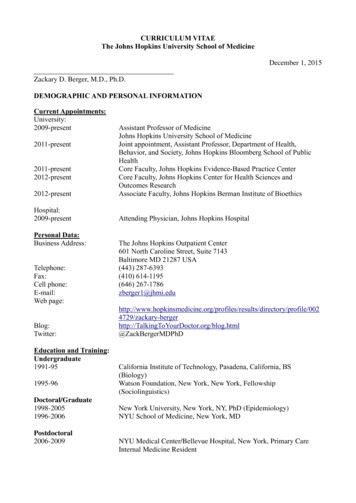

Transcription

2021Guide to BenefitsNONREPRESENTED EMPLOYEES OF THEJOHNS HOPKINS HOSPITAL AND THE JOHNSHOPKINS HEALTH SYSTEM CORPORATION

Contact rURL/Email AddressAbsence gwick.comAccident InsuranceUNUM800-635-5597unum.comAfter-Hours ClinicEmployee Health & WellnessCenter410-955-7374Auto & Homeowners man resources/benefits/healthy at hopkins/employee health wellness Back Up Child & Adult CareCare.com855-781-1303care.com/backupcareBanking ServicesJohns Hopkins Federal Credit 410-534-4500Union800-543-2870jhfcu.orgBenefits EnrollmentSmartSource443-997-5400my.jh.eduCare Management ProgramEHP800-557-6916ehp.orgCOBRA and Direct mCommuter Benefits (METRO ata.comCommuter Benefits (SmartTripCard)Critical Illness ay Care CenterBright a Dental800-932-0783deltadentalins.comEmployee Assistance man resources/benefits/jh loyee Discount ProgramLifeMartEmployee Well-beingHealthy at Hopkins833-554-4554my.jh.eduFlexible Spending s.comHealth, Safety and EnvironmentOccupational Health nal healthHospital Indemnity R Customer ServiceHR Solution Center443-997-5400HRSC@jhmi.eduIllnesses and injuries (nonemergency, non-work related)Life and Accidental Death &Dismemberment InsuranceEmployee Health & n resources/benefits/healthy at hopkins/employee health wellness centerMetLife443-997-5400HRSC@jhmi.eduLong Term ng Term 0ehp.orgPet Prepaid Legal ription t dicine.org/jhhr/pensionjhm.trsretire.comShort Term DisabilityMetLife833-622-0136Tuition Assistance on Assistance 0-424-4450ehp.orgWhole Life InsuranceUNUM800-635-5597unum.comWorkLife ProgramLive Near Your near-your-workdiscountmember.lifecare.com

ContentsIntroduction.2Eligibility.3Medical Plans.4Medical Plan Comparison.6Prescription Drug Benefits.8Dental Plans.9Vision Plan. 10Flexible Spending Accounts.11Well-being. 12Life and Disability Plans. 13Education Benefits. 15Time Off. 16Retirement Benefits. 17Voluntary Benefits. 18Enrollment Instructions.20Plan Rates. 21Summary Plan DescriptionThe Johns Hopkins Summary Plan Descriptions (SPDs)provide detailed information about the plans provided underthe Employment Retirement Income Security Act of 1974.It contains the plan administrator’s identity, requirementsfor eligibility and participation in the plan, circumstancesthat may result in disqualification or denial of benefits, andthe identity of insurers. The SPDs can be obtained from theBenefits section of the Human Resources website:SPDs provide information about:hopkinsmedicine.org/human resources/benefits/guides summary plan descriptions.htmlIf you want a free hard copy of any of the resources above,or if you have benefits-related questions, contact the HRSolution Center at 443-997-5400 or hrsc@jhmi.edu. Medical, dental and vision Flexible spending accounts Life insurance Short term and long term disability Pension and 403(b) plans2021 Guide to Benefits1

IntroductionWe value the people who work here, and The Johns HopkinsHospital (JHH) and The Johns Hopkins Health System Corporation(JHHSC) are proud of the selection of benefits we’ve madeavailable to you. These benefits are an important part of yourtotal compensation package as a Johns Hopkins employee, andwe encourage you to take time to read this guide and becomefamiliar with all that we offer for you and your family. This guideprovides a brief overview of our benefits — it is not intended tobe a complete source of thSystemSystemCorporationCorporation

EligibilityEmployeesAll employees regularly scheduled to work 20 or more hours per week, as well asweekend option nurses, are eligible for most benefits. For all benefits except paid time off, short-term disabilityand tuition assistance, coverage for new hires or newly eligibleemployees is effective the first day of the month after their date of hireor eligibility with completion of enrollment. All newly hired employeeshave 30 days from their date of hire to complete enrollment. For paid time off and short term disability benefits,employees regularly scheduled to work 20 or more hours per weekare eligible after completion of any probationary period. Employee tuition assistance is available after completion of anyprobationary period, and dependent tuition assistance is available toregular full-time employees after four years of continuous service (or twoyears of continuous service for employees hired before Jan. 1, 2018).DependentsWhen you enroll in a medical, dental, vision or dependent life insurance plan, youmay also elect coverage for: Your children (with submission of a birth certificate and Social Securitynumber) up to age 26, regardless of the child’s student or marital status. Your legal spouse (with submission of a certifiedmarriage certificate and Social Security number).If your spouse works for a Johns Hopkins Medicine affiliate, you cannot be coveredas both an employee and a dependent. In addition, your eligible dependents mayonly be covered under one plan.Family Status ChangesOutside the annual enrollment period, the only time during the plan year that youcan add or drop coverage or dependents is when you have a family status change.Qualifying events include marriage or divorce, birth of a child, death of a dependent, gain or loss of a spouse’s coverage, and a change in your spouse’s employmentstatus.To make a mid-year change in benefits, you must create a Qualifying Life Eventrequest in the enrollment system and upload supporting documentation within 30days of the life event.WHO IS ELIGIBLE:Employees scheduled30 hours/week: All benefits in this guideEmployees scheduled20-29 hours/week: All benefits except dependenttuition and paid parental leaveWeekend Option Nurses: All benefits exceptdependent tuition, paidtime off, paid parental leaveand short-term disability2021 Guide to Benefits3

Medical PlansChoosing Your Health PlanPlans under our Employer Health Programs (EHP)include prescription drug coverage, feature lowdeductibles and copays, and offer reduced costswhen you use Johns Hopkins preferred providersand facilities. You can choose between two plans.EHP EPO (EXCLUSIVE PROVIDERORGANIZATION) PLANThe EHP EPO plan is designed to help lower your monthlyhealth care costs while providing a wide choice of providers.If you only use in-network providers, the EHP EPO plan maybe a cost-effective option. The plan offers in-network coverageonly (it does not cover out-of-network care) — you can visitany provider in the Preferred Network or the EHP Network.EHP EPO PLAN: In-network care only Lower biweeklypremiums Higher deductiblesand out-of-pocketmaximums Reduced costs atpreferred providersand facilitiesEHP PPO PLAN: In- and out-ofnetwork care Higher biweeklypremiums Lower deductiblesand out-of-pocketmaximums 4Reduced costs ofservices by preferredproviders and facilitiesBiweekly premiums are lower in the EPO plan than in the preferredprovider organization plan, but out-of-pocket costs may be higherwhen you seek care.EHP PPO (PREFERRED PROVIDERORGANIZATION) PLANYou can visit both in-network and out-of-network providers under thisplan. Biweekly premiums are higher in the PPO plan than in the EPOplan, while out-of-pocket costs when you seek care may be lower.Please see the Plan Rates section of this guide for medical planrates.For details on the Employer Health Programs’ medical plans,please visit benefits.ehp.org.Finding In-Network Care: Know YourCostsPreferred NetworkWhat you pay for care depends on the services you need and whereyou go. For most covered services from Preferred Network providersand facilities, both plans pay 90% of the costs and you pay 10% (afterany deductible). This is often the most affordable option.EHP NetworkYou also have access to the EHP Network, which pays 80% of the cost,while you pay 20%. Fees vary among providers, so sometimes a lowcost EHP network provider is the most affordable choice.Preventive care services from Preferred and EHP Network providersare covered 100%, including diagnostic services for preventive exams,preventive mammograms and preventive colonoscopy.Take time to compare plans and decide what works best for you. Ifyou’re not sure how your provider is covered, go to ehp.org to learnmore.Cigna NetworkCigna is an extended network of over 1 million nationwide in-network providers beyond those directly contracted in the EHPNetwork. Cigna’s PPO network providers in all U.S. states, includingMaryland, are available to all EHP members. Cigna PPO networkservices are covered as in-network benefits. To find a Cigna PPOprovider visit ehp.org.Out-of-Network CareUnder the PPO plan, out-of-network providers (those not in theEHP Network) are covered at 70%, and you pay 30% of the costs.However, under the EPO plan, out-of-network care is not covered,and you will pay 100% of the costs.The Johns Hopkins Hospital and Johns Hopkins Health System Corporation

Prescription Drug BenefitsWhen you enroll in a Johns Hopkins EHP medical plan,prescription drug benefits are included. This four-tier benefitoffers savings for using EHP’s approved drug formulary.A mail order option is available for most maintenancemedications.Terms You Should KnowAllowed amount: This is the amount the plan has negoti-ated with network providers to accept as full payment. Forexample, if a service is covered at 90%, you only pay 10% ofthe allowed benefit, up to your out-of-pocket maximum. Outof-network providers are not obligated to accept the allowedbenefit as payment in full and may charge you more. This iscalled balance billing.Balance billing: When an out-of-network provider billsyou for the difference between the provider’s charge and theallowed amount. For example, if the provider’s charge is 200and the allowed amount is only 155, 45 won’t be consideredwhen your claim is processed and the provider may bill youfor it. An in-network provider or facility cannot balance billyou for covered services.Out-of-Network providers: These are professional provid-ers and facilities who do not have a contract with EHP. Theirservices are subject to applicable copays, deductibles and coinsurance. These providers may balance bill you for charges above theallowed benefit amount.Preauthorization: This is a decision by your insurer or planthat a health care service, treatment plan, prescription drugor durable medical equipment is medically necessary. Thisis sometimes called prior authorization, prior approval orprecertification. EHP may require preauthorization for someservices before you receive them, except in an emergency.Preauthorization isn’t a promise that EHP will cover the cost.Preferred Network providers: Johns Hopkins and otherselect providers have contracts with EHP and have agreed toaccept discounted fees for their services. Preferred providerswill submit insurance claims to EHP on your behalf. You areresponsible for any copays, deductibles and coinsurance.Coinsurance: Coinsurance is the percentage of the cost youpay for certain covered services. The coinsurance percentage islower for services received from in-network providers than forthe same services from out-of-network providers.Copayment: This is a fixed dollar amount you pay at thetime service is rendered. This money goes directly to thehealth care provider.Deductible: The amount you pay each year before yourmedical plan begins providing benefits for care.EHP Network providers: These professional providers andfacilities have contracts with EHP and have agreed to acceptcertain fees for their services. They submit insurance claimsto EHP on your behalf. You are responsible for any copays,deductibles and coinsurance.Out-of-Pocket maximum: This is the most you will payout of pocket each year in deductible, copay and coinsurancecharges. When the total amount you have paid in a yearreaches the out-of-pocket limit, the plan will pay 100% ofyour copays and coinsurance for the remainder of the planyear (through Dec. 31).SPECIALTY APPOINTMENT LINE866-206-7210The Johns Hopkins EHP Specialty Appointment Linehelps facilitate more timely appointments for specialtycare with Johns Hopkins preferred providers.It is designed to improve all EHP members’ accessto Johns Hopkins specialty providers. The line is notintended to guarantee a specific turnaround time butinstead to ensure that whenever possible, EHP membersare seen within a reasonable time for their health issue.2021 Guide to Benefits5

Medical Plan ComparisonEHP EPO Plan(in-network only)Coverage DetailsPreferredNetwork**EHPNetwork**EHP PPO PlanPreferredNetwork**EHP Network**Out-ofnetworkAnnual Deductibleper person 500 150 ( 50K), 200 ( 50K- 120K), 300 ( 120K)(determined by salary tier) 750(all salary tiers)per family 1,000 300 ( 50K), 400 ( 50K- 120K) , 600 ( 120K)(determined by salary tier) 1,500(all salary tiers)per person 3,000 1,500 ( 50K), 2,000 ( 50K- 120K), 3,000 ( 120K)(determined by salary tier) 3,500(all salary tiers)per family 6,000 3,000 ( 50K), 4,000 ( 50K- 120K), 6,000 ( 120K)(determined by salary tier) 7,000(all salary tiers)Annual Out-of-Pocket Max.Coinsurancepay 10%pay 20%pay 10%pay 20%pay *EHP Network**Out-ofnetworkPrimary Care Office Visit 20 copay 20 copaySpecialist Office Visitpay 10%*pay 20%*pay 10%*pay 20%*pay 30%*Mental Health Visit 20 copay20 copay 10 copay 10 copaypay 30%*Wellness Visit 0 copay 0 copay 0 0pay **EHP Network**Out-ofnetwork 250 copay,then pay 10%* 250 copay,then pay 20%* 150 copay,then pay 10% 150 copay,then pay 20%* 500 copay,then pay 30%*Hospital Outpatientpay 10%*pay 20%*pay 10%*pay 20%*pay 30%*Lab Servicespay 10%*pay 20%*pay 10%*pay 20%*pay 30%* 250 copay* 250 copay* 250 copay* 250 copay* 250 copay* 40 copay 40 copay 25 25pay 30%*Office VisitsFacility ServicesHospital InpatientEmergency RoomUrgent Care 10 copay at designated PCP, otherwise 20 copay* For select services such as hospitalization, coverage begins once you have met the deductible for the year.** You can locate providers in the Preferred Network and EHP Network at ehp.org. The Preferred Network includes facilities and providers.6The Johns Hopkins Hospital and Johns Hopkins Health System Corporationpay 30%*

Medical Plan Comparison (cont’d)EHP EPO PlanNetwork**PreferredNetwork**EHP PPO PlanEHPNetwork**you pay 10%*you pay 20%*you pay 10%*you pay 20%*you pay 30%*Radiology Procedures(X-Ray, Ultrasound)you pay 10%*you pay 20%*you pay 10%*you pay 20%*you pay 30%*Advanced Radiology(MRI, CT, PET Scan)you pay 10%*you pay 20%*you pay 10%*you pay 20%*you pay ork**Network**Out-ofNetworkLab and DiagnosticsPreferredNetwork**Routine Lab TestsEmergency ServicesUrgent CareEHPOut-ofNetwork 40 copay 25 copay 25 copayyou pay 30%*Emergency Room(copay waived if admitted) 250 copay* 250 copay* 250 copay* 250 copay*Ambulance(Medically NecessaryTransport)you pay 10%*deductible,then no chargedeductible,then no chargedeductible,then no chargeEHPMental Health,Substance AbuseInpatient twork 250 copay peradmission,then pay 10%* 250 copayper admission,then pay 20%* 150 copay peradmission,then pay 10%* 150 copay peradmission,then pay 20%* 500 copayper admission,then pay 30%*Outpatient Facility 20 copay 10 copay 10 copayyou pay 30%*Outpatient Professional 20 copay 10 copay 10 copayyou pay **Network**Out-ofNetworkPhysical & OccupationalTherapy (60 visits peryear, pre-authorizationrequired for visits 13-60)you pay 10%*you pay 20%*you pay 10%*you pay 20%*you pay 30%*Speech Therapy (30visits per year, preauthorization required)you pay 10%*you pay 20%*you pay 10%*you pay 20%*you pay 30%*Chiropractic Care(20 visits per year)you pay 10%*you pay 20%*you pay 10%*you pay 20%*you pay 30%*Acupuncture(20 visits per year)you pay 10%*you pay 20%*you pay 10%*you pay 20%*you pay ork**Network**Out-ofNetworkHome Health Care(40 visits per year, preauthorization required)you pay 10%*you pay 20%*you pay 10%*you pay 10%*you pay 30%*Hospice Care(pre-authorizationrequired)you pay 10%*you pay 20%*you pay 10%*you pay 10%*you pay 30%*Therapy ServicesOther ServicesEHP* For select services such as hospitalization, coverage begins once you have met the deductible for the year.** You can locate providers in the Preferred Network and EHP Network at ehp.org.2021 Guide to Benefits7

Prescription Drug BenefitsUsing Your PrescriptionDrug BenefitsDrugs by Tier: Generic versus Brand NameWhen you get medications at a pharmacy, you are responsiblefor paying a copay or coinsurance.Prescription drugs are coveredunder the EHP medical plans. In most instances, your cost is the lowest whenyou select a generic drug — an affordable andeffective alternative to a brand name drug.Prescription drugs are available in four tiers, with savingswhen you use generic drugs or EHP’s preferred drugformulary. Preferred brand drugs have the next highest cost,but still cost less than other brand-name drugs. They arechosen for their clinical value and cost-effectiveness.Your cost to fill a prescription depends on which health careplan you are enrolled, the tier your drug is in, and whetheryou obtain the drug at a retail pharmacy or through mailorder (for maintenance medications). Nonpreferred brand name drugs are coveredunder the plan but have the highest cost. Finally, the cost of specialty drugs, which includeexpensive injectable and oral specialty medicationsfor specific conditions, depends on the drug.They are only available at a retail pharmacy.Retail versus Mail Order PrescriptionsYou can fill a prescription at any in-network CVS Caremarkpharmacy. Depending on your prescription, you may be ableto order a 90-day supply of maintenance medications, eitherat a retail pharmacy or through mail order. Mail order is aconvenient way to make sure your medications are current.If you are enrolled in the PPO medical plan, you can receivea discount when you use mail order to fill prescriptions formaintenance medications.Need More Information?You can find a list of preferred and nonpreferred drugs, learnabout quantity limits and prior authorization, and find anetwork pharmacy at:ehp.org/plan-benefits/pharmacySUMMARY OF PRESCRIPTION DRUG COSTSEPO PlanDrugs by TierGenericIn-Network Retail Pharmacy30-Day90-DayPPO PlanMail Order90-DayIn-Network Retail Pharmacy30-Day90-DayMail Order90-Day 10 copay 30 copay 30 copay 10 copay 30 copay 20 copayPreferred Brand25%, 40 min; 60 max25%, 120 min; 180 max25%, 120min; 180 max 40 copay 120 copay 80 copayNon-Preferred Brand50%, 65 min; 105 max50%, 195 min; 315 max50%, 195min; 315 max 65 copay 195 copay 130 copaySpecialty MedicationsAs Preferred/Non-PreferredRestricted to Retail30-day supplyAs Preferred/Non-PreferredRestricted to Retail30-day supplyEPO PlanPPO PlanAnnual Deductible 0 per person, 0 per family 0 per person, 0 per familyOut-of-Pocket Max 4,100 per person, 8,200 per family 3,600 per person, 7,200 per familyBenefitsNote: Oral generic contraceptives are 100% covered.8The Johns Hopkins Hospital and Johns Hopkins Health System Corporation

Dental PlansChoosing Your Dental PlanJohns Hopkins EHP offers you a choice of twodental plans through Delta Dental. Comprehensive Plan High Option PlanYou may receive care from any in-network or out-of-network provider, but yourout-of-pocket costs may be higher if you choose a non-PPO dentist. The two dentalplans are similar, the High Option Plan offers better benefits (including orthodonticcare) and slightly higher premiums.Please see the Plan Rates section of this guide for dental plan rates.Set up an online accountGet 24/7 information about your plan with an online services account at deltadentalins.com. Check benefits and eligibility, find a network dentist and more.Check in without an ID cardYou don’t need a Delta Dental ID card when you visit the dentist. Just provide your name,birth date, and ID or Social Security number. If your family members are covered underyour plan, they will need your information. If you prefer to show a paper or electronicdental ID card, sign in to Delta Dental’s online services to print or e-mail your card.IF YOU NEED TOSUBMIT A CLAIM, MAILIT TO:Delta Dental of PennsylvaniaP.O. Box 2105Mechanicsburg, PA 17055-6999Go to deltadentalins.com for more information, or call customer service at1-800-932-0783.SUMMARY OF DELTA DENTAL COSTSComprehensive PlanBenefits andCovered Services*Annual DeductibleMaximumsHigh PlanDelta Dental PPODentists**Out-of-NetworkDentistsDelta Dental PPODentists**Out-of-NetworkDentistsNone 50 per person, 150 per familyNone 50 per person, 150 per family 1,500 per person each calendar year 3,000 per person each calendar yearDiagnostic & Preventive ServicesExams, cleanings, x-rays & sealantsyou pay 0%you pay 20%you pay 0%you pay 20%Basic ServicesFillings, oral surgeryyou pay 20%you pay 40%you pay 20%you pay 40%Major ServicesCrowns, inlays, onlays,prosthodonticsyou pay 50%you pay 70%you pay 40%you pay 60%Orthodontic BenefitsAdults and dependent childrennot coverednot coveredyou pay 50%not coveredN/AN/A 1,500 LifetimeN/AOrthodontic Maximums* Limitations or waiting periods may apply for some benefits; some services may be excluded from your plan. Reimbursement is based on DeltaDental contract allowances and not necessarily each dentist’s actual fees.** Reimbursement is based on PPO contracted fees for PPO dentists,Premier contracted fees for Premier dentists and PPO contracted feesfor non-Delta Dental dentists.2021 Guide to Benefits9

Vision PlanEHP Vision PlanUnder the EHP vision plan, you can receive a full range of optometry and ophthalmology services. You and your coveredfamily members may each have one vision exam every year. Eyeglasses or contact lenses are available for a 10 copay and arecovered from 70– 175, depending on the frames or lenses required. The plan covers vision care services by providers in theRoutine Vision Care network as well as out-of-network providers. If you receive care from an out-of-network provider youmay pay more for some services.You can locate providers at ehp.org.Please see the Plan Rates section of this guide for vision plan rates.SUMMARY OF EHP VISION COSTSRoutine Vision Care NetworkContact LensesEyeglasses/Materials*Vision Exam**Out-of-NetworkMedically necessary 10 co-pay, then up to 170 10 co-pay, then up to 170Elective 10 co-pay, then up to 100 10 co-pay, then up to 100Single Vision 10 co-pay then up to 75 10 co-pay then up to 70Bifocal 10 co-pay then up to 95 10 co-pay then up to 80Trifocal 10 co-pay then up to 120 10 co-pay then up to 110Lenticular 10 co-pay then up to 175 10 co-pay then up to 160Frames 10 co-pay then up to 120 10 co-pay then up to 120Vision Exam 10 co-pay, then 100%Up to 35* One copay is charged for all materials combined.** One routine exam or contact lens fitting is covered every 12 months; contact lens fitting fee may be provided inlieu of eye exam, but not in the same benefit year.10The Johns Hopkins Hospital and Johns Hopkins Health System Corporation

Flexible Spending Accounts (FSA)Save on Taxes Each YearKeep more of the money you earn by enrolling in a flexiblespending account (FSA). FSAs offer you an easy way to save:You set aside money each paycheck on a pre-tax basis to usefor eligible expenses. There are two types of FSA, which coverdifferent types of expenses. You can enroll in one or both. Health care flexible spending account Dependent care flexible spending accountHealthEquity, formerly WageWorks, administers our flexiblespending accounts. For more information, visit wageworks.com.HEALTH CARE FSAWith a health care FSA, you can set aside pre-tax funds eachpay period to pay for medical expenses for you and yourdependents, including: Deductibles, coinsurance, office copaymentsand prescription drug copayments Eyeglasses, contact lenses, prescription sunglasses Orthodontia Immunizations/vaccinations (including flu shots)The maximum amount you may contribute per calendaryear is 2,750. If you enroll midyear, be sure to choose yourcontributions based on the pay periods left in the year.Carry Over 550 ofHealth Care FSA Funds Each YearYou can carry over up to 550 from one year to the next. Thatmeans you don’t have to worry if there’s a little money inyour health care FSA at the end of year — it will still be therewhen you need it in the following year. However, funds over 550 are forfeited at the end of the year.DEPENDENT CARE FSAA dependent care FSA reimburses you for expenses such asday care, before and after school programs, nursery school orpreschool, and adult day care.The maximum amount you may contribute per year is 5,000.Your contributions are distributed across all pay periods. Nocarry-over option is available in dependent care FSA plans —all unused funds at the end of the calendar year are forfeited.If you enroll midyear, be sure to choose your contributionsbased on the pay periods left in the year.SUBMITTING A CLAIMYou have until March 31 each year to file a claim, if necessary,for expenses you incurred during the previous year. EZ Receipts mobile app. Download thisfree mobile app to take a photo of receiptsand instantly submit them for payment. Pay My Provider. Access your FSA online and fill outa simple form to pay providers directly. This is best usedto pay for dependent care monthly, or for health carethat requires a recurring payment, such as orthodontia. Pay Me Back. File claims quickly and easily online,and get reimbursed quickly by direct deposit or check.HealthEquity processes claims in one to three business days.Visit irs.gov/pub/irs-pdf/p502.pdf (health care) or irs.gov/pub/irs-pdf/p503.pdf (dependent care) for a list of eligibleexpenses.Note: If your employment ends, FSA accounts and thepayment card are terminated on the last day of employment.Only claims incurred before your last day of employment willbe processed for reimbursement. All claims must be submitted within 90 days of employment end date.Payment CardThe first time you enroll in a health care FSA, you will receivea prepaid card from HealthEquity to be used for eligiblemedical expenses. Always remember to save your receipts.2021 Guide to Benefits11

Well-BeingSupport and Guidance on YourWell-Being JourneyAs a leader in health care, the Johns Hopkins Health System iscommitted to promoting healthy lifestyles and supporting ouremployees by creating an overall culture of health and well-being.We have built a workplace where it is easy to make healthy choices.We hope you’ll take advantage of the wide variety of programs andresources, such as smoking cessation, nutrition management andfitness. A comprehensive list of offerings can be found at bit.ly/HealthyatHopkinsResources.The Healthy at Hopkins portal is another way we help you takecharge of your health. The portal provides a one-stop shop foremployee health, including health and wellness events, integrationof activity data with wearable devices, tracking tools, an extensivelibrary of Johns Hopkins-sponsored health information and ourHealthy at Hopkins Rewards Program.Through Healthy at Hopkins, employees can complete activitiesthroughout the year to earn points for a onetime award at the endof the year. Regular full-time and regular part-time employeesare eligible to earn up to a 500 reward, and limited part-timeemployees can be awarded as much as 250.To

provider organization plan, but out-of-pocket costs may be higher when you seek care. EHP PPO (PREFERRED PROVIDER ORGANIZATION) PLAN You can visit both in-network and out-of-network providers under this plan. Biweekly premiums are higher in the PPO plan than in the EPO plan, while out-of-pocket costs when you seek care may be lower.