Transcription

Nepal Rastra BankBANK SUPERVISION DEPARTMENTBANKING SUPERVISIONANNUAL REPORT2001-2002

ForewordEffective supervision is prerequisite for growth and stability of financialsystem. This fact was further reinforced by the financial crisis observed in SouthAsian Countries during the period of 1996 to 1998.Banking system of Nepal has undergone significant change sinceliberalization of the financial sector in mid eighties. It has improved in quantitative aswell as qualitative terms. Though banking system in Nepal is not so multifacetedwhen compared to that of developed countries, it has definitely grown to becomemore complex in recent years.Supervisory strength at present is capable of meeting the existing challengeshowever, preparation for effective and efficient supervision even in the complexmarket situation, which is inevitable in future is necessary. In this regard efforts arebeing made for strengthening supervisory capability. Quality manpower is main focusof our recruitment policy. Licensing policy for establishment of banks was alsorevised. Nepal Rastra Bank, Bank supervision Byelaw is being implemented whichshall be effective in regularizing supervisory function. Efforts are being made forstrengthening the off site supervision system as an early warning system.This report is first effort of its kind to disseminate information to all concernedabout activities and developments in the area of Bank Supervision. Efforts made bythe concerned staff in this regard are praiseworthy. I hope this report will be helpfulto all interested partiesDr. Tilak Bahadur RawalGovernor2

PrefaceThis annual supervision report of the commercial bank is the firstattempt of its kind from the bank supervision department. The bank supervisiondepartment has been an important wing of the central bank of Nepal since it wasformed in 1984. It has assumed even more importance in recent years in wake ofprivate banks flowing in the financial system and discovery of frauds and forgerieswithin the banking system worldwide and of course Asian crisis experienced during1996 to 1998.The degree of infrastructure, manpower and efficiency required forsupervisory functions, by its very nature, depends on prevailing practices anddevelopment in the sector that is supervised. It follows that the nature, scope andextent of the job of a supervisor is changeable and runs parallel to the development inthe sector being supervised. The change has to be supported by proper legislations,regulations, infrastructure, manpower and more importantly willingness on the part ofsupervisors to keep pace with the new development.With Liberalization of financial sector in mid eighties number of banksand financial institutions have been increasing. These institutions provide services ofvaried nature by using advanced technologies. In this context supervisory function ofthe Nepal Rastra Bank has become more challenging. NRB has recognized andaccepted these challenges. Steps are taken to strengthen supervisory capacity byincreasing efficient and professional manpower and introducing new technologies.Meanwhile, It was also felt necessary to disseminate information amongst theinterested parties about the developments in Banks supervisory function. This reporthighlights the developments related to supervisory function as well as trendsobserved in the commercial banking during the financial year 2001-02. It is expectedthat the report will meet the information requirements of all concerned in this regard.As this is the first attempt to publish annual report by the department,any suggestions and recommendation to improve the report from various concernedparties will be highly appreciated and department is eager to incorporate thesuggestions and recommendations in coming year.Bir Bikram RayamajhiExecutive Director3

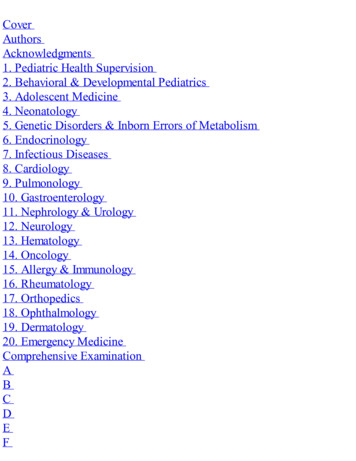

CHAPTER ONE1.Recent Development in the Banking System of Nepal:1.1.Current Scenario of Banking Sector:Financial system of Nepal is still in its primary stage of development.Small and fast growing financial sector comprises of commercial banks and otherfinancial institutions like development banks, finance companies, cooperatives etc. Sofar, development of financial services in the country is uneven. In some regions ofthe country, fast and advanced banking services are available while other regions arefully deprived of banking services.At present there are altogether 17 commercial banks in Nepal.Rastriya Banijya Bank is fully owned by HMG of Nepal while in case of Nepal BankLtd, HMG of Nepal is major shareholder. There are six joint venture banks incollaboration with the foreign investment partners and remaining seven banks arefully owned by Nepalese investors. As can be seen from the table given below mostof commercial banks were established during late eighties and early nineties due toliberalization of financial sector. Number of financial institutions is also growing.Non-banking financial system comprises of 55 finance companies, 21 developmentbanks (including rural development banks), 34 licensed cooperative institutions and15 non-government organizations. Keeping in view, such fast growth of financialinstitutions separate department for supervision of financial institutions wasestablished in 1998. At present there are separate departments for supervision ofcommercial banks and financial institutions namely bank supervision department andfinancial institution supervision department.Table no.1 List of Commercial Banks.S.N.1.2.3.4.5.6.Name of BankNepal Bank LimitedRastriya Banijya BankNabil Bank LimitedNepal Investment Bank LimitedStandard Chartered Bank Nepal LimitedHimalayan Bank Limited7.8.9.10.11.12.13.14.15.16.17.Nepal SBI Bank LtdNepal Bangladesh Bank LimitedEverest Bank LimitedBank of Kathmandu LimitedNepal Credit and Commerce Bank LimitedLumbini Bank LimitedNepal Industrial and Commercial Bank LimitedMachhapuchhre Bank LimitedKumari Bank LimitedLaxmi Bank ltd.Siddartha Bank Ltd.Established 9819982000200120022002From the perspective of resource mobilization, total depositscollected by the commercial banks during the review period were Rs.165, 479 millionwhile loans and advances disbursed during the same period was Rs.103125 million.The following table shows the tendency of growth of deposit and credit of previousfour years.4

Table no.2YearTrends Of Deposit And CreditsDepositGrowth (%)Credit(Rs. In Million)Growth 2013.102001-021654790.031031252.80.On capital market front, shares of commercial banks are regardedblue chip stocks. Most of commercial banks are able to make profit and distributedividends. Stock exchange bulletin also points out that active participation of bankingindustry stocks in capital markets have made them most influential factor in stockmarkets. Out of total market capitalization of Rs. 34,704 million of stocks listed in theNepal Stock Exchange Ltd., Rs.21227 million i.e., about 61.17% is contributed bybanking industry.To strengthen financial sector of the country, Nepal Rastra Bank hasstarted the financial reform process. Nepal Bank Limited and Rastriya Banijya Bank,the two senior banks of country were under heavy accumulated losses resultingcomplete erosion of its capital. Management of these banks is already given toforeign management team. New prudential regulations has been issued regardingcapital adequacy, loan loss classification and provisioning, single obligor limit,corporate governance etc.,1.2New Set Of Regulations: A Step Toward Financial Sector ReformLast year, Nepal Rastra Bank has issued new sets of regulations inline with international standards to address and minimize risks in financial business.These regulations cover capital adequacy, loan classification and provisioning, singleobligor limit, accounting policies and financial statements, liquidity risk, interest raterisk, foreign exchange risk, corporate governance, implementation of regulatorydirectives, regulation regarding investment in earnings assets etc.According to new capital adequacy regulation, the risk based capitalratio of the commercial banks is to be increased gradually from 8 percent (then) to 12percent up to 2004. Risk weightage on balance sheet assets and off-balance sheettransactions are also revised. Additional control measures have been taken tomeasure the capital fund, especially the tier 2 (supplementary) capital. Financialinstruments like redeemable preferred stock hybrid instruments, subordinated debtinstruments etc. are also included within the definition of capital fund.The new regulation also address upon the classification of loan andadvances and provisioning. Loans are classified as performing and non-performingloans. Regulation provides for “Overdue period of outstanding loans and advances’as minimum criteria for classification of loans and advances. Existing grades of loanshave been reduced from 6 to 4 Performing loans includes pass loans only, whilenon-performing loans includes substandard, doubtful and bad loans. Provisioningrequirements are changed as under:S.N.ClassificationProvisioning 100%5

Provision of 12.5 percent is to be made on all restructured andrescheduled loans. Repayment of principal and interest amount by overdrawingcurrent accounts resulting in debit balances or by exceeding limit of overdraft facilityis not allowed. Additional provision of 20 percent should be made for the loans, whichare disbursed against personal guarantees only.The new regulation on single obligor limit reduces the fund-basedlimit to a single customer (or group) from the then 35 percent of capital fund to 25percent of core capital and non-fund based limit from 50 percent of capital funds to 50percent of core capital. The regulation also addresses the cases when bank will beover exposed on the single industry or single sector of economy.The new regulation also aims to disclose true and fair picture of thebanks through their financial statements. Accounting policies and formats of thefinancial statements redefined and restructured to cope with best internationalpractices. New disclosure requirements have enhanced quality of commercial bank’sfinancial statements.The new regulations direct the commercial banks to report regularlyto the central bank regarding on maturity mismatches, interest rate risk and foreignexchange risk. The central bank regulation also sets limit on net open position offoreign currency to 30 percent of their core capital.The directives, regarding corporate governance, sets code of ethicsfor directors, chief executives, and employees of the banks. One of the provisions inthe regulation is to form the internal audit committee under the chairmanship of nonexecutive board member to enhance the internal control system. The shareholdershaving more than one percent shares, the directors and employees of the banks areprohibited from availing credit facilities.Nepal Rastra Bank has also issued regulations regarding the‘investment’ of the commercial banks. According to the new regulation, the banks arefree to invest in government and NRB securities. Investment in shares and bonds ofpublic companies in excess of 30% of bank’s core capital is not allowed. Similarly,investment in unlisted shares & bonds as well as securities of institutions licensed bythe NRB is not allowed.1.3Development related to banking legislation:Nepal Rastra Bank Act, 2002 was enacted with following objectives. To formulate necessary monetary and foreign exchange policy to maintainthe stability of price, to consolidate balance of payments for sustainabledevelopment of the economy; To promote stability, liquidity and growth of the banking and financial sector; To develop a secure, healthy and efficient system of payment, To regulate, inspect, supervise and monitor the banking and financial system;and To promote entire banking and financial system of Kingdom of Nepal and toenhance its public credibility.In the context of growing complexities of financial system,supervisory function of Nepal Rastra Bank has become more challenging. To thisend, enactment of Nepal Rastra bank has given more autonomy to Nepal RastraBank. As envisaged by the act, commercial banks should be under regularsupervision of NRB by performing on site as well as off-site examination.To strengthen supervisory function of NRB, Act has entrusted NRBBoard with more responsibility. Inspection reports of banks is to be submitted to The6

Governor within prescribed time limit and it has to be presented before Board. Boardis authorized to take appropriate action on the basis of such report. NRB is alsoauthorized to exchange cooperation with foreign supervisors on reciprocal basis tofacilitate supervision of banks and financial institutions under its jurisdiction.This Act regularized functioning of Credit Information Bureau (CIB)established under Nepal Banker’s association. CIB was brought under umbrella ofNepal Rastra Bank by aforesaid Act. Byelaws and regulatory framework of thisinstitution is under consideration.Act has empowered NRB to take enforcement actions against Banksand financial institutions in case of non-compliance. Enforcement actions asenvisaged by the Act are as under:1.4. Warning the bank; Obtaining written commitment from BOD for taking corrective action; Suspension or cancellation of services currently provided by bank; Restriction on distribution of dividends; Restriction on collection of deposits or lending activities of bank Partial or complete restriction on bank’s transactions; Suspension or revocation of bank’s license.Reforming Public Sector Banks:Nepal Bank Ltd and Rastriya Banijya Bank are pioneer banks of thecountry. These banks have largest branch network with more than 300 branchesacross the country. Service provided by these banks in rural areas of country iscommendable.Both these banks h

Nepal Stock Exchange Ltd., Rs.21227 million i.e., about 61.17% is contributed by banking industry. To strengthen financial sector of the country, Nepal Rastra Bank has started the financial reform process. Nepal Bank Limited and Rastriya Banijya Bank, the two senior banks of country were under heavy accumulated losses resulting