Transcription

The Basics of theWave PrincipleThe e-learning Series for TradersPresented by Wayne Gorman, Senior Tutorial InstructorElliott Wave InternationalP.O. Box 1618, Gainesville, GA 30503 USA800-336-1618 or 770-536-0309Fax 770-536-2514www.elliottwave.com 2006 Elliott Wave International

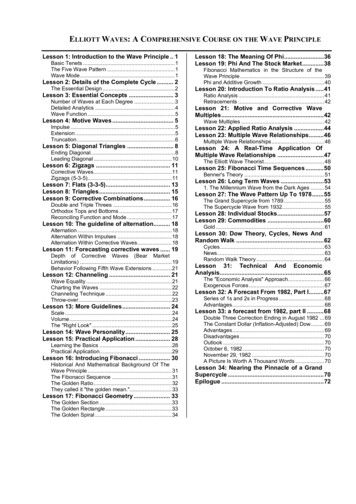

The Basics of the Wave Principle1.00Introduction — Ralph Nelson Elliott’s Discovery2.00Motive Waves3.00Corrective Waves4.00Rules5.00Guidelines6.00Wave Personalities7.00Fibonacci Relationships8.00Summary1.01

Financial Market Behavior CharacteristicsEmotional (Unconscious)SubjectiveImpulsiveIgnorance and UncertaintyHerdingValues Cannot Revert To Anything1.02

The Wave PrincipleFinancial Markets are Patterned1.03

Ralph Nelson Elliott(1871 – 1948) Crowd behavior trends and reverses in recognizable patterns,that he called waves.These structures link together to form larger versions of thesame patterns and how those, in turn, become the buildingblocks for patterns of the next larger size and so on.In 1938, he coined this phenomenon The Wave Principle.Nature’s Law — The Secret of the Universe1.04

1.05

1.06

1.07

1.08

1.09

A More Realistic Wave Depiction1.10

1245361.11

5671.12

The Wave PrincipleMankind’s progress (popularly measured bystock market valuation) is not a straight line,random or cyclical.Growth and thereby social systems are moving ina pattern consisting of five waves up and threewaves down.This pattern reflects the alternation of growth andnon-growth or decline.1.13

The Wave PrinciplePredict Market DirectionIdentify turning PointsProvide Guidance for Entering and Exiting Positions1.14

2.00

MOTIVE WAVESKey Characteristics Five-wave structures, numbered 1-5In the direction of the main trend of one larger degreeWave 2 cannot retrace more than 100% of wave 1Wave 3 can never be the shortest and is often thelongest2.01

MOTIVE WAVESFive-Wave Structures Impulse1. Extensions2. Truncations Diagonal Triangles2.02

IMPULSE WAVESKey Characteristics Wave 4 never enters the price territory of wave 1.Actionary waves 1, 3 and 5 are motive waves.Wave 3 is always an impulse wave.2.03

2.04

2.05

2.06

2.07

2.08

EXTENSIONSKey Characteristics Elongated impulse waveAppears in either wave 1, 3 or 5Often seen in wave 3 for the stock marketOften seen in wave 5 in commodities2.09

2.10

2.11

2.12

2.13

2.14

TRUNCATIONSKey Characteristics Wave 5 does not exceed the end of wave 3Contains necessary five subwavesOften occurs after a strong third wave2.15

2.16

2.17

2.18

DIAGONAL TRIANGLESKey Characteristics Wave 4 almost always moves into the priceterritory of wave 1Waves 1, 3 and 5 are composed of threesubwaves, not fiveFound at termination points of larger pattern,indicating exhaustion of larger patternNormally has wedge shape within twoconverging lines2.19

Diagonal Triangles2.20

2.21

2.22

2.23

2.24

2.25

2.26

SUMMARYThe Wave Principle Graphic of Mass PsychologyMotive Waves 5 Wave Structures, Main Trend of One Larger DegreeTypes of Motive Waves Impulse, Diagonal TriangleImpulse: Waves 1, 3, 5 5 Impulse Subwaves(Extensions, Truncations)Wave 4 Price Territory of Wave 1Diagonal Triangle: Waves 1, 3, 5 3 SubwavesWave 4 Price Territory of Wave 1Signal Imminent Major Trend Reversal2.27

3.00

Characteristics of Corrective WavesZigzag3.01

3.02

Characteristics of Corrective WavesFlat3.03

3.04

Characteristics of Corrective WavesTriangle3.05

Horizontal Triangles3.06

Barrier Triangles3.07

Running Triangles3.08

3.09

3.10

3.11

3.12

Characteristics of Corrective WavesCombination3.13

Combination3.14

3.15

3.16

3.17

Corrective Waves sition5SharpWave 235SidewaysWave 433SidewaysWave 4SidewaysWave 4X waveD3E33.18

Rules Of waves 1, 3 and 5, wave 3 can never be theshortest wave.Wave 2 can never retrace more than 100% ofwave 1.The end of wave 4 can never overlap theorthodox end of wave 1.Strong Guideline No portion of wave 4 can enter the price territoryof wave 1 or wave 2.4.00

Rules4.01

Rules4.02

RulesThis five-wave movecannot be the start ofa new trend. It can bewave C of acorrective pattern.4.03

RulesWhat might this be?Significant Bottom4.04

RulesWhat might this be?4.05

RulesWave 3 is never the shortest ofwaves 1, 3 and 5. This could bepart of a wave 3 extension.4.06

RulesSignificant BottomWhat might this be?4.07

RulesWhat might this be?4.08

RulesWave 4 does not overlap the price territoryof wave 1. This could be the start of a 3rdwave extension or an A-B-C correction.4.09

Guidelines Post-Triangle ThrustMeasurement5.00

GuidelinesWave Equality Two of the motive waves in a five-wavesequence will tend toward equality in time andmagnitude.This is generally true of the two non-extendedwaves.For example, if wave 3 is extended then waves1 and 5 will tend toward equality.5.01

Equality5.02

Equality5.03

GuidelinesAlternationWithin Impulse Waves If wave 2 is a sharp correction, expect wave 4to be a sideways correction, and vice versa.Sharp corrections never include a new priceextreme. Example: ZigzagsSideways corrections usually include a newprice extreme. Examples: Flats, Triangles, andCombinationsDiagonal triangles do not display alternation insubwaves 2 and 4.5.04

Alternation within Impulse Waves5.05

Alternation within Impulse Waves5.06

Alternation within Impulse Waves5.07

Alternation within Impulse Waves5.08

Alternation within Impulse Waves5.09

GuidelinesAlternationWithin Corrective Waves If a correction begins with a flat a-b-c structurefor wave A, then expect a zigzag a-b-cstructure for wave B, and vice versa.If a large correction begins with a simple a-b-czigzag for wave A, wave B will stretch out into amore complex a-b-c zigzag.5.10

GuidelinesAlternation within Corrective Waves5.11

GuidelinesAlternation within Corrective Waves5.12

Alternation within Corrective Waves5.13

Alternation within Corrective Waves5.14

Alternation within Corrective WavesZigzag5-3-55.15

GuidelinesDepth of Corrective WavesCorrections, especially when they are fourthwaves, tend to register their maximumretracement within the span of travel of theprevious fourth wave of one lesser degree andmost commonly near its terminus.5.16

GuidelinesDepth of Corrective Waves5.17

Depth of Corrective Waves5.18

Depth of Corrective Waves5.19

GuidelinesChannelingA parallel trend channel typically marks theupper and lower boundaries of impulse wavesand zigzag corrective waves.5.20

GuidelinesChanneling in Impulse Waves5.21

Channeling in Impulse Waves5.22

Channeling in Impulse Waves5.23

Channeling in Impulse Waves5.24

Channeling in Impulse Waves5.25

Channeling in Impulse Waves5.26

Channeling in Impulse Waves5.27

GuidelinesChanneling in Zigzags5.28

Channeling in Corrective Waves5.29

Channeling in Corrective Waves5.30

Channeling in Corrective Waves5.31

GuidelinesThrow-Over5.32

Throw-Over5.33

Guidelines — VolumeWaves Primary DegreeNormally, 3rd wave volume 5th wave volume5th wave volume 3rd wave volume 5th wave extensionWaves Primary DegreeHigher volume in 5th wavesAll-time high volume at terminal points in bull markets Volume often spikes briefly at the throw-over point of aparallel trend channel line or a diagonal triangle resistanceline.Volume contracts in corrective waves.5.34

Volume5.35

Post-Triangle Thrust Measurement5.36

5.37

5.38

Summary Two motive waves in a five wave sequence willtend toward equality.If the second wave is sharp, then the fourth wave isusually sideways, and vice versa.Corrective waves usually end in the span of theprevious fourth wave of one lesser degree.Impulse waves tend to be bounded by a channelcomposed of two parallel lines.A throw-over/throw-under occurs when wave 5terminates beyond the trend channel.The post-triangle thrust measurement estimatesprice target for the next wave in the pattern of onelarger degree.5.39

Wave Personality6.00

Wave Personality6.01

Fibonacci Relationships In Financial MarketsThe Golden RatioPHI Φ.618 or 1.6187.00

Golden Ratio, PHI, Φ7.01

Golden Ratio, PHI, Φ7.02

Fibonacci Relationships are Seenin Time and Amplitude Retracements Multiples7.03

Retracements7.04

Retracements7.05

Retracements7.06

Retracements7.07

Retracements7.08

Multiples in Impulse Waves7.09

Multiples in Impulse Waves7.10

Multiples in Impulse Waves7.11

Multiples in Impulse WavesNet of waves 1 through 3times .382 percentmovement of wave 57.12

Multiples within Corrective Waves — Zigzags7.13

Fibonacci Time Relationships7.14

Fibonacci Time Relationships7.15

Summary The Fibonacci Ratio (Φ), an irrational number approximating .618,known as the Golden Ratio, is found in nature, human biology,human thought, and aggregate human behavior such as the stockmarket.The Wave Principle is a robust fractal governed by Fibonaccimathematics.Sharp wave corrections tend to retrace 61.8% or 50% of theprevious wave.Sideways corrections tend to retrace 38.2% of the previous wave.Subdivisions of impulse waves tend to be related by Fibonaccinumbers .618, 1.0, 1.618 and 2.618.Subdivisions of corrective waves tend to be related by Fibonaccinumbers .382, .618, 1.0 and 1.618.7.16

The Basics of the Wave PrincipleSummary8.00

8.01

1245368.02

8.03

8.04

Rules8.05

Equality8.06

Alternation within Impulse Waves8.07

Alternation within Corrective Waves8.08

Depth of Corrective Waves8.09

Channeling in Impulse Waves8.10

Throw-Over8.11

Volume8.12

Post-Triangle Thrust Measurement8.13

Wave Personality8.14

Fibonacci Relationships In Financial MarketsThe Golden RatioPHI Φ.618 or 1.6188.15

Retracements8.16

Multiples in Impulse Waves8.17

Elliott Wave International770-536-0309 or 800-336-1618www.elliottwave.com

Wave Principle Presented by Wayne Gorman, Senior Tutorial Instructor Elliott Wave International P.O. Box 1618, Gainesville, GA 30503 USA 800-336-1618 or 770-536-0309 Fax 770-536-2514 www.elliottwave.com ' 2006 Elliott Wave