Transcription

The Monthly Magazine for LGFCU MembersFebruary 2013Volume 11 Issue 4W!etsaha t a Ws h in gwaebyaou mysrainydaewhtthE igow ndyenmo Managing your insurance costsMoney lessons that grow with you

President’s PointMaurice R. Smith, 20-year memberFebruary 2013Volume 11 Issue 43 EXPERT ADVICESherrie Krizic4 MONEY MATTERSManaging yourinsurance costs5 EXTRA CREDITMoney lessons thatgrow with you6 TAKING CASH FROMYOUR TRASH:Eight ways you may bethrowing money away9 MEMBER PROFILEAriane and Mia-Sophie,Durham10 YOUR RATESAim is a monthly publication of Local Government Federal Credit Union. The mission of thisperiodical is to provide financial education forCredit Union members and their families.Editor:Erica Hintonerica.hinton@lgfcu.orgDesigner:Edward Kensickiedward.kensicki@lgfcu.orgThe Credit Union is a not-for-profit cooperativeorganized for the benefit of providing affordablefinancial services to members.This is big news. Really BIG news! LGFCU announces the releaseof its very first mobile app for the iPad, iPod and iPhone. It’s called“Compass by LGFCU,” and is designed to work in concert with theLGFCU desktop version of Compass. Even better this highlyrated app is available at the iTunes store free of charge.Compass is a personal financial management tool for LGFCUmembers. It’s an interactive, self-help guide that assists memberswith budgeting, money management and financial planning. One ofthe best features of Compass is the ability to see all of your accountsin one place—even accounts from other institutions. Compassshows members where their money goes, and helps members fulfilltheir financial dreams.In order to use the Compass by LGFCU app, you must be aregistered Compass user through the desktop version. Once youregister your mobile device through the desktop version anddownload the app, your account information automatically showson your phone. Getting started is easy and takes just a few minutes.Thousands of members now use the desktop version of Compass,and the app has more exciting features. If you haven’t usedCompass yet, you are in for an eye-opening experience. And thebest is yet to come, as we continue to develop enhancements.We are eager to make Compass by LGFCU available to members.It gives you a powerful way to make the most of your money.P.S. Android users stay tuned. Your app is on the way.Board of Directors:Al Richardson, Chairman;Willie Best, Vice Chairman;Ruth Barnes, Treasurer;Jeanne Erwin, Secretary;David Dear; Lin Jones; Paul Miller;Aaron Noble; Frances Efird, Emeritus ;Jack Scoville, EmeritusComments or suggestions about yourCredit Union?Credit Union financial services are providedthrough the branch/ATM network and ContactCenter of State Employees’ Credit Union.Write:LGFCU Administrative Office323 West Jones Street, Suite 600Raleigh, North Carolina 27603Call:919.755.0534 or800.344.4846 (Toll Free)Email:info@lgfcu.org/ To improve the lives of our members /Photography and Illustration Credits: L GFCU: Erica Hinton istockphoto.com: bigstock.com:

Expert AdviceSherrie Krizic, SVP, Financial PlanningEvery year, my employer reminds Ican make changes to my W-4. I’m notexactly sure what to look for, or when achange is needed. Can you shed some light on this?– R.L., Gastonia, N.C.When you accepted your current job,you completed a W-4 Form so youremployer would know how muchwithholding tax to take out of your paychecks.But have you reviewed it since? You shouldreview your W-4 status each year to make sureyou’re taking advantage of every withholdingexemption for which you qualify. If your statushas changed, ask your employer for a new formto make any changes. You should considermaking changes when one of the followinghave occurred:Addition to your familyA new child is a dependent, thus revising yourW-4 Form to include another allowance willreduce your withholding tax, resulting inlarger paychecks.Purchase of a homeMost likely, if you purchase a home, you will bepaying mortgage interest, which can be used asa deduction on your tax return, reducing yourtax liability. By reducing your withholding,no more is taken out of your paycheck thannecessary to cover your tax liability.Newly married or divorcedIf you plan on filing jointly with your newspouse, you should change your withholdingstatus from single to married. By doing this,your paycheck will have less withholding sinceyou will no longer be taxed on the higher singleperson tax rate. The result: a larger paycheck.If you’re recently divorced, you should updateyour W-4 Form to reflect your now-single statussince you no longer will be filing jointly. Thismeans more money withholding will be takenfrom your paychecks.Received a large refund last year or youowed moneyIf you received a large refund, adjust your W-4so less of your earnings are withheld. This way,the government will not hold your money untilthe refund is paid to you. Instead, put extramoney in a savings account so it can earninterest. If you owed a significant amount oftaxes last year, reduce your allowances so moremoney is taken out of your paychecks. Thenyou don’t have to write a big check when youfile your tax return.Send me your financial rgLGFCUAttention: Expert Advice323 West Jones Street, Suite 600Raleigh, NC 27603877.367.5428February 2013 3

Money MattersManaging your insurance costsBy Anthony Dickinson, Insurance Agent, 10-year LGFCU memberGet into a conversation with a good insuranceagent, and you may find it can be rather dauntingand lengthy. However, staying abreast of yourinsurance can help manage the cost of coveragewhile still maintaining solid protection. Here area few areas to cover in your next conversation.Make sure coverage fits your specific risk.If you cherish or are emotionally attached tosomething, you should carry insurance to protectit. On the contrary, if you have little care orworry about the loss of an item (i.e., an old car),consider carrying less coverage. You should alsoconsider your “need” for specific property. If youneed a particular item or property, acquire thebest insurance you can afford to protect it.Choose the correct deductibles.Review your finances and determine how muchyou could pay if you had two losses in the sameyear. Can you afford your deductible? Raisingyour deductible can be an excellent way to savemoney, but be aware it will usually offer very littlesavings when compared to moderate deductibles.Work with an agent you trust, and whoreturns your calls.It’s important you work with an agent and acompany that cares about you personally, and willreturn your call every time you leave a message.This should be followed without exception. If youdon’t receive a return call from your companyor agent, you can’t count on them to help youmanage your costs or settle your claim. A goodagent will want to help you.Bundle your insurance.The insurance industry is currently trendingtoward providing discounts for bundling homeand auto insurance. Not only does this offera financial advantage, but it also provides theconvenience of working with just one agent.Call your agent today, and make sure you areinsured properly for the best price!Anthony Dickinson has been a licensedinsurance agent for 10 years.He can be reached atanthony.dickinson@ncfbins.com.4 aim

Extra CreditMoney lessons that grow with youIt may be hard to imagine, but learning to makesmart choices with money while you’re still a kidwill give you such an advantage as you get older.In fact, it’s so important that the President of theUnited States created an advisory council, calledthe President’s Advisory Council on FinancialCapability, or PACFC, whose job is to figure outways to help Americans learn about financial,or money, topics.One of the council’s biggest priorities is kids.The goal is to help kids learn these importantmoney lessons early. In order to be a financiallyresponsible adult, you will need to understandlots of things about money, like the importanceof saving, how credit cards work, and keepingyourself safe from identity theft.The PACFC worked with educators, researchersand money experts to come up with the 20 thingskids need to know to grow up and live financiallysmart lives.When you visit the website, you’ll see the 20lessons are divided by age group (3-5 years, 6-10years, 11-13 years, 14-18 years, and ages 18 andup). The ideas start simple and get harder as yougrow older. Each lesson also has activities you cando alone, or with an adult to help you rememberwhat you’ve learned. By the time you reach thelast two lessons, you’ll be a financial pro, ready totake on adulthood with all the money smarts youneed to succeed.The website also includes two posters you candownload. One lists all 20 tips, and the otherincludes the tips with the activities that go alongwith them. Print them out and post them in yourroom or on your refrigerator. You might evenwant to ask your teacher if you can hang a posterin your classroom.It is never too early to become money-smart.Happy learning!How many of these lessons do you know?Find out by visiting the website theycreated, called Money As You Grow(www.moneyasyougrow.org), thatteaches these 20 important lessons.February 2013 5

W!etsaha t a Wu r in gpoebyayo u msyrainadweththE igow ndyenmoA few dollars here, a few dollars there you may never notice.But add up a few dollars here, there and everywhere, and you maybe pouring hundreds—or even thousands—down the drain each year.Let’s take a look at a few places where these little leaks are likely to occur

1Paying full-price for gadgets and accessoriesWhether it’s a protective case for your cellphone or a zester for your kitchen, there’s no need topay retail price. Do you really need that name-brand cellphone case for 35, or will the one for 10work just as well? Many lesser-known brands and versions do just as good a job for half the priceor less. Visit www.cnet.com for unbiased reviews of everything from appliances to electronics and their price points.2Not utilizing your phone’s data planSpeaking of your cellphone, see how much data you’re actually using. Check your phone’s datausage. According to Nielsen data, the average U.S. mobile subscriber doesn’t even come close tousing 2GB of data, but more like 600MB. However, many people cough out 40- 60 for datathey will never use. Monitor your plan and see if you are using all you’re paying for if not, bumpit down to lower your bill. If you’re worried about going over your allowed data usage, sign up fortext or email alerts.3Paying high prices for organic foodsYou can still go organic just make it generic. Many larger retailers, such as Wal-Mart, Costco,Kroger and Whole Foods, offer their own line of organic foods. Some cost even less than thenon-organic name brands. If your grocery store doesn’t have its own organic section, ask anemployee for the name of their organic store brand and a list of the items they carry.4Leaving your stuff in storageIf you have things in a storage unit, when is the last time you saw it? Are you holding ontoclothes and furniture you really have no use for in the foreseeable future? Sell valuables througha consignment shop, donate them to charity for a tax write-off or simply throw away the junk.Not only can you make some money, but you’ll save upwards of 50 a month.February 2013 7

5Regular visits to the dry cleanerThe Bureau of Labor Statistics figures that families spend an average of 475 a year on laundry anddry-cleaning services. While big stains on delicate clothes may warrant a trip to the dry cleaners, chancesare you can get out the little stains and wrinkles yourself. There are several at-home dry cleaningkits that are easy to use, cost between 10 and 20, and allow you to clean as many as 24 garments.6Renting your cable modemIf you rent your modem from the cable company, you are likely spending at least 4 a month, or 48 a year. That’s about the price of a new one you can buy yourself and use year after year. If youplan on staying with your cable service provider for at least another year, go online to sites likeAmazon and Newegg.7Carrying insurance from different providersBundle home and auto insurance for a better deal. Insure through LGFCU, and see an averagesavings of 343 a year. Visit www.lgfcu.org/insurance for more information. Also, check out theMoney Matters article on page 4 for more money-saving tips on insurance.8Leaving money in your FSAFlex Spending Accounts (FSAs) are a great idea, but many people leaveunspent funds, which you lose to your employer. According to theEmployers Council On Flexible Compensation, while 40 percent ofthose forfeiting FSA money lost at 1, more than 20 percent lostmore than 500. Use unspent funds at the end of year for a newpair of glasses or contact lenses, dental services, over-the-countermedications or something you may not think is eligible likesunscreen or acupuncture.While changing up one habit may not produce noticeablesavings, changing several could, meaning money goesin your pocket, not down the drain.8 aim

Member ProfileAriane and Mia-Sophie, 8- and 5-year membersDurham, NCAriane and Mia-Sophie are ahead of the game.At the ages of 8 and 6, respectively, they alreadyhave a good sense of money, thanks for theirparents who started their oldest off early and onthe right path. Ariane was featured in Aim at theage of 1. Let’s see how the family has progressed “We knew the costs of everything from educationto cars to clothes would be higher and higher asAriane grew up, so we started saving for her assoon as we could,” Ariane’s mother, Brigitte, saidback in 2005. “It’s not always a whole lot, but weput a little each month into her Fat Cat Account.By the time she’s old enough to handle her ownmoney when she’s a Zard, there’ll be a bit for herto get started.”Flash forward seven years and another daughterlater, and this family is right on track. “Our goalscould probably be better defined, but we’re drivenby being practical—we put away what we can,”says dad, Michael. “We have a monthly autodraft that delivers a small sum each pay periodto each of their Money Market Accounts. This isalso where we put 50 percent of gift monies thegirls receive.”When they’re not reading, dancing, hiking,swimming or doing gymnastics, these two loveto save. “They get the idea of interest, and thatsaving has a purpose,” says dad. “Whenever theyget some coins, or a couple dollars, some goes inthe bank, some in the UNICEF box and somemight be spent.”Ariane (right), now 9, with sister Mia-Sophie, 5 another LGFCU Fat Cat.Ariane, a Fat Catmember since age 1.They’re also grasping the concept of money andhow it works. “They know we need it and thatwe always seem to have it,” says mom. “We havethem make retail purchases, work a “budget”when on a family trip, or earn a few bucks doingodd jobs.”Great job, Ariane, Mia-Sophie, mom and dad!Hopefully, we can follow up with your again ina few years and see how you’re doing.Would you like to see a friend orfamily member featured here?Phone: 800.344.4846Email: editor@lgfcu.orgWe’d love to hear your Credit Union story!February 2013 9

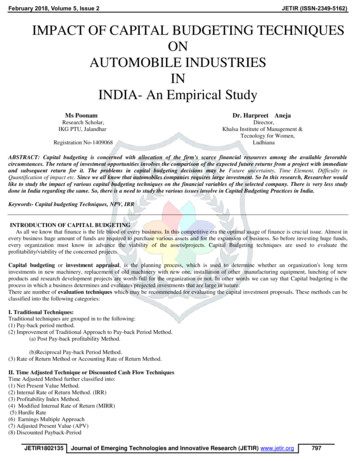

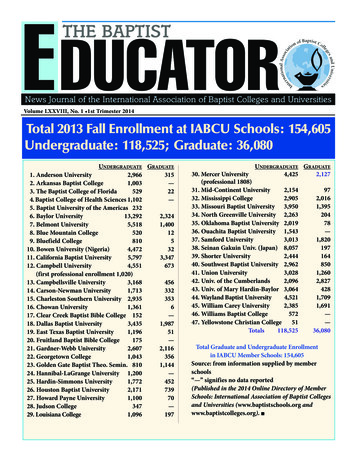

Your RatesLGFCU rates as of January 18, 2012Adjustable Rate Mortgages2-year ARM2-year ARM2-year ARM2-year ARM2-year ARM (First Time Homebuyer)5-year ARM5-year ARM5-year ARM (First Time Homebuyer)Green MortgagesDescriptionUp to 80% LTVLOW80.1–90% LTVMORTGAGE90.1–100% LTVRATES100.1–110% LTV100% LTVUp to 90% LTV90.1–100% LTV100% LTVMust meet ENERGY STAR ratingAdjustable Rate LoansHome Equity (1st mortgage w/ LGFCU)Home Equity (1st mortgage w/ other lender)Improved Property ( 50,000)PersonalSalary AdvanceVisa DescriptionUp to 90% LTVUp to 90% LTV10-yr max. term variableUnsec./Sec., Open/Closed-endOpen-end, 500 max.Grace periodPayD Rate4.75%5.50%9.75%10.75%12.00%—Fixed-Rate Loans10-, 15-, 20-year MortgageSecond MortgageGreen Second MortgageShare SecuredShare SecuredNew Vehicle (Special Rate)Used Vehicle 1New and Used Motorcycle 1New and Used Boat 1Recreational Vehicles (RV) 1ComputerDescription100% financing availableUp to 120 months, 50K max.Must meet ENERGY STAR ratingUp to 24 months25–48 monthsUp to 72 monthsUp to 72 monthsPayD RateDirect PayPlease inquire8.75%9.25%Please 5%8.25%7.75%8.25%7.75%8.25%6.50%7.00%APR : Annual Percentage RatePayD :Payroll DeductionLTV : Loan To ValueARM : Adjustable Rate MortgageNew up to 72 mos., Used up to 60 mos.New up to 72 mos., Used up to 60 mos.See www.lgfcu.org for termsUp to 36 months, 3,500 %4.25%4.26%4.75%4.83%5.75%5.83%5.75%5.83%Please inquireDOT : Deed of Trust hese rates are for new first mortgage loans and are subject to change daily. The rates for existingTadjustable-rate mortgage loans are subject to change at predetermined intervals and may be differentfrom the rates for new mortgages. Special financing for first time homebuyers (2- and 5-year ARM).Loan terms vary depending on model/year.1 Payroll Deduction payments provide substantial savings in processing costs for the Credit Union.We pass those savings on to members through lower loan rates.10 aimDirect Pay5.25%6.00%10.25%11.25%—9.75%

All rates, terms and conditions can vary and are subject to change.For additional information on any Credit Union accounts please visitwww.lgfcu.org, call your local branch or the Contact Center at 888.732.8562.ProductsRegular SharesFat Cat Shares ( 5 min. to open)Zard SharesHoliday SharesIRAsHealth Savings AccountCheckingMoney Market Shares6-month Share Term Certificate12-month Share Term Certificate18-month Share Term Certificate24-month Share Term Certificate30-month Share Term Certificate36-month Share Term Certificate48-month Share Term Certificate60-month Share Term CertificateMin. deposit 25.00 25.00 25.00 25.00 25.00 25.00 0.00 250.00 250.00 250.00 250.00 250.00 250.00 250.00 250.00 0.50%0.75%0.75%0.75%0.90%0.90%1.15%1.15%APY : Annual Percentage 50%0.75%0.75%0.75%0.90%0.90%1.15%1.15%Federally insured by NCUAQuoted rates, dividends and annualpercentage yields (APY) are subjectto change daily at the discretion ofthe Board of Directors. Minimum deposit to open eachaccount. Initial checking depositmust cover first box of checksand first 1 monthly service fee.There is no minimum balancerequired to earn dividends onShare, Checking and IRA/SEP/CESAaccounts. The minimum balanceto earn dividends on Share TermCertificates and dividends on MoneyMarket Share accounts is 250.Share Term Certificates are FixedRate accounts. All other accountsare Variable Rate accounts withrates subject to change daily.Fees, other conditions or earlywithdrawal penalties may reduce theearnings on an account. Ask a CreditUnion representative for furtherinformation about the fees andterms applicable to these accounts.Let’s get personal.FPOWaiting on final ad fromAsheville Tourismwww.lgfcu.org/fpFebruary 2013 11

A wedding? Home repairs? Getting your kidssettled into college? Take control of your debt.With competitive rates and a fixed term, an LGFCU Personal Loan puts youin control knowing exactly what you’ll be paying and how long it will take. No application fee Closed-end or open-end Secured or unsecured 0.5% discount for payroll deductionTo learn more or apply, visit www.lgfcu.org, stop by your local branch or callthe Contact Center at 888.732.8562.

LGFCU announces the release of its very first mobile app for the iPad, iPod and iPhone. It’s called “Compass by LGFCU,” and is designed to work in concert with the LGFCU desktop version of Compass. Even better this highly-rated app is available at the iTunes store free of charge. Compass is a pers