Transcription

Guide to Compliancewith State Audit RequirementsJanuary 2004(includes volume/issue 04)CPA-ZU 04NAICmaking progress . . . together

Copyright 1996, 2004 by National Association of Insurance CommissionersAll rights reserved.ISBN 0-89382-964-1National Association of Insurance CommissionersPublications Department816-783-8300Fax nted in the United States of AmericaNo part of this book may be reproduced, stored in a retrieval system, or transmitted in any form or by any means, electronicor mechanical, including photocopying, recording, or any storage or retrieval system, without written permission from theNAIC.Executive Headquarters2301 McGee Street, Suite 800Kansas City, MO 64108-2662816-842-3600Securities Valuation Office1411 Broadway, 9th FloorNew York, NY 10018-3402212-398-9000Federal & International RelationsHall of States Bldg.444 North Capitol NW, Suite 701Washington, DC 20001-1509202-624-7790

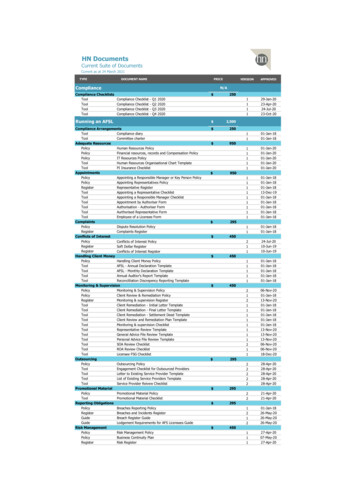

NAIC GUIDE TO COMPLIANCE WITH STATE AUDIT REQUIREMENTSTABLE OF CONTENTSForward. iCaveat.iiiSummary of Substantive Changes . vSection ISummary Chart of Audit Rules .1-1Section IISummary Outline of Audit Rules.2-1NAIC Rule Requiring Annual Audited Financial Statements.2-3Alabama Summary Outline .2-9Alaska Summary Outline .2-13Arizona Summary Outline.2-15Arkansas Summary Outline.2-17California Summary Outline .2-21Colorado Summary Outline.2-23Connecticut Summary Outline .2-27Delaware Summary Outline .2-31District of Columbia Summary Outline .2-35Florida Summary Outline.2-39Georgia Summary Outline.2-43Hawaii Summary Outline.2-47Idaho Summary Outline .2-49Illinois Summary Outline .2-53Indiana Summary Outline .2-57Iowa Summary Outline .2-61Kansas Summary Outline.2-65Kentucky Summary Outline .2-69Louisiana Summary Outline.2-73Maine Summary Outline .2-75Maryland Summary Outline .2-79Massachusetts Summary Outline .2-83Michigan Summary Outline .2-87Minnesota Summary Outline.2-91Mississippi Summary Outline .2-95Missouri Summary Outline .2-99Montana Summary Outline .2-103Nebraska Summary Outline .2-107Nevada Summary Outline .2-111New Hampshire Summary Outline .2-115New Jersey Summary Outline .2-117New Mexico Summary Outline.2-121New York Summary Outline.2-125North Carolina Summary Outline .2-129North Dakota Summary Outline.2-133Ohio Summary Outline .2-137Oklahoma Summary Outline.2-141

NAIC GUIDE TO COMPLIANCE WITH STATE AUDIT REQUIREMENTSOregon Summary Outline . 2-143Pennsylvania Summary Outline. 2-147Puerto Rico Summary Outline . 2-151Rhode Island Summary Outline. 2-155South Carolina Summary Outline. 2-159South Dakota Summary Outline . 2-161Tennessee Summary Outline . 2-165Texas Summary Outline . 2-169Utah Summary Outline . 2-173Vermont Summary Outline. 2-175Virgin Islands Summary Outline . 2-179Virginia Summary Outline. 2-183Washington Summary Outline. 2-187West Virginia Summary Outline . 2-191Wisconsin Summary Outline . 2-195Wyoming Summary Outline . 2-199Section IIIText of NAIC and State Audit Rules. 3-1Model Rule (Regulation) Requiring Annual Audited Financial Reports. 3-3Alabama Regulations . 3-11Alaska Statutes. 3-19Arizona Statutes . 3-21Arkansas Regulations. 3-23California Statutes. 3-31Colorado Regulations. 3-33Connecticut Regulations . 3-39Delaware Regulations . 3-47District Of Columbia Statutes. 3-55Florida Statutes . 3-63Georgia Regulations. 3-73Hawaii Statutes . 3-81Idaho Regulations . 3-85Illinois Regulations . 3-93Indiana Statutes. 3-101Iowa Regulations . 3-115Kansas Regulations. 3-123Kentucky Regulations. 3-131Louisiana Statutes . 3-139Maine Statutes. 3-141Maryland Insurance Laws and Regulations . 3-145Massachusetts Regulations . 3-153Michigan Statutes . 3-161Minnesota Statutes . 3-169Mississippi Statutes. 3-175Missouri Statutes. 3-181Montana Regulations . 3-191Nebraska Regulations . 3-199Nevada Statutes. 3-207New Hampshire Statutes. 3-217New Jersey Regulations. 3-219

NAIC GUIDE TO COMPLIANCE WITH STATE AUDIT REQUIREMENTSNew Mexico Regulations .3-227New York Statutes.3-235North Carolina Regulations.3-239North Dakota Administrative Code.3-249Ohio Statutes .3-257Oklahoma Statutes.3-267Oregon Regulations.3-269Pennsylvania Regulations.3-277Puerto Rico Regulations.3-289Rhode Island Insurance Regulation.3-297South Carolina Statutes .3-305South Dakota Statutes .3-307Tennessee Statutes.3-313Texas Statutes.3-321Utah Statutes .3-335Vermont Statutes .3-337Virgin Islands Insurance Statutes .3-341Virginia Administrative Code .3-345Washington Regulations.3-353West Virginia Insurance Statutes .3-361Wisconsin Regulations .3-369Wyoming Insurance Statutes.3-377Appendix A . A-1Subsequent Clarification of Statement of Position 95–4 Letters for State InsuranceRegulators to Comply with NAIC Model Audit Rule. A-3AICPA Statement of Position 95-4, (Letters to State Insurance Regulators to Complywith the NAIC Model Audit Rule). A-7Introduction . A-11Scope . A-11Conclusions—Form and Content . A-11Awareness . A-11Change in Auditor . A-12Qualifications . A-13Notification of Adverse Financial Condition . A-15Report on Internal Controls . A-16Effective Date. A-16Appendix BNAIC Annual Statement Instructions “Annual Audited Financial Reports” . B-1Annual Audited Financial Reports Annual Statement Instructions —Property & Casualty . B-3Annual Audited Financial Reports Annual Statement Instructions —Life, Accident And Health . B-11

NAIC GUIDE TO COMPLIANCE WITH STATE AUDIT REQUIREMENTS 20042003 National Association of Insurance Commissioners

NAIC GUIDE TO COMPLIANCE WITH STATE AUDIT REQUIREMENTSFORWARDThe NAIC staff has prepared this guide to assist insurers, certified public accountants, and other interested parties incomplying with the various state filing requirements for annual audited financial reports. These filing requirementsgenerally provide for, among other things, specific information concerning the filing and content of audited financialreports and other related letters and reports with the state insurance department. They also dictate specific guidelinesfor partner rotation in the accounting firm and retention and availability of workpapers.To supplement the information contained herein, a copy of the AICPA’s Statement of Position 95-4, “Letters to StateInsurance Regulators to Comply with the NAIC Model Audit Rule,” has been included in appendix A. This document,which provides illustrative guidance concerning the form and content of the letters and reports that may be required tobe filed with certain state insurance departments, includes examples for the Letter of Awareness, the Letter of Changein Auditor, the Letter of Qualifications, the Letter of Notification of Adverse Financial Condition, and the Report onInternal Controls.As of Dec. 31, 1995, all states, the District of Columbia, Puerto Rico, and the U.S. Virgin Islands had annualindependent audit requirements. In most of these states, the individual state has specific annual audit regulations thatgovern report and letter filing dates, report and letter content requirements, etc. While many states have adopted thelanguage of the NAIC Model Audit Rule, certain states have variances in the requirements that must be observed. Inaddition, some states require insurers to file annual audited financial reports in accordance with NAIC AnnualStatement Instructions for “Audited Financial Reports,” rather than through specific law or regulation. This section ofthe instructions mirrors much of the NAIC Model Audit Rule. However, the Annual Statement Instructions differfrom the NAIC Model Audit Rule in the following respects: The NAIC Annual Statement Instructions do not address possible exemptions for foreign or alieninsurers filing audited financial statements in another state. The NAIC Annual Statement Instructions exemption relating to an insurer’s size provides anexemption for “Insurers having direct premiums written of less than 1,000,000 in any calendaryear.” while the NAIC Model Audit Rule provides an exemption for “Insurers having directpremiums written in this state of less than 1,000,000 in any calendar year.” The NAIC Annual Statement Instructions for property — casualty insurers make specific reference tothe requirement (refer to AICPA SOP 92-8) that CPAs subject the current Schedule P, Part 1(excluding those amounts related to bulk and IBNR reserves and claim counts) to the auditingprocedures applied in the audit of the current statutory financial statements to determine whetherSchedule P, Part 1 is fairly stated in all material respects in relation to the basic statutory financialstatements taken as a whole. The NAIC Annual Statement Instructions for life, accident, and health insurers state that the insurershall require the independent CPA to subject the information included in the Supplemental Scheduleof Assets and Liabilities (see supplemental schedule provided in appendix B) to the auditingprocedures applied in the audit of the current statutory financial statements to determine whether suchinformation is fairly stated in all material respects in relation to the basic statutory financialstatements taken as a whole and agrees to the insurer’s annual statement filed with the state insurancedepartments and the NAIC.The supplemental schedule should be included with the audited annual statutory financial statements.The auditor should issue a report on the supplemental information as to whether the information isfairly stated in relation to the financial statements taken as a whole. 2003 National Association of Insurance 20042003CommissionersNational 2003 NationalAssociationAssociationof Insuranceof InsuranceCommissionersCommissionersi

NAIC GUIDE TO COMPLIANCE WITH STATE AUDIT REQUIREMENTSAs all licensed insurers are required to follow the NAIC’s Annual Statement Instructions, there will be instanceswhere the instructions’ guidance conflicts with the state’s statute or regulation. In these instances, the acceptedpractice is to defer to the state’s insurance statutes and regulations.This publication is not designed to address the annual audit requirements for health maintenance organizations,preferred provider organizations, risk retention groups, and other entities; however, the summaries and regulations ofeach state included herein may specify the applicability to such entities.This guide is divided into various sections as follows:Section I — This section provides a summary chart of significant annual audit requirements for each state incomparison to the requirements of the NAIC Model Audit Rule. However, this chart is not all-inclusive, and usersshould also refer to Sections II and III of this publication for additional comparisons and state specific exceptions tothe NAIC Model Audit Rule. In addition, the due dates referred to in the chart relate only to the due dates of theletters and reports and do not address letter/report content, which may or may not differ from the NAIC Model AuditRule.Section II — This section provides, in summary, information for all states concerning the filing and notification duedates, as well as a comparison of major provisions between the state’s audit rule and the NAIC Model Audit Rule.Within the individual state outlines, filing and notification due dates are provided for each state, while additionalinformation concerning letter/report content, partner rotation, workpaper retention, etc., is compared to the NAICModel Audit Rule. In those situations where a section within the individual state’s statute or regulation does not differfrom the NAIC Model Audit Rule, this is so noted on the state summary. Alternatively, if differences have beennoted, the applicable sections of the state’s regulation have been included in the summary. For those states that makespecific reference to the NAIC Annual Statement Instructions and do not have an audit rule per se, the relevantsections of the state audit regulation have been included, and users should refer to appendix B for a copy of the NAICAnnual Statement Instructions relating to Annual Audited Financial Reports.Section III — This section includes the text of the NAIC Model Audit Rule, as well as the text of each of the variousstates’ statutes and regulations regarding the audits of insurance company financial statements.Appendix A — This appendix contains the AICPA’s Statement of Position 95-4, “Letters for State InsuranceRegulators to Comply with the NAIC Model Audit Rule,” which includes an example of the Letter of Awareness, theLetter of Change in Auditor, the Letter of Qualifications, the Letter of Notification of Adverse Financial Condition,and the Report on Internal Controls.Appendix B — This appendix contains the Annual Audited Financial Reports instructions, per the NAIC AnnualStatement Instructions. Instructions for both property — casualty insurers and life, accident, and health insurers havebeen provided.Footnotes:Throughout each of these sections, the term CPA shall refer to independent certified public accountant or public accounting firm.ii 20042003 National 2003 NationalAssociationAssociationof Insurance ssociation of Insurance Commissioners

NAIC GUIDE TO COMPLIANCE WITH STATE AUDIT REQUIREMENTSCAVEATThe summaries contained herein are not intended to be all-inclusive and should not be relied on solely in determiningstate-specific requirements. Where a question exists with respect to any requirement, the state’s statute or regulationshould be reviewed and, where necessary, the state insurance department should be contacted. Every effort has beenmade to ensure the contents of this publication is complete and factually correct, but the NAIC makes no warranty asto the completeness or correctness of the information provided. All responsibility for compliance with individual stateinsurance codes rests solely with the insurance company and its independent auditor. Any errors or omissions noted inthe publication should be forwarded to NAIC Executive Headquarters, 2301 McGee Street, Suite 800, Kansas City,Missouri 64108-2662, attention Financial Examination Manager. 2003 National Association of Insurance 20042003CommissionersNational 2003 NationalAssociationAssociationof Insuranceof InsuranceCommissionersCommissionersiii

NAIC GUIDE TO COMPLIANCE WITH STATE AUDIT REQUIREMENTSiv 20042003 National 2003 NationalAssociationAssociationof Insurance ssociation of Insurance Commissioners

NAIC GUIDE TO COMPLIANCE WITH STATE AUDIT REQUIREMENTSSummary of Substantive ChangesThe following represents a summary of the states that had substantive changes in their audit requirements in 2003.The summary depicts those states that had substantial revisions, additions, or deletions to the previous guidance.Therefore, grammatical, formatting, or changes that do not alter the intent of the existing guidance are not included inthis summary. Connecticut — Sec. 38a-54-2 was amended to include definitions for an independent certified public accountantand indemnification. Sec. 38a-54-4 was amended to reword paragraph (B). Sec. 38a-54-6 was amended to addparagraph (c). Florida — Florida Statute was amended to change its department name to the Office of Insurance Regulation. Hawaii — Title 24.431:3-301-302 was amended to include that Annual Filings can be filed on or before March 1. Idaho — IDAPA 18.01.62 § 004 was amended to include the definition for Indemnification. Kansas — The Summary Chart of Audit Rules was amended to reword the Awareness Letter Deadline to indicatethat a CPA need only file once prior

NAIC GUIDE TO COMPLIANCE WITH STATE AUDIT REQUIREMENTS As all licensed insurers are required to follow the NAIC’s Annual Statement Instructions, there will be instances where the instructions’ g