Transcription

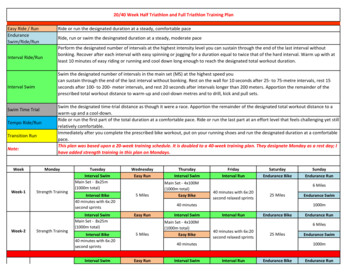

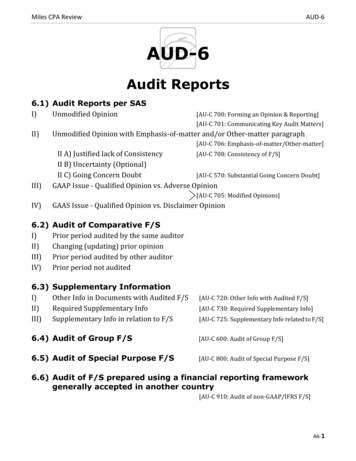

Miles CPA ReviewAUD-6AUD-6Audit Reports6.1) Audit Reports per SASI)Unmodified OpinionII)[AU-C 700: Forming an Opinion & Reporting][AU-C 701: Communicating Key Audit Matters]Unmodified Opinion with Emphasis-of-matter and/or Other-matter paragraph[AU-C 706: Emphasis-of-matter/Other-matter]III)II A) Justified lack of Consistency[AU-C 708: Consistency of F/S]II B) Uncertainty (Optional)II C) Going Concern Doubt[AU-C 570: Substantial Going Concern Doubt]GAAP Issue - Qualified Opinion vs. Adverse Opinion[AU-C 705: Modified Opinions]IV)GAAS Issue - Qualified Opinion vs. Disclaimer Opinion6.2)I)II)III)IV)Audit of Comparative F/SPrior period audited by the same auditorChanging (updating) prior opinionPrior period audited by other auditorPrior period not audited6.3)I)II)III)Supplementary InformationOther Info in Documents with Audited F/SRequired Supplementary InfoSupplementary Info in relation to F/S[AU-C 720: Other Info with Audited F/S][AU-C 730: Required Supplementary Info][AU-C 725: Supplementary Info related to F/S]6.4) Audit of Group F/S[AU-C 600: Audit of Group F/S]6.5) Audit of Special Purpose F/S[AU-C 800: Audit of Special Purpose F/S]6.6) Audit of F/S prepared using a financial reporting frameworkgenerally accepted in another country[AU-C 910: Audit of non-GAAP/IFRS F/S]A6-1

AUD-66.7)I)II)III)IV)Miles CPA ReviewOther Engagements & Reports based on SASReview of Interim (Quarterly) F/S[AU-C 930: Review Interim F/S]Summary F/S[AU-C 810: Summary F/S]Report on Compliance of Audited F/S[AU-C 806: Compliance of Audited F/S]Application of Accounting Principles[AU-C 915: Application of GAAP]Appendix: Reports per PCAOB ASA-6.1) Audit ReportsI)Unqualified Opinion[PCAOB AS 3101: Unqualified Opinion]II)Unqualified Opinion with Explanatory and/or Emphasis paragraphIII) GAAP Issue - Qualified Opinion vs. Adverse Opinion[PCAOB AS 3105: Departure from Unqualified]IV)GAAS Issue - Qualified Opinion vs. Disclaimer OpinionA-6.2) Audit of Comparative F/SI)Prior period audited by the same auditorII)Changing (updating) prior opinionIII) Prior period audited by other auditor[PCAOB AS 3105: Departure from Unqualified]A-6.3) Supplementary InformationI)Other Info in Documents with Audited F/SII)Required Supplementary InfoIII) Supplementary Info in relation to F/SIV) Selected Quarterly Data[PCAOB AS 2705: Reqd. Supplementary Info]A-6.4) Audit of Group F/S[PCAOB AS 1205: Part Audit by Other Auditors]A-6.6) Audit of Special Purpose F/S[PCAOB AS 3305: Special Reports]A-6.7) Other Engagements & ReportsI)Review of Interim (Quarterly) F/SII)Condensed F/S & Selected Financial DataIII) Report on Compliance of Audited F/SIV) Application of Accounting Principlesbased on PCAOB ASA6-2[PCAOB AS 2710: Other Info with Audited F/S][PCAOB AS 2701: Audit of Supplementary Info][PCAOB AS 4105: Review of Interim F/S][PCAOB AS 4105: Review Interim F/S][PCAOB AS 3315: Condensed F/S, Selected Data][PCAOB AS 3305: Special Reports][PCAOB AS 6105: Application of GAAP]

Miles CPA ReviewAUD-66.1) Audit Reports based on Auditor’s opinionUnmodified Opinion Unqualified OpinionIUNMODIFIED OPINIONStandard Audit ReportIIUNMODIFIED OPINION with“Emphasis-of-Matter” Para“Other-Matter” Para- A: Special purpose framework F/S(Non-GAAP)- C: Justified lack of Consistency- D: Going Concern doubt alleviated- D: Uncertainty & OtherCircumstances (optional)- E: Changing prior opinion- Comparative F/S (certain cases)- Additional circumstances- Restrict use of audit report (alsofor contractual/regulatory specialpurpose non-GAAP F/S)-MODIFIED OPINIONGAAP issue IIIMaterialbut notpervasive -A“except for” GAAP- A: Unjustified Non-GAAP orUnreasonable Estimate- C: Non-GAAP change- D: Inadequate disclosureIIIMaterial BPervasive-QUALIFIED OPINION-ADVERSE OPINION“do not present fairly”GAAP problem- A: Unjustified Non-GAAP orUnreasonable Estimate- C: Non-GAAP change- D: Inadequate disclosure-IVAQUALIFIED OPINIONIVBDISCLAIMER“except for” GAAS- PIC: Uncertainty- PIC: Scope Limitation“do not express an opinion”GAAS problem- TIP: Independence impaired- PIC: Uncertainty- PIC: Scope LimitationGAAS issueMaterialbut notpervasiveMaterial PervasiveWITHDRAW from the EngagementF/S false / fraudulent / deceptive / misleadingA6-3

AUD-6Miles CPA ReviewI) Unmodified Opinion (Standard Audit Report)IIndependent Auditor’s ReportTo the Board of Directors of ABC Company (Those Charged With Governance)Report on the Audit of the Financial Statements (1)OpinionWe have audited the financial statements of ABC Company, which comprise the balance sheet as of December31, 20X1, and the related statements of income, changes in stockholders' equity, and cash flows for the yearthen ended, and the related notes to the financial statements.In our opinion, the accompanying financial statements present fairly, in all material respects, the financialposition of ABC Company as of December 31, 20X1, and the results of its operations and its cash flows for theyear then ended in accordance with accounting principles generally accepted in the United States of America.Basis for OpinionWe conducted our audit in accordance with auditing standards generally accepted in the United States ofAmerica (GAAS). Our responsibilities under those standards are further described in the Auditor'sResponsibilities for the Audit of the Financial Statements section of our report. We are required to beindependent of ABC Company and to meet our other ethical responsibilities, in accordance with the relevantethical requirements relating to our audit. We believe that the audit evidence we have obtained is sufficientand appropriate to provide a basis for our audit opinion.Responsibilities of Management for the Financial StatementsManagement is responsible for the preparation and fair presentation of the financial statements in accordancewith accounting principles generally accepted in the United States of America, and for the design,implementation, and maintenance of internal control relevant to the preparation and fair presentation offinancial statements that are free from material misstatement, whether due to fraud or error.In preparing the financial statements, management is required to evaluate whether there are conditions orevents, considered in the aggregate, that raise substantial doubt about ABC Company's ability to continue as agoing concern for [insert the time period set by the applicable financial reporting framework].Auditor’s Responsibilities for the Audit of the Financial StatementsOur objectives are to obtain reasonable assurance about whether the financial statements as a whole are freefrom material misstatement, whether due to fraud or error, and to issue an auditor's report that includes ouropinion. Reasonable assurance is a high level of assurance but is not absolute assurance and therefore is not aguarantee that an audit conducted in accordance with GAAS will always detect a material misstatement whenit exists. The risk of not detecting a material misstatement resulting from fraud is higher than for one resultingfrom error, as fraud may involve collusion, forgery, intentional omissions, misrepresentations, or the overrideof internal control. Misstatements are considered material if there is a substantial likelihood that, individuallyor in the aggregate, they would influence the judgment made by a reasonable user based on the financialstatements.[continued .]A6-4

Miles CPA ReviewAUD-6In performing an audit in accordance with GAAS, we: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess the risks of material misstatement of the financial statements, whether due tofraud or error, and design and perform audit procedures responsive to those risks. Such proceduresinclude examining, on a test basis, evidence regarding the amounts and disclosures in the financialstatements. Obtain an understanding of internal control relevant to the audit in order to design audit proceduresthat are appropriate in the circumstances, but not for the purpose of expressing an opinion on theeffectiveness of ABC Company's internal control. Accordingly, no such opinion is expressed. (2) Evaluate the appropriateness of accounting policies used and the reasonableness of significantaccounting estimates made by management, as well as evaluate the overall presentation of thefinancial statements. Conclude whether, in our judgment, there are conditions or events, considered in the aggregate, thatraise substantial doubt about ABC Company's ability to continue as a going concern for a reasonableperiod of time.We are required to communicate with those charged with governance regarding, among other matters, theplanned scope and timing of the audit, significant audit findings, and certain internal control–related mattersthat we identified during the audit.Other Information [Included in the Annual Report]Management is responsible for the other information [included in the annual report]. The other informationcomprises the [information included in the annual report] but does not include the financial statements andour auditor’s report thereon. Our opinion on the financial statements does not cover the other information,and we do not express an opinion or any form of assurance thereon.In connection with our audit of the financial statements, our responsibility is to read the other information andconsider whether a material inconsistency exists between the other information and the financial statements,or the other information otherwise appears to be materially misstated. If, based on the work performed, weconclude that an uncorrected material misstatement of the other information exists, we are required todescribe it in our report.Report on Other Legal and Regulatory Requirements[The form and content of this section of the auditor's report would vary depending on the nature of theauditor's other reporting responsibilities.][Signature of the auditor's firm][City and state where the auditor's report is issued][Date of the auditor's report](1) The subtitle “Report on the Audit of the Financial Statements” is unnecessary in circumstances in which the secondsubtitle, “Report on Other Legal and Regulatory Requirements” is not applicable.(2) If the auditor also has the responsibility to express an opinion on the effectiveness of ICFR in conjunction with the auditof F/S, omit the following: “but not for the purpose of expressing an opinion on the effectiveness of ABC Company's internalcontrol. Accordingly, no such opinion is expressed”A6-5

AUD-6Miles CPA Review Overview of the Standard Audit Report for Non-Issuers:Title / Subtitle / OthersSectionCommentsTalks aboutGAAP / GAAS?Title – E.g., “IndependentAuditor’s Report”Addressee – E.g., “To theBoard of Directors and/orStockholders of ABCCompany”Report on the Audit of theFinancial Statements (1)OpinionBasis for OpinionSubstantial Doubt About theOnly whenEntity’s Ability to Continue as a relevantGoing ConcernKey Audit MattersOnly whenengaged toreportResponsibilities ofManagement for the FinancialStatementsAuditor's Responsibilities forthe Audit of the FinancialStatementsOther Information [Included in Only whenthe Annual Report]relevantGAAPGAASGAAPGAASReport on Other Legal andRegulatory ResponsibilitiesSignature of Auditor,Address of Auditor,Date of the Auditor’s Report(1) The subtitle “Report on the Audit of the Financial Statements” is unnecessary in circumstances inwhich the second subtitle, “Report on Other Legal and Regulatory Requirements” is not applicable.A6-6

Miles CPA ReviewAUD-6 Title - E.g., “Independent Auditor’s Report” The auditor's report should have a title that clearly indicates that it is the report of anindependent auditor Addressee - E.g., “To the Board of Directors and/or Stockholders of ABC Company” The auditor's report is normally addressed to those for whom the report is prepared. The reportmay be addressed to the entity whose F/S are being audited or to TCWG Since auditor is reporting on the F/S prepared by the management and the auditor needs tobe independent, the auditor cannot address the report to the managementExpress an opinion if F/S GAAP Opinion Opinion if F/S presented in conformity with the applicable financial reporting framework. Also: Identify the entity whose F/S have been audited State that the F/S have been audited. Identify the title of each statement that the financial statements comprise Refer to the notes Specify the dates of or periods covered by each F/S that the F/S comprise Identify the applicable financial reporting framework and its origin Understanding the Opinion section using the traditional “10 GAAS” conceptual framework Explicit Reporting Standards of GAAS audit A 1st standard: Accounting principles US GAAP (or applicable financial reportingframework)thE 4 Standard: Expression of an opinion Implicit Reporting Standards of GAAS audit only require comments when not complied andwould result in a report that is different from the standard reportC 2nd standard: ConsistencyrdD 3 standard: Disclosure Basis for OpinionAudit as per GAAS States that the audit was conducted in accordance with US GAAS Refers to the section of the auditor's report that describes the auditor's responsibilities underGAAS States that auditor is required to be independent of the entity and to meet the auditor's otherethical responsibilities, in accordance with relevant ethical requirements relating to the audit States whether the auditor believes that the audit evidence the auditor has obtained issufficient and appropriate to provide a basis for the auditor's opinionA6-7

AUD-6Miles CPA ReviewCover in AUD-6.1 (II B) Substantial Doubt About the Entity’s Ability to Continue as a Going Concern - only when relevant If, after considering identified conditions/events and management's plans, the auditorconcludes that substantial doubt about the entity's ability to continue as a going concern for areasonable period of time remains, auditor is required to include a separate section in theauditor's report under the heading “Substantial Doubt About the Entity's Ability to Continue asa Going Concern” that does the following:Disclosed Draws attention to the note in F/S that:in F/S as Discloses conditions/events identified and management's plans that deal with theseconditions or events, andper GAAP States that these conditions or events indicate that substantial doubt exists about theentity's ability to continue as a going concern for a reasonable period of timeThat’s why States that the auditor's opinion is not modified with respect to the matter Note: However, if conditions/events, considered in the aggregate, have been identified thatraise substantial doubt about the entity's ability to continue as a going concern for a reasonableperiod of time but, based on the audit evidence obtained, the auditor concludes thatsubstantial doubt has been alleviated by management's plans and adequate disclosure hasbeen made in the F/S, the auditor may include an emphasis-of-matter paragraph, makingreference to management's disclosures related to the conditions/events and management'splans related to those conditions/events Cover in AUD-6.1 (II B)A6-8

Miles CPA ReviewAUD-6 Key Audit Matters (KAMs) - only when engaged to report Determining KAMs - Matters that, in the auditor's professional judgment, were of mostsignificance in the audit of F/S of the current period. Selected from matters communicated withTCWG. E.g., Areas of higher assessed RMM, or significant risks identified Significant auditor judgments relating to areas in F/S that involved significant managementjudgment, including accounting estimates identified as having high estimation uncertainty Effect on the audit of significant events or transactions that occurred during the period Note: GAAS does not require the communication of KAMs on the Audit Report. Auditor toreport KAMs only when engaged to do so Communicating KAMs - Auditor should describe each KAM, using an appropriate subheading, ina separate section of the auditor's report under the heading “Key Audit Matters” Intro language in this section of the auditor's report should state the following: “Key audit matters are those matters that were communicated with those charged withgovernance and, in the auditor's professional judgment, were of most significance in theaudit of the financial statements of the current period.” “These matters were addressed in the context of the audit of the financial statements asa whole, and in forming the auditor's opinion thereon, and the auditor does not providea separate opinion on these matters.” Descriptions of individual KAMs in the “Key Audit Matters” section should: Include a reference to the related disclosures, if any, in the F/S Address why the matter was considered to be one of most significance in the audit andtherefore determined to be a KAM Address how the matter was addressed in the audit If no KAMs - If auditor is engaged to communicate KAMs but determines, based on the factsand circumstances of the entity and the audit, that there are no KAMs to communicate,auditor should include a statement to this effect in a separate section of the auditor's reportunder the heading “Key Audit Matters” KAM not a substitute for expressing a modified opinion - Auditor should not communicatea matter in KAM section of the auditor's report when the auditor would be required tomodify the opinion as a result of the matter In case of adverse opinion or disclaimer of opinion - No KAMs to be reported. To ensurethat the KAMs do not overshadow the adverse opinion or disclaimer Communication with TCWG - Audit should communicate: Those matters the auditor has determined to be KAMs, or If applicable, auditor's determination that there are no KAMs to communicateA6-9

AUD-6Miles CPA Review Responsibilities of Management for the Financial Statements Management F/S per GAAP Describes management's responsibility for the following: Preparation and fair presentation of F/S, and for the design, implementation, andmaintenance of I/C relevant to the preparation and fair presentation of F/S Evaluation of whether there are conditions or events, considered in the aggregate, that raisesubstantial doubt about the entity's ability to continue as a going concern Auditor's Responsibilities for the Audit of the Financial Statements Auditor Audit per GAAS State that the objectives of the auditor are to: Obtain reasonable assurance about whether the financial statements as a whole are freefrom material misstatement, whether due to fraud or error, and Issue an auditor's report that includes the auditor's opinion State that reasonable assurance is a high level of assurance but is not absolute assurance andtherefore is not a guarantee that an audit conducted in accordance with GAAS will alwaysdetect a material misstatement when it exists State that the risk of not detecting a material misstatement resulting from fraud is higher thanfor one resulting from error, as fraud may involve collusion, forgery, intentional omissions,misrepresentations, or the override of I/C State that misstatements are considered material if there is a substantial likelihood that,individually or in the aggregate, they would influence the judgment made by a reasonable userbased on the F/S Further describe an audit by stating that, in performing an audit in accordance with GAAS, theauditor's responsibilities are to: Exercise professional judgment and maintain professional skepticism throughout the audit. Identify and assess RMM of F/S, whether due to fraud or error, and design and performaudit procedures responsive to those risks. Such procedures include examining, on a testbasis, evidence regarding the amounts and disclosures in F/S Obtain an understanding of I/C relevant to the audit in order to design audit proceduresthat are appropriate in the circumstances, but not for the purpose of expressing an opinionon the effectiveness of the entity's I/C. Accordingly, no such opinion is expressed In circumstances in which the auditor also has a responsibility to express an opinion onthe effectiveness of I/C in conjunction with the audit of F/S, auditor should omit thefollowing: "but not for the purpose of expressing an opinion on the effectiveness of theentity's internal control. Accordingly, no such opinion is expressed." Evaluate the appropriateness of accounting policies used and the reasonableness ofsignificant accounting estimates made by management, as well as evaluate the overallpresentation of F/S Conclude whether, in the auditor's judgment, there are conditions or events, considered inthe aggregate, that raise substantial doubt about the entity's ability to continue as a goingconcern for a reasonable period of time State that the auditor is required to communicate with TCWG regarding, among other matters,the planned scope and timing of the audit, significant audit findings, and certain internalcontrol–related matters that the auditor identified during the auditA6-10

Miles CPA ReviewAUD-6Cover in AUD-6.3 (I) Other Information [Included in the Annual Report] - only when relevant Relates to auditor’s responsibilities relating to other information included in an entity’s annualreport - whether financial or non-financial information (other than F/S & auditor’s report) Covered in AUD-6.3 (I) Auditor should include a separate section in the auditor’s report on F/S with the heading “OtherInformation” or other appropriate heading: State that management is responsible for the other information Identify other information and a state that the other information does not include the F/Sand the auditor’s report thereon State that the auditor’s opinion on F/S does not cover the other information and that theauditor does not express an opinion or any form of assurance thereon State that, in connection with the audit of F/S, auditor is responsible to read the otherinformation and consider whether a material inconsistency exists between the otherinformation and the financial statements or the other information otherwise appears to bematerially misstated State that, if, based on the work performed, the auditor concludes that an uncorrectedmaterial misstatement of the other information exists, the auditor is required to describe itin the auditor’s report If the auditor has concluded that an uncorrected material misstatement of the otherinformation exists, a statement that the auditor has concluded that an uncorrected materialmisstatement of the other information exists and a description of it in the auditor’s report Other Reporting Responsibilities - If the auditor addresses other reporting responsibilities in theauditor’s report in addition to GAAS, these other reporting responsibilities should be addressed in aseparate section of the auditor’s report. In such a situation, the overall report is divided intosubtitles Subtitle #1: “Report on the Financial Statements” - This heading is added following theMajor responsibilityaddressee, and prior to the first section of the report Subtitle #2: “Report on Other Legal and Regulatory Responsibilities” - This heading and theOther responsibilityrelated report are added following the report on the F/SA6-11

AUD-6Miles CPA Review Signature, Auditor’s Address & Report Date Auditor’s Signature - Manual or printed signature of the auditor’s firm Auditor’s Address - Name the city and state (or country) where the auditor practices Audit Report Date - Date on which sufficient appropriate audit evidence to support auditopinion has been obtained, ordinarily the last day of fieldwork (NOT the date on which thereport is signed) Rationale - The date of the auditor’s report informs the user of the auditor’s report that theauditor has considered the effect of events & transactions of which the auditor becameaware and that occurred up to that date Sufficient appropriate audit evidence includes evidence that Audit documentation has been reviewed Entity’s F/S & disclosures have been prepared Management has asserted its responsibility for F/S (representation letter) For comparative F/S, date of the most recent audit is used Dual Date option for footnote - If the auditor discovers facts, which would need to beRefer disclosed as footnote on the F/S, subsequent to the last day of fieldwork (i.e., original dateAUD-4 that sufficient appropriate audit evidence is obtained) but prior to the report release, theauditor may dual date the report - i.e., the date on which the auditor obtains the footnoteSubsequentinfo is included as an additional date along with the original report dateEvents Audit report body remains unchanged, since the F/S footnote discusses the issue Auditor’s responsibility for events occurring subsequent to the original report date islimited to the specific event described in the relevant note to the F/S Illustration of dual date:(Date of auditor’s report), except as to note Y, which is as of (date of completion of auditprocedures limited to revision described in note Y)A6-12

Miles CPA ReviewAUD-6 Note: Reference to Auditing Standards in the Auditor's Report Audits in accordance with GAAS and another set of auditing standards - Only if the entireaudit was conducted in accordance with both the sets of auditing standards, the auditor mayindicate that the audit was also conducted in accordance with the other set of auditingstandards (e.g., International Standards on Auditing or Government Auditing Standards) Additional language should be added to the “Basis for Opinion” section in such a situation:Basis for OpinionWe conducted our audits in accordance with auditing standards generally accepted in the UnitedStates of America (GAAS) and in accordance with International Standards on Auditing (ISAs). Ourresponsibilities under those standards are further described in the Auditor's Responsibilities forthe Audit of the Financial Statements section of our report. We are independent Audits in accordance with GAAS and PCAOB AS - When conducting an audit of F/S inaccordance with PCAOB AS and the audit is not within the jurisdiction of the PCAOB, the auditoris required to also follow GAAS. In addition, the auditor should: Use the report required by the PCAOB. Amend the PCAOB (issuer) report to state the audit was also conducted in accordance withGAASA6-13

AUD-6Miles CPA ReviewII) Unmodified Opinion with Emphasis-of-matter and/orOther-matter paragraph(s)II In certain circumstances, the auditor may determine that it is necessary to add additionalcommunications to the auditor’s report without modifying the auditor’s opinion. This is done usingemphasis-of-matter and other-matter paragraphs GAAS & ISA use the terms “emphasis-of-matter” & “other-matter” paragraphs whereas PCAOBuses the term “explanatory” paragraph Auditor should communicate these circumstances to TCWG (along with the proposed wordingof the emphasis-of-matter or other-matter paragraph)“Emphasize” a matter presented or disclosed in the F/S Emphasis-of-matter Paragraph - Refers to a matter appropriately presented or disclosed in the F/Sthat is of fundamental importance to users’ understanding of the F/S and needs to be“emphasized” on the Auditor’s Report (as per auditor’s professional judgment) Included in auditor’s report when required by GAAS, or at the auditor’s discretion, provided: Auditor not required to modify the opinion as a result of the matter When the auditor is engaged to report on KAMs, the matter has not been determined to bea KAM to be communicated in the auditor's report When the auditor includes an emphasis-of-matter paragraph, the auditor should Use the heading “Emphasis of Matter” or other appropriate heading Required to use heading "Emphasis-of-Matter" when auditor engaged to report KAMs Describe the matter being emphasized and refer to the relevant disclosures (or note #)about the matter in the F/S Indicate that the auditor’s opinion is not modified with respect to the matter emphasized Included in the following circumstances: {Study with the 4 standards of reporting in traditionalGAAS “All Clean & Dirty Elements”!}AUD- A Special purpose framework F/S (not general purpose framework like GAAP or IFRS) - F/Sprepared in accordance with an applicable special purpose framework (other than6.5regulatory basis F/S intended for general use) Accounting principles GAAP or IFRSCAUD6.1D Justified lack of Consistency - Justified change in accounting principle that has a materialeffect on the F/SConsistency is lacking, but for a justified reason Going Concern doubt is alleviated - If conditions/events identified raises substantial doubtabout the entity's ability to continue as a going concern for a reasonable period of time BUT, based on audit evidence obtained, auditor concludes that substantial doubt has beenalleviated by management's plans and adequate disclosure has been made in the F/SDisclosed in F/S but still emphasized on Audit Report Uncertainty & Other Circumstances (optional) - Appropriately presented/disclosed in F/Sbut auditor still considers necessary to emphasize. E.g., Uncertainty related to outcome of unusually important litigation or regulatory action Unusually important subsequent events; e.g., major catastrophe having a significanteffect on the entity’s financial position Significant related party transactionsAUD6.2EA6-14 Changing prior opinion - In case of subsequently discovered facts that lead to a change inaudit opinion, auditor may use emphasis-of-matter or other-matter para, as appropriateExpression of an “updated” opinion

Miles CPA ReviewAUD-6Communicate a matter “other” than those presented or disclosed in the F/S Other-Matter Paragraph - Refers to a matter “other” than those that are presented or disclosed inthe F/S that is of fundamental importance to users’ understanding of the F/S and needs to beemphas

Miles CPA Review AUD-6 A6-7 Title - E.g., “Independent Auditor’s Report” The auditor's report should have a title that clearly indicates that it is the report of an independent auditor Addressee - E.g., “To the Board of Directors and/or Stockholders of ABC Company” The aud