Transcription

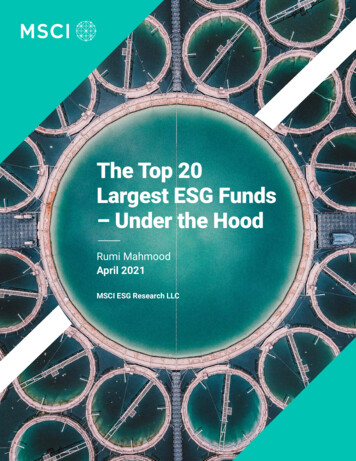

The Top 20Largest ESG Funds– Under the HoodRumi MahmoodApril 2021MSCI ESG Research LLC1 msci.com

Contents3Introduction4Twenty Largest ESG Funds8Exposures and Positioning12Carbon Intensity14Fund Selection – Piece(s) of Cake2 msci.com

IntroductionESG funds have experienced rapidgrowth as of late. As with much infinancial markets, with great growthcomes great influence, and even greaterscrutiny. Investors are increasinglyinquisitive about the holdings of fundsthat claim to incorporate ESG into itsanalytical procedures, and rightfullyso. Aside from the financial materialityaspect of ESG considerations, formany investors it’s important for afund’s holdings to align with theirown values and principles. ESG fundscurrently offer investors a spectrumof sustainability, creating challengesfor those looking to align their capitalwith their values. Simply put, not allESG funds are the same as their ESGpolicies and the resulting sustainabilityattributes can vary significantly. In thisreport we looked at the largest equityESG funds globally, their holdings andESG attributes, alongside things toconsider when conducting ESG fund duediligence and selection.3 msci.comKey Findings: The 20 largest ESG funds in our coverage collectivelyaccounted for approximately 13% of total assets undermanagement globally in ESG equity funds. There was analmost even split between active and index-based fundinvestment approaches, with active funds accounting forover 57% of AUM. Information technology was the largest sector allocationfor most funds, with almost no allocation in energy.Google was the most commonly held stock across mostfunds; Alphabet Inc. was included in 12 funds, with anaverage weight of 1.9%. Despite the overall low allocation to energy, there were11 funds that both held energy stocks and exhibiteda lower carbon intensity than those with no energyexposure, highlighting the fact that single stockallocations were not always the main driver of a fund’soverall ESG attributes.1Within MSCI’s fund universe of coverage as of Dec 31, 2020.

TwentyLargestESG FundsThe 20 largest ESG funds in our coverage held more thanUSD 150 billion in assets combined, as of December 31,2020. Collectively, these 20 funds represent approximately13% of the total assets under management (AUM) globallyin ESG equity funds.Despite their nominal similarities these ESG funds varywidely in their manager’s investment approach and holdingcomposition. There is a nearly even split between indexbased and active funds, including both mutual funds andETFs. Active funds accounted for a slight majority of heldassets, holding over 50% of total AUM; while the remainingAUM held by index-based funds were divided evenlybetween mutual funds and ETFs (Exhibit 2). A number ofthematic funds were also featured in this list of active andindex-based strategies, namely water and clean energyproducts, collectively accounting for approximatelyUSD 20 billion.2The funds varied widely in tenure and domicile, the oldestfund has been managed for more than 30 years old, and theyoungest for just over five. But two-thirds of total AUM (overUSD 100 billion) was held in funds less than twenty yearsold (Exhibit 3), and half of them were domiciled in Europewhere ESG adoption has been long established. However,the geographic focus of most funds was U.S. equities.24 msci.comAll fund characterizations based on data from Broadridgeand MSCI ESG Research, as of Dec. 31, 2020

Exhibit 1: Top 20 Largest ESG Equity Funds by AUM#NameAssets USDInceptionDomicileBillionGeographicFund TypeFocusMSCI ESGPeer PercentileRatingRank31Parnassus Core Equity Fund22.941992U.S.U.S.Active FundA83rd2iShares ESG Aware MSCI USA ETF13.032016U.S.U.S.Index-based ETFA82nd3Vanguard FTSE Social Index Fund10.872000U.S.U.S.Index-based FundBBB41st9.872003UKActive FundA61st9.582011LuxembourgActive FundA81st8.692013IrelandGlobalIndex-based FundA35th8.312010LuxembourgGlobalActive FundAA89th4567Stewart Investors Asia Pacific LeadersSustainability FundVontobel Fund - mtx SustainableEmerging Markets LeadersNorthern Trust World Custom ESGEquity IndexPictet - Global EnvironmentalOpportunitiesPacific exJapanEmergingMarkets8Pictet - Water8.022000LuxembourgGlobalActive FundAA-9KLP AksjeGlobal Indeks I7.692004NorwayGlobalIndex-based FundA31st7.372008LuxembourgGlobalActive FundAA89thU.S.Active FundA98thIndex-based ETFA98th10Nordea 1 - Global Climate andEnvironment11Parnassus Mid-Cap Fund6.902005U.S.12iShares ESG Aware MSCI EM ETF6.832016U.S.13iShares Global Clean Energy UCITS ETF6.522007IrelandGlobalIndex-based ETFA45th14iShares Global Clean Energy ETF6.512008U.S.GlobalIndex-based ETFA45th15Nordea 1 - Emerging Stars Equity Fund6.412011LuxembourgActive FundA87th16TIAA-CREF Social Choice Equity Fund6.321999U.S.U.S.Index-based FundA86th17Handelsbanken Hallbar Energi5.852014SwedenGlobalActive FundA77th18Putnam Sustainable Leaders Fund5.811990U.S.U.S.Active FundA92nd19iShares MSCI USA SRI UCITS ETF5.632016IrelandU.S.Index-based ETFAA99th20Calvert Equity Fund5.371987U.S.U.S.Active FundA95thEmergingMarketsEmergingMarketsSource: MSCI ESG Research LLC and Broadridge as of Dec. 31, 20203Percentile rank of the fund within its peer group and within the global universe of funds in the MSCI coverage universe.5 msci.com

USD96.4AUM USD BillionActive Fund1196.43Index-based Fund433.58Index-based ETF538.52bnbn# Funds03StrategyUSD72.1Exhibit 2: Fund Strategy BreakdownIndex-basedActiveExhibit 3: ESG Fund Age and Assets Under Management87506405430320# FundsAUM USD Billions60210010-1010-2020-3030-400Fund Ages, YearsAUM USD Billions# FundsSource: Broadridge and MSCI ESG Research as of Dec. 31, 2020The order of size and order of flows in the top 20 aredifferent. Index-based strategies saw the lion’s share ofinflows, exceeding over USD 20 bn (Exhibit 5). The iSharesESG Aware MSCI USA ETF alone witnessed in excess ofUSD 7 billion in flows. Thematic funds – clean energy,6 msci.comwater - were particularly popular in 2020 collectivelywitnessing over USD 15 bn in flows, two listings of theiShares Global Clean Energy ETF saw collective flows inexcess of USD 7 billion.

Exhibit 4: Top 20 Ranked by Flow in 2020FundFlows USD Millions (12 mo.)Fund ESG RatingFund TypeiShares ESG Aware MSCI USA ETF7,126.0 MAIndex-based ETFPictet Environmental Opp4,227.1 MAAActive FundiShares Global Clean Energy (US Listing)3,986.5 MAIndex-based ETFiShares Global Clean Energy UCITS ETF3,522.2 MAIndex-based ETFHandelsbanken Hallbar Energi3,454.9 MAActive FundiShares ESG Aware MSCI EM ETF3,345.5 MAIndex-based ETFNordea 1 Glob Climate2,957.3 MAAActive FundiShares MSCI USA SRI UCITS ETF2,599.7 MAAIndex-based ETFVontobel Fund mtx Sust EM Leaders2,345.6 MAActive FundNorthern Trust World Cst ESG1,927.7 MAIndex-based FundNordea 1 - Emerging Stars Equit1,599.3 MAActive FundVanguard FTSE Social Index Fund1,347.2 MBBBIndex-based FundParnassus Mid Cap Fund963.0 MAActive FundParnassus Core Equity Fund686.3 MAActive FundCalvert Equity Fund574.4 MAActive FundKLP AksjeUSA471.9 MAIndex-based FundPictet-Water444.1 MAAActive FundTIAA-CREF Social Choice Equity307.3 MAIndex-based FundPutnam Sustainable Leaders Fund-385.6 MAActive FundStewart Investors Asia Pacific-953.9 MAActive FundSource: MSCI ESG Research LLC and Broadridge as of Dec. 31, 202054 M4,0Index-based ETFActive FundSource: MSCI ESG Research LLC andBroadridge as of Dec. 31, 20207 msci.com20,580MIndex-based Fund15,912MExhibit 5: Top 20 Flow by Fund Type

Exposures andPositioningExhibit 6: Sector Exposures – Tech vs. erialsReal 83.381.470.00iShares ESG Aware MSCI USA 54Vanguard FTSE Social taplesParnassus Core ServicesFund Sector Holdings (%)Stewart Investors APAC Leaders Sust2.644.5920.690.0013.23Vontobel - mtx Sustainable EM 35.13Northern Trust World Custom ESG 1.24Pictet - Global Environmental 864.059.27Pictet - 25KLP AksjeGlobal Indeks ordea 1 - Global Climate and 1.525.64Parnassus 4.56iShares ESG Aware MSCI EM 9iShares Global Clean Energy UCITS iShares Global Clean Energy Nordea 1 - Emerging Stars 1.06TIAA-CREF Social Choice 2.67Handelsbanken Hallbar 4.49Putnam Sustainable 4.94iShares MSCI USA SRI UCITS .82Calvert .00Source: MSCI ESG Research LLC and Broadridge as of Dec. 31, 2020Sector exposures across the funds revealed thatinformation technology was the largest allocation in mostfunds, and an almost zero allocation in energy (Exhibit 6).This was one of the key drivers behind the shorter-termrecent outperformance of ESG funds relative to their nonESG counterparts, as tech stocks rallied in 2020 whilstenergy declined.Google was the most commonly held stock across mostfunds; Alphabet Inc. was in 12 funds, with an averageweight of 1.9% (Exhibit 7), followed by Ecolab, Thermo8 msci.comFisher Scientific and Microsoft. The companies with thehighest average weight across the funds were Apple (5.6%)and Microsoft (5.0%); the market return of these firmswas 30% and 41% respectively in 2020. It should be notedhowever, that turnover takes place within funds and theranks and weighting held by these companies may nothave been constant for the entirety of the year, and that thisanalysis represents an end of year snapshot.

0.530.020.010.020.010.52V.F. CORPORATIONNIKE, INC.THE HOME DEPOT, INC.BORGWARNER INC.Hasbro, Inc.LOWE'S COMPANIES, INC.VAIL RESORTS, INC.AMAZON.COM, INC.CHIPOTLE MEXICAN GRILLTRACTOR SUPPLY 080.03AAA 10A 9LINDE PUBLIC LIMITED COMPANYINTERNATIONAL FLAVORS &FRAGRANCES INC. AA 8A 6BALL CORPORATIONA 6NEWMONT CORPORATIONAA 5PPG INDUSTRIES, INC.AIR PRODUCTS AND CHEMICALS, INC.BBB 5THE SHERWIN-WILLIAMS COMPANYBBB 5THE MOSAIC COMPANYA 5DUPONT DE NEMOURS, INC.A TIESMATERIALSECOLABECOLABINC.INC.AMERICAN WATER WORKS COMPANYEVERSOURCE ENERGYCONSOLIDATED EDISON, INC.CENTERPOINT ENERGY, INC.SEMPRA ENERGYORSTED A/SPUBLIC SERVICE ENTERPRISE GROUPEDISON INTERNATIONALESSENTIAL UITILITIES INCNEXTERA ENERGY, INC.9 msci.comBBBAAAABBBAAAAAABBBBBBAAA8665554444Min Wgt %BB 12BBB 7A 7A 7BBB 6BB 6BB 6B 6BB 6BB 5Max Wgt %COMMUNICATIONSERVICESALPHABET INC.DISCOVERY, INC.ELECTRONIC ARTS INC.CABLE ONE, INC.VERIZON COMMS INC.LIBERTY GLOBAL PLCLIBERTY BROADBAND CORP.ZILLOW GROUP, INC.FOX CORPORATIONCOMCAST CORPONEOK, INC.HESS CORPORATIONCHENIERE ENERGY, INC.CHEVRON CORPORATIONCONOCOPHILLIPSSchlumberger N.V.VALERO ENERGY CORPBAKER HUGHES COMPANYEXXON MOBIL CORPORATIONPHILLIPS 07CHARLES SCHWAB CORPCME GROUP INC.MARSH & MCLENNAN INC.MOODY'S CORPORATIONBLACKROCK, INC.S&P GLOBAL INC.FACTSET INC.T. ROWE PRICE GROUP INC.PNC FINANCIAL INC.TRAVELERS COMPANIES THERMO FISHER SCIENTIFIC INC. BBB 10DANAHER CORPORATIONBB 9AGILENT TECHNOLOGIES INC.AA 9CERNER CORPORATIONAA 8BECTON, DICKINSON AND COA 7GILEAD SCIENCES, INC.AA 7WATERS CORPORATIONAA 7AMGEN INC.AA 7HOLOGIC, INC.AA 7VERTEX PHARMA INCAA 60.160.030.290.040.13AMERICAN TOWER CORPORATION AAAAEQUINIX, INC.BBDIGITAL REALTY TRUST, INC.ABOSTON PROPERTIES, INC.AAPROLOGIS, INC.AAACBRE GROUP, INC.HEALTHPEAK PROPERTIES, INC.AASBA COMMUNICATION CORPBBBALEXANDRIA REAL ESTATEBBBUDR, 030.160.050.040.070.050.02Name8766666655Av Wgt %3.470.170.080.520.330.150.040.091.490.70ESG Rating# YMin Wgt SMax Wgt %9888888777HEALTH CAREAv Wgt %AAAAAAAAAAAAAAAABBBBBAAANameREAL ESTATE# FundsINFORMATIONTECHNOLOGYMICROSOFT CORPORATIONAPPLIED MATERIALS, INC.CADENCE DESIGN INC.ADOBE INC.TEXAS INSTRUMENTSAUTODESK, INC.TRIMBLE INC.SYNOPSYS, INC.APPLE INC.NVIDIA CORPORATIONCONSUMERDISCRETIONARYESG RatingExhibit 7: Top 10 Common Holdings by GICS Sector4Source: Refinitiv/Lipper and MSCI ESG Research LLC asof Dec. 31, 20204GICS, the Global Industry Classification Standard jointly developed byMSCI and Standard & Poor’s.

Exhibit 8: Information Technology– Industry Groups100%12039080704567608504093010201011012IT Services13SemiconductorsSoftware & Services14Electronic Equipment& Components1Parnassus Core EquityFund2iShares ESG Aware MSCIUSA ETF3Vanguard FTSE SocialIndex Fund4Stewart InvestorsAsia Pacific5Vontobel6Northern Trust WorldCst ESG7Pictet Environmental Opp8Pictet-Water9KLP AksjeUSA10 Nordea 1 Glob Climate11 Parnassus Mid Cap Fund151612 iShares ESG Aware MSCIEM ETF13 iShares Global CleanEnergy14 iShares Global CleanEnergy1715 Nordea 1 - EmergingStars Equit16 TIAA-CREF SocialChoice Equity18192017 HandelsbankenHallbar Energi18 Putnam SustainableLeaders Fund19 iShares MSCI USA SRIUCITS ETF20 Calvert Equity FundSource: Refinitiv/Lipper and MSCI ESG Research LLC as of Dec. 31, 202010 msci.com

The most commonly held information technology stocks were Microsoft(9 funds), followed by Applied Materials and Cadence Design Systems(8 funds each). Within information technology, the industry groups withthe largest exposure across most funds were software and services,and semiconductors (Exhibit 8). The largest fund investors into theseindustry groups were active funds; Pictet Environmental Opportunities(21.3%) and Parnassus Core Equity (19.1%), whereas index-basedapproaches allocated approximately half that of their active peers,averaging a 9% exposure. The concentration of fund investmentinto these industry groups has had significant impact on therecent outperformance of ESG. To put the performance ofthese industries into context, in 2020, the MSCI WorldSoftware & Services Index returned 38.7%, while theMSCI World Semiconductors and SemiconductorEquipment Index returned 46.7%, by far among thebest performing subsectors within the informationtechnology sector.Despite the general absence of energy exposurein the above funds, some did have minorallocations to energy stocks. Out of those thatdid, for example, the iShares ESG Aware MSCIUSA ETF had a 2.15% allocation to energy,which included 11 oil and gas names such asExxon and Chevron. The iShares MSCI USA SRIETF, comparatively, held considerably less: at0.72% of only two names, Phillips 66 and Oneok.Why? Because index methodology matters, anddifferent indexes provide investors with diverseinvestment choices. The iShares ESG AwareMSCI USA ETF tracks an index5 that employs anoptimization process to maximize exposure to ESGfactors while maintaining a target tracking error to theparent MSCI USA index within a specified range, alongwith being sector-diversified and targeting companieswith high ESG ratings in each sector. Compare this to theiShares MSCI USA SRI ETF that tracks an index that isconsiderably more stringent in its investment criteria, and aims toprovide exposure to companies with the highest ESG ratings whileexcluding companies with certain negative social or environmentalimpacts. In this case the exclusions are more far reaching, removingcompanies involved in nuclear power, tobacco, alcohol, gambling,weapons and civilian firearms, thermal coal and more6.5MSCI USA ESG Focus Index6MSCI SRI Indexes Methodology11 msci.com

Carbon IntensityThe majority of funds in our analysis that did not holdany energy stocks were active funds and most that didwere index-funds. But how does that reconcile with realworld carbon emissions? The energy sector tends to befirst in line when it comes to ESG scrutiny, making it easyto presume that funds with energy exposure would leadto more exposure to pollutive companies, or higher fundemissions and carbon intensity 7, 8. However, holdingsalone do not provide the full picture, in fact there arefunds within this group that do not have any energystocks but exhibit a substantially higher carbon intensitythan those that do (Exhibit 9).Exhibit 9: Fund Weighted Average Carbon Intensity vs. HoldingsHighModerate# Industrials Stocks# Energy Stocks# Utilities Stocks160350.00140300.00120250.00200.0080150.00# Stocks10060100.004050.00200Source: Refinitiv/Lipper and MSCI ESG Research as of Dec. 31, 202012 msci.comHandelsbanken Hallbar EnergiPictet-WaterPutnam Sustainable Leaders FundParnassus Mid Cap FundiShares Global Clean EnergyNordea 1 Glob ClimatePictet Environmental OppVontobel Fund mtx Sust EM LeadersiShares ESG Aware MSCI EM ETFParnassus Core Equity FundTIAA-CREF Social Choice EquityNorthern Trust World Cst ESGKLP AksjeUSACalvert Equity FundiShares ESG Aware MSCI USA ETFNordea 1 - Emerging Stars EquitVanguard FTSE Social Index FundStewart Investors Asia Pacific0.00iShares MSCI USA SRI UCITS ETFFund Weighted Average Carbon Intensity - Tons CO2 Equivalent/USD Million SalesLow7Third of low-carbon funds invest in oil and gas stocks Financial Times (ft.com)8ESG funds defy havoc to ratchet huge inflows Financial Times (ft.com)

Pictet Water for example, is athematic fund with no energyexposure, yet it exhibits aconsiderably higher carbon intensitythan the rest in the list, predominantlydriven through its industrials andutilities holdings. Investors oftenlaude funds that exclude energy, butthis is not the only pollutive industry,and different funds have differentgoals. Pictet Water may have ahigh carbon intensity, but it aims tocapture investment opportunitiesacross all areas of the globalwater industry, with a particularfocus on water supply, clean watertechnology and environmentalservices. This niche theme couldtherefore be considered to be moreenvironmentally beneficial in thelong-run, providing more exposureto the development of sustainablesolutions, as opposed to investing insectors with inherently low carbonintensity, such as financials orcommunication services, which lackimmediate business involvement inthe engineering of solutions. This allgoes to show that understanding thenuances of fund mandates matter.13 msci.com

Fund Selection –Piece(s) of CakeThe ESG fund universe is anything but uniform. Thelargest funds are very much a reflection of the spectrumof investors’ choice and preferences, active andindex-based, integration, values & screens based, andthematics. They highlight the fact that there is no one wayto invest sustainably, demonstrate clearly that differentinvestors may be at different stages in their ESG journey,and that their preferences can be quite diverse.14 msci.comThese funds differ from one another, often quitesubstantially. Investors moving into ESG may wish toconsider these differences very carefully to ensure thattheir investments are actually aligned with their owninvestment principles. Alongside fundamental analysis,risk/reward considerations, sector, and geographicexposures, attaining a good understanding of fund ESGpolicies can help investors make more informed funddecisions in this regard.

iShares MSCI USA SRINorthern Trust World Custom ESG Handelsbanken Hallbar EnergiVontobel mtx Sust EM LeadersNordea 1 - Emerging Stars EquityPictet - Global Environmental Opp Nordea 1 - Global Climate and Environment Pictet-Water KLP AksjeGlobal Indeks Stewart Investors APAC Leaders SustiShares ESG Aware MSCI USA iShares Global Clean Energy TIAA-CREF Social Choice EquityParnassus Mid Cap Vanguard FTSE Social IndexParnassus Core Equity iShares ESG Aware MSCI EMBest in classOptimizedThematicNatural resourcesEnvironmentHuman capitalStakeholder oppositionCorporate behaviourBusiness involvement screeningAdult entertainmentAlcoholBiocidesCivilian firearmsConventional weaponsGamblingGmoNuclear powerNuclear weaponsTobaccoNormsThermal coalPutnam Sustainable LeadersCalvert EquityExhibit 10: Not all ESG Funds Are the Same - ESG Policies Vary Source: MSCI ESG Research LLC as of Dec. 31, 2020Introspection can be a good place to start when it comesto fund selection. What are my values and principles,in order of preference? What matters the most? Whatdo I care about most, and what would be acceptable ascollateral benefits? Optimizing multiple parameters canbe challenging. Also, it may be important to look beyondjust holdings, as single names alone have historically notdictated overall ESG attributes.15 msci.comEffectively, ESG funds are like a cake. We can’t have ourcake and eat it, but we can eat some parts of the cake. It’sa matter of systematically prioritizing which parts matterthe most.

About MSCIMSCI is a leading provider of critical decision support tools and servicesfor the global investment community. With over 50 years of expertise inresearch, data and technology, we power better investment decisions byenabling clients to understand and analyze key drivers of risk and returnand confidently build more effective portfolios. We create industry-leadingresearch-enhanced solutions that clients use to gain insight into and improvetransparency across the investment process.About MSCI ESG Research Products and ServicesMSCI ESG Research products and services are provided by MSCI ESGResearch LLC, and are designed to provide in-depth research, ratings andanalysis of environmental, social and governance-related business practicesto companies worldwide. ESG ratings, data and analysis from MSCI ESGResearch LLC. are also used in the construction of the MSCI ESG Indexes.MSCI ESG Research LLC is a Registered Investment Adviser under theInvestment Advisers Act of 1940 and a subsidiary of MSCI Inc.To learn more, please visit www.msci.com.16 msci.com

Notice and disclaimerThis document and all of the information contained in it, including without limitation all text, data, graphs, charts (collectively, the “Information”) is the property of MSCI Inc. or its subsidiaries (collectively,“MSCI”), or MSCI’s licensors, direct or indirect suppliers or any third party involved in making or compiling any Information (collectively, with MSCI, the “Information Providers”) and is provided forinformational purposes only. The Information may not be modified, reverse-engineered, reproduced or redisseminated in whole or in part without prior written permission from MSCI. All rights in theInformation are reserved by MSCI and/or its Information Providers.The Information may not be used to create derivative works or to verify or correct other data or information. For example (but without limitation), the Information may not be used to create indexes,databases, risk models, analytics, software, or in connection with the issuing, offering, sponsoring, managing or marketing of any securities, portfolios, financial products or other investment vehiclesutilizing or based on, linked to, tracking or otherwise derived from the Information or any other MSCI data, information, products or services.The user of the Information assumes the entire risk of any use it may make or permit to be made of the Information. NONE OF THE INFORMATION PROVIDERS MAKES ANY EXPRESS OR IMPLIEDWARRANTIES OR REPRESENTATIONS WITH RESPECT TO THE INFORMATION (OR THE RESULTS TO BE OBTAINED BY THE USE THEREOF), AND TO THE MAXIMUM EXTENT PERMITTED BY APPLICABLELAW, EACH INFORMATION PROVIDER EXPRESSLY DISCLAIMS ALL IMPLIED WARRANTIES (INCLUDING, WITHOUT LIMITATION, ANY IMPLIED WARRANTIES OF ORIGINALITY, ACCURACY, TIMELINESS,NON-INFRINGEMENT, COMPLETENESS, MERCHANTABILITY AND FITNESS FOR A PARTICULAR PURPOSE) WITH RESPECT TO ANY OF THE INFORMATION.Without limiting any of the foregoing and to the maximum extent permitted by applicable law, in no event shall any Information Provider have any liability regarding any of the Information for any direct,indirect, special, punitive, consequential (including lost profits) or any other damages even if notified of the possibility of such damages. The foregoing shall not exclude or limit any liability that may not byapplicable law be excluded or limited, including without limitation (as applicable), any liability for death or personal injury to the extent that such injury results from the negligence or willful default of itself,its servants, agents or sub-contractors.Information containing any historical information, data or analysis should not be taken as an indication or guarantee of any future performance, analysis, forecast or prediction. Past performance does notguarantee future results.The Information should not be relied on and is not a substitute for the skill, judgment and experience of the user, its management, employees, advisors and/or clients when making investment and otherbusiness decisions. All Information is impersonal and not tailored to the needs of any person, entity or group of persons.None of the Information constitutes an offer to sell (or a solicitation of an offer to buy), any security, financial product or other investment vehicle or any trading strategy.It is not possible to invest directly in an index. Exposure to an asset class or trading strategy or other category represented by an index is only available through third party investable instruments (if any)based on that index. MSCI does not issue, sponsor, endorse, market, offer, review or otherwise express any opinion regarding any fund, ETF, derivative or other security, investment, financial product ortrading strategy that is based on, linked to or seeks to provide an investment return related to the performance of any MSCI index (collectively, “Index Linked Investments”). MSCI makes no assurancethat any Index Linked Investments will accurately track index performance or provide positive investment returns. MSCI Inc. is not an investment adviser or fiduciary and MSCI makes no representationregarding the advisability of investing in any Index Linked Investments.Index returns do not represent the results of actual trading of investible assets/securities. MSCI maintains and calculates indexes, but does not manage actual assets. Index returns do not reflectpayment of any sales charges or fees an investor may pay to purchase the securities underlying the index or Index Linked Investments. The imposition of these fees and charges would cause theperformance of an Index Linked Investment to be different than the MSCI index performance.The Information may contain back tested data. Back-tested performance is not actual performance, but is hypothetical. There are frequently material differences between back tested performance resultsand actual results subsequently achieved by any investment strategy.Constituents of MSCI equity indexes are listed companies, which are included in or excluded from the indexes according to the application of the relevant index methodologies. Accordingly, constituentsin MSCI equity indexes may include MSCI Inc., clients of MSCI or suppliers to MSCI. Inclusion of a security within an MSCI index is not a recommendation by MSCI to buy, sell, or hold such security, nor isit considered to be investment advice.Data and information produced by various affiliates of MSCI Inc., including MSCI ESG Research LLC and Barra LLC, may be used in calculating certain MSCI indexes. More information can be found in therelevant index methodologies on www.msci.com.MSCI receives compensation in connection with licensing its indexes to third parties. MSCI Inc.’s revenue includes fees based on assets in Index Linked Investments. Information can be found in MSCIInc.’s company filings on the Investor Relations section of www.msci.com.MSCI ESG Research LLC is a Registered Investment Adviser under the Investment Advisers Act of 1940 and a subsidiary of MSCI Inc. Except with respect to any applicable products or services from MSCIESG Research, neither MSCI nor any of its products or services recommends, endorses, approves or otherwise expresses any opinion regarding any issuer, securities, financial products or instruments ortrading strategies and MSCI’s products or services are not intended to constitute investment advice or a recommendation to make (or refrain from making) any kind of investment decision and may notbe relied on as such. Issuers mentioned or included in any MSCI ESG Research materials may include MSCI Inc., clients of MSCI or suppliers to MSCI, and may also purchase research or other productsor services from MSCI ESG Research. MSCI ESG Research materials, including materials utilized in any MSCI ESG Indexes or other products, have not been sub

Vontobel Fund mtx Sust EM Leaders 2,345.6 M A Active Fund Northern Trust World Cst ESG 1,927.7 M A Index-based Fund Nordea 1 - Emerging Stars Equit 1,599.3 M A Active Fund Vanguard FTSE Social Index Fund 1,347.2 M BBB Index-based Fund Parnassus Mid Cap