Transcription

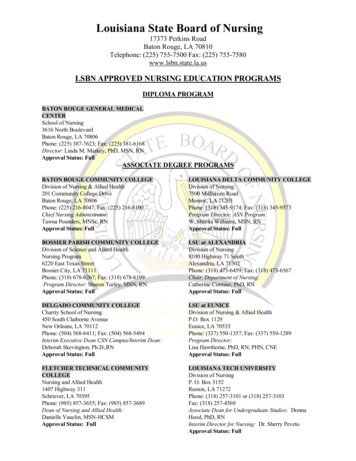

THTHLOSRTURUSRTYR YA ASOTHE EO OF FF IFCI CI AI AL LMMAAGGAAZ IZNI NE EO OF FT HE EL OUUI SI ISAI ANNA AC COONNSTCCT ITOI ON NA ANND DI NI NDDUUSTS SS OCCI AI AT ITOI ONNO JCATNOUBAERRY 2 2001 31 4VVOOLLUUMMEE 65I ISSSSUUEE 1 3FINANCINGTECHNOLOGYLOUISLYNN BUSINESSAPPS CAFEFOR SMALLP. 5P. 11 P.7IANAthe member services arm of lci workers’ compANGELE BLUEAPARTMENTSLOUISIANACRABP. 13 P. 11

CONTENTS:Association News . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 1Events . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2On the Issues: Finance . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 5-8Member Spotlight: Cafe Lynn . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11-12Member Spotlight: Louisiana Blue Crab . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13-14LCI Workers’ Comp Corner . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 17-18Association News::: Family Night – Thank you to everyone who attendedthe LCI/LCIA Family Night on November 2, 2013 atthe Louisiana Children’s Museum in New Orleans. Wehad a blast! Hope to see more new faces (and ourregulars) at our next Family Night, coming laterthis year.:: Online Safety Classes – LCI and LCIA now offer online safety classes. Each user will have access to courses that cover a variety of safetytopics relevant to their specific industries. To access these classes, log into the Member Portal at members.lciwc.com and click on the“Online Safety Classes” tab. To begin using the system, please follow the directions on how to register.:: Event Registration – While you can still view events on the LCIA website, registrations will now go through the LCI/LCIA Member Portal.Please log into the Member Portal to view and register for all LCIA events.1

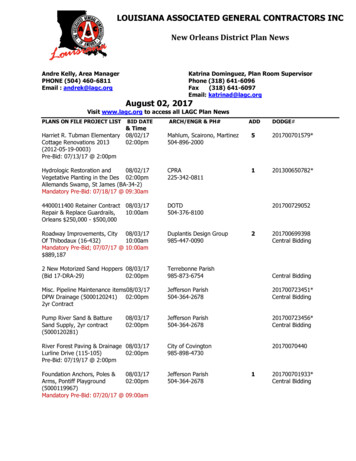

LCIA Events:JANUARYJULY“DEATH & TAXES”WEBINAR: WHAT YOU NEED TO PREPAREFEATURED ONLINE SAFETY CLASS:FOR A WORKERS’ COMP AUDITFIRST AIDWHEN: JULY 1010:30 AM - 11:15 AMLCI WEBINAR SERIES: LCIA BENEFITSWHERE: ONLINEWHEN: JANUARY 810:30 AM - 11:30 AMLCI AUDIT WALK-IN APPOINTMENTS:WHERE: ONLINECOMPLETE YOUR WORKERS’ COMP AUDITWHEN: JULY 11CPR AND FIRST AID TRAINING9:00 AM - 7:00 PMWHEN: JANUARY 24WHERE: BATON ROUGE8:00 AM - 2:00 PMCROWNE PLAZAWHERE: DOUBLETREE HOTEL(Come meet LCI’s auditing team toKENNERcomplete your audit face to face.)BUSINESS BASICS WEBINAR: “CHECKLISTWEBINAR: FINANCIALLY PLANNING FOROF WHAT YOU NEED TO DO YOUR 2013 TAXESYOUR BUSINESS’S FUTUREAND HOW TO AUDIT-PROOF YOURSELF”WHEN: JULY 17WHEN: JANUARY 2910:30 AM - 11:15 AM10:30 AM - 11:30 AMWHERE: ONLINEWHERE: ONLINECUSTOMER SERVICE TRAINING: HOW TOLUNCH & LEARN: KEEPING AN EYE ON YOURRELATE TO AND RETAIN YOUR CUSTOMERSBUSINESS WITH ProjectNOLAWHEN: JULY 19WHEN: JANUARY 319:00 AM - 10:30 AM11:30 AM - 1:00 PMWHERE: NEW ORLEANSWHERE: IRISH HOUSEFAIR GRINDS COFFEE HOUSENEW ORLEANSFEBRUARYAUGUST“FINANCE FEBRUARY”AND LADDERSAFETYLUNCHWITH LCI: GETTO KNOW YOURWORKERS’ COMPFEATURED ONLINE SAFETY CLASS:WHEN:AUGUST 7LADDER SAFETY11:30 AM - 1:00 PMWHERE: PINEVILLEQUICKBOOKS FOR BEGINNERSPARIAN MEXICANGRILLWHEN: ELFEBRUARY59:00 AM - 2:00 PMWORKERS’COMP 101: CLAIMS ANDWHERE: MARRIOTTLOSS CONTROLBATON ROUGEWHEN: AUGUST 73:00 SERIES:PM - 5:00PMLCI WEBINARAUDITINGWHERE:WHEN: PINEVILLEFEBRUARY 12PROTEMPS10:30 AM - STAFFING11:30 AMSOLUTIONSWHERE: ONLINE OFFICEWEBINAR:USE DOTHERONLINEMARKETINGTOOLSBY APPOINTMENT OR WALK-INTOPROMOTEYOUR BUSINESSWHEN:FEBRUARY17 - 21WHEN: AUGUST8:00 AM21- 5:00 PMAMOFFICE- 11:15 AMWHERE: 10:30LCI/LCIAWHERE: ONLINEMANDEVILLEMARCHSEPTEMBER“MARKETING MARCH”SAFETY WEBINARFEATURED ONLINE SAFETY CLASS:WHEN: SEPTEMBER 11OFFICE ERGONOMICS AND INDUSTRIAL10:30 AM - 11:15 AMERGONOMICSWHERE: ONLINELCI WEBINAR SERIES: WHAT YOU NEEDSAFETYBREAKFAST:LIFTINGTO DO FORWORKERS’PROPERCOMP WHENANTECHNIQUESEMPLOYEE IS INJUREDWHEN:WHEN: SEPTEMBERMARCH 12 129:0010:30AMAM- -10:3011:30AMAMWHERE:METAIRIEWHERE: ONLINEHOLIDAY INNBUSINESS BASICS WEBINAR:CPRCERTIFICATIONONLINEMARKETINGWHEN:WHEN: SEPTEMBERMARCH 19 269:0010:30AMAM- -12:0011:30PMAMWHERE:METAIRIEWHERE: ONLINEHOLIDAY INNASK THE EXPERTS: ALL ABOUT MARKETINGWHEN: MARCH 288:00 AM - 2:00 PMWHERE: NEW ORLEANSLUNCHLCI: GETTO KNOWYOURASK THEWITHEXPERT:SCHEDULEA 30-MINUTEWORKERS’COMPAPPOINTMENT WITH A FINANCIAL PLANNERWHEN:AUGUSTTO DISCUSSYOUR23PERSONAL FINANCIAL11:30AM -BUSINESS1:00 PM OWNERGOALS AS A SMALLWHERE:BATONROUGEWHEN: FEBRUARY 19ACMEOYSTER9:00 AM- 5:00HOUSEPMWHERE: LCI/LCIA OFFICE“WHAT’S MANDEVILLEGOING ON WITH HEALTH CARE?”AN OVERVIEW OF THE ACA LAWSWHEN: AUGUST 284:30 PM - 6:00 PMWHERE: NEW ORLEANSZEA RESTAURANTFor more information and toFormoreforinformationandgoto toregisterthese events,registerfortheseevents,gotoLCI and LCIA’s Member Portalwww.lciassociation.com/events,at rasBurasatat985.612.6733.985.612.6733.2

Notes From The AssociationLCI Workers’ Comp doesn’t just want to be your workers’ comp provider, we want to be a resource that can helpyou grow your company and attain your business objectives. Because we work with over 3,000 small andmid-sized Louisiana companies, including many start-ups, we are in a unique position to learn and understandwhat a company needs in order to grow and be successful.Like you, Louisiana is our home. We live here. We work here. In fact, it’s the only state where we do business. Webelieve that you, the small and mid-sized businesses, are the main drivers in our economic success. We want tosee you grow, and we are committed to your success.Mark TullisAdministratorLCI Workers’ CompThis is why in 2009 LCI set up a special member services organization named LCIA that has only one mission – toprovide useful and desired business resources to you, our clients. Throughout the year and throughout the State,LCIA offers workshops, seminars, networking events, and family events where you can learn from experts andconnect with other business owners. We are here to work with you, and we feel confident when saying that noother workers’ comp provider in Louisiana offers more business resources than we do. So please take advantageof all that LCIA offers.:: MarkSince I started here at LCIA three years ago, we have regrouped, restructured, and recommitted LCIA. Today, weare still working to bring you, LCI policyholders, the best services we can provide. We strive to extend exclusiveprograms that no other workers’ comp carrier offers – high quality, no to low-cost business developmentassistance, safety instruction, and industry training. And because you hold an LCI Workers’ Comp policy, yourbusiness can receive all of these benefits through LCIA.Christina BurasAssociate Director, LCIAHere at LCIA, we are constantly looking to improve our services. In 2013, we kicked off our online programs byoffering more webinars and by providing online safety training. And looking towards this upcoming year, we haveonce again set the bar high to ensure we offer you the best programs we can. That said, we’re excited to delve intoour numerous projects, such as: securing discounts for you and scheduling more industry-specific workshops. Ourbusiness is your business, so we want to see you succeed. You’re In Good Company with LCI and LCIA.:: Christina33

As you think about what 2014 will bring for you and your business,consider how LCI’s Member Services Arm, LCIA, might be able tohelp you with your goals. LCIA hosts workshops and webinars ona variety of topics, from QuickBooks to workers’ comp and fromsales to safety. And access to these programs is included withyour workers’ comp policy.So if you’re one to make New Year’s resolutions, we recommendadding “attend an LCIA workshop” to the list. We think it will fitnicely with our resolution: Continue to offer programs that helpour members’ businesses grow.For more information about LCIA, please visit lciassociation.com. You may also contactChristina Buras, LCIA’s Associate Director, at christina@lciassociation.com or at 985.612.6733.

ON THE ISSUESIssues:On theKnowing where to turn for business financing can be anoverwhelming task, whether you are just starting out, or you have beenaround for several years. Since there is no one-size-fits-all lendingsolution to help a business meet financial needs, we want to make sure that you learn about differentoptions. We hope you find the following articles about bank lending, as well as two alternative sources of financing– crowdfunding and microfinancing – useful.FINANCINGWhat is Bank Lending?Eric Van Hoven, Retail Branch Manager,Gulf Coast Bank & TrustAbout Bank LendingAlthough every bank has its own set ofguidelines and policies to help navigatelending decisions, financial institutions’lending policies are heavily intertwinedwith regulatory policy administered bygovernmental agencies. That being said,bank financing is more traditional innature than other financing sources.The process of acquiring financingfrom any institution can be aided bya knowledgeable lending officer thatcan serve as a resource and guideto applying for and securing capital.Most banks require some type of formalapplication process that can includerequests for detailed personal financialstatements that show the financialstrength of the borrower (as well asproof of income in the form of personal5and/or business tax returns) and otherfinancial statements.Who Bank Lending BenefitsGenerally, each credit decision isconsidered on a case-by-case basis. Inmost situations, the loan amounts arebased on a combination of what thecustomer requests, what the businessneeds, and what the business can affordto pay back. There is no real set minimumincome requirement, but decisions aremore based on the amount of debt currentlybeing serviced, and how the new loanrequest will affect the company’s abilityto repay. Each credit decision can takeinto account the personal credit history ofborrower, business cash flow, as well asincome that may be derived from sourcesoutside of the business operation andassets that can be pledged.Since each business is analyzedseparately and every lending institutionhas different guidelines and tolerances, itis hard to make blanket statements aboutwhat is considered a strong business.Ideally, lending institutions would preferto collateralize loans, where possible, tocompanies with solid cash flow and historyof ability to repay. However, lendinginstitutions can deviate from this basedon factors such as creditworthiness, cashflow, history with the institution, abilityto add guarantors, or the utilization ofSBA programs.

:: Line of Credit:A business line of credit is a devicethat allows you to borrow money as itis needed. You open the line of creditwith a lender, and it typically has amaximum amount of money that youcan borrow. A line of credit can be usedto fill the gaps in cash flow, generallyfor more established businesses with ahistory of ability to repay debt.:: Commercial Real Estate Loans:As the name implies, a commercialreal estate loan is secured by arental property, such as an apartmentbuilding, office building, shoppingcenter, or by some sort of businessrelated property, like a hotel,bowling alley or self-storage facility.These types of loans are generallyset up for well establishedbusinesses that have a good trackrecord of borrowing and solid credithistory; however some institutionsLocalFlexibilityWhen it comes to small business lending,Community Banks are generally moreflexible than larger national institutions.In fact, according to the IndependentCommunity Bankers of America (ICBA), in2012, Community Banks were the primarysource of lending for small businessesand farms. Statistics from the ICBA showthat Community Banks with less than 10Billion in assets accounted for 57.9% ofoutstanding bank loans to small businesses.will consider startups and newerbusinesses based off of satisfactorycollateral and certain credit criteria.Whether you are building, renovating,or purchasing, a Commercial RealEstate loan can be customized to meetyour needs.SBA LoansFor businesses who do not qualify for atraditional bank loan, the Small BusinessAdministration (SBA) provides a numberof financial assistance programs for smallbusinesses that have been specificallydesigned to meet key financing needs,including debt financing, surety bonds,and equity financing.Because the SBA does not make directloans to small businesses, it is common forbanks to partner with the SBA to providethe opportunity for debt financing. TheSBA sets the guidelines for loans, whichare then made by its partners (lenders,The 5 Cs of Credit::: Capacity – refers to the ability to meet loan payments.:: Capital – is the money invested in the business and is an indicator of how much is atrisk should the business fail.:: Conditions – refer to the intended purpose of the loan, for example working capital,additional equipment, and new offices.:: Character – is the obligation that a borrower feels to repay the loan.www.mcmf.netcommunity development organizations,and micro lending institutions). TheSBA guarantees that these loans will berepaid, thus eliminating some of the riskto the lending partners. When a businessapplies for an SBA loan, it is actuallyapplying for a commercial loan, structuredaccording to SBA requirements with anSBA guaranty. SBA-guaranteed loans maynot be made to a small business if theborrower has access to other financing onreasonable terms.An SBA loan is perfect for a wide variety ofpurposes including franchises, businessacquisitions, lines of credit, and evencommercial real estate initiatives. AnSBA loan option may be ideal for botha startup company and an establishedorganization because it offers:::::::::Lower Monthly PaymentsFlexible TermsLow Down PaymentFinancing Closing CostsTo qualify for an SBA loan, the smallbusiness must meet the bank’s lendingcriteria, as well as the SBA’s requirements.In addition, the lender providing the SBAguaranteed loan must certify that it wouldnot provide the loan under the proposedterms and conditions without an SBAguaranty. The applicant must be eligibleand creditworthy, and the loan must bestructured under conditions acceptable toSBA for a guaranty to be issued.In closing, each lender has its ownguidelines, credit criteria, and process.It is important to keep this in mind whenevaluating your method for borrowingmoney for you or your business. A goodway to get started is to ask around – askother business owners who they havea relationship with and would they bewilling to recommend the work of an areafinancial institution.For more information, visit www.gulfbank.com orcontact me at ericvanhoven@gulfbank.com6ON THE ISSUESTypes of Bank Loans:: Term LoanBusiness term loans are the mostbasic form of loans to take out. Theyare usually simple and straightforwardand have no specially designatedpurpose. Term loans can be taken outfor whatever a business needs. Forexample, term loans could be usedto purchase real estate, permanentworking capital, or equipmentpurchase. The terms on these loanscan vary and can be done securedor unsecured.

ON THE ISSUESWhat is Microlending?Mel Robertson, VP of South Louisiana Operations,Accion LouisianaHow to Get StartedTo get started, simply call toll-free:888-215-2373. Or visit the AccionLouisiana website at www.accionlouisiana.org. Applications are available online oryou can visit one of our Louisiana officesin Baton Rouge, Alexandria, Shreveportand New Orleans. Addresses and contactnames are listed on the website.About MicrolendingAccion Louisiana is an extension of AccionTexas Inc., the nation’s largest micro- andsmall business lender that provides creditand services to small businesses andentrepreneurs that do not have access toloans from commercial sources. It wasestablished in 1994 in San Antonio, Texas, andhas been in Louisiana since 2009. Accion’sfinancial and business support services helpentrepreneurs strengthen their businesses,stabilize and increase their incomes, createemployment and contribute to the economicrevitalization of their communities. InLouisiana, Accion makes loans rangingfrom 500 to 250,000 and provides a widevariety of educational services to aspiringand existing small business owners.7Who Microlending BenefitsAccion Louisiana’s lending and educationalservices are available to startups andestablished businesses that do not haveaccess to loans from commercial sources,including banks. Accion lends to all kindsof business people: restaurant owners,beauty salon operators, constructioncontractors, daycare providers andmore. Most clients use loans for workingcapital or equipment purchases. And themajority of Accion clients have lower-than-average incomes.Why Microlending WorksSmall businesses benefit greatly fromAccion’s services because it helps themestablish or improve their credit andprovides both the financial and educationaltools they need to succeed. Accion’srelationships with its clients are verypersonal and “one-on-one.” The ultimategoal is to help a small business flourish sothat, eventually, the business can go on tobecome “bankable.”

ON THE ISSUESWhat is Crowdfunding?Broderick McClinton, Co-Founder, Equity EndeavorAbout CrowdfundingMany small business owners are unfamiliarwith the concept of crowdfunding, so we’vespent a lot of time educating folks aboutit. Crowdfunding occurs when a largegroup of individuals each commit a smalldollar amount in order to raise money forsomething specific. Crowdfunding hasbeen used to help fund creative projects,non-profits, start-ups, and numerousother causes.Who Crowdfunding BenefitsOur crowdfunding platform, EquityEndeavor, was specifically designed tomeet the needs of small businesses. Ourplatform works best for existing directto-consumer small businesses that arelooking for capital in order to achieve atangible goal. Example projects includethe addition of outdoor space in a usuallycrowded restaurant or a local yoga studiorenovating an existing, but unpleasantdressing room.How Crowdfunding WorksThere are currently three main typesof crowdfunding: lending, donations,and rewards::: The final type, rewards-based, doesnot swap equity or debt but insteadoffers rewards and perks with realvalue to crowdfunders in exchange fortheir contributions.About Equity CrowdfundingA fourth type of crowdfunding, equitycrowdfunding, is not allowed under currentlaw but has gained prominence becauseof the passage of the JOBS Act. Equitycrowdfunding is the idea of selling equityto large pools of investors through onlinefunding portals. Currently, unaccreditedinvestors are not allowed to participatebut as the JOBS Act is implemented thiscould change. Many entrepreneurs andcompanies are watching this closely.About Equity Endeavor’s PlatformEquity Endeavor is a rewards-basedplatform. We allow business owners toraise funds without giving up equityor having to pay principal and interestpayments. In exchange for theircontributions, Community Builders (ourterm for crowdfunders) can receive avariety of rewards, which include products,services, rentals, and experiences. Theserewards have REAL economic value aswell as an intrinsic value. Furthermore,we work closely with business ownersto make sure the rewards are costeffective. Most importantly, everyoneinvolved benefits from the project oncethe campaign goal is met and the projectis completed. Crowdfunders receive theirrewards and, when visiting the businessthey contributed to, benefit from theimprovement or expansion that was made.Small business owners raise the capitalneeded to improve their businesses, andat the same time, bring their customersand community

Jan 01, 2019 · a variety of topics, from QuickBooks to workers’ comp and from sales to safety. And access to these programs is included with your workers’ comp policy. So if you’re one to make New Year’s resolutions, we recommend adding “a