Transcription

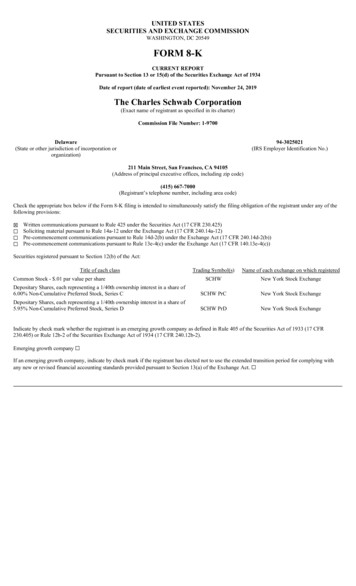

UNITED STATESSECURITIES AND EXCHANGE COMMISSIONWASHINGTON, DC 20549FORM 8-KCURRENT REPORTPursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934Date of report (date of earliest event reported): November 24, 2019The Charles Schwab Corporation(Exact name of registrant as specified in its charter)Commission File Number: 1-9700Delaware(State or other jurisdiction of incorporation ororganization)94-3025021(IRS Employer Identification No.)211 Main Street, San Francisco, CA 94105(Address of principal executive offices, including zip code)(415) 667-7000(Registrant’s telephone number, including area code)Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of thefollowing provisions: Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 140.13e-4(c))Securities registered pursuant to Section 12(b) of the Act:Title of each classTrading Symbol(s)Name of each exchange on which registeredSCHWNew York Stock ExchangeDepositary Shares, each representing a 1/40th ownership interest in a share of6.00% Non-Cumulative Preferred Stock, Series CSCHW PrCNew York Stock ExchangeDepositary Shares, each representing a 1/40th ownership interest in a share of5.95% Non-Cumulative Preferred Stock, Series DSCHW PrDNew York Stock ExchangeCommon Stock - .01 par value per shareIndicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (17 CFR230.405) or Rule 12b-2 of the Securities Exchange Act of 1934 (17 CFR 240.12b-2).Emerging growth company If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying withany new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 1.01 Entry into a Material Definitive AgreementAgreement and Plan of MergerOverviewOn November 24, 2019, The Charles Schwab Corporation (“Schwab”) entered into an Agreement and Plan of Merger (the “Merger Agreement”)with TD Ameritrade Holding Corporation, a Delaware corporation (“TD Ameritrade”), and Americano Acquisition Corp., a Delaware corporationand wholly owned subsidiary of Schwab (“Merger Subsidiary”). Upon the terms and subject to the conditions of the Merger Agreement, MergerSubsidiary will merge with and into TD Ameritrade (the “Merger”), with TD Ameritrade surviving as a wholly owned subsidiary of Schwab. TheMerger Agreement was unanimously approved by the Board of Directors of each of Schwab and TD Ameritrade, as well as the StrategicDevelopment Committee of the TD Ameritrade Board of Directors—a committee comprised solely of outside, independent directors that wasestablished by the Board of Directors of TD Ameritrade to oversee and conduct the process and all negotiations concerning the transaction on behalfof the TD Ameritrade Board of Directors.Pursuant to the Merger Agreement, at the effective time of the Merger (the “Effective Time”), each share of common stock, par value 0.01 pershare, of TD Ameritrade (“TD Ameritrade Common Stock”) issued and outstanding immediately prior to the Effective Time (other than treasuryshares held by TD Ameritrade and certain shares held by Schwab), will be converted into the right to receive 1.0837 shares of voting common stock,par value 0.01 per share, of Schwab (“Schwab Common Stock”) (the “Merger Consideration”); provided, however, that if the MergerConsideration issuable in respect of shares of TD Ameritrade Common Stock owned by The Toronto-Dominion Bank (“TD Bank”) and its affiliatesas of immediately prior to the Effective Time, together with any other shares of Schwab Common Stock then owned by TD Bank and its affiliates,would equal a number of shares of Schwab Common Stock exceeding 9.9% (or such lower percentage of shares of Schwab Common Stock as theFederal Reserve Board permits TD Bank to acquire in the Merger consistent with a determination that TD Bank does not control Schwab forpurposes of the Bank Holding Company Act of 1956, as amended (the “BHC Act”), or the Home Owners’ Loan Act of 1933, as amended(“HOLA”)), of the issued and outstanding shares of Schwab Common Stock as of immediately following the Effective Time, then TD Bank willreceive one share of nonvoting common stock, 0.01 par value per share, of Schwab (“Schwab Nonvoting Common Stock” and, together withSchwab Common Stock, “Schwab Common Shares”) in lieu of each such excess share of Schwab Common Stock.Treatment of Equity AwardsAt the Effective Time, each outstanding and unexercised option to purchase shares of TD Ameritrade Common Stock, whether vested or unvested,will be assumed by Schwab and become an option to purchase shares of Schwab Common Stock, on the same terms and conditions as applied toeach such option immediately prior to the Effective Time, except that (A) the number of shares of Schwab Common Stock subject to such optionwill equal the product of (i) the number of shares of TD Ameritrade Common Stock that were subject to such option immediately prior to theEffective Time multiplied by (ii) 1.0837, rounded down to the nearest whole share, and (B) the per-share exercise price will equal the quotient of (1)the exercise price per share of Schwab Common Stock at which such option was exercisable immediately prior to the Effective Time, divided by (2)1.0837, rounded up to the nearest whole cent, and except that each option (A) which is an “incentive stock option” (as defined in Section 422 of theInternal Revenue Code of 1986 (the “Code”)) shall be adjusted in accordance with the requirements of Section 424 of the Code and (B) shall beadjusted in a manner that complies with Section 409A of the Code.At the Effective Time, each outstanding restricted stock unit award with respect to shares of TD Ameritrade Common Stock, whether vested orunvested, will be assumed by Schwab and become a restricted stock unit award with respect to shares of Schwab Common Stock (each, a “SchwabRSU Award”), on the same terms and conditions as applied to such restricted stock award immediately prior to the Effective Time, except that thenumber of shares of Schwab Common Stock subject to such restricted stock award will equal the product of (i) the number of shares of TDAmeritrade Schwab Stock that were subject to such restricted stock award prior to the Effective Time multiplied by (ii) 1.0837, rounded to thenearest whole share.At the Effective Time, each outstanding restricted stock unit award with respect to shares of TD Ameritrade Common Stock that is eligible to vestbased on the achievement of performance goals (each, a “TD Ameritrade PSU Award”) will be converted into a restricted stock unit award ofSchwab representing the right to receive shares of Schwab Common Stock with respect to each share of TD Ameritrade Common Stock underlyingsuch TD Ameritrade PSU Award (with the number of shares of TD Ameritrade Common Stock earned to be determined based on the greater of (x)the actual level of achievement of the applicable

performance goals as determined by the compensation committee of TD Ameritrade prior to the Effective Time using the information available as ofthe latest practicable date prior to the Effective Time and (y) the target level) (each, a “Schwab PSU Award”), except that the number of shares ofSchwab Common Stock subject to such Schwab PSU Award will equal the product of (i) the number of shares of TD Ameritrade Common Stockthat were subject to such Schwab PSU Award immediately prior to the Effective Time multiplied by (ii) 1.0837, rounded to the nearest whole share.At the Effective Time, each outstanding restricted stock unit award with respect to shares of TD Ameritrade Common Stock outstanding under theTD Ameritrade Holding Corporation 2006 Directors Incentive Plan, including each deferred restricted stock unit award and any stock unit issued inrespect of deferred cash fees (each, a “TD Ameritrade Director RSU Award”), whether vested or unvested, will vest, if unvested, and be cancelledand converted into the right to receive the Merger Consideration as if such TD Ameritrade Director RSU Award had been settled in shares of TDAmeritrade Common Stock immediately prior to the Effective Time; except that each such TD Ameritrade Director RSU Award that constitutes“deferred compensation” for purposes of Section 409A of the Code will instead be settled at the earliest time that would not result in the applicationof additional taxes or penalties under Section 409A of the Code, and each TD Ameritrade Director RSU Award for which settlement is delayed willbe converted into a fully vested Schwab RSU Award.Closing ConditionsThe obligation of the parties to consummate the Merger is subject to customary conditions, including, among others, (i) the approval and adoptionof the Merger Agreement by TD Ameritrade’s stockholders, including by the holders (other than TD Bank, the Significant Stockholders (as definedbelow) and their respective affiliates) of a majority of the outstanding shares of TD Ameritrade Common Stock (other than shares of TD AmeritradeCommon Stock held by TD Bank, the Significant Stockholders and their respective affiliates), (ii) the approval by Schwab’s stockholders of theissuance of Schwab Common Shares in the transaction (the “Share Issuance”) and an amendment to Schwab’s certificate of incorporation to createSchwab Nonvoting Common Stock with 300 million shares authorized for issuance (the “Charter Amendment”), (iii) the absence of any law,injunction, judgment, order or decree prohibiting or making illegal the consummation of the Merger or any of the other transactions contemplatedby the Merger Agreement and the ancillary agreements, (iv) the early termination or expiration of any applicable waiting period or periods under theHart-Scott-Rodino Antitrust Improvements Act of 1976, as amended, and receipt of specified governmental consents and approvals (in the case ofSchwab’s obligations to close, without the imposition of a Burdensome Condition (as defined below)), (v) compliance by Schwab and TDAmeritrade in all material respects with their respective obligations under the Merger Agreement and (vi) subject in most cases to exceptions that donot rise to the level of a “Parent Material Adverse Effect” or a “Company Material Adverse Effect” (each as defined in the Merger Agreement), asapplicable, the accuracy of representations and warranties made by Schwab and TD Ameritrade, respectively. The obligation of Schwab and TDAmeritrade to consummate the Merger is also subject to there not having occurred an event that has had or would reasonably be expected to have,individually or in the aggregate, a “Company Material Adverse Effect” or “Parent Material Adverse Effect”, respectively. The obligation of Schwabto consummate the Merger is also subject to the parties having received from the Federal Reserve Board a determination in form and substancereasonably satisfactory to Schwab or, as determined by Schwab in its sole discretion, other acceptable confirmation, that the consummation of theMerger will not result in Schwab either (i) being deemed to be “controlled” by TD Bank as that term is interpreted by the Federal Reserve Boardunder the BHC Act or HOLA or (ii) being deemed to be in “control” of any of the TD Subsidiary Banks (as defined in the Merger Agreement) asthat term is interpreted by the Federal Reserve Board under the BHC Act or HOLA (the “Noncontrol Determinations”).Representations and Warranties; CovenantsThe Merger Agreement contains customary representations and warranties from both Schwab and TD Ameritrade with respect to each party’sbusiness. The Merger Agreement contains customary covenants, including covenants by (i) TD Ameritrade to, subject to certain exceptions, conductits business in the ordinary course during the interim period between the execution of the Merger Agreement and the consummation of the Mergerand (ii) Schwab to not conduct its business outside the ordinary course during the interim period between the execution of the Merger Agreementand the consummation of the Merger to the extent it would, or would reasonably be expected to, prevent, enjoin, alter or materially delay thecontemplated transactions.Under the Merger Agreement, each of Schwab and TD Ameritrade has agreed to use its reasonable best efforts to take all actions and to do all thingsreasonably necessary, proper or advisable to consummate the Merger, including obtaining all consents required to be obtained from anygovernmental authority or other third party that are necessary, proper or advisable to consummate the Merger. Notwithstanding such generalobligation to obtain such consents of governmental authorities, Schwab is not required to take certain actions if such action would reasonably beexpected to have a material adverse effect on Schwab, TD Ameritrade and their respective subsidiaries, taken as a whole, in each case, measured ona scale relative to the size

of TD Ameritrade and its subsidiaries (a “Burdensome Condition”).The Merger Agreement provides that Schwab will take all necessary action to cause Todd Ricketts, who has been designated by TD Ameritrade, andtwo other individuals who will be designated by TD Bank to be appointed to the Board of Directors of Schwab as of the Effective Time, providedthat such individuals meet (i) the director qualification and eligibility criteria of the Nominating and Corporate Governance Committee of the Boardof Directors of Schwab and (ii) any applicable requirements or standards that may be imposed by a regulatory agency for service on the Board ofDirectors of Schwab, and will otherwise be reasonably acceptable to the Nominating and Corporate Governance Committee of the Board ofDirectors of Schwab.Stockholder Meetings; Non-Solicitation; Intervening EventsThe Merger Agreement requires each of Schwab and TD Ameritrade to convene a stockholder meeting for purposes of obtaining the necessarySchwab stockholder approval and TD Ameritrade stockholder approval. In addition, subject to certain exceptions, each of Schwab and TDAmeritrade have agreed (i) not to solicit alternative transactions or enter into discussions concerning, or provide information in connection with, anyalternative transaction and (ii) that its Board of Directors will recommend that its stockholders approve the Share Issuance and the CharterAmendment or approve and adopt the Merger Agreement, as applicable.Prior to the approval of the Share Issuance and the Charter Amendment by Schwab’s stockholders or the approval and adoption of the MergerAgreement by TD Ameritrade’s stockholders, as applicable, the Board of Directors of Schwab or the Board of Directors of TD Ameritrade, asapplicable, may, in connection with (i) the receipt of a “Parent Superior Proposal” or a “Company Superior Proposal” (each as defined in the MergerAgreement), respectively, or (ii) a “Parent Intervening Event” or a “Company Intervening Event” (each as defined in the Merger Agreement),respectively, change its recommendation in favor of the Share Issuance and the Charter Amendment or the Merger Agreement, respectively, in eachcase, subject to complying with notice and other specified conditions, including giving the other party the opportunity to propose changes to theMerger Agreement in response to such Parent Superior Proposal, Company Superior Proposal, Parent Intervening Event or Company InterveningEvent, as applicable, if the failure to make such change in recommendation would be reasonably likely to be inconsistent with its fiduciary duties.Notwithstanding a change in recommendation by the Board of Directors of Schwab or the Board of Directors of TD Ameritrade, Schwab or TDAmeritrade, as applicable, is still required to convene the meeting of its stockholders as described above.Termination; Termination FeeThe Merger Agreement may be terminated by Schwab and TD Ameritrade by mutual agreement. Furthermore, either party may terminate theMerger Agreement if (i) subject to limited exceptions, the Merger has not been consummated on or before November 24, 2020, which may beextended to May 24, 2021 under certain circumstances if required regulatory approvals have not been obtained by the earlier date (such November24, 2020 date as it may be extended, the “End Date”), (ii) an applicable law prohibits the Merger and, in the case of an order or injunction, suchorder or injunction has become final and non-appealable, (iii) the required vote of TD Ameritrade’s stockholders is not obtained at TD Ameritrade’sstockholder meeting and (iv) the required vote of Schwab’s stockholders is not obtained at Schwab’s stockholder meeting.Schwab may terminate the Merger Agreement if (i) the Board of Directors of TD Ameritrade changes its recommendation to its stockholders toapprove and adopt the Merger Agreement, (ii) subject to limited exceptions, a required regulatory approval has been denied and such denial hasbecome final and non-appealable or on a final basis the relevant regulatory authority has determined not to grant the consent without imposing aBurdensome Condition, (iii) subject to limited exceptions, TD Ameritrade is in breach of the Merger Agreement in a manner that would result in afailure of the applicable closing condition and such breach either cannot be cured or has not been cured within forty-five days or (iv) subject tolimited exceptions, TD Ameritrade materially breaches the provisions of the Merger Agreement relating to non-solicitation of alternativetransactions or convening TD Ameritrade’s stockholder meeting.TD Ameritrade may terminate the Merger Agreement if (i) the Board of Directors of Schwab changes its recommendation to its stockholders toapprove the Share Issuance and the Charter Amendment, (ii) subject to limited exceptions, a required regulatory approval has been denied and suchdenial has become final and non-appealable, (iii) subject to limited exceptions, Schwab is in breach of the Merger Agreement in a manner thatwould result in a failure of the applicable closing condition and such breach either cannot be cured or has not been cured within forty-five days or(iv) subject to limited exceptions, Schwab materially

breaches the provisions of the Merger Agreement relating to non-solicitation of alternative transactions or convening Schwab’s stockholder meeting.In the event of a termination of the Merger Agreement under certain circumstances, Schwab or TD Ameritrade may be required to pay a terminationfee of 950 million to the other.TD Ameritrade would be required to pay to Schwab a termination fee of 950 million if the Merger Agreement is terminated (i) by Schwab prior toreceipt of TD Ameritrade stockholder approval as a result of a change in the recommendation of the Board of Directors of TD Ameritrade to itsstockholders to approve and adopt the Merger Agreement, (ii) by Schwab due to TD Ameritrade’s breach in any material respect of the provisionsof the Merger Agreement relating to non-solicitation of alternative transactions or convening TD Ameritrade’s stockholder meeting or (iii) bySchwab or TD Ameritrade if the necessary TD Ameritrade stockholder approval is not obtained and, at the time of termination, the MergerAgreement was terminable under clause (i) or (ii) above. In addition, TD Ameritrade would be required to pay to Schwab a termination fee of 950million if (w) the required vote of TD Ameritrade’s stockholders is not obtained at TD Ameritrade’s stockholders meeting, (x) prior to such vote, analternative acquisition of TD Ameritrade was publicl

unvested, will be assumed by Schwab and become a restricted stock unit award with respect to shares of Schwab Common Stock (each, a “Schwab RSU Award”), on the same terms and conditions as applied to such restricted stock award