Transcription

/OPUS*GROUPANNUALREPORTYEAR ENDED 312015/DECEMBER 2015CONTENTFASTERSMARTEROPUS GROUP LIMITEDAND CONTROLLED ENTITIESA.C.N. 006 162 876

Company DirectoryDIRECTORSRichard F. Celarc Chairman / Executive DirectorChuk Kin Lau Executive DirectorMei Lan Lam Executive DirectorPaul A. Young Non-Executive DirectorCOMPANY SECRETARIESLaura LouVirginia LeeREGISTERED OFFICE ANDPOSTAL ADDRESS12 Rachael Close, Silverwater NSW 2128CONTACT NUMBERSTelephone: (02) 9584 7680Facsimile: (02) 9648 5887AUDITORSBDO East Coast PartnershipLevel 11, 1 Margaret StreetSydney NSW 2000SHARE REGISTRYBoardroom Pty LimitedLevel 12, 225 George StreetSydney, NSW 2000GPO Box 3993Sydney, NSW 2001Telephone: 1300 737 760 / (02) 9290 9600BANKERSAustralia and New Zealand Banking Group Limited242 Pitt Street, Sydney NSW 2000SOLICITORSThomson GeerLevel 25, 1 O’Connell Street, Sydney NSW 2000STOCK EXCHANGEListed on the Australian Securities Exchange (‘ASX’)ASX CODEOPG (Fully Paid Ordinary roup.com.au2OPUS GROUP* ANNUAL REPORT YEAR ENDED 31 DECEMBER 2015

SINGAPORESYDNEYCANBERRAMELBOURNEAUCKLAND3

All your print and supplychain needs underDESIGNPRINTMAILWA R E H O U S ED I G I TA L4OPUS GROUP* ANNUAL REPORT YEAR ENDED 31 DECEMBER 2015

INDEXChairman’s Letter6OPUS Business Model7Our Operations & Divisions8Cheif Executive Officer’s Report9Key Strategies11Business Prospects, Opportunities and Risks132015 Operating and Financial Review15Directors’ Report18Auditor’s Independence Declaration30Corporate Governance Statement32Annual Financial Report38Additional Information93NCI 2016 Annual ReportOPUS has designed, typeset, printed anddigitally published the report for a second year.5

CHAIRMAN’S LETTERDear Fellow Shareholders,On behalf of the OPUS Group Board, I am delightedto present our Annual Report for the full year ended 31December 2015.2015 was a year that allowed us to build on the financialrestructure we put in place in 2014. Whilst 2014 was avery busy period implementing what we did, 2015 wasthe year that we put it all into action.In 2015 we delivered what I believe to be a strongresult and one that leveraged our relationship with 1010Printing Group (1010). As I have mentioned previously,we see 1010 as one of the world’s most progressive andforward looking printing businesses. In conjunction with1010, we have world class printing facilities in China,Singapore, New Zealand and Australia with sales officesand agents in Hong Kong, the United States, UnitedKingdom and Europe in addition to Australasia.It is very pleasing to report that all of our plans for 2015have been executed on time and to budget which haslaid the foundations for continued success in 2016.As Executive Chairman, I can also report that ourgoal to return to a much more hands on business hasbeen achieved and we are strongly engaged now withour major customers and supplier partners to deliversustainable benefits, centred on speed and efficiencies.We have made selective Capex investments that willdeliver on our promise of improved speed to marketdelivered more efficiently, therefore offering both deliveryand cost saving benefits. A good example of this hasbeen the purchase of the assets of Protectaprint (PAP).PAP is a leading embellishment company who specialisein producing world class cover finishes for our trade andrelated books.We have integrated PAP into our business, effectivelybringing in-house the full spectrum of cover finishproduction. Having this capability under one roofcreates major productivity improvements and againleads to improved speed and pricing.6We have also worked hard and focused on the nichesour various businesses operate in. We have strongbrands, each a leader in their segments. By workingclosely with each business and staying close to ourcustomers we are focusing on our strengths anddelivering improved customer and business outcomes.We are also working much more closely with ouroperations team to ensure we release latent capacity. Inshort, as we increase revenue, we will do this withoutincreasing overheads or direct costs proportionately.Our improved IT and Production systems will allow usto flex labour utilising the equipment we have in smartershift patterns.We are also working closely with our IT and systemsteams to deliver significantly improved auto and semiauto ordering systems for our major customers. Yetanother way to reduce both parties costs and improveour speed of turnaround.I called 2014 our transformative year, 2015 has beenour year to set firmly in place the foundations for us todeliver ongoing benefits to shareholders and customersand importantly, set the scene for a sustainablebusiness.Thank you for your support so far and I look forward toreporting our six months results mid-year which I believewill show further improvements and proof our businessmodel can and will deliver on our strategy.Yours faithfullyRichard F. CelarcChairmanOPUS GROUP* ANNUAL REPORT YEAR ENDED 31 DECEMBER 2015

OPUS BUSINESS MODELThe Board presents the Operating and Financial Review for the year ended 31 December 2015,which has been designed to provide the shareholders with a clear and concise overview ofOPUS Group’s operations, financial position, business strategies and prospects. The review alsoprovides contextual information, including the impact of key events that have occurred duringthe year and material business risks faced by the business so that shareholders can make aninformed assessment of the results and prospects of OPUS Group. The review complementsthe financial report. OPUS Group has changed its year end to 31 December to align with thefinancial year end of its ultimate holding company in 2014. As a result, the comparative figure ofthe financial statements is prepared for the six months ended 31 December 2014.Our Business ModelOPUS Group is an Asia-Pacific, technology based(Australian headquartered) printing group, servicing twoPacific. The regional solution allows customers to selectthe optimal content solution based on product type, runlength, timing, location, security and fulfilment.operational platforms – Publishing Services and OutdoorOPUS Group’s competitive advantage is to combineMedia. Employing a dynamic technology platform,the three strengths of specialisation, speed and scale.the OPUS Group produces and distributes publishedOPUS Group provides full service capability for specialistcontent at the speed and scale required by a range ofmarkets based on factors such as quality, technicalthe nationallibraryJ U N E2 0 14of austraLia magazineTHE NATIONALLIBRARYOF AUSTRALIA MAGAZINEnationaral librstray of auliaCYFOANMKCROECNESANDMUCHMONREEL SON’SMISCOS INOGMK INGARWBLITCAHPTGIVASATEDBYTHEDAeL etrepooSme’sELhpLoucGSHanAMdmpeethANaVtret imaLMornooicerphhtraGartuV irdt:earERVeV iLLsLain?013june 2r isand technology-led communications solutions for Asiachain.esregional solutions enable it to handle business servicessmarter via an integrated full service end-to-end valuehthe United Kingdom and Europe. OPUS’s innovativeto produce and deliver published content faster andnoffices and agents in Hong Kong, United States,OPUS Group’s vision is to be the partner of choiceL ibcompany with printing facilities in China and salesand business services across multiple regions.hGroup is an international integrated print managementpositioned to deliver a range of complementary productsicGroup”), a substantial shareholder of OPUS Group. 1010through new digital technology. OPUS Group is uniquelypaaccess through 1010 Printing Group Limited (“1010OPUS Group is aligned to meet clients’ needs on speedLeMaryborough, Canberra and Auckland with globalshort run, time sensitive printing and business services.exend value chain with facilities in Singapore, Sydney,high value add services. OPUS Group is a leader inJaThe OPUS Group offering includes a regional end-to-capability, specialised equipment, unique expertise andS e p t e m b e r 2 013increasingly global customers.ketyou r pocwor ld inmuc h more ter s theanditime mas pen to paperetre es marcity of ra’s mou nta in lakcan ber7

OUR OPERATIONS & DIVISIONSPublishing Services DivisionTRADElargest publishers.With facilities operating in Singapore, Sydney,OUTDOORLMIPACanberra, Maryborough and Auckland, the PublishingServices Division offer spans the electronic, digitalLMfor pleasure, Government and many of the world’sIPAESand digital content for professional, educational, readISHING SERVBLICPU& PROFESONALSIONATIALUCEDproduction, management and distribution of printedGOVERNMENTIPALMThe Publishing Services Division is responsible for theOUTDOORand offset book production spectrum with a suite ofcomplementary business services including Print onDemand, back catalogue fulfilment, content and digitalThe Outdoor Media Division remains at the forefront ofasset management, direct to consumer distribution,industry development for new and exciting productsvirtual warehousing, web storefront and EDI andand technologies and is a member of the Hewlettmailing.Packard global advisory board on technology andinnovation.Customers in the Publishing Services Division canaccess multiple content and service delivery optionsOpus Group sold its Outdoor Media Business in Newacross traditional print, digital print-on-demand,Zealand in October 2015.distribute & print and online electronic delivery.Outdoor Media DivisionThe Outdoor Media Division is the largest provider ofgrand and large format printing for outdoor advertisingand is a leading production house in Australia.This involves the creation, production and distributionof outdoor media advertising material and corporatesignage, such as billboards, bus advertising, retaildisplays, building and vehicle wraps and tradeexhibitions using a wide variety of flexible and rigidmaterials and offering a full range of in-house finishing.8OPUS GROUP* ANNUAL REPORT YEAR ENDED 31 DECEMBER 2015

CHIEF EXECUTIVE OFFICER’S REPORTAs our Executive Chairman has outlined, we haveWhilst e-books remain in the mix, the dire predictionsreported a solid year in terms of performance. Thisfor the read-for-pleasure market of a few years ago didhas been delivered by a strong focus on our businessnot materialise. Depending on the genre, eBooks as afundamentals now that we are debt free and supportedpercentage of revenue in this market has stabilised or areby the 1010 Printing Group (1010). Each business in thein slight decline.Group is a leader in their market and we have workedhard to ensure their strengths are reinforced as we returnThe overall supply chain continues to evolve withto our core values.customers taking advantage of new technology that canproduce faster whilst also reducing stock holding andThe Group 2015 revenue was slightly down on the Juneassociated costs.2014 full year: December 2015 115,465,000 comparedto June 2014* 116,873,000, primarily due to theFor us, the change in the customer supply chain isdivestment of our New Zealand outdoor media business,working towards our model. Our strategy has beenOmnigraphics in October 2015.to deliver faster and do so more efficiently expand ourcompetitive edge. This is now crossing over with marketPleasingly the work done on adding value withdemand – books ordered much later, in lower quantitiescustomers, leveraging 1010’s strengths alongside theand then ordered again to demand.disciplines of cost management, resulted in an improvedprofit after tax of 12,047,000 compared to June 2014 ofOur Capex plan is to invest in equipment and solutions 47,073,000 loss.that achieve improved speed, efficiencies and inputcosts. From a Publishing Division perspective, we haveFrom a market perspective, our customers areinvested in a series of upgrades to our substantial T410demanding increased speed to market and price.Hewlett Packard state of the art inkjet digital integratedThis continues to be a key element of our strategic andprinting line.operational initiatives.This line, the first solution in the Southern Hemisphere ofWith 1010’s support, we are selectively investing and as Iits kind (see photo on page 12 of this report), is scaleablehave detailed under the divisional reports, this investmentfor upgrades to speed, colour and finishing.is primarily centred on digital production and finishing.The key criteria remains to produce faster and to do soThe upgrade Capex will see the machine achieve outputsmore efficiently to ensure we remain competitive.not previously envisaged with the total production donein-line i.e. from paper to finished and bound productI will briefly update you on our two core divisions:without any human touch.Publishing Services DivisionThere has also been a substantial investment in ourOur three businesses in Australia, McPherson’s, Ligare andCanPrint and our Singapore business, COS that make upthe Publishing Services Division have performed well.The publishing market we operate in has seen a return toprinted books both in the read for pleasure sector and inSydney facility with the commissioning of a colour inkjetproduction line. This latest digital technology is idealfor the educational market and able to produce efficientcolour print without the set up costs associated withtraditional colour printing, especially on lower run sizesthe market is now requiring.part, the Education market.*Note we changed reporting periods from Financial to Calendar year in 2015.9

CHIEF EXECUTIVE OFFICER’S REPORT cont.As Richard has mentioned, another important investmenta medium term view that this will change out morehas been to bring in-house all aspects for the productionfrequently on the back of the faster content changeof book cover finishing. This will enable all productioncreated by digital.to be completed in house for books, delivering on ourstrategy of speed and efficiency.Outdoor Media Division2016 OutlookThere is good momentum in our business as wefocus on our niche sectors, value-add and strengths.The sale of our New Zealand outdoor media business,Market conditions remain uncertain with continuedOmnigraphics concluded in October 2015 as outlined atpressure on margins and input costs; however wethe time.believe that in conjunction with 1010 and leveragingthe benefits of that relationship that we will be able toCactus Imaging in Australia continues to grow. Recently,continue to deliver strong and improved results.we have invested in the latest HP3500 digital latex printdevice. This investment will allow further diversificationYours faithfullyinto the transit and retail markets, using an extremelyproductive and eco-friendly solution.The outdoor media sector continues to grow and whilstdigital signage is the fastest growing platform in thesector, traditional print is being maintained with10Clifford D.J. BrigstockeChief Executive OfficerOPUS GROUP* ANNUAL REPORT YEAR ENDED 31 DECEMBER 2015

KEY STRATEGIESValue chain managementThe additional resources available from 1010 Grouphave strengthened OPUS Group’s procurementefficiency. Having these economies of scale is akey success factor in our industry. The combinedprocurement budget enables the expanded group to beone of the largest in the industry. This will translate to acost saving for OPUS Group. The combined extensivenetwork in the printing industry enables OPUS Groupto have a strong back up and great flexibility on theservices offering to its customers.Operations efficiencyTo assimilate and streamline the internal processamong all the facilities, the OPUS Group ICT team isworking to enhance the ERP system and standardisesome operating systems. This enables managementto efficiently align and allocate resources amongstdifferent facilities and better support the growing needfor regional distribution and print solutions. The speedin execution and access to data is vital for success.11

KEY STRATEGIES cont.Technology upgradeOPUS Group continues to upgrade its technologyto increase its competitive edge. OPUS Group willcontinue its investment in new printing technologyand solutions. OPUS’ non‐traditional print elementsand a growing range of products and servicesform part of OPUS Group’s comprehensive offerfor OPUS Group encompasses a distributionsystem to produce and supply products toconsumers, with agility to respond quickly tochange and lead our customers in this dynamicenvironment, across all aspects of our business.Operational and strategic focusto help publishers meet the changes currentlyFollowing the successful capital restructure andtaking place in their supply chain. OPUS Groupcost base reset in 2014, OPUS Group is continuallyDigital leverages off its internet trading and datareviewing the market it operates in and resourceexchange technology platform, providing an onlineallocation to ensure that operations are deliveredcontent management and distribution system thatin the most cost effective mode. Management willalso integrates with customers and with our digitalcontinue to improve its cost structure and focus onprinting equipment.markets with more opportunity for growth and scalein order to maximise shareholders’ wealth.OPUS Group Digital is the mechanism by whichOPUS Group’s strategic prospects and its valuechain extension strategy meet. The digital strategy12OPUS GROUP* ANNUAL REPORT YEAR ENDED 31 DECEMBER 2015

BUSINESS PROSPECTS,OPPORTUNITIES AND RISKSHaving gone through a successful capitalas part of the comprehensive solution offer. Known asrestructuring and comprehensive review ofOPUS Digital this includes but is not limited to micro-the existing facilities and cost base reset,OPUS Group returned to profit in 2015. OPUSGroup managed to retain key managersand customers after its cost base reset. Thewarehousing, fulfilment offers, e-book conversions,database mailing, web shop front development andmanagement, subscription and EDM marketingservices, both physical and online.majority of capital reinvestment is now beingOPUS Group intends to leverage the new technologiesdirected towards new digital equipment toto be a leaner and more efficient manufacturer of printimprove turnaround times and productivity torelated products. These include non-traditional printenhance our competitiveness. OPUS Groupexpects to increase its sales revenue in thecoming financial year.elements and a growing range of products and servicesas part of OPUS Group’s comprehensive offer to helppublishers meet the changes currently taking place intheir supply chain.The Board is cautious about the risks which mayReduced print run sizes with increasedimpact the future financial performance of OPUSorder frequencyGroup when looking for opportunities in the markets.The opportunities, risks and the business prospectsas a result of execution of the Board’s strategy arediscussed below:Digital influencePublishers are reducing print costs and volumes. OPUSGroup is facing the risk of printing market consolidation.As global publishers consolidate their supply chains andlook to partners who can extend their services offering,speed to market becomes an essence to the success.OPUS Group continues to upgrade its technology, whichThe slow growth in the size of the publishing marketincludes in-house ERP system and digital print solutions,and the threat of digital transformation is notable. Theto meet customers’ demand. Our proprietary IPALM latest data shows printed books and e-books canplatform enables a combination of Print on Demand andco-exist. In parallel with this and to offset any declinePrint to Demand solution to our customers. The ability toin print related products, OPUS has been steadilyprint faster and more cost effectively is the competitivebuilding its range of non-print products and servicesedge of OPUS Group.13

BUSINESS PROSPECTS,OPPORTUNITIES AND RISKS cont.Slow growth in the domestic economy and foreignOPUS Group has been reset to increase itsexchange fluctuationscompetitiveness in the domestic market. OPUSThe majority of OPUS Group sales are generatedin Australia, and the provision of domestic printingservices will continually dominate OPUS Group’sturnover. With the expected slow growth in thedomestic economy, OPUS Group’s turnover may beadversely impacted by adverse consumer sentiment.The principal raw material used in OPUS Group’sbusiness is paper. The USD appreciation will affect thepaper price and hence dampen OPUS Group’s profitmargin.14Group is partnering with 1010 Group, to strengthenits sourcing network and bargaining power with thesuppliers. OPUS Group is performing a wider role inthe value chain by adding services and distributionplatforms to support customers’ needs. While OPUSGroup is able to provide its customers with locationalflexibility in Australia, we also have support frommanufacturing facilities outside of Australia. It allowsOPUS Group to tailor an optimum solution to eachcustomer.OPUS GROUP* ANNUAL REPORT YEAR ENDED 31 DECEMBER 2015

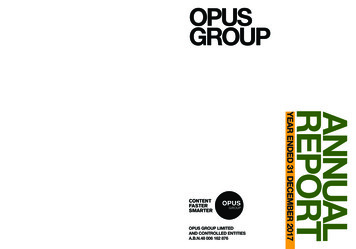

2015 OPERATING ANDFINANCIAL REVIEWOPUS Group reported revenue of 115,465,000,which is lower than the year ended 30 June2014 figures (Six months ended 31 December2014: 57,969,000; Year ended 30 June 2014: 116,873,000). The slight drop was caused by thedisposalof the Outdoorbusiness in NewOPUS GroupLimitedMediaand nd in Oct 2015. The profit for the OPUSGroup after providing for income tax amounted to4.2015 OPERATING RESULT, FINANCIAL SUMMARY AND COMMENTARY 12,047,000 (Six months ended 31 December 2014:OPUSGroup reportedof June 115,465,000,which is lower than the year ended 30 June 2014 figures (SixLoss 8,771,000;Year revenueended 302014: Lossmonths ended 31 December 2014: 57,969,000; Year ended 30 June 2014: 116,873,000). The slight drop was 47,073,000).caused by the disposal of the Outdoor Media business in New Zealand in Oct 2015. The profit for the OPUS Groupafter providing for income tax amounted to 12,047,000 (Six months ended 31 December 2014: Loss 8,771,000;Year ended 30 June 2014: Loss 47,073,000).Further details in respect of these results areFurther detailsprovidedbelow:in respect of these results are provided below:Reported Financial PerformanceYear ended31 Dec 2015AUD ’000sSix monthsended31 Dec 2014AUD ’000sYear ended30 Jun 2014AUD ’000s% ChangeFavourable /(unfavourable)Year ended30 Jun 2014Revenue from ordinary activities115,46557,969116,873(1%)Operating income and (35,046)129%Net finance costs(213)(1,554)(7,262)97%Profit / (loss) before income tax9,799(7,853)(42,308)123%Income tax benefit / (expense)2,248(918)(4,765)147%Profit / (loss) after income tax12,047(8,771)(47,073)126%Basic profit / (loss) per share (cents)12.50 (21.67) (401.76) *103%Operating profit / (loss) before netfinance costsDue to the rounding of figures small discrepancies may exist* restated to reflect the share consolidation on the basis of 1 for every 10 shares on 24 October 201415

2015 OPERATING ANDFINANCIAL REVIEW cont.The Publishing Services Division recorded anFinancial HighlightsFollowing the successful restructure of the OPUSOPUS Group Limited and Controlled EntitiesGroupin theandpriorFinancialperiod, EBITDAfor both divisionsOperatingReviewand profit before income tax, have both improved.Financial HighlightsEBITDA of 13,189,000 which increased 4% whencompared to the year ended 30 June 2014 (Sixmonths ended 31 December 2014: 3,395,000;Year ended 30 June 2014: 12,697,000). TheOutdoor Media Division recorded an EBITDA ofThePublishing Services Division generated revenueFollowing the successful restructure of the OPUS Group in the prior period, EBITDA for both divisions and profit 4,307,000 which increased 43% when comparedbeforeincome tax,haveboth improved.of 94,963,000whichdecreased1% whento the year ended 30 June 2014 (Six months endedcompared to the year ended 30 June 2014 (SixThe Publishing Services Division generated revenue of 94,963,000which decreased1% whenYearcompared31 December2014: 1,925,000;ended to themonthsended31 December 46,384,000;year ended30 June2014 (Six2014:monthsended 31 December 2014: 46,384,000; Year ended 30 June 2014:30 June 2014: 3,015,000). Others represents 95,491,000).Services DivisionYearended 30TheJunePublishing2014: 95,491,000).The managed to retain its key customers. The revenue of the OutdoorMedia Division was 20,502,000 4% down on the year endedunallocated30 June 2014(Six monthsendedOPUS31 Decembercorporateexpenses.Group 2014:PublishingServicesDivisionto retain 11,585,000;Year ended30managedJune 2014: 21,382,000). The decrease is mainly due to sale of the Outdoor Mediamanaged to decrease corporate expenses tobusinessin New Zealand.itskey customers.The revenue of the Outdoor 3,799,000 which decreased 30% when comparedMediaDivision was 20,502,000downanonEBITDAtheThe PublishingServicesDivision 4%recordedof 13,189,000 which increased 4% when compared to theto the year ended 30 June 2014 (Six months endedyear endedended 3030 Junemonths endedyearJune 20142014 (Six(Six monthsended 3131 December 2014: 3,395,000; Year ended 30 June 2014: 12,697,000). The Outdoor Media Division recorded an EBITDAof 4,307,000whichincreasedYear43%endedwhen 3031 December2014: 3,370,000;December2014: 11,585,000;30 Junecompared tothe yearended 30 YearJuneended2014 (Sixmonths ended 31 December 2014: 1,925,000; Year ended 30 JuneJune 2014: 5,418,000).2014: 3,015,000).representsunallocated2014: 21,382,000).OthersThe decreaseis mainlydue tocorporate expenses. OPUS Group managed to decreasecorporate expenses to 3,799,000 which decreased 30% when compared to the year ended 30 June 2014 (Sixsaleof theOutdoorMedia businessin New Zealand.monthsended31 December2014: 3,370,000;Year ended 30 June 2014: 5,418,000).Year ended31 Dec 2015AUD ’000sRevenuePublishing Services DivisionOutdoor Media DivisionTotal RevenueEBITDAPublishing Services DivisionOutdoor Media DivisionOthersTotal EBITDASix monthsended31 Dec 2014AUD ’000s(restated)Year ended30 Jun 2014AUD ’000s(restated)% ChangeYear ended30 Jun 33%EBITDA on ordinary activities13,697Six monthsended31 Dec 2014AUD ’000s(restated)1,950Depreciation and amortisationFinance incomeFinance costsImpairment of goodwillImpairment of property, plant and equipmentDebt forgiveness (net)Profit / (loss) before income tax per the ConsolidatedStatement of Profit or Loss and Other Comprehensive 308)Year ended31 Dec 2015AUD ’000sYear ended30 Jun 2014AUD ’000s(restated)10,294OPUS Group recorded profit before income tax of 9,799,000 (Six months ended 31 December 2014: loss of 7,853,000; Year ended 30 June 2014: loss of 42,308,000). The net finance cost was reduced to 213,000 P*31 December2014: 1,554,000;ended30 June312014: 7,262,000) 2015after the successful debt16 months

OPUS Group recorded profit before income tax of 9,799,000(Six months ended 31 December 2014: loss of 7,853,000; Yearended 30 June 2014: loss of 42,308,000). The net finance costwas reduced to 213,000 (Six months ended 31 December 2014: 1,554,000; Year ended 30 June 2014: 7,262,000) after thesuccessful debt reduction.OPUS Group Limited and Controlled EntitiesOperating and Financial ReviewAsset and Capital Structure (as at date of the Consolidated Statement of Financial Position)2015AUD ’000s2014AUD Total current assetsTotal current liabilitiesNet current assetsCash:Bank debt and borrowingsFinance lease liabilitiesCash and cash equivalentsNet cashTotal equityDue to the rounding of figures small discrepancies may exist.* Bank debt and borrowings excludes off balance sheet bank guarantees and letters of credit.The financial position of OPUS Group continues its improvement after the recapitalisation transaction in late 2014.The financial position of OPUS Group continues its improvement after the recapitalisation transaction in late 2014.As at 31 December 2015, OPUS Group had total equity of 27,649,000 (2014: 16,267,000).As at 31 December 2015, OPUS Group had total equity of 27,649,000 (2014: 16,267,000).There is net working capital of 16,448,000 (2014: 5,314,000). The current ratio is 1.8 (2014: 1.2). OPUS Grouphad cash at period end of 11,459,000 (2014: 7,119,000). The only interest bearing liabilities are the finance leaseThereis networking capital 16,448,000(2014: 5,314,000).The currentratio isDuring1.8 (2014:1.2).OPUSOPUSGroupGroupliabilitiesof 151,000(2014: oftotalbank debt andfinancelease liabilities 4,018,000).the year,repaidthepromissorynoteof SGroup’sgearinghad cash at period end of 11,459,000 (2014: 7,119,000). The only interest bearing liabilities are the finance leaseratio, which is calculated on the basis of the total interest-bearing debts over the total equity, is 1% (2014: 25%).liabilities of 151,000 (2014: total bank debt and finance lease liabilities 4,018,000). During the year, OPUS Grouprepaid the promissory note of 1,900,000 plus accrued interest to Commonwealth Bank. OPUS Group’s gearingratio, which is calculated on the basis of the total interest-bearing debts over the total equity, is 1% (2014: 25%).17

DIRECTORS’ REPORTThe directors present their report, together with the Having been a print business owner for overconsolidated financial statements, on the consolidated35 years, Mr Celarc has a wealth of industryentity (referred to hereafter as the “OPUS Group”)knowledge and operational experience. He is wellconsisting of OPUS Group Limited (referred to hereafterrespected in industry with a reputation of highas the “Company” or “parent entity”) and the entities itintegrity and good work ethics.controlled at the end of, or during, the ye

OPUS Group is a leader in short run, time sensitive printing and business services. OPUS Group is aligned to meet clients’ needs on speed through new digital technology. OPUS Group is uniquely positioned to deliver a range of complementary products and business services across multiple regions. OP