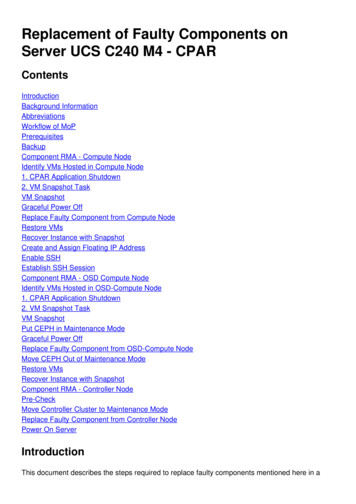

Transcription

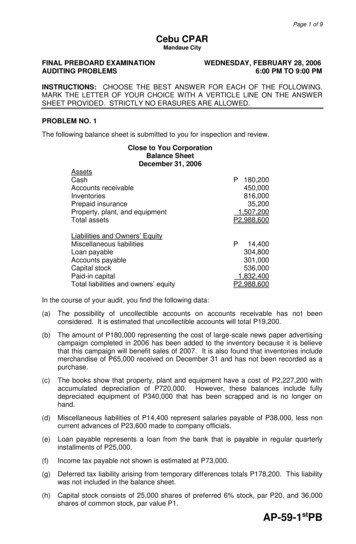

Page 1 of 9Cebu CPARMandaue CityFINAL PREBOARD EXAMINATIONAUDITING PROBLEMSWEDNESDAY, FEBRUARY 28, 20066:00 PM TO 9:00 PMINSTRUCTIONS: CHOOSE THE BEST ANSWER FOR EACH OF THE FOLLOWING.MARK THE LETTER OF YOUR CHOICE WITH A VERTICLE LINE ON THE ANSWERSHEET PROVIDED. STRICTLY NO ERASURES ARE ALLOWED.PROBLEM NO. 1The following balance sheet is submitted to you for inspection and review.Close to You CorporationBalance SheetDecember 31, 2006AssetsCashAccounts receivableInventoriesPrepaid insuranceProperty, plant, and equipmentTotal assetsLiabilities and Owners’ EquityMiscellaneous liabilitiesLoan payableAccounts payableCapital stockPaid-in capitalTotal liabilities and owners’ equityP 400304,800301,000536,0001,832,400P2,988,600In the course of your audit, you find the following data:(a)The possibility of uncollectible accounts on accounts receivable has not beenconsidered. It is estimated that uncollectible accounts will total P19,200.(b)The amount of P180,000 representing the cost of large-scale news paper advertisingcampaign completed in 2006 has been added to the inventory because it is believethat this campaign will benefit sales of 2007. It is also found that inventories includemerchandise of P65,000 received on December 31 and has not been recorded as apurchase.(c)The books show that property, plant and equipment have a cost of P2,227,200 withaccumulated depreciation of P720,000. However, these balances include fullydepreciated equipment of P340,000 that has been scrapped and is no longer onhand.(d)Miscellaneous liabilities of P14,400 represent salaries payable of P38,000, less noncurrent advances of P23,600 made to company officials.(e)Loan payable represents a loan from the bank that is payable in regular quarterlyinstallments of P25,000.(f)Income tax payable not shown is estimated at P73,000.(g)Deferred tax liability arising from temporary differences totals P178,200. This liabilitywas not included in the balance sheet.(h)Capital stock consists of 25,000 shares of preferred 6% stock, par P20, and 36,000shares of common stock, par value P1.AP-59-1stPB

Page 2 of 9(i)Capital stock have been issued for a total consideration of P1,134,400; the amountreceived in excess of the par values of the stock has been reported as paid-in capital.Net income and dividends were recorded in Paid-In Capital.QUESTIONS:Based on the above and the result of the audit, determine the adjusted amounts of thefollowing:1.2.3.4.5.6.7.8.9.Current assetsa. P1,347,200b. P1,217,200c. P1,282,200d. P1,462,200Noncurrent assetsa. P1,530,800b. P1,507,200c. P1,190,800d. P1,167,200Total assetsa. P2,878,000b. P2,473,000c. P2,789,400d. P2,813,000Current liabilitiesa. P512,000b. P577,000c. P504,000d. P600,600Noncurrent liabilitiesa. P383,000b. P204,800c. P406,600d. P433,000Total liabilitiesa. P983,600b. P895,000c. P716,800d. P960,000Contributed capitala. P634,400b. P1,134,400c. P598,400d. P536,000Owners’ equitya. P1,853,000b. P2,096,200c. P1,918,000d. P2,368,400Under PAS 1 Presentation of Financial Statements, which of the following should bedisclosed in the balance sheet?a. A statement of compliance with PFRSb. The measurement basis used for the revaluation of assets.c. Information about the key assumptions used in the depreciation of assets.d. The carrying amount of property, plant and equipment.10. If you have no reservations concerning the fairness of the client’s financialstatements, then you should issue a (an)a. Unqualified opinion.c. Disclaimer of opinion.b. Qualified opinion.d. Adverse opinion.PROBLEM NO. 2Your audit of the Weygandt Corporation disclosed that the company owned the followingsecurities on December 31, 2005:Trading securities:SecurityCrosswind Corp.Fortune, Inc.10% , P200,000 face value , Coastwise bonds(interest payable every Jan. 1 and Jul. ble-for-sale securities:SecurityUltimate ProductsFinite Corp.GUTS, ,280,000P8,560,000AP-59-1stPB

Page 3 of 9Held to maturity:Cost12%, 2,000,000 face value, Innovator bonds (interestpayable annually every Dec. 31)Book valueP1,900,000 P1,926,000During 2006, the following transactions occurred:Jan. 1Receive interest on the Coastwise bonds.Mar. 1Sold 8,000 shares of Fortune, Inc. stock for P152,000.May 15Sold 3,200 shares of GUTS, Inc. for P15 per share.July 1Received interest on the Coastwise bonds.Dec. 31Received interest on the Innovator bonds.31Transferred the Innovator bonds to the available-for-sale portfolio. Thebonds were selling at 101 on this date. The bonds were purchased onJanuary 2, 2005. The discount was amortized using the effective interestmethod.The market values of the stocks and bonds on December 31, 2006, are as follows:Crosswind Corp.Fortune, Inc.10% Coastwise bondsUltimate ProductsFinite Corp.GUTS, Inc.P22 per shareP15 per shareP151,200P42 per shareP28 per shareP18 per shareQUESTIONS:Based on the above and the result of your audit, determine the following:11. Gain or loss on sale of 8,000 Fortune, Inc. shares on March 1, 2006a. P8,000 lossb. P64,000 lossc. P8,000 gaind. P64,000 gain12. Realized gain or loss on sale of 3,200 GUTS, Inc. shares on May 15, 2006a. P9,600 lossb. P3,200 lossc. P9,600 gaind. P3,200 gain13. Total interest income for the year 2006?a. P260,000b. P289,640c. P251,120d. P286,00014. The amount that should be reported as unrealized gain in the statement of changes inequity regarding transfer of Innovator bonds to available-for-sale?a. P94,000b. P123,640c. P64,360d. P015. Carrying value of Trading Securities and Available-for-sale securities as of December31, 2006 should beTrading securities Available-for-sale securitiesa.P482,400P11,466,400b.P602,400P 0PROBLEM NO. 3The property, plant and equipment section of Warfield Corporation’s balance sheet atDecember 31, 2005 included the following items:LandLand improvementsBuildingsMachinery and equipmentP 600,000280,0002,200,0001,920,000AP-59-1stPB

Page 4 of 9The following transactions occurred during 2006:a)A tract of land was acquired for P300,000. As of December 31, the company has notdetermined its future use.b)A plant facility consisting of land and building was acquired from Heneral Company inexchange for 40,000 shares of Warfield’s common stock. On the date of acquisition,Warfield’s stock had a closing market price of P37 per share on the Philippine StockExchange. The plant facility was carried on Heneral’s books at P220,000 for landand P640,000 for the building on the date of exchange. Current appraised values forland and building, respectively, are P460,000 and P1,380,000.c)On May 1, 2006, items of machinery and equipment were purchased at a total cost ofP896,000, inclusive of 12% VAT. Additional costs of P26,000 for freight and P52,000for installation were incurred.d)Expenditures totaling P190,000 were made for new parking lots, streets andsidewalks at the corporation’s various plant locations. These expenditures had anestimated life of 15 years.e)A machine costing P160,000 on January 1, 1998, was scrapped on June 30, 2006.Double-declining-balance depreciation has been recorded on the basis of a 10-yearuseful life.f)A machine was sold for P40,000 on July 1, 2006. Original cost of the machine wasP88,000 on January 1, 2003, and it was depreciated on a straight-line basis over anestimated useful life of 7 years and a salvage value of P4,000.QUESTIONS:Based on the above and the result of your audit, determine the following:16. Adjusted balance of Land as of December 31, 2006a. P970,000b. P1,060,000c. P1,270,000d. P1,460,00017. Adjusted balance of Buildings as of December 31, 2006a. P3,580,000b. P3,500,000c. P2,200,000d. P3,310,00018. Adjusted balance of Machinery and Equipment as of December 31, 2006a. P2,646,000b. P2,550,000c. P2,472,000d. P2,710,00019. Loss on scrapping of machine on June 30, 2006a. P21,475b. P24,160c. P26,845d. P020. Loss on sale of machine on July 1, 2006a. P6,000b. P4,000c. P18,000d. P0PROBLEM NO. 4In 2001, Kieso Corporation acquired a silver mine in Benguet. Because the mine islocated deep in the Benguet mountains, Kieso was able to acquire the mine for the lowprice of P50,000. In 2002, Kieso constructed a road to the silver mine costing P5,000,000.Improvements to the mine made in 2002 cost P750,000. Because of the improvements tothe mine and the surrounding land, it is estimated that the mine can be sold for P600,000when the mining activities are complete.During 2003, five buildings were constructed near the mine site to house the mine workersand their families. The total cost of the five buildings was P1,500,000. Estimated residualvalue is P250,000. In 2001, geologists estimated 4 million tons of silver ore could beremoved from the mine for refining. During 2004, the first year of operations, only 5,000tons of silver ore were removed from the mine. However, in 2005, workers mined 1 milliontons of silver. During that same year, geologists discovered that the mine contained 3million tons of silver ore in addition to the original 4 million tons. Improvements ofstAP-59-1 PB

Page 5 of 9P275,000 were made to the mine early in 2005 to facilitate the removal of the additionalsilver. Early in 2005, an additional building was constructed at a cost of P225,000 tohouse the additional workers needed to excavate the added silver. This building is notexpected to have any residual value.In 2006, 2.5 million tons of silver were mined and costs of P1,100,000 were incurred at thebeginning of the year for improvements to the mine.QUESTIONS:Based on the above and the result of your audit, determine the following: (Round offdepletion and depreciation rates to two decimal places)21. Depletion for 2004a. P6,300b. P6,500c. P7,250d. P5,55022. Depletion for 2005a. P1,300,000b. P1,820,000c. P780,000d. P870,00023. Depreciation for 2005a. P250,000b. P490,000c. P180,000d. P210,00024. Depletion for 2006a. P1,950,000c. P2,425,000d. P2,275,000c. P1,225,000d. P450,000b. P2,150,00025. Depreciation for 2006a. P525,000b. P625,000PROBLEM NO. 5You gathered the following information related to the Patents account of the Lady HanCookie Corporation in connection with your audit of the company’s financial statementsfor the year 2006.In 2005, Lady Han developed a new machine that reduces the time required to insert thefortunes into its fortune cookies. Because the process is considered very valuable to thefortune cookie industry, Lady Han patented the machine. The following expenses wereincurred in developing and patenting the machine:Research and development laboratory expensesMetal used in the construction of the machineBlueprints used to design the machineLegal expenses to obtain patentWages paid for the employees’ work on the research, development, andbuilding of the machine (60% of the time was spent in actually buildingthe machine)Expense of drawing required by the patent office to be submitted with thepatent applicationFees paid to the government patent office to process 068,000100,000During 2006, Lady Han paid P150,000 in legal fees to successfully defend the patentagainst an infringement suit by Cookie Monster Corporation.It is the company’s policy to take full year amortization in the year of acquisition.QUESTIONS:Based on the above and the result of your audit, determine the following:26. Cost of patenta. P580,000b. P1,128,000c. P648,000d. P 798,000AP-59-1stPB

Page 6 of 927. Cost of machinea. P1,236,000b. P1,040,000c. P1,648,000d. P1,168,00028. Amount that should charged to expense when incurred in connection with thedevelopment of the patented machinea. P1,480,000b. P1,608,000c. P1,000,000d. P029. Carrying amount of patent as of December 31, 2006a. P522,000b. P1,015,200c. P583,200d. P 837,90030. The most effective means for the auditor to determine whether a recorded intangibleasset possesses the characteristics of an asset is toa. Analyze research and development expenditures to determine that only thoseexpenditures possessing future economic benefit have been capitalized.b. Vouch the purchase by reference to underlying documentation.c. Inquire as to the status of patent applications.d. Evaluate the future revenue-producing capacity of the intangible asset.PROBLEM NO. 6Lady Choi Corporation manufactures television components and sells them with 6-monthwarranty under which defective components will be replaced without charge. OnDecember 31, 2005, Estimated Liability for Product Warranty had a balance of P765,000.By June 30, 2006, this balance had been reduced to P120,375 by debits for estimated netcost of components returned that had been sold in 2005.The company started out in 2006 expecting 8% of the peso volume of sales to be returned.However, due to the introduction of new models during the year, this estimated percentageof returns was increased to 10% on May 1. It is assumed that no components sold duringa given month are returned in that month. Each component is stamped with a date at timeof sale so that the warranty may be properly administered. The following table ofpercentages indicates the like pattern of sales return during the 6-month period of thewarranty, starting with the month following the sale of components.Month Following SaleFirstSecondThirdFourth through sixth – 10% each monthPercentage of TotalReturns Expected20%302030100%Gross sales of components were as follows for the first 6 months of 000The company’s warranty also covers the payment of freight cost on defective componentsreturned and on the new components sent out as replacements. This freight cost runsapproximately 10% of the sales price of the components returned. The manufacturing costof the

The following balance sheet is submitted to you for inspection and review. Close to You Corporation Balance Sheet December 31, 2006 Assets Cash P 180,200 Accounts receivable 450,000 Inventories 816,000 Prepaid insurance 35,200 Property, plant, and equipment 1,507,200 Total assets P2,988,600 Liabilities and Owners’ Equity Miscellaneous liabilities P 14,400 Loan payable 304,800 Accounts .