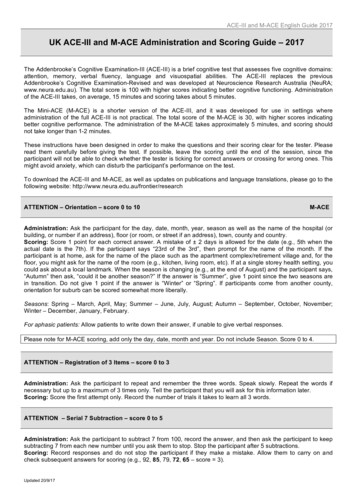

Transcription

CustomsHandbookFor Solar PV Productsin ZimbabweJune 2021

The Foreign, Commonwealth & Development Office (FCDO)Africa Clean Energy Technical Assistance Facility June 2021Tetra Tech International DevelopmentThis report was co-authored by the Africa Clean Energy Technical Assistance FacilityProsperity House, Westlands Road,P.O. Box 4320, 00100, Nairobi, Kenya.Tel: 254 (0)20 271 0485DisclaimerThis handbook is provided on the basis that it is for the use of the UK Foreign, Commonwealth and Development Office only. Tetra Tech InternationalDevelopment Ltd will not be bound to discuss, explain or reply to queries raised by any agency other than the intended recipients of this report. Tetra TechInternational Development Ltd disclaims all liability to any third party who may place reliance on this report and therefore does not assume responsibilityfor any loss or damage suffered by any such third party in reliance thereon. The handbook does not replace ZIMRA regulations. It serves as a guide andZIMRA has the final say on matters of duty etec.pa ge 2

ContentsABBREVIATIONS4FOREWORD51. HOW TO USE THIS HANDBOOK62. ZIMBABWE’S FISCAL POLICY FRAMEWORK FOR ENERGY ACCESS72.1 CUSTOMS DUTIES73. ENERGY ACCESS PRODUCT IMPORTATION GUIDE83.1 SOLAR LANTERNS93.2 SOLAR HOME SYSTEMS103.3 ENERGY ACCESS APPLIANCES AND TOOLS123.4 MINIGRIDS133.5 MISCELLANEOUS ENERGY ACCESS EQUIPMENT154. SOLAR PV IMPORTATION PROCEDURES164.1 IMPORTATION PROCESS MAP174.2 PROCEDURES FOR IMPORTATION OF GOODS FOR CONSUMPTION184.3 FORMS214.4 FEES225. MITIGATING IMPORTATION CHALLENGES235.1 HOW TO OBTAIN PRE-CLEARANCE235.2 ISSUE RESOLUTION AT THE BORDER245.3 ISSUE RESOLUTION AFTER CUSTOMS CLEARANCE246. PROVISION FOR UPDATING THE CUSTOMS HANDBOOK25page 3

AbbreviationsACE TAFAfrica Clean Energy Technical Assistance FacilityASYCUDAAutomated System for Customs DataCECustoms and ExciseFCDOForeign, Commonwealth and Development OfficeGOGLAGlobal Off-Grid Lighting AssociationGOZGovernment of ZimbabweIECInternational Electrotechnical CommissionIFCInternational Finance CorporationLEDLight-emitting diodeMoEPDMinistry of Energy and Power DevelopmentMoFEDMinistry of Finance and Economic DevelopmentOGSOff-Grid SolarSHSSolar Home SystemsSIStatutory InstrumentVATValue Added Taxpa ge 4

ForewordSolar power is one of the key resources to provide universal access to electricity andreduce GHG emissions in Zimbabwe. Solar energy also eases of power shortages inZimbabwe, thereby improving quality of life.While the benefits of solar energy are clear, there are obstacles that have slowed marketpenetration. One concern from ZIMRA officials and industry has been the importation ofdifferent types of solar energy products. In a bid to move towards solving the problem,the Government in partnership with ACE TAF, ZIMRA, and REAZ has developed the‘Customs Handbook for Solar PV Products in Zimbabwe.’The handbook provides a practical interpretation of the Customs and Excise Act andrelevant regulations in relation to solar products. The purpose of this handbook is toguide importers, government and other stakeholders on the clearance process, tariffcodes, rates of duty and product description for ease of reference.Solar products are expected to be key drivers to the economy and information is criticalfor the sector to grow. By providing greater clarity about the importation processes forsolar PV products in Zimbabwe, we hope that this handbook may be a useful referencethat contributes to the strengthening of Zimbabwe’s power sector.Author/signatoryJune 2021page 1

1. How to Use thisHandbookWith the evolution of the off-grid solar (OGS) sector in recent years and therising volume of OGS products into Zimbabwe, there is a need to providemore clarity on the exemption status of commonly imported OGS products.This comprehensive Customs Handbook aims to help clarify importation processesandreduce areas of misinterpretation by customs officials as well as importers or theirclearingagents.This Handbook complements applicable legislation and is intended to helpachieve more predictable and consistent classification and clearance of Solar productsin line with Government’s energy policy initiatives.Section 2 of this handbook is a concise overview of fiscal policy in Zimbabwe, with afocus on Statutory Instrument (SI) 147.Section 3 consists of a thorough importation guide as of January 2021 for solar lantern,solar home systems (SHS), minigrid, and other energy access products that arecommonly imported into Zimbabwe.1 The guide consists of the following information forintegrated kits and component parts:Product descriptionsHS CodesIllustrationsApplicable duty ratesApplicable value-added tax (VAT)Section 4 provides an importation process map as well as step-by-step description ofeach stage of the importation process. This section also includes information aboutforms and fees required for importation.Section 5 provides a brief overview of mitigation procedures in the event of importationchallenges before clearance, at the border and after customs clearance.Section 6 outlines a provision for regularly updating future versions of this CustomsHandbook.1At the time of drafting MOEPD has proposed several changes for applicable customs duty rates. These have not yet been gazettedand so this document does not reflect the proposals.pa ge 2

2. Zimbabwe’s Fiscal PolicyFramework for EnergyAccessThe Government of Zimbabwe’s (GOZ)first step towards the elimination of tariffsand taxes on solar systems and productswas through SI 147 of 2010. SI 147 suspendedcustoms duties for a limited number of productsthat included solar PV panels and light-emittingdiode (LED) lighting (see Table 1 below). SI 147 of2010 did not include solar inverters and agriculturalproducts (that may be solar PV-powered) such asegg incubators and solar dryers as the customsduty rates in the Second Schedule to the CustomsTariff Book were already at 0%.Table 1: Products currently with substantive duty rates removed in the Customs Tariff Book or suspendedthrough SI 147 of 2010 and SI 13 of 2020.Existing Exemptions for Energy Access ProductsCommodity CodeDescription of GoodsRate of DutySI8504.40.00Static converters0%NA8436.21.00Poultry incubators and brooders0%NA8479.89.00Solar dryer0%NA8419.1910Domestic storage water heaters0%147 (2010)8419.1990Other0%147 (2010)8539.3920Compact fluorescent tubes and bulbs of a gas type 0%of not exceeding 25w and voltage exceeding 170v147 (2010)8541.4000Photosensitive semiconductor devices, includingphotovoltaic cells whether or not assembled inmodules or made up into panels; light emittingdiodes.0%147 (2010)9032.8900Other instruments and apparatus not specifiedelsewhere.0%147 (2010)8507.60.00Lithium-ion accumulators0%13 (2020)Support for the renewable energy sector wasfurther enshrined in subsequent National EnergyPolicy of 2012, the Vision 2030 strategy releasedin 2018, and most recently the National RenewablePolicy of 2019. In the 2020 fiscal budget, theMinistry of Finance and Economic Development(MoFED) called for the suspension of duty andVAT on all solar components and parts. Thisfiscal pronouncement automatically triggered thereview of SI 147 to include other SHS componentsand parts such as charge controllers, batteries,balance of system components and other solartechnologies. SI 78 of 2021 included a specificCommodity Code for integrated SHS (9405.40.60)with a 0% rate of duty.page 3

3. Energy Access ProductImportation GuideThis section provides a comprehensiveoverview of energy access equipmentcommonly imported into Zambia. Thesection is divided into the following subsections:For integrated systems, the following informationis provided:Product or system categoryComponent parts1Solar lanterns2Solar home systemsIllustration3Energy access appliances and toolsShipment details4MinigridsPacking details5MiscellaneousAdditional features considered under thiscategoryFor each component product, the followinginformation is provided:HS Code (for integrated system)Requirement for correlation of components tocomplete systemsProductApplicable duty rate (for integrated system)Product descriptionApplicable VAT (for integrated system)HS CodeApplicable tax rates (Import duty & VAT) as of31 December 2020.Illustrationpa ge 4

3.1 Solar LanternsSolar lanterns (integrated kits) Product or system categorySolar lanternComponent partsLED light, solar panel,built-in rechargeablebattery, integratedcontrol unitHS Code8513.10.20Sub-types considered under thiscategorySolar lantern with integrated radioShipment detailsSingle consignmentPacking detailsSystem components packed in the same boxSystem components packed in separate boxes i.e., solar panels andsolar lanterns packed separatelyAdditional features considered underthis categoryMay include secondary cables (e.g., USB).Requirement for correlation ofcomponents to complete systemsNoneApplicable duty rate0%Applicable VAT14.5% Solar Lanterns (component parts) ProductProduct Description Solar PanelsPhotosensitive semiconductor 8541.40.00devices, whether or notassembled in modules or madeup into panels0%14.5%Light-emitting diode 40%14.5%Solar batteries8507.60.000%14.5%Charge control units for solarpower (for a voltage notexceeding 1000V)8537.10.0020%14.5% LED LightingHS CodesImport Duty VAT Solar torch (rechargeable) Lithium-ion Battery Solar charge control units page 5

3.2 Solar Home SystemsSolar Home Systems (Integrated Kits)Product or system category Solar home system (complete kit)Component partsSolar powered lighting system comprising of a solar panel, multiple LED lights,battery, inverter, charge control unit, casing and cabling.HS Code9405.40.60Additional featuresconsidered under thiscategoryIncludes primary cables /interconnecting cables (i.e., panel to control unit andlights to the control unit)Includes secondary cables (i.e.,USB cables for charging phonesand rechargeable torch)Includes rechargeable torch charged from the systemIncludes rechargeable radio, charged from the systemSolar lighting system can be charged via USBShipment detailsSingle consignmentPacking detailsSystem components packed in the same boxSystem components packed in separate boxes e.g., solar panels, lights,secondary cables, batteries and control units packed separatelyApplicable duty rate0%Applicable VAT14.5%Solar Home Systems (Component Parts)ProductProduct DescriptionSolar PanelsPhotosensitive semiconductor 8541.40.00devices, whether or notassembled in modules or madeup into panels0%14.5%LEDLightingLight-emitting diode (LED)lamps8539.50.0010%14.5%Solar torch m-ionBatterySolar batteries8507.60.000%14.5%Solar chargecontrol unitsCharge control units for solarpower (for a voltage notexceeding 1000V)8537.10.0020%14.5%pa ge 6HS CodesImport Duty VAT

Solar Home Systems (Component Parts)Solar Home Systems (Component Parts)ProductProduct DescriptionHS CodesImport Duty VATStaticConvertersInverters for solar power(Electrical transformers, staticconverters and s for solar power(Electrical transformers, staticconverters and inductors) withcharge control units8504.40.000%14.5%Solar chargecontrol unitsCharge control units for solarpower (for a voltage notexceeding 1,000 V)8537.10.0020%14.5%Solar cablesInsulated wire, cable (including 8544.49.00co-axial cable) and otherinsulated electric conductors,whether or not fitted withconnectors.15%14.5%SolarSwitchesElectrical Apparatus forswitching and protectingelectric circuits.8536.50.0010%14.5%SolarBreakersElectrical Apparatus forswitching and protectingelectric circuits.8536.20.1010%14.5%SolarBreakersOther automatic circuitbreakers8536.20.9010%14.5%page 7

3.3 Energy Access Appliances and ToolsEnergy Access Appliances and ToolsProductProduct DescriptionHS CodeImport Duty VATSolar cooker/OvenAn apparatus for cookingfood using the energy ofdirect sunlight8516.60.0040%14.5%DC fanOther fans8414.59.9020%14.5%DC fridgeor freezerRefrigerators of ahousehold type,compression type8418.21.0060%14.5%DC fridge orFreezerOther refrigeratorshousehold type8418.29.0060%14.5%DC radioReception apparatus nReception apparatus fortelevision8528.72.0040%14.5%DC irrigationPumpPumps for liquids, whetheror not fitted with ameasuring device.8413.81.005%14.5%EggIncubatorsPoultry incubators andbrooders8436.21.000%14.5%HairClippersOther hair clippers with selfcontained electric motor8510.20.9020%14.5%SewingMachinesSewing machines of thehousehold type8452.10.005%14.5%Solar dryerSolar productive use tool8419.31.000%14.5%pa ge 8

3.4 MinigridsMinigrid Component PartsProductProduct DescriptionHS CodeImportDutyVATSolar PanelsPhotosensitive semiconductor8541.40.00devices, whether or notassembled in modules or made upinto panels0%14.5%LED LightingLighting emitting diode (LED)lamps8539.50.0010%14.5%Lead acid batteryfor piston engineSolar batteries8507.10.0060%14.5%Other lead acidAccumulatorSolar batteries8507.20.0020%14.5%Nickel cadmiumBatteriesSolar batteries8507.30.0015%14.5%Nickel ironBatteriesSolar batteries8507.40.0020%14.5%Nickel-metalhydride batterySolar batteries8507.50.0020%14.5%Lithium-ionBatterySolar batteries8507.60.000%14.5%OtherAccumulatorsSolar rs for solar power(Electrical transformers, staticconverters and inductors)8504.40.000%14.5%page 9

Minigrid Component PartsProductProduct DescriptionHS CodeImportDutyVATHybrid invertersInverters for solar power(Electrical transformers, staticconverters and inductors) withcharge control units8504.40.000%14.5%Solar chargecontrol unitsCharge control units for solar8537.10.00power (for a voltage not exceeding1,000V)15%14.5%Solar CableInsulated wire, cable (including co- 8544.49.00axial cable) and other insulatedelectric conductors, whether or notfitted with connectors.15%14.5%Solar breakersElectrical Apparatus for switchingand protecting electric circuits.8536.20.1010%14.5%Solar breakersBreaking capacity of 6kPA andbelow8536.20.9020%14.5%Solar switchesElectrical Apparatus for switchingand protecting electric circuits.8536.50.0010%14.5%DC irrigationPumpPumps for liquids, whether or notfitted with a measuring device.8413.81.005%14.5%Standard 20-footshipping containerContainers specially designed forcarriage of goods8609.00.000%14.5%PV ModuleSupportStructureSteel solar module rack7308.90.9025%14.5%pa ge 10

3.5 Other commonly imported solar equipmentMiscellaneous energy access equipmentProductProduct DescriptionHS CodeImport DutyVATFlorescent Lampsand bulbsDischarge lamps –florescent8539.31.0010%14.5%Solar GeysersSolar geyser8419.19.100%14.5%Solar StreetLightsOther Electric lampsand lighting fittings9405.40.500%0%page 11

4. Solar PV ImportationProceduresSection 38(1) of the Customs and Excise Act,Chapter 23:02 of the Laws of Zimbabwe,provides that Goods shall not be importedinto Zimbabwe without an entry and declarationbeing made and without such duties as may beimposed by law being paid or secured.Section 39(1) further provides for the entry ofimported goods be made at the time of importationor 10 days after the time of importation for one ofthe following purposes:for consumption - This is the importation wherecustoms import procedures are conductedand concluded at the customs port of firstarrival. Regulation 18(1)(a)(i) of the Customsand Excise (General) Regulations, 2001 (SI154 of 2001) provides for the completion andsubmission of bill of entry for the goods inForm 21 for consumption on importation at thecustoms port of entry.for warehousing in a bonded warehouse –This is the importation procedure where animporter of any dutiable goods may warehousethem in any warehouse duly licensed undersection 68 of the Customs and Excise Actwithout payment of duty on the first importation.All goods so warehoused are subjected to theprovisions of the Customs and Excise Act andpa ge 12any regulations or rules made thereunder.Importation for warehousing is provided forunder Section 70 of the Customs and ExciseAct.for removal in bond to an inland place forfurther entry - This is where an importer of anydutiable goods may, subject to approval by theCommissioner, remove the goods in bond to aninland place in accordance with Section 83(1) ofthe Customs and Excise Act. Where the goodsare then warehoused after the removal in bond,the provisions of the Customs and Excise Actrelating to bonded warehouses, in so far asthey are applicable to, and compatible with,such purposes, terms and conditions, apply tocustoms warehouses.It must be noted that almost all the importation ofgoods for energy access is done for consumptionwhere customs import procedures are conductedand concluded at the customs port of first arrival.This is because the other two forms (i.e., forwarehousing in bonded warehouses and for inbond carriage to inland place) for further entryare more costly as the importer needs to incuradditional costs in warehouse/storage charges,removal of bond fees payable to the agents andhandling costs at the bonded warehouse.

4.1 Importation Process MapBelow is the importation process map for Zimbabwe. This importation process map may also be printedseparately for customs agents or other stakeholders.12Importer appoints ClearingAgent if not registered withZIMRA to do own clearingImporter or Clearing Agent,fund prepayment account,through their Clearing Agent,lodges in an entry anddeclaration in form F21 andpay an ASUCUDA Processingfee of ZWL 800.00 per entry.3The lodgment of entry should beaccompanied by:vv The Invoice on which the goodswere bought;vv Packing List for the goods imported;vv Manifestvv Customs value declarationImporter or Clearing Agent, does aSelf-Assessment and entry registrationcommits funds in prepayment account44.1 Green LaneDeclaration goes forassessment4.2 Yellow LaneDeclaration goes throughdocument checksCustoms Examination –Customs examine the entry.4.3 Red LanePhysical Inspection ofthe goods imported5Queries and Amendments(customs queries and importerthrough CA amends accordingly)If there are any amendments to be made to theentry, the importer amends the entry and onlodgment of an amended entry in the ASYCUDA,pays ZWL83.40, which is an ASUCUDA processingfee for processing the amended bill of entry.64.4 Blue LaneDeclaration isautomaticallyassessedAt assessment level, queries and amendmentscould still occur. The assessor could query the entryin which case it goes back to the examination officerto consider the query raised at assessment level.Customs Assessment todetermine whether the selfassessed taxes declaredunder step 3 are correct.87Customs AssessmentsDeclaration FinalizationRelease Order(Goods are releasedto the importer)page 13

4.2 Procedures for Importation of Goods forConsumptionThis is the importation procedure and process for the importation of solar PV products where the customsprocedures are conducted and finalized at the port of entry. This handbook does not differentiate betweenimportation at a border crossing and at an airport as ZIMRA has only one official importation process.Under the ZIMRA Client Service Charter there is an undertaking to process a clean customs declarationwithin 3 hours of bill entry submission.The importation procedure is as follows:Step 1 – Appointment of a Clearing Agent by the ImporterThe person intending to import goods may in terms of Section 35 of theCustoms and Excise Act appoint a Registered Clearing Agent to act onhis behalf. This is not compulsory under Zimbabwe Customs law thereforeindividual importers can perform their own customs clearance formalitiesprovided they are registered with ZIMRA. However very few companies doin-house customs clearing, the majority appoint a clearing agent, to help withthe customs formalities at the border on their behalf.Step 2 – Lodgment of Entry (Entry and Declaration)For imports by road the Agent/Transporter registers manifest in ASYCUDA andgives details to the running number to Declarant/Agent for pre-clearance. Allcommercial importations by road transport are now required to be pre-clearedin terms of Section 5A of the Customs and Excise (General) Regulations asamended by SI 9 of 2018. For goods imported by other means of transport theimporter may pre-clear but it’s not mandatory. Before the arrival of the goodsan importer is required to make an entry and declaration (lodge an entry in theASYCUDA system) in form 21 as provided for under Section 39 of the Customsand Excise Act. The Declaration must be accompanied by the followingdocumentation:(a)Original Invoice on which the goods were bought;(b)Packing List for the goods imported; and(c) Manifest (road manifest if goods are imported by road, Airway bill if goodsare imported by air, Railway advise note if goods are imported by rail).pa ge 14

The declarant/agent upon pre-clearance and registration of the bill of entry is requiredto have funded his prepayment account in the ASYCUDA system and the amount ofduty is committed to the particular entry.In the case of goods being imported and covered under SI 147 and SI 13 the customsrate of duty is zero and VAT at a standard rate of 14.5% is currently payable.Step 3 – Self assessment and payment of any customs duties dueOn lodgment of a bill of entry, the Declarant/Agent, makes an own assessmentof the duties to be paid and deposits such amount into his prepayment accountin ASYCUDA system. The funds are automatically paid upon assessmentof the bill of entry. In all cases where the imported goods are subject to anacceptable sale transaction the valuation for customs duty purposes shall bebased on the invoice value in terms Section 106 of the Customs and ExciseAct. Kindly note that Zimbabwe uses the Cost, Insurance and Freight (CIF)basis of valuation. This means that the cost, insurance and freight paid up tothe point of importation are all included in the value on which the rate of dutyis applied.However, if Customs are in doubt of the values declared by the importer, theywill ask for further evidence (may be specific) to verify the correctness of thedeclared values. If they are still not satisfied, they will then use alternativemethods of valuation in their hierarchical order in consultation with the importer.This is in accordance with the WTO Valuation Decision 6.1 that deals withsituations where declared values are in doubt.Step 4 – Custom’s ExaminationThe next stage is where Customs makes an examination. The Entry can go toRed Lane, Yellow Lane, Blue Lane or Green Lane in the ASYCUDA system.(a) RED Lane: All declarations that are selected red will first be handled by theCustoms Examining officer and record their documentary check results in theASYCUDA system. A physical examination (PE) order is issued on Form 45to enable the physical inspection of the goods to be undertaken to determineif the declaration is in line with the actual goods imported.(b) YELLOW Lane: Customs may only do a documentary check. Documentarychecks are mainly to verify the correctness of all information appearing onthe face of the bill of entry and that all required supporting documentation isattached. For example, where the value of the goods as declared on the bill ofentry (Form 21) is very different from the Value appearing on the commercialinvoice, Customs will undertake such documentary check to establish whythe values are different. However, Customs could make a determinationbased on the documentary check findings to send the goods to the Red laneeven if the ASYCUDA assigned them the yellow lane in which case the goodswould have to undergo a physical inspection.(c) GREEN Lane: Entries in this lane are automatically assessed after a set time.The risk of fraud or mistakes on these entries is perceived to be low based onpage 15

set risk profiles in the ASYCUDA system and therefore their movement acrossthe border is facilitated.(d) BLUE Lane: This lane is for Authorised Economic Operators (AEOs). Theentry automatically assesses and is subject to possible post clearance auditchecks.In most cases, importation under tax incentives is assigned the Yellow or RedLane and go through physical inspections as a safeguard measure by customsto guard against fraudulent misclassification of items that may not qualify to beimported under the incentive.Step 5 – Queries and AmendmentsThis step is done at the time of examination of the entry in step 4. It’s a stagewhere customs query the declaration made in form 21 or the Declarant/Agent,may decide to make an amendment to the declaration in terms of GeneralRegulation 18(6). This is normally the stage that delays the clearing of goodsbecause it depends on how long the importer takes to respond to the queriesand provide additional information/amendments required by customs and forthe customs to respond to the response from the importer especially where animporter disputes the query.The most common queries and amendments are in relation to Commoditycodes, declared values, declared origin, description of goods and procedurecodes.As an example, the examining officer may determine that the goods havebeen misclassified or undervalued, the officer may query the entry andrequests for an amendment which the importer may agree to or may not agreeto. If the importer agrees to make the necessary amendments to the entry, theamended entry will have to be accompanied by payment of amendment fees,reassessed taxes and the accompanying penalties. If on the other hand theimporter disagrees to the query, this will trigger an appeal process as outlinedin Section 5.2 below. The goods can however be provisionally cleared subjectto a cash deposit to cover the duty at stake in terms of General Regulation18(8).Step 6 – Custom’s AssessmentThis process is done by the Examining Officer for declarations without queries orby the Queries Officer after resolution of queries. Once examining officer clearsthe entry, it then goes for assessment to now determine if the self-assessed taxesdeclared under step 3 are correct. At assessment level, queries and amendmentscould still occur. The assessor could query the entry in which case it goes back tothe examination officer to consider the query raised at assessment level.pa ge 16

Step 7 – Assessed Declaration FinalizationIf everything is clean after undergoing the above steps (i.e., all documentationprovided and no queries and amendments or further queries amendments),Customs accepts the declaration made by the importer. The Chief Examinerundertakes final checks and finalizes the assessed declaration.Step 8 – Release orderOnce the Chief Examination Officer undertakes the final checks and assessmentis done, then a release order is issued, and the goods are released by customsto the importer for consumption. Currently as a Covid-19 mitigation measure therelease order printing function is being done by the Declarant/Agents ASYCUDAprofile in order to reduce physical interaction with the Customs Office.4.3 FORMSThe following are the required importation formsin accordance with the provisions of the Customsand Excise Act:(1) The Customs and Excise Entry and DeclarationForm (Form 21): An importer is requiredto make an entry and declaration of goodsimported in Form 21 as required by Subsection(1) of Section 39 of the Customs and ExciseAct. Form 21 is set out in the First Schedule,Part II of the Customs and Excise (General)Regulations, 2001 (SI 154 of 2001). Animporter is also required to attach the followingdocuments to Form 21:(a) Original Invoice on which the goods werebought;(b) Packing List for the goods imported;(c) Valuation declaration forms; and(d) Manifest (road manifest if goods areimported by road, Airway bill if goods areimported by air, Railway advise note ifgoods are imported by rail).(2) The Customs and Excise Bill of entry QueryNotification/ Request to Amend an Entry (Form45): In an event that the declaration made inForm 21 is incorrect, the importer may requestto amend the entry using Form 45. Form 45 isset out in the First Schedule to the Customsand Excise (General) Regulations, 2001 (SI154 of 2001).(3) Application to lodge a cash deposit as securityfor an obligation (Form 122). In an event thatclearance for consumption cannot be finalisedat the time of importation for any reason,importer can make an application to pay adeposit in order to facilitate the release of thegoods.(4) Declaration of particulars relating to CustomsValue where Transaction Value Method is used(Form 52A). Whenever the Transaction valuemethod has been used this completed valuedeclaration form must be attached to the Form21.(5) Declaration of particulars relating to CustomsValue where other Methods of Valuation areused (Form 53A). Whenever a valuationmethod other than the Transaction valuemethod has been used this completed valuedeclaration form must be attached to the Form21page 17

(6) Application of registration of Value Ruling onF54B. In the event that there is a relationshipas defined in Section 104(3) between the sellerof goods and the importer an application forthe registration of a value ruling on this form isrequired.(7) Declaration of particulars relating to CustomsValue – Value Ruling (Form 54B). In the eventthat a Value Ruling has been issued, it mustalways be attached to the Form 21 wheneveran importation between the related seller andimporter are involved.4.4 FEESAll fees to be paid under the Customs and ExciseAct are prescribed in Part XV of the Customsand Excise (General) Regulations, 2001 (SIpa ge 18154 of 2001). The Following are the feesprescribed to be paid by importers: Fees to be paid on the entry of goods: The feeto be paid on entry of goods is set out in PartXV of the Regulations SI 154 of 2001 and iscurrently set at a sum equal to eight hundredZimbabwean dollars (ZWL800.00) for eachentry; and Fees to be Paid on any correction to a bill ofentry: The fe

Dec 31, 2020 · ‘Customs Handbook for Solar PV Products in Zimbabwe.’ The handbook provides a practical interpretation of the Customs and Excise Act and relevant regulations in relation to solar products. The purpose of this handbook is to guide importers, governmen