to foreclosure any better as far as FICO Scores are concerned? . 8How do loan modifications affect a FICO Score?. 8How does refinancing affect my FICO Score?. 9Bankruptcy . 9How will a bankruptcy affect my FICO Scores? . 9More about FICO Scores & Financial Health . 9Do employers use FICO Scores in hiring decisions? . 9Are FICO Scores used in insurance underwriting? . 9Are FICO Scores unfair to minorities? . 9How are FICO Scores calculated for married couples? . 10How can I manage my credit and FICO Score responsibly?. 10What’s the ideal utilization ratio? . 10Will spending less and saving more affect a FICO Score? . 10Do accounts that are not on my credit reports affect my FICO Scores? . 10What are the factors of late payments, and how do they affect FICO Scores? . 11How long will negative information remain on my credit files? . 11Glossary of Credit Terms . 11Charge-off . 11Collection . 11Consumer Reporting Agency (CRA) . 11Credit account . 11Credit file . 12Credit history. 12Credit limit . 12Credit obligation. 12Credit report . 12Credit risk . 12Credit score . 12Default. 12Delinquent . 12Equal Credit Opportunity Act (ECOA). 12Fair Credit Reporting Act (FCRA) . 12 2013-2018 Fair Isaac Corporation. All rights reserved.iii

Frequently Asked Questions about FICO ScoresFICO . 13FICO Industry Score . 13FICO Scores . 13FICO Score NG . 13Inquiry . 13Installment debt . 13Permissible purpose . 13Revolving credit/debt. 13Score factors . 13Scoring model . 13Utilization . 13 2013-2018 Fair Isaac Corporation. All rights reserved.iv

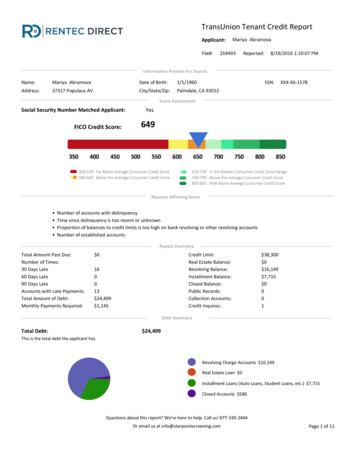

Frequently Asked Questions about FICO ScoresIntroduction to Credit ScoringWhen you apply for credit—such as a credit card, auto loan or mortgage—the company from which you are seekingcredit checks your credit report from one or more of the three major consumer reporting agencies. In addition toyour credit report, they will most likely use a credit score, such as a FICO Score, in their evaluation of credit riskbefore lending their money to you.Each lender has its own process and policies for making decisions when reviewing a credit application. Most lendersconsider a FICO Score along with additional information, either from one or more of your credit reports or fromsupplemental information you provide with your application, such as your income.What is in a credit report?Although each consumer reporting agency formats and reports this information differently, all credit reports containbasically the same categories of information. Identifying Information - Your name, address, Social Security number, date of birth and employmentinformation. This information is not used in calculating FICO Scores; it is only used to identify you. Updatesto this information come from information you supply to your lenders.Credit Accounts - Most lenders report information about each account you have established with them. Theyreport the type of credit account, the date you opened the account, your credit limit or loan amount, the accountbalance, and your payment history.Credit Inquiries - Your credit reports list the inquiries that lenders have made for your credit reports within thelast two years. When you apply for a loan, you authorize your lender to ask for a copy of your credit reports.This is how inquiries appear on your reports.Bankruptcies and Collections - Consumer reporting agencies also collect bankruptcy (often found in thepublic record segment of a credit report) information from state and county courts, and delinquencies reportedby collection agencies.How do I check my credit report for free?You may get a free copy of your credit report from each of the three major consumer reporting agencies annually.To request a copy of your credit report, please visit: www.annualcreditreport.com. Please note your free creditreport will not include your FICO Score. Because your FICO Score is based on the information in your creditreport, it is important to make sure that the credit report information is accurate.What if there’s an error on my credit report?If you find an error on one or more of your credit reports, contact the consumer reporting agency or the organizationthat provided the information to the agency. Both parties are responsible for correcting inaccurate or incompleteinformation in your report as required by the Fair Credit Reporting Act.Equifax Disputes n)Experian Disputes nion Disputes redit)What is a credit score?A credit score is a number summarizing your credit risk, based on your credit data. A credit score helps lendersevaluate your credit profile and influences the credit that’s available to you, including loan and credit cardapprovals, interest rates, credit limits and more.About FICO Scores 2013-2018 Fair Isaac Corporation. All rights reserved.1

Frequently Asked Questions about FICO ScoresWhat is FICO?FICO, formerly known as Fair Isaac Corporation, is the company that invented FICO Scores. Starting in the 1950s,FICO sparked a revolution in credit risk assessment by pioneering credit risk scoring for credit grantors. This newapproach to measuring risk enabled banks, retailers and other businesses to improve their performance and toexpand consumers’ access to credit. Today, FICO Scores are widely recognized as the industry standard formeasuring credit risk.It is important to note that while FICO works with the consumer reporting agencies to provide your FICO Scores, itdoes not have access to or store any of your personal data or determine the accuracy of the information in your creditfile.What are FICO Scores?FICO Scores are the most widely used credit scores. Each FICO Score is a three-digit number calculated from thedata on your credit reports at the three major consumer reporting agencies—Experian, TransUnion and Equifax.Your FICO Scores predict how likely you are to pay back a credit obligation as agreed. Lenders use FICO Scoresto help them quickly, consistently and objectively evaluate potential borrowers’ credit risk.How are FICO Scores different?Not all credit scores are FICO Scores. Because FICO Scores are the credit scores most widely used by lenders—FICO Scores are used in over 90% of U.S. credit lending decisions 1—knowing your FICO Scores is the best wayto understand how potential lenders could evaluate your credit risk when you apply for a loan or credit. Other creditscores, which use scoring formulas different from FICO’s, may not give you an accurate representation of the scoresyour lender uses when assessing your credit profile.What goes into FICO Scores?FICO Scores are calculated from the credit data in your credit report. This data is grouped into five categories;below is a detailed breakdown of the relative importance of each category. As you review this information, keep inmind that: FICO Scores take into consideration all of these categories, not just one or two.The importance of any factor (piece of information) depends on the information in your entire credit report.FICO Scores look only at the credit-related information on a credit report.FICO Scores consider both positive and negative information on a credit report.1. Payment History - Approximately 35% of a FICO Score is based on this information: 1Payment information on many types of accounts:o Credit cardso Retail accountso Installment loanso Finance company accountsBankruptcy and collection itemsMercator Advisory Group, Analysis, 2018 2013-2018 Fair Isaac Corporation. All rights reserved.2

Frequently Asked Questions about FICO Scores Details on late or missed payments (“delinquencies”), bankruptcies, and collection itemsNumber of accounts that show no late payments, or are currently paid as agreed2. The Amounts You Owe - Approximately 30% of a FICO Score is based on this information: Amount owed on all accountsAmount owed on different types of accountsBalances owed on certain types of accountsNumber of accounts which carry a balanceHow much of the total credit line is being used on revolving credit accountsHow much is still owed on installment loans, compared with the original loan amountsCredit utilization is one of the most important factors evaluated in this category, considers the amount you owecompared to how much credit you have available. While lenders determine how much credit they are willing toprovide, you control how much you use. FICO’s research shows that people using a high percentage of theiravailable credit limits are more likely to have trouble making some payments now or in the near future, compared topeople using a lower level of available credit.Having credit accounts with an outstanding balance does not necessarily mean you are a high-risk borrower with alow FICO Score. A long history of demonstrating consistent payments on credit accounts is a good way to showlenders you can responsibly manage additional credit.3. Length of Credit History - Approximately 15% of a FICO Score is based on this information:In general, a longer credit history will increase a FICO Score, all else being equal. However, even people who havenot been using credit long can get a good FICO Score, depending on what their credit report says about theirpayment history and amounts owed. Regarding length of history, a FICO Score takes into account: How long credit accounts have been established. A FICO Score can consider the age of the oldest account, theage of the newest account and the average age of all accounts.How long specific credit accounts have been established.How long it has been since you used certain accounts.4. New Credit - Approximately 10% of a FICO Score is based on this information:FICO’s research shows that opening several credit accounts in a short period of time represents greater risk—especially for people who do not have a long credit history. In this category, a FICO Score takes into account: How many new accounts have been opened.How long it has been since a new account was opened.How many recent requests for credit have been made, as indicated by inquiries to the consumer reportingagencies.Length of time since inquiries from credit applications were made by lenders.Whether there is a good recent credit history, following any past payment problems.Looking for an auto, mortgage or student loan may cause multiple lenders to request your credit report, even thoughyou are only looking for one loan. In general, FICO Scores compensate for this shopping behavior in the followingways: FICO Scores ignore auto, mortgage, and student loan inquiries made in the 30 days prior to scoring, so theinquiries won’t affect the scores of consumers who apply for a loan within 30 days.After 30 days, FICO Scores typically count inquiries of the same type (i.e., auto, mortgage or student loan)that fall within a typical shopping period as just one inquiry when determining your score.5. Types of Credit in Use - Approximately 10% of a FICO Score is based on this information:FICO Scores consider the mix of credit cards, retail accounts, installment loans, finance company accounts andmortgage loans. It is not necessary to have one of each, and it is not a good idea to open a credit account you don’tintend to use. In this category, a FICO Score takes into account: 2013-2018 Fair Isaac Corporation. All rights reserved.3

Frequently Asked Questions about FICO Scores What kinds of credit accounts are on the credit report? Whether there is experience with both revolving andinstallment accounts, or has the credit experience been limited to only one type?How many accounts of each type exist? A FICO Score also looks at the total number of accounts established.For different credit profiles, how many is too many will vary depending on the overall credit picture.What is left out of FICO Scores?FICO Scores consider a wide range of information on a credit report. However, they do NOT consider: Race, color, religion, national origin, age, sex and marital statusSalary, or other employment information (however, lenders may consider this information separately)Where the consumer livesAny interest rate being charged on a credit card or other accountAny items reported as child/family support obligationsCertain types of inquiriesAny information not found in the credit reportWhat is a good FICO Score?FICO Scores generally range from 300 to 850, where higher scores demonstrate lower credit risk and lower scoresdemonstrate higher credit risk (note: some types of FICO Scores have a slightly broader range). What’s considereda “good” FICO Score varies, since each lender has its own standards for approving credit applications, based on thelevel of risk it finds acceptable. So one lender may offer its lowest interest rates to people with FICO Scores above730, while another may only offer it to people with FICO Scores above 760.The chart below provides a breakdown of ranges for FICO Scores found across the U.S. consumer population.Again, each lender has its own credit risk standards, but this chart can serve as a general guide of what a FICO Score represents.Score range800 or HigherRatingExceptional740 to 799Very Good670 to 739Good580 to 669FairLower than 580Poor What FICO Scores in this range meanWell above the average score of U.S. consumersDemonstrates to lenders that the consumer is an exceptional borrowerAbove the average of U.S. consumersDemonstrates to lenders that the consumer is a very dependable borrowerNear or slightly above the average of U.S. consumersMost lenders consider this a good scoreBelow the average of U.S. consumersSome lenders will approve loans with this scoreWell below the average of U.S. consumersDemonstrates to lenders that the consumer is a risky borrowerFICO’s research shows that people with a high FICO Score tend to: Make all payments on time each monthKeep credit card balances lowApply for new credit only when neededEstablish a long credit historyWhat are score factors?Score factors are delivered with a consumer’s FICO Score, these are the top areas that affected that consumer’sFICO Scores. The order in which the score factors are listed is important. The first factor indicates the area thatmost affected the score and the second factor is the next most significant influence. Addressing these factors canbenefit the score.What are the minimum requirements to calculate a FICO Score? 2013-2018 Fair Isaac Corporation. All rights reserved.4

Frequently Asked Questions about FICO ScoresA credit file must contain these minimum requirements (Note: The requirements vary slightly for FICO ScoresNG): At least one account that has been open for six months or moreAt least one account that has been reported to the consumer reporting agency within the past six monthsNo indication of deceased on the credit file (if you shared an account with a person reported as deceased, it isimportant to check your credit file to make sure you are not affected)How can FICO Scores help me?A FICO Score gives lenders a fast, objective and consistent estimate of your credit risk. Before the use of creditscoring, the credit granting process could be slow, inconsistent and unfairly biased. Keep in mind that FICO Scoresare only one of many factors lenders consider when making a credit decision. Here’s how FICO Scores may benefityou.Get credit faster - FICO Scores can be delivered almost instantaneously, helping lenders speed up credit card andloan approvals.Unbiased credit decisions - Factors such as your gender, race, religion, nationality and marital status are notconsidered by FICO Scores. When a lender uses your FICO Score, they’re getting an evaluation of your credithistory that is fair and objective.May save you money - A higher FICO Score can help you qualify for better rates from lenders—generally, thehigher your score, the lower your interest rate and payments.More credit available - Because FICO Scores allow lenders to more accurately associate risk levels withindividual borrowers, they allow lenders to offer different prices to different borrowers. Rather than making strictly“yes-no” credit decisions and offering “one-size-fits-all” credit products, lenders use FICO Scores to approveconsumers who might have been declined credit in the past. Lenders are even able to provide higher-risk borrowerswith credit that they are more likely to be able to manage.Do I have more than one FICO Score?To keep up with consumer trends and the evolving needs of lenders, FICO periodically updates its scoring model,resulting in new FICO Score versions being released to market every few years. Additionally, different lenders usedifferent versions of FICO Scores when evaluating your credit. Auto lenders, for instance, often use FICO AutoScores, an industry-specific FICO Score version that’s been tailored to their needs.Why is my FICO Score different than other scores I have seen?There are many different credit scores available to consumers and lenders. FICO Scores are the credit scores usedby most lenders, and different lenders may use different versions of FICO Scores. In addition, FICO Scores arebased on credit file data from a consumer reporting agency, so differences in your credit files may create differencesin your FICO Scores.Why do FICO Scores fluctuate/change?There are many reasons why a score may change. FICO Scores are calculated each time they are requested, takinginto consideration the information that is in your credit file from a consumer reporting agency at that time. So, as theinformation in your credit file at that CRA changes, FICO Scores can also change. Review your key score factors,which explain what factors from your credit report most affected a score. Comparing key score factors from the twodifferent time periods can help identify causes for a change in a FICO Score. Keep in mind that certain events suchas delinquent payments or bankruptcy can lower FICO Scores quickly.New CreditDoes a FICO Score alone determine whether I get credit? 2013-2018 Fair Isaac Corporation. All rights reserved.5

Frequently Asked Questions about FICO ScoresNo. Most lenders use several factors to make credit decisions, including a FICO Score. Lenders may look atinformation such as the amount of debt you can reasonably handle given your income, your employment history,and your credit history. Based on their review of this information, as well as their specific underwriting policies,lenders may extend credit to you even with a low FICO Score, or decline your request for credit even with a highFICO Score.What is a typical FICO Score for someone new to credit?FICO Scores are generated by complex mathematical algorithms based on unique credit report data, so there is no“typical” or “entry-level” score. While someone new to credit may have difficulty scoring in the highest scoreranges due to a limited number of active accounts and length of history, it is possible to have a FICO Score thatmeets lenders’ criteria for granting credit. FICO Scores consider the extent to which people can demonstrate agood track record of making payments on time. In fact, payment history is more important for FICO Scores (about35%) than length of credit history (about 15%).How is a credit history established?There are a few ways to establish a credit history, including the following. By applying for and opening a new credit card, a person with no or little credit history may not get very goodterms on this credit card—such as a high annual percentage rate (APR). However, by charging small amountsand paying off the balance each month, you won’t be paying interest each month so the high APR won’t hurtyour financial position.Those unable to get approved for a traditional credit card may be able to open a secured credit card to buildcredit history, provided the card issuer reports secured cards to the consumer reporting agency. This type ofcard requires a deposit of money with the credit card company. Charges can then be made on the secured card,typically up to the amount deposited.With both traditional and secured credit cards, keeping balances low, payi

Although each consumer reporting agency formats and reports this information differently, all credit reports contain basically the same categories of information. Identifying Information - Your name, address, Social Security number, date of birth and employment information. This information is not used in calculating FICO