Transcription

2014 ANNUAL REPORTSECURINGOURFUTUREWESTFIELD INSURANCE WESTFIELD BANK WESTFIELD SERVICES

HOW DO YOU PREDICT THE FUTURE?YOU CREATE IT.

For 167 years, Westfield has secured the future for ourcustomers by delivering on our promise to help restorelives and rebuild businesses when the unexpectedoccurs. We enable peace of mind and financial stabilityfor those who rely on us in the most trying times.KNOWLEDGETRUSTINTEGRITYRESPECTSTEWARDSHIP3

FROMWESTFIELDGROUP’SCEO &LEADERSECURING OUR FUTUREI am extremely proud to be a part of Westfield and even moreproud of what we accomplished in 2014. Westfield had anothergreat year across its insurance operations, Westfield Bank andWestfield Services. We demonstrated solid operating resultsand continued to strengthen our balance sheet to meet ourobligations to customers.of 2014. A vital part of our overall corporate plan, this was thelargest initiative we’ve ever undertaken at Westfield. A claimcan be a very dramatic experience for our customers. We needto provide the best possible response to help them. At the sametime, we want to learn from their experiences to improve ourproducts and services.Westfield’s statutory surplus now exceeds 1.9 billion, the most inthe Company’s history. This provides us a position of strength tofulfill our commitments and invest in the Company.All of our independent agency partners are important toour success. They continue to be influenced by consumers,technology, and merger and acquisition trends. In 2014, weupdated the Trilogy and Horizon programs, instituted changesto our compensation program and expanded our businessplanning with them. These initiatives ultimately ensure strongerrelationships between Westfield and our agency partners. Weare both committed to working together to mutually support thepolicyholders and to profitably grow the Company.According to consultant, educator and author, Peter Drucker,“The best way to predict the future is to create it” and that’sexactly what we are doing at Westfield.For over 167 years, Westfield has secured the future for ourcustomers by delivering on our promise of protection when theunexpected occurs. As the theme of this year’s annual reportsuggests, we have been making several key investments to solidifythe Company’s future success. These include improving the wayswe meet the needs of our customers and strengthening thevaluable relationships we enjoy with our independent agencypartners. We are “Securing Our Future” at Westfield.Through a tremendous team effort involving individuals acrossthe entire Company, we successfully implemented the first phaseof our new claims management system during the final quarter4The recent acquisition of Valley Savings Bank by WestfieldBank further demonstrated ongoing efforts to shape ourown future, as we continue to enhance our presence in thenortheast Ohio market by acquiring another like-mindedfinancial institution. Continuing to employ a successfulexpansion formula has helped Westfield Bancorp grow froma start-up at its inception in 2001, into a thriving communitybank with more than 1 billion in assets just 14 years later,securing the future and enabling further growth.

In perhaps the most visible move toward securing the futureof both our Company and industry, the Westfield InsuranceFoundation donated 500,000 to Kent State University to supporta Bachelor of Science in Insurance Studies program. This donationand endowment provides scholarships to students within theprogram and promotes career opportunities within the insuranceindustry, demonstrating Westfield’s commitment to developingtop local talent in order to infuse our industry with the nextgeneration of insurance professionals.LOOKING TOWARD 2015We are poised to build on our recent initiatives and financialstrength. We look to our future with courage and conviction.We have a proven record of protecting our policyholders. Thecompanies that will be successful in the coming years will be thosethat can develop deep insight about the risks their policyholdersface and the markets they serve. The consumer also expects usto provide cost effective and competitive products and services.To accomplish these objectives, we will continue to invest in ourpeople, processes and technology. And, we will continue to investin the agency partners who are crucial to our success.I have been part of this Company and industry for 35 years. It isa great industry!Later this year, I will be turning over the reins to Ed Largent tolead Westfield. This has been a planned leadership successionoverseen by the Ohio Farmers Board of Directors. We will executea seamless transition to maintain continuity for our Company andour customers.I have worked closely with Ed over the years and have the utmostconfidence in him. I have faith that our leadership team is focusedon the future and positioned to take the necessary steps so thatwe will be here to meet our customers’ needs well into the future.Our people are our most important asset. They do their verybest every day to support our customers and agents. Theirexceptional performance is evidenced by the customer serviceawards we win each year. I know they will rise to the challengesthe future holds.And finally, I would be remiss if I didn’t thank all of ouremployees and independent agency partners for theirextraordinary efforts. It is only through your tireless efforts thatwe are able to build Westfield into one of the premier regionalinsurance companies in America.5

SHARINGKNOWLEDGE.BUILDINGTRUST. Westfield Group is a customer-focusedinsurance and banking group of businesses. Atthe time of the Company’s founding in 1848,fires were the difference between prosperityand hardship for families, for businesses and forentire communities. The Company was formedby farmers for farmers to insure them againstsuch a loss in their small town. Our creationwas prophetic; just 23 years later, the Great Fireof 1871 burned 3.3 square miles of Chicago,killed an estimated 300 people and caused anestimated 200 million in damages, leaving100,000 people homeless and destroying morethan 17,000 structures.6ABOUTWESTFIELD GROUPWESTFIELD INSURANCEis a super-regional property and casualtyinsurance company. We provide a broadportfolio of commercial and personalinsurance products and surety bondsbacked by knowledgeable employees anda network of professional independentinsurance agencies. Among the nation’stop 50 largest property and casualtyinsurance groups, Westfield Insurance hasearned the rating of A (Excellent) or betterfrom A.M. Best Company for more than76 consecutive years.WESTFIELD BANKprovides relationship-based banking services for businesses and individuals across northeast Ohioand for independent insurance agencies across the country. Customers look to Westfield Bank forknowledgeable, personal service, local decision-making and the convenience of online bankinganytime and anywhere. Customers choose Westfield Bank for the peace of mind that comes fromworking with bankers who know them and are committed to their success. BauerFinancial awardsWestfield its 5-Star (Superior) rating.WESTFIELD SERVICESis a specialty insurance agency and services firm based in Columbus, Ohio. A resource forindependent insurance agencies, Westfield Services offers customer service center support, accessto specialty insurance products and structured settlement solutions for claims. Westfield Servicesmanages the Westfield Flood Program through the National Flood Insurance Program, marketing tomore than 500 agencies nationally.

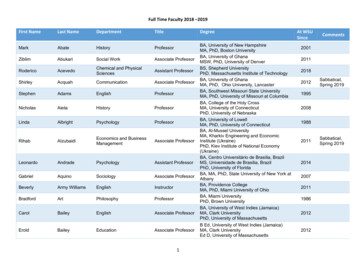

ANTRSPUSSS8%4%BASED ON NET WRITTEN PREMIUMINENTIORIBTAORAGMIX OF BUSINESSWORKERS’COMP7%AS OF 12.31.14PERSONAL LINES36%MIDDLE MARKET24%WESTFIELD INSURANCE FINANCIAL HIGHLIGHTSSUSMALLBUSINESS18%PREPARED IN ACCORDANCE WITH STATUTORY ACCOUNTING PRINCIPLESRETY3%20112010 1,733,059 1,675,391 1,606,982 1,535,537 1,477,693172,066198,853132,999(51,431)131,729FOR THE YEARNet Written PremiumNet Operating Gain (Loss)NET WRITTENPREMIUM(in millions)Combined Ratio97.10%94.60%99.18%111.69%99.59%Operating Ratio89.04%87.06%91.09%102.81%91.01%Return on Surplus9.27%11.93%9.21%-3.75%10.04%Net Premium Growth Rate3.44%4.26%4.65%3.91%2.34% 4,743,063 4,514,995 4,163,422 3,915,276 808,6901,525,5631,361,7101,382,899Net Writings to Surplus0.910.931.051.131.07Annual Surplus Growth5.18%18.56%12.03%-1.53%11.51% 1,7332012 1,6752013 1,6072014 1,478(Unaudited) 1,536(Dollars in Thousands)AT YEAR ENDTotal Admitted AssetsNet Loss and LAE ReservesNet Unearned Premium4Surplus7

ALWAYS LOOKING AHEADIn 2014, we continued to invest in our ability to meetcustomer needs, strengthen relationships with ourindependent agency and community partners, andreinforce our long-term competitive position.8

NEW CLAIMS MANAGEMENT SYSTEMOur new claims management system, a vital part of our claims transformation initiative, went live during the fourth quarter of2014. The new system will enhance our customer claims experience and advance our analytics capabilities so we can betterunderstand risk, develop new products and continuously improve the services we offer. When fully implemented, it will be thetechnical foundation that allows Westfield to meet customer claims expectations both now and well into the future.WHY IT IS NECESSARYCOMPANY BENEFITSAs our customer expectations evolve, Westfield must providethe increasing accuracy, speed, flexibility and understandingthey demand. Meanwhile, the handling of claims has becomeincreasingly complex due to discipline-specific tools, processes andregulatory requirements. Our systems must provide flexibility toadapt to the changing needs of our customers and the industriesin which they operate. The new claims management initiative willprovide these capabilities in many aspects of our business, fromcommunications to discipline-specific claims expertise to betterloss prevention and mitigation.Our claims department is a primary source of customer interaction,so this system is a critical driver of customer acquisition andretention. The system also improves analysis and understanding tosupport future decisions in Westfield’s continuing transformationaleffort. Further, it will deliver fraud and workers’ compensationseverity predictive models – the first we have used in our claimsoperations. Other anticipated benefits include earlier identificationof severe losses, streamlined assignment of claims professionals andquick referrals to third-party services.CUSTOMER BENEFITSWestfield has always had a strong reputation for excellentcustomer service, but customer expectations are rising. Our mostrecent brand study indicated that consumers value accuracy,expertise, knowledge, speed and consistency. The new claimsmanagement project delivers on these qualities, providingcommercial and personal lines customers with a faster and moresatisfying claims experience. Customers have responded positively,for example, to making rental-car reservations when they firstreport an automobile claim.NEXT STEPSIn 2008, Westfield invested in anenterprisewide business intelligencecapability. This platform has beenadopted in departments throughout ourorganization and supports data-drivendecisions that are having a positive effecton business performance. Our new claimsmanagement system will be integratedwith this platform to increase the impactof data in managing our business.9

DISTRIBUTION NETWORKWe executed the next phase of our distribution strategy and furthered our Trilogy and Horizonprograms to better align Westfield with our independent agency partners and help secure thelong-term viability of our business model.ABOUT THE TRILOGY AND HORIZONPROGRAMSEvery two years, Westfield conducts an extensive review to evaluateour agencies and identify top-performing agencies that have theability to achieve a higher level of partnership and above-averagegrowth. These agencies become our Trilogy and Horizon partners.BENEFITS FOR TRILOGY AND HORIZONAGENCIESAgencies that achieve Trilogy or Horizon status receive significantadditional benefits, including: Opportunities for increased compensation in the form ofenhanced contingency Enhanced benefits and access to competitions for items such asmerchandise and travel Access to strategic support and funding to assist in agencygrowth and improvement Service model and support personalized to each WestfieldTrilogy and Horizon agencyIn 2014, we invested in a seriesof support materials that guideTrilogy and Horizon agenciesthrough available Westfieldresources and benefits.10SUPPORT FOR ALL AGENCIESThroughout Westfield’s history, the quality of our independentagency partners has always been an asset, an advantage andan important benefit to our customers. Westfield is able toappoint agencies selectively because of the value created and thereputation earned as a stable and trustworthy insurance partner.Our value proposition for all Westfield agencies includes access toa wide range of insurance products, experienced and professionalemployees, competitive compensation, and agency-focusedofferings from Westfield Services and Westfield Bank.Westfield Agents Association (WAA) – This is a representativeorganization for Westfield independent agencies that sheds lighton the challenges, concerns and potential solutions for issuesagencies face. The Association is focused on providing advocacyand education for its members. The WAA Board works closely withleaders at Westfield to provide perspective on various initiatives andtheir impact on the overall agency force.The Association Perpetuation Plan (TAPP) – TAPP providesproduct management and sales training for emerging producersand future agency principals. The program covers technicalcommercial lines product training, and advanced commerciallines and personal lines coverages. It also includes advanced salestraining led by industry experts and training on industry tools suchas Rough Notes Producer Online.

National Industry Involvement – Westfield is an active memberof a number of trade associations and industry groups, includingthe Independent Insurance Agents and Brokers of America Inc.(IIABA). Through our Government Relations division, Westfieldorganizes an event at which agents have the opportunity tomeet with legislators at the IIABA annual legislative meeting inWashington, D.C. Some of the national IIABA programs for whichWestfield provides active support and participation are: Trusted Choice – This consumer-facing performancepledge promotes the value of independent agents and setsthe standard of service that customers expect and deserve.Westfield is a Trusted Choice company partner for itshomeowner, auto and business lines. TrustedChoice.com (formerly Project CAP) – This digitalmarketing platform allows insurance buyers to get accurateinformation and live quotes, providing new sales opportunitiesfor independent agents. Young Agents – A network for future industry leaders, YoungAgents offers leadership skills training and other resources tocultivate tomorrow’s agency principals. Agents Council for Technology (ACT) – A forum forcompanies, agencies, associations and technology providers todiscuss industry challenges and opportunities, ACT focuses onenhancing workflow, security and online marketing. Best Practices – With support from partner companies such asWestfield, the Council for Best Practices develops tools to helpindependent agencies improve, grow and increase in value. Future One – Formed to shape insurance laws and improveindustry regulation, Future One conducts the most authoritative,in-depth research available on independent agents and brokers,and the independent agency system. It uses this information toinform those involved in the legislative and regulatory processes.Education – Westfield is a longtime advocate of educationalinitiatives that advance the insurance industry, as evidencedthrough the support of the following initiatives: Kent State University Bachelor of Science in InsuranceStudies – The Westfield Insurance Foundation endowmentof 500,000 supports the educational programming,student scholarships and promotion of career opportunitieswithin the industry. Scholarships – In partnership with the Westfield AgentsAssociation, Westfield provides seven scholarships toInsurance and Risk Management majors selected from anational pool of candidates. Griffith Insurance Education Foundation – An affiliate ofThe Institutes, this foundation is a nonadvocacy, educationalorganization that provides risk management and insuranceeducation for students and public policymakers.“As a student majoringin insurance studies,the financial expense ofpursuing my education canbe a barrier to realizing thisgoal. The scholarship hasallowed me to continue todevelop my skills througheducation, training andexperience and will help asI begin my journey towarda new and exciting careerin the insurance industry.”MICHELE QUINN,Kent State Insurance Studies majorand Westfield scholarship recipient InVest – A partner of IIABA, InVest is designed to introducestudents to careers in insurance and create a talent pipeline forthe future workforce of the independent agency system. Gamma Iota Sigma – The industry’s business fraternityfor students majoring in insurance, risk management andactuarial science.11

COMMERCIAL INSURANCEMIDDLE MARKETSMALL BUSINESSServing mid-sized and larger businesses, Westfield’s Middle Marketteam partners with agents to help their customers navigate thecomplexities of insurance products and mitigate exposures to risk.Middle market professionals are positioned throughout the countryto bring local expertise, deliver exceptional service, build strongrelationships. They are supported by a team of functional experts inunderwriting, risk control, claims, billing and premium audit. Thiscustomer-focused approach assembles a full complement of trustedadvisors to fully understand each customer’s unique operation andcustomize a risk management plan that meets individual needs.Quality insurance protection is important for even the smallestbusinesses. Tailored for privately held small businesses,Westfield Insurance offers both property and liability productsto help customers safeguard their buildings and otherproperty against losses or damages, while also shielding theirassets from third-party losses. By offering a wide range ofoptional coverages to small-business customers, Westfield’sexperienced underwriting team leverages technologyand automation so agents and customers receive theresponsiveness they need and deserve.As with other Westfield business units, our Middle Market team isopen to quality new business opportunities with our agency partners.2014 HIGHLIGHTS Underwrote 65 million in new business, continuing ourmomentum and representing solid growth from 2013 Promoted our custom billing feature, allowingcustomers to tailor billing options by the seasonalityof their business, by location or because of an unusualpayment schedule Improved customer retention by nearly 4 percentagepoints Reduced overhead to lower underwriting expenses Implemented new business pricing standards to raiseconsistency between new and renewal pricing122014 HIGHLIGHTS Added 41.6 million in new business, representingstrong year-over-year growth Generated 24.3 million in statutory income, extendingprofitability to 10 of the past 11 years

SURETYSince beginning the practice in 1956, Westfield Insurance haswritten surety bonds serving a broad range of customers, industriesand institutions. Products include contract bonds, court and judicialbonds, probate bonds, license and permit bonds, public officialbonds and miscellaneous indemnity bonds. Westfield’s experiencedteam of surety underwriters and dedicated surety claims counselare experts who provide comprehensive full-service contract andcommercial surety solutions.Licensed in 48 states and ranked as the nation’s 21st

WESTFIELD BANK provides relationship-based banking services for businesses and individuals across northeast Ohio and for independent insurance agencies across the country. Customers look to Westfield Bank for knowledgeable, personal service, local decision-making and the convenience