Transcription

ACORN USER GUIDE1

WHAT IS ACORN?Acorn is a powerfulconsumer classificationtool that segmentsthe UK populationby postcode.By analysingdemographic data,social factors,population andconsumer Acorn providesbehaviour an understandingof differenttypes of peopleand places.2

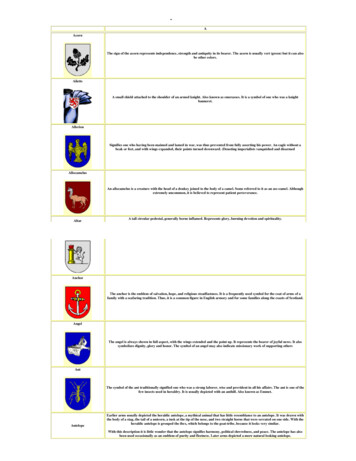

ACORN PROVIDES AN UNDERSTANDING OF DIFFERENT TYPES OF PEOPLE & PLACESCategoryAcornsegments theUK populationinto:1. Affluent Achievers2. Rising Prosperity3. Comfortable Communities5 CATEGORIES17 GROUPS4. Financially Stretched59 TYPES5. Urban AdversityGroupTypeALavish Lifestyles1-3BExecutive Wealth4-9CMature Money10-13DCity Sophisticates14-17ECareer Climbers18-20FCountryside Communities21-23GSuccessful Suburbs24-26HSteady Neighbourhoods27-29IComfortable Seniors30-31JStarting Out32-33KStudent Life34-36LModest Means37-40MStriving Families41-44NPoorer Pensioners45-48OYoung Hardship49-51PStruggling Estates52-56QDifficult Circumstances57-593

ACORN CATEGORY KEY CHARACTERISTICS22.5%9.3%27.0%23.2%17.0%Age range55 25-4435-64All ages16-34House typeDetachedhouseFlat ormaisonetteSemi-detachedor detachedSemi-detachedor terracedFlat orterraced000-2Mixed3 OwnedoutrightPrivatelyrentingOwned outrightor mortgagedSocialrentingSocialrenting% of UK populationChildren at homeHouse tenure4

HELPING INCREASE THE VOLUME AND VALUE OF CUSTOMERSEnable marketsizing projectsTailor productofferings with the mostappropriate messageOptimise branch orretail networksAcquire and retain themost valuable customersDeliver services in amore cost efficientmannerUnderstand consumers’channel preferencesBuild models andenhance existingsegmentationsDevelop newpropositions andproductsSelect target audiencesfor campaign selectionsAssess demand forlocal services5

HOW ACORN IS BUILT1 DATA SOURCES2 ANALYSIS3 ALLOCATION4 ENHANCEMENTA variety of GDPR compliantdata sources are used in thebuild of Acorn – from acombination of:Statistical techniques are usedto best utilise these differenttypes of data to create apostcode level dataset. TheAcorn structure is definedthrough iterative, complexalgorithms.Machine learning is used toallocate postcodes to themost appropriate Acorncategory, group and type.Profiling using researchpanels builds out richinsight into eachsegment.Open DataGovernment DataSW19 6DD- Financial Research Survey- Online SurveySW19 6DECommercial DataCACI Proprietary DataCrime SurveyFor England & Wales6

USING THE PEN PORTRAITSThe purpose of these pen portraits is to summariseeach of the segments across key demographics,financial status and lifestyle traits.Acorn contains information relating tomany more attributes which isavailable within the Knowledge Sheet.7

PEN PORTRAITS8

Category 1Affluent AchieversCategory 2Rising ProsperityCategory 3Comfortable CommunitiesCategory 4Financially StretchedCategory 5Urban AdversityGroupsTypesA Lavish LifestylesB Executive WealthC Mature Money1-34-910-13D City SophisticatesE Career Climbers14-1718-20F Countryside CommunitiesG Successful SuburbsH Steady NeighbourhoodsI Comfortable SeniorsJ Starting Out21-2324-2627-2930-3132-33K Student LifeL Modest MeansM Striving FamiliesN Poorer Pensioners34-3637-4041-4445-48O Young HardshipP Struggling EstatesQ Difficult Circumstances49-5152-5657-59R Not Private Households60-62Category 6Not Private Households

1Affluent Achievers12.0M22.8%UK Adultsof UKAge rangeHouse type55 DetachedFinancial situationHouse tenureRunninginto debtOwnedoutrightSavinga lotChildren at homeNumber of beds04 Acorn Groups within Category 1: Affluent AchieversThese are some of the most financially successful people in theUK. They live in affluent, high status areas of the country. Theyare healthy, wealthy and confident consumers. CACI 2019A. Lavish LifestylesB. Executive WealthC. Mature Money6%55%39%

Category 1AffluentAchieversGroupsA Lavish LifestylesB Executive WealthC Mature Money

1 A Lavish Lifestyles0.7M1.3%UK Adultsof UKThe most affluent people in the UK who live comfortable lifestyles with few financial concerns. These individuals are typically empty nesters, who live inlarge detached homes that they own outright and which are often worth millions.DEMOGRAPHICSBRANDSSHOPPINGAge rangeChildren at home55-740House tenureFamily structureOwnedoutrightCoupleNumber of bedsHouse typeLEISUREWEBSITESDIGITALATTITUDES4 DetachedI worry aboutonline securityFINANCIAL PROFILEHousehold incomeUKLondonShopping online makesmy life easier58%55%33%UK average: 55%UK average: 53%UK average: 34%KEY INTERNET USAGE% Disposable incomeUKFinancial situationThis group are more likely toLondon 72k 74k49% 48%Average: 40kAverage: 44kAverage: 44%Average: 39%Runninginto debtSavinga lotresearch savings andinvestments online CACI 2019I couldn’t live without theinternet on my mobileTECHNOLOGY USAGEThis group are morelikely to purchaseairline tickets onlineThis group are more likelytoown a smartwatch,fitness band orpayment band

1 B Executive Wealth6.5M12.3%UK Adultsof UKHigh income people, successfully combining jobs and families. These are wealthy families living in larger detached or semi-detached properties either inthe suburbs, the edge of towns or in semi-rural locations.DEMOGRAPHICSBRANDSSHOPPINGAge rangeChildren at home45-642House tenureFamily structureOwnedoutrightCoupleNumber of bedsHouse typeLEISUREWEBSITESDIGITALATTITUDES4DetachedI worry aboutonline securityFINANCIAL PROFILEHousehold incomeShopping online makesmy life easier58%58%31%UK average: 55%UK average: 53%UK average: 34%KEY INTERNET USAGE% Disposable incomeUKLondonUK 60k 63k50% 49%Average: 40kAverage: 44kAverage: 44%Financial situationThis group are more likely toLondonAverage: 39%browse for hotelsRunninginto debtSavinga lot CACI 2019I couldn’t live without theinternet on my mobileonlineTECHNOLOGY USAGEThis group are morelikely to purchaseholidays onlineThis group are more likelytoown an iPhone

1 C Mature Money4.9M9.3%UK Adultsof UKOlder, affluent people with the money and time to enjoy life. These people tend to be older empty nesters and retired couples. Many live in rural townsand villages, others live in the suburbs of larger towns. They are prosperous and live in larger detached or semi-detached houses or bungalows.DEMOGRAPHICSBRANDSSHOPPINGAge rangeChildren at home65 0House tenureFamily structureOwnedoutrightCoupleNumber of bedsHouse typeLEISUREWEBSITESDIGITALATTITUDES4DetachedI worry aboutonline securityFINANCIAL PROFILEHousehold incomeShopping online makesmy life easier58%52%26%UK average: 55%UK average: 53%UK average: 34%KEY INTERNET USAGE% Disposable incomeUKLondonUK 46k 50k54% 51%Average: 40kAverage: 44kAverage: 44%Financial situationThis group are more likely toLondonAverage: 39%Runninginto debtSavinga lot CACI 2019I couldn’t live without theinternet on my mobileresearch homeinsurance onlineTECHNOLOGY USAGEThis group are morelikely to purchaseevent tickets onlineThis group are more likelytoown a tablet

Category 1Group ALavishLifestylesTypes1 Exclusive enclaves2 Metropolitan money3 Large house luxury

1 A 1 Exclusive enclaves51K0.1%UK Adultsof UKThese are some of the wealthiest people in the country, including top businessmen, officials, bankers, lawyers and as such they will have significant levels of savings and investments.They live in multi-million pound properties, are likely to have premium bank accounts and are more likely to have investments in shares, unit trusts and bonds.FINANCIAL SITUATIONFinancially sophisticated, the variety and level of expenditure of their shopping is well above averageThey have a very high levelof savingsRunninginto debtSavinga lotHousehold income is verynearly twice the averageI am very good atmanaging moneyUKLondon 79k 80k65%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESMore likely than average toworry about online securityDEMOGRAPHICSCouples and empty nesters living in large propertiesHouse tenureHouse typeNumber of children45-64OwnedoutrightDetached0 CACI 2019Tend to agree that shoppingonline makes their life easier78%55%UK average: 55%UK average: 53%TECHNOLOGYAge rangeConfident users of the internet and engaged in social channelsLove to buy new gadgetsand appliancesTheir internet usage iswell above the averageLowHighWill own a range of tech gadgets, usually from premium brandsStreamsTV servicesOwns smartwatch, fitnessband or payment band36%74%17%UK average: 34%UK average:40%UK average: 8%

1 A 2 Metropolitan money82K0.2%UK Adultsof UKThese affluent professionals live in large apartments or town houses in London or other major cities. Most own their homes and have paid off the mortgage. Many will have seniormanagerial or other professional occupations where six figure salaries are the norm. They will see their home as an asset, and are likely to have investments in shares, savingsaccounts and be building up a personal pension. They are also likely to have premium bank accounts.FINANCIAL SITUATIONTheir financial portfolio will be diverse and plans for retirement will probably include investmentsAble to save and will alsohave significant investmentsRunninginto debtSavinga lotHousehold income isalmost twice the averageI am very good atmanaging moneyUKLondon 74k 74k56%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESComfortable online, they have the highest online expenditure of all the Acorn TypesMore likely than average toworry about online securityDEMOGRAPHICSCouples and empty nesters living in large properties58%54%UK average: 55%UK average: 53%TECHNOLOGYAge rangeHouse tenureHouse typeNumber of children45-74OwnedoutrightDetached0 CACI 2019Tend to agree that shoppingonline makes their life easierLove to buy new gadgetsand appliancesTheir internet usage iswell above averageLowHighTech savvy, they like premium products that make their life easierStreamsTV servicesOwns smartwatch, fitnessband or payment band37%60%16%UK average: 34%UK average: 40%UK average: 8%

1 A 3 Large house luxury532K1.0%UK Adultsof UKThese empty nesters are living in large detached houses and a significant proportion will have paid off their mortgage. They are likely to have a high level of savings and investments.Those who still work will hold senior managerial and professionals jobs, and they have the money to spend freely and frequently on their credit cards. They can afford frequent andexpensive holidays.FINANCIAL SITUATIONWith high earnings, they will be saving for retirement and their children’s futureComfortably off, many willhave a good level of savingsRunninginto debtSavinga lotHousehold income is very high,well above the averageI am very good atmanaging moneyUKLondon 71k 71k65%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESBusy lives, their internet usage is slightly lower than the other types in Acorn Group AMore likely than average toworry about online securityDEMOGRAPHICSEmpty nesters, living in large properties58%57%UK average: 55%UK average: 53%TECHNOLOGYAge rangeHouse tenureHouse typeNumber of children55-74OwnedoutrightDetached0 CACI 2019Tend to agree that shoppingonline makes their life easierLove to buy new gadgetsand appliancesTheir internet usage iswell above the averageLowHighWill own a range of the tech gadgets, often from premium brandsStreamsTV servicesOwns smartwatch, fitnessband or payment band36%60%13%UK average: 34%UK average: 40%UK average: 8%

Category 1Group BExecutiveWealthTypes4 Asset rich families5 Wealthy countryside commuters6 Financially comfortable families7 Affluent professionals8 Prosperous suburban families9 Well-off edge of towners

1 B 4 Asset rich families1.40M2.7%UK Adultsof UKThese affluent professional families tend to be older with a high proportion being retired. However some will be empty nesters or have older independent children living at home.They typically live in large detached houses, and most have paid off their mortgage. There are high levels of savings and investments across a portfolio likely to include stocks andshares, unit trusts and National Savings, and they manage their money carefully.FINANCIAL SITUATIONFinancially confident, they willl use a wide range of financial productsComfortably off, many willhave a good level of savingsRunninginto debtSavinga lotHousehold income iscomfortably above the averageI am very good atmanaging moneyUKLondon 55k 59k70%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESWhilst use of the internet is above average, they use it more for convenienceMore likely than average toworry about online securityDEMOGRAPHICSOlder families, some with independent children, and empty nesters, living in large propertiesTend to agree that shoppingonline makes their life easier58%55%UK average: 55%UK average: 53%Their internet usage isabove the averageLowHighTECHNOLOGY Not typically early adopters, they are more likely to wait until gadgets become cheaperAge rangeHouse tenureHouse typeNumber of children55-74OwnedoutrightDetached2 CACI 2019Love to buy new gadgetsand appliancesStreamsTV servicesOwns smartwatch, fitnessband or payment band30%41%10%UK average: 34%UK average: 40%UK average: 8%

1 B 5 Wealthy countryside commuters1.31M2.5%UK Adultsof UKWealthy commuters living in semi-rural areas, villages and the fringes of small towns, form the bulk of this type. Properties are either traditional or modern semi-rural developments.These are established neighbourhoods where most of the resident families and older couples tend to have settled for a good number of years. Incomes are mostly higher thanaverage and these households tend to have built up a good level of savings and investments.FINANCIAL SITUATIONAble to easily save, they are looking forward to a secure retirementComfortably off, many willhave a good level of savingsRunninginto debtSavinga lotHousehold income is50% above the UK averageI am very good atmanaging moneyUKLondon 60k 61k66%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESSlightly cautious, but comfortable online, spend the least online within Acorn Group BMore likely than average toworry about online securityDEMOGRAPHICSEmpty nesters in large detached homes58%58%UK average: 55%UK average: 53%TECHNOLOGYAge rangeHouse tenureHouse typeNumber of children55 MortgagedDetached0 CACI 2019Tend to agree that shoppingonline makes their life easierLove to buy new gadgetsand appliancesTheir internet usage iswell above the averageLowHighWhilst not at the forefront of tech, they will own premium devicesStreamsTV servicesOwns smartwatch, fitnessband or payment band33%51%11%UK average: 34%UK average: 40%UK average: 8%

1 B 6 Financially comfortable families1.33M2.5%UK Adultsof UKThese are well-off working families, with school-aged children. Many of these families live in modern estates of relatively large detached houses and will commute for their jobs,typically earning above the national average. The majority have a mortgage and, whilst a number may have built up savings and investments, for some this might be limited byoutgoings, mortgage payments and other borrowing.FINANCIAL SITUATIONWhilst incomes are well above average, their mortgage payments may be proportionally highAble to save, despite highoutgoingsRunninginto debtSavinga lotHousehold income iscomfortably above the averageI am very good atmanaging moneyUKLondon 58k 61k66%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESFrequent users of the internet, they embrace the convenience it bringsMore likely than average toworry about online securityDEMOGRAPHICSFamilies with school-age children living in large properties58%60%UK average: 55%UK average: 53%TECHNOLOGYAge rangeHouse tenureHouse typeNumber of children45-64MortgagedDetached2 CACI 2019Most agree that shoppingonline makes their life easierTheir internet usage iswell above the averageLowHighLikely to have plenty of tech in the house, including top of the range games consolesLove to buy new gadgetsand appliancesStreamsTV servicesOwns smartwatch, fitnessband or payment band36%46%11%UK average: 34%UK average: 40%UK average: 8%

1 B 7 Affluent professionals460K0.9%UK Adultsof UKThese households are usually located centrally in towns and in the outer areas of large cities in streets combining a high proportion of higher priced flats and apartments set amongstlarger houses. However, there are rural pockets of Affluent professionals in the national parks and in coastal locations. The residents tend to be well educated and most incomes willbe comfortably above average. Some will have built up above average levels of savings and have investments.FINANCIAL SITUATIONFree spending, with a good level of disposable income, some may have high mortgage paymentsAble to save, despite highoutgoingsRunninginto debtSavinga lotHousehold income iscomfortably above the averageI am very good atmanaging moneyUKLondon 59k 62k66%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESFrequent users of the internet, they spend the most online within Acorn Group BMore likely than average toworry about online securityDEMOGRAPHICSEmpty nesters living in, or on the outskirts of, metropolitan areas58%58%UK average: 55%UK average: 53%TECHNOLOGYAge rangeHouse tenureHouse typeNumber of children45-64OwnedoutrightDetached0 CACI 2019Tend to agree that shoppingonline makes their life easierTheir internet usage iswell above the averageLowHighThey have an above average take up of tech devices, but may wait before buyingLove to buy new gadgetsand appliancesStreamsTV servicesOwns smartwatch, fitnessband or payment band33%45%11%UK average: 34%UK average: 40%UK average: 8%

1 B 8 Prosperous suburban families926K1.8%UK Adultsof UKThese older families and empty nesters will typically live in streets of larger semi-detached or detached houses. A good number are in professional or managerial jobs with salarieswell above the national average. These families are financially secure - a high proportion will have paid off the mortgage on their home and the remainder will have a relatively shortterm left on their mortgage. They may have a mix of savings plans, unit trusts and ISAs. Some will have investments in stocks and shares and National Savings.FINANCIAL SITUATIONWith high earnings, they will be saving for retirement and their children’s futureComfortably off, many willhave a good level of savingsRunninginto debtSavinga lotHousehold income is50% above the UK averageI am very good atmanaging moneyUKLondon 63k 64k64%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESFrequent users of the internet, they embrace the convenience it bringsMore likely than average toworry about online securityDEMOGRAPHICSFamilies with older children and empty nesters living in large properties58%58%UK average: 55%UK average: 53%TECHNOLOGYAge rangeHouse tenureHouse typeNumber of children45-54OwnedoutrightSemidetached2 CACI 2019Tend to agree that shoppingonline makes their life easierTheir internet usage isabove the averageLowHighThey have an above average take up of tech devices, but may wait before buyingLove to buy new gadgetsand appliancesStreamsTV servicesOwns smartwatch, fitnessband or payment band31%45%11%UK average: 34%UK average: 40%UK average: 8%

1 B 9 Well-off edge of towners1.06M2.0%UK Adultsof UKThese are wealthy couples with school age children or whose children have left home. Employment is largely in senior managerial and professional occupations. They typically live inlarger detached houses that are more expensive than other property in the neighbourhood. These neighbourhoods tend to be new-build estates on the outskirts of towns and cities.The majority of household incomes are likely to be significantly higher than the national average and these families may have built up savings accounts and investments.FINANCIAL SITUATIONWith a good level of disposable income, they are able to set money aside in savings and investmentsComfortably off, many willhave a good level of savingsRunninginto debtSavinga lotHousehold income is vey high,well above the UK averageI am very good atmanaging moneyUKLondon 67k 69k67%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDES Frequent users of the internet, online spend is amongst the highest of all the Acorn TypesMore likely than average toworry about online securityDEMOGRAPHICSFamilies with school-age and older children living in large properties58%60%UK average: 55%UK average: 53%TECHNOLOGYAge rangeHouse tenureHouse typeNumber of children45-64MortgagedDetached2 CACI 2019Most agree that shoppingonline makes their life easierLove to buy new gadgetsand appliancesTheir internet usage iswell above the averageLowHighThey are the most tech-engaged within Acorn Group BStreamsTV servicesOwns smartwatch, fitnessband or payment band36%51%15%UK average: 34%UK average: 40%UK average: 8%

Category 1Group CMatureMoneyTypes10 Better-off villagers11 Settled suburbia, older people12 Retired and empty nesters13 Upmarket downsizers

1 C 10 Better-off villagers1.51M2.9%UK Adultsof UKThese older couples, with some families, live in the larger, more expensive housing found in villages and the edges of small towns. This will include a fair number of old traditionalproperties. Incomes are above average. Many will have paid off their mortgage and have built up good savings and investments in some mix of bonds, shares, unit trusts and ISAs. Afair number are well-qualified and have professional or managerial jobs, or did so before they retired.FINANCIAL SITUATIONExpenditure is the highest of all the Types within Acorn Group CMany will have a good levelof savingsRunninginto debtSavinga lotHousehold income iscomfortably above the averageI am very good atmanaging moneyUKLondon 53k 54k62%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESThey have by far the highest levels of online spend within Acorn Group CMore likely than average toworry about online securityDEMOGRAPHICSEmpty nesters and families with older children, living in large properties58%55%UK average: 55%UK average: 53%TECHNOLOGYAge rangeHouse tenureHouse typeNumber of children55-74OwnedoutrightDetached0 CACI 2019Tend to agree that shoppingonline makes their life easierLove to buy new gadgetsand appliancesTheir internet usage isabove the averageLowHighThey are unlikely to have the latest tech in their homesStreamsTV servicesOwns smartwatch, fitnessband or payment band28%40%9%UK average: 34%UK average: 40%UK average: 8%

1 C 11 Settled suburbia, older people1.62M3.1%UK Adultsof UKMany of the residents in these streets of predominantly semi-detached houses are pensioners or nearing retirement age. They tend to have good educational qualifications and workor have worked in professional or managerial occupations. Overall incomes are higher than average although the incomes of those with pensions will be less than those inemployment. Most will own their home outright. Often financially astute, they might have a mix of savings and investments.FINANCIAL SITUATIONThey are likely to have a mix of different savings productsComfortably off, many willhave a good level of savingsRunninginto debtSavinga lotHousehold income iscomfortably above the averageI am very good atmanaging moneyUKLondon 51k 53k64%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESMore likely than average toworry about online securityDEMOGRAPHICSRetired couples, living in properties with 3 bedroomsHouse tenureHouse typeNumber of children65 OwnedoutrightSemidetached0 CACI 2019Less likely to feel that shoppingonline makes their life easier57%52%UK average: 55%UK average: 53%TECHNOLOGYAge rangeDespite being older, their online spend is above the average for the UKLove to buy new gadgetsand appliancesTheir internet usage isaround the averageLowHighComfortable with technology, they will own a range of devicesStreamsTV servicesOwns smartwatch, fitnessband or payment band29%41%9%UK average: 34%UK average: 40%UK average: 8%

1 C 12 Retired and empty nesters1.20M2.3%UK Adultsof UKThese streets are typically dominated by older people, with the majority of the population usually aged over 55. Many will have settled here for a number of years, although there isstill a relatively active housing market as newcomers retire to these areas. It is more usual that, prior to retirement, many will have had senior managerial or professionaloccupations. The majority own their home outright. Quite a high proportion will own shares or bonds and have built up reserves in savings accounts, cash ISAs and national savings.FINANCIAL SITUATIONThey have the highest level of disposable income of the Types within Acorn Group CHaving paid off the mortgage,they are able to saveRunninginto debtSavinga lotHousehold income isaround the averageI am very good atmanaging moneyUKLondon 39k 44k65%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESOf all Acorn Types, they have the second highest level of concern over internet securityMore likely than average toworry about online securityDEMOGRAPHICSRetired and empty nester couples, living in larger properties62%46%UK average: 55%UK average: 53%TECHNOLOGYAge rangeHouse tenureHouse typeNumber of children55 OwnedoutrightDetached0 CACI 2019Less likely to feel that shoppingonline makes their life easierLove to buy new gadgetsand appliancesTheir internet usage isaround the averageLowHighThey are more likely to find new technology confusingStreamsTV servicesOwns smartwatch, fitnessband or payment band27%34%7%UK average: 34%UK average: 40%UK average: 8%

1 C 13 Upmarket downsizers542K1.0%UK Adultsof UKA significant number of these small flats are owned by pensioners, with middle-aged professionals and managers usually owning the rest of the housing. There are also a significantproportion who privately rent. These upmarket flats typically occur in coastal resorts, other areas to which folk often retire, and recent purpose-built developments of homes forolder people.FINANCIAL SITUATIONThey are likely to have a good private pension which allows them to lead a comfortable lifeComfortably off, many willhave a good level of savingsRunninginto debtSavinga lotHousehold income isa little below the averageI am very good atmanaging moneyUKLondon 37k 41k63%Average: 40kAverage: 44kUK average: 57%of themagreeDIGITALATTITUDESWhilst most will use the internet regularly, online spend is below the UK averageMore likely than average toworry about online securityDEMOGRAPHICSRetired couples and singles, living in properties with 1 or 2 bedrooms58%52%UK average: 55%UK average: 53%TECHNOLOGYAge rangeHouse tenureHouse typeNumber of children65 Owned outrightor rentedFlat ormaisonette0 CACI 2019Less likely to feel that shoppingonline makes their life easierTheir internet usage isabove the averageLowHighLikely to own several devices, but typically wait until the technology is establishedLove to buy new gadgetsand appliancesStreamsTV servicesOwns smartwatch, fitnessband or payment band29%40%9%UK average: 34%UK average: 40%UK average: 8%

2Rising Prosperity5.0M9.4%UK Adultsof UKAge rangeHouse type25-44Flat ormaisonetteFinancial situationHouse tenureRunninginto debtPrivatelyrentingSavinga lotChildren at homeNumber of beds01-2These are generally younger, well educated, professionalsmoving up the career ladder, living in our major towns and cities.Singles or couples, some are yet to start a family, others will haveyounger children. CACI 2019Acorn Groups within Category 2: Rising ProsperityD City SophisticatesE Career Climbers37%63%

Category 2RisingProsperityGroupsD City SophisticatesE Career Climbers

2 D City Sophisticates1.9M3.6%UK Adultsof UKYounger individuals enjoying the city lifestyle with lots of opportunities to socialise and spend. These affluent younger people generally rent flats in majortowns and cities. Whilst incomes are well above average, their level of disposable income is restricted due to high rents.DEMOGRAPHICSBRANDSSHOPPINGAge rangeChildren at home25-440House tenureFamily structurePrivatelyrentingSingleNumber of bedsHouse typeLEISUREWEBSITESDIGITALATTITUDESFlat ormaisonette1I worry aboutonline securityFINANCIAL PROFILEHousehold incomeShopping online makesmy life easier54%64%47%UK average: 55%UK average: 53%UK average: 34%KEY INTERNET USAGE% Disposable incomeUKLondonUK 52k 53k28% 27%Average: 40kAverage: 44kAverage: 44%Financial situationThis group are more likely toLondonAverage: 39%Runninginto debtSavinga lot CACI 2019I couldn’t live without theinternet on my mobilebrowse forrestaurants onlineTECHNOLOGY USAGEThis group are morelikely to take out aloan onlineThis group are more likelytoown an iPhone

2 E Career Climbers3.1M5.8%UK Adultsof UKYounger singles and couples, some with young children, living in more urban locations. They live in flats, apartments and smaller houses, which they willbe renting. They will have started saving what they can in order to put down a deposit on a house in the future.DEMOGRAPHICSBRANDSSHOPPINGAge rangeChildren at home25-441House tenureFamily structurePrivatelyrentingCouple withchildrenNumber of bedsHouse typeLEISUREWEBSITESDIGITALATTITUDESFlat ormaisonette1-2I worry aboutonline securityFINANCIAL PROFILEHousehold incomeShopping online makesmy life easier55%64%44%UK average: 55%UK average: 53%UK average: 34%KEY INTERNET USAGE% Disposable incomeUKLondonUK 47k 44k36% 32%Average: 40kAverage: 44kAverage: 44%Financial situationThis group are more likely toresearch mortgagesLondonAverage: 39%onlineRunninginto debtSavinga lot CACI 2019I couldn’t live without theinternet on my mobileTECHNOLOGY USAGEThis group are morelikely to purchaseairline tickets onlineThis group are more likelytoown a smartwatch,fitness band orpayment band

Category 2Group DCitySophisticatesTypes14 Townhouse cosmopolitans15 Younger professionals in smaller flats16 Metropolitan professionals17 Socialising young renters

2 D 14 Townhouse cosmopolitans404K0.8%UK Adultsof UKTh

CACI Proprietary Data Government Data Open Data Commercial Data A variety of GDPR compliant data sources are used in the build of Acorn -from a combination of: ANALYSIS Statistical techniques are used to best utilise these different types of data to create a postcode level dataset. The Acorn structure is defined through iterative, complex .