Transcription

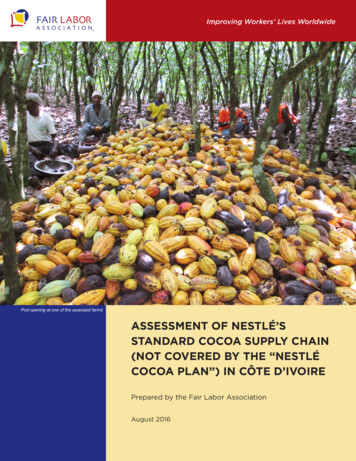

SUSTAINABLE COMMODITIESMARKETPLACE SERIES 2019Global Market Report: CocoaVivek Voora, Steffany Bermúdez, Cristina LarreaWestern Europe and developing economies inAsia are driving demand for cocoa but farmrisks may affect supply in the long-termCocoa is primarily produced by hand and itsproduction has never experienced widespreadmechanization.1–3 Despite this limitation, approximately4 million tonnes of cocoa beans have been producedannually around the world since 2010.4 The beansare first transformed into cocoa liquor and then intococoa butter or cocoa powder for producing chocolate,cosmetics and a variety of foodstuffs.Exported cocoa beans, whether whole or broken, rawor roasted, had a combined value of USD 8.6 billionin 2017.5,6 The global cocoa beans market is expectedto grow at a compound annual growth rate (CAGR) of7.3 per cent from 2019 to 2025 to reach USD 16.32billion.7 The chocolate industry, which consumed 43 percent of all cocoa in 2017, had a retail market value ofUSD 106.19 billion in 2017 and is expected to grow toUSD 189.89 billion by 2026.6,8The cocoa sector is an important source of livelihoods,providing revenue for 40 to 50 million people in2012, mostly in developing countries and including 16Low Human Development Countries (LHDCs).9,10An estimated 5 million farming households dependon cocoa as a cash crop, and 70 per cent of cocoa isproduced by smallholders living on less than USD 2 perday and relying on cocoa for 60 to 90 per cent of theirincome.9 The cocoa and chocolate industry also generatejobs in importing countries, where cocoa beans areoften exported for processing and sale to end consumers.In 2011, it supported about 2,000 companies in theEuropean Union and 650 companies in the UnitedStates, employing 70,000 people overall.9In 2016, the largest exporter of cocoa beans was Côted’Ivoire (USD 3.9 billion), followed by Ghana (USD2.5 billion) and Nigeria (USD 0.8 billion). The largestimporters were the Netherlands (USD 2.6 billion),Germany (USD 1.5 billion) and the United States(USD 1.3 billion).11Although supply has kept up with demand in recent years,the market research firm The Economist Intelligence Unitpredicts a shortage of supply in the long-term due to pooryield returns and low prices that are discouraging youthto work in the sector.12 Despite this long-term projection,the global supply-demand of cocoa closed with a smallsurplus in 2018, which is expected to increase to 39,000metric tonnes in 2019.13 This surplus keeps prices forthe producers low, further disincentivizing farmers fromworking in cocoa production.The cocoa sector is projected to grow, driven primarilyby its extensive appeal, popularity and wide use in thefood and beverage industry. According to Euromonitor,increased demand for chocolate with perceived healthbenefits and more exotic flavours is expected in WesternEurope and North America, which are the traditionalchocolate consuming markets.14,15 This includeschocolate made with single-origin cocoa, products withreduced sugar content, premium and dark chocolate,as well as new flavours. Demand for cocoa products isalso increasing in emerging economies.12,16 Chocolatesales are projected to grow in countries experiencingincreases in GDP per capita such as China, Mexico,Indonesia, Turkey and India, as end consumers in thesecountries have greater disposable income to spend onsuch products.17Outside of chocolate confectionary products, growthin the cocoa sector overall will come from increasing

VSS-compliant Cocoa Accounted for at Least 29 Per Cent of Total Cocoa Production in 2016Figure 1. Global cocoa production trend 2008 to 201610,204,500,000Metric Tonnes4,000,000VSS Compliant3,500,000PotentiallyVSS nt production volumes refer to cocoa produced in compliance with one or more VSSs. Conventional production volumes do not comply with any existingVSS. Production volumes that are defined as potentially VSS-compliant cannot be definitively listed in either category with the data currently available.demand for cocoa ingredients (i.e. cocoa powder usedin sweet biscuits and cookies) primarily in Asia, ledby China, India, Japan and the Philippines due tothe growth of the middle-upper class and increasedyouth’s income.18,61 Notably, Asia is expected to becomethe second largest consumer market of cocoa-basedingredients in the world after Western Europe.14Within the sector, sustainably produced cocoa is alsoexpected to grow faster than conventionally producedcocoa, with the rapid proliferation of voluntarysustainability standards (VSS) in the sector.10,19 In 2016,29 per cent of the market was made up of VSS-compliantcocoa while cocoa that was potentially VSS-compliantrepresented 18 per cent and conventional cocoaproduction accounted for 53 per cent of the market.10Although the cocoa sector is expected to experiencea 7.3 per cent Compound Annual Growth Rate(CAGR) from 2019 to 2025, there are important riskson the cocoa supply side that can limit this potentialexpansion.7 Market price volatility has historicallybeen a significant challenge for cocoa farmers, which hasrecently been exacerbated by the uncertainty over thetiming and terms of Brexit, given the United Kingdom’simportance in cocoa trading.21,22 Cocoa future pricesdropped drastically from USD 3,422 per tonne in late2015 to USD 1,769 per tonne in mid-2017, which hasinfluenced the price paid for cocoa beans to the farmer(farm-gate price).23Coupled with price volatility, income disparity acrossthe value chain remains a persistent challenge in thesector. For instance, despite supplying the key ingredientof chocolate bars, cocoa farmers in Cote d’ Ivoire andGhana earn only 3 to 6 per cent of the chocolate bars’retail market value.24 To remediate price volatility andincome disparities, Cote d’Ivoire and Ghana, whichaccount for over 60 per cent of global cocoa productionwith 80 per cent of volumes sold before harvest, areworking towards setting a minimum Free on Board(FOB) export price of USD 2,600 per tonne as a measureto improve farm-gate prices, and ultimately farmer’incomes (farmers receive approximately 70 per cent ofthis FoB price)25,26 Setting a cocoa floor price in the twolargest producing countries will provide more certaintyfor their farmers, and would be a game changer for thesector. Nevertheless, establishing an adequate floor pricefor cocoa requires an assessment of the cost and pricedistribution across the chain. It is important that thisinclude consideration of the status of producers from allcocoa growing countries to achieve an equitable outcome.Other important challenges in meeting increasingdemand include ageing cocoa trees, which lead to aconsiderable reduction in yields; the effects of risingtemperatures in major producing countries in WestAfrica, which might undermine production levels andencourage shifts in production sites, and could triggerfurther deforestation27; and systemic poverty, which

affects the large majority of cocoa producers28. Thesechallenges need to be addressed by coordinated effortsbetween industry actors, including governments,standard setting bodies, development organizationsand private companies to ensure the benefits from thecontinued growth in cocoa demand is equitably sharedacross the value chain.Increased consumption of sustainable cocoain traditional markets drives significantgrowth of VSS-compliant productionVoluntary sustainability standards (VSS) emerged inthe cocoa sector over 20 years ago. These standards areintended to provide consumers with more sustainablecocoa purchasing options. VSS offer producers alabel or means to distinguish their products in themarketplace, so that consumers can then identify themand their attributes more easily. To earn that labelor distinguishing feature, the producer must adoptspecified practices that are more socio-economicallyequitable and environmentally sound than conventionalproduction, and have those practices assessed andverified. Several companies that purchase cocoa haverelied on VSS compliant cocoa to meet their sustainablesourcing commitments, improve the reliability of theircocoa supplies and mitigate reputational risks. Doingso provides them with a competitive edge on multiplelevels. In particular, VSS labels have allowed companiesto differentiate their products in the marketplace, wherethey aim to appeal to consumers who want to addresssustainability challenges such as income disparities,child and forced labour and deforestation through theirpurchase decisions.A,29,30To date, there are some promising signs of successon the supply side. According to our analysis, VSScompliant cocoa experienced a CAGR of about 46per cent from 2008 to 2016, accounting for at least 29per cent of the total cocoa production in 2016. UTZCertified, Rainforest Alliance, Fairtrade and Organicare the main VSSs in the cocoa sector when rankedby the volume of production they cover.10 In 2016, atleast 1.3 million metric tonnes were VSS-compliant,with a value estimated at USD 2.1 billion.10,31 Thisvalue is derived from the average producer prices percountry, as reported by the Food and AgricultureOrganization of the United Nations (FAO), which isAHow Much Cocoa is Certified by EachStandard?Figure 2. Standard-compliant cocoa productionvolumes in 201610UTZ Certified1,188,166 MTRainforest Alliance473,480 MTFairtrade International291,917 MTOrganic157,275 MTLIVELIHOODS40 to 50 million people worldwide earn revenue fromcocoa production5 million of these are farming households70 per cent of these are smallholder farmsthen applied to the volume of VSS-compliant cocoaproduced per country. The majority of VSS-compliantproduction comes from Africa, at approximately 75 percent, (led by Côte d’ Ivoire, Ghana and Nigeria) withsome important volumes coming from the DominicanRepublic, Ecuador, Indonesia and Peru.10 Theconcentration of VSS-compliant cocoa in West Africacould constitute a risk for the growth of VSS-compliantcocoa, as the region has experienced conflict, politicalchallenges and uncontrolled deforestation that cannotbe overlooked.32,33To review the purpose of each VSS and the set of requirements producers need to comply with regarding different sustainability issues, please access the SSI Reviewsin the following link: https://iisd.org/ssi/

On the demand side, VSS-compliant cocoa productionhas been driven mainly by large cocoa traders andmanufacturers that source cocoa from VSSs. Thismay change as cocoa processors and manufacturersincreasingly show interest in developing their owncorporate sustainable cocoa sourcing programs, such asthe Cocoa Life Scheme from Mondelez Internationaland Cocoa Horizons from Barry Callebaut, which aredisplacing independent third party standards.34,35 The 13largest cocoa consuming companies (traders, grindersand manufacturers) purchased 6 million metric tonnesof cocoa in 2016. From this total, 2.2 million metrictonnes came from sustainable sources that were eithercompliant with VSS or corporate schemes36.Progress Toward Sourcing More Sustainable Cocoa36,44–52Figure 3. Major cocoa consuming companies and their sustainable sourcing commitments100% sustainable sourcing by 2025Barry Callebaut1,020,000100% sustainable sourcing by 2030Cargill750,000Traders-grinders100% sustainable sourcing by 2021Cemoi102,000* Cocoanect100,000* Ecom593,000100% sustainable sourcing by 2020Olam950,000* Sucden500,000* ToutonCommitment to 100%sustainable sourcing by etric TonnesIn 2017, Olam's total cocoa consumptionwas 950,000 metric tonnes, of which 26%was sustainably sourced. They are close toreaching their goal of 100% by 2020.26% SustainableConsumption in 201674% ConventionalConsumption in 2016950,000 MT100% sustainable sourcing by 2020Ferrero Group135,000Manufacturers100% sustainable sourcing by 2020Hershey Co200,000Conventional Consumption(MT, 2017)100% sustainable sourcing by 2020MarsSustainable Consumption(MT, 2017)410,000Sustainable SourcingCommitment (% and year)100% sustainable sourcing by 2020Mondelez International450,000* data not found for sustainablesourcing commitments53% sustainable sourcing by 2020Nestlé434,000For Touton, data refers to 2016;and for Cargill, data refers toperiod (01.06.2016 – 31.05.2017)Note: these numbers might reflect double counting of sustainable consumption volumes as traders listed might sell to listed manufacturers. Manufacturers and traders tendnot to disclose to whom/from whom they sell/source sustainable volumes of cocoa due to confidentiality reasons.

Extrapolating from the sourcing commitments of thelargest cocoa consuming companies, and assessing theseagainst existing sourcing information, an additional2.5 million metric tonnes of sustainable cocoa couldbe consumed by 2030. The leading buyers’ sourcingcommitments are driven mainly by final end consumerpreferences to purchase more sustainable and healthierproducts.37 Notably, the cocoa sector shows clear signsof continued growth in the demand for sustainablecocoa-based products. According to Euromonitor,chocolate confectionery from sustainable cocoa sourcesaccounted for 8 per cent of the total global [retail]market value in 2017, fuelled by increased demandfrom Western Europe and North America. This trendis expected to continue.6 Recent evidence suggests thatorganic cocoa is expected to have a 9.5 per cent CAGRin the period 2019 to 2025 and to reach USD 620million in retail value by 2025.38–41There may be projected shortfalls in cocoa supplydue to the above-mentioned risks, which may stifleexpected growth. However, there is potential foryield improvements in the largest growing countriesby investing in replacing ageing trees, expandingcocoa-agroforestry systems, and improving producercapacities to address climate change. These potentialimprovements provide grounds to remain confidentin the growth of VSS-compliant cocoa. Interestingly,rejuvenating and expanding cocoa tree plantations isbeing touted as a potential response to climate changefor coffee farmers.42,43Potential for continued expansion of VSScompliant cocoa in LHDCsCocoa is produced mainly in developing countries,which could see some significant benefits fromimplementing more sustainable production practices.Among these are increased yields, improved householdincome, enhanced working and living conditions, andbetter environmental protection.53,54 Despite the existingVSS presence in many of these countries, povertypersists among cocoa farmers, which threatens theviability of downstream industries.55,56 Coordinatedstrategies between industry actors, includinggovernments, standard setting bodies, developmentorganizations and private companies are needed toaddress the systemic causes of poverty that affectcocoa farmers, and to consider what role VSS can playand what other policies and mechanisms are needed.MARKET VALUEOver USD 2.1 billion for VSS-compliant cocoa, based on2016 cocoa producer pricesCAGR 2008–2016Conventional production is down by 7%while VSS production is up by 46%VSS production in LHDCs is up by 25%COCOA PRODUCTION IN LHDCS43% of total cocoa produced61% of VSS-compliant cocoa producedbased on 2016 dataThe risks that systemic poverty could have on thereliable supplies of cocoa beans have motivated largechocolate confectionary companies to develop their ownsustainability programmes and invest directly in theircocoa producers.34,55,57,58Strategies that could help address poverty amongcocoa farmers include offering higher prices for cocoaharvests,56 defining mechanisms for price stabilization,adopting more efficient interventions to sustainablecocoa production, such as landscape or jurisdictionalapproaches to lower certification costs, and addingvalue to the cocoa bean through further processing inproducing countries. For instance, an InternationalLabour Organization (ILO) study estimated thatprocessing 40 per cent of Ghana’s cocoa beans beforeexport could create an additional 4,000 permanentprocessing jobs.59 However, tariff escalation appliedto cocoa beans and their processed products whenexporting to certain markets might disincentivizedomestic processing. A recent study60 on tariffescalation involving the Ghanaian cocoa sector revealedmixed results and suggests that the potential forfurther domestic cocoa processing for export shouldbe considered by looking at specific cases. It alsoindicates that other barriers to value addition shouldbe examined closely. In an attempt to address povertyin the cocoa sector, VSS have initiated coordinateddiscussions and research efforts, in collaboration withother supply chain stakeholders, to develop measuresto enable living wages, landscape certification and theeradication of forced and child labour.

Cocoa-Growing Regions of the WorldConventional ProductionLowHighHarvest AreaPotentially VSS CompliantMediumVery HighPrevalent VSS-Compliant AreaVSS CompliantPapua New GuineaIndonesiatonnesSignificant Producer HDIUgandaCameroonNigeriaGhanaTogoCôte d'IvoireBrazilDominican RepublicVenezuelaColombiaPeruEcuadorMexicoFigure 4. Distribution of cocoa production in the top fifteen producing countries in 2016500,000250,0000Sources: see endnotes 10, 62,63Download high resolution version of the map at ons/ssi-global-market-map-cocoa.pdfThe most promising opportunities for VSS-compliantcocoa production to address sustainable developmentchallenges can be assessed by examining the humandevelopment level of cocoa-producing countries basedon their Human Development Index (HDI). Ouranalysis found that out of 59 cocoa growing countries,16 were LHDCs and 10 of these produced VSScompliant cocoa in 2016. LHDCs produced 43 per centof total cocoa production and 61 per cent of total VSScompliant cocoa production in the same year. VSS havea strong presence in cocoa-producing LHDCs, primarilydue to their presence in Côte d’ Ivoire. Excluding Côted’ Ivoire from this assessment results in a LHDC shareof total and VSS-compliant cocoa production of 10 percent and 9 per cent respectively.There are signs of growth in VSS-compliant productionamong LHDCs: looking at the 2008 to 2016 period,VSS-compliant cocoa production in LHDCs, evenwithout Côte d’ Ivoire, increased at a CAGR ofapproximately 25 per cent. In 2016, the largest volumeof certified cocoa production in LHDCs was UTZCertified, followed by Rainforest Alliance, Fairtradeand Organic.10 As part of a coordinated multistakeholder approach to address poverty in LHDCs,the continued expansion of VSS-compliant cocoaproduction in these countries could result in importantsustainable development benefits via the adoption ofmore sustainable agriculture practices. This includesaddressing some of the challenges described above, suchas by ensuring fairer farmer incomes, prevention offorced and child labour and avoided deforestation.As such, there are promising signs of VSS expansionpotential among countries that are already producingsignificant shares of the world’s cocoa and that havebegun to adopt VSSs, including some countries thatare LHDCs. Aside from Côte d’ Ivoire and Ghana,Indonesia, Cameroon and Brazil all offer good prospectsfor more sustainable cocoa production considering theirtotal cocoa output and the existing presence of VSS.Among the LHDCs, those with the most potential formaximizing sustainable development outcomes are Côted’Ivoire, Nigeria and Togo, according to our analysisbased on 2016 figures. This is based on their share of

total cocoa production, existing VSS presence and theirHDI value. Papua New Guinea, Uganda and Guinea areother notable prospects for expanding VSS-compliantcocoa production within LHDCs. These are countriesthat have yet to support VSS-compliant cocoa production.If properly implemented as part of broader sustainabledevelopment strategies, VSS can be an importantcatalyst to improve the livelihoods of cocoa farmers andcontribute to poverty alleviation in cocoa-producingcountries regardless of their development status.Due to the concentration of cocoa production inLHDCs, it is important to ensure that its productionresults in poverty alleviation and sustainabledevelopment. Emerging corporate sustainability cocoaprogrammes may provide the additional resourcesneeded to address poverty in the sector. In addition,government efforts to stabilize cocoa markets byestablishing a floor price could reshape the sector byenabling a more equal income distribution across cocoavalue chains and providing farmers with more reliableand equitable returns for their efforts. Coordinatedefforts led by prominent cocoa organizations suchas the International Cocoa Organization and theWorld Cocoa Foundation could result in positivedevelopments for the entire sector. Alongside thesedevelopments, VSS are expected to continue having animportant role in enabling the emergence of a moresustainable cocoa sector.Potential to develop south-south trade, local processing and consumption of cocoa in leadingAfrican producing countries. In 2016, cocoa grinding remains concentrated in Europe.Figure 5. Trade flows of the largest producer countries in 2016, in metric tonnesCameroon213,718 [9.09%]Côte d’Ivoire1,234,900 [52.52%]Ghana678,359 [28.85%]Indonesia41,567 [1.77%]Nigeria182,701 [7.77%]Asia141,093 [6.00%]Europe1,552,485 [66.03%]North America372,291 [15.86%]South America66,707 [2.58%]South Asia215,502 [9.17%]Sources: see end notes 64,65.These five countries represents the 80 per cent of total cocoa production in 2016. The % in brackets for each country represents the proportion of the total volume of cocoaexported in 2016 by the five countries. The % in brackets for each region represents the proportion of the total volume of cocoa imported in 2016 from the 5 countries.

ENDNOTES1.Nieburg, O. (2016). High tech revolution: Ecuador’s cocoa sector prepares to mechanize. ConfectioneryNews.Retrived from: eburg, O. (2015). Technological black hole to mechanize smallholder cocoa sector. ConfectioneryNews.Retrived from: s3.Gayi SK, Tsowou K. (2017). Cocoa Industry: Integrating Small Farmers into the Global Value Chain (p. 49). UN.Retrieved from d-finance/cocoa-industry cfb75b0e-en4.Shahbandeh, M. (2019). Cocoa production worldwide from 1980/81 to 2018/19 (in 1,000 tons) Retrived bal-cocoa-production/5.United Nations Department of Economics and Social Affairs. (2019). UN Comtrade Database: InternationalTrade Statistics. Retrived from https://comtrade.un.org/data6.Eghbal, M. (2018). Global Chocolate Industry: From Bean to Bar. Euromonitor International. Retrived industry/7.Grand View Research. (2019). Cocoa Beans Market Size, Share & Trends Analysis Report By Application(Cosmetics, Confectionery, Pharmaceuticals), By Product (Butter, Powder, Liquor), By Distribution Channel(Online, Offline), And Segment Forecasts, 2019 - 2025. Retrieved from s/cocoa-beans-market8.MarketWatch. (2019). Global Chocolate Market is Projected to Reach US 189.08 Billion by 2026. Retrievedfrom lionby-2026-2019-01-239.Houston, H. & Wyer, T. Why Sustainable Cocoa Farming Matters for Rural Development. (2012). Center forStrategic & International Studies. Retrived from a-farmingmatters-rural-development10.Lernoud, J., Potts, J., Sampson, G., Schlatter, B., Huppe, G., Voora, V., et al. (2018). The State of SustainableMarkets 2018 - Statistics and Emerging Trends. International Trade Centre. Retrieved from t-FIN-web2.pdf11.Tridge. (2019). Cocoa Bean suppliers, wholesale prices, and global market information. Retrieved from The Economist Intelligence Unit. (2015). Cocoa Forecast World March 2015. Retrieved from https://store.eiu.com/article.aspx?productid 188492877313.International Cocoa Organization. (2019). Quarterly Bulletin of Cocoa Statistics, Vol. XLV - No. 1 - Cocoa year2018/19.14.Euromonitor International. (2016) Global trends and developments in Cocoa ingredients (world). Retrieved u, D. (2017) Health & wellness chocolate to outpace regular category: Euromonitor. ConfectioneryNews.Retrieved from romonitor16.Fact.MR. (2018) Cocoa Market Forecast, Trend Analysis & Competition Tracking - Global Market insights 2018to 2028. Retrived from elly, J. (2017) The Challenges, Risks, and Opportunities of Chocolate on a Global Scale. EuromonitorInternational. Retrieved from e/18.Food and Beverage Asia. (2019). Olam Aquires Indonesia’s Largest Cocoa Processor, BT Cocoa. Retrievedfrom ocoa/1860

19.Yu, D. (2017). Chocolate confectionery contributes most to value sales of sustainable cocoa products:Euromonitor. ConfectioneryNews. Retrieved from e-cocoa-products20.Food and Agriculture Organization of the United Nations. (2017). FAOSTAT, Crops. Retrieved from http://www.fao.org/faostat/en/#data/QC21.Harden, M. (2018). Cocoa Supply Chain and Mars’ Sustainability Pledge. The Borgen Project. Retrieved ars/22.Suri, A. (2018). Cocoa Market Knowledge, Risks and Opportunities. Olam. Retrieved from ge-risks-and-opportunities.html23.Hecht, A. (2018). Cocoa Screams Higher. Seeking Alpha. Retrieved from eams-higher24.Sehti, S. (2018) Cocoa has a poverty problem. You can help by eating more dark chocolate. New Food Economy.Retrieved from -coast-ghana/25.Dontoh, E. & Garcia Perez, I. (2019). Top Cocoa Growers Halt Sales Amid Drive to Agree Minimum Price.Bloomberg. Retrieved from inimum-price26.Nieburg, O. (2019). What do farmers and the ICCO think of Ghana and Côte d’Ivoire’s minimum cocoa price?ConfectioneryNews. Retrieved from -minimum-cocoa-price27.Schroth, G., Läderach, P., Martinez-Valle, A.I., Bunn, C., Jassogne, L. (2016). Vulnerability to climate change ofcocoa in West Africa: Patterns, opportunities and limits to adaptation. Science of The Total Environment, Volume 556.28.Fairtrade International. (2018). Cocoa. Retrieved from infofairtradenet/product/cocoa29.World Cocoa Farmers Organization. (2018) Challenges. Retrieved from /30.Forum Nachhaltiger Kakao. (n.d.). Challenges in the Cocoa Sector. Retrieved from n-the-cocoa-sector/31.Food and Agricultural Organization of the United Nations. (2018). FAOSTAT, Value of Agriculture Production.Retrieved from http://www.fao.org/faostat/en/#data/QV32.Linzer, I. (2019). Benin’s unrest reflects a broader worrying trend in West Africa. African Arguments. Retrievedfrom , M., Neelam, V., Stephen, M. (2015). The Challenge of Stability and Security in West Africa.World Bank and Agence Française de Développement. Retrieved from 203334.Potts, J. Throwing the Chocolate Bar out with the Bathwater: How Cadbury’s transition to an in-housesustainability standard threatens the sustainability of the cocoa sector. (2017). International Institute forSustainable Development. Retrieved from commentary.pdf35.Subramanian, S. (2019). Is fair trade finished? The Guardian. Retrieved from urys36.Fountain, A. & Huetz-Adams, F. (2018). Cocoa Barometer 2018. VOICE Network. Retrieved from 9/08/Cocoaborometer2018 web4.pdf37.Nielsen. (2018). The Evolution of the Sustainability Mindset. Retrieved from es (2019). Global Organic Cocoa Market Insights, Forecast to 2025. Retrieved from uto-27S55/global-organic-cocoa

39.Nielsen. (2018). What’s Sustainability Got To Do With It? Retrieved from /whats-sustainability-got-to-do-with-it40.CBI Ministry of Foreign Affairs. (2019). Exporting certified cocoa to Europe. Retrieved from ied-cocoa41.Reuter. (2019). Global Organic Cocoa Market 2019 Analysis, Size, Share, Trends and by Product, Company,Region and Consumption, Industry Analysis

importance in cocoa trading.21,22 Cocoa future prices dropped drastically from USD 3,422 per tonne in late 2015 to USD 1,769 per tonne in mid-2017, which has influenced the price paid for cocoa beans to the farmer (farm-gate price).23 Coupled with price volatility, income disparity across