Transcription

IV. How to Calculate Prevailing WagePaymentsThe term "prevailing wage" means the total base hourly rate of pay and bona fide fringebenefits customary or prevailing for the same work in the same trade or occupation in the townwhere the project is to be constructed. The prevailing wage rate schedules developed by theU.S. Department of Labor (and used by the Connecticut Department of Labor) indicate specificamounts for both components of the rate.Title 29, Part 5, Subpart B of the Code of Federal Regulations provides detailed informationabout the types of payments that can be used to meet prevailing wage requirements under theDavis-Bacon Act. These interpretations are also used by the Connecticut Department of Labor inits enforcement of the state's prevailing wage law.Bona fide fringe benefits can include the contractor’s expenditures for medical or hospital care,compensation for occupational injuries or illnesses, life insurance, disability and sicknessinsurance, pensions, vacation and holiday pay. However, these items only apply towardprevailing wage requirements if the contractor is not required by federal, state, or local law toprovide the benefit.If a contractor selected for a prevailing wage project does not typically provide benefits equal tothe mandated level, cash payments (paid as taxable wages) can be made to employees inamounts sufficient to meet the required total wage rate (base hourly pay and fringe benefits). Aworker would then have the option of using the additional money to purchase the type ofbenefit not provided (e.g., medical or life insurance), if feasible given the cost and availability ofthe commodity. Federal regulations also allow a contractor to pay less than the specified hourlypay component as long as the value of the fringe benefit component is high enough to producea combined total equal to the required wage. In this instance, however, the worker must bepaid at least their regular contractual hourly rate.

Blank certified payroll forms WWS-CP1-2 and sample copies are included in this guidebook.The state certified payroll forms may be downloaded from the Department of Labor, Wage &Workplace Standards Division Website: tm.(this form is in an adobe "fillable" format)Federal certified payroll forms or out of state certified payroll forms do not meet therequirements of Connecticut General Statutes, Section 31-53(f) and cannot be used on projectscovered under C.G.S. Section 31-53.Computerized forms are acceptable provided they contain ALL the information requested on theConnecticut form. We recommend that you submit your computerized form to this departmentfor approval prior to use.Effective October 1, 1997, Public Act 97-263 requires weekly certified payrolls and compliancestatements to be filed on a monthly basis with the contracting agency.Effective: October 1, 2009, Public Act 09-25 mandates that certified payrolls must now becompleted weekly and filed monthly “by mail, first class postage prepaid” to the contractingagency. The certified payrolls can still be processed through the existing format:1.2.3.Mailed with their requisition to whom ever that contractor has a contract with.Then each contractor level continues to submit the certified payrolls up thecontractor chain until they arrive at the contracting agency.Each contractor level should retain the envelope the certified payrolls weresubmitted in by stapling it to the applicable certified payroll as verification ofcompliance.Certified Payrolls must be filed for Each Week, once work has been started on the project, evenwhen NO Work is performed. If NO Work is performed for the entire month, this departmentwill accept the filing of one certified payroll for entire month.Please note that contractors do not list a worker’s social security number on the statecertified payroll forms. These certified payrolls shall be considered a public record, and everyperson shall have the right to inspect and copy such records in accordance with the provisionsof Connecticut General Statutes, Section 1-15.

The Certified Statement of Compliance must be signed by the “owner”.1. The owner is either: individual owner, major or equal officer of corporation, equalpartner, or LLC managing or equal members only.2. A stamp, photocopy, or electronic signature is not acceptable.3. No employee can be authorized to sign on the owner’s behalf.What are you required to submit when the project is covered by both State prevailing wage andFederal Davis-Bacon prevailing wage requirements?1. A Department of Transportation project that is also covered under the Federal DavisBacon Act requires you to submit both the State of Connecticut Certified Payroll formWWS-CP1 and the U.S. Department of Labor Form WH-347.2. Federal Stimulus Money for ARRA work that is being performed on any state or municipalproject, which exceeds the state’s monetary thresholds, requires you to submit both theState of Connecticut Certified Payroll form WWS-CP1 and the U.S. Department of LaborForm WH-347.a. To eliminate the necessity of completing two (2) separate certified payroll formsfor each week, you may complete the front page of the State WWS-CP1 certifiedpayroll form to report the time and wage information.b. Submit both state and federal compliance certification statements (signing 2separate compliance statements)c. Include a separate detached sheet listing the worker’s names and the last fourdigits of the worker’s social security number.On Connecticut Department of Transportation (CONNDOT) projects only, contractors arerequired to report ALL WORKERS under Section B who perform work on site but ARE NOTcovered under the prevailing wage requirements. Example: Engineer, architect, projectmanager, surveyor, balancing technician, security guard, fire watchman, etc.Note: The time and wage information needs to be reported for Section B workers, but is notrequired to be paid at prevailing wage if the work they are performing is not covered under anylaborer or mechanic classification listed on the prevailing wage rate schedule.Any questions regarding the use of this form may be directed to the Wage & WorkplaceStandards Division at (860) 263-6543.

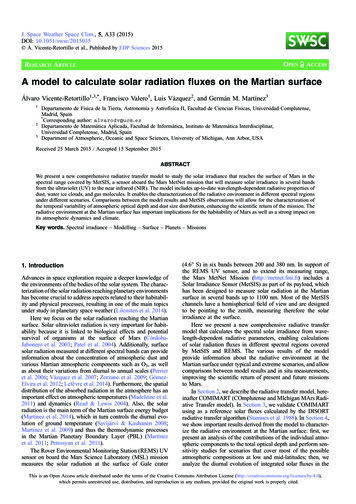

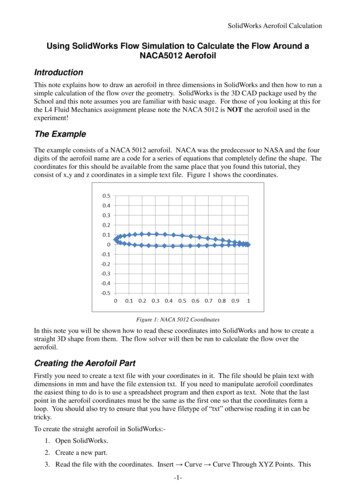

[New] In accordance with Section 31-53b(a) of the C.G.S. each contractor shall provide a copy of the OSHA 10 Hour Construction Safety and Health Card for each employee, to be attached to the firstcertified payroll on the project.PAYROLL CERTIFICATION FOR PUBLIC WORKS PROJECTSIn accordance with Connecticut General Statutes, 31-53Certified Payrolls with a statement of complianceshall be submitted monthly to the contracting agency.Connecticut Department of LaborWage and Workplace Standards Division200 Folly Brook Blvd.Wethersfield, CT 06109WEEKLY PAYROLLCONTRACTOR NAME AND ADDRESS:SUBCONTRACTOR NAME & ADDRESSWORKER'S COMPENSATION INSURANCE CARRIERPOLICY #PAYROLL NUMBERWeek-EndingDatePERSON/WORKER,APPR MALE/ADDRESS and SECTION RATE FEMALE% ANDRACE*PROJECT NAME & ADDRESSEFFECTIVE DATE:EXPIRATION DATE:WORKCLASSIFICATIONSMTDAY AND DATEWTHTrade License Type& Number - OSHA10 Certification NumberHOURS WORKED EACH DAYTYPE OFFRINGEBENEFITSTOTAL FRINGEPer HourTotalBENEFIT PLAN1 through 6O/T HoursCASH(see back)1. S-TIME 2. Base Rate3. 4. O-TIME 5. Cash Fringe6. 1. S-TIME 2. Base Rate3. 4. O-TIME 5. Cash Fringe6. 1. S-TIME 2. Base Rate3. 4. O-TIME 5. Cash Fringe6. 1. S-TIME2. Base Rate3. 4. O-TIMETotal STFSHoursBASE HOURLYRATE Cash Fringe7/13/2009GROSS PAYTOTAL DEDUCTIONSFOR ALLFEDERAL STATEWORKPERFORMEDTHIS WEEK FICAWITHWITH-GROSS PAY FORTHIS PREVAILING CHECK # ANDRATE JOBNET PAYLISTOTHERHOLDING HOLDING5. 6. *IF REQUIREDWWS-CP1OSHA 10 ATTACH CARD TO 1ST CERTIFIED PAYROLL*SEE REVERSE SIDEPAGE NUMBEROF

*FRINGE BENEFITS EXPLANATION (P):Bona fide benefits paid to approved plans, funds or programs, except those required by Federal or StateLaw (unemployment tax, worker’s compensation, income taxes, etc.).Please specify the type of benefits provided:1) Medical or hospital care4) Disability2) Pension or retirement5) Vacation, holiday3) Life Insurance6) Other (please specify)CERTIFIED STATEMENT OF COMPLIANCEFor the week ending date ofI,,of, (hereafter known asEmployer) in my capacity as(title) do hereby certify and state:Section A:1. All persons employed on said project have been paid the full weekly wages earned by them duringthe week in accordance with Connecticut General Statutes, section 31-53, as amended. Further, Ihereby certify and state the following:a) The records submitted are true and accurate;b) The rate of wages paid to each mechanic, laborer or workman and the amount of payment orcontributions paid or payable on behalf of each such employee to any employee welfare fund, asdefined in Connecticut General Statutes, section 31-53 (h), are not less than the prevailing rateof wages and the amount of payment or contributions paid or payable on behalf of each suchemployee to any employee welfare fund, as determined by the Labor Commissioner pursuant tosubsection Connecticut General Statutes, section 31-53 (d), and said wages and benefits are notless than those which may also be required by contract;c) The Employer has complied with all of the provisions in Connecticut General Statutes,section 31-53 (and Section 31-54 if applicable for state highway construction);d) Each such employee of the Employer is covered by a worker’s compensation insurancepolicy for the duration of his employment which proof of coverage has been provided to thecontracting agency;e) The Employer does not receive kickbacks, which means any money, fee, commission, credit,gift, gratuity, thing of value, or compensation of any kind which is provided directly orindirectly, to any prime contractor, prime contractor employee, subcontractor, or subcontractoremployee for the purpose of improperly obtaining or rewarding favorable treatment inconnection with a prime contract or in connection with a prime contractor in connection with asubcontractor relating to a prime contractor; andf) The Employer is aware that filing a certified payroll which he knows to be false is a class Dfelony for which the employer may be fined up to five thousand dollars, imprisoned for up tofive years or both.2. OSHA The employer shall affix a copy of the construction safety course, program ortraining completion document to the certified payroll required to be submitted to the contractingagency for this project on which such employee’s name first appears.(Signature)(Title)Submitted on (Date)Section B: Applies to CONNDOT Projects ONLYThat pursuant to CONNDOT contract requirements for reporting purposes only, all employeeslisted under Section B who performed work on this project are not covered under the prevailingwage requirements defined in Connecticut General Statutes Section 31-53.(Signature)(Title)Submitted on (Date)Note: CTDOL will assume all hours worked were performed under Section A unless clearlydelineated as Section B WWS-CP1 as such. Should an employee perform work under bothSection A and Section B, the hours worked and wages paid must be segregated for reportingpurposes.***THIS IS A PUBLIC DOCUMENT******DO NOT INCLUDE SOCIAL SECURITY NUMBERS***

PAYROLL CERTIFICATION FOR PUBLIC WORKS PROJECTSWeekly Payroll Certification ForPublic Works Projects (Continued)Week-Ending Date:Contractor or Subcontractor Business Name:WEEKLY PAYROLLPERSON/WORKER,ADDRESS and SECTIONAPPR MALE/RATE FEMALE%ANDRACE*WORKCLASSIFICATION SMTDAY AND DATEWTHFTrade License Type& Number - OSHA10 Certification NumberSTotal ST BASE HOURLYHoursRATETOTAL FRINGEBENEFIT PLANO/T HoursCASHTotalHOURS WORKED EACH DAYS-TIMETYPE OFGROSS PAYTOTAL DEDUCTIONSGROSS PAY FORFRINGEFOR ALL WORKFEDERAL STATETHIS PREVAILING CHECK # ANDBENEFITSPERFORMEDRATE JOBNET PAYLISTPer HourTHIS WEEK1 through 6FICA WITHWITHOTHER(see back)HOLDING HOLDING1. Base Rate2. 3. 4. O-TIME Cash Fringe5. 6. 1. S-TIME Base Rate2. 3. 4. O-TIME Cash Fringe5. 6. 1. S-TIME Base Rate2. 3. 4. O-TIME Cash Fringe5. 6. 1. S-TIME Base Rate2. 3. 4. S-TIME Cash Fringe5. 6. 1. S-TIME Base Rate2. 3. 4. S-TIME Cash Fringe5. 6. *IF REQUIRED7/13/2009WWS-CP2NOTICE: THIS PAGE MUST BE ACCOMPANIED BY A COVER PAGE (FORM # WWS-CP1)PAGE NUMBEROF

nl.!e3enge[New] In accordance with Section 31-53b(a) of the CG.S. each contractorcertificd payroll on the project.shall provide a copy of the OSHA 10 Hour Construction2. S-TIMEBaseRateEFFECTIVEDATE: TRACTORPAYROLL CERTIFICATION WEEKLYFORBENEFITSPUBLIC DepartmentWORKSPAYROLLXYZCorporationConnecticutof Labor NAME & ADDRESS402 Totalxxx.xxI.1. # calElectrical2322WITHHOLDINGWITHCASHNETLineman20 6 y INSURANCEBASECLASSIFICATION1I0URLWORKCHECK .WEEK88 &PAGE sRATEPERFORMEDGROSSFRINGE 1,582.802.FOR3.WORKTYPEPerS NSGROSSHOLDINGPAYTolalFORLISTP-xxxxG-xxxST OffHouRATEWORKER'SJOBCOMPENSATIONCARRIER#125CT 063898SProject26 ntice4.REQUIRED L9/26/09Week-EndingFRINGE 1,500.002.200Brook5. I PLAN# #BAC888892840 Foil)' 'IF19.99In 53 POLICYDOT105-296,Route82OF Base Rate30.75 81vd. OSHA xxx.xxWethersfield, 8.82CT 06109;:LOSHA 10 -ATIACHSafety and Health Card for each employee,CARD TO 1ST CERTIFIED PAYROLLDATE:12/31/09WageIto be attached to the firstand WorkplaceStandardsDivision

*FRINGEBENEFITSEXPLANATION(P):Bona fide benefits paid to approved plans, funds or programs, except those required by Federal or StateLaw (unemployment tax, worker's compensation, income taxes, etc.).Please specify the type of benefits provided:1) Medical or hospital care4) DisabilityBlue Cross2) Pension or retirement5) Vacation, holiday3) Life Insurance6) Other (please specify)UtopiaCERTIFIEDSTATEMENTOF COMPLIANCE-----------'For the week ending date of 9/26/09I,ofRobert CraftEmployer)Sectionin my capacity asXYZ Corporation, (hereafter known as(title) do hereby certify and state:OwnerA:I. All persons employed on said project have been paid the full weekly wages earned by them duringthe week in accordance with Connecticut General Statutes, section 31-53, as amended. Further, Ihereby certify and state the following:a) The records submitted are true and accurate;b) The rate of wages paid to each mechanic, laborer or workman and the amount of payment orcontributions paid or payable on behalf of each such employee to any e'mployee welfare fund, asdefined in Connecticut General Statutes, section 31-53 (h), are not less than the prevailing rateof wages and the amount of payment or contributions paid or payable on behalf of each suchemployee to any employee'welfarefund, as determined by the Labor Commissioner pursuant tosubsection Connecticut General Statutes, section 31-53 (d), and said wages and benefits are notless than those which may also be required by contract;c) The Employer has complied with all of the provisions in Connecticut General Statutes,section 31-53 (and Section 31-54 if applicable for state highway construction);d) Each such employee of the Employer is covered by a worker's compensation insurancepolicy for the duration of his employment which proof of coverage has been provided to thecontracting agency;e) The Employer does not receive kickbacks, which means any money, fee, commission, credit,gift, gratuity, thing of value, or compensation of any kind which is provided directly orindirectly, to any prime contractor, prime contractor employee, subcontractor, or subcontractoremployee for the purpose of improperly obtaining or rewarding favorable treatment inconnection with a prime contract or in connection with a prime contractor in connection with asubcontractor relating to a prime contractor; andf) The Employer is aware that filing a certified payroll which he knows to be false is a class Dfelony for which the employer may be fined up to five thousand dollars, imprisoned for up tofive years or both.2.OSHA-Theemployershall affix a copy of the constructionsafety course,training completiondocument to the certified payroll required to be submittedagency for this project on which such employee'sname first appears. (Signature)ow ,(Title)programorto the contracting/o/ -) t/Submitte6on (.Date)Section B: Applies to CONNDOT Projects ONLYThat pursuant to CONNDOT contract requirementsfor reporting purposes only, all employeeslisted under Section B who performed work on this project are not covered under the prevailingwageRquirementsdefined in Connecticut General Statutes Section 31-53.o u/I./e; "(Title)Note: CTDOL will assume all hours worked were performed under Section A unless clearlydelineatedas Section B WWS-CP I as such. Should an employee perform work under bothSection A and Sectionpurposes.B, the hours workedand wages paid must be segregatedfor reporting***THIS IS A PUBLIC DOCUMENT******DO NOT INCLUDE SOCIAL SECURITY NUMBERS***Cj

DISCHARGING FRINGE BENEFIT OBLIGATIONS UNDER THE FEDERAL DAVIS BACONACT, PART 5Discharging Fringe Benefit Obligations FB1. Paid in cash.2. Incurring cost for "bona fide" fringe benefits.3. By a combination of the above.Contractor/Subcontractor can pay less than the required minimum hourly wages as longas hourly rate plus fringe benefit equals the total required.Crediting of FB Payments: (Reg. 5.5(a)(1)(I)) Contributions to FB plans must be made notless often than - quarterly.Payments or cost incurred must be made in the hourly rate specified for each individualperforming covered contract work.FB's must be "bona fide"; those common to the construction industry. No credit can betaken for any benefit required by law (social security contributions or workerscompensation, etc.)If under payments have been determined, contractor/subcontractor can be allowed tomake payments to a bona fide FB plan on behalf of the underpaid employees (15f10).Cash Equivalent Credit for FB payments: Period of time to be used is the period coveredby the contribution. Contractor/subcontractor may offset annual cost by convertingcosts to an hourly cash equivalent Cost of FB divided by total number of working hours(both covered and noncovered hours since contractor/subcontractor’ s cannot usecontributions made for non-government work to discharge or offset their obligations oncovered work) (15f1 1). If the amount of contribution varies per worker, credit must bedetermined separately for the amount contributed on behalf of each worker(e.g. Singleinsurance coverage versus family coverage). contractor/subcontractor can use"previous" year's experience for total hours worked for a benefit paid for in advance (orfor one that he/she anticipates to pay) as long as comparison or period chosen isreasonable.Workers excluded from a plan for whom contractor/subcontractor makes nocontribution or incurs no cost must be paid in cash or furnished other bona fide FB'sequal in monetary value. If plan requires contributions to be made during eligibilitywaiting period, credit may be taken, but no credit is allowed for contributions for

workers who by definition are not eligible to participate (due to age or part-timeemployment) (15f12).Pension profit Sharing Plans PSPs (15f13).Contributions must be irrevocably made to a trustee or a third party.PSPs are not usually creditable towards meeting contractor/subcontractor 's prevailingwage obligation.1. Uncertainty.2. Discretionary nature.3. If contributions made annually they would not meet quarterly requirement (orcontractor/subcontractor must contribute irrevocably to an escrow account)(15f13(c))Vesting provisions are allowed if they meet the requirements of the EmployeeRetirement Income Act.Contractor may not use

The prevailing wage rate schedules developed by the U.S. Department of Labor (and used by the Connecticut Department of Labor) indicate specific amounts for both components of the rate. Title 29, Part 5, Subpart B of the Code of Federal Regulations provides detailed informationFile Size: 1MB