Transcription

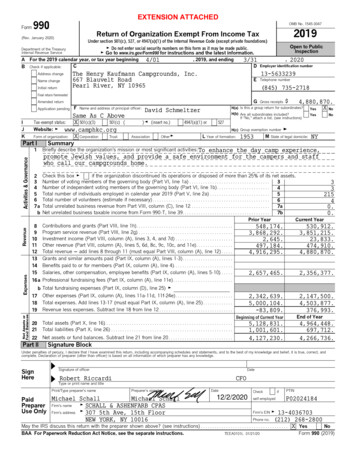

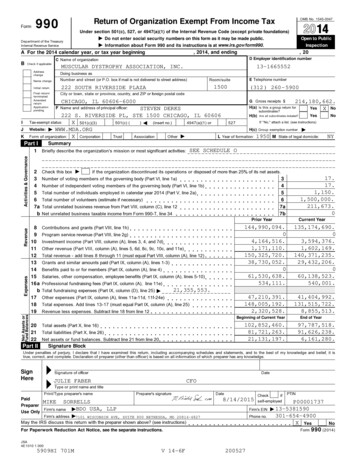

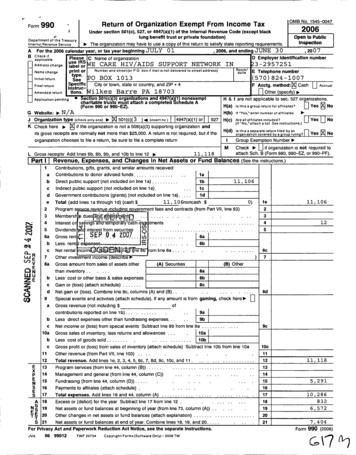

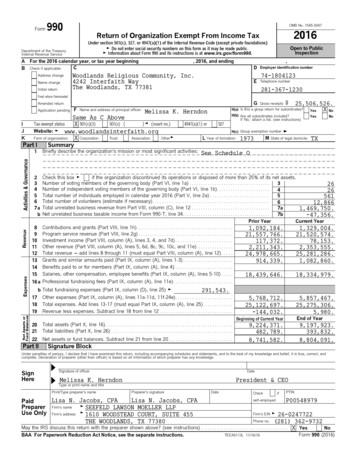

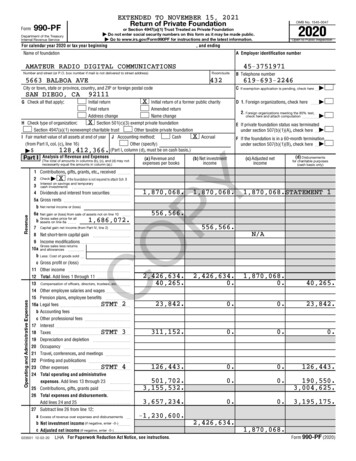

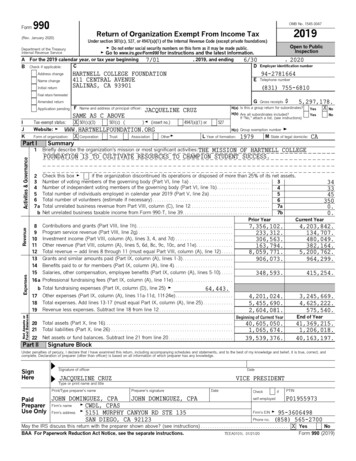

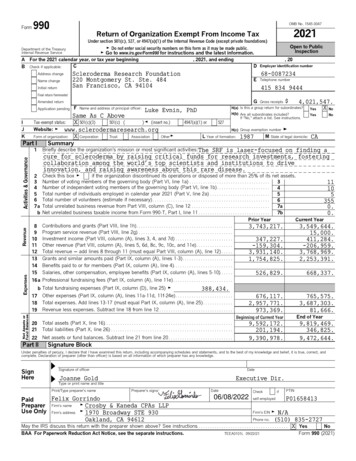

Form990OMB No. 1545-00472021Return of Organization Exempt From Income TaxUnder section 501(c), 527, or 4947(a)(1) of the Internal Revenue Code (except private foundations)G Do not enter social security numbers on this form as it may be made public.G Go to www.irs.gov/Form990 for instructions and the latest information.For the 2021 calendar year, or tax year beginning, 2021, and endingCDCheck if applicable:Open to PublicInspectionDepartment of the TreasuryInternal Revenue ServiceABAddress changeName changeInitial returnScleroderma Research Foundation220 Montgomery St. Ste. 484San Francisco, CA 94104, 20Employer identification number68-0087234ETelephone number415 834 9444Final return/terminatedGAmended returnFGross receipts 4,021,547.X NoYesH(a) Is this a group return for subordinates?Luke Evnin, PhDH(b) Are all subordinates included?YesNoSame As C AboveIf "No," attach a list. See instructions.)H (insert no.)Tax-exempt status:501(c) (4947(a)(1) or527IX 501(c)(3)JWebsite: G www.sclerodermaresearch.orgH(c) Group exemption number GKForm of organization:TrustAssociationOtherGL Year of formation: 1987M State of legal domicile: CAX CorporationPart ISummary1 Briefly describe the organization's mission or most significant activities: The SRF is laser-focused on finding acure for scleroderma by raising critical funds for research investments, fosteringcollaboration among the world’s top scientists and institutions to driveinnovation, and raising awareness about this rare disease.Application pending234567ab89101112131415Name and address of principal officer:Check this box Gif the organization discontinued its operations or disposed of more than 25% of its net assets.Number of voting members of the governing body (Part VI, line 1a) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .311Number of independent voting members of the governing body (Part VI, line 1b) . . . . . . . . . . . . . . . . . . . . . . .410Total number of individuals employed in calendar year 2021 (Part V, line 2a) . . . . . . . . . . . . . . . . . . . . . . . . . .55Total number of volunteers (estimate if necessary) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .6355Total unrelated business revenue from Part VIII, column (C), line 12. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7a0.Net unrelated business taxable income from Form 990-T, Part I, line 11 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .7b0.Prior YearCurrent YearContributions and grants (Part VIII, line 1h). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .3,743,217.3,549,644.Program service revenue (Part VIII, line 2g). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .15,000.Investment income (Part VIII, column (A), lines 3, 4, and 7d) . . . . . . . . . . . . . . . . . . . . . . . . .347,227.411,284.Other revenue (Part VIII, column (A), lines 5, 6d, 8c, 9c, 10c, and 11e). . . . . . . . . . . . . . . .-159,304.-206,959.Total revenue ' add lines 8 through 11 (must equal Part VIII, column (A), line 12) . . . . .3,931,140.3,768,969.Grants and similar amounts paid (Part IX, column (A), lines 1-3). . . . . . . . . . . . . . . . . . . . . .1,754,825.2,253,391.Benefits paid to or for members (Part IX, column (A), line 4). . . . . . . . . . . . . . . . . . . . . . . . . .Salaries, other compensation, employee benefits (Part IX, column (A), lines 5-10). . . . . .526,829.668,337.16 a Professional fundraising fees (Part IX, column (A), line 11e) . . . . . . . . . . . . . . . . . . . . . . . . . .b Total fundraising expenses (Part IX, column (D), line 25) G388,434.171819Other expenses (Part IX, column (A), lines 11a-11d, 11f-24e) . . . . . . . . . . . . . . . . . . . . . . . . .Total expenses. Add lines 13-17 (must equal Part IX, column (A), line 25) . . . . . . . . . . . . .Re

Form 990 (2021) Page 5 Part V Statements Regarding Other IRS Filings and Tax Compliance (continued) Yes No 2a Enter the number of employees reported on Form W-3, Transmittal of Wage and Tax State- ments, filed for the calendar year ending with or within the year covered by this return. . . . .