Transcription

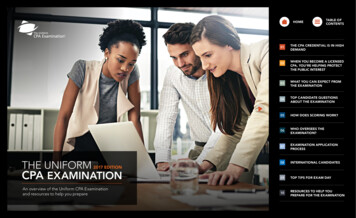

HOME0102TIONTHE UNIFORMCPA EXAMINATIONTABLE OFCONTENTSTHE CPA CREDENTIAL IS IN HIGHDEMANDWHEN YOU BECOME A LICENSEDCPA, YOU’RE HELPING PROTECTTHE PUBLIC INTEREST03WHAT YOU CAN EXPECT FROMTHE EXAMINATION04TOP CANDIDATE QUESTIONSABOUT THE EXAMINATION05HOW DOES SCORING WORK?06WHO OVERSEES THEEXAMINATION?07EXAMINATION APPLICATIONPROCESS08INTERNATIONAL CANDIDATES09TOP TIPS FOR EXAM DAY10RESOURCES TO HELP YOUPREPARE FOR THE EXAMINATION2017 EDIAn overview of the Uniform CPA Examinationand resources to help you prepare

HOME0102The Uniform CPA Examination (“Examination”) protects the public interest by helping toensure that only qualified individuals become licensed as U.S. Certified Public Accountants(CPAs). The CPA credential is the only licensing qualification in accounting and auditing inthe United States.THE CPA CREDENTIAL IS IN HIGHDEMANDWHEN YOU BECOME A LICENSEDCPA, YOU’RE HELPING PROTECTTHE PUBLIC INTEREST03WHAT YOU CAN EXPECT FROMTHE EXAMINATION04TOP CANDIDATE QUESTIONSABOUT THE EXAMINATION05HOW DOES SCORING WORK?06WHO OVERSEES THEEXAMINATION?07EXAMINATION APPLICATIONPROCESS08INTERNATIONAL CANDIDATES09TOP TIPS FOR EXAM DAY10RESOURCES TO HELP YOUPREPARE FOR THE EXAMINATIONThis booklet provides individuals interested in becoming a CPA with information aboutthe profession, testing requirements and details, and candidate resources.TABLE OFCONTENTS

HOMETABLE OFCONTENTS010201THE CPA CREDENTIAL IS IN HIGH DEMAND. 202WHEN YOU BECOME A LICENSED CPA, YOU’RE HELPING PROTECT THE PUBLIC INTEREST. 303WHAT YOU CAN EXPECT FROM THE EXAMINATION. . . 404TOP CANDIDATE QUESTIONS ABOUT THE EXAMINATION. . 705HOW DOES SCORING WORK? . 906WHO OVERSEES THE EXAMINATION?. 1007EXAMINATION APPLICATION PROCESS. 1108INTERNATIONAL CANDIDATES. 1209TOP TIPS FOR EXAM DAY. 1310RESOURCES TO HELP YOU PREPARE FOR THE EXAMINATION. . 14TABLE OFCONTENTSTHE CPA CREDENTIAL IS IN HIGHDEMANDWHEN YOU BECOME A LICENSEDCPA, YOU’RE HELPING PROTECTTHE PUBLIC INTEREST03WHAT YOU CAN EXPECT FROMTHE EXAMINATION04TOP CANDIDATE QUESTIONSABOUT THE EXAMINATION05HOW DOES SCORING WORK?06WHO OVERSEES THEEXAMINATION?07EXAMINATION APPLICATIONPROCESS08INTERNATIONAL CANDIDATES09TOP TIPS FOR EXAM DAY10RESOURCES TO HELP YOUPREPARE FOR THE EXAMINATION

HOMETHE CPA CREDENTIALTABLE OFCONTENTS01 IS IN HIGH DEMAND01THE CPA CREDENTIAL IS IN HIGHDEMANDTOP 5 REASONS TO PURSUE THE CPA02in demandfor accountingand financeprofessionalsis projectedthrough 2024.Source: U.S. Bureau of Labor Statistics,December 2015FlexibilityPrestigeand respectCPA itiesNon-credentialedEarningpotentialCPAs earn an average of 10–15% more thantheir counterparts in the accounting field.WHEN YOU BECOME A LICENSEDCPA, YOU’RE HELPING PROTECTTHE PUBLIC INTEREST03WHAT YOU CAN EXPECT FROMTHE EXAMINATION04TOP CANDIDATE QUESTIONSABOUT THE EXAMINATION05HOW DOES SCORING WORK?06WHO OVERSEES THEEXAMINATION?07EXAMINATION APPLICATIONPROCESS08INTERNATIONAL CANDIDATES09TOP TIPS FOR EXAM DAY10RESOURCES TO HELP YOUPREPARE FOR THE EXAMINATIONSource: Robert Half 2017 Salary Guide2

HOMEWHEN YOU BECOME A LICENSED CPA,TABLE OFCONTENTS02 YOU’RE HELPING PROTECT THE PUBLIC INTEREST01If you want to become a CPA — the only licensing qualification for the accountingand auditing profession in the United States — you must pass the Uniform CPAExamination.02The purpose of the Examination is to provide reasonable assurance to the 55 U.S.accountancy jurisdictions (50 states plus the District of Columbia, Puerto Rico, the U.S.Virgin Islands, Guam and the Commonwealth of Northern Mariana Islands*), that thosewho pass possess the minimum level of technical knowledge and skills necessary forinitial licensure. The public interest is protected when only qualified individuals arelicensed as CPAs.The 4 E’s to CPA licensureOf the four requirements,only the Examination isuniform and accepted forCPA licensure by alljurisdictions. Experience,Education and Ethicsrequirements vary byjurisdiction.ExperienceEducation CPAExaminationTHE CPA CREDENTIAL IS IN HIGHDEMANDWHEN YOU BECOME A LICENSEDCPA, YOU’RE HELPING PROTECTTHE PUBLIC INTEREST03WHAT YOU CAN EXPECT FROMTHE EXAMINATION04TOP CANDIDATE QUESTIONSABOUT THE EXAMINATION05HOW DOES SCORING WORK?06WHO OVERSEES THEEXAMINATION?07EXAMINATION APPLICATIONPROCESS08INTERNATIONAL CANDIDATES09TOP TIPS FOR EXAM DAY10RESOURCES TO HELP YOUPREPARE FOR THE EXAMINATIONEthics***The Commonwealth of Northern Mariana Islands does not currently accept applicants for the Examination, but does accept scores from other jurisdictions for initial licensure.**Certain states require a separate ethics assessment in addition to what is tested on the CPA Examination.3

HOMEWHAT YOU CAN EXPECTTABLE OFCONTENTS03 FROM THE EXAMINATION01Working in partnership with key stakeholders directlyconnected to the profession, the AICPA continually assessesthe required knowledge and skills a newly licensed CPA mustpossess. This ongoing assessment and collection of valuableinsight is reflected in the Examination’s content, ensuring itremains highly relevant to and aligned with professional practice.02As the profession evolves, so too does the Examination. Tomaintain the Examination’s relevance, reliability and defensibility,the AICPA initiated a rigorous, multi-year research initiative withthe goal of driving the Examination’s evolution. This initiativeincluded the participation of countless stakeholders connected tothe profession who contributed their essential insight andfeedback. The result of this in-depth research is the foundation ofwhat is the current Examination.*The following page provides an overview of the Examinationstructure.Visit aicpa.org/cpaexam for more information and resourcesabout the CPA Examination.THE CPA CREDENTIAL IS IN HIGHDEMANDWHEN YOU BECOME A LICENSEDCPA, YOU’RE HELPING PROTECTTHE PUBLIC INTEREST03WHAT YOU CAN EXPECT FROMTHE EXAMINATION04TOP CANDIDATE QUESTIONSABOUT THE EXAMINATION05HOW DOES SCORING WORK?06WHO OVERSEES THEEXAMINATION?07EXAMINATION APPLICATIONPROCESS08INTERNATIONAL CANDIDATES09TOP TIPS FOR EXAM DAY10RESOURCES TO HELP YOUPREPARE FOR THE EXAMINATION* Candidates will maintain credit for sections passed prior to launch of the current Examination.4

HOMEAN OVERVIEW OF THE CPA EXAMINATION01FOUR SECTIONS*ITEM TYPESAuditing and Attestation (AUD)Business Environment and Concepts (BEC)Financial Accounting and Reporting (FAR)Regulation (REG)Multiple-Choice Questions (MCQs)The multiple-choice portions of theexamination are administered in thefirst two testlets of each section.*Each section is divided into small segments calledtestlets. There are five testlets per section.Task-Based Simulations (TBS)Task-based simulations are case studiesthat allow candidates to demonstratetheir knowledge and skills by generatingresponses to questions rather than simplyselecting an answer. They typicallyrequire candidates to use spreadsheetsand/or research authoritative literatureprovided in the Examination.TESTING TIMEAUD: 4 hoursBEC: 4 hoursFAR: 4 hours TOTAL:REG: 4 hours 16 hours02Written Communication TasksWritten communication tasks are foundonly in the BEC section. Candidatesmust read a scenario and then write anappropriate document relating to thescenario. The instructions state whatform the document should take (suchas a memo or letter) and its focus. Thecandidate’s response should providethe correct information in writing thatis clear, complete and professional.Authoritative LiteratureThroughout each section, candidates haveaccess to authoritative literature, whichmay be used in completing simulations.Candidates are strongly encouraged toreview the Examination Blueprints, whichcover Examination content, skills and morethan 600 representative task statements.AUDTestlet 136 MCQTestlet 236 MCQTestlet 32 TBSBECTestlet 131 MCQTestlet 231 MCQTestlet 32 TBSFARTestlet 133 MCQTestlet 233 MCQTestlet 32 TBSREGTestlet 138 MCQTestlet 238 MCQTestlet 32 TBSBREAKS15-minute standardized break (where theclock pauses and does not count againsttesting time). Optional breaks still permitted.STANDARDIZED BREAKEXAMINATION CONTENTTestlet 43 TBSTestlet 53 TBSTestlet 42 TBSTestlet 53 WCTTestlet 43 TBSTestlet 53 TBSTestlet 43 TBSTestlet 53 TBSTABLE OFCONTENTSTHE CPA CREDENTIAL IS IN HIGHDEMANDWHEN YOU BECOME A LICENSEDCPA, YOU’RE HELPING PROTECTTHE PUBLIC INTEREST03WHAT YOU CAN EXPECT FROMTHE EXAMINATION04TOP CANDIDATE QUESTIONSABOUT THE EXAMINATION05HOW DOES SCORING WORK?06WHO OVERSEES THEEXAMINATION?07EXAMINATION APPLICATIONPROCESS08INTERNATIONAL CANDIDATES09TOP TIPS FOR EXAM DAY10RESOURCES TO HELP YOUPREPARE FOR THE EXAMINATIONOPTIONAL BREAKS5

HOMEUniform CPA ExaminationExamination BlueprintsThe Blueprints serve as the primary preparation resourcefor any candidate who wants to know what content appearson the Examination, content score weighting, and the skilllevel at which content will be assessed. The Blueprints alsoprovide more than 600 tasks representative of what acandidate may be asked to do on the examination, making itan essential study tool.To the right is an example of a few pages from the Blueprintsthat cover the AUD section of the Examination.THE CPA CREDENTIAL IS IN HIGHDEMANDApproved by the Board of ExaminersAmerican Institute of CPAsFebruary 11, 2016Effective Date April 1, 201702SECTION INTRODUCTIONAuditing and AttestationThe Auditing and Attestation (AUD) section of the Uniform CPA Examination (theExam) tests the knowledge and skills that a newly licensed CPA must demonstratewhen performing:Audits of issuer and nonissuer entities (including governmental entities, not-forprofit entities, employee benefit plans and entities receiving federal grants)Attestation engagements for issuer and nonissuer entities (includingexaminations, reviews and agreed-upon procedures engagements) 2016 American Institute of CPAs. All rights reserved.Preparation, compilation and review engagements for nonissuer entities andreviews of interim financial information for issuer entities.Newly licensed CPAs are also required to demonstrate knowledge and skills relatedto professional responsibilities, including ethics and independence .The engagements tested under the AUD section of the Exam are performed inaccordance with professional standards and/or regulations promulgated by variousgoverning bodies, including the American Institute of CPAs (AICPA), Public CompanyAccounting Oversight Board (PCAOB), U.S. Government Accountability Office (GAO),Office of Management and Budget (OMB) and U.S. Department of Labor (DOL). Alisting of standards promulgated by these bodies, and other reference materialsrelevant to the AUD section of the Exam, are included under References at theconclusion of this Introduction .Review Engagement – as a presumptively mandatory procedure required underStatement for Accounting and Review Services No . 21 (AR-C section 90), or during anThe AUD section blueprint is organized by content AREA, content GROUP andcontent TOPIC . Each topic includes one or more representative TASKS that a newlylicensed CPA may be expected to complete when performing audits, attestationengagements or accounting and review services engagements .AUDITING AND ATTESTATION (AUD)Summary BlueprintWHEN YOU BECOME A LICENSEDCPA, YOU’RE HELPING PROTECTTHE PUBLIC INTERESTAudit Engagement – during planning, as a substantive procedure, or near the endof the engagement to assist with forming an overall conclusion on the financialstatements .The tasks in the blueprint are representative . They are not intended to be (nor shouldthey be viewed as) an all-inclusive list of tasks that may be tested in the AUD sectionof the Exam . Additionally, it should be noted that the number of tasks associated witha particular content group or topic is not indicative of the extent such content group,topic or related skill level will be assessed on the Exam .Content Allocation03WHAT YOU CAN EXPECT FROMTHE EXAMINATION04TOP CANDIDATE QUESTIONSABOUT THE EXAMINATION05HOW DOES SCORING WORK?06WHO OVERSEES THEEXAMINATION?07EXAMINATION APPLICATIONPROCESS08INTERNATIONAL CANDIDATES09TOP TIPS FOR EXAM DAY10RESOURCES TO HELP YOUPREPARE FOR THE EXAMINATIONThe following table summarizes the content areas and the allocation of content testedin the AUD section of the Exam:CONTENT AREAALLOCATIONArea IEthics, Professional Responsibilities and GeneralPrinciples15–25%Area IIAssessing Risk and Developing a PlannedResponse20–30%Area IIIPerforming Further Procedures and ObtainingEvidence30–40%Area IVForming Conclusions and Reporting15–25%Content Organization and TasksTasks included in the AUD section blueprint may, and typically do, relate to multipleengagement types . For example, tasks related to Analytical Procedures (includedunder Area III, Group C, Topic 1) may be performed during a:Content Area AllocationAccess the Blueprints at aicpa.org/examblueprints.01BLUEPRINTSTABLE OFCONTENTSWeightI . Ethics, Professional Responsibilities and General Principles15–25% 2016 American Institute of CPAs. All rights reserved.II . Assessing Risk and Developing a Planned Response20–30%III . Performing Further Procedures and Obtaining Evidence30–40%IV . Forming Conclusions and Reporting15–25%Skill AllocationUniform CPA Examination Section Blueprints: Auditing and Attestation

licensed CPA may be expected to complete when performing audits, attestation engagements or accounting and review services engagements. Tasks included in the AUD section blueprint may, and typically do, relate to multiple engagement types. For example, tasks