Transcription

Medicare Set Aside CYAApril Pettengill, RN, CRRN, CDMS,CNLCP, MSCC, CBISObjectives for today Understand the Medicare SecondaryPayer Act Understand the SCHIP and SMART Acts Understand the Medicare Set-Asideprocess and requirements in settlements Discuss administration of the MSA1

Medicare Secondary Payer Act Medicare Secondary Payer Act: A collection of statutory provisions codified during the 1980’s with theintension of reducing federal health care costs (see Zinman v. Shalala67 F.3d 841,845 9th cir. 1995) Provides that CMS may pursue damages against any entity thatattempts to shift the burden of medical costs to Medicare. Medicare Secondary payer act requires: Medicare interests must be taken into account for allsettlements where future medical care is settling 2004 CMS began enforcing Specific criteria for submission Requires that all Medicare covered goods and services beincluded Non-covered costs are not required to be added into theallocation Costs should be by State Fee schedule or Usual and Customaryif no fee schedule. Longshore is priced using federal feeschedule.Workers Compensation CMS has a formal process inplaceConsequences of non-compliancecan be severe. Among these, theCenters for Medicare andMedicaid Services (CMS) may: Deny the claimant futuremedical care Designate its own allocation,which may be as much as theentire settlement amount Sue the claimant, claimant’sattorney, and /or insurancecarrier (where doubledamages can be sought)2

Liability Cases USA v. Baxter International (345 F. 3d 866 11th Circuit2003) Good Faith Determination – Does the settlementinclude costs for future medical treatment? Medicare must be considered a secondary payer toprotect the carrier from potential damages. 2003 Memo states MSA needed in Subrogation: if Liability relieves Workers Comp settlementEnforcement in Liability- CMS has now begun auditingsettlements Implementation of Recovery contractor Mandatory reportingMedicare and Medicaid SCHIPExtension Act of 2007 December 29, 2007 President Bush signed the Medicare and MedicaidSCHIP Extension Act (MMSEA) of 2007: As of July 1, 2009 primary payers handling workers compensation, third partyliability, self –insurance, no fault insurance and automobile claims will need toidentify to CMS claimants entitled to Medicare. Identifying claimants per the legislation provides it is necessary to “determinewhether a claimant (including an individual whose claim is unresolved) is entitledto benefits under the program under this title on any basis.” [section111(a)(8)(A)(i)] What needs to be reported includes identity of the claimant as well as “otherinformation deemed necessary by the Secretary to enable the Secretary to makean appropriate determination concerning coordination of benefits, including anyapplicable claim recovery.” [section 111(a)(8)(B)(ii)] Time frame for reporting was not defined HOWEVER 1,000 per day fine for“each day of non-compliance with respect to each claimant” if not reported The same thresholds will most likely be used, but those thresholds are rumoredto be changing – going lower.3

SMART ActStrengthening Medicare and Repaying Taxpayers Act Adds a discretionary element to the civil penalties fornon-reporting under Section 111 of the MMSEA (safeharbor) Expedites the conditional payment demand process Added an “appeal” process Limits the timeframe for claims againstplans/beneficiaries Stop using SSN or HCIN numbers for the MSP processMandatory Reporting / The new provisions for Liability Insurance (including Self-Insurance), No-FaultInsurance, and Workers' Compensation found at 42 U.S.C. 1395y(b)(8): Who must report: "an applicable plan." the identity of a Medicare beneficiary whose illness, injury, incident, or accident was at issueas well as such other information specified by the Secretary to enable an appropriatedetermination concerning coordination of benefits, including any applicable recovery claim.When/how reporting must be done: " [T]he term 'applicable plan' means the following laws, plans, or other arrangements,including the fiduciary or administrator for such law, plan or arrangement: (i) Liabilityinsurance (including self-insurance). (ii) No fault insurance. (iii) Workers' compensation lawsor plans."What must be reported: Add reporting rules; do not eliminate any existing statutory provisions or regulations. Thenew provisions do not eliminate CMS' existing processes if a Medicare beneficiary (or his/herrepresentative) wishes to obtain interim conditional payment amount information prior to asettlement, judgment, award, or other payment.Include penalties for noncompliance. In a form and manner, including frequency, specified by the Secretary. Information shall be submitted within a time specified by the Secretaryafter the claim is resolved through a settlement, judgment, award, or other payment(regardless of whether or not there is a determination or admission of liability). Submissions will be in an electronic format.4

COBC and MSPRC Merger As of February 11, 2014 the Coordinationof Benefits and the Medicare SecondaryPayer Recovery contractors have merged. New entity is called the Coordination ofBenefits and Recovery Center (COB&R) New contact information: Phone: 855-7982627When to contact COB&R To obtain conditional payment (lien)amounts To obtain final recovery (demand) amount Questions about repaying Medicare Request a waiver of recovery Request a first level of appeal with respectto the determination contained in demandletter or determination made on a waiverof recovery request.5

Satisfying Medicare in Non-Group HealthPlan Liability Settlements Specific information has now beenidentified: Name, address, telephone #,DOB, gender, SSN, and HCIN Primary plan type, policy #, claim#, incident information, ICD-9codes, body parts, policy holder Resolution of claim: Settlement date if known Amount of settlement Claim resolution including Contested or non-contested Ongoing responsibility if any Funding Expect more memos as theprocess becomes more defined.Liability (3rd party claims) are nowbeing discussed.Criteria’s Met – Now what? A MSA or Medicare Set aside Allocation is developed. The allocation is a report that addresses the Medicare covered goods andservices to be submitted to CMS Coordination of Benefits Center in Detroit Must summarize injury covered, previous care, medications, anticipated care andassociated costs Conditional payments need to be identifiedThe MSA is submitted along with other information required by Medicareand the COBC Submitter letterConsent formRated age or life expectancyLife care planSettlement agreement or proposed or court orderSet-Aside Administrator or copy of agreementMedical recordsPayment historyFuture treatment plan (allocation report)Supplemental or additional information6

What is a MedicareSet-Aside Allocation? A Medicare Set-Aside (MSA) allocation isa document that specifies future injuryrelated medical needs and associatedcosts. Only Medicare-covered expensesare required to be identified. Federal government audit of 2002 foundmore than 40 Billion in legitimate andenforceable liens against claimssettlements that did not contain approvedMSA allocations. Effective October 2006, CMS is auditingboth Workers Compensation and Liability Need to be sure that if the MSA is not submittedto CMS then the information must be addressedin the settlement paperwork.When is a Medicare Set AsideAllocation Necessary?A Workers’ Compensation MSA is reviewed byCMS in the following two situations: When claimant iscurrently eligible forMedicare**AND“a total settlementamount” of greaterthan 25,000.00OR Claimants with a“reasonable expectation”of Medicare enrollmentwithin 30 months of thesettlement dateANDa total settlement ofgreater than 250,000.00Medicare’s interest MUST be taken into consideration in all settlements.**When a claimant is currently Medicare Eligible, a MSA must be completed regardless of settlementamount7

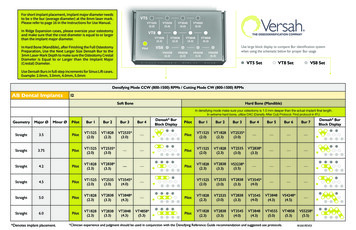

How is a Medicare Set-AsideAllocation Developed? Information is provided to the companywho will be developing and submitting theMSA Specific information is required Conditional payments also need tobe identified CMS developed a WCMSA ReferenceGuide that is available on line Goes through the whole process andrequirements. The submitter sends the document to thereferral source If all parties agree then it is submitted tothe contractor to reviewMedicare Prescription Part D All MSA’s developed andsubmitted must includemedications Medicare does not payfor all medications Medicare Part D All beneficiaries aresupposed to sign up soassume they have part Dcoverage.8

Who Is Qualified to Developa Medicare-Set Aside?Medicare Set-Aside Consultant Certified (MSCC)Training The candidate must complete 30 hours of training course related to MSPcompliance that has been approved by the CHCC and pass the examinationadministered by CHCCProfessional Experience A minimum of 12 months of full time employment within the past 3 years in any ofthe following industry disciplines (within the Workers’ Compensation or Liabilityinsurance industry). Nurses Life Care Planners Insurance Claims Adjusters AttorneysFollowing the course, there is an exam, a peer review, and requirements of 15 clockhours of approved education every three years 5 hours of which need to be specific toMSA’s. End Result: Accurate Medicare set-aside allocations that protect CMS AND your interests.MSA Process MSA and documents are sent tothe COB&R The contractor reviews theinformation PortalMailContractor can agree, develop for moreinformation or counter the MSAThe contractor sends their reviewand recommendations to theRegional Office.Regional office reviews therecommendationThe submitter, beneficiary, andattorneys receive a copy of thedetermination.9

Development Demands Requests for clarification of denied or unrelatedconditions, or documents not provided. Request for current records, current paymentrecords, current medication information Requests for settlement information, type ofsettlement (lump v. annuity), and administrationtype (self v. professional) Cases closed in 10 days! It will re-open when the information is provided.MSA after Settlement Money must be in a separate interest bearingaccount just to be used for the items in the MSA Money must not be used until recipient is onMedicare An annual accounting summary must be submitted toMedicare This can be either the recipient or a paid Administrator If the money is not used in its entirety during the yearit is rolled over into the next year. If the money is used up before the end of the year ortotally used, Medicare will then pay for the injurycare.10

MSA Administration: Self v.Professional Self administration: the beneficiary isresponsible for paying the bills incurred forinjury related expenses. Professional administration: payingsomeone to administer the MSA. Two types currently available: Full professional custodial Medical accounts Self-administration supportWhat Happens When a Client Seeks Treatment inSelf v. Professional AdministrationSelf Administration Bill arrives in the mail Person has to determine ifcovered by MSA If not, they need to notifyprovider to bill otherinsurance or Medicare fornon-injury related care Person determines what to pay Person sends check toprovider Person may need to explain toprovider why they are payingat certain rateProfessional Administration Bill sent to company Company determinescoverage If not covered, issue letterto provider with explanation Company re-prices bill per feeschedule (if appropriate) Company cuts check andissues an EOB Provider can call company withquestions11

The Take Away Medicare’s interests need to beconsidered in all settlements. MSAs are not required and they are notrequired to be submitted. Conditional payments (liens) need to beresolved Report the final settlement Consider type of administrationFor More Information:Questions?Contact InformationApril Pettengill, RNCRRN, CDMS, CNLCP, MSCC802-849-2956april@alpmedicalconsultants.com12

Medicare Secondary Payer Act Medicare Secondary Payer Act: A collection of statutory provisions codified during the 1980’s with the intension of reducing federal health care costs (see Zinman v. Shalala 67 F.3d 841,845 9th cir. 1995) Pro