Transcription

ANNUALREPORT2019

Farm Credit of the Virginias, ACAFARM CREDIT OF THE VIRGINIAS, ACA2019 ANNUAL REPORTContentsMessage from the Interim Chief Executive Officer . 2-3Report of Management . 4Report on Internal Control over Financial Reporting . 5Consolidated Five-Year Summary of Selected Financial Data . 6Management’s Discussion & Analysis of Financial Condition & Results of Operations. 7-17Disclosure Required by FCA Regulations . 18-24Report of the Audit Committee .25Report of Independent Auditors .26Consolidated Financial Statements . 27-31Notes to the Consolidated Financial Statements . 32-56ManagementJ. Robert Frazee. Interim Chief Executive OfficerBrad Cornelius . Chief Credit OfficerPete Cypret .Chief Risk OfficerA. Katie Frazier . Chief Marketing and External Affairs OfficerTeresa A. Harris . Lending Division Leader - NorthMichael S. Jonas . Lending Division Leader - SouthM. Kay Manchester . Chief Training and Human Resource OfficerJustin Weekley . Chief Financial OfficerBoard of DirectorsDonna M. Brooke-Alt . ChairpersonDonald W. Reese . Vice ChairpersonRonald L. Bennett . DirectorDavid Wayne Campbell . DirectorRobert M. Chambers, Jr. . DirectorKevin C. Craun . DirectorCharles E. Horn, Jr. . DirectorPaul M. House . DirectorMelody S. Jones . DirectorJames F. Kinsey . DirectorCharles B. Leech, IV . DirectorMilton L. McPike, Jr. . .DirectorBarry W. Shelor . DirectorAlfred W. Stephens, Jr. . DirectorJohn E. Wells . Director12019 Annual Report

Farm Credit of the Virginias, ACAOn Tuesday, March 3, 2020, there was a transition in executive leadership for Farm Credit of the Virginias. Peery Heldreth is no longerserving as Chief Executive Officer. Tenured Farm Credit System executive, J. Robert “Bob” Frazee, assumed the role of Interim CEO.For additional information, visit our website at, eleases.aspx.Message from the Interim Chief Executive OfficerAs Interim CEO, I’m pleased to report that Farm Creditof the Virginias rounded out another solid financial yearand made great strides in carrying out our mission tosupport agriculture and the rural communities we serve.This year, the association made the decision to hone inour internal focus to ensure the long-term health andfinancial soundness of Farm Credit of the Virginias. Wereviewed and made necessary changes to our internalcontrols and credit decision-making practices so that wemay meet the needs of our current and future customerowners for years to come.between the US and China offering relief from thelengthy period of economic conflict and resulting tradewar. The agreement will reopen Chinese markets onagricultural goods. After years in steady decline, thedairy industry saw improved milk prices in the latter partof 2019, consistent with projections into 2020. This yearalso saw the expansion of hemp production. We urge ourcustomer-owners to do their homework before jumpinginto this product as developing regulation could have asignificant impact on the ability to harvest a viable crop.Farm Credit of the Virginias takes prides in our efforts todevelop and distribute value-added resources to benefitour customer-owners and the greater agriculturalcommunity through our Knowledge Center. In 2019, theKnowledge Center delivered a host of offerings, bothnew and old favorites, in a variety of platforms coveringvarious facets of agriculture to accommodate a greaterdemographic. These programs include the AgBiz Plannercourse, Dairy Management Institute, Farm ManagementInstitute, Farm Transition and Succession Planningcurriculum, Technology in Agriculture webinar series,Tax Considerations for Agriculture webinar series, highschool curriculum for agricultural-focused successplanning, Graze and Gallop series, Livestock RiskProtection program, online QuickBooks course, andmany more. We encourage all of our customer-owners tocapitalize on these resources to strengthen their businessmanagement for further success.Farm Credit of the Virginias’ net income in 2019 was 46 million, which was 5.7 million above budgetprojections. This year’s overall net income was lowerthan 2018 by approximately 6.6 million due toreceiving 3.5 million less in special patronage fromAgFirst Farm Credit Bank, 1.7 million less frominterest income from non-accrual loans, and 1.2 millionless from the Farm Credit System Insurance Corporation.Due to our internal focus and retooling of creditpractices, we did not keep up with the amortization ofour existing loan portfolio, as such, we ended the yearwith 1.79 billion in loan volume, a decrease of morethan 3% over last year.Each year, our board of directors approves anappropriate level of patronage dividends, carefullybalancing the operational goals of the cooperative withthe desire to return as much cash to our members aspossible. In April 2019, the Association distributedanother record-setting patronage dividend resulting fromthe strong financial performance in 2018. We werepleased to deliver 40 million to our customer-owners inpatronage this year. We were particularly delighted todeliver a record-setting patronage dividend in 2019 dueto the heightened challenges many of our agriculturalconstituents faced this year and in recent years. Many aresuffering from the impact of extreme weather andprolonged commodity price weakness and volatility. Theagriculture industry remains a dynamic and everchanging landscape. Although 2019 saw difficult timesin many of our market sectors, the year also yieldedsome notable wins for producers with excitingprojections on the horizon.To support our broader footprint, Farm Credit of theVirginias makes considerable donations throughout thecalendar year to programs dedicated to strengthening ourrural communities. We made a concerted effort in 2019to seek out initiatives that benefit our nation’s veterancommunity, and in some cases, help them realize theirdream of working in the agricultural field. We willcontinue this philanthropic push in 2020. Our holidaycontributions this year totaled 15,000 distributedamongst four worthy charities; the MountaineerFoodbank – Veteran Table, Creative Works Farm, theWest Virginia Food & Farm Coalition, and the ArcadiaCenter for Sustainable Food & Agriculture – VeteranProgram.Additionally, over the course of the year, we madecountless donations to non-profits, industryorganizations, youth leadership programs, communitygroups, and initiatives to support and promoteagriculture, forestry, and our rural communities, at theIn December, lawmakers in Congress approved thepassage of the U.S.-Mexico-Canada Agreement(USMCA), welcomed legislation for producers in ourfootprint. The end of the year also saw an agreement22019 Annual Report

Farm Credit of the Virginias, ACAlocal, state, and association-wide level. In 2019, thesecharitable contributions in our communities totaled morethan 300,000, not including our marketing efforts in theevents and sponsorship domain. Beginning in 2020,these funds will be allocated through the recently boardapproved Farm Credit of the Virginias CharitableContributions Program, a new system which puts intoplace a process to provide strategic direction on theallocation of our association’s charitable contributions.As a cooperative, delivering on our mission goes beyondour financial performance. We strive to deliverpersonalized attention and care in our individualrelationships with our customer-owners. Our relationshipand customer service teams are dedicated to crafting thebest solutions to meet your individual needs. Ourconsistently high customer satisfaction survey resultsindicate that these efforts do not go unnoticed, and wevalue the opportunity to serve you.We, too, continue to ensure that we’re strengthening ourrural communities through our advocacy efforts andsharing the Farm Credit story in Washington, DC. Ourassociation was instrumental in the planning andexecuting of more than a dozen legislative farm visitsand industry roundtables this year, both in and aroundour footprint. On these outings, Farm Credit of theVirginias employees and board members joinedcongressional representatives on tours of our customerowners’ operations to discuss the obstacles facing ourproducers and the steps that need taken to remedy themat the legislative level.Critical to these efforts is a highly capable, highlycommitted staff of employees, many of whom have beenwith our cooperative for decades, although it is no secretour association attracts vibrant talent. In 2019, we werepleased to bring on an influx of new team members tofill roles at all levels of the organization to increaseefficiencies association-wide.One key addition to our leadership team was BradCornelius, who came on board as our new Chief CreditOfficer, replacing Chip Saufley who retired mid- 2019.We thank Chip for his years of contribution and service,and look forward to working with Brad in the years tocome. Brad brings with him more than 20 years ofexperience serving, and leading, the AgFirst district’scooperative lending efforts, including most recentlyserving as Chief Executive Officer of Cape Fear FarmCredit.Farm Credit of the Virginias ushered 23 customerowners, board members, and employees to Capitol Hillin July to participate in the Farm Credit Fly-in andMarketplace Reception. Our association alone conductedmore than 10 appointments with our local representativesto discuss legislation vital to the strengthening of ourcommunities. We also brought along products from ourcustomer-owners to share with members of Congress,congressional staff, and other agricultural stakeholders atthe reception.This year, we created the new leadership role of ChiefRisk Officer, filled by Pete Cypret, who brings morethan 20 years of experience in risk management offinancial institutions, including serving as an ExecutiveRisk Manager for Australia’s largest bank. Pete will leadour enterprise risk management program which willensure our safety and soundness by identifying,assessing, and preparing for current and future risk.In 2019, our association worked hand-in-hand with theFarm Credit Council to strengthen grassroots advocacyin our footprint by implementing an action alert systemfor customers, board members, and employees to easilyreach their respective representatives and pledgeconstituent support for legislation. Our associationcarried out two grassroots campaigns this year, agenerally-focused initiative to spread awareness of thesimple action alert system, and a second campaign togarner support for the passage of the USMCA.Looking ahead to 2020, we are steadfast in ourendeavors to ensure we are meeting the lending needs ofour agricultural constituents and the rural communitieswe serve. Farm Credit of the Virginias will remain theleaders in our field, through good times and bad, byproviding extensive local knowledge and agriculturalexpertise, competitive rates, excellent customer service,and leveraging our strong financial position to provideattractive patronage dividends. We are grateful for ourloyal customer-owners and the great industry we serve.To ensure our continued success and that of ourcustomer-owners, Farm Credit of the Virginias placed aheavy emphasis in 2019 on seeking efficiencies in ouroperation and retooling our internal processes tocontinually improve our delivery of services and torespond proactively to the dynamic landscape of theindustries we serve. We are proud that for more than 100years, we have been evolving alongside our customersand our communities, and we will continue to ensure thatwe enhance our efforts to best serve you.J. Robert FrazeeInterim Chief Executive OfficerMarch 12, 202032019 Annual Report

Farm Credit of the Virginias, ACAReport of ManagementThe consolidated financial statements have been auditedby independent auditors, whose report appearselsewhere in this annual report. The Association is alsosubject to examination by the Farm CreditAdministration.The accompanying consolidated financial statements andrelated financial information appearing throughout thisannual report have been prepared by management ofFarm Credit of the Virginias, ACA (Association) inaccordance with generally accepted accountingprinciples appropriate in the circumstances. Amountswhich must be based on estimates represent the bestestimates and judgments of management. Managementis responsible for the integrity, objectivity, consistency,and fair presentation of the consolidated financialstatements and financial information contained in thisreport.The consolidated financial statements, in the opinion ofmanagement, fairly present the financial condition of theAssociation. The undersigned certify that we havereviewed the 2019 Annual Report of Farm Credit of theVirginias, ACA, that the report has been prepared underthe oversight of the audit committee of the Board ofDirectors and in accordance with all applicable statutoryor regulatory requirements, and that the informationcontained herein is true, accurate, and complete to thebest of our knowledge and belief.Management maintains and depends upon an internalaccounting control system designed to providereasonable assurance that transactions are properlyauthorized and recorded, that the financial records arereliable as the basis for the preparation of all financialstatements, and that the assets of the Association aresafeguarded. The design and implementation of allsystems of internal control are based on judgmentsrequired to evaluate the costs of controls in relation tothe expected benefits and to determine the appropriatebalance between these costs and benefits. TheAssociation maintains an internal audit program tomonitor compliance with the systems of internalaccounting control. Audits of the accounting records,accounting systems and internal controls are performedand internal audit reports, including appropriaterecommendations for improvement, are submitted to theBoard of Directors.Donna M. Brooke-AltChairperson of the BoardJ. Robert FrazeeInterim Chief Executive OfficerJustin WeekleyChief Financial OfficerMarch 12, 202042019 Annual Report

Farm Credit of the Virginias, ACAReport on Internal Control Over Financial ReportingThe Association’s management has completed anassessment of the effectiveness of internal control overfinancial reporting as of December 31, 2019. In makingthe assessment, management used the framework inInternal Control — Integrated Framework (2013),promulgated by the Committee of SponsoringOrganizations of the Treadway Commission, commonlyreferred to as the “COSO” criteria.The Association’s principal executives and principalfinancial officers, or persons performing similarfunctions, are responsible for establishing andmaintaining adequate internal control over financialreporting for the Association’s Consolidated FinancialStatements. For purposes of this report, “internal controlover financial reporting” is defined as a process designedby, or under the supervision of the Association’sprincipal executives and principal financial officers, orpersons performing similar functions, and effected by itsBoard of Directors, management and other personnel, toprovide reasonable assurance regarding the reliability offinancial reporting information and the preparation of theConsolidated Financial Statements for external purposesin accordance with accounting principles generallyaccepted in the United States of America and includesthose policies and procedures that: (1) pertain to themaintenance of records that in reasonable detailaccurately and fairly reflect the transactions anddispositions of the assets of the Association, (2) providereasonable assurance that transactions are recorded asnecessary to permit preparation of financial informationin accordance with accounting principles generallyaccepted in the United States of America, and thatreceipts and expenditures are being made only inaccordance with authorizations of management anddirectors of the Association, and (3) provide reasonableassurance regarding prevention or timely detection ofunauthorized acquisition, use or disposition of theAssociation’s assets that could have a material effect onits Consolidated Financial Statements.Based on the assessment performed, the Association’smanagement concluded that as of December 31, 2019,the internal control over financial reporting was effectivebased upon the COSO criteria. Additionally, based onthis assessment, the Association determined that therewere no material weaknesses in the internal control overfinancial reporting as of December 31, 2019.J. Robert FrazeeInterim Chief Executive OfficerJustin WeekleyChief Financial OfficerMarch 12, 202052019 Annual Report

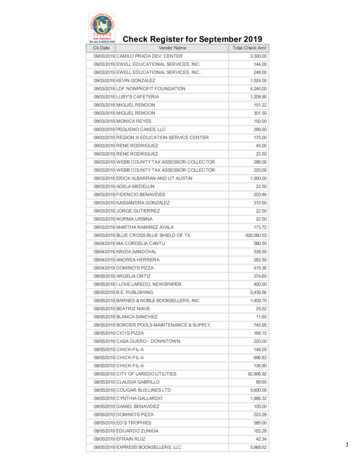

Farm Credit of the Virginias, ACAConsolidated Five - Year Summary of SelectedFinancial Data(dollars in thousands)20192018Balance Sheet DataCash 6,979Loans1,788,804Allowance for loan losses(16,034)Net loans1,772,77020,527Equity investments in other Farm Credit institutions965Other property owned44,926Other assetsTotal assets 1,846,167Notes payable to AgFirst Farm Credit Bank*Accrued interest payable and other liabilitieswith maturities of less than one yearTotal liabilitiesCapital stock and participation certificatesRetained earningsAllocatedUnallocatedAccumulated other comprehensive income (loss)Total members' equityTotal liabilities and members' equityStatement of Income DataNet interest incomeProvision for loan lossesNoninterest income (expense), netNet incomeKey Financial RatiosRate of return on average:Total assetsTotal members' equityNet interest income as a percentage ofaverage earning assetsNet (chargeoffs) recoveries to average loansTotal members' equity to total assetsDebt to members' equity (:1)Allowance for loan losses to loansPermanent capital ratioTotal surplus ratioCore surplus ratioCommon equity tier 1 capital ratioTier 1 capital ratioTotal regulatory capital ratioTier 1 leverage ratioUnallocated retained earnings (URE) andURE equivalents leverage ratioNet Income DistributionEstimated patronage refunds:CashDecember 31,201720162015 4,7001,850,777(15,313)1,835,46420,7291,47747,281 1,909,651 5,0821,844,949(17,461)1,827,48820,7631,22149,054 1,903,608 5,7301,798,996(14,483)1,784,51319,6982,46746,125 346,451 1,757,675 1,353,895 1,422,676 1,437,895 1,423,922 ,392,89712,60692,568333,389(36)436,191 1,846,16792,568337,408(24)440,378 1,909,65192,568319,790(30)422,821 1,903,60892,568287,846(24)390,823 1,858,53392,568259,626(22)364,778 1,757,675 54,1061,000(7,125)45,981 57,0702,500(1,949)52,621 54,1973,2505,99756,944 51,1602,750(5,190)43,220 0 35,000 25,000* General financing agreement is renewable on a one-year cycle. The next renewal date is December 31, 2020.** Not applicable due to changes in regulatory capital requirements effective January 1, 2017.62019 Annual Report 15,000 15,000

Farm Credit of the Virginias, ACAManagement’s Discussion & Analysisof Financial Condition & Results of Operations(dollars in thousands, except as noted)days after the end of the fiscal year and distributes the Annualreports to shareholders within 90 days after the end of the fiscalyear. The Association prepares an electronic version of theQuarterly report, which is available on the internet, within 40days after the end of each fiscal quarter, except that no reportneeds to be prepared for the fiscal quarter that coincides withthe end of the fiscal year of the Association.GENERAL OVERVIEWThe following commentary summarizes the financial conditionand results of operations of Farm Credit of the Virginias, ACA,(Association) for the year ended December 31, 2019 withcomparisons to the years ended December 31, 2018 andDecember 31, 2017. This information should be read inconjunction with the Consolidated Financial Statements, Notesto the Consolidated Financial Statements and other sections inthis Annual Report. The accompanying consolidated financialstatements were prepared under the oversight of the AuditCommittee of the Board of Directors. For a list of the AuditCommittee members, refer to the “Report of the AuditCommittee” reflected in this Annual Report. Information in anypart of this Annual Report may be incorporated by reference inanswer or partial answer to any other item of the Annual Report.FORWARD LOOKING INFORMATIONThis annual information statement contains forward-lookingstatements. These statements are not guarantees of futureperformance and involve certain risks, uncertainties andassumptions that are difficult to predict. Words such as“anticipates,” “believes,” “could,” “estimates,” “may,” “should,”“will,” or other variations of these terms are intended to identifythe forward-looking statements. These statements are based onassumptions and analysis made in light of experience and otherhistorical trends, current conditions, and expected futuredevelopments. However, actual results and developments maydiffer materially from our expectations and predictions due to anumber of risks and uncertainties, many of which are beyondour control. These risks and uncertainties include, but are notlimited to:The Association is an institution of the Farm Credit System(System), which was created by Congress in 1916 and hasserved agricultural producers for over 100 years. The System’smission is to maintain and improve the income and well-beingof American farmers, ranchers, and producers or harvesters ofaquatic products and farm-related businesses. The System is thelargest agricultural lending organization in the United States.The System is regulated by the Farm Credit Administration,(FCA), which is an independent safety and soundness regulator. political, legal, regulatory and economic conditionsand developments in the United States and abroad; economic fluctuations in the agricultural, rural utility,international, and farm-related business sectors; weather-related, disease, and other adverse climatic orbiological conditions that periodically occur thatimpact agricultural productivity and income; changes in United States government support of theagricultural industry and the Farm Credit System, as agovernment-sponsored enterprise, as well as investorand rating-agency reactions to events involving othergovernment-sponsored enterprises and other financialinstitutions; and actions taken by the Federal Reserve System inimplementing monetary policy.The Association is a cooperative, which is owned by themembers (also referred to throughout this Annual Report asstockholders or shareholders) served. The territory of theAssociation extends across a diverse agricultural region ofVirginia, West Virginia and Maryland. Refer to Note 1,Organization and Operations, of the Notes to the ConsolidatedFinancial Statements for counties in the Association’s territory.The Association provides credit to farmers, ranchers, ruralresidents, and agribusinesses. Our success begins with ourextensive agricultural experience and knowledge of the market.The Association obtains funding from AgFirst Farm CreditBank (AgFirst or Bank). The Association is materially affectedand shareholder investment in the Association could be affectedby the financial condition and results of operations of the Bank.Copies of the Bank’s Annual and Quarterly Reports are on theAgFirst website, www.agfirst.com, or may be obtained at nocharge by calling 1-800-845-1745, extension 2832, or writingSusanne Caughman, AgFirst Farm Credit Bank, P. O. Box 1499,Columbia, SC 29202.CRITICAL ACCOUNTING POLICIESThe financial statements are reported in conformity withaccounting principles generally accepted in the United States ofAmerica. Our significant accounting policies are critical to theunderstanding of our results of operations and financial positionbecause some accounting policies require us to make complex orsubjective judgments and estimates that may affect the value ofcertain assets or liabilities. We consider these policies criticalbecause management must make judgments about matters thatare inherently uncertain. For a complete discussion ofsignificant accounting policies, see Note 2, Summary ofCopies of the Association’s Annual and Quarterly reports arealso available upon request free of charge on the Association’swebsite, www.farmcreditofvirginias.com, or by calling1-540-886-3435, extension 5040, or writing Justin Weekley,Farm Credit of the Virginias, P.O. Box 899, Staunton, VA24402-0899. The Association prepares an electronic version ofthe Annual Report, which is available on the website, within 7572019 Annual Report

Farm Credit of the Virginias, ACASignificant Accounting Policies, of the Notes to theConsolidated Financial Statements. The following is a summaryof certain critical policies.ECONOMIC CONDITIONSDuring 2019, the general economy continued to grow. Unlike in2018, the Federal Reserve decreased the federal funds rate aquarter of a point three times during the year, driving interestrates lower. Overall, the real estate market including farms andhouses continued to experience growth. Part of the strength inthe general economy was the job market, where unemploymentcontinued to remain at historically low levels during the year,and labor force participation continued to increase. These arefavorable conditions for the part-time farm segment, which isheavily dependent on non-farm employment. The Associationhas a significant concentration for part-time farmers in the loanportfolio. Allowance for loan losses — The allowance for loan lossesis maintained at a level considered adequate bymanagement to provide for probable and estimable lossesinherent in the loan portfolio. The allowance for loanlosses is increased through provisions for loan losses andloan recoveries and is decreased through allowancerevers

AgFirst Farm Credit Bank, 1.7million less from interest income fromnon-accrual loans, and 1.2 million less fromthe Farm CreditSystem Insurance Corporation. Due to our internalfocus and retooling of credit practices, we did not keep up with the amortization of our existing loan portfolio, as such, we ended the year