Transcription

The State EmploymentImpact of a 15Minimum WageTechnical Analysis By:Dr. William Even, Miami UniversityDr. David Macpherson, Trinity UniversityJanuary 2021

About the EconomistsDR. DAVID MACPHERSON is the E.M. Stevens Professor of Economics at TrinityUniversity, where he also serves as department chair. Prior to joining TrinityUniversity, he held the Rod and Hope Brim Eminent Scholar Chair in Economics,and was Director of the Pepper Institute on Aging and Public Policy at Florida StateUniversity. Earlier, he served as an assistant and associate professor of economicsat Miami University. Macpherson’s research has been concentrated on examiningfactors that cause deviations from wage equalization. In particular, he has focusedon the role of trade unions, pensions, wage discrimination, industry deregulation,and the minimum wage. Macpherson has written over 60 journal articles and bookchapters. He is a co-author of the undergraduate textbooks Economics: Privateand Public Choice and Contemporary Labor Economics. He also co-authored thebook Pensions and Productivity. With Barry Hirsch, he provides union data toresearchers and the public through the web site www.unionstats.com.DR. WILLIAM EVEN is a Professor of Economics in the Farmer School of Businessat Miami University. He received his Ph.D. in economics from the University of Iowain 1984. He is a research fellow with the Scripps Gerontology Center, the EmployeeBenefits Research Institute and the Institute for the Study of Labor. His recentresearch examines the effects of minimum wage laws, the Affordable Care Act, theeffect of Greek affiliation on academic performance, and the relationship betweenskills and earnings among older workers. His research has been funded by severalorganizations including the U.S. Administration on Aging, the U.S. Departmentof Education, and the Employment Policies Institute. Even has published journalarticles in a variety of outlets including the Journal of Labor Economics, the Reviewof Economics and Statistics, the Journal of Human Resources, Economic Inquiry,Industrial and Labor Relations Review, and Industrial Relations. His recent teachingexperience includes courses in introductory microeconomics, labor economics, andundergraduate and graduate courses in econometrics.THE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE2

Executive SummaryThe crisis created by the spread of COVID-19 and subsequent shutdowns hasseverely affected America’s employees and businesses, and state economies stillface a long road to full recovery to pre-pandemic activity levels. As part of hispandemic relief plan, President Biden has proposed raising the federal minimumwage to 15 and eliminating the tip credit—a plan that is estimated to cost over 2million jobs nationwide.The pandemic placed severe hardships on employers, slashing revenues and cashflows that resulted in layoffs and furloughs of over 20 million employees in the firstthree months of the outbreak in the United States.1 For businesses in hospitalityor restaurants where profit margins are already narrow, job losses and businessclosures were especially rampant, and recovery to pre-COVID levels remainsslow.2 Additional government restrictions on business reopening have continued tonegatively affect businesses and employees: for establishments struggling to remainopen, oftentimes cutting jobs or workers’ hours has been one of the only solutions.3In spite of mounting obstacles to staying in business, Biden’s proposal to raise thefederal minimum wage to 15 and end the tip credit would create more hardshipand losses for already-struggling businesses.In this study, economists William Even and David Macpherson estimate the impactsof a similar policy by using a methodology based on assumptions developed bythe nonpartisan Congressional Budget Office’s assessment of the 2019 Raisethe Wage Act. This methodology features updated assumptions that account forchanges since 2019, including the coronavirus outbreak. The economists providestate- and demographic-level estimates of the employment impact of raising thefederal minimum wage to 15, comparing employment effects by age, sex, race andethnicity, occupation type, and industry.They estimate that if enacted, Biden’s proposal would result in 2 million jobs pay-and-hourssurvey-finds.htmlTHE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE3

across the United States.4 This plan, which is estimated to cost employers acrossthe country over 99 billion, will cause massive job cuts in most states, particularlythose at or near the current federal wage, including Pennsylvania (143,402 jobslost), Ohio (108,312), Wisconsin (83,683), South Carolina (55,304), Utah (35,039),New Hampshire (13,179), West Virginia (12,331), and Delaware (10,044).In this release, the economists also provide the estimated cost of a 15 minimumwage to employers by state and by industry. Nationally, states’ restaurant andbartending employees are projected to bear a large portion of the resulting joblosses, and the economists estimate that Biden’s proposal will cost the nation’srestaurants and bars 27 billion alone.The impact on job losses in this study does not account for slowed employmentgrowth, and in some cases job loss, in areas where the minimum wage has alreadybeen increased to 15. In addition, the study only analyzes impacts through 2027,a period of time put forth by the Raise the Wage Act in 2019. Depending on thetimeline for implementing a 15 minimum wage and eliminating the use of thetip credit, the negative effects on businesses and their employees could be muchgreater.Federal and state policymakers must take into account the impact of enactinga 15 federal minimum wage: artificially raising labor costs for employers whilethey struggle to recover from the pandemic will cause states to lose hundreds ofthousands of jobs.4This analysis of estimated employment impacts resulting from a federal minimum wageincrease to 15 was conducted before Florida passed their own 15 state minimum wage.Therefore, actual job losses in Florida will result from the state policy, not from a nationalminimum wage raise as is estimated in this study.THE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE4

The Movement to Raise the FederalMinimum WageSince its inception nearly a century ago, the inflation-adjusted value of the UnitedStates federal minimum wage has fluctuated from its lowest, 4.14 in 1948, to itshighest, 10.28 in 1963.5 Since 1990 as the nominal federal minimum wage hasrisen rapidly from 3.35 per hour, the inflation-adjusted value of minimum wagerates over the years has fluctuated around 7.44.In recent history, movements across the country and within individual states havepushed to nearly double the minimum wage to 15 per hour, increase tipped wagesat similar rates, and eliminate tip credits altogether. As of 2020, twenty-eight citieshave enacted at least a 15 minimum wage floor, including San Francisco andSeattle.6 In addition, seven states and the District of Columbia have implemented a 15 minimum wage, most of which include phased increases to reach this new levelover several years.7Across the US, states have already enacted minimum wage hikes that supersedethe current federal level, which currently stands at 7.25. While each of the 50states vary in terms of cost of living, business earnings growth, and inflation, morethan half are set to raise their minimum wage levels by 2027. Of those slated toexperience state-level minimum wage growth over the next six years, 17 states willraise levels by up to 4, and nine will raise levels by more than 4. For those stateswithout legislation raising their minimum wage, six already have levels that arehigher than the federal minimum.8 For a full list of already enacted minimum wageincreases by 2027, see Appendix Table A1.5Adjusted to reflect 2019 dollar values. https://fred.stlouisfed.org/graph/?graph id ge-lawsdoubled-this-yearTHE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE5

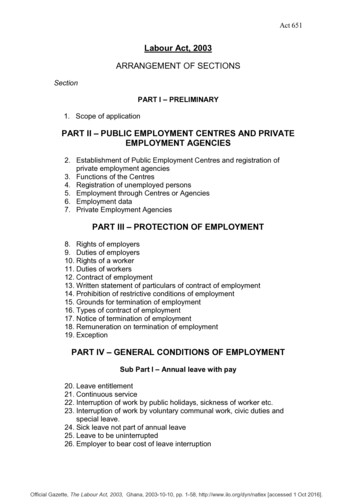

Currently scheduled minimum wage increases, by amount of increase.Amount Increase2019 -2027States Included 0AL, DE, GA, HI, IA, ID, IN, KS, KY, LA, MS, NC, ND, NE, NH,OK, PA, RI, SC, TN, TX, UT, WI, WV, WY 0.01 - 2.99AK, AR, AZ, CO, FL, ME, MI, MN, MT, NY, OH, SD, VT 3 - 3.99DC, NV, OR, WA 4 - 4.99CA, MA, MD, MO, NM 5 - 5.99CT, NJ, VA 6 - 6.99IL 7 - 7.99noneThe movement toward raising the federal minimum wage to 15 has gained tractionwith elected officials at the federal level as well. Out of 27 Democratic candidates forpresident in the 2020 election, 21 expressed affinity for raising the federal minimumspecifically to 15, while two others also endorsed raising the federal minimum by aslightly lower amount.9 The party-nominated Biden-Harris campaign has expressedits view on the issue, building a 15-per-hour minimum wage into the campaign’splatform.10 Advocates of raising the federal minimum wage have also endorsed theDemocratic nominee as a champion for minimum-wage workers.11Facing potential ideological shifts in the Legislature and Oval Office in the upcomingNovember election, understanding the impacts of significantly raising the federalwage floor will be especially important to affected employees, businesses, and thegreater economies subject to experience HE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE6

Background on Raise theWage Act (2019)The most recent proposal that has come to fruition from nation-wide campaigns forincreasing minimum wage, entitled the “Raise the Wage Act”, was passed by theU.S. House of Representatives in July 2019. If enacted, the legislation would raisethe federal minimum, currently set to 7.25, to 8.40. Each year thereafter wouldsee a 1.10 increase to the minimum wage, until it reaches 15. If this bill were topass the Senate and be signed into law in 2021, this 15 level would be reachedby 2027. Subsequently, future annual increases to the federal minimum would beindexed to the median hourly wage for employees.12 According to this proposal,tipped minimum wages would also increase incrementally to 12.60-per-hour aftersix years, raising the federal minimum tipped wage by 491 percent. Once they reachthis level, the tipped minimum would be subject to rise by 1.50 annually until itreaches the regular minimum level, at which point the tip credit would be eliminatedand the tipped minimum will equal the regular minimum.This staggering rate of increase in the federal minimum wage is unprecedented, andwould have significant impact as businesses and employees seek to adjust to theserapidly changing wage floors. From 2000 to the present, the federal minimum roseby 41 percent. If enacted, the Raise the Wage Act dictates that the federal minimumwill rise by 107 percent from 2020 to 2027.Recent Increases in U.S. Federal Minimum Wage (2000-2020)Compared with Raise the Wage Act Proposals (2021-2027). 15 12 9 6 3 ll/116th-congress/house-bill/582/textTHE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE7

Many states would be required to increase minimum wage levels beyond currentlyscheduled hikes if the federal minimum were raised to 15 per hour. In addition,if the Raise the Wage Act is passed, a majority of states will be required to raisetheir minimum wage levels by 5 or more by 2027, a significant shock to stateeconomies and business owners in a relatively short period of time. For a full list ofstate minimum wage increases that would be required to comply with a federal 15minimum, view Appendix Table A2.State-by-state minimum wage increases required by 2027 to comply with theRaise the Wage Act 15 federal minimum.Regular StateMinimum IncreaseStates Included 0 - 2.99none 3 - 3.99CO, DC, NY, OR, WA 4 - 4.99AZ, CA, HI, MA, MD, ME, RI, VT 5 - 5.99AK, AR, CT, DE, MI, MN, NJ, SD 6 - 6.99FL, IL, MO, MT, NE, NV, OH, WV 7 - 7.99AL, GA, IA, ID, IN, KS, KY, LA, MS, NC, ND, NH, NM,OK, PA, SC, TN, TX, UT, VA, WI, WY**States in red denote a state that, aside from potential implementation of a 15 federal minimumwage, do not have minimum wage increases currently slated through 2027.The impact on tipped wages will be significant as well. If a federal minimum tippedwage is enacted to reach 12.60 by 2027, thirty-three states will be required toraise their tipped wages by 8 or more in the next six years. This period of steepwage growth for tipped workers would be followed by further rises, as the minimumtipped wage would continue to grow by 1.50 annually until it matches theregular minimum wage. Such growth could be considered unsustainable for manybusinesses, localities, and states. To view a full list of state-by-state increases in theminimum tipped wage required to comply with a federal tipped minimum of 12.60by 2027, see Appendix Table A3.THE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE8

State-by-state minimum tipped wage increases required by 2027 to comply withthe Raise the Wage Act 12.60 federal tipped minimum.State TippedMinimum IncreaseStates Included 0 - 1.99none 2.00 - 3.99AK, HI, MN, OR, WA 4.00 - 5.99AZ, CA, CO, MT, NV 6.00 - 7.99CT, FL, IL, ND, SD, VT 8.00 - 9.99AR, DC, IA, ID, MA, MD, MI, MO, NJ, NH, OH, PA, RI, WV 10.00 AL, DE, GA, IN, KS, KY, LA, MS, NC, NE, NM, OK, SC, TN, TX,UT, VA, WI, WYTHE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE9

Economic Implications of a 15Federal Minimum WageThe 15 minimum does not have historical or economic precedent, and a nationalincrease of this magnitude could have serious negative impacts on the nation andeach individual state. Despite the fact that minimum wage policy intends to raisewages for the lowest earners in society, significant changes such as raising thefederal minimum to 15 may actually have negative effects on the poorest workers.In a 2018 study, David Neumark concludes:“Research on the US fails to find evidence that minimum wageshelp the poor; they may actually increase the number of poor andlow-income families.”13Neumark notes that more than half of poor households have no workers, andalso that some workers are poor because of low hours, not low wages. Increasingminimum wages to 15 does not alleviate any of this type of poverty. In fact, newand traditional literature on the effects of minimum wage raises suggest that despiteminimum wage-earners receiving higher wages due to these policies, the increasedcost to business owners to employ such workers will result in reduced employment.As business owners experiencing limited profit margins and cash flow are facedwith steep annual increases in employment costs, which do not necessarily matchthe rate of revenue increases, employers will be forced to cut costs by eliminatingjobs altogether.In a 2019 review of traditional and new literature surrounding the minimumwage issue, Jeffrey Clemens challenges a 15 federal minimum wage and arguesthat such a policy would have severe effects on minimum wage employmentopportunities, especially for low-skilled workers:“This is particularly true when we consider regions where low housingand labor costs support the social and labor market integration of bothimmigrants and low-skilled native-born workers. More than doublingthe minimum wage, from 7.25 to 15.00, risks radically altering theentry-level opportunities on which these individuals mum-wage-roadmap-navigating-recent-researchTHE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE10

Evidence from areas that have previously enacted significant minimum wage raisesalso suggests a negative impact on employment. After Seattle’s minimum wagewas raised to 13 in 2016, researchers at the University of Washington found thathours worked by low-wage employees were reduced, and total payroll in such jobsdeclined despite the hourly wage increase, due to the decrease in hours worked.15In San Francisco, another city with a 15 minimum wage, as the minimum wageincreased over time, each 1 increase correlated with a 14 percent increase in theprobability that a median-rated restaurant would close, according to a study fromHarvard Business School.16 The authors noted that there was no significant impactof minimum wage increases on 5-star restaurants, suggesting that businessesalready struggling to bring in customers may be most overwhelmed by minimumwage increases and be forced to lay off employees, and ultimately close, in order tocut losses.Published in the Federal Reserve Bank of San Francisco’s Economic Letter,Neumark concludes that due to the inevitability of losing jobs as a result of raisingminimum wage levels, policy makers must analyze the costs and benefits ofenacting heightened minimum wage policies. In addition, Neumark notes that theimpact of lost jobs due to minimum wage policy must be taken into account whenassessing the effects of minimum wage on alleviating poverty, as some workers mayexperience increases in take-home pay at the cost of other workers’ ://papers.ssrn.com/sol3/papers.cfm?abstract id iles/el2015-37.pdfTHE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE11

Analysis of Raising the FederalMinimum Wage to 15In 2019, the nonpartisan Congressional Budget Office (CBO) released a studyanalyzing the effects of raising the federal minimum wage from 7.25 to 15.Economists William Even and David Macpherson analyze the specific Raise theWage Act proposal, which would not only raise the federal minimum to 15, butalso raise the tipped minimum wage to 12.60 by 2027. (The full methodology canbe found in the subsequent section.)The economists use the same methodology as that in the 2019 CBO study, butupdate assumptions about the growth of future wages, employment, and pricesto reflect CBO forecasts released in 2020. They analyze impacts for two cohortsof employees: tipped, where the proposed minimum by 2027 is 12.60, and nontipped, where the proposed minimum by 2027 is 15.Using CBO methodology and updated economic assumptions from the CBO, theeconomists estimate that out of 19 million workers that will be affected by a risingfederal minimum wage, over 2 million jobs will be lost due to this policy. Half ofthe job losses will be concentrated in the Arts, Entertainment, and Recreation andAccommodation and Food Services industries, as 0.9 million jobs will be lost inrestaurants and bars alone.The following map presents total job losses projected for each state by 2027 dueto raising the federal minimum wage to 15. Texas projects to have the highestlosses, totaling over 370,000 jobs lost by 2027. Pennsylvania, Florida, NorthCarolina, Ohio, and Georgia are all expected to see over 100,000 jobs lost in thenext six years as well.THE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE12

Projected Job Losses by 2027 due to the Raise the Wage ActStateNumber of Jobs Lost by 2027StateNumber of Jobs Lost by 2027Texas370,664New *133,328Idaho19,801North Carolina121,581Nebraska18,639Ohio108,312New 84,554Nevada14,921Wisconsin83,683New Hampshire13,179Indiana83,517West Virginia12,331Louisiana60,644New Jersey11,825Michigan59,411Illinois10,688South na6,475Oklahoma44,983South Massachusetts5,791Kansas34,425North Dakota4,672Iowa33,080Arizona4,157THE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE13

StateNumber of Jobs Lost by 2027StateNumber of Jobs Lost by 2027Rhode Island3,909Connecticut1,269Hawaii3,630Dist. of ton0Vermont1,425Oregon0Maine1,282536*Note: This analysis of the job impacts of a 15 national minimum wage includes effects on Florida,which were estimated prior to the November passage of Amendment 2, a ballot measure to raise thestate’s own minimum wage to 15 by 2026. The job loss estimated here is the projected result for afederally-binding wage increase where Florida’s state level was lower. In a state-specific study, theeconomists estimated Amendment 2 would cost the state 158,000 jobs, due to the ballot measurelanguage taking effect one year earlier than the national increase analysis, and Florida’s annualindexing of its minimum wage prior to the new schedule.These projections account for future job losses if a federal 15 minimum wage isenacted in 2021. However, these impacts, if realized, will add to losses alreadyincurred due to areas that have already escalated minimum wage levels to 15 orhigher. This analysis will not capture the full impact of raising the federal minimumon employment in states that have already implemented phased plans to raise theirminimum wages to 15. States that have enacted plans to phase-in a 15 minimumwage include California, New York, Illinois, Massachusetts, Connecticut, NewJersey, and Maryland, as well as the District of Columbia, which currently has a 15minimum wage.In a study that particularly focuses on impacts in Florida, where increasing the stateminimum to 15 is on the ballot this November, the economists note the vulnerabilityof these projections: due to COVID-19 and other economic factors, a wider range ofbusinesses and jobs may be affected by a rapidly rising federal minimum wage thaneven presented in this analysis.By breaking down these losses demographically, the economists conclude thatcertain groups across the United States will be more severely affected by a nationalminimum wage hike. Workers from the 16 – 19 age group will be disproportionatelyaffected in terms of job loss, accounting for 42 percent of projected job losses by2027. The teenage category also claims the highest ratio of jobs lost per number ofaffected employees: over 32 percent of jobs affected by minimum wage hikes for 1619 year olds will be lost. All age categories will experience job loss, however, withthe 65 and over group projected to see nearly 75,000 lost jobs by 2027 due solely tothe steadily rising national minimum wage.THE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE14

Job loss distribution by age16-1920-2425-3435-4445-5455-6465 700,000-800,000-900,000Affected by 15Minimum WageJob Loss for 15Minimum WagePercent of JobsAffected to be 76.0%65 1,164,19074,7696.4%19,031,2052,014,32010.6%Age GroupTotalWomen are also likely to experience significantly more job losses than men as aresult of a 15 federal minimum wage. Analysis by the economists shows that notonly are 59 percent of minimum wage jobs held by women and slated to be affectedby these wage increases, this means that 1.2 million jobs held by women will be lostby 2027 due to this policy, accounting for 61 percent of total losses.THE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE15

Job loss distribution by sexAffected by 15Minimum WageJob Loss for 15Minimum WagePercent of JobsAffected to be 11.0%Total19,031,2052,014,32010.6%SexMaleLosses will manifest by race and ethnicity groups as well. While proposed minimumwage increases will affect jobs held largely by white and non-Hispanic workers, thepercentage of losses through 2027 to affected jobs is significant and comparableacross all groups. For example, the number of jobs lost for each group will accountfor 11 percent of affected jobs for white workers, 9 percent of affected jobs for blackworkers, and 11 percent of affected jobs for workers in other race categories. Nearly10 percent of jobs affected for workers identifying as Hispanic will also be lost as aresult of raising the federal minimum wage by 2027.Job loss distribution by race and eAffected by 15Minimum WageJob Loss for 15Minimum WagePercent of AffectedJobs to be ,014,32010.6%THE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE16

000Affected by 15Minimum WageJob Loss for 15Minimum WagePercent of AffectedJobs to be cTipped workers will also experience more vulnerability than non-tipped workers toraising the minimum wage to 15. This is especially impactful, as tipped workersearn more than minimum wage due to their tips, and have resisted efforts toeliminate the tipped wage. Tipped employees are guaranteed by the Fair LaborStandards Act to receive compensation equivalent to the regular minimum wage inthe event that tips do not put total wages at or above the minimum.18 According todata by the U.S. Census Bureau, the average hourly wage for a tipped restaurantemployee is nearly 14, with top earners making more than 24 per hour.19 A 2016Census Bureau study found that increasing the tipped minimum wage by 5 or 6percent subsequently results in a decrease in tip income of similar magnitude, andemployment for tipped employees decreases as the tipped minimum wage rateincreases.20 By raising the federal tipped minimum wage to 12.60 by 2027, thisrepresents anywhere from a 27 to 491 percent increase depending on the state’scurrent level, which could have a severe impact on weekly earnings of q/esa/flsa/002.htm#: :text s%20the&text rs/2016/adrm/carra-wp-2016-03.pdfTHE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE17

Restaurant servers have spoken out against eliminating the tip credit due to the factraising their wages to a federal minimum would reduce tips, and as a result theirtotal compensation. This hike would ultimately would create increased labor costsand a reduced number of jobs in the affected industries. After originally eliminatingthe tip credit, Maine voters passed a referendum in 2017 to restore the state tippedwage after tipped workers testified that eliminating the tip credit resulted in lowercompensation.21 Servers in New York and Washington, D.C. also rallied against thepush to raise the tipped wage to the city minimum wage.22 As legislators in NewMexico introduced bills in favor of raising the regular and tipped minimum wagelevels, a former server reflected:“ Most servers and bartenders earn well over the minimum wage.Many of us see ourselves as professional, commission-basedsalespeople. A minimum wage without a tip credit would effectivelyturn career servers — the most experienced of whom can earn up to 24 an hour or more — into entry-level employees. If legislators hadconsulted with tipped workers, they would learn that we have noappetite for one unfair wage.”23While 1.3 million non-tipped workers and 693,000 tipped workers will experiencejob loss by 2027, the number of jobs lost for tipped workers represents a muchhigher proportion of affected jobs. Nearly 31 percent of tipped workers affectedby this rise in minimum wage will lose their jobs by 2027, while only 8 percent ofnon-tipped workers affected will lose their jobs. Raising the tipped minimum bythis magnitude would be an especially cruel burden on tipped employees, as theseprojected earnings and employment losses would be the result of a policy that suchemployees have actively resisted. This also does not account for subsequent raisesin the tipped minimum wage past 2027, which will continue to rise by 1.50 annuallyuntil it reaches the same level as the non-tipped minimum, eliminating the tip credit.Such further increases may continue to add to the job loss experienced by tippedworkers across the ww.facebook.com/groups/1816776225063871/ ican.com/opinion/my rease/article 5564d648-58f9-54e4-aa75-a6487e9577db.htmlTHE STATE EMPLOYMENT IMPACT OF A 15 MINIMUM WAGE18

Job loss distribution by occupation typeNon-Tipped WorkersTipped -1,200,000-1,400,000Affected by 15Minimum WageJob Loss for 15Minimum WagePercent of Jobs Affectedto be LostNon-Tipped workers16,792,4811,320,7797.9%Tipped workers2,238,724693

specifically to 15, while two others also endorsed raising the federal minimum by a slightly lower amount.9 The party-nominated Biden-Harris campaign has expressed its view on the issue, building a 15-per-hour minimum wage into the campaign's platform.10 Advocates of raising the federal minimum wage have also endorsed the