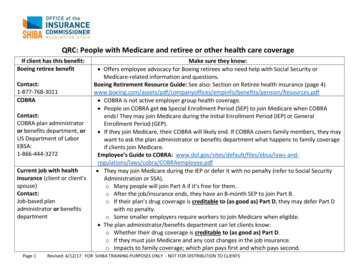

Transcription

2022Retiree HealthInsurance PlansFor RetiredSDCERA Members

Table of ContentsEligibility.1Enrollment in a plan.1Health Insurance Allowance.22022 Monthly Premiums .3Medical Plans.4Dental Plans.9Notice of Creditable Coverage. 10COBRA Continuation. 11Legal Notices. 13

Who can enroll?Retired Members,surviving spouses/partners, andeligible dependentsWhen can I enroll?Annually during OpenEnrollment, or within 30days of an eligible eventsuch as retirementDo I need to re-enrollevery year?No, your currentSDCERA‑sponsoredplan election(s) willrenew automaticallyif you take no actionduring Open Enrollment2022 Health InsurancePlans for Retired MembersIf you are enrolled in an SDCERA-sponsored health plan, your current planelection(s) will automatically renew for the 2022 calendar year, unless yourequest a change.EligibilitySDCERA sponsors group medical and dental insurance plans for retiredMembers and their eligible dependents. In addition, if you are the survivingspouse/partner or dependent of a deceased SDCERA Member and youreceive a monthly SDCERA retirement benefit, the plans are also available toyou. Eligible dependents include a spouse or registered domestic partner andchildren under age 26.If you elect an SDCERA-sponsored health plan, the cost for coverage isdeducted directly from your monthly retirement benefit payment. Please beadvised that in order to enroll in a plan, the amount of your monthly pensionbenefit must exceed the full cost of the premium(s) being deducted.Plans provide coverage in both California and out‑of‑state serviceareas, but service areas vary by plan. Please contact the plan to verifythat you live within its service area before enrolling. Premiums andtypes of medical plans vary based on Medicare eligibility. Dental plans areavailable to Members regardless of age and Medicare eligibility.SDCERA does not offer plans that provide coverage to Members livingoutside of the United States.Enrollment in a planYou may enroll or make changes to your current SDCERA‑sponsoredplan selection during Open Enrollment from November 1through November 19, 2021. Enrollment or changes outside of theannual Open Enrollment period are limited to qualifying life events(see Page 2). If you wish to continue your current SDCERASponsor health insurance plan election(s), you do not need to doanything during Open Enrollment; your current plan election(s) willrenew automatically. If you change your plan, or enroll for the firsttime, allow 30 days from the effective date for the carrier to recognizeyour coverage. Plan ahead for any necessary prescriptions or care you mayrequire.2022 Health Insurance Plans1

Enrollment or changes outside of the annual Open Enrollment period are limited. You can cancel coverage foryourself or your dependents at any time. You may be eligible to enroll or make changes within 30 days if you havea qualifying life event noted below: retire become eligible for Medicare (or your dependent becomes eligible) add a dependent due to marriage, domestic partner registration, birth, adoption or placement for adoption move outside your plan’s service area lose eligibility for coverage, such as conclusion of COBRA or Cal-COBRA lose eligibility for other coverage (or if the employer stops contributing toward your or your dependents’other coverage), or lose eligibility (not due to termination for cause) for Medicaid, Medi-Cal, Children’s Health Insurance Program(CHIP), Healthy Families Program, or Access for Infants and Mothers Program (you must requestenrollment within 60 days)If you are (or your dependent is) eligible for Medicare and the other is not, you can enroll in separate plans(Medicare and non‑Medicare) with the same carrier.If you are (or your dependent is) turning 65 in 2022 and will become eligible for Medicare, the SDCERA HealthPlans Service Center will send correspondence to your mailing address approximately 90 days prior to your 65thbirthday outlining necessary steps to enroll in Medicare and providing information about SDCERA‑sponsoredMedicare plans. In the meantime, you may enroll in a non‑Medicare plan through SDCERA.To enroll in medical and/or dental plans, please visit health.sdcera.org, click on Retiree Health insuranceProgram and then “Enrollment”, and follow the steps outlined to obtain a copy of the SDCERA HealthInsurance Plans Enrollment form. This form is used to process your request, which includes enablingpremium deductions to cover the cost of plan premiums and using your address for health zone coverageverification purposes. Please note, enrollment in some of the SDCERA-sponsored Medicare plans requires aseparate carrier-specific form. More information is available on the Retiree Health Insurance Program page. Youmay submit your form(s) requesting enrollment in an SDCERA‑sponsored plan online or by mailing or faxingyour completed form(s) to the SDCERA Health Plans Service Center.Medical plan coverage details and premiums begin on Page 4 of this booklet. Dental coverage details andpremiums are on page 9. The premiums shown for medical and dental plans are per person, per month.Tier I and Tier II Members: Health Insurance AllowanceThe Health Insurance Allowance (HIA) helps offset the cost of premiums for medical, dental and prescriptionplans. In addition to the allowance, 93.50 may be reimbursed to offset the cost of Medicare Part B. You areeligible for HIA if you are a retired Tier I or Tier II Member who has at least 10 years of SDCERA service creditor is receiving a disability retirement. Monthly allowance amounts range from 200 to 400. The HIA is not avested SDCERA benefit and is not guaranteed. The allowance may be reduced or discontinued at any time.To use your HIA towards the cost of a medical, dental and/or prescription plan not sponsored by SDCERA,complete the Health Insurance Allowance Request form. You must enroll in the program each January to bereimbursed.22022 Health Insurance Plans

2022 Monthly PremiumsNon-Medicare PlansPlanMonthly Premium Per PersonHealth Net HMO 2,132.85Kaiser Permanente HMO 1,088.422022 MONTHLY PREMIUMSMedicare PlansPlanMonthly Premium Per PersonHealth Net HMO 735.92Health Net Seniority Plus 302.56Kaiser Permanente Senior Advantage 237.14UnitedHealthCare Group Medicare Advantage 304.71UnitedHealthCare Senior Supplement 578.89Dental PlansPlanMonthly Premium Per PersonCIGNA Dental Care (DHMO) 18.64Delta Dental PPO 45.732022 Health Insurance Plans3

NON-MEDICARE PLANS GENERALLY FOR THOSE UNDER 65Non-Medicare plansGenerally for those under age 65These plans are only available in the state of California.1.800.522.0088Group 57358-Awww.healthnet.comIMPORTANT NOTESHMO planSDCERA-sponsored medical plans do not have overall annual or lifetimelimits. Service area varies by plan. Please confirm you live within a plan’sservice area before enrolling. Refer to each plan’s coverage documents forexact terms and conditions of coverage. If there is a discrepancy betweenthis summary chart and the plan documents, the plan documents will govern.You are required to use theprimary care physician youselect from a list of providers.Monthly premium per person 2,132.85Any applicable deductible must be met beforecoverage shown is effective.Requires preauthorization.Annual deductibleAmbulanceAnesthesiaIf covered, services generally include initialexaminations; additional visits for treatment;x-ray and laboratory fees when prescribed.Preauthorization may be required.Chiropractic visitDurable medicalequipmentEmergency careNoneCovered in fullCovered in fullNot coveredCovered in fullIncludes accidental injury and acuteillness; the copayment shown is when visiting anemergency room and iswaived if you are admitted.Fitness club membership 35Discounts availablePreventive screening covered in full; allother 20 per exam.No coverage for hearing aids.Hearing care andhearing aidsRequires a physician’s prescription.Covered in full up to 30 days; 10copayment starts on the 31st dayafter the 1st visit.Coverage is for a semi-private room.Covered in fullCovered in fullCovered in fullThe copayments shown are for officevisits unrelated to hospitalization. 20 per office visitCoverage shown is for visits due to hospitalization.Covered in fullPrescription medications from amail ordersponsored by the carrierThe copayments in all cases are forthe number of days shown. 20 generic, 60 brand name, 90 non‑formulary. 90‑day supply.Prescription medications from apharmacyUnless noted, non-formulary prescriptions arecovered by the same copaymentswhen deemed medically necessary. 10 generic, 30 brand name, 45non-formulary.30-day supply.An asterisk (*) indicates the plan will cover this carein full for diagnoses coveredunder the Mental Health Parity Act.*Covered in fullNo limit on daysHome health careHospice careHospital room and boardLaboratory feesPhysician care (doctor visits)unrelated to hospitalizationPhysician care (doctor visits) dueto hospitalizationPsychiatric care (inpatient)Psychiatric care (outpatient)Rehabilitation therapy 20 per visit, unlimited visitsPhysical, speech, occupational,pulmonary, and cardiacSkilled nursing facilitySurgery (inpatient)Surgery (outpatient)Urgent careVision careand eyewearX-rays4Health Net HMO2022 Health Insurance PlansCovered in fullCovered in full up to 100 daysAn asterisk (*) indicates non-emergency.Covered in fullCovered in full 35 20 per exam;No coverage for eyewear.Covered in full

Kaiser Permanente HMO1.800.464.4000Group 104302www.kp.orgHMO planNON-MEDICARE PLANS GENERALLY FOR THOSE UNDER 65You are required to use Kaiser Permanente physiciansand facilities. A higher premium will apply if you enroll inthis plan when eligible for Medicare. 1,088.42NoneCovered in fullCovered in full 10 per visit, up to 20 visitsCovered in full 25Discounts available. Visit www.choosehealthy.comPreventive screening covered in full; All other 20 per exam.No coverage for hearing aids.Covered in full up to100 daysCovered in fullCovered in fullCovered in full 20 per office visitCovered in full 15 generic, 30 brand name.Up to a 100-day supply. 15 generic, 30 brand name.Up to a 100-day supply. Specialty drugs up to 30 days.*Covered in fullUnlimited visits 20 per visit, unlimited visits 0 inpatient,Covered in full up to 100 daysCovered in full 20 copayment 20*No charge for routine eye examswith a plan optometrist. 20/exam.Covered in full2022 Health Insurance Plans5

Medicare information for SDCERA-sponsored plansSDCERA-sponsored Medicare plansAlthough you may be enrolled in MedicarePart A and Part B, you may still have medicalexpenses not covered by Medicare; therefore,enrolling in an additional insurance plan such asan SDCERA‑sponsored medical plan may helppay for expenses that Medicare does not cover.As long as you are covered by anSDCERA‑sponsored medical plan, youwill have the option of joining a Medicaredrug plan in the future—without a penalty.SDCERA‑sponsored medical plans meet theCenters for Medicare and Medicaid Services(CMS) creditable coverage guidelines. TheNotice of Creditable Coverage on Page 10 of thisbooklet provides you with the documentationyou need to prove that you have had creditablecoverage through an SDCERA‑sponsored plan.This notice protects you from penalty chargesand allows you to join a Medicare drug plan inthe future (if you so decide).SDCERA offers three types of Medicare healthplans for Members covered by Medicare Part Aand Part B. SDCERA-sponsored plans includecomprehensive medical coverage as well as theMedicare prescription drug coverage; therefore,if you enroll in an SDCERA-sponsored plan,your drug coverage will be provided through theSDCERA‑sponsored plan you select. If you enrollin a separate Medicare prescription plan (Part D),you and your dependents will be disenrolled from theSDCERA‑sponsored plan.Medicare Supplement plans allow you to keepyour Medicare benefits and use any physician orfacility that accepts Medicare.Medicare HMO plans coordinate theircoverage with Medicare. You may also useyour Medicare card to obtain services outside62022 Health Insurance Plansyour health plan.Medicare Advantage plans require yourMedicare Part A and Part B to be assigned to ahealth plan.Refer to the Medicare Information page on theRetiree Health Insurance Program page ofhealth.sdcera.org for more information about thetypes of Medicare health plans.If you are eligible for Medicare, but your dependentis not (or if you are not eligible for Medicare andyour dependent is), and you both want to enrollin SDCERA‑sponsored plans, you may enroll inseparate plans with the same carrier.You must submit a copy of both sides of yoursigned Medicare identification card to confirm youreligibility for enrollment in an SDCERA‑sponsoredMedicare plan. If you have submitted a copy in thepast, you do not need to submit another copy. Ifyou are (or your dependent is) newly enrolled inMedicare Part A and Part B, please submit a copyof the signed card to the SDCERA Health PlansService Center when you receive it.If you are (or your dependent is) covered byMedicare Part A only or Medicare Part B only,different premiums may apply. If this situationaffects you, contact the SDCERA RetireeHealth Insurance Program Service Center at1.866.751.0256 to confirm your monthly premium.For information about the Medicare program,enrollment deadline or to contact Medicare, visitwww.medicare.gov or call 1.800.633.4227.

Medicare plansHealth Net HMOHealth Net Seniority PlusGenerally for those over age 651.800.522.0088Group 57358-Bwww.healthnet.com1.800.275.4737Group 57358-Swww.healthnet.comIMPORTANT NOTESMedicare HMO planMedicare Advantage planMonthly premium per personAnnual deductibleAmbulanceApplicable deductible must be metbefore coverage shown is effective.Requires preauthorization.AnesthesiaChiropractic visitIf covered, services generallyinclude initial examinations; additionalvisits for treatment; x-ray andlaboratory fees when prescribed.Preauthorization may be required.Durable medical equipmentEmergency careIncludes accidental injury and acuteillness; the copayment shown is whenvisiting an emergency room and iswaived if you are admitted.Fitness club membershipHearing care andhearing aidsHome health careRequires a physician’s prescription.Hospice careHospital room and boardCoverage is for a semi-private room.Laboratory feesPhysician care (doctor visits) Copayments shown are for office visitsunrelated to hospitalizationunrelated to hospitalization.Physician care (doctor visits)Coverage shown is for visits due todue to hospitalizationhospitalization.Prescription medicationsfrom a mail ordersponsored by the carrierPrescription medicationsfrom a pharmacy before reachingMedicare Part D CatastrophicCoverage StagePsychiatric care (inpatient)Copayments are for the number ofdays shown. Copays may vary whenthe Medicare Part D CatastrophicCoverage stage is reached.Unless noted, non-formularyprescriptions are covered by thesame copayments when deemedmedically necessary.An asterisk (*) indicates the plan willcover this care in full for diagnosescovered under the Mental HealthParity Act.Psychiatric care (outpatient)Medicare benefit must beassigned to the plan. Youare required to use theHealth Net physician you selectfrom a list of providers. 735.92 302.56NoneNoneCovered in fullCovered in fullCovered in fullCovered in fullNot covered 5 per visit up to 20 visits throughAmerican Specialty Health NetworkCovered in fullCovered in full 35 20Discounts availableVisit www.choosehealthy.comSilver & FitPreventive screening covered in full;all other 20 per exam.No coverage for hearing aids. 20 per exam, 2 standard hearingaids every 36 months covered in fullCovered in full up to 30 days; 10 copayment starts on the 31stday after the 1st visit.Covered in fullCovered in fullCovered per Medicare guidelinesCovered in fullCovered in fullCovered in fullCovered in full 20 per office visit 20 per office visitCovered in fullCovered in full 30 generic, 60 brandname, 100 non-formulary.90‑day supply. Administeredby SilverScript. 30 generic, 60 brand name, 90 non-formulary.90-day supply. 15 generic, 30 brandname, 50 non-formulary.30-day supply. Administeredby SilverScript. 15 generic, 30 brand name, 45non-formulary. 30-day supply.*Covered in fullCovered in full 20 per visit 20 per visitCovered in fullNo copay forMedicare-covered servicesCovered in full up to 100 daysCovered in full up to 100 daysSurgery (inpatient)Covered in fullCovered in fullSurgery (outpatient)Covered in fullCovered in full 35 20 per exam.No coverage for eyewear.Covered in full 20 20 per exam. 100 paid foreyewear every 2 years.Covered in fullRehabilitation therapyPhysical, speech, occupational,pulmonary, and cardiacSkilled nursing facilityUrgent careVision careand eyewearX-raysAn asterisk (*) indicates non‑emergency.2022 Health Insurance Plans7MEDICARE PLANS GENERALLY FOR THOSE OVER 65SDCERA-sponsored medical plans do not have overall annual orBenefits coordinated withlifetime limits. Service area varies by plan. Please confirm you live Medicare (primary); may usewithin a plan’s service area before enrolling. Refer to each plan’s Medicare outside of network.coverage documents for exact terms and conditions of coverage. You must use a primary careIf there is a discrepancy between this summary chart and the plan physician from the providers listdocuments, the plan documents will govern.for HMO to cover services.

UHCGroup Medicare AdvantageUHCSenior SupplementCustomer service—1.800.457.8506Prospective Member—1.877.714.0178Group CA: 004497; AZ: 060499; NV: 667201www.uhcretiree.com/sdcera/homeCustomer service—1.800.851.3802Prospective Member—1.800.698.0822Group 05408www.uhcretiree.com/sdcera/homeMedicare Advantage planMedicare Supplement planMedicare benefit must be assigned tothe plan, or a higher premium andtraditional Kaiser HMO benefitsapply. You are required to use KaiserPermanente physicians and facilities.This plan provides coverage in California,Arizona and Nevada. Medicare benefitmust be assigned to the plan. You arerequired to use the primary care physicianyou select from a list of providers.This plan is available nationwide.You may use any physician or facilitythat accepts Medicare. 237.14 304.71 578.89NoneNoneNoneCovered in fullCovered in fullCovered in full. No preauthorization required.Covered in fullCovered in fullCovered in full 10 per visit, up to 20 visits 5 per visit, up to 20 visitsSpinal manipulation covered; 0 per visit.Other services generally not covered.Covered in fullCovered in fullCovered in full 20 20 250 deductible outside of the U.S.,20% thereafter.Discounts available atwww.choosehealthy.comSilver Sneakers Fitness membershipSilver Sneakers Fitness membership 10 per examNo coverage for hearing aids. 0 per exam; hearing aids coveredup to 500 every 36 months.Exams covered; 0 per visit for Medicarecovered exams. Hearing aids not covered.Covered in full. Refer to evidence ofcoverage from the plan.Covered in fullCovered in fullCovered in fullCovered per Medicare guidelinesCovered in fullCovered in fullCovered in fullCovered in fullCovered in fullCovered in fullCovered in full 10 per office visit 20 per office visitCovered in fullCovered in fullCovered in fullCovered in full 10 generic, 20 brand nameUp to a100-day supply. 20 generic, 60 brand name, 60 non‑preferred brand formulary.90-day supply. 20 generic, 70 brand name; 100 non-preferred brand formulary.90-day supply. 10 generic, 20 brand nameUp to a 100-day supply. 10 generic, 30 brand name, 30 non‑preferred brand formulary.30-day supply. 10 generic, 35 brand name; 50 non-preferred brand formulary.30-day supply.*Covered in fullUnlimited visitsCovered per Medicare guidelinesup to 190 days per lifetimeCovered in full up to 150 days 10 per visit, unlimited visits 20 per visitCovered in full 0 inpatient; 10 per visit outpatient 0 copayCovered in fullCovered in full up to 100 daysCovered in full up to 100 daysCovered in full up to 100 daysCovered in fullCovered in fullCovered in full 10 per procedureCovered in fullCovered in full 10* 10 per exam. 150 allowance for eyewear every 2 years.Covered in full 10 copay (in- and out-of-network) 20 per exam. 75 per eyewear every 2 years.Covered in full 0 per Medicare-covered exam. Medicare-coveredeyewear is reimbursed. Non-Medicare is not covered.Kaiser PermanenteSenior AdvantageMEDICARE PLANS GENERALLY FOR THOSE OVER 651.800.464.4000Group 104302-00www.kp.orgMedicare Advantage planCovered in full in the U.S.;82022 Health Insurance PlansCovered in fullCovered in full

SDCERA-sponsored dental plansWhen deciding which dental plan will provide the best coverage for you, consider the differences between a dental healthmaintenance organization (DHMO) plan and a dental preferred provider organization (PPO) plan.Dental PPO plans give you the flexibility to have allcovered services provided by the dentist of your choice;however, you pay less if you select a dentist within thenetwork the plan has contracted with to provide services,because network dentists charge patients pre‑negotiateddiscount rates for services. If you choose to see anout‑of‑network dentist, the reimbursement amount isbased on the network’s regional schedule of benefits fora geographic area. If your dentist charges more than anetwork dentist’s allowed fee, you are responsible forpaying the difference.To enroll in a dental plan listed below and establish payment deductions to cover the cost of plan premiums, completeand submit the SDCERA Health Insurance Plans Enrollment form on the Retiree Health Program page ofhealth.sdcera.org.Dental plansCIGNA Dental Care (DHMO)Delta Dental PPORefer to each plan’s coverage documentsfor exact terms and conditions of coverage.If there is a discrepancy between thissummary chart and the plan documents,the plan documents will govern.1.800.244.6224Group number 3217340www.cigna.com1.800.765.6003Group number 02472-00001www.deltadentalins.comThis plan is available in 39 of 50 states.States without coverage: AK, HI, ME,MT, ND, NE, NM, RI, SD, VT and WY.This plan provides coverage nationwide.Monthly premium per person 18.64 45.73for retired Members and dependentsIN-NETWORKOUT-OF-NETWORK* 50 per person 50 per personNo maximum 1,500 per person 1,000 per personCopayments vary by service; refer tothe schedule of patient charges availablefrom the plan.80% of PPO contractedfee after deductible hasbeen met80% of PPO contractedfee after deductible hasbeen met100% formost services100% of PPO contractedfee with no deductible100% of PPO contractedfee with no deductible50% of PPO contractedfee after deductible hasbeen met50% of PPO contractedfee after deductible hasbeen met50% of PPO contractedfee; 1,000 lifetimemaximum, per person fororthodontia services.50% of PPO contractedfee; 1,000 lifetimemaximum, per personfor orthodontia services.Annual deductibleAny applicable deductible must bemet before coverage shown is effectiveunless noted.Annual maximum benefitBasic and restorative servicesFillings, sealants, simple extractionsNoneDiagnostic and preventive servicesEmergency treatment for pain,oral exams, prophylaxis, spacemaintainers, x-raysOther basic and major servicesBridges, crowns, dentures,endodontics, implants, oral surgery,periodontal treatmentCopayments vary by service; refer tothe schedule of patient charges availablefrom the plan.Implants are not covered under theDHMO plan; however, implant crownsare covered.OrthodontiaFor adults and eligibledependent children*IfCopayments vary by service; refer tothe schedule of patient charges availablefrom the plan.you go out-of-network, visit a Delta Dental Premier dentist for lower costs.2022 Health Insurance Plans9DENTAL PLANSDHMO plans contract with their own network ofdentists and all care is coordinated by the dental officeyou select. You may change your dental office at anytime. If you receive care (other than emergency services)that is not coordinated by your dental office, you arerequired to pay the full cost for the services you receive.The cost of your out-of-pocket expense in a DHMOdental plan is based on a schedule of patient charges.There are no charges for many diagnostic and preventiveservices, and most other types of service require you topay a copayment.

Notice of Creditable CoverageImportant notice about your prescription drug coverage and MedicareThe prescription drug coverage provided under the SDCERA-sponsored medical plans for retired Membersis expected to pay out, on average, at least as much as the standard Medicare prescription drug coverage will pay.If you are enrolled in an SDCERA-sponsored Medicare plan, and you decide to enroll in a separate Medicaredrug plan, your entire current SDCERA-sponsored medical and prescription drug coverage will end for you andall covered dependents. If you decide to join a Medicare drug plan and drop your current SDCERA-sponsoredcoverage, be aware that you and your dependents will be unable to get your SDCERA-sponsored healthcoverage back until the next Open Enrollment period.Members enrolled in an SDCERA-sponsored prescription drug plan receive notice of creditable coverageannually. You may receive this notice at other times in the future, such as before the next period during whichyou may enroll in Medicare prescription drug coverage, if SDCERA-sponsored plan coverage changes, or uponyour request.102022 Health Insurance Plans

COBRA Continuation CoverageThe Consolidated Omnibus Budget Reconciliation Act (COBRA) provides retired Members,non‑Member payees, and their dependents who lose SDCERA-sponsored coverage theright to continue medical and dental coverage for limited periods of time due to certainCOBRA‑qualifying events.Electing COBRA coverageIf you are eligible to elect COBRA continuation coverage due to a qualifying event, you have60 days (from the date of the COBRA election notice or the date you lose coverage, whicheveris later) to elect COBRA continuation coverage.COBRA Qualifying eventsCOBRA defines a qualifying event as the loss of health plan coverage that is attributableto death of the Member, divorce, legal separation, annulment or dependent(s) ineligibility(for instance, your dependent(s) no longer satisfies the requirements for coverage, such asattainment of age 26).Each individual who is affected by the qualifying event may independently elect continuationcoverage. This means that if you and your dependents are entitled to elect continuationcoverage, you each may decide separately whether to do so. The covered Member or thespouse/registered domestic partner is allowed to elect on behalf of any dependent children oron behalf of all qualified beneficiaries; COBRA coverage is limited to a maximum of 36 monthsand the following terms and conditions apply: COBRA premiums are calculated based on current monthly medical or dental planrates plus a two percent administrative fee. You may only continue the coverage that was in effect on the date of thequalifying event. Coverage is extended only to those individuals covered at the time of thequalifying event.2022 Health Insurance Plans11

COBRA Continuation Coverage (cont.)COBRA participants are subject to the same plan coverage levels and administrativerules (e.g., adding dependents and changing or canceling coverage) that apply tonon‑COBRA participants.COBRA is provided subject to your eligibility for coverage under the law and the plan.SDCERA reserves the right to terminate your continuation coverage retroactively if youare later determined to be ineligible.Federal law places responsibility upon the Member or the Member’s eligible dependent(s)to notify within 60 calendar days of death, divorce, legal separation, annulment ordependent’s ineligibility. If you or your eligible dependent(s) do not notify the SDCERAHealth Plans Service Center of the qualifying event within the required time frame, youand your dependents will be ineligible for COBRA. Other forms of notice will not bindthe plan.You will be ineligible for COBRA coverage if you do not notify the SDCERAHealth Plans Service Center within 60 days of a qualifying event.122022 Health Insurance Plans

Legal NoticesSDCERA Retiree Health Program administration credit and feesSDCERA Retiree Health Program administration feesThe administrative expenses of the health benefit program are paid by each plan participant. The healthbenefit program expenses are divided equally among all participants, resulting in a monthly fee per personfor each plan in which they enroll (applicable to both medical and dental plans). This fee is applicable toSDCERA-sponsored plans and the Health Insurance Allowance program.2022 Health Insurance Plans13

CHIP/Medicaid NoticePremium Assistance Under Medicaid and the Children’s Health Insurance Program (CHIP)If you or your children are eligible for Medicaid or CHIP and you are eligible for healthcoverage from your employer, your state may have a premium assistance program that canhelp pay for coverage, using funds from their Medicaid or CHIP programs. If you or yourchildren aren’t eligible for Medicaid or CHIP, you may not be eligible for these premiumassistance programs but you may be able to buy individual insurance coverage through theHealth Insurance Marketplace. For more information, visit www.healthcare.gov.If you or

Health Net Seniority Plus 302.56 Kaiser Permanente Senior Advantage 237.14 UnitedHealthCare Group Medicare Advantage 304.71 UnitedHealthCare Senior Supplement 578.89 Non-Medicare Plans Medicare Plans Plan Monthly Premium Per Person CIGNA Dental Care (DHMO) 18.64 Delta Dental PPO 45.73 Dental Plans 202 2 MONTHLY PREMIUMS