Transcription

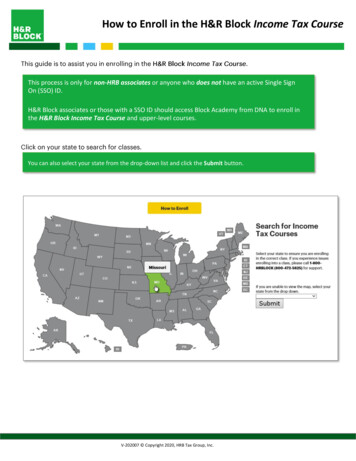

How to Enroll in the H&R Block Income Tax CourseThis process is only for non-HRB associates or anyone who does not have an active Single SignOn (SSO) ID.H&R Block associates or those with a SSO ID should access Block Academy from DNA to enroll inthe H&R Block Income Tax Course and upper-level courses.You can also select your state from the drop-down list and click the Submit button.V-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseAll fields that have a * next to them are required.If you have an account created already, click on the “Already a User? Login here” link.V-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseThe email address used will be your Username for your guest account and must be a valid email address.You will receive an email at that address with a link to complete your account registration.V-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseAll fields that have a * next to them are mandatory.V-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseIf you have been given a coupon code, you can enter it in the Purchase Summary section in theupper-right portion of the screen. Enter the code and click the Apply button.V-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseIf you are having difficulty finding classes using your City and State, try just searching using the PostalCode.ALL session times are initially displayed in Central Time Zone until you change your time zone in youraccount preferences. You will have an opportunity to do this after creating your account.V-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseAll fields that have a * next to them are required.If you have an account created already, click on the “Already a User? Login here” link.V-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseThe email address used will be your Username for your guest account and must be a valid email address.You will receive an email at that address with a link to complete your account registration.V-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseAll fields that have a * next to them are mandatory.V-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseIf you have been given a coupon code, you can enter it in the Purchase Summary section in theupper-right portion of the screen. Enter the code and click the Apply button.V-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax CourseV-202007 Copyright 2020, HRB Tax Group, Inc.

How to Enroll in the H&R Block Income Tax Course V-202007 Copyright 2020, HRB Tax Group, Inc. Author: Keschinger, John Created Date: 9/1/2020 12:53:34 PM