Transcription

EXECUTIVE INSIGHTSVOLUME XV, ISSUE 21Physician Practice Management – A New ChapterPhysician Practice Management companies (PPMs) are gain-The Insights in Briefing attention again. In 2012, kidney-care giant DaVita boughtHealthCare Partners; the combined company immediately After failing dramatically in the late 1990s, Physicianstarted acquiring and partnering with other large practices. AlsoPractice Management companies (PPMs) are back.in 2012, private equity firm Audax Group acquired AdvancedPhysician groups' affiliation with PPMs is accelerat-Dermatology & Cosmetic Surgery and Welsh, Carson, Andersoning and hospitals are more active purchasers than& Stowe formed U.S. Anesthesia Partners. Even more recently,ever before.private equity shop Clayton, Dubilier & Rice completed the IPO After two decades of healthcare industry evolution,PPMs have a much stronger value proposition. They arebetter positioned than traditional physician officesto make capital investments, manage risk, contractwith payers, acquire patients, increase administrativeefficiency, and achieve other economies of scale –i.e., to meet the substantially increased demands ofphysician groups. Success for PPMs depends in large part on motivatingof Envision Healthcare (formerly Emergency Medical ServicesCorporation) in August 2013 – a firm they had taken privatein 2011.Developments such as these might send shivers through thosewho remember the physician practice management debaclefrom the 1990s. Back then, PPM companies such as Phycorand MedPartners evolved the traditional back-office servicesmodel into an industry roll up, building sprawling empires ofmedium to large multispecialty and single-specialty physicianphysicians by forming and clearly communicating thepractices. With the success of the early entrants, many well-group’s value proposition, aligning incentives, ensuringfunded followers jumped in. In 1997 alone, public PPMs raisedeffective governance, and providing support in the 2bn to fund the acquisition spree. Any physician group ofphysicians’ local context rather than applying national,scale auctioned itself to the highest bidder. By the peak of thecookie-cutter guidelines.phenomenon, in 1998, Sherlock Company estimated there were39 public and 125 private PPMs. The arrival of next generation PPMs will provide manyopportunities across the healthcare value chain, andThen the bubble burst. Initiated by bankruptcy announce-everyone from payers to private equity investors canments from MedPartners and FPA Medical Management in Julyposition themselves to benefit.1998, eight of the 10 largest publicly traded PPMs had declaredbankruptcy by 2002. Many doctor groups bought back theirPhysician Practice Management – A New Chapter was written by Bill Frack, Managing Director and Head of L.E.K. Consulting's Americas Healthcare ServicesPractice and Nurry Hong, Managing Director in L.E.K. Consulting’s Los Angeles office. For more information, contact healthcare@lek.com.L.E.K. Consulting / Executive InsightsINSIGHTS @ WORKTMLEK.COM

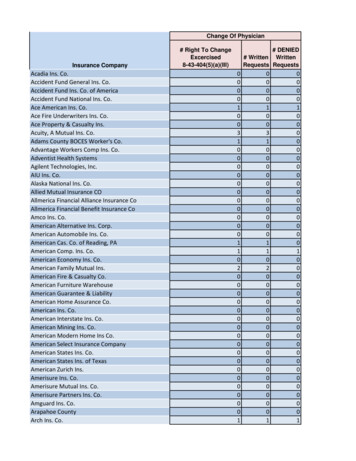

EXECUTIVE INSIGHTSpractices at pennies on the dollar. So what happened? Fundamentally, the competition for a relatively limited pool of physi-Case Studycian groups large enough to be interesting targets drove pricesto unsustainable levels, often 50-100% above the underlyingWhen Pacific Physician Services Inc. (PPSI), a long-cash-flow value (see sidebar). The time to bubble burst wasterm L.E.K. Consulting client, approached us in lateaccelerated by rapid margin compression, a result of decliningpremium revenue caused by a particularly vicious downturn in1994 to analyze their poor performance acquir-the underwriting cycle combined with the PPMs’ inability tobend their cost curves. To compound the problem, acquireding groups, the answer to their problem was pricegroups grew rapidly disenchanted as PPMs’ focus on new acqui-discipline. By refusing to pay above the fundamen-sitions left them low on the priority list. Their frustration onlytal cash-flow value of the business, PPSI was neverincreased when deals founded on equity participation collapsedcompetitive. Faced with the conundrum of payingin value. Faulty fundamentals caused the whole movement tocollapse in a heap (see Figure 1).value-destroying multiples to meet market growthAlmost 20 years later, we are witnessing a resurgence of PPMs.expectations, they made the rational choice and soldPhysician groups are again favored targets of PPMs, and evento MedPartners in December 1995.more hospitals and health systems are on the hunt than twodecades ago – either as part of their efforts to develop ACOsor because they are looking to protect their referral bases inthe face of declining reimbursement.1 Approximately 40% ofBut physician practice management was an innovation thatphysicians today are either hospital employees or employees offailed because it was premature and poorly executed, not un-a practice owned by a hospital or health system. To industrysound. Twenty years later, PPMs have a clear strategic rationaleveterans, it looks like a bad remake of a bad movie.and value proposition. Indeed, the need is stronger than ever.2Figure 1Combined Market Cap of Top 20 Publicly Traded PPMs 12,000 10,000Market Cap 8,000 6,000 4,000 2,000Jun '00Sep '00Dec '99Mar '00Jun '99Sep '99Dec '98Mar '99Jun '98Sep '98Dec '97Mar '98Jun '97Sep '97Dec '96Mar '97Jun '96Sep '96Dec '95Mar '96Jun '95Sep '95Dec '94Mar '95Jun '94Sep '94Dec '93Mar '94Jun '93Sep '93Dec '92Mar '93Jun '92Sep '92Mar '920Source: Citi Research, Company Filings, Factset, ThomsonPage 21For example, see Tip Kim's, "Hospital Economics and Healthcare Reform: No Free Lunch (In Fact, I Might Go Hungry),” L.E.K. Executive Insights, Volume XV, Issue 102Source: Jackson HealthcareL.E.K. Consulting / Executive Insights Volume XV, Issue 21INSIGHTS @ WORKTMLEK.COM

EXECUTIVE INSIGHTSPhysician group requirements have evolved substantially fromrecruitment are rapidly evolving. This confluence of factorsback-office efficiency – which is still a primary need – to includerequires sophisticated, local patient-acquisition programs thatcapabilities such as advanced patient-acquisition methods, pop-are not in physicians’ domain of expertise.ulation-health and risk management and clinical effectiveness.These are all requirements that most physician groups, even4. Administrative efficiency. When it comes to operationalthose of some scale, are not capable of efficiently providing forefficiency, the typical physician practice still has significantthemselves. The sequel to the PPM drama is likely to be moreroom for improvement. As a general rule, physicians wantsuccessful than the original – as long as PPMs adopt several keyto practice medicine, not manage the back office or maketactics to make PPM ventures succeed.decisions regarding revenue-cycle management, purchasing,and other tasks that are traditionally the purview of manage-Why PPMs Make Sensement executives.There are several fundamental gaps in the capabilities ofTwo decades later these needs have grown more acute. Thetraditional physician offices that PPMs fill (see Figure 2 for annumber, complexity and capital intensity of electronic front-example of PPMs’ value proposition):office and back-office systems have grown exponentially.The number and complexity of capitated risk contracts have1. The ability to make capital investments. Today’s clini-expanded under the next wave of risk delegation. The adminis-cal and back-office environments are increasingly becomingtrative burden, regulatory requirements, patient billing, etc. haselectronic, a transition that demands capital investment,also increased.sophisticated software, and process-management systemsthat are anathema to professional services organizations inPerhaps most importantly, physicians’ attitudes about owner-general and doctor organizations in particular. In addition,ship and independence are changing. Whereas going into soloeffective management requires sophisticated data sharingprivate practice was traditionally the dream pursued by mostacross the value chain – independent physician practices simplymedical students, now most want jobs as salaried employees.do not have the wherewithal to manage data sharing well.In a recent poll of medical graduates, 75% of respondents saidthey preferred to work either in a group or hospital-affiliated2. Population-health and risk management. Traditional fee-practice.3 In large part, this evolution is a function of the exactfor-service arrangements incentivized physicians to maximizecomplexities of practice management that a PPM is designed toutilization. In the wake of healthcare reform, many specialtiesaddress. PPMs can take the hassle out of practicing medicine.will see increases in bundled payments and other models thatWith the supply of larger group practices increasing, PPMstransfer the financial risk to the provider. To succeed, physicianshould see increasing demand for their services.groups require the ability to negotiate sophisticated risk-sharingagreements with payers and the actuarial support to identifythe patient populations and trends that drive medical-cost infla-Complicationstion. They also need to learn and share the care-model innova-In the short term, accelerating hospital acquisition of physiciantions that drive lower healthcare costs and increase quality.groups could provide PPMs with real competition for groupaffiliation. However, we expect that, as hospital foundation3. Patient-acquisition sophistication. Patient decision mak-employment contracts come up for renewal, the penduluming is changing due to increased patient financial responsibilitywill swing in favor of physicians’ independence from hospitalsfor medical care and the increasing transparency of physician– as older physicians retire, productive, middle-aged physiciansquality. At the same time, e-marketing platforms for patientmay feel trapped and be more inclined to return to physiciancentric practices.3Source: Cejka SearchL.E.K. Consulting / Executive InsightsINSIGHTS @ WORKTMLEK.COM

EXECUTIVE INSIGHTSFigure 2The PPM Value PropositionHuman ResourcesManagementPractice Operations /Management ServicesCorporate/NetworkStructureAffiliate Support ServicesNetwork expansion/New clinic acquisition Physician group target identification and transactionsupport Site location and architectural services Space and equipment planning and procurementClinical Clinical protocols and best-practice sharingIT Development or evaluation and selection of all required ITsystems Revenue-cycle management EMR systems tailored to practice specialties Virtual practice/patient communications applicationsReimbursement Insurance contract review, analysis and (re)negotiation Coding analysis and fee schedule development Revenue-cycle management (claims, billing, collections)Commercial Comprehensive, diagnostic marketing assessment Customized marketing, media, and promotion plan toattract more patients, increase referrals, and increasenumber of insurance payers Marketing-material development, including website design,development, search engine optimization Referral-network development and capture program Patient-financing programsOther operations/management support Operational performance improvement Work-flow analysis and scheduling Financial reporting and best-practices benchmarking Clinical, administrative, and financial performancemeasurement and reporting Guidelines for implementation of new strategies Operational turnaround for distressed practicesCompensation andbenefits Wage, salary and benefit methodologies and employeeincentive plans Payroll processingAccounting and legalservices Federal, state and local certifications and licensures Compliance support and all necessary manuals, forms,policies and procedures Enhanced coverage and pricing for malpractice, health,life, and property & casualty insurance Cost containment and significant group-purchasingdiscount plans Staff planning, recruiting, and hiring Employee position descriptions and manuals Human resources administration and ERISA expertise Clinical and administrative education and trainingprogramsRecruitment, training,and employeemanagement Capital and coordination of/access to attractive financingfor equipment/space build-out Reduced capital risk and liabilitySource: Company websites, L.E.K. analysisThe second complicating factor is the participation of MCOs.United Healthcare recently acquired AppleCare MedicalWho Will WinManagement (49% stake); Memorial Healthcare IPA; WellMedWhile conditions currently favor the growth of PPMs,Medical Management (80% stake); non-clinical manage-tactics deployed by individual organizations will play a largement assets and personnel of Monarch HealthCare medicalrole in determining which organizations succeed and whichgroup; and Aveta Inc. In another example, Humana purchasedones fail. From our work in and around the PPM space overConcentra and Metropolitan Health Networks and has publiclythe last two decades, L.E.K. Consulting has identified a numberstated its intentions to continue to acquire providers. With theof best practices and detailed tactics for PPM success; the mostimplementation of mandatory medical loss ratios, profit po-important include:tential has shifted to the provider side and payers will continuePage 4to be aggressive bidders for multispecialty groups with strong1) “What have you done for me?” A strong physician-Medicare share. How successful MCOs will be at extending ac-group value proposition (which is clearly and frequentlyquired expertise to new markets remains to be seen. While thecommunicated).acquired groups have compelling capabilities, potential providerThe foundation of a winning partnership depends on thepartners will need strong economic incentive to overcome theirphysicians’ belief that they are far better off than they woulddiscomfort with payer partners.be independently. Back-office administrative effi

Case Study When Pacific Physician Services Inc. (PPSI), a long-term L.E.K. Consulting client, approached us in late 1994 to analyze their poor performance acquir-ing groups, the answer to their problem was price discipline. By refusing to pay above the fundamen-tal cash-flow value of the business, PPSI was never competitive. Faced with the conundrum of paying value-destroying multiples to meet .