Transcription

Attestation of Compliance – Service ProvidersPayment Card Industry (PCI)Data Security StandardAttestation of Compliance forOnsite Assessments – Service ProvidersVersion 2.0October 2010

Instructions for SubmissionThe Qualified Security Assessor (QSA) and Service Provider must complete this document as a declaration of theService Provider’s compliance status with the Payment Card Industry Data Security Standard (PCI DSS). Completeall applicable sections and submit to the requesting payment brand.Part 1. Service Provider and Qualified Security Assessor InformationService Provider Organization InformationCompany Name:Magento, Inc.Contact Name:Motti DaninoDBA(s):Title:Telephone:Business Address:E-mail:City:State/Province:URL:(310) 367-533410441 W. Jefferson Blvd.,Suite 200CACountry:http://www.magento.comUSAQualified Security Assessor Company InformationCompany Name:TrustwaveLead QSA Contact Name:Lanny StoltenbergTitle:Telephone:(719) 339-0188E-mail:Business Address:70 W. Madison St., Suite 1050City:State/Province:ILCountry: USAURL:www.trustwave.comHead of BusinessOperations, Magento Gomotti@magento.comCulver CityZip:90232Principal 02Part 2 PCI DSS Assessment InformationPart 2a. Services Provided that WERE INCLUDED in the Scope of the PCI DSS Assessment(check all that apply)Tax/GovernmentFraud and ChargebackPayment Processing-POSPaymentsServicesPayment Processing –Payment Processing –Payment Processing-InternetATMMOTOIssuer ProcessingPayment Gateway/SwitchClearing and Settlement3-D Secure HostingAccount ManagementLoyalty ProgramsProviderBack Office ServicesPrepaid ServicesMerchant ServicesHosting Provider – WebManaged ServicesBilling ManagementHosting Provider –Network Provider/TransmitterHardwareRecords ManagementData PreparationOthers (please specify):List facilities and locations included in PCI DSS review: Headquarters in Culver City, CA, and supportin Kiev, Ukraine (via WebEx sessions) and the Rackspace datacenters in London, UK and Chicago, ILPart 2b. RelationshipsDoes your company have a relationship with one or more third-party service providers (for example,gateways, web-hosting companies, airline booking agents, loyalty program agents, etc.)?YesNoPart 2c. Transaction ProcessingPCI DSS Attestation of Compliance for Onsite Assessments — Service Providers, Version 2.0Copyright 2010 PCI Security Standards Council LLC

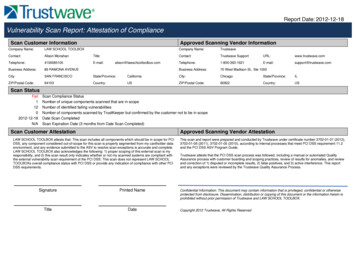

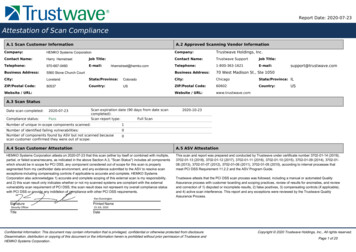

How and in what capacity does your business store, process and/or transmit cardholder data?Magento provides a SaaS platform for customers to set up virtual store fronts. Customers may leverage manypayment options within their shopping carts via an iFrame connection (i.e,: PayPal and Authorize.net or theMagento Payment Bridge). If the customer opts to use the Magento Payment Bridge, the bridge acts as a front-endto PayPal, Payflow, PAYONE, Authorize.net, First Data,DIBS, CyberSource, PSiGate, WorldPay, Orgone, SagePay, eWay or Braintree payment gateways for transaction processing. The scope of this assessment was focusedspecifically on the hosted Magento Payment Bridge functionality. The deployed version of the hosted MagentoPayment Bridge is also offered as an application sold to customers and has been PA-DSS certified by Coalfire.Please provide the following information regarding the Payment Applications your organization uses:Payment Application in UseMagento Payment BridgeVersion Number1.11.11.15Last Validated according to PABP/PA-DSSPart 3. PCI DSS ValidationBased on the results noted in the Report on Compliance (“ROC”) dated March 8, 2012, Lanny Stoltenbergasserts the following compliance status for the entity identified in Part 2 of this document as of March 8, 2012(check one):Compliant: All requirements in the ROC are marked “in place1,” and a passing scan has beencompleted by the PCI SSC Approved Scanning Vendor Trustwave thereby Magento has demonstratedfull compliance with the PCI DSS 2.0.Non-Compliant: Some requirements in the ROC are marked “not in place,” resulting in an overallNON-COMPLIANT rating, or a passing scan has not been completed by a PCI SSC Approved ScanningVendor, thereby (Service Provider Name) has not demonstrated full compliance with the PCI DSS.Target Date for Compliance:An entity submitting this form with a status of Non-Compliant may be required to complete the ActionPlan in Part 4 of this document. Check with the payment brand(s) before completing Part 4, since not allpayment brands require this section.Part 3a. Confirmation of Compliant StatusQSA and Service Provider confirm:The ROC was completed according to the PCI DSS Requirements and Security AssessmentProcedures, Version 2.0, and was completed according to the instructions therein.All information within the above-referenced ROC and in this attestation fairly represents the results ofthe assessment in all material respects.The Service Provider has read the PCI DSS and recognizes that they must maintain full PCI DSScompliance at all times.No evidence of magnetic stripe (that is, track) data2, CAV2, CVC2, CID, or CVV2 data3, or PIN data4storage after transaction authorization was found on ANY systems reviewed during this assessment.1“In place” results should include compensating controls reviewed by the QSA. If compensating controls are determined tosufficiently mitigate the risk associated with the requirement, the QSA should mark the requirement as “in place.”2Data encoded in the magnetic stripe or equivalent data on a chip used for authorization during a card-present transaction. Entitiesmay not retain full magnetic stripe data after transaction authorization. The only elements of track data that may be retained areaccount number, expiration date, and name.34The three- or four-digit value printed on the signature panel or face of a payment card used to verify card-not-present transactions.Personal Identification Number entered by cardholder during a card-present transaction, and/or encrypted PIN block present withinthe transaction message.PCI DSS Attestation of Compliance for Onsite Assessments — Service Providers, Version 2.0Copyright 2010 PCI Security Standards Council LLC

Part 4. Action Plan for Non-Compliant StatusPlease select the appropriate “Compliance Status” for each requirement. If you answer “No” to any ofthe requirements, you are required to provide the date Company will be compliant with the requirementand a brief description of the actions being taken to meet the requirement. Check with the paymentbrand(s) before completing Part 4 since not all payment brands require this Select One)1Install and maintain a firewallconfiguration to protectcardholder data.YesNo2Do not use vendor-supplieddefaults for system passwordsand other security parameters.YesNo3Protect stored cardholder data.YesNo4Encrypt transmission ofcardholder data across open,public networks.YesNo5Use and regularly update antivirus software.YesNo6Develop and maintain securesystems and applications.YesNo7Restrict access to cardholder databy business need to know.YesNo8Assign a unique ID to eachperson with computer access.YesNo9Restrict physical access tocardholder data.YesNo10Track and monitor all access tonetwork resources and cardholderdata.YesNo11Regularly test security systemsand processes.YesNo12Maintain a policy that addressesinformation security.YesNoRemediation Date and Actions(if Compliance Status is “No”)PCI DSS Attestation of Compliance for Onsite Assessments — Service Providers, Version 2.0Copyright 2010 PCI Security Standards Council LLC

full compliance with the PCI DSS 2.0. Non-Compliant: Some requirements in the ROC are marked “not in place,” resulting in an overall NON-COMPLIANT rating, or a passing scan has not been completed by a PCI SSC Approved Scanning Vendor, thereby (Service Provider Name) has not d emonstrated full