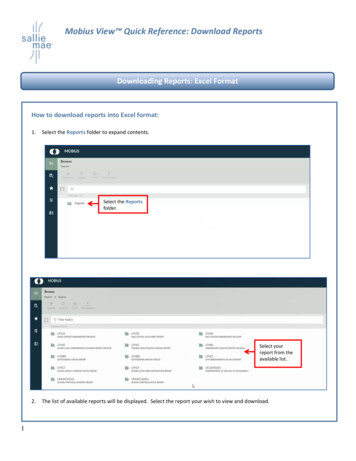

Transcription

Exploring the S&PA Descriptive ViewFor Qualified Investors only

IntroductionThe S&P 500 is the world’s most widely followed index, used not only to track the performance of USstocks but also as the main driver of global markets.In this document, we present a brief description of the index, breaking down its contents in terms ofsector and industry.We also highlight the largest US stocks that are not in the S&P (Zoom, Square, Uber, Moderna, etc ) aswell as the very large caps that we believe are less well known by European Investors.Table of Contents: Part 1: Major Sectors and Industries Part 2: The Biggest of the Biggest Part 3: Less Well-Known Mega-Caps Part 4: Biggest Stocks Not in the S&P Part 5: Largest companies by SizeThis document useshyperlinks. Click onthe Home Icon in thetop corner of eachpage to navigate backtothetableofcontents.Annex: Part 6: Sector BreakdownThis content is for informational purposes only and does not constitute a solicitation,recommendation or endorsement to buy or sell any securities.For Qualified Investors only

The S&P By Sector and IndustryInformation TechnologySoftwareTechnology HardwareTechnology ServicesSemiconductorsElectrical EquipmentRenewable EnergyInternet Media & ServicesConsumer DiscretionaryE-Commerce DiscretionaryAutomotiveRetail - DiscretionaryLeisure Facilities & ServicesApparel & Textile ProductsRetail - Consumer StaplesInternet Media & ServicesHome ConstructionHome & Office ProductsWholesale - DiscretionaryTechnology HardwareLeisure ProductsHealth CareBiotech & PharmaMedical Equipment & DevicesHealth Care Facilities & SvcsSoftwareCommunication ServicesInternet Media & ServicesEntertainment ContentTelecommunicationsCable & SatellitePublishing & BroadcastingAdvertising & MarketingLeisure Facilities & ServicesFinancialsBankingInsuranceInstitutional Financial SvcsAsset ManagementSpecialty FinanceTechnology 5%37.96%30.61%12.89%8.36%5.54%4.64%Software is led by Microsoft but alsoincludes dozens of large-scale companies,remaining the largest industry of the S&P.Apple makes up more than 80% of thehardware segment.Payment technologies (Visa, Paypal etc. )account for 2/3 of the services segment.Amazon alone is 96% of E-Commerce,basically 1/3 of the entire ConsumerDiscretionary space.Tesla drove up the share of Automobileswithin the sector.Pharmas (10% of which are Biotechs) areonly 40% of the Healthcare sector.The Communication Services sector wascreated in 2018 and accumulates mediagiants such as Alphabet, Facebook andDisney, along with Telecom companies.Banks are only 40% of the Financialssector.The 9 largest industry groups represent more than 50% of the S&P.For Qualified Investors only

The S&P By Sector and IndustryIndustrialsTransportation & LogisticsAerospace & DefenseDiversified IndustrialsMachineryElectrical EquipmentCommercial Support ServicesTechnology ServicesTransportation EquipmentIndustrial Support ServicesEngineering & ConstructionWholesale - DiscretionaryHome ConstructionConsumer StaplesRetail - Consumer StaplesHousehold ProductsBeveragesFoodTobacco & CannabisWholesale - Consumer StaplesEnergyOil & Gas ProducersOil & Gas Services & EquipMaterialsChemicalsMetals & MiningContainers & PackagingConstruction MaterialsSteelUtilitiesElectric UtilitiesGas & Water UtilitiesReal EstateREITReal Estate 0.80%4.97%2.11%2.36%94.35%5.65%2.33%96.87%3.13%The boom of e-commerce has boostedthe value of logistic stocks.Following the fall of GE, the large multiindustrialsgroup has becomelessrelevant than it used to be.The Consumer Staples space has alsodeclined in relevance.Energy is no longer a major sector in theUS.There are only two mining companies inthe S&P (Freeport that mines Copper,and Newmont that mines Gold).Chemicals make up most of the Materialssector.Real Estate was “spun off” fromfinancials in 2016 and is mostlycomposed of interest rate sensitive REITs.For Qualified Investors only

Companies Bigger than 100BnThe rise of the S&P 500 in 2020 has pushed the value of a few companiesabove 1Trn and has increased the number of companies worth more than 100bn to 82.NameApple IncMicrosoft CorpAmazon.com IncAlphabet IncFacebook IncTesla IncBerkshire Hathaway IncVisa IncJPMorgan Chase & CoJohnson & JohnsonWalmart IncMastercard IncNVIDIA CorpWalt Disney Co/TheUnitedHealth Group IncProcter & Gamble Co/TheBank of America CorpPayPal Holdings IncHome Depot Inc/TheIntel CorpNetflix IncComcast CorpExxon Mobil CorpVerizon Communications IncAdobe Incsalesforce.com IncCoca-Cola Co/TheAbbott LaboratoriesNIKE IncAT&T IncChevron CorpBroadcom IncEli Lilly and CoCisco Systems Inc/DelawareAbbVie IncOracle CorpMerck & Co IncPfizer IncPepsiCo NKETCVXAVGOLLYCSCOABBVORCLMRKPFEPEPMkt Cap( 6182.2Revenue( .345.839.148.041.970.4EV ( '00088'300291'000SegmentTechnology HardwareSoftwareE-Commerce DiscretionaryInternet Media & ServicesInternet Media & ServicesAutomotiveInsuranceTechnology ServicesBankingBiotech & PharmaRetail - Consumer StaplesTechnology ServicesSemiconductorsEntertainment ContentHealth Care Facilities & SvcsHousehold ProductsBankingTechnology ServicesRetail - DiscretionarySemiconductorsInternet Media & ServicesCable & SatelliteOil & Gas esMedical Equipment & DevicesApparel & Textile ProductsTelecommunicationsOil & Gas ProducersSemiconductorsBiotech & PharmaTechnology HardwareBiotech & PharmaSoftwareBiotech & PharmaBiotech & PharmaBeveragesFor Qualified Investors only

Companies Bigger than 100BnNameThermo Fisher Scientific IncAccenture PLCTexas Instruments IncQUALCOMM IncMedtronic PLCMcDonald's CorpDanaher CorpWells Fargo & CoCostco Wholesale CorpT-Mobile US IncHoneywell International IncNextEra Energy IncMorgan StanleyCitigroup IncUnion Pacific CorpBristol-Myers Squibb CoUnited Parcel Service IncCharter Communications IncPhilip Morris International InBoeing Co/TheLinde PLCAmgen IncStarbucks CorpCaterpillar IncCharles Schwab Corp/TheGoldman Sachs Group Inc/TheLowe's Cos IncRaytheon Technologies CorpGeneral Electric CoIntuit IncApplied Materials IncAmerican Express CoInternational Business MachineBlackRock IncDeere & CoServiceNow IncEstee Lauder Cos Inc/TheAdvanced Micro Devices IncMicron Technology Inc3M CoBooking Holdings AMATAXPIBMBLKDENOWELAMDMUMMMBKNGMkt Cap( 2.9100.1Revenue( 9.821.432.26.8EV ( 2'60040'00096'80026'400SegmentMedical Equipment & DevicesTechnology ServicesSemiconductorsSemiconductorsMedical Equipment & DevicesLeisure Facilities & ServicesMedical Equipment & DevicesBankingRetail - Consumer StaplesTelecommunicationsDiversified IndustrialsElectric UtilitiesInstitutional Financial SvcsBankingTransportation & LogisticsBiotech & PharmaTransportation & LogisticsCable & SatelliteTobacco & CannabisAerospace & DefenseChemicalsBiotech & PharmaLeisure Facilities & ServicesMachineryAsset ManagementInstitutional Financial SvcsRetail - DiscretionaryAerospace & DefenseDiversified IndustrialsSoftwareSemiconductorsSpecialty FinanceTechnology ServicesAsset ManagementMachinerySoftwareHousehold ProductsSemiconductorsSemiconductorsDiversified IndustrialsInternet Media & ServicesFor Qualified Investors only

Largest Less Well-Known CompaniesMany large US companies are often overlooked or little known by non-USInvestors. This is usually because they are very US-centric B2C companies(United Health, TJX, Target, ) or because they are complex B2B businesses(Thermo Fisher, Fiserv, ).Here we present a list of very large US companies in the S&P that we believe(very subjectively) are less known by European Investors.We also present a short description of these companies on the next page.NameUnitedHealth Group IncAbbott LaboratoriesThermo Fisher Scientific IncMedtronic PLCDanaher CorpNextEra Energy IncUnion Pacific CorpCharter Communications IncIntuit IncAmerican Tower CorpTarget CorpStryker CorpFidelity National InformationLam Research CorpTJX Cos Inc/TheTruist Financial CorpS&P Global IncFiserv IncUS BancorpChubb LtdCigna CorpPrologis IncPNC Financial Services Group IAutomatic Data Processing IncZoetis IncAnthem IncHumana LRCXTJXTFCSPGIFISVUSBCBCIPLDPNCADPZTSANTMHUMMkt Cap( 75.675.675.674.949.1Revenue( 121.977.2EV ( ry groupHealth Care Equipment & ServicHealth Care Equipment & ServicPharmaceuticals, BiotechnologyHealth Care Equipment & ServicHealth Care Equipment & ServicUtilitiesTransportationMedia & EntertainmentSoftware & ServicesReal EstateRetailingHealth Care Equipment & ServicSoftware & ServicesSemiconductors & SemiconductorRetailingBanksDiversified FinancialsSoftware & ServicesBanksInsuranceHealth Care Equipment & ServicReal EstateBanksSoftware & ServicesPharmaceuticals, BiotechnologyHealth Care Equipment & ServicHealth Care Equipment & ServicFor Qualified Investors only

Largest Less Well-Known Companies UnitedHealth Group, Anthem and Humana are the largest US managed healthcare companiesproviding coverage to millions of Americans. Fidelity National Information is a financial insurancecompany providing insurance to real estate and mortgage industries, claiming to have a 42.6% USmarket share. Cigna and Chubb are the two largest US insurance companies. Abbott Laboratories, Medtronic and Stryker are international providers of medical equipmentand services. Thermo Fisher and Danaher are life science companies and global producers oflaboratory equipment and services. NextEra Energy is a Florida based electricity provider and one of the world’s largest electricitygenerators using wind and solar. Union Pacific is the largest US rail transportation company whose history started in 1862 with thefirst transcontinental railroad. Charter Communications is a telecommunications company who is sizable due to its aggressiveacquisitions of cable television competitors, most notably Time Warner Cable. American Tower is a spin-out infrastructure REIT from CBS Corporation, and is one of the largestcommunications tower owners in North America with a strong exposure to the development of 5G.Prologis is an REIT specialized in logistic facilities and a massive beneficiary of e-commerce. Truist Financial Corp the largest US regional bank that was formed after the merger of BB&T andSunTrust Banks. US Bancorp and PNC Financial are the second and third largest regional banksin the US. Fiserv is a payment services provider. Automatic Data Processing is provider of HR outsourcingsolutions. Intuit is a financial software company that is most famous for its creation of the TurboTaxtax filing software. Lam Research Corp is a manufacturer of semiconductor processing equipment. Target is a discount retail giant competing with Walmart and Costco. The company is so successfullargely due to the competitiveness of its private label brands. TJX is a discount apparel retailer withpopular brands like TJ Maxx and TK Maxx in the US and UK. S&P Global, the publisher of the S&P 500, is a financial services firm engaged in providingcompany credit ratings and financial data analytics to global markets. Zoetis is the world's largest producer of medicine and vaccinations for pets and livestock, spun-offfrom Pfizer in 2013.For Qualified Investors only

Largest US Stocks Not in the S&PThere is now a large numbers of companies that would be big enough in terms of marketcap to enter the S&P 500 but that do not meet specific c

acquisitions of cable television competitors, most notably Time Warner Cable. American Tower is a spin-out infrastructure REIT from CBS Corporation, and is one of the largest communications tower owners in North America with a strong exposure to the development of 5G. Prologis and