Transcription

IR320May 2020SmartbusinessA guide for businesses andnon-profit organisations

ird.govt.nz1IntroductionBeing your own boss and going into businessfor yourself can be an exciting challenge. So cantaking responsibility for running a non-profitorganisation such as a kohanga reo or sportsclub. However, being in business or running anorganisation also carries certain responsibilities.As the rules that apply to businesses generallyalso apply to non-profit organisations, the term"business" in this guide includes non-profitorganisations as well as businesses.There are, however, certain tax rules that onlyapply to non-profit organisations. If you arerunning a non-profit organisation and need moreinformation go to www.ird.govt.nz or call us.This guide has information on: what records to keep and suggestions on howto keep them cashflow forecasting and time management your basic tax responsibilities how to use your records to save you time andmoney in meeting those responsibilities.ird.govt.nzGo to our website for information and to use ourservices and tools.How to get our forms and guidesYou can get copies of our forms and guides atird.govt.nz/forms-guidesGST added to myIR secure onlineservicesIf you complete your GST registration throughmyIR, in most cases you'll receive immediateconfirmation of your GST number and registrationdetails (which you can save for your own records).Then, each time your return is due for filing we'lladvise when the return is available in myIR foryou to complete and submit by the due date. Seepage 66 for more information on myIR.GST filing through accountingsoftwareYou can file your GST return directly to usthrough your accounting software.If you use accounting software to prepare yourGST return, check with your software provider tosee if they offer this service.For more information go to ird.govt.nz/gst Log in or register for myIR - manage your taxand entitlements online. Calculators and tools - use our calculators,worksheets and tools, for example, to checkyour tax code, find filing and payment dates,calculate your student loan repayment. Forms and guides - download our forms andguides.Forgotten your user ID or password?Request these online from the myIR login screenand we’ll send them to the email address we holdfor you.The information in this booklet is based on current tax laws at the time of printing.

ird.govt.nz3Part 1 - General5Getting started5Getting an IRD number7Basic tax responsibilities8Paying your tax before the due date8How to make payments8Keeping records is important8Benefits of keeping accurate records9What records to keep9Companies31Non-profit organisations31Charities register31Tax on interest and dividends32Provisional tax33Paying provisional tax33How do I pay provisional tax?35Budgeting for provisional tax35Interest35How long to keep your records10For more help35Personal records10Part 5 - Expenses37Part 2 - Source documents11Claiming expenses for income tax37Banking records11Capital expenses37Income records13Using your own vehicle in the business38Expenses records14Using your home for the business39Part 3 - BookkeepingTravel expenses4015Entertainment expenses40Cashbooks16Website expenses40Petty cash book20Fixed assets records41Wagebooks22Depreciation41Time management23Depreciation methods42Recording methods24Making your bookkeeping systemwork for you25Part 6 - GST (goods andservices tax)45Registering for GST45Charging GST45Claiming GST45GST on grants and subsidies45GST and secondhand goods46Exempt and zero-rated goods and services46Tax invoices46GST returns49Late filing penalty49Electronic filing49Accounting for GST49Using your cashbook to do your GST return50Part 4 - Income tax27Income27Your first year in business is not tax-free27Early payment discount27Drawings28Balance date28Paying income tax28What return to use for income tax29Preparing financial accounts30Income tax rates30Sole traders30Partnerships30GeneralContents

4SMART BUSINESSGeneralPart 7 - More information53Part 9 - Services you may need66Accident compensation53myIR66Independent earner tax credit (IETC)53Need to speak with us?66Student loan repayments530800 self-service numbers66Working for Families Tax Credits54Supporting businesses in our community66Research and development (R&D) losstax credit55Tax Information Bulletin (TIB)67Business Tax Update67Audits67Late payment67Putting your tax returns right67Part 8 - Employerresponsibilities57Deducting PAYE58Using your wagebook to complete yourEmployment information59Completing your employment information60Paying PAYE60Accident Compensation Corporation (ACC)60Student loan deductions61Student loan extra deductions61Child support deductions61KiwiSaver62Employee Share Scheme (ESS) benefits62Payroll giving63Employer's superannuation cash contribution(employer contribution)63FBT (fringe benefit tax)65Electronic filing65Non-payment of employer deductions penalty 67Voice ID68If you have a complaint about our service68Privacy68Where to go for more help69

ird.govt.nz5Getting startedIn this part we give you an overview of your taxresponsibilities. We also discuss record keepingin general and explain what sort of records youshould keep.Before going any further, you first need to establishwhether you're actually in business. You needto be sure because the tax laws are different forindividuals and businesses.How do I know if I'm in business?In general, you're in business when:These are the factors we look at to decide if you'rein business: the nature of the activity how much time, money and effort you put intothe activity how long you've been running or are intendingto run the activity how much you make from the activity whether you run the activity in a similar way tomost businesses in the same trade if you intend to make a profit. you start charging others for the goods orservices you produceIf you aren't sure whether your activity fits ourdefinition of a business, we can help you. you supply these goods or services on a regularbasisYour profit is the amount you're left with afterdeducting expenses from all your sales and incomefor a certain period. When you're in business you'llhave to pay income tax on the profits. you intend to make a profit from selling yourgoods or services.GeneralPart 1 - General

6SMART BUSINESSBusiness typesGeneralThe chart below gives a brief description of different business types and basic facts about how they're run.While we can explain the tax responsibilities of each of these business types, you may like to talk to anaccountant or lawyer about the most appropriate business type for your needs.Business typeWhat it isHow it worksSole traderA sole trader is a person trading ontheir own. The business is controlled,managed and owned by that person.There are usually no formal or legalprocesses to become a sole trader.The owner or manager is personallyentitled to all profits, but is alsopersonally responsible for all businesstaxes and debts.PartnershipA partnership is where two or morepeople join together to run abusiness. Each partner contributessomething to the business and, inreturn, each shares in any profit orloss. Each partner is also responsiblefor any debt within the partnership.A formal partnership agreement canbe prepared.Partners share responsibility forrunning the business, and share theprofits and losses equally unless theagreement says otherwise.The partnership does not pay incometax. It distributes the partnershipincome to the partners who pay taxon their own share.CompanyA company is a formal and legalentity in its own right, separatefrom its shareholders (or owners).It's formed when a group of peopleexchange money and/or propertyfor shares in an enterprise registeredunder the Companies Act.To register a company go towww.companies.govt.nzNon-profitorganisationsA non-profit organisation is anysociety, association or organisation: not carried on for the profit orgain of any member, and whose rules do not allow money,property, or any other benefitsto be distributed to any of itsmembers.There is a legal registration process youwill have to pay for.More money can be raised with moreowners.The company owns the assets andliabilities of the business and isresponsible for any debts.The shareholders' liability for losses islimited to their share of ownership inthe company.Some non-profit organisations maybe incorporated, ie, registered with theMinistry of Economic Development.Non-profit organisations can haveprofit-making activities taxed as businessincome in the normal way. Theseorganisations must have written rules toget an income tax exemption.

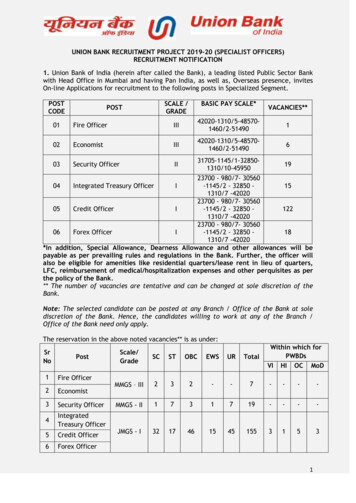

ird.govt.nz7Getting an IRD numberGeneralThe table below tells you what form to use and what we'll need from you. See page 6 for a briefdescription of the different business types.Business typeWhat you'll need to doSole traderYou use your personal IRD number for your business. If you don't have a personalIRD number, complete an IRD number application - resident individual - IR595form to apply for one.PartnershipComplete an IRD number application - resident non-individual - IR596 form with alist of the names and IRD numbers of each of the partners.CompanyApply for an IRD number online at the same time as you incorporate yourcompany through the Companies Office website www.companies.govt.nzThe Companies Office will send your company IRD number information to uselectronically once the company is incorporated. Alternatively, use an IR596 with acopy of the company's certificate of incorporation.TrustComplete an IR596 with a copy of the trust deed.Non-profitorganisationsComplete an IR596 with a list of the names and IRD numbers of the executive officeholders, and a copy of the certificate of incorporation (if you're incorporated), or acopy of the constitution if you don't have a certificate of incorporation.NoteIf you're unsure about any of these requirements, call us on 0800 377 774. When you've been issuedwith an IRD number please use it in all your business dealings with us.You can apply for an IRD number on our website. Go to ird.govt.nz/IRDnumberIR596March 2019OFFICE USE ONLYIRD number application – resident non-individualIRD number issued/confirmedComplete this form if you’re a New Zealand resident, otherwise use the IRD number application - non-resident/offshorenon-individual (IR744). Answer all questions and sign the declaration.1.Print the full name of the organisation2.Is this application for a branch?Mereana and Jo MoeraNoYes Print the IRD number of the main branch or head office and attach acompleted GST (IR360) and/or PAYE (IR334) registration form, then go toQuestion 15.(8 digit numbers start in the second box.3.Tick the organisation type from the list belowCompanyPartnershipClose companyOrdinary partnershipWidely held companyUnit trustLimited partnershipSuperannuation schemeEstate or trustIRD number issued/confirmedComplying trustIRD numberapplication - resident individualForeign trust Please read the Notes section before you complete this applicationNon-complying trust Please complete this application using capital letters—don’t use abbreviations Please completeEstateapplication in blue and/or black pen.Registered – widely heldPublic authorityRegistered – not widely heldChildren under 16Club or societyLocal authorityNot registeredsocietyclub1. If you are applyingIncorporatedfor a child, printyour orownIRD number here.Special companyKiwiSaverLife insuranceForeignMāori authorityBody corporate5.July 2017OFFICE USE ONLYCooperativeAgent non-resident insurer4.IR595)Complete a Māori authority election (IR483) form TitleJa n e tWi s e m a nMrStreet addressSuburb or RD(8 digit numbers start in the second box.Industrialand provident societyFirst name(s)SurnameIf the trade name is different from thename shown above, print it herePrint the street address of the place ofbusinessUnincorporated society or clubFriendly societyApplicant informationBuildingsociety2. Name of applicantas shownon identity documentsTown or cityPostcodeMrsMissMsOther)

8Personal IRD numberGeneralTo apply for your personal IRD number, completean IRD number application - resident individual IR595 form.Basic tax responsibilitiesSMART BUSINESSPaying your tax before the duedateIt's important to pay your tax by the due date toavoid penalties and interest being charged. You cando this by:Here are some of the basic tax responsibilities mostbusinesses will have. making payments to us before the due date,either regularly or as money is available You'll need to get an IRD number if you don'talready have one. If you're a sole trader, youcan use your personal IRD number. arranging an automatic payment for the wholeamount by the due date If you're in business as a company orpartnership you'll need a new IRD number.This number will be used for GST (goods andservices tax) as well. You may have to complete financial accountsand various tax returns each year, such asincome tax and GST returns. If you're an employer, you may have tomake PAYE, student loan, child support andKiwiSaver deductions and pay these to us. Seepage 57. Businesses and some organisations have towork out their profits, so they can calculatehow much income tax to pay. This is explainedin Part 4. You may have to pay provisional tax duringthe year. See page 33. You have to register for GST if your turnover isover 60,000. See page 45. If you're a sole trader you have to pay yourstudent loan repayments direct to us. This isbecause no repayment deductions are madefrom income as you earn it. See our bookletStudent loans - making repayments - IR224 formore information.Our tax system relies on people meeting their taxresponsibilities voluntarily, and there are penaltiesif you don't comply. Our guide Penalties andinterest - IR240 has full details. putting money aside in a special bank accountfor tax and paying in one lump sum before thedue date - that way, you may get interest on themoney.How to make paymentsGo to ird.govt.nz/pay to find out about paying by: internet banking credit or debit card, and direct debit.Keeping records is importantNo matter what sort of business you're running,you need to be able to see what you've paid andwhat you're owed so you can budget. Your bankmanager, accountant or investors may also needto see your business records at some time tokeep track of your progress and help plan yourbusiness's future.Several government departments also require youto keep records by law, especially for statistics andtax reasons.Record keepingYour records must be in English or Mäori unlessyou get approval from us to use another language.Benefits of keeping accuraterecordsAs soon as you decide to go into business, it'simportant you start keeping accurate records,because it's much harder to work backwards at alater date.There are legal reasons for keeping accuraterecords, as well as good business reasons.

ird.govt.nzAccurate records will help you determine whetheryour business is making enough money to meet itsexpenses. They'll show you what you're spendingmoney on and where the money is coming from.This will help you in budgeting and decisionmaking. Non-profit organisations will findaccurate records help them keep track of grants ormembers' fees and how funds are being spent.Increase your chances of getting finance orfundingWhat records to keepHere is a broad outline of the type of records youmust keep.You must keep enough records to be able tocalculate your income and expenses and to confirmyour accounts.For tax records kept in te reo Mäori there aresome exceptions: Certain phrases in the GST Act eg “tax invoice”must be in English Numerals must be in Arabic eg 1, 2, 3 etc.Good record keeping makes it easier for others toknow whether to invest in your business or project.It's much easier to put a good case together whenapplying for loans or grants if you've got accuraterecords to support your intentions. Keepingaccurate records is good evidence a business is beingrun professionally, which makes it a better prospectfor investment. This is also true if you're thinking ofselling the business. Potential buyers can check yourperformance by looking at your records. receipts and invoices issuedSave time and moneyFor business expenses, keep records such as:You'll find that the more up-to-date your recordsare, the quicker you'll get through your tax returnsand other paperwork. If you're doing the day-today bookkeeping, your accountant won't haveto spend valuable time (that you're paying for)getting your books in order. You'll be able to usethe accountant's services for more specialised taxand financial advice instead. your cashbook and petty cash bookAudits will take less timeIf you're in business you can expect to be auditedby us at some stage. There will be less time spenton the audit if your records are well kept.For business income records, you must keep: account books, such as your cashbook, journalsand ledgers bank statements and deposit slips worksheets showing tax return calculations any other necessary documents to confirmaccount entries. receipts and invoices received bank statements and cheque butts depreciation calculations (see page 42) details of travel expenses entertainment expenses (see page 40) motor vehicle logbooks, telephone and powerbills and other such records (see pages 38 to 40) wage records for employees (see page 22) legal statements, such as purchase or saleagreements of a business and leases interest and dividend statements.You must also keep records for all your businessassets and liabilities at the end of the year, including: lists of debtors and creditors stocktake figures a fixed asset register (see page 41) final profit and loss statements andbalance sheets.GeneralBetter control of your business ororganisation9

10SMART BUSINESSThese are some further records different types oforganisations must keep.GeneralPartnershipsa partnership agreement(if you have one)Companiesthe certificate of incorporation,minute booksTruststhe trust deed and minute booksIncorporatedorganisationsthe certificate of incorporationIt's important to keep all this information, aswe routinely audit business records. There arepenalties if you haven't been keeping full records.How long to keep your recordsKeep all your business records (including thosein electronic form) for at least seven years fromthe end of the tax year or the taxable period theyrelate to.Even after you stop operating your business youstill have record keeping responsibilities.If you or your accountant send your tax returns tous electronically, they must be kept for seven years,either electronically or paper based.If you complete your Employment information- IR348 electronically, you don't have to keepa paper copy, but you'll need to ensure you canreproduce the schedules you've sent us.Your payroll records are a base for the data onthe schedules and you must keep these records forseven years.Reducing the time records must be keptYou may apply to us to destroy certain businessrecords four years after the return period theyrelate to. Call us on 0800 377 774 for moreinformation.Personal recordsIt's a good idea to keep all personal records andtransactions separate from business records. This isbest achieved by using separate cheque and savingsaccounts for the business. As with business records,you must keep all private records (includingprivate bank account records) for seven years.

ird.govt.nz11Part 2 - Source documentsSourcedocumentsSource documents show details of money comingin or going out of a business. They show moneyyou've received or expect to receive, and moneyyou've paid or expect to pay. These documentscarry all the information you need to put into yourbookkeeping system and include banking, incomeand expense records.Banking recordsStarting up a business accountIt's a good idea to keep separate bank accountsfor personal and business purposes. When openinga business bank account, use your registeredbusiness, trust or organisation name to give a clearindication that it's not a personal account.You may want to open a separate bank account forlarge bills and taxes and transfer money from yourmain account throughout the year to cover these.Cheque booksYou must complete the cheque butts as you writeout cheques and keep the butts for your businessrecords.If you write a lot of cheques, record on the front ofeach completed cheque book the cheque numbersand the dates the cheques were written. File oldcheque books in date order.Make sure you fill in these details on each chequebutt: the date of payment the name of the person or business you arepaying (the payee) the amount of the cheque the type of goods or services purchased.12 November 20 13ToRoss RumbleFor Plumbing services Date of paymentName of payeeType of goods orservice purchasedBalance bt.fwdDepositsSubtotalThis chequeBalance c'd fwdGST285 00GST included290794Amount of cheque

12SMART BUSINESSDeposit booksMany businesses use deposit books to record theirsales. In your deposit book write down: the date of the depositBanking CorporationAmount 20 August 20132,752.20Total2,752.20Date the payer's name (the person you got the fundsfrom) the amount of each deposit.SourcedocumentsThe deposit book will usually have columns forrecording information about whether the deposit isfrom a cheque, credit card docket or cash. (Proceeds of cheques etc, will not be available tiountiln cleared).BankingCorpora3Deposited for credit of ugust 20120 ATellerNTellerG T OL I NW E LThe stamped deposit bookis your receipt from the bankUse supplementary deposit booksand record details of depositsBanking CorporationBranchForWellingtonJ. BloggsDeposit bookDateAccount no.20 August 2013030584 0048218-00Date of depositName of accountParticulars of cheques etc, to be completedby depositorFor customer'suse (receipt no./annalysis code)286121529107649826Bank123F. RossB. RewitiS. JonesBranchIOUBCABMSAmount 1,000 00752 951,000 00Name of each payer andamount of each deposit45678910DrawerBankAmountF. RossB. RewitiS. JonesIOUBCABMS1,000 00752 951,000 00111213Total chequesTotal cashSub totalTo be used only asLess chargesTotal deposit2,752 950 752,752 20If you don't use a supplementary depositbook, make sure you record all details onthe back of your deposit slip

ird.govt.nzArrange with your bank to send statements whenit's convenient for you. It's a good idea to havethe statement issued on the last day of the month- it may assist you in preparing your GST returnsand will make it easier to complete your bankreconciliation. There is more information on bankreconciliation on pages 18 and 19.Keep all your business and private bank statementsand file them in date order. You won't be able tocomplete your end-of-year business accounts untilyou have them all. Most banks will charge you forreplacement statements.Managing your banking All business transactions should go through thebusiness bank account. Bank all business income you receive into yourbusiness bank account. Charge all purchases to the business, andpay for them electronically or by cheque so apermanent record of each payment will appearin your bank statement. Transfer money to a separate account for largebills and taxes. If you take money out of the business forpersonal use, clearly identify it as "personaldrawings". If you need to put some of your own moneyback into the business, clearly identify it as"personal funds introduced". If you want to make purchases for the businesson a credit card, you should use a separate cardfor business expenses only.Income recordsIt's good business practice to send invoices toyour customers. Invoices help you to keep trackof money coming in and going out. There are nospecial requirements for what an invoice shouldshow, as long as it can help prove a particulartransaction took place.An invoice will generally show: the seller's name the purchase date the amount paid or to be paid a description of the goods or services being sold.GST invoices must show further details - seepages 46-48.Eftpos and credit card salesKeep all copies of the vouchers and voucherschedules from your eftpos and credit card sales.Make sure you include your eftpos and credit cardsales when working out your total sales for themonth.Debit and credit notesYou must send your customers a debit note ifthe price of goods or services has increased afterthe original invoice was issued. If the price hasdecreased, you must send your customer a creditnote.Debit and credit notes must show the words "debitnote" or "credit note" in a prominent place, inaddition to the details required for an invoice.SourcedocumentsBank statements13

14Cash register tapeSome businesses, such as dairies, make a largenumber of cash sales. These businesses don't haveto record the name of each customer in a cashbookor issue a tax invoice for every sale.SourcedocumentsIt's more appropriate for such businesses to use acash register tape. Make sure all your cash salesare recorded on the tape. Keep these tapes in adaily order by highlighting the date on each one,and store them with your other sales records.The amount you deposit as cash sales in yourcashbook should equal the total on your cash tape.Expenses recordsYou need to keep records of all your expenses forincome tax purposes.Invoices for purchasesIf you buy goods or services on credit forthe business you'll usually be sent an invoicerequesting and recording payment.Make sure you keep your invoices for purchases.Don't send them back to the supplier with yourremittance advice and payment.If you receive regular supplies from a supplier,it's a good idea to tick off all the invoices you'vereceived against the supplier's monthly statement.That way you can make sure you're not paying aninvoice twice.It's helpful to sort your expenses invoices intothose you've paid and those you haven't paid yet.You can store those that have been paid with anypaid monthly statements in cheque number or datepaid order. As a reminder, write the date, chequeamount and cheque number on the statementor invoice.SMART BUSINESSTo tell the difference between paid invoices andthose still to be paid, put them into separate files.Store the paid invoices and statements in a filecalled "accounts paid". Store the invoices yet tobe paid in a separate file, until they are due forpayment, and call this file "creditors" or "accountspayable".Credit card purchasesWhen you make purchases using a credit card forthe business, make sure you keep: your credit card vouchers payment receipts monthly statements.It's good practice to attach your credit cardvouchers and receipts to the monthly statement,so they are all in one place.When you get your credit card statement from thebank listing your credit card expenses, go throughit and write down what each expense was for.NoteIf you're registered for GST, your credit cardpurchases should be claimed in the period thepurchase was made (don't claim against theactual payment you make to your credit cardcompany).Invoices for purchases of 50 or lessKeep all invoices, cash sale dockets, till receiptsand other evidence for these smaller purchases.NoteIf you're registered for GST, you'll need tokeep all tax invoices for purchases over 50.See page 46 for more information.

ird.govt.nz15Part 3 - BookkeepingBookkeeping is transferring the information fromyour source documents, such as invoices andreceipts, into: cashbooks for recording payments in and out petty cash books for smaller purchases wagebooks for employees' pay records.Many businesses use computerised bookkeepingsystems. There are a number of accounting andbookkeeping packages available built on the basicprinciples of manual bookkeeping.BookkeepingWith these three types of record books you canrun your business as well as meeting most of yourtax responsibilities. We'll take you through settingup and using each book.

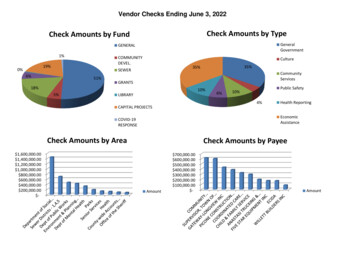

16SMART BUSINESSCashbooksA well-kept cashbook allows you to: keep track of how much money is coming inand how you are spending moneyA cashbook is a record of all payments and receiptsby cheque, eftpos, credit card transactions anddirect credit. It shows different types of salesand income, purchases and expenses under theappropriate headings. The headings you'll usedepend on the type of business or organisationyou run. The headings should describe the type oftransactions you make most often. prepare a cashflow budget of future incomeand expenses (see page 26 for cashflowbudgets) prepare end-of-year financial accounts complete various tax returns.Choose revenue items relevantand common to your businessNew month on new pageGive yourself spaceNovember sales and incomeBookkeepingDATEREFERENCE3 November5 November7 November14 November21 November25 November27 November30 NovemberCustomer SaleGovernmentSale of computerJoe BloggsInterest receivedCustomer SaleCustomer SaleCustomer SaleTOTALSBANK 0000035GSTRECEIVEDSALES260 8758 70146 741,739 138802935862,22743489618FUNDSGRANTS INTRODUCED INTEREST(NO GST) (NO GST)391 30200 005,8691,9563,91313,478Separate column for GST onlyif you're registered for GST57520426SUNDRY391 30200 00978 2615 3515 35978 26Choose expense items relevantand common to your businessNovember purchases and expensesDATEREFERENCE3 November5 November7 November14 November21 November25 November26 November28 November28 November28 November30 November30 November30 November30 NovemberS. Tool LtdSteve HairaLandlord (rent)Petrol CoJoe BloggsGST paid to IRDS. Tool LtdPetrol CoSteve HairaS. Tool LtdS. Tool LtdPetrol CoBank feesTerm loanTOTALSCHQBANKGSTPAID 273100 3,500 00 456 101 650 0097 102 750 0055 007 103 104 400 00 105 310 98 106 7,000 00 91350 006 107108 650 00 109 1,000 00 130110 1,125 00 14611125 00310 25 DD AP 800 0016,326 23 1,761WAGESPURCHASES (NO GST)52 3,043 48831704 6,086 9652437426869 57978 2651 10,978 27650 00RENT652 17LOAN DRAWINGS BANK FEESMOTORSUNDRYVEHICLE

Petty cash book 20 Wagebooks 22 Time management 23 Recording methods 24 Making your bookkeeping system work for you 25 Part 4 - Income tax 27 . In general, you're in business when: you start charging others for the goods or services you