Transcription

CorporateGovernanceTowards a moreprominent role forthe SupervisoryBoardMergers &Acquisitionswww.pwc.nl/corporategovernance

Table of contentsAt PwC, our purpose is to build trust insociety and solve important problems.We’re a network of firms in 157 countrieswith more than 276,000 people. At PwCin the Netherlands over 5,400 peoplework together. We’re committed todelivering quality in assurance, tax andadvisory services. Tell us what matters toyou and find out more by visiting us atwww.pwc.nl.PwC refers to the PwC network and/orone or more of its member firms, each ofwhich is a separate legal entity. Pleasesee www.pwc.com/structure for furtherdetails.2PwCIntroduction3Success and failure in M&A5M&A strategy8The acquisition process11Divestitures and carve-outs15The public offer18Post-deal integration21Developing M&A capabilities24

IntroductionMerger and acquisition activity (mergers, acquisitions, joint ventures,divestitures) is at an all-time high. M&A volumes are now higher thanduring the internet boom of 1999- 2001 and the M&A boom of 2004 – 2007that was fuelled by cheap credit. Asian M&A activity, particularly in and outof China, has contributed to this growth, while European M&A is still belowprevious peak levels.Maarten van de PolPartner DealsThe current M&A cycle is driven by the search for growth in the post-crisislow growth world, exceptionally low interest rates and abundant liquidity.Economic growth rates around the world are now structurally lower than beforethe financial and economic crisis. As a result, organic revenue growth of manycompanies is in the low single digits and M&A has become an importantinstrument for growth. M&A is facilitated by exceptionally low costs of financingand abundant liquidity, which are the result of unorthodox measures centralbanks have taken to revive economic growth. In many of the world’s majoreconomies interest rates are now exceptionally low or, in some countries,even negative. In addition, many companies are sitting on record amounts ofcash, as they have recovered from the economic and financial crisis. Thesecash balances can be either paid out to shareholders or used to revive growththrough capital expenditure, R&D or M&A.In the M&A market corporate acquirers are competing against private equityfirms and sovereign wealth funds. In the search for yield, institutional investorsare increasing their allocations to alternative investments of which private equityis a major category. Similar to corporates holding all-time high levels of cash,private equity firms have record amounts of funds available for investments(‘dry powder’).Mergers & Acquisitions Introduction3

CorporateGovernanceTowards a moreprominent role forthe SupervisoryBoardApril 2019Mergers &Acquisitionswww.pwc.nl/corporate-governanceThis book is principallyaimed at Non-executivedirectors of a corporatebusiness, in particularDutch listed corporates,but many areas areequally relevant for Nonexecutive directors ofother organizations. It isa practical guide; it doesnot cover all the legal orregulatory aspects of anM&A process.4PwCM&A is an important strategic option that companies can leverage to makenecessary leaps in the competitive marketplace. It can help companies toobtain a higher market share and a broader customer base, and gain accessto new technology, products and distribution channels. Yet, at the same time,M&A is very risky and many deals fail, sometimes bringing companies to thebrink of failure. Reasons for failure vary and range from opportunistic M&A andoverpayment to poor integration. For many companies mergers and acquisitionsare irregular events for which they lack capabilities and processes. This iscompounded by biases in M&A that cloud M&A decision-making, such as dealfever, tunnel vision and strong incentives to complete a deal.We are of the opinion that the M&A track record of many Dutch corporates,which consists of successes but also of many failures, demonstrates the needfor a more prominent role of Supervisory Boards. Supervisory Boards are wellpositioned to take a long-term view of a deal, which can act as a counterbalanceto the deal pressure that management may find itself in. The combinedexperience of the Non-executive directors, which covers a variety of industries,competitive environments and mergers and acquisitions, are invaluable to helpmanagement extract more value from M&A and reduce the risks involved.

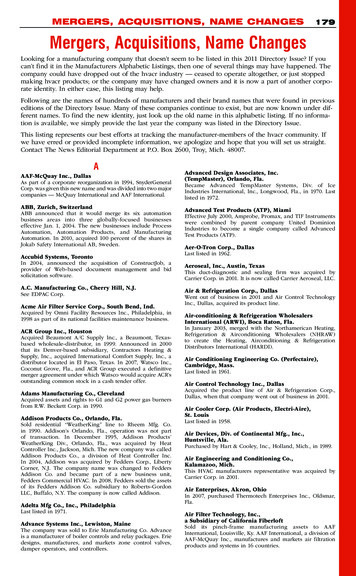

Success and failure in M&AThere are myriads of anecdotes of failed M&A deals.According to academic research, failure rates rangefrom 50% to 80%. To be more precise, these failurerates apply to acquirers. Shareholders of targetcompanies typically receive a large premium on thesale of their shares. And multi-business corporationsthat divest non-core activities typically achievesuperior shareholder returns as they reverse theconglomerate discount embedded in their shareprices.While failed acquisitions understandably catch thepublic attention, many acquirers are actually verysuccessful. Success and failure is therefore notsomething beyond the control of acquirers, but can bemanaged. For companies considering an acquisitionit is crucial to have an understanding of the factorsthat contribute to the success or failure of a deal. Thetable on page 6 and 7 contains some key factors thataccording to academic research contribute to thesuccess and failure of acquisitions.M&A strategy‘Relatedness’ or strategic ‘fit’ appears to be of greatrelevance to M&A success. Recent comprehensiveresearch by Strategy&, part of the PwC network, hasshown that the degree to which a deal contributesto an acquirer’s system of capabilities, either byleveraging the acquirer’s current capability systemor by enhancing that system with complementarycapabilities, greatly enhances the acquirer’s return.This book will address the key attention points forSupervisory Boards in M&A matters, both relating tothe opportunities for value creation and managingthe substantial risks. We will do so by following thesequence of the M&A process: from strategy, toexecution and post-deal integration. We will also payattention to the capabilities and processes a companyneeds to successfully execute and implement amerger or an acquisition.Deal executionPost-dealintegrationM&A process / capabilitiesMergers & Acquisitions Success and failure in M&A5

Raising the probabilityof successStrategically motivateddealsAcquisitions of relatedbusinessesAcquisitions of privatefirmsLarge related dealBuyer obtains controlBuy during ‘cold’M&A marketsSynergies are cost andcapex relatedFrequent acquirerNegotiated deal6PwC

Factors that distinguish good acquisitions frombad ones: evidence from academic researchRaising the probabilityof failureExplanationOpportunistic dealsOpportunistic deals rarely have a strategic fit and acquirers are ill prepared tointegrate these deals.Acquisitions ofunrelated businessesAcquirers often lack a sufficiently deep understanding of unrelatedbusinesses.Acquisition of listedfirmsAcquirers of listed companies have to pay a premium of typically 30% - 40%above the share price. This impedes the financial success of a deal.Large ‘transformational’dealAlthough eye-catching, ‘transformational’ deals are very complex in manyrespects.Merger of equalsMergers of equals raises the probability of infighting and tends to slow downpost-deal decision-making.Buy during ‘hot’ M&AmarketsIn ‘cold’ M&A markets, prices are low and the most attractive targets are stillup for sale. In ‘hot’ M&A market prices are high while the best targets are nolonger available.Synergies are revenuerelatedRevenue synergies often prove difficult to realise; acquirers have a higherdegree of control over the realisation of cost and capex synergies.Infrequent acquirerFrequent acquirers can learn from previous deals and are able to developinternal M&A capabilities.Auctioned dealAuctions drive up acquisition prices and allow for less due diligence thannegotiated deals.Mergers & Acquisitions Success and failure in M&A7

The M&A strategyM&A strategyDeal executionPost-dealintegrationM&A process / capabilitiesGeneralMergers and acquisitions have increasingly becomean important part of the corporate strategy of manycompanies. How M&A fits into a company’s strategyand complements organic growth depends very muchon the industry the company operates in, its marketposition and its strategy for value creation. ThroughM&A companies can make necessary leaps in thecompetitive marketplace. M&A can, for instance, helpcompanies to take advantage of the benefits of scalethat results from consolidation in mature markets andto gain access to new technology, markets, productsand distribution channels. It can also help companiesrespond to unprecedented disruption in industriessuch as financial services, technology and energy.In our opinion, an M&A strategy should: Be specific about how M&A complements organicgrowth, how it creates value and how it contributesto the objectives of the company. Include detailed information on M&A targets andcriteria. On which countries and markets shouldM&A activities be focused? Which market positionsare we aiming for? What is the minimum andmaximum target size? What are the expectedsynergies?8PwC P rovide details on the M&A budget and on financingpossibilities for M&A. Contain specifics about potential targets, the way todevelop a pipeline and a strategy to approach thesetargets. Flag potential antitrust issues in the acquisition ofany of these targets. Have the ‘end in mind’, which means the integrationstrategy should be clearly linked to the dealstrategy. Take into account the resources and managementtime required to execute and integrate deals. Thisshould typically set a limit on the amount, size andnature of deals. Pursuing small targets may not beworth the management effort required to executeand integrate these deals. Large deals, particularlyif they are outside the acquirer’s current productmarkets, are more risky and consume significantresources and management attention.M&A is not only about acquisitions, but also aboutdivestitures. Multi-business corporations shouldreview their business portfolio on a regular basis fordivestiture candidates. Divestitures should not only beconsidered for poorly performing activities, but alsowhen new owners can add more value to a business.Divestments free up management time and capitalthat can then be reallocated to those divisions oractivities where more value can be created.

Companies have a natural tendency to pursue growth,even when growth is not creating value. Typically a lotof emotion has to be overcome before a divestmentdecision can be made. It is therefore crucial that areview of the business portfolio to identify candidatesfor divestiture is performed in a structured and timelyfashion. Preparing for divestitures can take fromseveral months up to one or even two years.We also advise managements of listed companies toreview their strategy through the lens of investors andpotential activist investors. An approach by activistinvestors typically sends shivers through corporateboard rooms, but boards should be braced for moreas institutional investors are significantly increasingasset allocations to activists.Activist investors typically take a small stake ina company and then privately engage with itsmanagement to discuss their proposals to makestrategic and operational changes to increaseshareholder value. If a company’s reaction is notsatisfactory they may either sell their stakes or gopublic with their proposals. These proposals mayinclude a sale of the company to a bidder, thusrealising an acquisition premium or a restructuringof the business portfolio, breaking companies apartand reallocating capital. Activist investors do notobtain control to force their agenda on a company,their stakes are too small for that. Rather, they actas catalysts: when their involvement and intentionsbecome public, other shareholders may join in andthe Management Board might lose control over thedirection their company in going. Ultimately this maylead to a hostile takeover.Management should therefore assess whether ornot the company is vulnerable to an approach byactivist investors. Have the share price and operatingperformance been lagging peers? Is the industry goingthrough rapid changes? Does the business portfoliocontain unrelated or non-core assets? Managementshould consider which relevant issues activists bringto the table and address those issues before anyapproach. Which issues may activist investors bringforward with which management would rightfullydisagree? This can be either because activists haveonly limited insight into the company’s strategy andperformance, or because their proposals sacrificelong-term value for short-term gains.Mergers & Acquisitions The M&A strategy9

Role of Supervisory BoardIn our opinion the Supervisory Board should holdregular discussions with the Management Board onthe strategy of the company and the role of M&A.Typically the Supervisory Board attends annualstrategy days, with the Management Board andother functions, such as staff in charge of M&A,business development and divisional management.The Supervisory Board should oversee that: The M&A strategy is clearly embedded in thecorporate strategy and is consistent with longterm value creation. The M&A strategy is translated in sufficientlydetailed acquisition criteria and targets. The company applies sound financial returncriteria for M&A that are consistent with long termvalue creation.10PwC sound financing plan is in place.A The company has sufficient resources andmanagement time available to execute and digestdeals. The corporate portfolio is being reviewed on aregular basis to identify possible candidates fordivestment.The M&A strategy will result in a pipeline of M&Atargets. The development of the pipeline shouldbe discussed in the regular Supervisory Boardmeetings. The Supervisory Board should verify iftargets fit the criteria that have been set.

The acquisition processM&A strategyDeal executionPost-dealintegrationM&A process / capabilitiesGeneralGrowth through acquisitions is inherently more riskythan organic growth. Organic growth allows forgradual investments which can be adjusted on thebasis of learning and new information. In contrast anacquisition is an investment ‘at once’, typically fullypaid for upfront, in a company of which the acquirerhas less knowledge than its own business. Nowhereis this risk more apparent than in the deal phase.Acquisitions are frantic, involving many corporatefunctions, multiple business units and a myriad ofadvisers. Acquisitions are subject to time pressure,often compounded by competitive bidding situations,which forces acquirers to make decisions on thebasis of limited information. And in the later stagesof the deal ‘tunnel vision’ and ‘deal fever’ are likelyto set in, creating biases in decision making. This iscompounded by the high stakes involved in M&A andthe potential conflicts of interest.If managed incorrectly, acquisitions can expose acompany to unwarranted risks: it may end up witha business it should not own, it may overpay, or itmay not be able to manage and integrate the targetcompany. If financed with too much debt a badacquisition can even bring a company to the brink ofdisaster.In our opinion the following elements are crucial in theacquisition process: Throughout the acquisition process a companyshould stick to the criteria set out in its M&Astrategy in a disciplined manner. Valuations of the target company are oftenoutsourced to the financial advisers of thecompany. We are of the opinion that a companyshould assume responsibility for the valuation asit knows its own business better than its advisers.Financial forecasts, especially synergies, are proneto enthusiasm and over-optimism. Valuationsshould be fact-based, objective and consistent withindustry benchmarks. Throughout the acquisitionprocess, the valuation should be updated for thedue diligence findings and the integration plan thatis prepared in this phase. The due diligence should not only focus on risks,but also on identifying additional sources of value(upsides). This necessarily requires the involvementof many participants in a due diligence: bothinternal functions and business units as well asexternal advisers. The due diligence should alsoprovide information for the proper structuring ofthe acquisition and information on areas where theacquirer should obtain contractual protection inthe purchase agreement. If synergies between theacquirer and the target company form an importantvalue driver, it is important that these synergies arequantified and also subject to due diligence.Mergers & Acquisitions The acquisition process11

A detailed integration plan should be prepared,specifying how the target will be managed andintegrated and how and when the value from thedeal will be captured. A sound financing plan, specifying the impacton the financial solvency and credit rating of thecompany. The financing plan should also includescenario analyses to assess the impact of adversedevelopments. Management should firmly stay in control ofthe deal and the acquisition process. This is achallenge, especially for infrequent acquirersthat lack experience and typically rely heavily onoutside advisers. The acquisition process shouldalso include checks and balances to contain dealfever and conflicts of interest that results in biaseddecision-making.In case the target company is listed, the offerprocess has to comply with specific regulations,which aims to achieve an orderly and transparentprocess.12PwC

Role of Supervisory BoardIn the acquisition phase, the involvement of theSupervisory Board increases. Supervisory Boardmeetings become more frequent. To facilitate swiftdecision-making it is advisable that a transactioncommittee be created, for instance consisting oftwo members of the Management Board and twomembers of the Supervisory Board. The transactioncommittee facilitates accelerated decision-makingwhich is crucial in the acquisition phase. Thecommittee is involved in the transaction on a dayto-day basis and in the preparation of the deal, buthas no decision-making authority. The decisionmaking and approval remains in the domains of theManagement Board and the Supervisory Board,respectively.In our opinion, the following list contains the keyattention points for Supervisory Board: Targets should only be formally approached bymanagement after approval by the SupervisoryBoard. Supervisory Boards should stay incontrol. Lower management levels and countrymanagers should not be allowed to pursuedeals in isolation and without consultation. As ageneral rule, Non-executive directors can giveinformal introductions, but should themselves notapproach targets. he Management Board submits an acquisitionTproposal to the Supervisory Board, which includes:- The deal rationale- A valuation of the target and synergies- A summary of due diligence reports and duediligence findings. The transaction committeeshould get the full due diligence reports- A concrete and detailed integration plan- A sound financing planI n arriving at a decision to approve the deal and amandate for further negotiations, the SupervisoryBoard should seek satisfactory answers to thefollowing questions:- Why should we make this acquisition?- Do we have the right resources to integrate thetarget?- Has the Management Board hired the properadvisers, e.g. for valuation, due diligence andfinancing? Is the fee structure appropriate?- Are the financial forecasts and synergies basedon management assumptions and know-howof the business rather than on the options ofits advisers? Is the valuation based on realisticrather than stretched assumptions?Mergers & Acquisitions The acquisition process13

- H ow much of the synergies do we pay away andis the value creation substantial enough to warrantthe effort and risks of the deal?- Are the financing terms acceptable and will thecompany be exposed to unacceptable risks as aresult of the financing structure?- What are the key risk factors of the deal andhow have these been addressed in a satisfactorymanner?- The integration plan should include a clearblueprint for the organisation in the post-dealphase, actions linked to priorities, and cleartargets and milestones. The integration planshould also include a clear communication plan.- Have adverse developments been factored in?For instance: what if the integration process takeslonger than anticipated? Has the potential loss ofkey clients and personnel been considered?- Have scenarios been prepared to ensure thecompany is still viable if the deal turns out poorlyin combination with other adverse developmentlike a recession? he Supervisory Board should ensure that theTdecision-making has been done in an unbiased andobjective manner. The Supervisory Board shouldinquire about which discussion has taken placein the Management Board, particularly regardingopportunities and risks of the acquisition.14PwCThe Supervisory Board should also obtaininformation from managers outside theManagement Board, such as the CFO and divisionmanagement. he Supervisory Board should consider whetherTit can make use of the same advisers as theManagement Board or whether it should haveits own advisers. The size of the target, thecomplexity of the acquisition and the financing ofthe deal are important considerations. In case theSupervisory Board relies on the same advisers asthe Management Board, it should not only haveaccess to their reports, but these advisers shouldalso be available to the Supervisory Board forexplanations and clarifications. Public companies(naamloze vennootschappen) require approvalof the general meeting of shareholders for theacquisition of targets that exceed a certain valuethreshold (Section 2:107a (1)1/c of the Dutch CivilCode). If this requirement is met, the SupervisoryBoard should consider to hire independent advisersfor the valuation and fairness opinion.

Divestitures and carve-outsM&A strategyDeal executionPost-dealintegrationM&A process / capabilitiesGeneralMulti-business corporations should regularly reviewtheir business portfolio and assess if a division shouldbe divested. The key criterion should be whether thebusiness unit is non-core and another owner could addmore value to the business.Candidates for divestment should be identified atan early stage, because the process of separation istypically complex and time consuming. It is crucialthat the separation is completed before the salesprocess starts, so as to avoid hick-ups and unpleasantsurprises in the sales process. Over the years, mostcorporations have centralised a lot of their supportfunctions and moved to ERP systems which arecomplex to unwind. Divestitures will also leave thecompany with ‘stranded’ overhead costs and it takestime to reduce these costs on a structural basis.Proper preparation is essential for a company in orderto remain in control of the sales process. A key riskin divestment processes is that the ManagementBoard lacks detailed information about the divisionor business that is put up for divestment. In such asituation, a purchaser may at some point seize theinitiative in the transaction process. Consequently,value is eroded in the sales process. These riskscan be mitigated by commissioning vendor duediligence before the launch of the sales process andby implementing the right management incentivestructures. A vendor due diligence helps to maintaincontrol over the sales process and the issuing ofinformation. It identifies the positive and negative pointsof the business in an early stage and avoids surpriseslater in the process.The separation process should start with differentbuyer categories in mind and define deal packages foreach of them. The consideration of different exit routesallows a dual track process (M&A transaction and IPO),which creates flexibility and competitive pressure inthe sales process. Typical exit routes to consider are:strategic buyers which have local infrastructure, foreignstrategic buyers, private equity and IPO. The lattertwo categories typically don’t have an organisationalinfrastructure in place and for these buyers thedivested business should be designed as a standalone company. An integral part of the preparation isthe design of transitional services that the vendor mayneed to offer to potential buyers, for instance in IT,accounting and purchasing, in order to facilitate thesale and integration into the buyer.Another important element is the communicationof the separation and the decision about whichemployees will go with the divestiture and whichwill stay. The natural tendency once the plan for adivestiture has been communicated, is to give lessattention to the divested business, while insteadMergers & Acquisitions Divestitures and carve-outs15

it should get more attention in order to maximisevalue. There will also be a period of uncertainty foremployees that may either go with the divestedbusiness or stay with the selling company. In eithercase, it is important that employees are incentivisedto stay so that the value of the divestment ismaximised.Corporate management needs to pay specialattention to the risk that the loyalty of divisionalmanagement shifts to its new prospective owner.This will especially be the case in a sale to privateequity. The divisional management is often crucialfor the private equity firm to meet the objectivesof the acquisition and this is reflected in themanagement incentive structure. Key managersof the business will be asked to invest in the newcompany. This, of course, puts the divisionalmanagement in a delicate position. Corporatemanagement should pro-actively manage thisconflict of interest. For example, they shouldapprove the business plan that is submitted to theprivate equity buyer and make sure to be in controlof the process of information exchange with thebuyer. Corporate management should also leadthe negotiations on price and the future position ofdivisional management.16PwCRole of Supervisory BoardIn many respects, the sales process mirrors the franticnature of the acquisition process, although there aresome marked differences. The acquisition processis focussed on overcoming information asymmetriesand obtain a detailed understanding of how the targetwill create value after the deal has been closed. Incontrast, the divestment process is more focussedon optimisation of the disentanglement and the salesprocess. Also in the case of divestments we advisethe formation of a transaction committee and wesuggest that the Supervisory Board applies similarconsiderations to decide whether or not to hire its ownindependent advisers.In our opinion, the key attention points of theSupervisory Board are: Approval of the decision to divest a business unit ordivision, ensure it is in line with corporate strategy,and based on a separation analysis and vendor duediligence. Oversee that the company properly addresses thehigh degree of uncertainty to which employees areexposed during the separation and sales processby properly incentivising staff that may either gowith the divested business or stay with the sellingcompany.

nsure that the corporate management hasEestablished procedures to deal with the shift of thedivision’s management allegiance to the buyer’sside. This is likely to be the case in any deal, butparticularly in a sale to private equity. Approval of the start of the sales process, possiblyfollowing multiple tracks and buyer categories.Relevant criteria for each alternative to considerare: deal value, stranded overhead costs, carveout complexities, required transitory agreements,deal certainty, competitive pressure and flexibilityif market conditions change. The Supervisory Board should ensure that in thesales process the interests of the stakeholdersinvolved in the company are properly weighed.Besides price, also non-financial criteria need tobe considered, for example the reputation of thebuyer, the position of the divested company inthe organisational structure of the buyer, and thefuture location of the divisional head office andR&D centres. Another important aspect is thecapital structure of the divestment in the post-dealphase. The latter is of particular relevance in caseof a sale to a private equity party. The SupervisoryBoard should ensure itself, preferably with thehelp of external advisers, that the degree ofleverage the private equity buyer is planning to putin the divestment is acceptable.Further the Supervisory Board has the responsibilityto make sure that non-financial criteria do notremain on the level of good intentions but get realcontractual teeth.Mergers & Acquisitions Divestitures and carve-outs17

The public offerM&A strategyDeal executionM&A process / capabilitiesGeneralAn actual or proposed public offer for the shares ofa listed company marks the beginning of a stressfulperiod for the target company. A successful publicoffer means the end of a company’s independence,an outcome which in most cases is not part of thedeliberate strategy of a company. The managementof a target company involved in the negotiations of afriendly public offer runs a large risk of losing controlin the process and become a plaything of anyonewith an interest in the outcome of the offer. This canbe caused by, for instance, a leakage of informationand by competing bidders. Management losesmore control if the offer process turns hostile andmanagement is side-lined in the deal.In the case of a public offer, the ManagementBoard and the Supervisory Board are responsiblefor a careful weighing of the interests of all thestakeholders involved in the company. Thisincludes the analysis of alternative options, suchas a continuation of a stand-alone future, possiblycombined with a change in strategy, and theconsideration of the pros and cons of alternativebuyer ca

Mergers & Acquisitions Introduction 3 Introduction Merger and acquisition activity (mergers, acquisitions, joint ventures, divestitures) is at an all-time high. M&A volumes are now higher than during the internet boom of 1999- 2001 and the M&A boom of 2004 – 2007 that was fuelled by cheap credit. Asian M&A activity, particularly in and outFile Size: 2MB