Transcription

November 2018DATA ANALYTICSAn Information Resource for IFAC Members

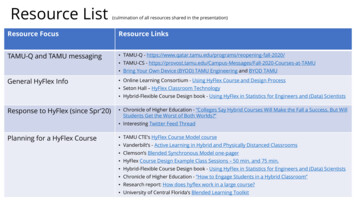

What is Data Analytics?Data analytics is a broad term that encompassesmany diverse techniques and processes ofdrawing insights from historical data over time.Today the term is most often used to describe theanalysis of large volumes of data and/or highvelocity data, which presents unique computationaland data-handling challenges.2

Why is Data Analytics Important?Advanced Data AnalyticsCost reductionFaster, betterdecision makingRevenuegrowthNew productsand servicesRisk andcontrolsMarginimprovement3

4Types ofData AnalyticsDescriptive, Diagnostic, Predictive, Prescriptive4

Descriptive AnalyticsCategorization and classification of informationWhat ishappening?Revenue and expenses, inventory counts, sales taxVerification of large amounts of data5

Diagnost ic AnalyticsMonitor changes in dataWhy did ithappen?Analyze variances, calculate historical performanceBuild reasonable forecasts6

Predict ive AnalyticsAssess likelihood of future outcomesWhat isgoing tohappen?Identify patterns in forecastsAct as trusted advisor to business leaders7

Prescript ive AnalyticsMake recommendations for future growthWhat shouldhappen?Raise concerns for potential poor choicesValuable insight has significant impact on business8

Data Analytics and FinancialReporting/Audit

Data Analytics in Financial Reporting Together with automation, analytics enables better riskunderstanding across thousands of data points in P&L reportingData analytics can improve the co-operation with externalauditors to detect patterns and trends, and identify processimprovements that can increase efficiency and enhance auditqualityUncover valuable insights within the financials, and bettermanage risk across the organizationThe automation of large parts of audit plans using analytics canalso make the internal audit function more efficient and effective10

Data Analytics and AuditBig data and analyticshelp to deliver a morerelevant audit.Sample Based ModelContinuous MonitoringPreciseRecommendations11

Data Analytics and Business

Data Analytics in BusinessUtilize insights to transform business modelsBusinesses use real-time data to empowerdecision makingGain deeper insights into client behaviorsand potential opportunities and risks13

Business Use Cases

In an effort to help their finance teamshift from reporting the business tobecoming effective partners in runningthe business, Adobe has beeninvesting in the workflows needed tointegrate disparate data sources anddeliver actionable businessintelligence.Here are a few key lessons they'velearned.

1. Turn digital data into insight and draw conclusionsthat help drive the business. Traditional metrics to track a promotion targeting first-time buyersmight be the number of new customers and resulting revenue.But as a result of your shift to digital — you now have access todata that you haven't previously tracked:― Who are those customers?― Would they have purchased without the promotion, anyway?― What is their journey from interest to purchase? Handled correctly, data insight could be an opportunity to buildcustomer loyalty and drive new sales.

In the previous scenario, which part of your organizationwould you expect to recognize the business insight in thedata and bring it to your attention? Finance? Sales?Marketing? Customer support?2. To start, data needs to be visible to different parts of anorganization. But making use of it requires collaborationand communication. That often requires a culturalshift. It's about each and every team believing theyhave the permission, influence and respect they need tothink beyond the confines of their traditional roles andtake broader responsibility for the business.

3. Figuring out how to act on your data insight shouldalways lead from the perspective of the customer. This would lead to questions like:― How are our customers using our products?― What features provide them with the most value?― How can we help our customers learn more about our products?― What are the differences in usage and value by customersegments? And, of course, it might lead you to look at your data in newways to see if you have additional information about your newcustomers, or if they are using the product in unexpected ways.

AmEx looks for indicators that canreally predict loyalty and uses bigdata to develop sophisticatedpredictive models to analyzehistorical transactions and 115variables to forecast potential churn.The company believes it can nowidentify 24% of Australian accountsthat will close within the next fourmonths.

The Coffee Club collects point-of-saledata on the time of day of purchases, theday of the week, other items purchased inthe same transaction, and traffic countversus average spend. They also crossreference with other datasets. It wasfound, for example, that a drizzle of rainon Saturdays would increase traffic instores, but heavy rain on Sundays woulddeter customers from shopping centresites.

H&M continually needed to cut prices toclear out unsold inventory in its 4,288stores around the world. In an effort tobetter stock individual stores withmerchandise local clientele desires, H&Mis using big data and Artificial Intelligence(AI) to analyze returns, receipts andloyalty card data to tailor themerchandise for each store whetherlocated in Sweden, the United Kingdomor the United States

A free web-basedpersonal financialmanagement serviceMint.com uses big data toprovide users information abouttheir spending by categoryand have a look where theyspent their money in a givenweek, month or year.

Infinity realized it had years of adjusters' reportsthat could be analyzed and correlated to instancesof fraud. It built an algorithm out of that project andused the dark data underutilized informationassets that have been collected for single purposeand then archived to reap 12 million insubrogation recoveries.

Kimberly-Clark generates a lot of complex data such assales and marketing spend, store performance, andpurchasing information from several sources thatresided in inflexible systems that made it difficult to use.By consolidating the data with a platform powered byTableau, Amazon Redshift, and Panoply, it is nowaccessible to more professionals within the organizationand they are saving time (eight hours weekly) andmoney ( 250,000 over the course of two years) fromspending less time collecting and sorting data, and moretime interpreting it.

Harnessing the Power of Data

2018 Big Data Executive SurveyNewVantage Partners surveyed senior business andtechnology executives from leading Fortune 1000companies to understand how they are investing in andderiving business value from their Big Datainvestments.

Of the 60 Fortune 1000 or industryleading firms represented in the2018 survey,77.2%97.2%are from the financialservices industryindicated that their company isinvesting in Big Data and AI

While investment in BigData and AI initiativesappear to be widespread(97.2% of respondents),investment levelsappear to be relativelymodest for mostorganizations at thistime.Greater than 500M12.7%60.3%Under 50M27.0% 50M 500M

The survey results indicate that developing advanced analytics tosupport improved business decision making was identified as thehighest priority, and generated the highest success rate84.1%36.2%Of firms are investing inthis objectiveOf those firms cite thisobjective as top priority65.2%23.2%Of firms are investing toimprove customer serviceOf those firms cite improvedcustomer service as top priority

80.9% of executivesagree that culturalchallenges (people process) represent thegreatest challenge toovercome in achievingtheir goal of a datadriven culture nottechnology (19.1%).PeopleProcessTechnology48.5%32.4%19.1%

63.4% of executives reported having established and appointed a ChiefData Officer (CDO), recognizing that data is a vital business asset.However only 39.4%agreed that the primaryresponsibility of data,data strategy, and dataresults belongs to theCDO.A CFO would beincluded in the 12.7% ofOther C-Executive.39.4%Chief Data Officer23.9%No Single Point of AccountabilityChief Information OfficerOther C-ExecutiveChief Analytics Officer Chief DataScientist15.5%12.7%8.5%

Why Some Companies areturning to Chief Data Officers

“To truly appreciate the increasing needfor the CDO’s role, one must firstunderstand that 90% of the world’s datawas created in the past two years alone.That’s a lot of information for a companyto suddenly organize, secure and makesense of, let alone make strategicdecision on.” Matthew Thomas, CDO, Pandera Systems (a leader inhelping firms deliver analytics and automated decisioncapabilities)

CDO – Typical Responsibilities Control and secure data Maximize data’s value with accessibility throughout anorganization while continuing to maintain this controlledstate Provide decision-ready data to other executives toimprove cycle times and cost on capital projectconsiderations Manage the information necessary to run the business

Other Use Cases of DataAnalytics for Accountants

Harnessing the Power of DataAnalyze complex taxation questionsTaxAccountantsExpedition of investment decisionsFaster response to opportunities36

Harnessing the Power of DataFind behavioral patternsAccountantsasInvestmentAdvisorsBuild analytical modelsIdentify investment opportunities37

Interesting Resources1. The Next CFO TVCFO vs. CDO @ L'Oréal: a data showdown(Source: Mazars)2. Unlocking the value of data: CFO role re-defined(Source: KPMG)

Data Analytics WebinarAccess Webinar Here39

Copyright 2018 by the International Federation of Accountants (IFAC). All rightsreserved. Written permission from IFAC is required to reproduce, store or transmit,or to make other similar uses of this document, save for where the document isbeing used for individual, non-commercial use only. Contact permissions@ifac.org.

Data analytics is a broad term that encompasses many diverse techniques and processes of drawing insights from historical data over time. Today the term is most often used to describe the analysis of large volumes of data and/or high-velocity data, which presents