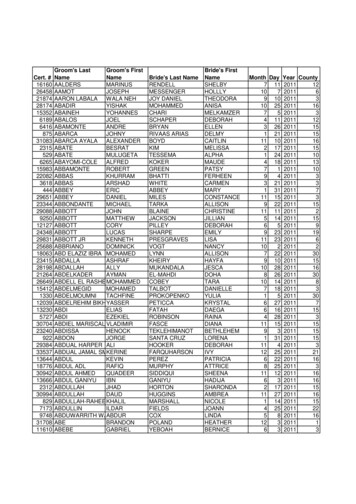

Transcription

LexisNexis Risk Solutions Customer Education2011 Course CatalogCO U RS ES AVAIL A BLEA B O U T USS o lu t i ons B as ic sInteractive collaborative sessions focusedon helping new users become proficient inusing LexisNexis Risk Solutions.LexisNexis Risk Solutions Customer Educationoffers Courses, Webinars and CustomizedTraining to help you maximize your Return onInformation when utilizing LexisNexis RiskSolutions.A dv a nc e d S o lu t i on s Ed u ca t i onCustomized sessions offered to existingLexisNexis Risk Solutions customersdesigned to incorporate industry‐specificbest practices into end users’ dailyactivities.Tr a i n‐ T h e‐ Tr a in er P r ogr am sPrograms designed to educate andempower training professionals ordesignated employees, certifying them totrain on LexisNexis Risk Solutions.eL e ar ni ng M o d u le sAnywhere, anytime. Thirty‐minute modulesdesigned to help new users becomeefficient in using LexisNexis Risk Solutions.Our Customer Education programs offer acomprehensive approach to learning. We provideeLearning, Distance Learning, and OnsiteClassroom Training to meet your educationneeds.We work directly with management and end‐users to educate on the most effective ways toutilize LexisNexis Risk Solutions.We turn new users into knowledgeable users, andknowledgeable users into expert users!Collectively, Customer Education possesses over75 years of LexisNexis experience, 25 years ofCollections and Skip Tracing experience, 14 yearsof Banking and Mortgage Lending experience, 10years of Human Resources experience, and 40years of adult education experience.

Table of ContentsCourses OfferedCross‐FunctionalFocus‐On Series:System Administration . 4Trainers . 5Management . 6LexisNexis Train‐The‐Trainer (T3) . 7Introduction to Accurint General . 8Introduction to Lexis .com . 9Introduction to Nexis . 10Receivables ManagementAccurint for Collections:Skip Wizard . 11Basic Search Logic . 12Intermediate Search Logic . 13Advanced Search Logic . 14LexisNexis Collection Solutions:Basic Search Logic . 15Intermediate Search Logic . 16Advanced Search Logic . 17Financial ServicesLexisNexis InstantID :Basic Consumer Verification . 18Basic Business Verification . 19LexisNexis InstantID Q&A:Basic ID Verification and Authentication . 20Advanced ID Verification and Authentication . 21LexisNexis Anti‐Money Laundering Solutions:Basic Search Logic . 22Intermediate Search Logic . 23Advanced Search Logic . 24Introduction to Risk Investigations . 25Next

Table of ContentsCourses OfferedFinancial Services, continuedIntroduction to Bridger Insight XG:Basic User Version . 26System Administrator Version . 27Risk Management:Basic Search Logic . 28Intermediate Search Logic . 29Advanced Search Logic . 30ScreeningLexisNexis Volunteer Screening . 31LexisNexis Business Edition . 32LexisNexis Enterprise Edition. 33LexisNexis Resident Screening . 34LexisNexis Contractor Screening . 35InsuranceAccurint for Insurance:Basics . 36Intermediate . 37Advanced . 38Medical Records Retrieval . 39Rate Evasion Evaluation Tool. 40Accurint for Insurance Comprehensive Class . 41Accurint for Insurance Plus . 42General InformationContact Information . 43Frequently Asked Questions . 43Home

Cross‐FunctionalFocus On: System AdministrationCourseDescriptionTeaches systems administration functionswithin a LexisNexis Risk Solution.TargetAudienceAny person who is or will be a systemadministrator for any given LexisNexis RiskSolution.CourseObjectives Locate your LexisNexis Risk SolutionsAccount Manager name, phone numberand email address Manage company and individual access tosearches and reports Demonstrate how to add or delete users Explain how to change or reset userpasswords Post a payment online Retrieve current and historic billinginformation Monitor search activity of all users Restrict user access by IP address Access report manager to view details orreports that have been run in the pastseven daysCourseLengthDeliveryMethods1‐hour Onsite* eLearning Module Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Cross‐FunctionalFocus On: TrainersCourseDescriptionTrainers will educate those users who will betraining and/or coaching others on a givensolution. In addition to learning the solution,participants will learn what to highlight duringtraining, as well as a of variety training tips.TargetAudienceAny person who will be training or coachingcolleagues on a particular LexisNexis RiskSolution.CourseObjectives Utilize the solution at both the Basic,Intermediate, and Advanced levels Answer end‐users’ questions about thesolution Incorporate training tips into your onsitetrainingsCourseLengthDeliveryMethods1‐2 hours Onsite* Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Cross‐FunctionalFocus On: ectivesCourseLengthDeliveryMethodsProvides managers who may or may not beend‐users, training on a given solution as wellas information on systems administration,and/or coaching techniques.Managers who want a more advancedunderstanding of a given LexisNexis RiskSolution. Utilize the solution at both the Basic,Intermediate, and Advanced levels Navigate and use the SystemAdministration functions in the “MyAccount” area Answer end‐user questions about thesolution Coach end‐users on successfulimplementation of the solution1.5‐2 hours Onsite* Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Cross‐FunctionalLexisNexis Train‐The‐Trainer (T3):Solution Education Designation bjectives& BenefitsCourseLengthDeliveryMethodsThe T3 Solution Education DesignationProgram will develop the skills of yourinternal training staff to a proficient level,allowing for any future training to beconducted in‐house at your convenience. Seasoned users of the LexisNexis RiskSolutions System Administrators, Management staffor internal training Demonstrate mastery to train internalemployees on the LexisNexis RiskSolutions Quarterly “how to educate” updates and/orretraining on solution enhancements andnew solution releases Semi‐annual (twice a year) recertification Customized materials Learning programs designed and developedfor incorporation into new hire programs1 day Onsite**For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Cross‐FunctionalIntroduction to Accurint ivesCourseLengthDeliveryMethodsThis course will introduce participants toAccurint . Participants will receive training innavigating and researching people andbusinesses using our vast collection of publicrecords resources.New users or users looking for a refreshercourse on the Accurint solution. Explain the initial log‐in requirements,product menu, and roll up technology Articulate the benefits of the coveragescreen Explain the customizable “My Accurint” tab Demonstrate how to run a person andbusiness search and interpret the results Explain the “We Also Found” feature Describe best practices for locating rightparty contact information in Phones Plusand Directory Assistance using multiplesearch methodologies Explain the benefits of using secondarysources, such as Assets, Court, and Newssearches1 hour Onsite* eLearning Module Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Cross‐FunctionalIntroduction to Lexis .comCourseDescriptionThis course will introduce participants to ourlegal content. LexisNexis provides access toan extensive offering of legal documents,treatises, public records and news sources.This includes exclusive access to industry‐leading legal content such as Shepard’s ,CCH and Mathew Bender , as well asexclusive news sources such as the WallStreet Journal.TargetAudienceNew users or users looking for a refresher onLexis .com.CourseObjectives Demonstrate how to retrieve individualdocuments quickly and easily Explain how to navigate Sources using theLegal, News & Business and Public Recordssearches Demonstrate effective use of theShepard’s feature Develop a search strategy using terms,connectors, and segments Demonstrate how to research usingPrecision Search Commands Articulate the benefit of the online Helpfunctionality Explain how to save searches for future useor save as an AlertCourseLengthDeliveryMethods1‐1.5 hours Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Cross‐FunctionalIntroduction to Nexis CourseDescriptionThis course will introduce users to a trustedresource for news and business information.Participants will learn how to research avariety of different news, business, publicrecords and international sources, as well aslegal content.TargetAudienceNew users or users looking for a refresher onNexis .CourseObjectives Explain how to navigate within sources andcreate and name source selections Develop a search strategy using terms,connectors, and segments Demonstrate how to search using PrecisionSearch Commands Locate and navigate online help Explain the purpose of the coverage screen Demonstrate how to save searches forfuture use or save as an Alert Review how to explore companyhierarchies and company structures usingCompany DossierCourseLengthDeliveryMethods1‐1.5 hours Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Receivables ManagementAccurint for Collections: Skip WizardCourseDescriptionThis course will introduce participants toAccurint for Collections Skip Wizardfunctionality. Participants will be able toexplain the Skip Wizard step‐by‐step processin retrieving consumer location information.The Skip Wizard will also present varioussearch techniques that will aid in the locationof Right Party Contact (RPC) information.TargetAudienceNew users with no skip trace experience, orusers that will be using the Skip Wizardplatform in their daily workflow.CourseObjectives Explain the step‐by‐step process of SkipWizard Demonstrate a social security numbersearch on your consumer Explain the purpose of the balance andreference fields Interpret search results provided by SkipWizardCourseLengthDeliveryMethods30 minutes‐1 hour Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Receivables ManagementAccurint for Collections: Basic Search LogicCourseDescriptionThis course will introduce participants toAccurint for Collections. Participants willreceive instruction in best practices toretrieve right party contact information.TargetAudienceNew users or users looking for a refresher onAccurint for Collections.CourseObjectives Explain product menu, rollup technology,and log‐in requirements Demonstrate Just in Time training tips toimprove effectiveness Demonstrate person and business searchand interpret results Identify best practices for interpreting theresults of various reports, including: Contact card report Comprehensive report Business report Explain We Also Found feature Describe best practices for locating rightparty contact information in Phones Plusand Directory Assistance using multiplesearch methodologiesCourseLengthDeliveryMethods1‐1.5 hours Onsite * One‐On‐One Coaching * eLearning Module Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Receivables ManagementAccurint for Collections: Intermediate SearchLogicCourseDescriptionThis course will instruct participants on searchprocess improvement, and will establish a setof best practices in debt recovery utilizingAccurint for Collections.TargetAudienceExisting users of the Accurint for CollectionssolutionCourseObjectives Explain precision searches within PersonSearch results Demonstrate features of Deep Skip searchto drill down on additional debtor qualifiers Identify best practices to search andinterpret People at Work results Demonstrate how to effectively utilizesecondary sources such as licenses, courts,and asset searches Identify best practices for interpreting andutilizing multiple reports, to include: Property Reports Asset Reports Business Contact ReportCourseLengthDeliveryMethods1 hour Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Receivables ManagementAccurint for Collections: Advanced jectivesCourseLengthDeliveryMethodsThis advanced course is designed to uncoverall best practice search options through usingindustry specific Skip Trace techniques.Existing users of Accurint for Collections. Define First and Second Level Skip Tracing Identify best practices for First Level SkipTracing Identify best practices for Second Level SkipTracing Review effective communicationtechniques to secure location informationfrom third parties Demonstrate mastery of key concepts ofFirst and Second Level Skip Tracingtechniques using real‐world scenarios2 hours Onsite * One‐On‐One Coaching **For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Receivables ManagementLexisNexis Collection Solutions: Basic SearchLogicCourseDescriptionThis course will introduce participants toLexisNexis Collection Solutions and will assistthem in locating current contact informationfor delinquent debtors.TargetAudienceNew users or users looking for a refresher onLexisNexis Collection Solutions.CourseObjectives Identify and explain sign‐in requirements,product menu, and rollup technology Demonstrate navigating online Help andCoverage screens Demonstrate how to search and interpret: Person Search Business Search Explain the Next Steps feature, to includerelatives, neighbors, and associates Explain how to run and interpret results ofvarious reports, including: Contact Card Finder Report Pre‐Litigation Report Business Report Describe best practices for locating rightparty contact information in Phones Plusand Directory AssistanceCourseLengthDeliveryMethods1‐1.5 hours Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Receivables ManagementLexisNexis Collection Solutions: IntermediateSearch esCourseLengthDeliveryMethodsThis course will instruct participants on searchprocess improvement and will establish a setof best practices in debt recovery utilizingLexisNexis Collection Solutions.Existing users of LexisNexis CollectionSolutions. Articulate the benefits of the Help andCoverage functionality Explain how to execute Expert Searcheswithin returned Person Search results Demonstrate and explain Deep Skip search,and how to utilize Deep Skip results to drilldown on additional debtor qualifiers Identify and interpret best practices forutilizing People at Work results Explain benefits of using secondary sourcessuch as Assets, Court, and News searchesand, demonstrate best practices withineach search Demonstrate mastery in executing andinterpreting the following reports: Property Reports Asset Reports Business Contact Report1 hour Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Receivables ManagementLexisNexis Collection Solutions: AdvancedSearch esCourseLengthDeliveryMethodsThis advanced course is designed to uncoverall best practice search options by usingindustry specific Skip Trace techniques touncover right party contact information.Existing users of LexisNexis CollectionSolutions. Define First and Second Level Skip Tracing Identify and demonstrate best practices forFirst Level Skip Tracing Identify and demonstrate best practices forSecond Level Skip Tracing Review effective communicationtechniques to secure location informationfrom third parties Demonstrate mastery of key concepts ofFirst and Second Level Skip Tracingtechniques in real‐world scenarios2 hours Onsite * One‐On‐One Coaching **For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesLexisNexis InstantID :Basic Consumer VerificationCourseDescriptionThis course will assist new users of InstantID in the verification of a consumer’s identity atkey stages in an account cycle, includingaccount opening, and when key accountfactors change.TargetAudienceNew users or users looking for a refresher onLexisNexis InstantID Solution.CourseObjectives Demonstrate basic searches using applicantand customer information Interpret high and low risk scores Identify high risk indicators Differentiate between customer‐providedinformation and LexisNexis ’ resultsprovided in the verification table Explain actions to be taken in follow‐upstepsCourseLengthDeliveryMethods45 minutes Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesLexisNexis InstantID :Basic Business VerificationCourseDescriptionThis course will assist new users of InstantID in the verification of a Business andAuthorized Agent’s identity credentials at keystages in an account cycle, including accountopening, and when key account factorschange.TargetAudienceNew users or users looking for a refresher onLexisNexis InstantID .CourseObjectives Demonstrate basic searches usingapplicant/customer information Interpret high and low risk scores Identify high risk indicators Differentiate between customer‐providedinformation and LexisNexis’ resultsprovided in the verification table Explain actions to be taken in follow‐upsteps Identify and confirm relationships betweena business and the s45 minutes Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesLexisNexis InstantID Q&A:Basic ID Verification and eObjectivesCourseLengthDeliveryMethodsThis course will teach new users how to utilizeInstantID Q&A as a means to protect theirorganizations through the implementation ofknowledge‐based authentication (KBA). KBAemploys sophisticated analytics to build acomprehensive knowledge profile via aninteractive question and answer process.New users or users looking for a refresher onLexisNexis InstantID Q&A. Define knowledge‐based authentication(KBA) Demonstrate steps required to initiatequestion sequence Explain how to identify pass/fail results45 minutes Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesLexisNexis InstantID Q&A:Advanced ID Verification and AuthenticationCourseDescriptionThis course will teach users how to deploy anABA‐endorsed tool to protect theirorganizations through the use of knowledge‐based authentication (KBA). KBA employssophisticated analytics to build acomprehensive knowledge profile via aninteractive question and answer process.TargetAudienceExisting users of LexisNexis InstantID Q&A.CourseObjectives Define question type Define question sequence Identify techniques for delivering questionsto customers Explain best practices with transactionmonitoring Utilize reporting Identify trend spottingCourseLengthDeliveryMethods1 hour Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesLexisNexis Anti‐Money Laundering Solutions:Basic Search LogicCourseDescriptionParticipants will learn due diligencetechniques critical in the process ofidentifying customers as required forcompliance. This session will aid in the reviewof how individuals and businesses protecttheir companies; and capitalize onintelligence and analytics.TargetAudienceNew users or users looking for a refresher onLexisNexis AML.CourseObjectives Demonstrate how to navigate the productmenu and its unique rollup technology Identify three methods to conduct a search Explain and review History and Feedbackfunctions Demonstrate a Person Search and explorethe Actions feature Explain how to retrieve comprehensiveSmartLinx Reports Distinguish between results found in PhoneLook Up and Phones Plus Explain best practices with businessresearch Demonstrate a Real Property search andinterpret Property Deeds & AssessmentsresultsCourseLengthDeliveryMethods1 hour Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesLexisNexis Anti‐Money Laundering Solutions:Intermediate Search esCourseLengthDeliveryMethodsThis intermediate level course will focus onadditional AML features, including a variety ofregulatory and compliance resources. Thisadditional functionality enables institutions tocomply with regulations, prevent fraud, andperform in‐depth due diligence.Seasoned users of LexisNexis AML. Demonstrate Product Menu and Searchfunctionality Explain Person Search (for Deep Skippurposes) Demonstrate ability to verify the identity ofyour subject using InstantID with Red Flags Explain the addition of FraudDefender Explain best practices with People at Work Explain the purpose of IRS Verify and SSAVerify Demonstrate how to retrieve a LexisNexis Identity Report and explain results Explain Negative News searches concerningindustry risk, bankruptcies, and criminalactivity1 hour Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesLexisNexis Anti‐Money Laundering Solutions:Advanced Search esCourseLengthDeliveryMethodsThis advanced course is designed to uncoverall best practice search options throughindustry specific research techniques directlyrelevant to workflow needs. This course willestablish best practices for businesses tocomply with regulations, prevent fraud, andperform in‐depth due diligence.Seasoned users of LexisNexis AML. Explain and review all aspects of theproduct menu and solution functionality Identify and explain best practices withincorporating the solution into your existingworkflow Demonstrate mastery and best practiceswith every component of the solution Demonstrate solution expertise throughscenario‐based exercises and apply thesemulti‐level techniques directly to yourworkflow‐specific research requirements2 hours Onsite * One‐On‐One Coaching **For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesIntroduction to Risk InvestigationsCourseDescriptionThis course will introduce new users toLexisNexis Risk Investigations. This session isdesigned to aid in business and individualresearch, help users protect their companies,and capitalize on intelligence and analytics.TargetAudienceNew users or users looking for a refresher onLexisNexis Risk Investigations.CourseObjectives Explain the product menu and rolluptechnology Explain the purpose of the Coverage areas Demonstrate a Faces of the Nation searchto verify and validate individual andbusiness information Demonstrate and analyze report results Review Recent Searches Explain We Also Found Distinguish between results found inReverse/Basic Look‐up and Phones Plus,and interpret results of a Phones PlussearchCourseLengthDeliveryMethods1 hour Onsite * One‐On‐One Coaching * Web‐Based Virtual Classroom*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesIntroduction to Bridger Insight XG: Basic jectivesCourseLengthDeliveryMethodsThis course will introduce participants toLexisNexis Bridger Insight XG, an industry‐leading tool that helps companies screenagainst watchlists to deter crimes such asterrorism, money laundering, and illicitfinancial activity. New users of Bridger Insight XG New or existing System Administrators Explain how to access Bridger Insight XG viathe Browser Client (or the Smart Client) Independently obtain a new password Demonstrate how to review a Real‐TimeSearch Route match results to the appropriateperson Explain and utilize the Alert Inbox Access and run a Real‐Time Report Explain how to develop and run a Query Demonstrate how to locate and downloadmaterials from the Bridger Client Servicessite1 hour Onsite * Web‐Based Virtual Classroom eLearning Module*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesIntroduction to Bridger Insight XG: SystemAdministrator ivesCourseLengthDeliveryMethodsThis course will introduce participants toLexisNexis Bridger Insight XG, an industry‐leading tool that helps companies screenagainst watch lists to deter crimes such asterrorism, money laundering, and illicitfinancial activity.System Administrators Explain System Settings set up and Values Demonstrate the use of the Alert Inbox andfilters Establish Predefined Search Establish Accept List Explain Custom Watch List set up (FinCen) Review Real‐Time Search and Batch Search Demonstration execution of a Query todisplay results1.5 hours Onsite * Web‐Based Virtual Classroom eLearning Module*For qualifying customers. Contact your LexisNexis Risk Solutions Sales Representative to learn more.Home

Financial ServicesRisk Management: Basic Search LogicCourseDescriptionThis course will focus on fraud prevention/detection, identity verification, and generaldue diligence research techniques critical foridentifying customers. This solution can beused throughout a customer lifecycle: front‐end verification/compliance, ongoingmonitoring, exception processing, and duediligence.TargetAudienceNew users or users looking for a refresher onthe LexisNexis Risk Management (RM)SolutionCourseObjectives Explain how to navigate the product menuand its unique rollup technology Identify four methods to conduct a search Demonstrate and review History andF

administrator for any given LexisNexis Risk Solution. Course Objectives Locate your LexisNexis Risk Solutions Account Manager name, phone number and email address Manage company and individual access to searches and reports Demonstrate how to add or delete users