Transcription

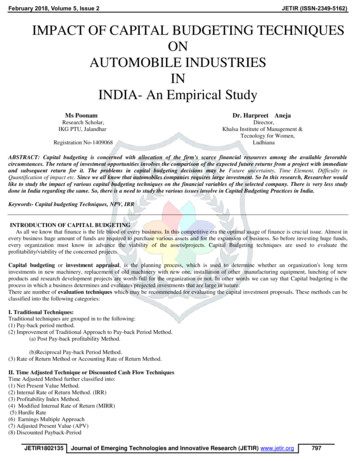

Volume 8, Issue 2 February 2018OklahomaEconomic ReportTMNews and analysis of Oklahoma’s economyA publication of the Office of the State Treasurer Treasurer Ken Miller, Ph.D.An environment for growthOne of the primary responsibilitiesof any state government is creatingand maintaining an environmentconducive to business and job growth.It’s a component of stategovernment’s key purpose –improving the quality of life of itscitizens.In addition to providing an educatedand healthy workforce, safeneighborhoods and an efficienttransportation system, recruitment isnecessary due to competition amongthe states.InsideNumbers tell the storyGovernor Mary Fallin has taken anactive role inSeasonallyluring businessesadjusted data fromto bring qualityGovernor Marythe Oklahomajobs to Oklahoma.Fallin has takenEmployment SecurityCommission showIn a guestan active role inbetween Januarycommentary inluring businesses to that2017 and Januarythis edition ofbring quality jobs to 2018 Oklahomathe Oklahomaadded more thanEconomic Report,Oklahoma.”25,000 jobs. AlsoGovernor Fallinduring that time, theoutlines specificstate jobless rate decreased by onesuccesses over the past year andongoing efforts to continue thosesuccesses going forward.SEE GROWTH PAGE 3“Growing the Oklahoma Economy Guest commentary byGovernor Mary Fallin Oklahoma STABLE Programcoming soon Year-to-date GeneralRevenue tops estimate February reports reflectincreasing growth rate inGross Receipts to the Treasury Oklahoma unemploymentrate holds steady in JanuaryCountieswith publiclyannounced newand expandingcompanies in2017 Economic IndicatorsEditorTim Allen, Deputy Treasurer forCommunications and ProgramAdministrationSource: New and Expanding Companies Annual Report 2017, Oklahoma Department of CommerceState Capitol Building, Room 217 Oklahoma City, OK 73105 (405) 521-3191 www.treasurer.ok.gov

Oklahoma Economic ReportTMFebruary 2018Guest CommentaryBy Governor Mary FallinPro-business policies attracting widevariety of businesses, diversifyingOklahoma’s economyIt’s spring, and in Oklahomathere is a feeling of energy andexcitement.We are a growing state. Latest U.S.Census Bureau reports show thatfrom 2010 to 2017, Oklahomasaw a population gain of 179,266people. The 4.8 percent growthmade Oklahoma No. 25 in thenation for percentage growthand brought the population to3,930,864 people in July 2017.We can see that growth in manyparts of the state, with theconstruction of new apartmentsand houses along with thedevelopment of new businessesand entertainment venues.The state’s energy sector isimproving, and our state’s businessclimate is healthy. Our pro-businesspolicies are attracting a widevariety of jobs and businesses tothe state, which are diversifying oureconomy.Oklahoma offers an incredibly lowcost of business with the lowest taxburden in the country.We have one of the lowest costs ofliving in the country; our electricpower costs are the second-lowestin the nation. At the same time,Oklahoma offers a great quality oflife.“My No. 1 priority asgovernor is to createmore jobs and attractmore investmentin order to build amore prosperousOklahoma.”My No. 1 priority as governor is tocreate more jobs and attract moreinvestment in order to build amore prosperous Oklahoma. Eventhough my term is winding down,I continue to pursue pro-growthpolicies that will allow Oklahoma toremain one of the best states to dobusiness.So far this year, we’ve had somemajor developments concerningwww.treasurer.ok.gov Page 2companies coming to Oklahoma orexpanding in our state: Kratos Defense & SecuritySolutions: The Californiabased company is openingadministrative and engineeringoffices as well as productionfacilities in Oklahoma City.The offices and productionsfacilities will accommodateexpected increased demand forhigh-performance, jet-poweredunmanned aerial tactical andtarget drone systems. Thecompany hopes to be in the newfacility by the end of the year, andto have 350 to 500 employeesworking there within five years; A similar company is looking veryseriously at moving its operationsto Oklahoma City; A major consumer goodsmanufacturing company fromSEE FALLIN PAGE 3

Oklahoma Economic ReportTMFebruary 2018FallinFROM PAGE 2Europe plans to break groundon a factory in northeasternOklahoma later this month. Thecompany plans to employ about300 workers. About 500 workerscould be needed for the facility’sconstruction, which could take 18months. Google will spend 600 millionto expand its data center innortheastern Oklahoma. This willbring Google’s total investmentat its Oklahoma campus top morethan 2.5 billion. The data centeropened in 2011, employs morethan 400, and is Google’s secondlargest data center in the world.So 2018 is off to a great start.Last year, new and existingcompanies across the stateannounced a total of more than 6billion in new investments.Of the 83 public announcementsmade, 23 were from newcompanies moving into the statein 2017. The investments areexpected to eventually lead to 3,500new jobs.The previous year, in 2016, 66announcements were madestatewide, which totaled 2.2billion in investments with 14coming from companies newto Oklahoma. More than 5,200jobs are expected from thoseannouncements.This information, from theOklahoma Department ofCommerce, only deals withcompanies making publicannouncements. It does not includeretail-only companies, bank branchoffices or hospitals.Government in and of itself doesnot create jobs, But it shouldprovide the right environmentto grow the economy through afree-market system, unfettered byburdensome regulations.With the right policy decisions,we can boost Oklahoma’s forwardmomentum and create more jobsand career opportunities for ourcitizens.GrowthFROM PAGE 1half of one percentage point, from 4.6percent to 4.1 percent.With 1.77 million people listed asemployed in Oklahoma as of January2018, the number of those withoutjobs is slightly more than 76,000. Thisreflects a decrease in unemploymentof almost 8,500 people over the year.DiversificationOklahoma has long been knownas a state with a commodity-basedeconomy.The largest component of the state’seconomy is the oil and gas industry,while agriculture plays a key role.However, not to be ignored is theimpact of federal military-related jobs.The commerce department’s list oftop Oklahoma employers ranks theDepartment of Defense as number onewith 68,690 workers spread acrossfive locations.The state’s top private-sectoremployer is Wal-Mart Associates Inc.with some 34,000 workers across thestate.Integris Health, Inc. is ranked numberthree with approximately 9,000 jobs.Chickasaw Nation Enterprises, withits gaming and non-governmentbusiness operations, is in fourth placewith 7,500 employees according tothe report.Foreign-owned companies alsoprovide numerous jobs in the state.The report lists 397 foreign-ownedcompanies from 11 countries asemploying some 39,500 Oklahomans.Mexican-owned companies employthe largest number at 6,846.Canadian-owned companies are themost numerous at 66, followed by theUnited Kingdom with 64.Opinions and positions cited in the Oklahoma Economic ReportTM are not necessarily those of Oklahoma State Treasurer Ken Miller orhis staff, with the exception of the Treasurer’s Commentary, which of course, is the viewpoint of the treasurer.www.treasurer.ok.gov Page 3

Oklahoma Economic ReportOklahoma STABLEPlan coming soonThis spring, the state treasurer’soffice is planning to launch theOklahoma STABLE Plan, thestate’s official ABLE program.ABLE, which stands forAchieving a Better LifeExperience, was createdby Congress as a way togive people with disabilitieseasy access to savings andinvestment opportunitieswithout jeopardizing state andfederal benefit assistance.The federal program,established under section 529Aof the federal tax code, allowsqualified individuals to save upto 15,000 per year for qualifieddisability expenses.For the past year, since stateenabling legislation (HouseBill 2821) took effect, thetreasurer’s office has beenworking with experts in the fieldto put together Oklahoma’splan.Year to date General Revenuetops estimateEight months into Fiscal Year 2018,allocations to the General RevenueFund (GRF), the state’s mainoperating account, are 3.6 billion andexceed the estimate by 120.4 million,or 3.5 percent, according to theOffice of Management and EnterpriseServices.Sales tax allocations to the GRF total 1.4 billion and top the estimate by 43.9 million, or 3.2 percent.Net income tax collections, acombination of individual andcorporate income taxes, havecontributed 1.4 billion to GeneralRevenue through February, toppingthe estimate by 198.2 million, or 16.8percent.Other sources, a combination ofsmaller miscellaneous revenuestreams, contributed 464.3 million tothe GRF. That is 72.7 million, or 13.5percent less than the estimate.Gross production taxes on oil andnatural gas provided 185.4 million tothe GRF, below the estimate by 41.7million, or 18.4 percent.The STABLE program was foundto have the most responsiveand flexible program, alongwith low fees charged toparticipants.Motor vehicle taxes brought 129.4million to the GRF and are 7.2million, or 5.3 percent, less than theestimate.The GRF receives about 50 percent ofstate Gross Receipts to the Treasuryduring the fiscal year. During thefirst eight months of FY-18, the GRFhas received 46.1 percent of the 7.7billion of total gross receipts. Fiscal Year-to-Date General Revenue Estimate vs. Actual 4,000Oklahoma’s program will beoperated in partnership withthe Ohio State Treasurer’sOffice. 3.5% 3,000(in millions)Ohio’s STABLE program waschosen following a Request forProposals from ABLE providers.A total of five responses werereceived.February 2018TMEstimateActual 2,000 16.8% 3.2% 1,000-13.5%-18.4% 0Total GRFIncomeGross Prod.Source: Office of Management and Enterprise Serviceswww.treasurer.ok.gov Page 4-5.3%SalesMotor Veh.Other

Oklahoma Economic ReportJanuary GrossReceipts to theTreasury & GeneralRevenue comparedJanuary Gross Receipts to theTreasury totalled 1.1 billion,while the General RevenueFund (GRF), as reported by theOffice of Management andEnterprise Services, received 596 million, or 52.3%, of thetotal.The GRF received between32.7% and 54.1% of monthlygross receipts during the past12 months.February 2018TMFebruary reports reflectincreasing growth rate in GrossReceipts to the TreasuryFebruary Gross Receipts to theof growth has risen from 0.5 percentTreasury grew by 15.5 percent fromin January 2017 to this month’s 15.5the same month ofpercent.the prior year and“The trend lineTogether withreflect an increasingshows increasinggrowth rate inother economicgrowth in Oklahomacollections overindicators,itgross collections,”the past year, Stateappears the state’s Miller said.Treasurer Ken Millerannounced today.economy is gaining “Together with other“From January gross receipts,the GRF received:momentum.”For 13 of the past14 months, monthlygross receipts havemomentum.”increased over the prior year. Individual income tax: 70.6%During that time, the monthly rateeconomic indicators,it appears the state’seconomy is gainingSEE REVENUE PAGE 6 Corporate income tax: None Sales tax: 46% Gross production-Gas: 72.2%Monthly Gross Receipts vs. Prior Year 75 Gross production-Oil: 14.9% Motor vehicle tax: 26.8% Other sources: 48.8%January GRF allocationsexceed the estimate by 8.6percent. Fiscal-year-to-datecollections are ahead of theestimate by 3.9 percent.December insurance premiumtaxes totaled 152,722, anincrease of 12,828, or 9.2%,from the prior year.Tribal gaming fees generated 12.1 million during the month,up by 1.1 million, or 9.7%, fromJanuary 2017. 50 25 0- 25Income Tax- 507r-1Ma7r-1ApPRELIMINARYIncome TaxGross ProductionSales Tax (1)Motor VehicleOther Sources (2)TOTAL REVENUEGross Production-17yMa7n-1Ju7l-1JuSales TaxFebruary-17238.137.9323.953.5106.2759.5Dollar change (in millions) from prior yearwww.treasurer.ok.gov Page 5-17gAuMotor 0.5877.3-17vNoOther-17cDe8n-1Ja18b-FeVariance From Prior 117.815.5%Source: Office of the State Treasurer

Oklahoma Economic ReportTMFebruary 2018RevenueFROM PAGE 5during 2017. The additional revenuecomes primarily from changes in salestax exemptions and gross productiontax incentives.February gross receipts showincreases in collections fromindividual income, sales, and grossproduction taxes.The new revenue accounts for 3.6percent of February gross receipts.Decreases are seen in corporateincome and motor vehicle taxcollections. The bottom line for themonth is up by 117.8 million.Out of 6.8 billion in gross collectionssince August, 172.6 million, or2.5 percent, has resulted from lawchanges from last year.Collections from the past 12 monthscompared to the previous 12 monthsshow growth in every major revenuestream except for corporate incometax.Other indicatorsThe Oklahoma Business ConditionsIndex has topped growth neutral forseven consecutive months.Total 12-month collections are up by 929.3 million, or 8.6 percent.New revenue collectionsThe February index was set at 60.5, upfrom 57.8 in January.The tax commission attributes 31.7million in February to new revenueresulting from legislation enactedNumbers above 50 indicateanticipated economic growth duringthe next three to six months.Total Gross Production Tax Collections 70Gross income tax collections, acombination of individual andcorporate income taxes, generated 273.7 million, an increase of 35.7million, or 15 percent, from theprevious February.Individual income tax collections forthe month are 268.5 million, up by 36.1 million, or 15.6 percent, fromthe prior year.Corporate collections are 5.2 million,a decrease of 474,000, or 8.3 percent.Sales tax collections, includingremittances on behalf of cities andcounties, total 363.1 million inFebruary. That is 39.2 million, or12.1 percent, more than February2017.Compared to January reports, grossproduction collections are up by 6million, or 9.8 percent. 55(in millions)February gross collections total 877.3 million, up 117.8 million, or15.5 percent, from February 2017.Gross production taxes on oil andnatural gas generated 66.8 million inFebruary, an increase of 28.9 million,or 76.1 percent, from last February.March 2016 – February 2018Motor vehicle taxes produced 53.2million, down by 280,000, or 0.5percent, from the same month of2017. 40 25Current 12 months 10MarFebruary collectionsAprMay(Total receipts in millions.)JunJulPrior 12 monthsAugSepOctNovDecJanFebSource: Oklahoma Tax Commissionwww.treasurer.ok.gov Page 6Other collections, consisting ofabout 60 different sources includinguse taxes, along with taxes on fuel,tobacco, and alcoholic beverages,SEE REVENUE PAGE 7

Oklahoma Economic ReportFebruary 2018TMRevenueFROM PAGE 6produced 120.5 million during themonth. That is 14.4 million, or 13.5percent, more than last February.Twelve month collectionsGross revenue totals 11.7 billionfrom the past 12 months. That is 929.3 million, or 8.6 percent, morethan collections from the previous 12months.Sales taxes for the 12 monthsgenerated 4.5 billion, an increase of 324.1 million, or 7.7 percent, fromthe prior period.Oil and gas gross production taxcollections brought in 593.8 millionduring the 12 months, up by 226.5million, or 61.7 percent, from theprevious period.timely and broad view of the state’smacro economy.It is provided in conjunction withthe General Revenue Fund allocationreport from the Office of Managementand Enterprise Services, whichprovides important information tostate agencies for budgetary planningpurposes.Motor vehicle collections totalThe General Revenue Fund receives 759.4 million for the period. This isless than half of the state’s grossanincreaseof 19.4million,or2.6receiptsOKLAHOMAEMPLOYMENT S EwithC U theR IremainderT Y C OpaidM MinI S S IGross income taxes generated 4.1percent, from the trailing period.rebates and refunds, remitted to citiesbillion for the period, reflecting anoff-theincrease of 212.2 million, or 5.4O K L A H O M A E M P L O Y M E NandT counties,S E C U andR I placedT Y CintoO MM I S S IOther sources generated 1.7 billion,topearmarkstootherstatefunds.percent, from the prior 12 months. Bringing Oklahoma’s Labor Market to Life!up by 147.2 million, or 9.4 percent,the previous12,year.Individual income tax collections total FORfromRELEASE:O K L A HMarchO M A 2018E M P BringingL O Y M E Oklahoma’sN T S E C ULaborR I T MarketY C OtoM Life!M I S S I 3.7 billion, up by 227.2 million, orAbout Gross Receipts to theLearn more6.5 percent, from the prior 12 months.FOR RELEASE: March 12, 2018TreasuryOKLAHOMAEMPLOYMENT REPORT – January 2018 Bringing Oklahoma’sLaborto Life!Read the fullGrossMarketReceiptsCorporate collections are 419.8Since March 2011, the Office ofmonthlyreportandviewmillion for the period, a decrease of OKLAHOMA EMPLOYMENT REPORT – January 2018FORtheRELEASE:March 12,has2018State Treasurerissuedunchangedin Januaryadditionalcharts and graphsat 15 million, or 3.5 percent, over the Oklahoma’s unemployment ratethe monthly Gross Receipts to thehttps://go.usa.gov/xnuJS.previous ate held steady at 4.1 percent in January, while theTreasuryreport,unemploymentwhich providesaOklahoma’srate unchanged in JanuaryEconomic Research & AnalysisEconomic Research & AnalysisEconomic Research & AnalysisOKLAHOMA EMPLOYMENT REPORT – January 2018unemployment rate was also 4.1 percent for the fourth consecutive month in January. The state’s seasadjusted unemployment rate was down by 0.5 percentage point compared to January 2017.Oklahoma’s seasonally adjusted unemployment rate held steady at 4.1 percent in January, while theunemployment rate was also 4.1 percent for the fourth consecutive month in January. The state’s seasadjusted unemployment rate was down by 0.5 percentage point compared to January 2017.Oklahoma’s unemployment rate unchanged in JanuaryOklahoma unemploymentrate holds steady in JanuaryUnemp.Labor lyrate held steadyat 4.1 percentin January, while therate*January2018 adjusted unemploymentwas also 4.1 percent for the fourth consecutive month in January. The state’s seasAt 4.1 percent, Oklahoma’s seasonally- unemployment sted unemployment rate wasdown by 0.5percentagepointcompared toUnemployment*January 2017.Laborforce*Employment*adjusted unemployment rate inJanuary remained unchanged sinceSeptember of last year, according tofigures released by the OklahomaEmployment Security Commission.State jobless numbers improved byfive-tenths of a percentage point overthe year.The U.S. jobless rate was also setat 4.1 percent in January equalto Oklahoma’s rate for a fourthconsecutive ntReportrate*United StatesJanuary 2018Oklahoma4.1%* Data adjustedfor seasonal factorsUnited ,00076,220161,115,000Labor Labor ,220OKLAHOMA Dec '17161,115,0001,842,333Labor 5,5666,684,00076,220Unemployment*76,235JanOct 8for seasonal factors*JanuaryData 84.1%4.1%Unemp.4.1%rate** Data adjusted for seasonal factorsNov '174.1%Jan '184.1%Oct '174.1%Dec '174.1%Unemp.Sept '174.1%

three with approximately 9,000 jobs. Chickasaw Nation Enterprises, with its gaming and non-government business operations, is in fourth place with 7,500 employees according to the report. Foreign-owned companies also provide numerous jobs in the state. The report lists 397 foreign-owned