Transcription

Financial Independence:Living a Debt Free LifestyleLCDR Shondelle Wilson-Frederick, PhDBlack Commissioned Officers Advisory Group (BCOAG)November 16, 20211

Disclaimers The information in this presentation are my own personal viewsand do not reflect the views of First Baptist Church ofGlenarden (FBCG), Prosperity Partners Ministry (PPM), U.S.Public Health Service Commissioned Corps, or the federalgovernment. I am not a financial expert. If you seek professional advise onfinances and investing, please contact a certified financialprofessional.2

My Debt Free JourneyJune 2015Jan2014Followeda budget,usedCASHonly, cutexpensesDebt Free3

What is Net Worth?ASSETSLIABILITIES4

Median Household Assets by Race and Ethnicity,U.S. Census Bureau, SIPP 2019Total Assets at Financial Institutions (Median)Total Retirement Accounts (Median) 80,250 60,900 60,000 24,000 20,000 6,000Total 12,500 1,500Black alone 2,700Hispanic (any race)Asian alone 8,000White alone, notHispanic5Source: U.S. Census Bureau, Survey of Income and Program Participation, Survey Year 2019, Public Use Data; Internet Release Date: 9/16/2021

Median Net Worth for Households by Race andEthnicity, U.S. Census Bureau, SIPP 2019Median Net WorthMedian Net Worth (Excluding Equity in Own Home) 153,400 166,000 97,680 62,470 31,900 29,990 8,178Total 63,530 2,753Black alone 8,830Hispanic (any race)Asian aloneWhite alone, notHispanic6Source: U.S. Census Bureau, Survey of Income and Program Participation, Survey Year 2019, Public Use Data; Internet Release Date: 9/16/2021

Household Debt Climbs to 14.96 hhdc Assessed 10.13.217

Non-Housing Debt hdc Assessed 10.13.218

How Did I Get Here?9

Where Do I y-steps10

Setting SMART Goals What are your short( 2y), mid-term (3-6y),and long-term personal,professional and financialgoals ( 7y)?11

Budget: Making a Plan for Your Money NerdWallet article: Free Budget Spreadsheets and Budget Templates Federal Trade Commission https://www.consumer.gov/ et Mint.com -template/ Offer various different budget templates (e.g. household, daycare, etc.) PPM Budget Template See information listed under the March 6th class r Dave Ramsey’ Every Dollar er-easierway-to-budget12

The Power of Small Wins is Motivating Dave Ramsey call’s this process the “Debt Snowball”1 List debt smallest to highest, regardless of interest rate Apply the extra money from cutting expenses or additionalincome streams to the 1st debt After paying off the first debt, apply that payment plus extracash to the second debt Keep repeating process until all consumer debt is gone Harvard Business Review2 article “focusing on paying down the account with the smallest balance tends tohave the most powerful effect on people’s sense of progress – and thereforetheir motivation to continue paying down their t-card-debt13

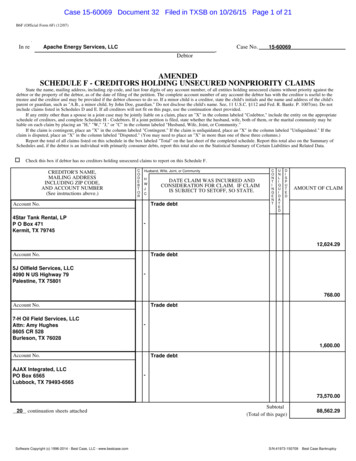

Debt Snowball/Debt Dash ExampleCol 1Col 2Col 3Col 4Col 5Col 6Col 7Col tra DebtPaymentTotal PaymentmadePayoff(Mon)TotalMonthsAMEX Blue 3,200.0015% 100.00 1,500.00 1,600.002.02.0TSP Loan 5,000.008% 225.00 1,600.00 1,825.002.74.7Car Loan 10,000.004% 450.00 1,825.00 2,275.004.49.1Sallie Mae 65,000.0012% 900.00 2,275.00 3,175.0020.529.6Total 83,200.00 1,675.00PPM Debt Dash Form es/prosperity/images/downloads/Debt Dash Plan Template.doc14

Public Student Loan Forgiveness (PSLF) ProgramNovember 2020 – April 2021 PSLF Form Report9 Total Number of PSLF Forms Submitted10 Forms in Active Processing11 Incomplete (Missing Information), Processed Forms12 Complete, Processed Forms35 Count of forms that meet requirement for PSLF371) Government382) Non-Profit - Section 501(c)(3) or Other45 Count of forms that did not yet meet requirements for PSLF391,333145,96576,666168,7023,4582%eligiblefor PSLF59%41%164,73946 Reasons that forms did not meet requirements for PSLF47No open Direct Loans in repayment for at least 120 months at the time of submission82%48Has open Direct Loans in repayment for at least 120 months, but has less than 120 monthsof qualifying employment at time of submission14%49Has open Direct Loans in repayment for at least 120 months, has at least 120 months ofqualifying employment at time of submission, but has less than 120 PSLF QualifyingPayments at time of submission98%NOTeligiblefor PSLF4%April 2021 PSLF Data - rgiveness/pslf-dataGAO Study on PSLF DOD and Its Personnel Could Benefit from Additional Program Information - f15

Public Service Loan Forgiveness (PSLF): LimitedWaiver Opportunity, effective Oct. 6, 2021-Oct. 31,2022 U.S. Department of Education announced that prior ineligible payments willcount as a qualifying payment Applies to student loan borrowers with Direct Loans, those who have alreadyconsolidated into the Direct Loan Program, and those who consolidate into theDirect Loan Program by Oct. 31, 2022 By Oct. 31, 2022, borrowers must submit: Consolidation application PSLF form—the single application used for a review of employment certification, paymentcounts, and processing of forgiveness Visit the PSLF Help Tool, at StudentAid.gov/PSLF Must have qualifying employment Parent PLUS loans are not eligible under the limited PSLF waiver To learn more, visit imitedwaiver16

Stats on PSLF Limited Waiver Opportunity1 550,000borrowersPreviously consolidated their loans & may see progresstoward PSLF grow automatically, with the averageborrower receiving 23 additional payments 1.74 billion 2.82 billionIncluding 22,000 borrowers who will beimmediately eligible to have their federal studentloans discharged without further action on their partAnother 27,000 borrowers could potentially qualify forforgiveness if they certify additional periods program-overhaul17

Saving for When Life Happens and EmergenciesEmergency Fund: 3-6 months of household expenses forjob loss or major emergency (e.g. leaking roof, replacingHVAC, etc.)Life Happens Fund: non-emergency householdexpenses (e.g. car repairs)Additional Resources Consumer Finance Protection Bureau (CFPB) CFPB Money Management Tools for service members 360degrees Financial Literacy, American Institutes of CPAs18

What is the Envelope Method?Complete your monthly budget and identify categories thatneed a cash envelope (e.g. gas, groceries, entertainment,restaurants, etc)Label each envelope with the categories from your budgetWithdraw cash for expenses and place the cash in separate envelopes for each categoryMoney in each envelope needs to last for entire monthWhen the envelope is empty you can’t spend anymore moneyAdditional information available from: (1) udgeting/(2) -system-explained19

Why?What is YourFor DesiringFinancial Freedom Only you can answer this question Are you tired of getting paid at the first of the month, andwithin 2 weeks you’re relying on credit cards? Do you use your credit cards to cover vehicle repairs or otheremergencies, but cannot pay off the balance each month? Perhaps these aren’t your challenges, but would you like tosave more money to accomplish other personal goals.20

Estate Planning: Creating a FREE Will Military One Source, Estate Planning legal/estate-planning/estateplanning/ Ft. Meade, Staff Judge Advocate on/staff-judge-advocate Legal assistance division that provides free services Advice and assistance on legal separations and other family law mattersWills and estate planningLandlord tenant problems, debt disputes, contracts, and other issuesNotary services, Powers-of-Attorney documentsA wide range of informational materials Walter Reed, Office of General Counsel General-Counsel21

Resources Allotment Form from PHS CompensationBranch (3/2021) Use the Direct Deposit Sign Up - Standard Form1199A (EG) Specify the allotment amount on Section G for eachallotment Submit completed form to CCHQ Financial Branchvia eCMCS Thrift Savings Plan Start, stop, or change the amount of your contributions (including contributions towardthe catch-up limit if you’re turning 50 or older). Fund Information Trainings are offered at least twice each month22

Resources Prosperity Partners Ministry r Michelle Singletary’s, WaPo Personal finance columnist, Color of Money gletary/ Dave Ramsey, personal finance adviser https://www.daveramsey.com/ Servicemember Civil Relief Act (SCRA) ers-veterans-and-militaryfamily-members rce/servicemembers-civil-relief-act/23

Resources TSP/401K Millionaires /401k-millionaires-record-high/ -report/2021/01/secrets-of-the-tsps-2million-man/ crop-of-tsp-millionaires/ Books: 21 Day Financial Fast: Your Path to Financial Peace and Freedom, Michelle Singletary What to Do with Your Money When Crisis Hits: A Survival Guide, Michelle Singletary (new) The Total Money Makeover: A Proven Plan for Financial Fitness, Dave Ramsey (FREE viaHHS LMS) The Millionaire Next Door, Thomas Stanley, PhD & William Danko, PhD Everyday Millionaires, Chris Hogan Dollars and Sense: How We Misthink Money and How to Spend Smarter, Dan Ariely & JeffKreisler24

Contact InformationLCDR Shondelle .gov25

26

What to Do with Your Money When Crisis Hits: A Survival Guide, Michelle Singletary (new) The Total Money Makeover: A Proven Plan for Financial Fitness, Dave Ramsey (FREE via HHS LMS) The Millionaire Next Door, Thomas Stanley, PhD & William Danko, PhD Everyday Millionaires, Chris Hogan Dollars