Transcription

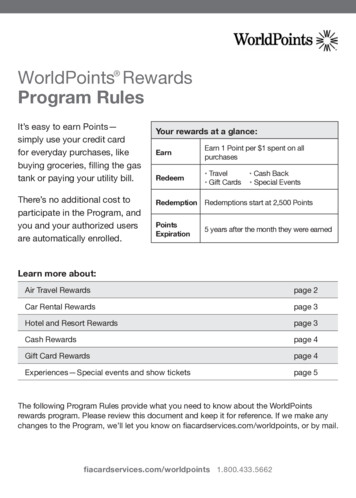

BankAmericard Power Rewards Program RulesIt’s easy to earn Points —simply use your Card foreveryday purchases, likebuying groceries, filling thegas tank or paying yourutility bill.There’s no additionalcost to participate in theProgram, and you andyour authorized users areautomatically enrolled.Rewards at a glance:Base Earn*Earn 1 Base Point for every 1spent on Net PurchasesBonus Earn*Preferred Rewards/PreferredRewards for Wealth ManagementBonus (if qualified & enrolled):Earn 25%–75% more Points**Redeem Travel Gift CardsMinimumRedemptionRedemptions start at 2,500 PointsExpirationPoints expire 5 years after the monththey were earnedForfeiturePoints are subject to forfeiture.See page 3. Cash Back* If you are enrolled in a specific Partner Rewards Offerin the Partner Rewards program, you will not earn Baseor Bonus Earn on qualifying transactions at that specificMerchant. You will earn the Partner Rewards instead.** See page 2 for eligibility details.Learn more about:Travel Rewardspage 4Cash Rewardspage 6Gift Card Rewardspage 7The following Program Rules provide what you need to know about the Program. Pleasereview this document and keep it for reference. If We make any changes to the Program,We will let you know on bankofamerica.com or by mail.bankofamerica.com800.434.8313

Page 1Basic terms and definitionsBase Points — The number of Points youwill earn with each purchaseBilling Cycle — The period of time betweenmonthly bills or monthly billing statements,as defined in your Credit Card AgreementBonus Points — The number of additionalPoints you can earn with each purchase,subject to the terms of certain bonus offersor enrollment-based programsCard — A BankAmericard Power Rewards Visa or Mastercard credit cardCardholder (also referred to as “you”) —Individual Cardholders, Joint Cardholdersand authorized users, if any, with a Cardaccount and charging privileges (excludingcorporations, partnerships or other entities)Cash Rewards — A statement credit, anelectronic Automated Clearing House (ACH)System deposit into a checking or savingsaccount with Bank of America, N.A., acontribution to an eligible Cash ManagementAccount with Merrill, or a check; CashRewards are issued in U.S. dollarsEligible Account — A Bank of America checking or savings account and/or aqualifying Cash Management Account withMerrill; Eligible Accounts are determined byBank of America, N.A.Joint Cardholder — Joint owner of theCard account who shares full responsibilityof account with the Primary Cardholder;does not include authorized usersMerchant — A merchant who has contractedwith Us to provide a Partner Rewards OfferNet Purchases — The amount of purchasesless any credits, returns and adjustmentsPartner Rewards — The rewards that youearn while enrolled in a Partner Rewards OfferPartner Rewards Offer — An offer to youto earn Partner Rewards, instead of yourProgram Rewards, on Net Purchases withthat MerchantPoints — Points that are earned orredeemed through the ProgramPreferred Rewards/Preferred Rewardsfor Wealth Management Programs —Optional benefits and rewards programs,separate from this Card Program, availableto Bank of America customers/Merrill clientswho have met certain deposit accountand deposit/investment balance criteria.Qualification and enrollment requirements,and other program details, are available atbankofamerica.com/preferred‑rewardsPrimary Cardholder — First-namedCardholder on the Card accountProgram — The BankAmericardPower Rewards programProgram Rules — Refers to the terms andconditions in this document, which governthe Program; these Program Rules areseparate from the terms of the Credit CardAgreement provided with your CardRewards — Rewards that you can receiveby redeeming PointsSite — The Program website atbankofamerica.comTravel Center — The website or call centerwhere Cardholders can purchase travel orredeem Points for travelTravel Rewards — Air travel, car rentals,hotel stays and other travel options that arepaid for fully or partially by redeemingPointsWe/Us/Our — Bank of America, N.A., theadministrator and issuer of the ProgramHow are my Points calculated? We will calculate your Points with eacheligible transaction and award (or deduct)the resulting Points, including twodecimals (for example, 1.01 x 1 1.01Points). We calculate and round Base and BonusPoints separately.Base Points We calculate the number of Base Pointsyou will earn with each purchase or returntransaction you make.

Page 2 The transaction amount (positive ornegative dollars) multiplied by your baseearn rate of 1 Point equals your BasePoints. For example, a purchase of 1.01 x 1base earn rate 1.01 Base Points. Similarly, a return of - 1.01 x 1 base earnrate -1.01 Base Points.Bonus Points You may earn Bonus Points based onmeeting certain criteria or taking certainactions (such as enrolling in the PreferredRewards program); details willaccompany the offer. We calculate the number of Bonus Pointsyou will earn with each purchase or returntransaction you make, but separately fromthe calculation for your Base Points. The transaction amount (positive ornegative dollars) multiplied by the bonusearn rate for that particular offer equalsyour Bonus Points. For example, a purchase of 1.00 x .50bonus earn rate 0.50 Bonus Points. Similarly, a return of - 1.00 x .50 bonusearn rate -0.50 Bonus Points.Points Rounding Any Points calculations resulting in morethan two decimals will be rounded up tothe next hundredth of a Point (forexample, 1.013 rounds up to 1.02).How do I earn Points? Earn 1 Base Point for every 1 spent onNet Purchases. 1.01 x 1 earn rate 1.01Points. There’s no limit on the number of Pointsthat can be earned. From time to time, special promotionsmay feature the ability to earn BonusPoints; details will accompany the offer. Points are subject to verification. If you are enrolled in a specific PartnerRewards Offer in the Partner Rewardsprogram, you will not earn Base or BonusEarn on qualifying transactions at thatspecific Merchant. You will earn thePartner Rewards instead.Visit the Site or refer to your monthly billingstatement to see how many Points you’veearned.Transactions not eligible for PointsYou won’t earn Points for: Balance Transfers and Cash Advances,including, but not limited to, travelerschecks, money orders and other cashequivalents Fees, interest charges and credit insurance Fraudulent transactionsIf I’m a Bank of Americacustomer or Merrill client whohas qualified for and enrolled inthe Preferred Rewards/Preferred Rewards for WealthManagement Program, how doI earn the Preferred Rewards/Preferred Rewards for WealthManagement Bonus?What you should know To be qualified for enrollment in thePreferred Rewards/Preferred Rewardsfor Wealth Management (formerlyknown as Banking Rewards forWealth Management) Programs, youmust own certain Bank of Americadeposit accounts and maintain specificbalances in Bank of America depositaccounts and/or in Merrill investmentaccounts. Details are available atbankofamerica.com/preferred‑rewards. After enrolling in the PreferredRewards/Preferred Rewards for WealthManagement Programs, or if you arealready enrolled and open a new Card, itmay take up to 30 days for the PreferredRewards/Preferred Rewards for WealthManagement Bonus to become activeon your Card(s).

Page 3 If you move to a higher (or lower) rewardtier, it may take up to five days for the higher(or lower) Preferred Rewards/PreferredRewards for Wealth Management Bonusto become active on your existing Cards. For enrolled members who change theircard type, as long as the new Card is aneligible credit card, it may take up to fivedays for the Preferred Rewards/PreferredRewards for Wealth Management Bonusto become active on the new Card. Acomplete list of ineligible cards is availableat bankofamerica.com/preferred‑rewards. If more than one Cardholder on a Cardaccount (Primary Cardholder and JointCardholder) is enrolled in the PreferredRewards/Preferred Rewards for WealthManagement Program, the account willreceive the Preferred Rewards/PreferredRewards for Wealth Management Bonuslevel based on the Cardholder with thehigher tier. If a Joint Cardholder with a higher tieris added to a Card account, it may takeup to 30 days for the higher PreferredRewards/Preferred Rewards for WealthManagement Bonus to become activeon that Card. Your Preferred Rewards/PreferredRewards for Wealth ManagementProgram enrollment status and tier canchange depending on the balance youmaintain in your qualifying deposit/investment account(s). The Preferred Rewards/PreferredRewards for Wealth ManagementBonuses are calculated and awardedseparately from any other Bonus Pointsor account-opening bonus, if applicable. This product is not eligible for benefitsunder the Preferred Rewards for Businessprogram. If you are enrolled in a specific PartnerRewards Offer in the Partner Rewardsprogram, you will not earn Base or BonusEarn on qualifying transactions at thatspecific Merchant. You will earn thePartner Rewards instead.How the Preferred Rewards/PreferredRewards for Wealth Management Bonusworks If either the Primary Cardholder or JointCardholder on the account is enrolledin the Preferred Rewards/PreferredRewards for Wealth ManagementPrograms, the Preferred Rewards/Preferred Rewards for WealthManagement Bonus will be added asBonus Points to the Base Points you earnwith each 1 spent on Net Purchases. The amount of Bonus Points you earndepends on your Preferred Rewards/Preferred Rewards for WealthManagement Program enrollment statusand tier at the time the purchase posts toyour account as follows:- Gold tier (25% bonus earn rate):Earn 1.25 Points (.25 Bonus Points 1 Base Point)- Platinum tier (50% bonus earn rate):Earn 1.50 Points (.50 Bonus Points 1 Base Point)- Platinum Honors tier (75% bonus earnrate): Earn 1.75 Points (.75 BonusPoints 1 Base Point)- Preferred Rewards for WealthManagement (75% bonus earn rate):Earn 1.75 Points (.75 Bonus Points 1 Base Point) For example, if you earn 100 Base Points,the Preferred Rewards Bonus (based onyour tier when the purchase posts to youraccount) will add 25, 50, or 75 BonusPoints, totaling 125, 150, or 175 Points.What are the types ofRewards?Use your Points to enjoy a varietyof Rewards, including: Travel Cash Gift Cards

Page 4How do I redeem my Points?Just sign in to your Online Banking accountat bankofamerica.com, select youraccount, select “Rewards,” and click“Redeem Points,” or call 800.434.8313.What you need to know Points are available for redemption assoon as they appear on your monthlybilling statement. The most up-to-date number of Pointsyou have available to redeem (whichreflects any Points adjustments, transfers,or redemptions) is available online or atthe number above and may differ from theavailable Points shown on your lastmonthly billing statement. You can only redeem Points in wholePoint increments, but any fractions ofPoints will continue to accumulate towardthe next whole Point for futureredemptions. If your account loses charging privilegesbut regains them before the point ofaccount closure, your Points will beavailable for redemption once thecharging privileges are restored. Points can only be redeemed if theaccount is open and has activecharging privileges. In order to redeem for Rewards, youmust be an individual (no corporations,partnerships, or entities). If the owner(s) of the Card accountvoluntarily closes the Card account, or iffor any reason We close the Card account,any unused Points associated with theaccount are subject to immediateforfeiture, unless specifically authorizedby Us within 90 days of the closure. However, if the Card account is closed inconnection with a death or incapacity ofthe Card account owner, Points eligiblefor redemption may be redeemed if anauthorized representative of the estate,as determined by Us, requests Pointsredemption within 57 days of an accountclosure. Whether Points are eligible for redemption depends on the final statusof the account, is subject to the accountbeing closed and paid in full, and is inOur sole discretion. Rewards will only beissued upon request and in the name ofthe deceased Primary Cardholder. In theevent redemptions are mailed, they aresent in the name of the deceased PrimaryCardholder and to the address We havein Our system of record for that person.These redemption provisions do not applyto jointly held accounts where there is atleast one surviving owner of an account.When you request a Reward, Points willbe deducted from your account basedon the Point value of the specific Rewardon the date of the request.All redemptions are final once processed.You can’t transfer or sell Points to anotherperson. However, you may be able totransfer Points from one Bank of Americaaccount to another. Call for moreinformation to see if your accountqualifies.Points are non-negotiable and have nocash value except when redeemed forCash Rewards.Points expire five years after the monththey were earned.Travel RewardsYou can redeem Points for: Airline travel Car rentals Hotel stays Other Travel OptionsWhat you should know Travel Reward redemptions start at2,500 Points. Availability of certain airlines, flights, carrental companies, hotels and other traveloptions are limited to those on the TravelCenter reservation system. Not allairlines, flights, car rental companies andhotels may be available.

Page 5 You’ll earn Points for any additional costscharged on your Card. Exchanges or refunds for no-shows orunused portions of travel aren’t allowed.Make sure you provide proper proof ofcitizenship or naturalization, if required. Fees may be charged by the Programfor changes and cancellations of travelbookings after travel reservations areconfirmed. Additional fees may be imposedby an airline, car rental company, hotel orother travel supplier based on their changeand cancellation policies. Any applicablechange and cancel fees will be disclosedat the time of booking or cancellation. Except where allowed by the airline, carrental company or hotel, all redemptionsare non-refundable. Travel pricing is subject to availability atthe time of redemption. Travel documents will be sent to the emailaddress you provide at the time ofredemption. There may be age restrictions for airline,car rental and hotel reservations. Contactthe airline, car rental company or hoteldirectly for details. Optional charges are not included inthe Reward (e.g., baggage fees, tips,insurance, airline amenities).Air Travel RewardsStay at any participating hotel worldwide. The number of Points you need toredeem for a hotel Reward will bedetermined at the time of redemption. No minimum stay required. Accommodations and services varydepending on the property. Hotel-mandated fees, such as resort fees,and other optional charges are notincluded in the award. You may berequired to present a credit card atcheck-in to cover these charges.Use Points to fly to destinations worldwide,using air Rewards:Air RewardsWho is eligibleAny CardholderUsable for worldwide travelYesSpecial booking requirementsNoLimits on the cost of flight(maximum dollar value)NoWhat you should know The Travel Center is not responsible fortravel itinerary changes made by theairlines. Contact the airline prior todeparture for any changes or delays. Seating requests made at the time ofbooking are not guaranteed. Contactairlines directly to confirm your seats.Air Rewards The number of Points you need toredeem for an air Reward will bedetermined at the time of redemption. You can redeem for an unlimited dollarvalue on your ticket.Car Rental RewardsUse your Points to rent a vehicle. The number of Points you need toredeem for a car rental Reward will bedetermined at the time of redemption. Optional charges are not included in theReward (e.g., refueling, liability insurance,drop-off charges). You may be required topresent a credit card at check-in to coverthese charges. You must meet credit, age and driverrequirements. Present your Card when you pick up andreturn the car.Hotel RewardsOther Travel Rewards Available travel reward options maychange from time to time. The number of Points you need toredeem will be determined at the timeof redemption.

Page 6 Any optional charges are not includedin the Reward. You may be requiredto present a credit card to cover thesecharges. You must meet any credit, age andother requirements.Cash Rewards You can redeem Points for a statementcredit, an electronic deposit into anEligible Account, or a check. Cash Rewards redemptions start at2,500 Points. Cash Rewards can be redeemed inincrements of 1 Point. There is no limit to the number of Pointsyou can redeem. The Redemption value of your Points is1%. For example: 2,500 Points 25.00. This information is available on the Siteand is subject to change.Automatic Redemption To turn on automatic redemption, go tothe Site or call the number on the back ofyour Card to designate an EligibleAccount. After you turn on automatic redemption,at the end of each calendar month duringthe month your Points balance meets orexceeds the minimum Points required forredemption, all of your available Pointswill be automatically redeemed. Points expire five years after the monththey were earned. Points expiration rules still apply whenauto redemption is turned on. Monitoryour Expiring Points Schedule once youhave turned on auto redemption. The Expiring Points Schedule for yourCard account can be viewed in OnlineBanking (bankofamerica.com). The cash value will be deposited viaelectronic transfer into the Eligible Accountthat you selected as long as your Card isopen with active charging privileges. You can turn off automatic redemptionany time through the Site or by telephone.If you do, you will need to request anyfuture Cash Rewards.Requesting a Statement Credit Points redeemed for statement credit toyour Card will post to your account withinthree business days of the date ofredemption. Statement credits will generally be appliedto your existing balance with the highestpriced Annual Percentage Rate. If you receive a statement credit, you arestill responsible for paying your MinimumPayment Due shown on each monthlybilling statement you receive from Us.Redemptions for an Electronic Depositinto an Eligible Account When you redeem for an electronicdeposit into an Eligible Account, We willsend it to the account you have indicatedwithin five business days of your request. If an electronic deposit is rejected for anyreason, We will void the deposit andreinstate the Points to your Card account. If an electronic transfer is rejected, Wewill notify you within 15 business days ofyour request at the email address on file.Requesting a check Cash Rewards checks will only be madepayable to the individual designated byUs as the Primary Cardholder. We will mail each check to the PrimaryCardholder’s billing address via first-classU.S. mail within 14 business days of theredemption. Checks can only be sent within the 50United States and U.S. territories. We are not responsible for lost, stolen orundelivered checks. Requests for multiple checks areprocessed and mailed separately. Checks are valid for 90 days from date ofissue. An expiration date will appear oneach check.

Page 7 We will void any check that is notpresented for payment before theexpiration date. In such cases, We willaward the Cash Rewards as a statementcredit posting to your Card within twoBilling Cycles following the expirationdate. This will appear on your account asa retail credit adjustment. There is no limit to the number of checksyou can receive.Gift Card RewardsUse your Points for gift cards from a varietyof retailers.Shopping online Browse the Site for gift card options whichare updated regularly.About gift cards Rewards may be issued as gift cards orgift certificates. The names and logos of merchants areused with permission of the merchantsand all trademarks are the property oftheir respective owners. Your Program does not guarantee theavailability of a specific gift card, and thechoices available may change withoutnotice. Gift cards/certificates are subject to theterms and conditions set by the merchant/retailer who issues the gift card/certificate. Visa and Mastercard branded gift cardsexpire if not used prior to the expirationdate on the card (approximately 12months). Additional fees may apply. Visa and Mastercard gift card terms andconditions will be sent with the card.Shipping Gift cards can only be shipped within the50 United States and U.S. territories. Gift cards can be sent to a P.O. Box orstreet address. Check the Site for gift card shipping terms.Additional TermsProgram changesChanges to the Program and the ProgramRules may occur from time to time. Whenany change is made, We will postrevisions on the Site. In some cases, Wemay notify you of changes by mail.However, it’s your responsibility to reviewthe Site or any correspondence to stayaware of any changes.We may choose to: Discontinue or change the redemptionoptions or values at any time. Discontinue or replace any Reward with asimilar one of equal or greater value. Change any part of the Program,Program Rules or participating partners,Rewards or special offers. Terminate the Program or discontinueyour participation in it for any reason.For example, We may disqualify you fromearning and redeeming Points if We findthat you or someone else used youraccount in a way that breaks theProgram Rules.Changes may also affect outstandingtransactions and Points, including: The earnings rate for Points The minimum amount of Points requiredfor redemption The types of transactions that qualify forPoints The type or value of Rewards The expiration date of Points, and themaximum number of Points that maybe earned per month, year or othertime periodThe Program is not scheduled to end ona predetermined date.Disputes regarding Points Discrepancies about Points earningsare not treated as Card billing disputes.

Page 8Please refer to your Credit CardAgreement or the annual Your BillingRights notice for details about billingdisputes. All decisions regarding Points disputesshall be final.Refunds on Card transactionsIf you earn Points with a Card transactionthat is later refunded — and you redeemthose Points for a Reward — We may: Cancel reservations and void traveldocuments Stop payment on any checks Withhold subsequent Points Collect any amounts you owe; this mayinclude charging an equivalent dollaramount to your Card in the form of a BankCash AdvanceCombining Points, Rewards and otherspecial promotionsUnless specifically authorized by Us,Points and Rewards may not be combined: With other discounts, special rates,promotions or other reward programsoffered by Us With any other entity, including airlinefrequent flier, hotel frequent guest or othertravel-related or membership rewardcharge, or credit card programProgram administration Bank of America, N.A. manages theCash Rewards portion of the Program. Bank of America, N.A. is the exclusiveissuer and administrator of the Program. An independent third party manages thegift card and certificate Rewards portionsof the Program. An independent third-party travel agencymanages the travel portion of the Program. Aspire Loyalty Travel Solutions LLC, anaffiliate of Bridge2 Solutions, LLC,complies with the laws in the states thatrequire registration in order for an agencyto sell or offer to sell travel services:California* (2122200-50)Florida (ST39969)Iowa (1253)Washington (603527613)*Registration as a seller of travel does notconstitute approval by the State of California.Aspire is not a participant in the CaliforniaTravel Consumer Restitution Fund.General liabilityThe Card is separate and distinct fromany accounts you may have withBank of America and its affiliates.Approval of this Card account does notmean that any other account will beestablished for you.You agree to release Bank of America, N.A.and any of its affiliates from all liability,including: Any injury, accident, loss, claim, expenseor damages you or anyone with youexperience when using any Reward. If atall, the sole extent of any liability will notexceed the actual value of the Reward. Any claims, expenses and legal feesarising from or related to any violationof the Program Rules by you or anyoneusing your Card account. Any typographical errors or omissionsin any Program-related document. The use of any personal or otherinformation you provide to anymerchants in connection withprocessing your Reward. Delayed or lost correspondence sent byU.S. mail or any other form of delivery,including email. Any error, omission, interruption, deletion,defect, delay, theft, destruction, orunauthorized access to, or alterationof, Points you earn or redeem.Third-party suppliers are independentcontractors; they aren’t employees ofBank of America, N.A., Visa U.S.A., Inc.,Mastercard International Incorporated,or any of their affiliates.

Page 9We do not endorse or guarantee any of thegoods, services or information provided bythe Program’s third-party suppliers.You agree that to process yourtransactions, the information you providewill be disclosed to merchants and otherparties involved in your transaction.Examples of such information includeyour shipping address, Card number andbilling information.Rewards may constitute taxable incometo you and you are responsible for any taxliability that may arise from receivingRewards. You may be issued an InternalRevenue Service Form 1099 (or otherappropriate form) that reflects the valueof Rewards. Please consult your taxadvisor, as neither We, nor Our affiliates,provide tax advice.All aspects of the Program are governedby the laws of the State of North Carolina.In states that don’t allow the disclaimer ofwarranties or exclusion of liability, theabove limitations may not apply.For information about Our rights and yourresponsibilities regarding the online portionof the Program, see the Terms of Use atthe Site.All other company, product and servicenames may be trademarks or servicemarks of others and their use does notimply endorsement or an association withthis Program. 2021 Bank of America CorporationService marks and trademarksPower Rewards, Cash ManagementAccount, BankAmericard, Bank of Americaand the Bank of America logo are registeredtrademarks of Bank of America Corporation.Visa is a registered trademark of VisaInternational Service Association and isused by the issuer pursuant to license fromVisa U.S.A. Inc.Mastercard is a registered trademark ofMastercard International Incorporated andis used by the issuer pursuant to license.PWR 202105 DPRI-02-21-0103.E

Travel Rewards page 4 Cash Rewards page 6 Gift Card Rewards page 7 The following Program Rules provide what you need to know about the Program. Please review this document and keep it for reference. If We make any changes to the Program, . Card — A BankAmericard Power Rewards