Transcription

Summary of Legislation andRegulations Included in theAnnual Energy Outlook 2022March 2022Independent Statistics & Analysiswww.eia.govU.S. Department of EnergyWashington, DC 20585

This report was prepared by the U.S. Energy Information Administration (EIA), the statistical andanalytical agency within the U.S. Department of Energy. By law, EIA’s data, analyses, and forecasts areindependent of approval by any other officer or employee of the U.S. Government. The views in thisreport therefore should not be construed as representing those of the U.S. Department of Energy orother federal agencies.U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 2022i

March 2022The version of the National Energy Modeling System (NEMS) used for the U.S. Energy InformationAdministration’s (EIA) Annual Energy Outlook 2022 (AEO2022) generally represents currentlegislation, environmental regulations, and international protocols, including recent governmentactions that had implementing regulations as of the end of November 2021. The potential effects ofproposed federal and state legislation, regulations, or standards are not reflected in NEMS. Inaddition, NEMS does not reflect sections of legislation that have been enacted but have not beenfunded or lack implementation regulations. A list of the federal and selected state legislation andregulations included in AEO2022, including how we incorporated them, is provided in each module’sdocumentation. This document provides an overview of all the relevant regulations and includessummary tables that represent both new and existing legislation and regulations represented inNEMS.U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 2022ii

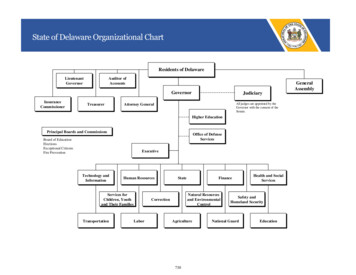

March 2022Table of ContentsNew Laws and Regulations Reflected in the Reference case . 1Federal . 1State . 1Existing Laws and Regulations Reflected in the Reference Case . 1Renewable portfolio standards . 1Delaware . 7Oregon. 7State energy efficiency resource standards and goals . 7Appendix A: Federal and Selected State Legislation and Regulations in the Annual Energy Outlook2022 . 11U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 2022iii

March 2022New Laws and Regulations Reflected in the Reference caseFederalThe Infrastructure Investment and Jobs Act was passed in November 2021, and we incorporatedseveral of its provisions related to the energy sector in AEO2022. In the electric power sector, a civilnuclear credit program was established to support nuclear power plants that are struggling to remaineconomically viable in competitive electricity markets and are at risk of shut down. A total of 6billion is appropriated for fiscal years 2022–2026.StateIn 2021, Delaware and Oregon enacted new legislation for their respective renewable portfoliostandards (RPS) programs.Existing Laws and Regulations Reflected in the Reference CaseThe AEO2022 reflects a number of state-level policies that affect its projections of the electricitygeneration mix.The AEO2022 Reference case divides state regulations into two general categories: state RPS andstate energy efficiency programs.Renewable portfolio standardsTo the extent possible, the AEO2022 reflects state laws and regulations enacted as of November2021, that establish minimum requirements for renewable generation or capacity for utilitiesoperating in the state. These requirements represent known RPSs. The AEO2022 projections do notinclude laws and regulations with either voluntary goals or targets that can be substantially satisfiedwith nonrenewable resources.The AEO2022 Reference case assumes that states will meet their RPS targets, yet it also assumes thatstates will not necessarily meet targets for interim years. We estimate RPS compliance constraints inmost regions; however, because NEMS is not a state-level model, each state generally representsonly a portion of one of the NEMS electricity regions. In general, we have confirmed therequirements for each state through original legislative or regulatory documentation, including theDatabase of State Incentives for Renewables & Efficiency (DSIRE).Most states are meeting or exceeding their required levels of renewable generation, based onqualified generation or purchases of renewable energy credits. 1 A number of factors helped makeRPS compliance attainable for generators, including: New RPS-qualified generation capacity timed to take advantage of federal incentivesLower cost of wind, solar, and other renewable technologiesState and local policies that either reduce costs (for example, equipment rebates) or increaserevenue streams (for example, net metering) associated with RPS-eligible technologiesG. Barbose, U.S. Renewables Portfolio Standards: 2017 Annual Status Report (Berkeley, CA: Lawrence Berkeley NationalLaboratory, July 2017).1U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 20221

March 2022The RPS requirements for each state, as modeled for the AEO2022, are in Table 1.Table 1. Aggregate renewable portfolio standards requirements as modeled for AEO2022QualifyingrenewablesQualifying other (thermal,efficiency, nonrenewable,distributed generation, etc.)StateTargetArizona (AZ)15% by 2025Solar, wind, biomass,hydro, LFG, andanaerobic digestionbuilt after January 1,1997Direct use of solar heat,ground-source heat pumps,renewable-fueled CHP, andfuel cells using renewablefuelsCalifornia (CA)60% electricitygeneration by2030, 100%carbon-free by2045Geothermal electric,solar thermal electric,solar photovoltaics,wind (all), biomass,MSW, LFG, tidal,wave, ocean thermal,wind (small),hydroelectric (small),and anaerobicdigestionSolar, wind, biomass,hydro, andgeothermalEnergy storage and fuel cellsusing renewable energyRecycled energy, coal-minemethane, pyrolysis gasproduced from MSW, andfuel cellsCredit trading is allowed.Renewable distributed generationrequirement applies to investorowned utilities (3% of sales by2020) and electric cooperatives(0.75% or 1% of sales by 2020,depending on size). Generation iseligible to earn credit multipliers ifit is associated with certainprojects that have specificownership or transmission tieswith small utilities, entities, orindividuals.Solar, wind, biomass,hydro (withexceptions),geothermal,LFG/MSW, anaerobicdigestion, and marineSolar, wind, biomass,hydro, geothermal,LFG/MSW, and marineCHP and fuel cellsSolar, wind, biomass,hydro, geothermal,LFG, anaerobicdigestion, and marineFuel cellsCredit trading is allowed.Obligated providers may complythrough an alternative compliancepayment of 55/MWh. The targetis composed of three class tiersthat have tier-specific targets.Credit trading is allowed. Thetarget includes a solar-specific setaside equivalent to 2.5% of salesby 2023. Obligated providers mayalso comply through a tier-specificalternative compliance payment.Credit trading is allowed. Creditmultipliers are awarded for severalcompliance specifications,including a 300% credit awardedfor generation from in-statedistributed solar and renewablefueled fuel cells. Target increasesfor some suppliers can be subjectto a cost threshold.Colorado (CO)Connecticut (CT)30% by 2020 forinvestor-ownedutilities, 20% by2020 for largeelectriccooperatives,10% by 2020 forothercooperativesand municipalutilities servingmore than40,000customers48% by 2030(44%renewables, 4%efficiency andCHP)District ofColumbia (DC)100% by 2040Delaware (DE)40% by 2035Nuclear and hydroelectric(large) qualify after 2030toward the 100% carbonfree by 2045 targetDirect use of solar andcofiringCompliance mechanismsCredit trading is allowed withsome bundling restrictions.Distributed generation is required,starting at 5% of target in 2007and increasing to 30% by 2012 andafter.Credit trading is allowed withsome restrictions. Renewableenergy credit prices are capped at 50 per megawatthour (MWh).U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 20222

March 2022StateHawaii (HI)Target100% by 2045Illinois (IL)25% by 2026(3,000megawatts[MW] solar and1,300 MW wind)105 MW ofeligiblerenewableresources35% by 2030(and anadditional 1%per yearthereafter)Iowa l electric,solar thermal electric,solar photovoltaics,wind (all), biomass,hydroelectric,hydrogen, geothermalheat pumps, MSW,CHP, landfill gas, tidal,wave, ocean thermal,wind (small),anaerobic digestion,and fuel cells usingrenewable fuelsSolar, wind, biomass,hydro, anaerobicdigestion, andbiodieselQualifying other (thermal,efficiency, nonrenewable,distributed generation, etc.)Solar water heat, solar spaceheat, and solar thermalprocess heatNoneSolar, wind, sometypes of biomass andwaste, and smallhydroSolar, wind, hydro,some biomasstechnologies,LFG/MSW,geothermal electric,anaerobic digestion,and marineNoneFuel cellsMaryland (MD)50% by 2030Solar, wind, biomass,geothermal,LFG/MSW, anaerobicdigestion, and marineSolar water heating, groundsource heat pumps, and fuelcellsMaine (ME)100% by 2050Solar, wind, biomass,hydro, geothermal,LFG/MSW, and marineCHP and fuel cellsMichigan (MI)15% by 2021,with specificnew capacitygoals for utilitiesthat serve moreSolar, wind, hydro,biomass, LFG/MSW,geothermal electric,anaerobic digestion,and marineCHP, coal with carboncapture and sequestration,and energy efficiencymeasures for up to 10% of autility’s sales obligationCompliance mechanismsCredits cannot be traded. Eligibilityof several of the qualifying otherdisplacement technologies wasrestricted after 2015. Utilitycompanies can calculatecompliance over all utilityaffiliates.Credit trading is allowed. Targetincludes specific requirements forwind, solar, and distributedgeneration. The procurementprocess is subject to a cost cap.Iowa’s investor-owned utilities arecurrently in full compliance withthis standard, achieved primarilythrough wind capacity.Credit trading is allowed. Thetarget for new resources includes asolar-specific goal to achieve 400MW of in-state solar capacity,which is translated into an annualtarget for obligated providers.Obligated providers can complythrough an alternative compliancepayment (ACP), which varies inlevel by the requirement class. TheACP is designed to be higher thanthe cost of other complianceoptions.Credit trading is allowed. Thetarget includes minimum levels ofcompliance from solar andoffshore wind. Utilities can pay anACP, instead of procuring eligiblesources, with a tier-specificcompliance schedule.Credit trading is allowed. TheMaine Public Utilities Commissionsets an annually adjustedalternative compliance payment.Community-based generationprojects are eligible to earn creditmultipliers.Credit trading is allowed. Solarpower receives a credit multiplier;other generation and equipmentfeatures—such as peakgeneration, storage, and usingU.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 20223

March 2022StateMinnesota (MN)Targetthan one millioncustomers31.5% by 2020(Xcel), 26.5% by2025 (otherinvestor-ownedutilities), or 25%by 2025 (otherutilities)QualifyingrenewablesQualifying other (thermal,efficiency, nonrenewable,distributed generation, etc.)Solar, wind, hydro,biomass, LFG/MSW,and anaerobicdigestionCofiring and hydrogenSolar, wind, hydro,biomass, LFG/MSW,anaerobic digestion,and ethanolSolar, wind, hydro,geothermal, biomass,and LFGFuel cellsCompliance mechanismsequipment manufactured instate—can earn bonus credits.Credit trading is allowed. Targetincludes 1.5% solar standard forinvestor-owned utilities. Xcel’starget also includes 25% of salesspecifically from wind and solar(with a 1% maximum for solar).State regulators can penalizenoncompliance at the estimatedcost of compliance.Credit trading is allowed.Noncompliance payments are setat double the market rate ofrenewables.Credit trading is allowed, with aprice cap of 10/MWh.Community-based projects havespecific targets.Credit trading is allowed. Impactson customer costs are capped atspecified levels. Solar and certainanimal waste projects havespecific targets.Missouri (MO)15% by 2021Montana (MT)15% by 2015North Carolina(NC)12.5% by 2021for investorowned utilities,10% by 2018 formunicipal andcooperativeutilities24.8% by 2025Solar, wind, smallhydro, biomass,geothermal, LFG, andmarineDirect use of solar heat,CHP, hydrogen, and demandreductionSolar, wind, smallhydro, marine, andLFGFuel cells, CHP,microturbines, direct use ofsolar heat, and groundsource heat pumps50% by 2030with the solarportion reaching5.1% in 2021before graduallydecreasing to1.1% by 203380% renewablegeneration by2040, 100%carbon-free by204550% renewablegeneration by2030, 100%carbon-free by2050Solar, wind, hydro,geothermal,LFG/MSW, and marineNoneSolar, wind, hydro,geothermal, and LFG(carbon-free includesnuclear)Zero-emission technology,not including nuclearCredit trading is allowed.Solar, wind, hydro,geothermal, biomass,and LFG/MSW(carbon-free includesnuclear)Credit trading is allowed.70% renewablegeneration by2030, 100%carbon-free by2040Solar, wind, hydro,geothermal, biomass,LFG, anaerobicdigestion, certainbiofuels, and marineWaste tires, direct use ofsolar and geothermal heat,and efficiency measures(which can account for onequarter of the target in anygiven year)Direct use of solar heat,CHP, and fuel cellsNew Hampshire(NH)New Jersey (NJ)New Mexico (NM)Nevada (NV)New York (NY)Compressed air energystorageCredit trading is allowed, andutilities may pay into a fundinstead of holding credits. Thetarget has four separatecompliance classes by technologytype.Credit trading is allowed, and stateregulators set an ACP. Solar andoffshore wind are subject toseparate requirements and haveseparate enforcement provisions.Credit trading is not allowed.Compliance is achieved throughpurchases by state authorities,funded by a surcharge on investorowned utilities. Government-U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 20224

March 2022StateTargetOhio (OH)Pennsylvania (PA)8.5% renewableenergyresources by202680% cleanenergy by 2030,90% cleanenergy by 2035,100% cleanenergy by 2050for investorowned utilities50% renewableenergy by 2040for all otherutilities18% by 2020Rhode Island (RI)38.5% by 2035Texas (TX)5,880 MW by2015Virginia (VA)100% carbonfree by 2045Vermont (VT)75% by 2032Washington (WA)100% carbonfree by 2045Wisconsin (WI)10% by 2015Oregon (OR)Qualifyingrenewables(carbon-free includesnuclear)Solar, wind, hydro,biomass, geothermal,and LFG/MSWQualifying other (thermal,efficiency, nonrenewable,distributed generation, etc.)CHP, fuel cells, anaerobicdigestion, and microturbinesCompliance mechanismsowned utilities may have theirown, similar programs.Credit trading is allowed. ACP areset by law and adjusted annually.Solar electricity generation has aseparate target.Credit trading is allowed, with anACP and a limit on expenditures of4% of annual revenue. Solarreceives a credit multiplier.Solar, wind, hydro,biomass, geothermal,LFG/MSW, anaerobicdigestion, and marineHydrogen. Any technologywith zero CO2 emissionsSolar, wind, hydro,biomass, geothermal,and LFG/MSWCHP, certain advanced coaltechnologies, certain energyefficiency technologies, fuelcells, direct use of solarheat, and ground-sourceheat pumpsFuel cellsCredit trading is allowed with anACP. Separate targets are set forsolar and two differentcombinations of renewable, fossilfuel, and efficiency technologies.Direct use of solar heat andground-source heat pumpsCredit trading is allowed withcapacity targets converted togeneration equivalents. Stateregulators may cap credit prices,and 500 MW must be fromresources other than wind.Credit trading is allowed.Solar, wind, hydro,biomass, geothermal,anaerobic digestion,LFG, biodiesel, andmarineSolar, wind, hydro,biomass, geothermal,LFG, and marineSolar, wind, hydro,geothermal, biomass,LFG, anaerobicdigestion, certainbiofuels, and marine(carbon-free includesnuclear)Geothermal, solar,wind, biomass, hydro,LFG, marine,anaerobic digestion,and fuel cells usingrenewable fuelsSolar, wind, hydro,biomass, geothermal,LFG, anaerobicdigestion, biodiesel,and marineSolar, wind, hydro,biomass, geothermal,NoneCredit trading is allowed with anACP. A separate target exists for90 MW of new renewablecapacity.Ground-source heat pumpsand CHPRenewable energy credits can bepurchased from plants whoseenergy can be delivered withinNew England, with an ACP of 0.01per kilowatthour (kWh).CHPCredit trading is allowed, but withan administrative penalty fornoncompliance.CHP, pyrolysis, synthetic gas,direct use of solar orCredit trading is allowed.U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 20225

March 2022Qualifying other (thermal,Qualifyingefficiency, nonrenewable,StateTargetrenewablesdistributed generation, etc.)LFG/MSW, smallbiomass heat, groundhydro, anaerobicsource heat pumps, and fueldigestion, and marinecellsSource: Table created by the U.S. Energy Information Administration, based on data from XXXXXNote: LFG landfill gas, CHP combined heat and power, MSW municipal solid wasteCompliance mechanismsOne factor that could result in states missing their RPS goals is slow or no growth in electricitydemand. To date, slowing demand has not affected these marginal sources, but the situation couldchange if demand is flat for an extended period.Further, although states have more qualifying generation in aggregate than they need to meet thetargets, states with technology-specific goals could still have shortages related to certaintechnologies. In addition, the projected pattern of aggregate surplus does not necessarily imply thatthe projected generation would be the same without state RPS policies. These policies may increaseinvestment in states where it would not otherwise occur or increase the amount of renewablegeneration projected, and in other states, renewable generation growth could exceed state targets oreven increase without target requirements. The results do suggest, however, that state RPS programswill not be the sole motivation for future growth in renewable generation.Currently, 30 states and the District of Columbia have enforceable RPS or similar laws (Table 1). 2Under such standards, each state determines its own levels of renewable generation, eligibletechnologies, 3 and noncompliance penalties. Many states have modified their existing programs inrecent years, building on their own implementation experience and changing market conditions.As states continue adopting 100% targets, they use terms such as carbon-free, carbon-neutral, orclean energy to define their policies. However, each state has defined these terms in its own way,and in some cases, they include fuels not considered renewable to count toward the policy target.When referring to these policies collectively, we call them carbon-neutral policies.In 2021, Delaware and Oregon enacted new legislation for their respective RPS programs, andConnecticut added requirements for battery storage.Summaries of state RPS policies may vary from source to source. The policies vary significantly from state to state, with nouniversal definition. EIA’s previous discussions of state RPS policies have included a policy in West Virginia that allowedseveral types of fossil-fueled generators to be built instead of renewable generators to meet the portfolio requirement.That policy is not included as an RPS in the AEO2022.3 Eligible technologies and even the definitions of technologies or fuel categories vary by state. For example, one state’sdefinition of renewables may include hydropower, but another’s may not. Table 1 provides more detail on how thetechnology or fuel category is defined by each state.2U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 20226

March 2022DelawareIn February 2021, Delaware enacted Senate Bill 33, which increased its RPS target to 40% ofelectricity sales from renewable sources by 2035. This new target replaced the previous target of 25%of sales from renewable sources by 2026. 4OregonIn July 2021, Oregon enacted House Bill 2021, which changed the previous target of 50% of sales ofelectricity from renewable sources by 2040 into two separate targets. Investor-owned utilities (IOUs)had their target increased to 100% clean energy generation by 2040, with interim targets of 80%clean energy generation by 2030 and 90% clean energy generation by 2035. Other utilities maintainthe previous 50% sales of electricity from renewable sources by 2040. 5In June 2021, Connecticut enacted Senate Bill 952, which requires 1,000 MWof battery storage to be installed by 2030. 6 State energy efficiency resourcestandards and goalsAEO2022 does not explicitly include state energy efficiency resource standards (EERS). EERS aremandatory, long-term reduction targets spanning at least three years that: Are sufficiently funded to allow covered entities to meet their targetsUse financial incentives or non-performance penaltiesUsually increase over timeNevertheless, these standards do inform modeling of utility and state energy efficiency incentives.Of the 30 states with mandatory or voluntary efficiency goals, 25 meet the definition of an EERS.Efficiency policies for utilities complement efficiency gained from structural changes, federalappliance standards, and enhanced building codes. The extent of the change in demand varies byregion and sector.State legislatures and public utility commissions (PUC) each create energy efficiency (EE) policies(Table 2). Savings targets are set as reductions from a single base year or as: An average of previous yearsA cumulative reduction during a compliance periodA percentage of projected electricity salesAs with the RPS, we confirmed EERS requirements for each state through original legislative orregulatory documentation and used DSIRE and the Advanced Energy Economy (AEE) PowerSuite toolsto support those efforts.Delaware State Senate, An Act to Amend Title 26 of The Delaware Code Relating To Renewable Energy Portfolio Standards,SB 33, 151 General Assembly, signed by governor on February 10, 2021,5 Oregon State House, Relating to clean energy; and prescribing an effective date, HB 2021-C, 81 Legislative Assembly,signed by governor on July 19, 2021.6 Connecticut State Senate, Public Act No. 21-53 An Act Concerning Energy Storage, SB 952, signed by governor on June 16,2021.4U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 20227

March 2022Table 2. Characteristics of state efficiency requirements or goals (as of November oloradoE&GConnecticutE&GDistrict New Hampshire E&GNew JerseyE&GNew MexicoElecTargeted electricity savings(requirements and goals)b2.5% annual saving and 22%cumulative savings by 2020;lower for co-ops1.2% saving from 2018 retailsalesDoubling energy efficiencysavings by 20305% of 2018 sales by 2028, pluspeak reductionsAverage 1.1% reduction fromforecast salesAbout 5% cumulative savingsfrom 2016 through 2021About 1.4% annualincremental savings between2009 and 2030Varies by IOU; cumulativesavings of 16% or 21.5%Varies by investor-ownedutility (IOU); average 0.89%annual incremental savingsQuick Start Energy Efficiency(EE) Pilot1.25% of sales in annualincrements through 20222% of sales by 2023 in 0.2%annual increments17.7 trillion British thermalunits (Btu) from 2019 to 2021( 2.7% of retail sales)1.0% of previous year’s sales,with tiered performanceincentives for up to 1.5%savings2% of previous three-yearweather-normalized average(Xcel); other IOUs 1.5%Quick Start EE program9.9% cumulative annualsavings by 202025% RPS, of which 10% of therequirement may be met withEE measures4.5% cumulative electricsavings by 20232% annual reduction fromprevious three-year averageCumulative 8% reduction from2005 sales by 2020; 5%Percentageof salescoveredc56%Current savings2020 incrementalperiod (range) savings including ntage 018--851,4150.82%69%20142025169,4780.68%U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 20228

March 2022StateTypeaNew YorkE&GNorth CarolinaElecOhioElecOregonE>argeted electricity savings(requirements and goals)breduction from 2020 sales by2025185 trillion Btu (TBtu) totalenergy reduction; 3% annualutility electricity savings targetby 2025. Overall Reformingthe Energy Vision goal forbuildings of 23% from 2012levels by 20305% of 2021 sales from 2008base; EE is an eligiblerenewable portfolio standard(RPS) resource17.5% EE targetPercentageof salescoveredcCurrent savings2020 incrementalperiod (range) savings including annualbeginning–ending(MWh)dPercentage 21956,9250.73%89%200920201,849,5820.77%1.30% of sales in annual61%20202021407,592increments through 2021PennsylvaniaElecVaries by utility; average96%201620211,070,341cumulative savings of 3.7%Rhode IslandE&GAnnual average incremental99%20212023247,424savings target of 2.0%TexasElec30% reduction in demand74%2013-968,179growth (about 0.1% annually)UtahElec1% annual reduction in80%2009-336,180electricity; energy efficiency isan eligible RPS resourceVermontElec1.7% incremental electricity98%2021202397,483sales savings (percentage of2019 annual sales) andseasonal peak demandreductionsVirginiaElecVaries by utility;87%20212025173,603Approximately 1.2% averageannual savings from 2019.WashingtonElecVaries by utility; about 2%83%20202021678,521incremental for IOUsWisconsinE&GLifecycle goal of 22.8100%20192022744,041terawatthours (TWh) overfour years (0.6%–0.7% ofsales)Source: Table by the U.S. Energy Information Administration, based on data from American Council for an Energy-EfficientEconomy, The 2020 State Energy Efficiency Scorecard (ACEEE 2020) and U.S. Energy Information Administration on FormEIA-861, Annual Electric Power Industry Report. State Electricity Profiles (November 4, 2021).a If an EERS covers electric utilities only, it is abbreviated as Elec; if both electric and natural gas utilities, as E&G.b Sales reductions refer to reductions in retail sales of electricity. Unless otherwise noted, they are incremental annualreductions, rather than cumulative savings. Base year indicates year (or average of previous years) against which targetedsavings are measured.c American Council for an Energy-Efficient Economy, The 2020 State Energy Efficiency Scorecard (ACEEE 2020), Appendix D,pages 151–158. The percentage of affected retail sales in an EERS depends on what entities are covered by an EERS, whichdiffers by state. We calculate percentages for states not included in ACEEE2020 (Louisiana, Missouri, and Mississippi), usingstate energy efficiency filings and our survey Form EIA-861, Annual Electric Power Industry Report (November 4, 2021).0.76%U.S. Energy Information Administration Summary of Legislation and Regulations Included in the Annual Energy Outlook 202290.47%2.33%0.23%1.06%1.83%0.14%0.76%1.10%

March 2022Information on DC’s targets is from a phone interview with Dan Cleverdon, Public Service Commission of the District ofColumbia, January 21, 2018.d Incremental annual energy efficiency savings, reported in megawatthours (MWh), on Form EIA-861, Annual Electric PowerIndustry Report (November 4, 2021). These savings are defined as changes in energy use caused in the current reportingyear by new participants in demand-side management (DSM) programs that operated in the previous reporting year or byparticipants in new DSM programs that operated for the first time in the current reporting year. Savings as a percentage ofretail sales are calculated based on utility retail sales data reported on the Form EIA-861.e Incremental annual electricity savings divided by total retail electricity sales for 2020, as reported to the U.S. EnergyInformation Administration on Form EIA-861, Annual Electric Power Industry Report. State Electricity Profiles (November 4,2021).fNot applicable, no end dateU.

heat and power (CHP), and fuel cells using renewable fuels Credit trading is allowed with some bundling restrictions. Includes distributed generation requirement, starting at 5% of target in 2007, growing to 30% by 2012 and after. California (CA) 60% electricity generati