Transcription

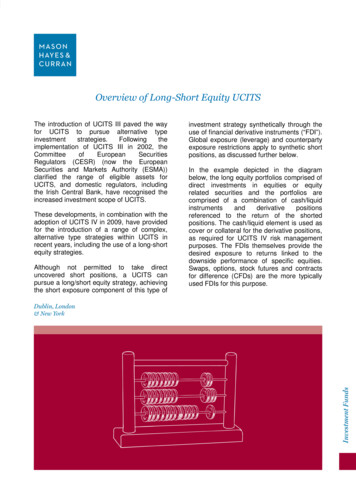

Overview of Long-Short Equity UCITSThe introduction of UCITS III paved the wayfor UCITS to pursue alternative n of UCITS III in 2002, theCommitteeofEuropeanSecuritiesRegulators (CESR) (now the EuropeanSecurities and Markets Authority (ESMA))clarified the range of eligible assets forUCITS, and domestic regulators, includingthe Irish Central Bank, have recognised theincreased investment scope of UCITS.These developments, in combination with theadoption of UCITS IV in 2009, have providedfor the introduction of a range of complex,alternative type strategies within UCITS inrecent years, including the use of a long-shortequity strategies.Although not permitted to take directuncovered short positions, a UCITS canpursue a long/short equity strategy, achievingthe short exposure component of this type ofinvestment strategy synthetically through theuse of financial derivative instruments (“FDI”).Global exposure (leverage) and counterpartyexposure restrictions apply to synthetic shortpositions, as discussed further below.In the example depicted in the diagrambelow, the long equity portfolios comprised ofdirect investments in equities or equityrelated securities and the portfolios arecomprised of a combination of nced to the return of the shortedpositions. The cash/liquid element is used ascover or collateral for the derivative positions,as required for UCITS IV risk managementpurposes. The FDIs themselves provide thedesired exposure to returns linked to thedownside performance of specific equities.Swaps, options, stock futures and contractsfor difference (CFDs) are the more typicallyused FDIs for this purpose.MHC-11699581-1

UCITSInvestmentreturnsLong BookEquitiesportfolioShort BookFDIsContract forpurchase/sale ofeconomic performance ofreference assetsCash andcashequivalentsplusCollateralCounterparty/or ExchangeTraded FDIsUnderlyingreferenceassetsMHC-11699581-1

Overview of Use of Financial DerivativeInstruments for Performance PurposesThe Central Bank’s UCITS Notice 10 sets outhigh level rules on the use of FDIs by UCITS,including a summary of permitted FDI, coverrequirementsandriskmanagementrequirements. This is complemented by theCentral Bank’s Guidance Note on FDIs thatcontains detailed provisions for the use ofFDI by UCITS. The following is a briefsummary of the Central Bank’s conditions forthe use of FDI for performance purposes(and not just for efficient portfoliomanagement) by UCITS.Conditions for the Use of FDIUCITS may invest in any type of exchangetraded or OTC FDI for investment purposessubject to the following conditions: the relevant reference items orindices, consist of one or more of thefollowing (FDI on commodities areexcluded):(i) a UCITS eligible asset (i.e.transferable securities, moneymarket instruments, units incollectiveinvestmentschemes, deposits with creditinstitutions, FDI (that meet therequirements of UCITS Notice21 and the Central Bank’sGuidanceNote2/07))including financial instrumentshavingoneorseveralcharacteristics of those assets;(ii) financial indices;(iii) interest rates;(iv) foreign exchange rates;(v) currencies; the FDI do not expose the UCITS torisks which it could not otherwiseassume (e.g. gain exposure to aninstrument/issuer/currency to whichthe UCITS cannot have a directexposure); the FDI do not cause the UCITS todiverge from its investment objectives; where a UCITS enters into a totalreturn swap or invests in other FDIwith similar characteristics, the assetsheld by the UCITS must comply withthe UCIT Regulations (the EuropeanCommunities(UndertakingsforCollective Investment in TransferableSecurities) Regulations 2011).Positions may create long or short exposureto the underlying asset and may result inleverage to the portfolio.Counterparty Exposure LimitsUCITS are required to limit their exposure toany single counterparty to 5% of net assetvalue. This can be extended to 10% wherethe counterparty falls within the category ofcertain credit institutions. Counterpartyexposure must include all exposures to thecounterparty (i.e. exposures related to OTCFDI and any other exposure to thecounterparty). The counterparty exposurecan be controlled through the receipt by theUCITS of acceptable collateral.Position Cover RequirementsWhereaUCITShasanobligation/commitment under a derivativecontract including synthetic short positions,the UCITS is required to have either cash orsecurities to settle its obligation under thederivative. Where the derivative is cashsettled, the UCITS must hold liquid assets(i.e. cash or money market instruments) ascover. Where physical delivery of theunderlying asset is required for settlement,the UCITS must hold the underlying asset atall times or sufficiently liquid assets where theunderlying asset consists of highly liquid fixedincome securities and/or the UCITSconsiders that the exposure can beadequately covered without holding theunderlying asset and details are provided inthe UCITS’ prospectus.MHC-11699581-1

Risk Management ProcessIn accordance with the requirements of theCentral Bank, UCITS are required toimplement a detailed risk managementprocess (“RMP”) that sets out how the UCITSwill monitor and manage risk relating to theuse of FDI. UCITS may apply either the“Commitment Approach” or alternatively usean advanced risk measurement methodologysuch as the Value-at-Risk model (“VaR”), asfurther described below.Previously, a UCITS was required tocategorise itself as being either a“sophisticated” or a “non-sophisticated” userof FDI, and this categorisation determined theappropriate risk management methodologythe UCITS should adopt. Sophisticated usersof FDI would apply the VaR model, whereasnon-sophisticated users of FDI would applythe Commitment Approach. Although suchcategorisation is no longer required, if aUCITS uses FDI as a material part of itsinvestment strategy or uses FDI in asophisticated manner, as opposed to usingFDI only for efficient portfolio management,the Central Bank will expect the UCITS tomonitor and manage risk by using the VaRmodel.When using the Commitment Approach, eachsub-fund within an umbrella-type UCITS mustensure that its global exposure does notexceed its net asset value. Therefore, underthe Commitment Approach a sub-fund of aUCITS may not be leveraged in excess of100% of its net asset value. In other words,the gross exposure of a UCITS sub-fundshould not exceed 200% of such fund’s netasset value. Given the hard limit on leverageexposure under the Commitment Approach, aUCITS implementing an investment strategythat takes on significant market exposure willneed to use an advanced risk managementmethodology such as VaR.VaR is a methodology that is used toestimate the risk or probability of loss in aportfolio. It is based on statistical analysis ofsimulated or historical price trends andvolatilities and is designed to predict the likelyscale of losses that might be expected tooccur in a portfolio over a given period oftime. VaR is used by UCITS that use FDI forcomplex investment strategies.The VaR model (absolute VaR) must adhereto the following requirements: the confidence level should be 99%; a maximum holding period of onemonth; a minimum historical observationperiod of one year (less if justified,for example on the grounds of recentsignificantchangesinpricevolatility); stress tests carried out at leastquarterly (to assess the likely impactof potential movements in interestrates, currencies and credit quality); back testing of the VaR model (aformal statistical process to compareactual portfolio returns to the VaRpredicted).It is the responsibility of the UCITS to selectan appropriate methodology to calculateglobal exposure. The selection should bebased on an assessment by the UCITS of itsrisk profile resulting from its investmentpolicies (including its use of FDI). A UCITSshould generally use an advanced riskmeasurement methodology (supported by astress testing program) such as VaR tocalculate global exposure where: it engages in complex investmentstrategies which represent a materialpart of the UCITS’ investment policy; it has more than a negligibleexposure to exotic FDI; or the commitment approach does notadequately capture the market riskof the portfolio.Although the governing body of the UCITS isrequired, as part of overall governance, toprovide oversight of the risk managementfunction, in practice the decision on theappropriate risk measurement methodologyis for the investment manager’s risk manager(in consultation with the portfolio manager) todetermine. In considering the appropriate riskmeasurement methodology, the risk managershould consider:MHC-11699581-1

which method is appropriate takinginto account the investment strategy,the complexity of FDI and theproportion of the portfolio that will becomprised of derivative positions; the limits on leverage exposureunder the Commitment Approachand whether this fits within theconstraintsofthe investmentstrategy; and operational considerations such asthe costs and ease of complying withthe relevant risk measurementmethodology.Typically, UCITS that use FDI to generateinvestment returns in a long-short strategyuse the VaR model. The VaR model allowsfor a greater degree of leverage, and wehave observed a number of UCITS whosegross exposure exceeds 500% of the UCITSnet asset value.Use of Prime BrokerageGlobal prime brokers are providing solutionsfor UCITS that utilise long-short strategies bymeans of “synthetic prime brokerage”products. Although UCITS are not permittedto take direct uncovered short positions (asnoted above) or to borrow stocks for thepurposes of short selling (or, for that matter,to appoint a “prime broker” to facilitate cashfinancing and short sales coverage or to actas custodian, clearing or settlement agent),synthetic prime brokerage is an alternativesolution that enables UCITS products to takepositions in equity and fixed incomederivatives that provide exposure tounderlying securities that they wouldotherwise be prohibited from investing indirectly.In this model, FDIs are deployed as asubstitute for borrowing equities to achieve ashort position, or as a substitute for equityfinancing to achieve leverage on the longside. By entering into a FDI, such asforwards, futures, CFDs or swaps, the UCITS(or its “prime broker”) may economically sellthe performance of an underlying referenceasset and profit if the underlying referenceasset decreases in value. The FDI mayprovide the economic position of being longor short securities, and because the UCITSdoes not hold the underlying securities, thereis no custody, clearing or settlement attachedto the trade. However, counterparty exposurelimits and position cover requirements as wellas limits on global exposure continue to applyto such synthetic short positions, asdiscussed above.Key ContactsFionán BreathnachPartnerHead of Investment Fundsd: 3531 614 5080e: fbreathnach@mhc.ieConor DurkinPartnerd: 3531 614 5261e: cdurkin@mhc.ieMHC-11699581-1

synthetic prime brokerage is an alternative solution that enables UCITS products to take positions in equit