Transcription

ANNUAL REPORT2014-15

Fourteen years of Responsible BankingLaxmi Bank was born in 2002 in the southern plains of Nepal, in one of the oldestand most vibrant industrial and commercial cities of the country – Birgunj.In 2005 we upgraded to a national level Bank and subsequently moved ourhead office to the country’s capital – Kathmandu. Along the way we merged withHISEF Limited, a significant milestone in the country’s corporate history as thefirst ever merger in Nepal.We are listed in the Nepal Stock Exchange with over 13,000 shareholders,represented by some of the country’s most respected business houses, CitizensInvestment Trust (a Nepal Government undertaking) and the general public.At Laxmi Bank we truly believe that the most meaningful contribution we canmake to our society is by being good at what we do – Banking.Embracing ‘Responsible Banking’ as our corporate responsibility ensures thatwe firmly remain on track to reach our aspiration of becoming the best managedand most respected financial institution in the country.Our responsibile banking initiatives include:?OrangeLoves ionFinancialInclusion

Board of directorsRajendra Kumar KhetanChairmanDinesh PoudyalRatan lal Shanghai NewDirectorDirectorRam KrishnaEXECUTIVE DIRECTORCITIZEN INVESTMENT TRUSTSwati RungataREPRESENTINGGENERAL PUBLICShambhu Prasad AcharyaPROFESSIONALDIRECTORBishwa Karan JainREPRESENTINGGENERAL PUBLIC

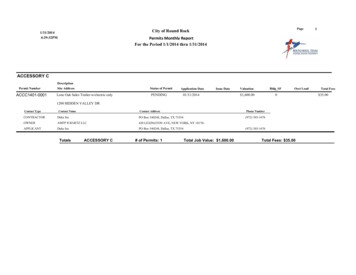

Consolidated Balance Sheetas at Ashad 31, 2072 (July 16, 2015)CAPITAL & LIABILITIESThis Year (in NPR)Previous Year (in NPR)1. Share Capital2,893,183,1902,337,965,7602. Reserves and Surplus1,278,395,262849,589,6623. Non Controlling --40,154,205,41830,529,615,9735,528,4771,889,8818. Proposed Cash Dividend-20,508,4729. Income Tax Liabilities 500,486This Year (in NPR)Previous Year (in 004. Debentures & Bonds5. Borrowings6. Deposit Liabilities7. Bills Payable10. Other LiabilitiesTotal Capital and LiabilitiesASSETS1. Cash Balance2. Balance with Nepal Rastra Bank3. Balance with Banks/Financial Institution317,247,637489,680,7114. Money at Call and Short Notice702,088,538738,323,0165. Investment6. Loans, Advances and Bills Purchase7. Fixed 04,810,860548,648,538478,265,7048. Non Banking Assets (net)9. Other AssetsTotal ,983,500,486Piyush Raj AryalSudesh KhalingRajendra K. KhetanChief Financial OfficerChief Executive OfficerChairmanDirectorsDate: 11 dec. 2015Dinesh PoudyalPlace - KathmanduRatan Lal SanghaiSambhu Prasad AcharyaRam Krishna PokharelSwati RoongtaVishwa Karan JainAs per our Reportof even dateRabindra RajbhandariPartnerfor RajMS & Co.Chartered Accountants

Consolidated Profit and Loss AccountFor the period Shrawan 1, 2071 to Ashad 31, 2072 (July 17, 2014 to July 16, 2015)ParticularsThis Year (in NPR)Previous Year (in NPR)1. Interest Income2,662,681,5482,519,187,6002. Interest ,043,9403. Commission and DiscountNet Interest Income229,652,893199,984,2654. Other Operating Income160,598,544115,738,7765. Exchange ,9606. Staff Expenses314,878,457262,034,7007. Other Operating Expenses345,853,947277,823,023Total Operating Income8. Exchange LossOperating Profit before provision for Possible Loss9. Provision for Possible LossesOperating Profit10. Non Operating Income 70643,021,220672,655,36720,982,48725,456,84711. Loan Loss Provision Written Back15,756,00053,740,785Profit from Regular 7752,152,99961,240,84167,708,04512. Profit/(Loss) from Extra-Ordinary ActivitiesNet Profit after including all Activities13. Provision for Staff Bonus14. Provision for Income Tax--177,722,879207,324,569* Provision for Previous Years' Tax221,977-* Deferred Tax Expense/ 81,460,812* Provision for Current Year's Tax15. Share of Non- Controlling interest in the Profit/ Loss ofSubsidiaryNet Profit/LossPiyush Raj AryalSudesh KhalingRajendra K. KhetanChief Financial OfficerChief Executive OfficerChairmanDirectorsDate: 11 dec. 2015Place - KathmanduDinesh PoudyalRatan Lal SanghaiSambhu Prasad AcharyaRam Krishna PokharelSwati RoongtaVishwa Karan JainAs per our Reportof even dateRabindra RajbhandariPartnerfor RajMS & Co.Chartered Accountants

Consolidated Profit and Loss Appropriation AccountFor the period Shrawan 1, 2071 to Ashad 31, 2072 (July 17, 2014 to July 16, 2015)ParticularsThis Year (in NPR)Previous Year (in COME1. Accumulated Profit up to Previous Year2. Current Year's Profit3. Exchange Fluctuation Fund4. Share Premium Fund transferred5. Adjustments in Retained ,537--EXPENSES1. Accumulated Loss up to Previous Year2. This Year's Loss--86,538,41595,368,7814. Contingent Reserve--5. Institutional Development Fund--6. Dividend Equalization Fund--3. General Reserve7. Staff Related Reserves8. Proposed Dividend9. Proposed Bonus Shares10. Special Reserve Fund11. Exchange Fluctuation Fund12. Capital Redemption Reserve Fund13. Capital Adjustment 4. Adjustments:--Deferred Tax Liability--Deferred Tax ,605467,862,44216.Accumulated Profit/(Loss)292,125,67026,767,09514. Investment Adjustment Reserve15. Share of Non-Controlling Interest in the Profit ofSubsidiary (before induction)Piyush Raj AryalSudesh KhalingRajendra K. KhetanHead - Finance & TreasuryChief Executive OfficerChairmanDirectorsDate: 11 dec. 2015Place - KathmanduDinesh PoudyalRatan Lal SanghaiSambhu Prasad AcharyaRam Krishna PokharelSwati RoongtaVishwa Karan JainAs per our Reportof even dateRabindra RajbhandariPartnerfor RajMS & Co.Chartered Accountants

25,014,454-Proposed cash DividendExchange Fluctuation FundClosing Balance at 31 Ashad 2072Calls in Advance2,893,183,190555,314,590-Fracional Bonus shares carried overNon controlling interest-Deferred Tax Reserve292,125,670-4,753,366(28,116,529)--Share Premium(50,000,000)-(3,344,026)--Investment Adjustment ReserveDebenture Redemption Fund(97,160)(450,000)-Capital Adjustment FundProposed Bonus SharesBonus provision carried forward fractional shares--Transfer to General Reserve(86,538,415)-430,806,8202,337,965,760Net profit for the periodRestated Balance(247,226)-Adjustments in Retained s(104,259)-2,337,965,760ShareCapitalPrior period adjustment in deferredtax reservesPrior period adjustment (LLP laghubitta excluded)AdjustmentsOpening Balance at 1 Shrawan 2071ParticularsFiscal Year --480,736,675GeneralReserveConsolidated Statement of Changes in erred herReserves 30,806,8203,185,907,041---3,187,555,423Total(in NPR)

Consolidated Cash Flow StatementFor the period Shrawan 1, 2071 to Ashad 31, 2072 (July 17, 2014 to July 16, 2015)Particulars(a). Cash Flow from Operating Activities1. Cash ReceivedThis Year (in NPR)Previous Year (in 83,1752,626,186,3922,523,560,4071.2 Commission and Discount Income253,666,250188,253,0591.3 Income from Foreign Exchange transaction120,381,572120,184,980-300,0001.1 Interest Income1.4 Recovery of Loan Written off1.5 Other Income2. Cash Payment2.1 Interest 53,8181,556,577,8491,648,235,1382.2 Staff Expenses377,092,207318,865,6932.3 Office Operating Expenses284,534,285231,521,6312.4 Income Tax Paid239,717,238215,246,3552.5 Other Expenses(248,365)(1,915,000)Cash Flow before changes in Working Capital(Increase) / Decrease in Current Assets1.(Increase)/Decrease in Money at Call and Short Notice2. (Increase)/Decrease in Short Term Investment3. (Increase)/Decrease in Loans, Advances and Bills 64,453,507(8,870,122,485)(3,216,445,318)4. (Increase)/Decrease in Other Assets(779,167,896)(694,825,585)Increase /( Decrease) in Current 4,553,686,9331. Increase/(Decrease) in Deposits2. Increase/(Decrease) in Certificates of Deposits--3. Increase/(Decrease) in Short Term Borrowings295,544,197140,115,5204. Increase/(Decrease) in Other Liabilities(b) Cash Flow from Investment Activities1. (Increase)/Decrease in Long-term Investment2. (Increase)/Decrease in Fixed Assets3. Interest income from Long term 4. Dividend Income5. Others--487,492,348(63,582,748)--2. Increase/(Decrease) in Share Capital & Share Premium555,314,590(40,610)3. Increase/(Decrease) in Other --(e) Current Year's Cash Flow from All Activities(381,270,395)1,868,354,700(f) Opening Balance of Cash and Bank5,334,093,3423,465,738,642(g) Closing Balance of Cash and Bank4,952,822,9475,334,093,342(c) Cash Flow from Financing Activitiesetc)1. Increase/(Decrease) in Long term Borrowings (Bonds,Debentures4. Increase/(Decrease) in Refinance/facilities received from NRB5. Interest expenses on Long term Borrowings (Bonds, Debenturesetc)/ Dividend Paid(d) Income/Loss from change in exchange rate in Cash & BankBalancePiyush Raj AryalSudesh KhalingRajendra K. KhetanChief Financial OfficerChief Executive OfficerChairmanDirectorsDate: 11 dec. 2015Place - KathmanduDinesh PoudyalRatan Lal SanghaiSambhu Prasad AcharyaRam Krishna PokharelSwati RoongtaVishwa Karan JainAs per our Reportof even dateRabindra RajbhandariPartnerfor RajMS & Co.Chartered Accountants

Consolidated Significant Accounting Policiesand Notes to AccountsNotes to Accountsi) General InformationFollowing intra group transactions and balances are eliminatedwhile preparing the consolidated financial statements:a. Reporting EntityLaxmi Bank Limited ("the Bank") is a limited liability companydomiciled in Nepal. The address of its registered office is in Hattisar,Nepal. The Bank has a primary listing on the Nepal Stock ExchangeLimited. The Bank is running a commercial banking business in Nepal.b. Consolidated Financial StatementsThe consolidated financial statements of the Bank as of 16 July 2015comprises of the Bank and its subsidiaries. The financial year ofsubsidiaries is common to that of the parent company.ii) Statement of ComplianceThe consolidated financial statements of the group and separatefinancial statements of the Bank have been prepared in accordancewith Nepal Accounting Standards ("NAS") issued by the NepalAccounting Standard Board except otherwise stated, Generally AcceptedAccounting Principles ("GAAP"), Bank & Financial Institutions Act(“BAFIA”), presentation and other requirements of NRB Directives and inconformity with the Companies Act, 2063.iii) Basis of ConsolidationThe group’s financial statements comprise of consolidation of financialstatements of the Bank and its subsidiaries, Laxmi Laghubitta BittiyaSanstha Ltd (“LLBS”) and Laxmi Capital Market Ltd (“LCM”).A subsidiary is an entity that is controlled by another entity (knownas the parent). Control exists when the bank has the power, directly orindirectly to govern the financial and operating policies of and enterprisefrom the date that control commences until the date that control ceases.The consolidated financial statements have been prepared inaccordance with International Financial Reporting Standards 10“Consolidated Financial Statements”. In preparing the consolidatedfinancial statements, the financial statements are combined line byline by adding the like items of assets, liabilities, equity, income andexpenses.All intra group transaction and balances, income and expensesand any unrealized gains/ losses arising from such inter-companytransactions and balances are eliminated in full while preparing theconsolidated financial statements.iv) Previous Year's FiguresPrevious year's figures are grouped or regrouped wherever necessary inorder to facilitate comparison.1. Intra group transactions and balancesAmount in NPR’000ParticularsLCMLLBSInvestment of LaxmiBank in subsidiaries100,00070,000Deposit with LaxmiBank24,0345,587Balance Sheet ItemsReceivables fromLaxmi BankLoan from Laxmi Bank3,258-513,1174,747-Interest Expense onLoan with Laxmi Bank-13,845Service Fees chargedto Laxmi Bank248Profit and LossAccount ItemsInterest Income onDeposit with LaxmiBankDividend incomereceived by LaxmiBank8,550Loan Loss Provision onLoan to LLBS2,9552. Restatement of Opening balanceFollowing amounts were adjusted in Consolidated Statementof Change in Equity and opening balance of Retained Earningand Deferred Tax Reserve has been restated.Amount in NPR’000RetainedEarningsDeferred TaxReservesOpening balance (from lastyear’s financials)26,76711,056Prior period adjustment (LLP onLaghubitta loan to be excludedfrom retained earning last year)(1,401)-Prior period adjustment indeferred tax reserves(104)104Adjustments in RetainedEarnings (restatement ofbalance of Reserves andSurplus of LCML)(247)ParticularsRestated Opening Balance25,01411,160

3. Tax liability reconciliationProfit as per finan

We are listed in the Nepal Stock Exchange with over 13,000 shareholders, . income/Loss from change in exchange rate in Cash & Bank Balance - - (e) Current Year's Cash flow from All Activities (381,270,395) 1,868,354,700 (f) Opening Balance of Cash and Bank 5,334,093,342 3,465,738,642 (g) Closing Balance of Cash and Bank 4,952,822,947 5,334,093,342 PIyuSH RAJ ARyAL SuDESH