Transcription

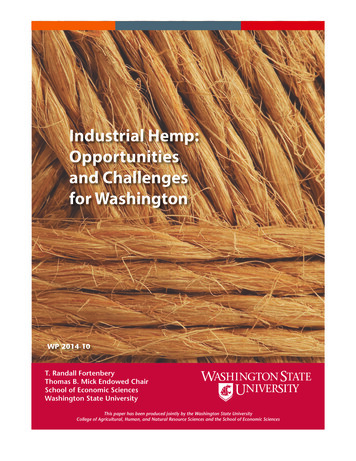

Industrial Hemp:Opportunitiesand Challengesfor WashingtonWP 2014-10T. Randall FortenberyThomas B. Mick Endowed ChairSchool of Economic SciencesWashington State UniversityThis paper has been produced jointly by the Washington State UniversityCollege of Agricultural, Human, and Natural Resource Sciences and the School of Economic Sciences

Executive SummaryThe recent passage of I-502 legalizing the production and consumption of recreational marijuana inWashington has heighted interest in the production of industrial hemp. Industrial hemp differs frommarijuana in the level of delta-9 tetrahydrocannabinol (THC) present in the plant. THC is the chemical mostresponsible for the psychoactive properties in marijuana. Industrial hemp has traditionally been defined ashaving less than 0.3 percent THC, although in some U.S. states it is now defined as having no more than1 percent THC.At the federal level, industrial hemp is still classified as a Schedule I controlled substance and under thepurview of the U.S. Drug Enforcement Administration (DEA). However, the 2014 Farm Bill signed into lawspring of 2014 does provide language in support of industrial hemp research conducted by state departmentsof agriculture and land grant universities.In addition to the Farm Bill, 19 states have recently passed some form of legislation in support of a commercialhemp industry. Nine states explicitly legalized the production of industrial hemp by private farmers, while theothers provided for various levels of research—from studies of the feasibility of commercial hemp productionto actual agronomic research involving hemp production at the research facilities.Despite a lack of industrial hemp production in the U.S., there are active markets for hemp-based products. Ithas been estimated that total U.S. sales of hemp products exceeded 581 million in 2013, with double-digitgrowth in year-over-year sales occurring the last several years.Because industrial hemp production has not been allowed in the U.S., the feed stocks necessary to satisfyU.S. demand for hemp products are currently imported. While imports originate from several locations, mostof the product directed at the food and body care industry comes from Canada (the U.S. is Canada’s largesthemp customer), while the fiber and finished clothing products tend to originate in China.Research in the U.S. suggests that hemp could be a competitive crop for U.S. farmers, although the mostrecent work is focused on production in the Midwest and southern states, not the Pacific Northwest. Directproduction experience in Canada supports this analysis, with much of its commercial production takingplace in traditional wheat producing regions.Because profitability studies in the U.S. are not based on actual commercial-scale production, the results aresomewhat speculative. However, it is likely that profit potential could be improved with active research incommercial hemp production. This includes work on cultivar selection for various production environments,pest and weed management systems, and harvest technology and management, as well as research on theactual market potential for hemp products—in other words, understanding the level of production thatwould be sustainable, given expected consumer demand for hemp products.Industrial Hemp: Opportunities and Challenges for Washington1

AbstractThe recent initiative in Washington (I-502) allowing for the production and consumption of recreationalmarijuana has added momentum to efforts to legalize industrial hemp production in Washington. Severalstates have already legalized industrial hemp production, and others have authorized production for researchpurposes.Despite recent changes in state laws, industrial hemp is still classified as a Schedule I controlled substanceunder federal drug policy, and as such is regulated by the U.S. Drug Enforcement Administration (DEA). Thisputs federal law and laws in states allowing industrial hemp production in potential conflict. However, the2014 Farm Bill does have language authorizing industrial hemp research at land grant universities and by statedepartments of agriculture; thus it appears likely that industrial hemp production for research purposes willnot be in violation of federal regulations.This report reviews the current production of industrial hemp globally, potential international and nationalmarket opportunities, and the extent to which industrial hemp might be attractive for Washington producers.It does not focus on other cannabis markets (recreational or medicinal marijuana). The term hemp here willrefer to cannabis with less than 0.3 percent THC (delta-9 tetrahydrocannabinol, the primary chemical thatleads to marijuana’s psychoactive properties). This is consistent with earlier definitions of hemp found in theliterature.The objective is to provide background for parties interested in evaluating the potential for increased statesupport for hemp research at both the university and private sector levels. Such research can help identifyopportunities and constraints associated with the development of a commercial hemp industry in Washington.IntroductionDespite restrictions on domestic production, there hasbeen an active movement to legalize industrial hempcultivation in the U.S. for at least the last two decades.Those in favor of developing a domestic hemp industrypoint to a host of potential benefits. On the productionside these include environmental benefits that resultfrom low pesticide and herbicide requirements,adaptability to a wide range of agronomic conditions,increased profit centers for U.S. farmers, and relativelylow water needs (Fortenbery and Bennett 2004).On the demand side, supporters point to increasedefficiency compared to other inputs for some industrialuses (e.g., paper production), health benefits of bothhemp oil and hemp seed consumption, competitive useas an input in textile manufacturing, and potential forthe development of new uses if supply were sufficient.As noted by R. Johnson (2012), it has been estimatedthat, globally, hemp and hemp by-products can befound in more than 25,000 products that span ninesub-markets: agriculture, textiles, automotive, furniture,food, personal care, construction, paper, and evenrecycling.Opponents of a domestic hemp sector are most concernedwith the inability to distinguish between hemp grownfor industrial uses and recreational marijuana. They alsoargue that potential profits are not sufficient to justifythe licensing and drug monitoring costs necessary toensure that industrial hemp is not, in fact, marijuanabeing produced for illicit markets (Fortenbery andBennett 2004). However, recent ballot initiativeslegalizing marijuana consumption in Washington,Industrial Hemp: Opportunities and Challenges for WashingtonColorado, Oregon, Alaska, and Washington D.C. suggestthat these concerns are becoming less valid, at leastfrom a local jurisdictional perspective. Given that theDEA still regulates all cannabis (whether produced forindustrial uses or human consumption) as a controlledsubstance, the concern may still be relevant to federallaw enforcement. The extent to which the concern isminimized for federal regulators hinges on whetherthey decide to aggressively enforce federal restrictionsagainst cannabis production and consumption inthose places where local law is no longer a constraint.At the time of this writing, it was still unclear how thedifferences between state and federal law might impactlocal market development, and thus the extent towhich distinguishing between recreation and industrialproduction would be an issue.Despite differences in state and federal policies, however,R. Johnson (2012) has argued that differentiatingbetween industrial hemp and recreational marijuanais not as challenging as critics suggest. Thus, evenin states that do not allow marijuana consumptionand production, it is unlikely that commercial hempproduction would be confused for marijuana, or viceversa. While the plants look similar if not managed, it isdifferent parts of the plants that have value to industrialusers as opposed to recreational users. Thus, they wouldnot look similar when being cultivated for their specificend uses.Background and HistoryAccording to both Kraenzel et al. (1998) and Vavilov(1992), hemp was one of the first crops to be domesticated2

and cultivated, and predates other fiber crops, includingboth cotton and flax. Cultivation dates back between4000 and 6000 years, with China being a major producerearly on. (They are still a major producer today.) Bythe 16th century, hemp was an important cash cropin Europe and was grown for both its fiber and seeds(P. Johnson 2000). As demand for hemp-based productsgrew, hemp became Russia’s largest agricultural export.It was also widely grown across the British Isles, and itwas from there that hemp was first introduced to NorthAmerica (Roulac and Hemptech 1997).petroleum-powered ships, which reduced the demandfor sail cloth. In addition, jute and abaca importsincreased because of cost. Jute competed with hempfabric, and abaca exhibited superior qualities for marinecordage due to its greater resistance to salt water and itsreduced weight (Dempsy 2000).In his article on the history of hemp in the British Isles,Gibson (2006) notes that industrial hemp productionin the United Kingdom can be documented as earlyas 343 BC. The production of hemp across the BritishIsles helped England develop their naval dominance inthe 18th and 19th centuries. As UK demand for hempincreased, imports were required. Most imports werefrom Russia, but Italy was the supplier of the highestquality hemp. Gibson notes that some UK legislators wereconcerned with the security implications of relying onthe import of raw materials so vital to national defense,and searched for ways to increase domestic productionin the 1800s. With the development of steam power andmetal ships, however, that all changed, and the Britishhemp industry essentially disappeared.World War II saw a short resurgence in U.S. hempproduction as both jute and abaca supplies wereinterrupted. The legal restrictions were lifted, and theUSDA Commodity Credit Corporation contracted withWar Hemp Industries, Inc., for production of hemp fiberand seed. This, in turn, led to War Hemp Industriesinvesting in several midwestern hemp processing mills.Following the war, restrictions on domestic hempproduction were re-imposed, and imports of jute andabaca re-established. A small fiber industry continuedin Wisconsin until 1958, but since then there hasessentially been no U.S. hemp production (Fortenberyand Bennett 2004; R. Johnson 2012).Hemp was first brought to New England in 1645where it was cultivated for its fiber content (U.S.Department of Agriculture 2000). Production spreadto Pennsylvania, and then south into Kentucky andVirginia. By 1775, Kentucky hosted a substantialcommercial cordage industry with hemp fiber servingas the primary input (Fortenbery and Bennett 2004).Roulac and Hemptech (1997) have identified bothPresidents Washington and Jefferson as commercialfarmers of hemp, and according to Kraenzel et al.(1998) the first couple of drafts of the Declaration ofIndependence were printed on hemp-based paper.Other early uses included hemp fabric in colonialsolders’ uniforms and the first U.S. flag sewn fromhemp fabric.Industrial hemp and marijuana share the same species,Cannabis sativa L, but represent different varieties(Fortenbery and Bennett 2004). As such, there aregenetic differences that lead to different chemicalcharacteristics, which, in turn, lead to different uses(Datwyler and Weiblen 2006).In addition to civilian demand, the U.S. Navy beganusing large amounts of both cordage and sailclothmade from hemp, and by the mind 1800s productionhad spread into Missouri and Illinois (Fortenbery andBennett 2004). Roulac and Hemptech (1997) estimatethat by this time there were 160 hemp-based factoriesemploying several thousand workers in Kentucky alone(Kentucky being the largest U.S. producer of hemp atthat time).After 100 years of aggressive growth, however, theU.S. hemp industry began to shrink in the late 1800s.The decline was precipitated by both technologicalinnovation and the discovery of alternative inputs fortraditionally hemp- based industries. These included thedevelopment of the cotton gin, which greatly reducedthe labor needed to refine cotton, thus reducing the costof cotton fabric, and the development of steam- andIndustrial Hemp: Opportunities and Challenges for WashingtonU.S. production of hemp was essentially eliminated in1937 with passage of the Marijuana Tax Act. This placedhemp production under the control of the U.S. TreasuryDepartment (Fortenbery and Bennett 2004).Hemp vs. MarijuanaA central argument against legalizing industrialhemp production in the U.S. has been the difficultyin distinguishing between industrial hemp grown forfiber and seed (with low THC)1 and marijuana grownfor its psychoactive properties (with high levels ofTHC) (Vantreese 1998). However, with the recentlegalization of marijuana in some states, this concernhas diminished. Further, R. Johnson (2012) has arguedthat because of the differences in their uses, marijuanaand industrial hemp look quite different when undercommercial cultivation. Industrial hemp is grown forthe stalk and seeds, and maximizing yields results intall plants with few leaves. Marijuana, on the otherhand, is grown for its leaves and tops, the parts of theplant with the largest concentrations of THC. As aresult, cannabis grown for its psychoactive propertiesis generally managed to control height and increasebushiness: that is, encouraging many leaves andbranches, thus leading to more flowers and buds.Cannabis varieties also vary by planting density:marijuana plants are spaced to allow bushiness whileindustrial hemp plants are planted much closer togetherto discourage branching and flowering.THC stands for delta-9 tetrahydrocannabinol, the chemical mostresponsible for the psychoactive properties in marijuana.13

Figure 1. World Productionof Industrial Hemp. Note:This underestimates totalglobal hemp productionas FAO does not appearto report production datafor some newer producers,including Canada andsome Western Europeancountries. While the dataabove is incomplete, theredoes not currently appearto be aggregated, reliable data on worldwideproduction at the currenttime (R. Johnson). Source:FAO, wHarvest timing and strategies also vary by variety, againallowing for detection of intended use. Thus, even instates where marijuana is not legal, industrial hemp maybe distinguishable from cannabis grown for marijuana,based on visual appearance.Western Hemisphere Hemp ProductionWhile hemp production in the U.S. has essentiallybeen banned for decades, it is actively cultivated inother parts of the world (Figure 1). After droppingsignificantly from the early 1960s through 1990, worldproduction has been relatively stable, between 100and 200 million tons of fiber and seed, combined,over the last couple of decades.2 However, the globaldistribution of production has experienced shifts inrecent years. North America and Europe, for example,have experienced significant growth in productionover the last ten years. There has been a resurgence inhemp production from former western producers thathad previously ceased production, as well as a focuson developing varieties and production practices thatfacilitate hemp production in non-traditional areas.According to R. Johnson (2012), there are about30 countries in Europe, Asia, and North and SouthAmerica, that allow for commercial hemp production.While some countries, particularly in Asia, neverbanned hemp production, many western countriesdid and have now relaxed those bans. There arecurrently fourteen countries in Europe alone that hosta commercial hemp industry, with most productionThis is based on data from the Food and AgricultureOrganization of the United Nations. However, the data appearsincomplete due to some countries not being explicitly listed.Thus, this likely under-states actual global production.2Industrial Hemp: Opportunities and Challenges for Washingtonoccurring in the United Kingdom (UK), France,Romania, and Poland. According to the EuropeanIndustrial Hemp Association, there were as many as50,000 acres of European crop ground being cultivatedfor hemp in the mid-2000s. Much of this was incountries like the UK, where hemp had been bannedprior to the mid-1990s.Hemp was re-introduced in Britain in the 1990s, largelyas a result of lobbying based on its environmentalproperties (Gibson 2006). Acreage steadily increasedin the 1990s, with most domestic production going tofood markets. Other hemp products, such as clothing,are also available to British consumers, but mosttextiles are made with hemp imported from China.In addition to the British resurgence, there havebeen attempts to re-introduce hemp in other partsof Northern Europe where hemp production alsodisappeared as naval demand softened. For example,there were a series of production trials in Swedenbetween 1999 and 2000 (Svennerstedt and Svensson2006). These were the first attempts to developproduction in Sweden since the early 1960s. Similarto the U.S., Sweden experienced significant growthin hemp fiber production during World War II, andthe industry was relatively stable from 1940 to 1960.However, the industry began to decline in the early1960s due to competition from synthetic fibers, and,by the mid-1960s, all industrial hemp production wasbanned in response to growing recreational drug use.The ban was altered when Sweden entered the EuropeanUnion in 1995 (Svennerstedt and Svensson). Initiallyexperimental cultivation under the supervision ofscientific institutions was allowed, and then in 2003commercial cultivation was legalized.4

Figure 2. Acres of Farm Ground Seededfor Hemp Cultivation in Canada. Source:Health 9920002001200220032004200520062007Commercial cultivation has also been re-introduced inFinland (Pahkala, Pahkala, and Syrjala 2008) and Italy(Amaducci 2005), both of which had been producersprior to the 1960s. Several other European countrieshave also seen the redevelopment of a hemp productionindustry following relaxations of earlier bans.The only current industrial hemp producer in NorthAmerica is Canada. Several Canadian universities,provincial governments, and small companies beganresearching industrial hemp as a Canadian crop in1994 (Agriculture and Agri-Food Canada 2013). Basedon commercial potential coming out of the research,the Canadian ban on industrial hemp productionimposed in 1938 was lifted in 1998. In March 1998, theIndustrial Hemp Regulations were put into effect. Thesecover the cultivation, processing, transport, sale, andimport and export of industrial hemp. The regulatorysystem is quite strict, and is administered by the Officeof Controlled Substances of Health Canada. They issuelicenses for all levels of hemp activity (production,trade, processing), and regulate production to ensurethat all hemp grown has a THC level of less than0.3 percent. They have also established a maximumstandard of 10 parts per million (ppm) for THC residuein hemp products, including grain, flour, and oil(Agriculture and Agri-Food Canada 2013).While highly regulated, the Canadian hemp industryhas grown significantly since 1998 (Figure 2). In recentyears, Canada has become a major hemp exporter.Export fiber value peaked in 2002 at over Can 274thousand, but by 2007 (the most recent data available)had fallen to just over Can 102 thousand. However,when all hemp (fiber and seed) is included, total exportvalue in 2007 exceeded Can 3.5 million.Beginning in 2003, however, Canada became a netimporter of hemp fiber (similar to the U.K.), suggestingthat Canadian increases in hemp production wereIndustrial Hemp: Opportunities and Challenges for Washington2008200920102011focused on producing seed, not fiber. This is confirmed inFigure 3. Once hemp oil and hemp seed are accounted for(data was first available in 2006), Canada is a net exporterof aggregate hemp products. Of the Can 3.5 millionin exports in 2007, over Can 2.6 million was fromhemp seed, and another Can 700 thousand from oil.According to Laate (2012), by 2010 the total value ofCanadian exports of hemp seeds, fiber, oil and oil-cakehad exceeded Can 10 million.Canada’s primary export customer is the U.S. (Figure 4),accounting for 59 percent of its exports in 2007.Another 12 percent went to the United Kingdom,11 percent to Japan, and 12 percent to Ireland. Theremaining 6 percent is scattered across a variety ofcountries. Laate has confirmed that, as of 2010, theU.S. remained Canada’s number one customer forexport of hemp products.U.S. Hemp Industry PotentialMarket DemandDespite no domestic production, there are severalhemp-based industries in the U.S. These industries arecompletely supported by imports of hemp, and thisis one factor, in addition to potential environmentalbenefits, that has motivated supporters of hemp overthe last couple of decades to campaign for legalizinghemp production in the U.S.Hansen and Geisler (2012) have estimated that thevalue of hemp food and body care products sold inthe U.S. in 2010 was 40.5 million and representedan increase of over 10 percent from the previous year.3They further note that the Hemp Industries AssociationThe report was originally written by Hansen, and then updatedby Geisler. It is not clear who is responsible for which portions,thus they are cited here as joint authors.35

Figure 3. Value and Quantity ofCanadian Hemp Imports and Exportsa.Source: Statistics Canada.1000 4,000,000900 3,500,000800 3,000,000 2,500,000600 2,000,000500TonnesCanadianDollars700400 1,500,000300 1,000,000200 500,000 010019981999ImportsValue(Can )20002001ExportsValue(Can 20070ExportsQuanEty(tonnes)Export statistics prior to 2006 are for fiberonly; statistics for seed and oil were notavailable prior to 2006.aFigure 4. Canadian Hemp Exports byCountry. Source: Reproduced fromAgriculture and Agri-Food IA) estimated the total retail value of hemp food,body care, and food supplements to be between 151and 171 million in 2012. When adding this to otherindustrial uses (clothing, car parts, building materials,etc.) HIA estimated total hemp product sales of about 500 million in 2012 (Hansen and Geisler 2012).In 2014, HIA estimated the 2013 U.S. market for hempfood and body care products totaled 184 million, anestimated increase of 24 percent over the previous year(Figure 5). They note that hemp-based non-dairy milk,shelled seeds, soaps, and lotions were areas with largegains in sales. When combined with industrial products(paper, auto parts, building materials, etc.), the U.S.markets accounted for at least 581 million in 2013sales (HIA).HIA identifies their data source as SPINS, an informationprovider for the natural and specialty products industry.According to HIA, SPINS estimates actually represent alower bound of total hemp sales because they excludeIndustrial Hemp: Opportunities and Challenges for Washingtonsales from large retailers, including Whole Foods andCostco, that do not segregate hemp sales data. Theyargue that SPINS under-estimates actual U.S. hemp salesby a factor of three, although they provide no rationalefor arriving at that estimate.R. Johnson (2012) notes that the import value of hempand hemp products used to support the sales describedabove are difficult to accurately estimate. Someproducts, like oilseeds and fiber, have only recently beendistinguished from other hemp products, and eventhen reporting errors are prevalent. For example, exportdata from Canada does not always match reported U.S.import data for the identical product (R. Johnson 2012).Recognizing the issues associated with data collection,Tables 1 and 2 nonetheless present estimates of bothimport values and import volumes for a host of rawhemp products. These are primarily products importedfor further processing—they do not generally includefinished hemp-based products imported, such as6

Figure 5. Growth of Retail Sales of HempProducts in the United States. Source:Hemp Industries 0%201120122013PercentGrowthfromPreviousYearTable 1. U.S. Hemp Imports in Dollars.2003Product 3in 1,000 1,3641,3621,057Hemp Seeds, Whether Or Not BrokenHemp Oil And Their Fractions, ChemicallyModifiedHemp Seed Oilcake & Other SolidResiduesTrue Hemp (Cannabis Sativa L.) Raw OrProcessed But Not Spun: Tow And WasteYarns Of True HempTrue Hemp ,3915,0506,7847,7307,724 10,897 12,7717,502 10,160Source: U.S. International Trade Commission, based on compilations from tariff and trade data from the U.S. Department of Commerce and the U.S. International Trade Commission.Table 2. U.S. Hemp Imports by Volume.Product 22013in 1,000 Units of QuantityHemp Seeds, Whether Or NotBrokenkilograms000035552360371272200Hemp Oil And TheirFractions, 5157208450Hemp Seed Oil Cake AndOther Solid Residueskilograms0000056201240298441601True Hemp (Cannabis SativaL.) Raw Or Processed But NotSpun: Tow And Wastekilograms4411711811721511038342895572Yarns Of True Hempkilograms147105113102115787642868970Woven Fabrics of True 319224Source: Reported by the U.S. International Trade Commission based compilations from tariff and trade data from the U.S. Department of Commerce and the U.S. International TradeCommission.Industrial Hemp: Opportunities and Challenges for Washington7

Table 3. U.S. Hemp Product PricesProduct Description200320042005200620072008US /kg————6.575.90Hemp Oil And Their Fractions, US /kgChemically .477.209.08——7.648.148.537.305.285.03in 1,000 Units of QuantityHemp Seeds, Whether Or NotBrokenHemp Seed Oilcake & OtherSolid ResiduesUS /kg—————8.219.018.979.899.9510.45True Hemp (Cannabis SativaL.) Raw Or Processed But NotSpun: Tow And WasteUS ns Of True HempUS en Fabrics of True HempFibersUS rce: Reported by the U.S. International Trade Commission.clothing. Note that the value of imports has averagedover 10.3 million dollars in the last four years (2010–2013), but there is significant variation from year toyear.There is also variation across products. Hemp seeds andoil are down significantly relative to earlier years, whileoil cake has had a large increase in import volume.Hemp fiber imports have been quite stable over thesample period.The primary supplier of hemp fiber to the U.S. is China(as is the case for both Canada and the U.K.), butother supplies are also imported from Western Europe,Romania, Hungary, and India. The largest hemp seedand oil cake supplier is Canada, and the total value ofCanadian imports has grown significantly in recentyears (R. Johnson 2012). As noted earlier, Canada itselfis a net importer of hemp fiber, and thus not a majorsource of fiber for U.S. industries.Table 3 shows U.S. hemp prices over the last decade.While there is variation from year to year, prices appearmore stable than they are for many other commodities.It appears that woven fabrics have incurred the largestprice increase over the last decade, while hemp oil pricesare actually lower in the more recent years. Hemp seedand seed cake appear to be the most valuable hempproducts by volume.Potential Benefits beyond Market DemandIn addition to satisfying domestic demand forcurrently produced and consumed hemp seed andfiber products, some proponents have pointed to boththe environmental benefits of commercial production(these are benefits that are expected to accrue to societyas a whole beyond the revenues earned by thosedirectly involved in the hemp supply chain),4 and thedevelopment of new potential markets.According to Smith-Heisters (2008), hemp grown forfiber5 is a low input, low environmental impact crop.This is based on a calculation of the complete life cycleof production, which includes not only the direct impactof hemp production itself on the environment, butalso the impacts associated with the manufacture andtransport of those inputs needed in hemp cultivation.For example, a crop that requires chemical fertilizers andpesticides would be “charged” for the environmentalcosts associated with the manufacture, transport, andstorage of the chemical inputs in calculating the crop’stotal life cycle impact.Because hemp grown for fiber requires fewer chemicalinputs than most other fiber crops, Smith-Heisters(2008) argues that it has a lower life cycle impact thanother fiber crops such as cotton, and this results in a netenvironmental benefit.When grown for fiber, hemp is seeded at very highdensities. Mooleki et al. (2006) recommends seeding at60 lbs/acre for an eventual plant density of 30 to 35 plantsper square foot. Because of the planting density and rapidgrowth, hemp quickly crowds out competing weeds,resulting in little to no herbicide use during the growthph

College of Agricultural, Human, and Natural Resource Sciences and the School of Economic Sciences WP 2014-10. . This report reviews the current production of industrial hemp globally, potential international and national . in the United Kingdom can be documented as early as 343 BC. The production of hemp across the British