Transcription

THE TAMIL NADUTRAVELLING ALLOWANCE RULES2005 EDITION[corrected upto 31st January 2005] GOVERNMENT OF TAMIL NADU2005

PREFACEThe 1993 edition of the owancetoGovernment servants and alsothe amendments issued to thevarious rules, etc., upto theperiod ending 9-3-1993.It has now been decided entstothevariousrules, etc., issued upto 31-12005.Any error or omission found inthis volume may be brought tothe notice of the Secretary toGovernment,FinanceDepartment.

N.NARAYANANFort St. George,Chennai – 600 009.Dated: 4-4-2005.Development CommissionerandPrincipal Secretary to GovernmentFinance Department

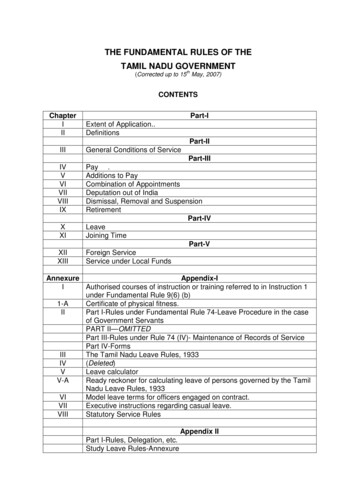

TABLE OF CONTENTSPART-ITAMIL NADU TRAVELLING ALLOWANCERULESRulesPages1.Title and Extent of Application112.Definitions21-53.Controlling Officers3-75-64.Grades of Government Servants8-1075.Different kinds of TravellingAllowance117-86.Government Servants notentitled to Travelling Allowance1287.Fixed Travelling Allowance13-179-118.Mileage Allowance18-2711-169.Journey by Railway28-321710.Journey by Sea33-351811.Journey by Air36-3818-2312.Daily Allowance on Tour39-4523-2713.Incidential Charge4628-2914.Flat Charge46 (A)3015.Special Rates for Speciallocalities473116.Actual expenses48-513117.Journeys by Conveyances52-5731-3218.Journeys on Tour58-6433-4019.Journeys of newly appointedGovernment Servant to join hisfirst post.65-6840-4120.Journeys on Transfer69-8541-59

RulesPages21.Journeys to attend onExamination86-8960-6122.Journeys when proceeding onor returning from leave90-9261-6323.Journeys on retirement,dismissal or termination ofemployment93-9563-6424.Journeys to give evidence96-10564-6625.Journeys on a course of Training10666-6926.Journeys for Special purposes107-10969-7127.Travelling allowance to thefamily of a Government servantwho dies in service1107228.Duties and powers110 (A) 110 (C)72-7429.Travelling Allowance Bill110 (D)74-7630.Special Rules for HigherOfficials1117731.Special Rules for Particulardepartments or officers11277ANNEXURESVideRulesI.II.III.Grades of GovernmentServants, rates of DailyAllowance—Mileage, etc.Pages8, 23,29, 40& 46A79-83List of Government Servantswho are not entitled to TravelingAllowance for ordinary journeyswithin their sphere of duty.1283Rates of Fixed MonthlyTravelling Allowance1784-85

VideRulesPagesIV.List of Governments andEstablishments exempted fromoperation of Rule 44 (30 dayshalt)4486-92V.List of Special Tracts in whichdaily allowance and mileage areincreased4793-99VI.List of Officers who, on transfer,are entitled to transport theirconveyances at the expense ofthe Government7099-100VII.Special Rules for High OfficialsVIII.XI.111Section-A. Governor101-105Section-B. Ministers106-117Special Rules for particulardepartments or officers RajBhavan StaffFixed Travelling AllowanceStatement of Short Tours andRecoveries112118-120110D121PART-IITravelling Allowance Rules ofPersons other than GovernmentServants122-126

PART-ITAMIL NADU TRAVELLING ALLOWANCERULESTITLE AND EXTENT OF APPLICATIONIn exercise of the powers conferred byFundamental Rule 44, the Governor of Tamil Nadu herebymakes the following rules:—1. These rules may be called the Tamil NaduTravelling Allowance Rules. They apply to all Governmentservants under the administrative control of the Tamil NaduGovernment who are subject to the Fundamental Rules andwhose pay is debitable to the Consolidated Fund of the Stateor the Consolidated Fund of tants of the Indian Audit and AccountsDepartment on deputation with the State Governmentshall be regulated under the rules of the StateGovernment.DEFINITIONS2. In these rules, unless the context otherwiserequires,—(i) Actual travelling expenses mean the actualcost of transporting a Government servant or otherperson to whom these rules apply, with his servantsand personal luggage, including charges for ferryand tolls.(ii) Controlling officer means an officer abovethe status of the claimant and to whom the claimantis administratively subordinate.

(iii) Daily allowance is a uniform allowance foreach complete period of 24 hours absence fromheadquarters, which is intended to cover the ordinarycharges incurred by a Government servant inconsequence of such absence.(iv) Day means a block of 24 hours ofabsence from headquarters at whatever hour theperiod begins and ends. A calendar day, however,begins and ends at midnight.(v) Family includes the following persons whoare wholly dependant on a Government servant:—1. Wife (one wife);2. Children;3. Step children;4. Adopted child if such adoption islegally recognized as conferring thestatus of a natural child under thepersonal law of the Governmentservant;5. Married daughter till she is placedunder her husband’s protection;6. Widowed daughter; and7. Father and mother;NOTEA Woman Government servant is entitled to claimtravelling allowance on account of her husband only if heis wholly dependent on her.RULINGAdopted father, adopted mother, step father andstep mother shall not be treated as members of the family.(vi)Firstappointmentincludestheappointment of a person not at the time holding any

appointment under Government even though he mayhave previously held such an appointment.(vii) Fixed travelling allowance is a monthlyallowance granted to a Government servant who isrequired to tour within a specified area for not lessthan a given period in each month.(viii) Flat charge (Terminal charges) is anallowance given at flat rates to a Governmentservant on tour to cover the expenditure incurred byhim for journeys between residence or place of haltor work and railway station or bus terminal or boatbasing inside harbour.(ix) Head of a Department means anyauthority specially declared by the Government to bethe Head of a department. It includes the followingofficers, etc.—1. SecretariestoGovernmentincluding Additional Secretaries toGovernment.2. stration.3. Director, Adi-Dravidar and TribalWelfare.4. Director, Stationery and Printing.5. Director of HealthFamily Welfare.ServicesandIn the case of Government servants who arenot subordinate to any of the above heads ofdepartments the questions which call for disposal byheads of departments shall be referredto theSecretary to Government concerned.(x) Incidental charge is an allowance given toa Government Servant to compensate expansions,

porterage, etc., involve in a journey on tour by air orrailway or a regular public motor service fromheadquarterstocampandfromcamptoheadquarters and is allowed for each of the day ofdeparture from headquarters and the day of arrivalback at headquarters.(xi) Lumpsum allowance is an allowance givento a Government servant to compensate expenses onpacking and loading of personal effects at one endand their unloading and unpacking at the other endas well as the unquantifiable expenses inconsequence of transfer.(xii) Mileageallowance is an allowancecalculated on the distance travelled which is given tomeet the cost of a particular journey.(xiii) Pay means the actual pay drawn by aGovernment servant and includes personal paygranted to protect a Government servant from loss ofemoluments but does not include personal paygranted on other considerations, special andadditional pay under Fundamental Rule 49.NOTES(1) In the case of a re-employed pensioner whosepay has been reduced in view of the pension drawn byhim, his pay shall be the pay which he would draw but forthe reduction in his pay.(2) In the case of a Government servant of theformer Travancore-Cochin State who has opted to remainin the Travancore-Cochin State scale of pay, pay shallinclude dearness pay.RULINGPersonal pay granted in lieu of special pay orother allowance which does not itself count as payshould not be treated as pay for the purpose ofcalculating travelling allowance.

(xiv) Public conveyance means a train orother conveyance which plies regularly for theconveyance of passengers, but does not include; ataxi-cab or other conveyance which is hired for aparticular journey.(xv) Transfer means the movement of aGovernment servant from one headquarters station inwhich he is employed to another such station,whether to take up the duties of a new post or inconsequence of a change of his nce granted to a Government servant to coverthe expenses which he incurs in travelling in theinterests of public service.It includes allowancesmaintenance of conveyances.grantedfortheCONTROLLING OFFICERS3. Deleted.4. A bill for travelling allowance, other thanfixed travelling allowance, shall be paid only if it issigned or countersigned by the controlling officer ofthe Government servant who presents it.5. The following classes of Governmentservants may present bills for travelling allowancewithout the counter-signature of a controllingofficer:—(a) The Chief Justice, Ministers, PuisneJudges of the High Court and Heads of Departments.(b) The Advocate-General, the GovernmentPleader, Chennai, the Additional GovernmentPleader, Chennai, the Public Prosecutor, Chennai,the City Government Pleader, Chennai, theCollectors and other officers who hold posts of therank of Collector, the District and Sessions Judges

and other officers who hold posts of the rank ofDistrict and Sessions Judge, the Chief Judge, Courtof Small Causes, the Official Receiver of the ee,theConservatorsofForests,theSuperintending Engineers, the Deputy InspectorsGeneral of Police, Chief Metropolitan Magistrate,Judicial Magistrates, the Judge, City Civil Court, theGeneral Managers of District Industries Centers, theWorks Manager, Government Press and the DeputyDirector, Family Welfare.(c) Heads of Offices.Provided that detailed and countersigned bills aresubsequently submitted to the Audit Officer foradjustment.[ G.O.Ms .N o .2 3 , Fin a n c e (Al l o w a n c e s ), d a t e d 1 0 -1 -1 9 9 5 ]6. Without the permission to the StateGovernment, a controlling officer may not delegate toa subordinate his duty of countersignature.NOTEThe Under Secretary to Government in PublicDepartment shall countersign the travelling allowancebills of Senior and Junior Personal Assistants toMinisters after comparing them with the tour programmesof the Ministers. The office copies of the travellingallowance bills shall be sent to Ministers for informationthen and there.7. Deleted.

GRADES OF GOVERNMENT SERVANTS8. The Government Servants are divided intofour grades as indicated in Annexure-I.RULINGS(1) The travelling allowance of a Governmentservant shall be revised when there is a delay in thesanction of an increment due in the normal course or infixing pay in the revised scale when a revision is made.(2) A Government servant’s claim to travellingallowance shall be regulated by the rules in force at thetime the journeys were undertaken.(3) In respect of Government servants who are onconsolidated rates of pay, a deduction from theconsolidated pay shall be made with reference to theexisting rates of dearness allowance and the grade fixedwith reference to the pay so reduced.9. The grade of a Government servant whosewhole time is not retained for the public service orwho is paid wholly or partly by fees, will bedetermined by the Government.10. A Government servant in transit from onepost to another belongs to the grade to which hewould belong if holding the lower of the two posts.DIFFERENT KINDS OF TRAVELLINGALLOWANCES11.Theallowances are:—differentkinds(a) Fixed travelling allowance(b) Mileage allowance(c) Daily allowanceoftravelling

(d) Incidental charge(e) Flat charge ( Terminal charge)(f) Actual expenses(g) Lumpsum allowance(h) Conveyance Allowance paid to Blind andOrthopaedicallyhandicappedStateGovernment employees -Rs. 150/- p.m.These orders shall apply to the Governmentemployees including Employees / Teachersworking under Local Bodies and also to theTeaching and non-teaching employees inaided educational institutions.[G.O. Ms. No. 445, Finance (Pay Cell), Dated 31-8-1998]RULINGGovernment servants cannotallowance of any kind other thanallowance during casual leave.draw travellingfixed travellingGOVERNMENT SERVANTS NOT ENTITLEDTO TRAVELLING ALLOWANCE12. The Government servants mentioned inAnnexure-II are not entitled to travelling allowancefor journeys performed in the discharge of ordinaryduties within their sphere of duty. When, however,they are acquired to travel on duty beyond theirsphere of duty, they may draw travelling allowancefor their entire journey including such part of it as iswithin their sphere of duty.RULINGA Government servant is not considered to havetravelled beyond his sphere of duty if, in order to shortenhis journey to some place within his sphere of duty, hehas to pass through stations which are not situated withinit.

FIXED TRAVELLING ALLOWANCE13. A day’s fixed travelling allowance is theamount arrived at by dividing the fixed travellingallowance for the specified period by the number ofdays on which the officer is required to be on tour.This allowance is not admissible during joining timeor leave other than casual leave.14. If a Government servant has not toured forthe prescribed number of days, his fixed travellingallowance shall be reduced for each day in deficit.RULINGWhen rates and conditions of fixed travellingallowance admissible in a specified period differ, eachpart of the period for which a different fixed travellingallowance is drawn should be considered separately andthe eligibility for full fixed travelling allowance for eachperiod of duty with reference to the actual number of tourdays in that period determined separately.15. The fixed travelling allowance of an officerwho uses on tour a motor vehicle provided at theexpense of Government or a conveyance other thana Government vehicle placed at his disposal withoutany charge, shall be reduced by 25 percentproportionately for the number of days of which hehas actually used the vehicle, if such days go tomake up the period of minimum touring. If, however,all or any of such days do not make up the period ofminimum touring, no reduction in the allowance needbe made in respect of those days.16. A Government servant, appointed to holdfull additional charge of one or more posts to each ofwhich a fixed monthly travelling allowance isattached, may draw only the largest of suchallowances.17. A statement of fixed monthly travellingallowances allowed is given in Annexure-III.

NOTE1. The existing quantum of Fixed TravellingAllowance as on 31-8-1998 shall be doubled.2. The existing quantum of Conveyance Allowanceas on 31-8-1998 shall be doubled.3. Consequent on increase in the Basic Pay bymore than three times and taking note of the increase inDaily Allowance ordered above, the existing monthlyceiling on Travelling Allowance shall be reduced from40% of pay to 20% of revised pay. Wherever the existingceiling is 45% of pay, it shall be reduced to 25% ofrevised pay.[G.O. Ms.No. 444, Finance (Pay Cell) dated 31-8-1998]4. In respect of Officers having jurisdiction overmore than one district and those having jurisdiction morethan two districts, the monthly ceiling shall be at 25% ofpay and at 27% of pay, respectively.[Letter No. 89715/Finance (Allowance)/2000-1, dated 17-4-2001]RULINGS(1) A claim for fixed travelling allowance shouldbe included in the main pay bill for the month.(2) The fixed travelling allowance drawn shall bedisbursed along with pay.(3) The entire period of absence from thespecified area (commencing with the day on which heleaves it and ending with the day on which he reaches itinclusive) will be counted towards the minimum numberof tour days prescribed for a month.(4) Fixed travelling allowance for the daysoccupied by the journey and halts on proceeding outsidethe specified area or on returning to it or for halts andjourneys extending outside such area can be exchangedfor travelling allowance including daily allowanceadmissible as for journeys and halts on tour.Thededuction to be made on account of fixed travelling

allowance for these days shall be at the rate of 1/30 of theamount of fixed travelling allowance sanctioned for amonth.NOTEThe employees provided with Government Vehicleare not eligible Fixed Travelling Allowance orConveyance Allowance.[Le t t e r N o .6 6 0 3 7 / F i n a n c e (A l l o w a n c e s )/1 9 9 4 -1 , d a t e d 3 -8 - 1 9 9 4 ](5) The journeys of Survey subordinates while onthe special duty of instructing in surveying shall beconsidered as on tour and on duty beyond theirjurisdiction.MILEAGE ALLOWANCE18. Deleted.19. The shortest route is that by which atraveller can most speedily reach his destination bythe ordinary modes of travelling.20. Mileage allowance for a journey betweentwo stations shall be calculated with reference to theshortest ordinary route or to the route which isdeclared by the Government to be the shortest route.NOTEAn officer who is entitled to travel by airconditioned or first-class accommodation travelling tostations beyond Tiruchirappalli on the TiruchirappalliRameswaram section and back to Chennai may claim theactual fare paid by him and daily allowance for thejourney by the main line route.

RULINGS(1) The following have been declared as ondam to Tiruchirappalli.(ii)The bus route between Thottiam andTiruchirappalli.(iii)The bus route between Tiruchirappalliand Kattuputhur.(iv)The route from Kodaikanal Roadstation to Kodaikanal via the newGhat road.(v)The road route between Salem andHosurviaDharmapuriandKrishnagiri.(vi)Chennai to Hosur via Bangalore forair and rail journeys.(vii)Chennai to Hosur via Krishnagiri forroad journey.(viii)The route via Mettupalayam andBhavanisagar to Thengumarahada inNilgiris District.(ix)The road route via Palayamcottai nelveli/Pettai.(x)Chennai to Kanyakumari District viaThiruvananthapuram for air journey.(xi)Air route between Chennai to Punevia Bombay.(2) The route via Kargudi and Teppakkadu shallbe the recognised route for Journeys betweenUdhagamandalam and Masinigudi. If however, a journeyis actually performed by the shorter route; viz., via Sigurghat road, the claim should be restricted to the distancetraversed by that route.

21. The head of the department may, forspecially recorded reasons, permit a Governmentservant to travel by and draw mileage allowance by aroute other than the shortest.RULINGWhere there are two routes by rail and an officertravels by the longer route for the reason that the shorterroute does not provide the class of accommodation whichhe is eligible for he will be allowed the railway farescalculated by the shorter route only by the class foraccommodation to which he is entitled.22. The Military Route Book shall be taken asa general guide for calculating the distances in thecase of all journeys. In cases in which the Collectorof the district finds that the distance given in thebook is not correct, he shall notify the correctdistance. The distance so fixed shall be calculatedwith reference to either—(1) the central point (if any) Specified in theMilitary Route Book, or(2) the central point given in the book “List ofdistances between railway stations and the fixedpoints in those stations”, if the Collector considersthis point to be more central or if no central point isgiven in the Military Route Book.If no central points are given in either book,the distances shall be calculated from such points asthe collector may fix.When any distance cannot be calculated formthe Military Route Book or the list of distances, theCollector of the district shall fix it.NOTEWhen a journey by road is combined with ajourney by mail or steamer, unless such journey by roadbe a journey to or from the Government servant’s

headquarters, mileage allowance shall be calculated onthe distance actually travelled for the distance betweenthe railway station and the central point whichever isless.23. Mileage allowance for a journey by roadshall be admissible as prescribed below:(a) Journey by motor car or motor cycle orscooter or moped—Mileage allowance is admissibleto Government servants, who are, on transferentitled to transport from the old to the new station amotor car, a motor cycle or scooter or moped atGovernment cost vide Annexure VI and who actuallytravel in a motor car or motor cycle or scooter ormoped, as the case may be. This allowance shall beadmissible for the entire distance travelled whetheror not the places journeyed are connected by railwayor by a regular public motor service in whole or inpart. The rates of mileage allowance car Rs.5 perkilometer for journeys performed by car and Rs.2.25per kilometer for journeys performed by motor cycle/scooter/moped .[G.O. Ms. No. 390, Finance (Allowances), dated 23-8-2000](b) Journey by any mode of conveyance otherthan motor car, motor cycle or scooter or mopedbetween places not connected by railway or by aregular public motor service by Government servantscoming under clause (a)—The rates of mileageallowance shall be as entered under column (8) ofAnnexure I.(c) Journey by any mode of conveyanceincluding motor car or motor cycle or scooter ormoped between places not connected by railway orby a regular public motor service by Governmentservants other than those coming under clause (a)—The rates of mileage allowance shall be as enteredunder column (8) of Annexure I.

NOTEWhen a road journey is made in continuation of ajourney by conveyance provided by Government, in aconveyance other than that provided by Government or byfoot for the distance at either end which could not betraversed by the conveyance so provided, the Governmentservant will be entitled to mileage for that distance ateither end.RULINGS(1) In cases where two or more journeys involvingon each occasion a return to headquarters are made by aGovernment servant on the same day, road mileage maybe allowed for the total distance covered on that dayprovided each of the journeys may be reckoned as ajourney on tour under rule 64 and provided further thatroad journeys of less than eight kilometers performedfrom headquarters on a day are not added on to the totaldistance travelled on that day.(2) Daily allowance is alsoGovernment servants drawing mileage.allowedto(3) The mileage allowance shall be increasedunder Rule 47 for journeys performed entirely or partly inspecial tracts and the increased rates are given only forjourneys performed in special tracts.(4) Mileage and daily allowance are allowed forjourneys made by walk in between places not connectedby rail or by a regular public motor service.(5) If a Government servant, who, on transfer, isentitled to transport a motor cycle/scooter/moped at theexpense of the Government under Annexure VI, maintainsa motor car and travels in it, he may claim mileage asadmissible for a journey by motor cycle/scooter/moped.(6) A Government servant is not entitled to addshort journeys within the eight kilometers radius toseparate journeys made on the same day which extended

beyond the eight kilometers radius and charge mileage forthe whole distance travelled.(7) Ruling (6) is applicable to similar journeysmade by a Government servant from camp.24. Deleted.25. Deleted.26. Deleted.27. In calculating mileage allowance, fractionsof a kilometer should be omitted from the total of abill for any one journey, but not from the variousitems which make up the bill.NOTE (1)The restriction of 200 miles (320 Kms) laid down,be made applicable to both own cars of the officers aswell as staff Cars attached to their departments, eitherright from their headquarters or in between the journey.The T.A. claims will be restricted to 320 Kms. Only andT.A. claims for journeys exceeding this limit will not beallowed.[G.O.Ms.No.312, Finance (Allowance-I), dated 17-5-1992]NOTE (2)The distance of 320 Km. is the total distancetravelled and not one way only but both ways to be takeninto account.[Govt. Letter No.82796/Allowance/1993, dated 12-9-1993]

JOURNEY BY RAILWAY28. Deleted.29. Eligibility for travel in different classes byRail as follows:Class of TravelEligibilityAC First Class byRailPay Scale of Rs.17,400-500-21,900and above.2 AC travel byRailPay Scales of Rs.12,000-375-16,500and above (including Senior Scales of AllIndia Service Officers.)First Class orAC-3 tier travelPay Scales of Rs. 8,000-275-13,500 andabove.RULINGWhen a Government servant proceeding on tourreserved the railway accommodation and cancelled itsubsequently in the exigencies of public service, he isentitled to claim refund of cancellation and reservationcharges.30. Deleted.31. Deleted.32. If a Government servant travels by a classlower than that to which he is entitled, he will drawthe fare of the class by which he actually travels.RULINGWhen a Government servant travels by a classhigher than the one by which he is entitled to travel, hisclaim for railway fare should be limited to that of theclass by which he is entitled to travel.

JOURNEYS BY SEA33. For journeys by sea, the Governmentservants specified in Annexure I are entitled to drawsteamer fares as below:—GradeType of accommodationI & IIDeluxe cabin/First class cabinIII & IVSecond class cabin34. If a Government servant travels in asteamer at Government expense, he is entitled todraw only the admissible daily allowance.RULINGRule 33 and 34 are intended to cover onlyjourneys within the limits of India proper and journeys bysea from one Indian port to another.35. Deleted.JOURNEY BY AIR36. Travel by air means journeys performed inthe aeroplanes of air transport companies. It doesnotinclude journeys performed by privateaeroplanes or air taxis.37. A Government servant authorised by theGovernment to travel by air may draw the fare paidfor the journey by air. If not so authorised he canonly draw the travelling allowance to which he wouldhave been entitled, if he had gone by rail, road orsteamer.

Eligibility for travel in different classes by air asfollows:—Class of TravelEligibilityAirtravelbyexecutive class:Pay scales ofRs. 22400-525-24500 and aboveAirtraveleconomy class:Pay scale ofRs. 12000-375-16500 and above(including senior scales of AllIndia Service Officers.)in[G.O.Ms .N o .4 6 4 , F i n a n c e (Al l o w a n c e s ), d a t e d 2 3 -1 -2 0 0 1 ]RULINGS(1) Air travel within the State shall be permittedto the Chief Secretary to Government and equal cadre ofofficials and all other officers are not permitted airjourney within the State[Letter No.24470/Finance(Allowances)/2002, dated 13-2-2002](2) The Director General of Police and theAdditional Director General of Police (Law and Order)shall also be permitted to travel by air within the State.[Letter No.22689/Finance(Allowances)/2002, dated 13-6-2002](3) The following Police Official shall also bepermitted to travel by air within the State:—1)2)3)4)5)6)7)8)9)All Inspectors General of Police (Law & Order)Additional Director General of Police, IntelligenceInspector General of Police, IntelligenceInspector General of Police, CB CID (SIT)Director of Fire and rescue ServicesSuperintendent of Police, Special Branch CIDSuperintendent of Police, 'Q' Branch CIDSuperintendent of Police, Security Branch, CID.Superintendent of Police, Special Division, SBCID.[Letter No.77562/Finance(Allowance)/2002-1, dated 1-11-2002]

(4) Chief Conservator of Forest, shall also bepermitted to travel by air within the State.[Letter No.84269/Finance(Allowance)/2002, dated 8-1-2003](5) Deputy Inspector General of Police (CID)Intelligence shall also be permitted to travel by airwithin the State.[Go v t . Let t e r N o .9 0 2 0 6 / A l l o w a n c e / 2 0 0 3 , d a t e d 2 6 -5 -2 0 0 3 ](6) All officers who are drawing the pay in thepay scale of Rs.12000–16500 have been authorised totravelby air outside the State while on duty.TheAide-de-Camp to the Governor while accompanying theGovernor and the Secretary to the Governor; if desired bythe Governor to accompany him by air within or outsidethe State, have also been authorised to travel by air.(7) Grade-I officers who are eligible to travel byair and other officers who are permitted to travel by airshall be reimbursed the actual payment made by them forinsurance upto Rs.1 lakh against accidents for theduration of the air journey.(8) Mileage may be allowed at the rate prescribedin Rule 23(a) for the journey by road from and to theairports performed by motor car and by taxi.(9) The claim for air fare shall be limited to theair fare charged by the airways companies for theeconomy class.(10) The Indian Airlines has offered the facilityof credit bookings to the Government of Tamil Nadu forthe credit Code Numbers as detailed below:—ItemNo.CodeNumber1.4448332Governor’s Secretariat2.4448120Public Department (for use ofChief Minister’s Office)3.4448812Public DepartmentCodal Controlling Authority

ItemNo.CodeNumber4.4448266Finance Department5.4448049Director of Agriculture6.4460090Legislative Assembly Secretariat7.4448766Chief Engineer (General)Codal Controlling AuthorityThe following procedures shall be adopted forsettling the Indian Airlines invoices for the journeyperformed under credit facility:—(i) No payment shall be effected by the userdepartments direct to Indian Airlines on theindividual invoices issued by the IndianAirlines forcredit facility utilised forjourney performed.(ii) Payment to the Indian Airlines shall beeffected directly by the Codal Controllingauthorities concerned on the consolidatedmonthly claim preferred by the IndianAirlines against each Code Number.(iii) The codal controlling authorities shalltransmit the individual invoices to the userdepartments in batches as and whenreceived from the Indian Airlines. Thedepartments availing the credit facilityunder the code n

The 1993 edition of the Tamil Nadu Travelling Allowance Rules, was brought out incorporating the changes effected to Rules of Travelling Allowance to Government servants and also the amendments issued to the various rules, etc., upto the period ending 9-3-1993. It has now been decided to bring out t