Transcription

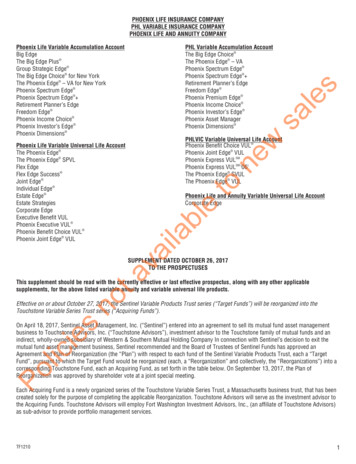

PHOENIX LIFE INSURANCE COMPANYPHL VARIABLE INSURANCE COMPANYPHOENIX LIFE AND ANNUITY COMPANYPHL Variable Accumulation AccountThe Big Edge Choice The Phoenix Edge – VAPhoenix Spectrum Edge Phoenix Spectrum Edge Retirement Planner’s EdgeFreedom Edge Phoenix Premium Edge Phoenix Income Choice Phoenix Investor’s Edge Phoenix Asset ManagerPhoenix Dimensions salesPhoenix Life Variable Accumulation AccountBig EdgeThe Big Edge Plus Group Strategic Edge The Big Edge Choice for New YorkThe Phoenix Edge – VA for New YorkPhoenix Spectrum Edge Phoenix Spectrum Edge Retirement Planner’s EdgeFreedom Edge Phoenix Income Choice Phoenix Investor’s Edge Phoenix Dimensions newPHLVIC Variable Universal Life AccountPhoenix Benefit Choice VUL Phoenix Joint Edge VULPhoenix Express VULSMPhoenix Express VULSM (06)The Phoenix Edge SVULThe Phoenix Edge VULtoPhoenix Life Variable Universal Life AccountThe Phoenix Edge The Phoenix Edge SPVLFlex EdgeFlex Edge Success Joint Edge Individual Edge Estate Edge Estate StrategiesCorporate EdgeExecutive Benefit VULPhoenix Executive VUL Phoenix Benefit Choice VUL Phoenix Joint Edge VULavailablePhoenix Life and Annuity Variable Universal Life AccountCorporate EdgeSUPPLEMENT DATED OCTOBER 26, 2017TO THE PROSPECTUSESnotThis supplement should be read with the currently effective or last effective prospectus, along with any other applicablesupplements, for the above listed variable annuity and variable universal life products.Effective on or about October 27, 2017, the Sentinel Variable Products Trust series (“Target Funds”) will be reorganized into theTouchstone Variable Series Trust series (“Acquiring Funds”).PoliciesOn April 18, 2017, Sentinel Asset Management, Inc. (“Sentinel”) entered into an agreement to sell its mutual fund asset managementbusiness to Touchstone Advisors, Inc. (“Touchstone Advisors”), investment advisor to the Touchstone family of mutual funds and anindirect, wholly-owned subsidiary of Western & Southern Mutual Holding Company In connection with Sentinel’s decision to exit themutual fund asset management business, Sentinel recommended and the Board of Trustees of Sentinel Funds has approved anAgreement and Plan of Reorganization (the “Plan”) with respect to each fund of the Sentinel Variable Products Trust, each a “TargetFund”, pursuant to which the Target Fund would be reorganized (each, a “Reorganization” and collectively, the “Reorganizations”) into acorresponding Touchstone Fund, each an Acquiring Fund, as set forth in the table below. On September 13, 2017, the Plan ofReorganization was approved by shareholder vote at a joint special meeting.Each Acquiring Fund is a newly organized series of the Touchstone Variable Series Trust, a Massachusetts business trust, that has beencreated solely for the purpose of completing the applicable Reorganization. Touchstone Advisors will serve as the investment advisor tothe Acquiring Funds. Touchstone Advisors will employ Fort Washington Investment Advisors, Inc., (an affiliate of Touchstone Advisors)as sub-advisor to provide portfolio management services.TF12101

Target FundsSentinel Variable Products Balanced FundSentinel Variable Products Bond FundSentinel Variable Products Common Stock FundSentinel Variable Products Small Company FundAcquiring FundsTouchstone Balanced FundTouchstone Bond FundTouchstone Common Stock FundTouchstone Small Company FundsalesPlease be advised that Phoenix Life Insurance Company, PHL Variable Insurance Company and Phoenix Life and Annuity Company arenot affiliated with Sentinel Asset Management, Inc. or Touchstone Advisors, Inc. and have no control or influence in this decision or thePlan.newUpon the Reorganization, each Target Fund will transfer all of its assets to the Acquiring Fund in exchange for (i) the Acquiring Fund’sassumption of the liabilities (other than certain excluded liabilities) of the Target Fund, as described in the Plan, and (ii) newly issuedshares of the Acquiring Fund having a value equal to the aggregate net assets of the Target Fund transferred to the Acquiring Fund. Assuch, on the closing date the Acquiring Funds are added to the list of available investment options for the products listed above andTarget Fund shareholders will become shareholders of the Acquiring Funds and will receive shares of the Acquiring Funds with a total netasset value equal to that of their shares of the Target Funds on the closing date. The Reorganizations are designed to be tax-free toshareholders.toThe Reorganizations are expected to take place on or about October 27, 2017. Effective October 27, 2017, any allocation of new premiumor transfer of value to, or withdrawal or other request for redemption from, one of the subaccounts that invests in a Target Funds will bedeemed to be an instruction for the subaccount investment option corresponding to the Acquiring Fund.availableIf your variable life policy or annuity contract value is allocated to a subaccount that invests in a Target Fund at the time theReorganizations occur, those subaccount units will be replaced by units corresponding to the subaccount that invests in the AcquiringFund, and thereafter the policy or contract value will depend on the performance of the Acquiring Fund subaccount(s). TheReorganizations will not result in any change in the amount of your accumulated policy or contract value or in the dollar value of yourinvestment in the separate account. The number of units in a subaccount investing in an Acquiring Fund that will be credited to yourvariable life policy or annuity contract as a result of the Reorganization(s) will depend on the value of the units of a subaccount investingin the Target Fund at the time the Reorganization(s) occurs.There will be no charge for any transfer of your account value to the subaccounts investing in the Acquiring Funds as a result of theReorganizations nor will any such transfer count against any applicable number of free transfers you are allowed under your contract.notIn addition, the Reorganizations do not cause any fees or charges under your policy or contract to be greater, and it does not alter yourrights or our obligations under the policy or contract. The Reorganizations are not expected to be a taxable event for federal income taxpurposes. You should consult with your tax advisor as to the tax consequences for your individual situation.sSummary information regarding investment options is provided herein (see “Appendix – Investment Options,” below). For more detailedinformation regarding each underlying fund you should consult the fund prospectus which can be found on our website,www.phoenixnsre.com*, or requested by writing to us at PO Box 8027, Boston, MA 02266-8027 or calling 1-800-541-0171. You shouldcarefully read the prospectus and consider the investment objectives, risks, charges, and expenses associated with any underlyinginvestment option before investing.ie‘ For all prospectuses including an Appendix – Investment Options, the Appendix is deleted and replaced with the following:licPlease note: This information is intended to provide a brief summary of each fund’s investment objective and advisor information. Notall funds listed here may be currently offered or available with your product.PoFund NameAlger Capital Appreciation Portfolio1,2AB VPS Balanced Wealth Strategy PortfolioCalvert VP S&P MidCap 400 Index PortfolioTF1210Investment ObjectiveLong term capital appreciationAchieve the highest total return consistent withthe Adviser’s determination of reasonable risk.Seeks investment results that correspond to thetotal return performance of U.S. commonstocks, as represented by the S&P MidCap 400IndexInvestment Advisor / SubadvisorFred Alger Management, Inc.AllianceBernstein L.P.Calvert Research and ManagementSubadvisor: Ameritas Investment Partners,Inc.2

Investment ObjectiveInvestment Advisor / SubadvisorSeeks to replicate, as closely as possible, beforethe deduction of expenses, the performance ofthe Standard & Poor’s 500 Composite StockPrice Index, which emphasizes stocks of largeUS companiesSeeks to replicate, as closely as possible, beforethe deduction of expenses, the performance ofthe Russell 2000 Index, which emphasizesstocks of small US companiesFederated Fund for U.S. Government Securities IIFederated High Income Bond Fund IIFederated Prime Money Fund IIFidelity VIP Contrafund PortfolioFidelity VIP Growth Opportunities PortfolioFidelity VIP Investment Grade Bond PortfolioSubadvisor: Northern Trust Investments,Inc.Federated Investment ManagementCompanyFederated Investment ManagementCompanyFederated Investment ManagementCompanyFidelity Management & Research CompanyCapital growthSubadvisor: FMR Co., Inc.Fidelity Management & Research CompanyAs high a level of current income as is consistentwith the preservation of capitalavailableFidelity VIP Growth PortfolioDeutsche Investment ManagementAmericas Inc.The Fund’s investment objective is to providecurrent income.The Fund’s investment objective is to seek highcurrent income.The Fund is a money market fund that seeks tomaintain a stable net asset value (NAV) of 1.00per Share. The Fund’s investment objective is toprovide current income consistent with stabilityof principal and liquidity.Long-term capital appreciationCapital appreciation Subadvisor: Northern Trust Investments,Inc.newDeutsche Small Cap Index VIPtoDeutsche Equity 500 Index VIPDeutsche Investment ManagementAmericas Inc.salesFund NameSubadvisor: FMR Co., Inc.Fidelity Management & Research CompanySubadvisor: FMR Co., Inc.Fidelity Management & Research CompanySubadvisor: Fidelity Investments MoneyManagement, Inc.Franklin Advisers, Inc.Seeks capital appreciation. Under normal marketconditions, the fund invests predominantly inequity securities of companies that theinvestment manager believes have the potentialfor capital appreciation.Seeks to maximize income while maintainingprospects for capital appreciation. Under normalmarket conditions, the fund invests in bothequity and debt securities.Seeks capital appreciation with income as asecondary goal. Under normal marketconditions, the fund invests primarily in U.S. andforeign equity securities that the investmentmanager believes are undervalued.Seeks long-term capital appreciation.Capital appreciationGuggenheim InvestmentsALPS Advisors, Inc.Capital appreciation and some current incomeSubadvisor: Ibbotson Associates, Inc.ALPS Advisors, Inc.Capital appreciationSubadvisor: Ibbotson Associates, Inc.ALPS Advisors, Inc.Ibbotson Income and Growth ETF Asset AllocationPortfolioCurrent income and capital appreciationSubadvisor: Ibbotson Associates, Inc.ALPS Advisors, Inc.Invesco V.I. American Franchise FundInvesco V.I. Equity and Income FundInvesco V.I. Core Equity Fund1,2Invesco V.I. Mid Cap Core Equity Fund1,2Lazard Retirement U.S. Small-Mid Cap EquityPortfolio1,2Capital growthCapital appreciation and current incomeLong term growth of capitalLong term growth of capitalLong term capital appreciationSubadvisor: Ibbotson Associates, Inc.Invesco Advisers, Inc.Invesco Advisers, Inc.Invesco Advisers, Inc.Invesco Advisers, Inc.Lazard Asset Management LLCFranklin Flex Cap Growth VIP FundnotFranklin Income VIP FundFranklin Mutual Shares VIP FundsGuggenheim VT Long Short Equity Fund1,2ieIbbotson Aggressive Growth ETF Asset AllocationPortfoliolicIbbotson Balanced ETF Asset Allocation PortfolioPoIbbotson Growth ETF Asset Allocation PortfolioTF1210Franklin Advisers, Inc.Franklin Mutual Advisers, LLC3

Investment ObjectiveLord Abbett Series Fund Mid Cap Stock PortfolioNeuberger Berman Advisors Management TrustGuardian PortfolioNeuberger Berman Advisors Management TrustMid Cap Growth PortfolioOppenheimer Capital Appreciation Fund/VAOppenheimer Global Fund/VAOppenheimer Main Street Small Cap Fund / VAPIMCO VIT CommodityRealReturn StrategyPortfolioPIMCO VIT Total Return PortfolioiesRydex VT Nova Fund1,2PolicTempleton Developing Markets VIP FundTempleton Foreign VIP FundTempleton Growth VIP FundTF1210Lord, Abbett & Co. LLCNeuberger Berman Management LLCThe Fund seeks growth of capital.Capital appreciationSubadvisor: Neuberger Berman LLCOFI Global Asset Management, Inc.Capital appreciationSubadvisor: OppenheimerFunds, Inc.OFI Global Asset Management, Inc.Subadvisor: OppenheimerFunds, Inc.OFI Global Asset Management, Inc.Capital appreciationMaximum real return consistent with prudentinvestment management.Maximum real return, consistent withpreservation of real capital and prudentinvestment management.Maximum total return, consistent withpreservation of capital and prudent investmentmanagement.Seeks to provide total returns that inverselycorrelate, before fees and expenses, to the pricemovements of a benchmark for U.S. Treasurydebt instruments or futures contracts on aspecified debt instrument on a daily basis. Thefund’s current benchmark is the daily pricemovement of the Long Treasury Bond. The funddoes not seek to achieve its investment objectiveover a period of time greater than one day.Seeks to provide investment results that match,before fees and expenses, the performance of aspecific benchmark on a daily basis. The fund’scurrent benchmark is 150% of the performanceof the S&P 500 Index. The fund does not seekto achieve its investment objective over a periodof time greater than one day.Seeks long-term capital appreciation. Undernormal market conditions, the fund invests atleast 80% of its net assets in emerging marketsinvestments.Seeks long-term capital growth. Under normalmarket conditions, the fund invests at least 80%of its net assets in investments of issuerslocated outside the U.S., including those inemerging markets.Seeks long-term capital growth. Under normalmarket conditions, the fund investspredominantly in equity securities of companieslocated anywhere in the world, includingemerging markets.notRydex VT Inverse Government Long Bond StrategyFund1,2Lord, Abbett & Co. LLCSubadvisor: Neuberger Berman LLCNeuberger Berman Management LLCavailablePIMCO VIT Real Return PortfolioLord, Abbett & Co. LLCnewLord Abbett Series Fund Growth and IncomePortfoliotoLord Abbett Series Fund Bond Debenture PortfolioInvestment Advisor / SubadvisorHigh current income and the opportunity forcapital appreciation to produce a high totalreturnLong-term growth of capital and income withoutexcessive fluctuations in market valueCapital appreciation through investments,primarily in equity securities, which are believedto be undervalued in the marketplaceLong term growth of capital; current income is asecondary goalsalesFund NameSubadvisor: OppenheimerFunds, Inc.Pacific Investment Management CompanyLLCPacific Investment Management CompanyLLCPacific Investment Management CompanyLLCGuggenheim InvestmentsGuggenheim InvestmentsTempleton Asset Management Ltd.Templeton Investment Counsel, LLCTempleton Global Advisors Limited4

Fund NameInvestment ObjectiveInvestment Advisor / SubadvisorSeeks capital appreciation and current incomeTouchstone Balanced Fund3Seeks capital appreciationSubadvisor: Fort Washington InvestmentAdvisors, Inc.Touchstone Advisors, Inc.Seeks growth of capitalSubadvisor: Fort Washington InvestmentAdvisors, Inc.Touchstone Advisors, Inc.Long-term growth of capital.Subadvisor: Fort Washington InvestmentAdvisors, Inc.Virtus Investment Advisers, Inc.Capital appreciation and current incomeSubadvisor: Kayne Anderson RudnickInvestment Management LLCVirtus Investment Advisers, Inc.Touchstone Common Stock Fund3Virtus KAR Capital Growth SeriesVirtus Rampart Enhanced Core Equity SeriesLong-term total returnSubadvisor: Duff & Phelps InvestmentManagement CoVirtus Investment Advisers, Inc.toHigh total return consistent with reasonable riskSubadvisor: Rampart InvestmentManagement Company, LLCVirtus Investment Advisers, Inc.availableVirtus Duff & Phelps International SeriesVirtus Duff & Phelps Real Estate Securities SeriesVirtus KAR Small-Cap Growth SeriesCapital appreciation and income withapproximately equal emphasisLong-term capital growthLong-term capital appreciation.Subadvisor: Kayne Anderson RudnickInvestment Management LLCVirtus Investment Advisers, Inc.High total return over an extended period of timeconsistent with prudent investment riskiesVirtus Strategic Allocation SerieslicWanger InternationalWanger SelectWanger USASubadvisor: New Fleet Asset ManagementLLCVirtus Investment Advisers, Inc.Subadvisor: Duff & Phelps InvestmentManagement CompanyVirtus Investment Advisers, Inc.notVirtus KAR Small-Cap Value SeriesnewTouchstone Small Company Fund3Virtus Newfleet Multi-Sector Intermediate BondSeriesSubadvisor: Fort Washington InvestmentAdvisors, Inc.Touchstone Advisors, Inc.salesTouchstone Bond FundSeeks to provide as high a level of currentincome as is consistent with the preservation ofcapital. Capital appreciation is a secondary goal.3Touchstone Advisors, Inc.Long-term growth of capitalLong-term growth of capitalLong-term growth of capitalSubadvisor: Kayne Anderson RudnickInvestment Management LLCVirtus Investment Advisers, Inc.Subadvisor(s): Duff & Phelps InvestmentManagement Co. and Kayne AndersonRudnick Investment Management, LLC(equity portion); New Fleet AssetManagement LLC (fixed income portion)Columbia Wanger Asset Management, LLCColumbia Wanger Asset Management, LLCColumbia Wanger Asset Management, LLCThis fund was closed to new investors on May 1, 2006.2Contract/policy owners who had value allocated to a fund before its applicable closure date, the following restrictions apply: (1) only regular premium payments areallowed into the fund; (2) no transfers from other funds are allowed into the fund; (3) existing allocation percentages may only be reduced and the fund may not beadded to an allocation schedule; (4) existing DCA percentages may only be reduced and the fund may not be added to a DCA allocation schedule; and (5) existingrebalancing percentages may only be reduced and the fund may not be added to the rebalancing allocation schedule.3Available on or about October 30, 2017.Po1TF12105

No longer available, on or about October 27, 2017:Sentinel Variable Products Bond FundSentinel Variable Products Common StockFundSentinel Variable Products Small CompanyFundSeeks a combination of growth of capital andcurrent income, with relatively low risk andrelatively low fluctuations in valueSeeks high current income while seeking tocontrol riskSeeks a combination of growth of capital,current income, growth of income andrelatively low risk as compared with thestock market as a wholeSeeks growth of capital***Sentinel Asset Management, Inc.Sentinel Asset Management, Inc.Sentinel Asset Management, Inc.salesSentinel Variable Products Balanced FundSentinel Asset Management, Inc.*newThis supplement should be retained with the prospectus, as amended, for future reference. If you have any questions, please contact usat 1-800-541-0171.Policiesnotavailableto* This is intended as an inactive textual reference only.TF12106

PHOENIX LIFE INSURANCE COMPANYPHL VARIABLE INSURANCE COMPANYPHOENIX LIFE AND ANNUITY COMPANYPHL Variable Accumulation AccountBig EdgeThe Big Edge Plus Group Strategic Edge The Big Edge Choice for New YorkThe Phoenix Edge – VA for New YorkPhoenix Spectrum Edge Phoenix Spectrum Edge Retirement Planner’s EdgeFreedom Edge Phoenix Income Choice Phoenix Investor’s Edge Phoenix Dimensions The Big Edge Choice The Phoenix Edge – VAPhoenix Spectrum Edge Phoenix Spectrum Edge Retirement Planner’s EdgeFreedom Edge Phoenix Premium Edge Phoenix Income Choice Phoenix Investor’s Edge Phoenix Asset ManagerPhoenix Dimensions tonewsalesPhoenix Life Variable Accumulation AccountPhoenix Life Variable Universal Life AccountPHLVIC Variable Universal Life AccountThe Phoenix Edge The Phoenix Edge SPVLFlex EdgeFlex Edge Success Joint Edge Individual Edge Estate Edge Estate StrategiesCorporate EdgeExecutive Benefit VULPhoenix Executive VUL Phoenix Benefit Choice VUL Phoenix Joint Edge VULavailablePhoenix Benefit Choice VUL Phoenix Joint Edge VULPhoen

Touchstone Variable Series Trust series (“Acquiring Funds”). On April 18, 2017, Sentinel Asset Management, Inc. (“Sentinel”) entered into an agreement to sell its mutual fund asset management business to Touchstone Advisors, Inc. (“Touchstone Advisors”), investment advisor to the Touchston