Transcription

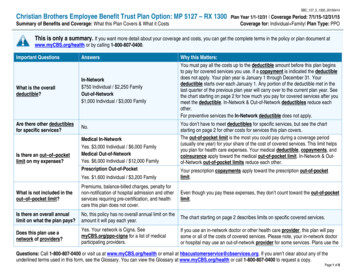

Christian Brothers Employee Benefit Trust Plan Option: MP 5127 – RX 1300Summary of Benefits and Coverage: What this Plan Covers & What it CostsSBC 127 5 1300 20150414Plan Year 1/1-12/31 Coverage Period: 7/1/15-12/31/15Coverage for: Individual Family Plan Type: PPOThis is only a summary. If you want more detail about your coverage and costs, you can get the complete terms in the policy or plan document atwww.myCBS.org/health or by calling 1-800-807-0400.Important QuestionsAnswersWhat is the overalldeductible?In-Network 750 Individual / 2,250 FamilyOut-of-Network 1,000 Individual / 3,000 FamilyAre there other deductiblesfor specific services?No.Is there an out–of–pocketlimit on my expenses?Medical In-NetworkYes. 3,000 Individual / 6,000 FamilyMedical Out-of-NetworkYes. 6,000 Individual / 12,000 FamilyPrescription Out-of-PocketYes. 1,600 Individual / 3,200 FamilyWhy this Matters:You must pay all the costs up to the deductible amount before this plan beginsto pay for covered services you use. If a copayment is indicated the deductibledoes not apply. Your plan year is January 1 through December 31. Yourdeductible starts over each January 1. Any portion of the deductible met in thelast quarter of the previous plan year will carry over to the current plan year. Seethe chart starting on page 2 for how much you pay for covered services after youmeet the deductible. In-Network & Out-of-Network deductibles reduce eachother.For preventive services the In-Network deductible does not apply.You don’t have to meet deductibles for specific services, but see the chartstarting on page 2 for other costs for services this plan covers.The out-of-pocket limit is the most you could pay during a coverage period(usually one year) for your share of the cost of covered services. This limit helpsyou plan for health care expenses. Your medical deductible, copayments, andcoinsurance apply toward the medical out-of-pocket limit. In-Network & Outof-Network out-of-pocket limits reduce each other.Your prescription copayments apply toward the prescription out-of-pocketlimit.What is not included in theout–of–pocket limit?Premiums, balance-billed charges, penalty fornon-notification of hospital admission and otherservices requiring pre-certification, and healthcare this plan does not cover.Even though you pay these expenses, they don’t count toward the out-of-pocketlimit.Is there an overall annuallimit on what the plan pays?No, this policy has no overall annual limit on theamount it will pay each year.The chart starting on page 2 describes limits on specific covered services.Does this plan use anetwork of providers?Yes. Your network is Cigna. SeemyCBS.org/ppo-cigna for a list of medicalparticipating providers.If you use an in-network doctor or other health care provider, this plan will paysome or all of the costs of covered services. Please note, your in-network doctoror hospital may use an out-of-network provider for some services. Plans use theQuestions: Call 1-800-807-0400 or visit us at www.myCBS.org/health or email at hbscustomerservice@cbservices.org. If you aren’t clear about any of theunderlined terms used in this form, see the Glossary. You can view the Glossary at www.myCBS.org/health or call 1-800-807-0400 to request a copy.Page 1 of 8

Christian Brothers Employee Benefit Trust Plan Option: MP 5127 – RX 1300Summary of Benefits and Coverage: What this Plan Covers & What it CostsSBC 127 5 1300 20150414Plan Year 1/1-12/31 Coverage Period: 7/1/15-12/31/15Coverage for: Individual Family Plan Type: PPOterm in-network, preferred, or participating for providers in their network. Seethe chart starting on page 2 for how this plan pays different kinds of providers.Do I need a referral to see aspecialist?No. You don’t need a referral to see aspecialist.You can see the specialist you choose without permission from this plan.Are there services this plandoesn’t cover?Yes.Some of the services this plan doesn’t cover are listed on page 5. See yourpolicy or plan document for additional information about excluded services. Copayments are fixed dollar amounts (for example, 15) you pay for covered health care, usually when you receive the service. Coinsurance is your share of the costs of a covered service, calculated as a percent of the allowed amount for the service. For example, if the plan’sallowed amount for an overnight hospital stay is 1,000, your coinsurance payment of 20% would be 200. This may change if you haven’t met yourdeductible. The amount the plan pays for covered services is based on the allowed amount. If an out-of-network provider charges more than the allowedamount, you may have to pay the difference. For example, if an out-of-network hospital charges 1,500 for an overnight stay and the allowed amountis 1,000, you may have to pay the 500 difference. (This is called balance billing.) This plan may encourage you to use In-Network providers by charging you lower deductibles, copayments and coinsurance amounts.CommonMedical EventIf you visit a health careprovider’s office orclinicServices You May NeedYour Cost If You Use anIn-Network ProviderOut-of-Network ProviderPrimary care visit to treat aninjury or illness 25 Copayment / visit40% Coinsurance / visitSpecialist visit 50 Copayment / visit40% Coinsurance / visitOther practitioner office visit20% Coinsurance / visit40% Coinsurance / visitNo ChargePrimary Care - 40%CoinsuranceFree Standing Clinic –40% CoinsurancePreventive care / screening /immunizationLimitations & ExceptionsNone.In-Network Allergy injections 5Copayment / visit.Limited to 12 visits per year, combined forall providers including, but not limited toacupuncturists & massage therapists.Health Care Reform guidelines apply. Outof-Network Payment may differ based onplace of service.Questions: Call 1-800-807-0400 or visit us at www.myCBS.org/health or email at hbscustomerservice@cbservices.org. If you aren’t clear about any of theunderlined terms used in this form, see the Glossary. You can view the Glossary at www.myCBS.org/health or call 1-800-807-0400 to request a copy.Page 2 of 8

Christian Brothers Employee Benefit Trust Plan Option: MP 5127 – RX 1300Summary of Benefits and Coverage: What this Plan Covers & What it CostsCommonMedical EventServices You May NeedSBC 127 5 1300 20150414Plan Year 1/1-12/31 Coverage Period: 7/1/15-12/31/15Coverage for: Individual Family Plan Type: PPOYour Cost If You Use anIn-Network ProviderOut-of-Network ProviderDiagnostic test (x-ray, bloodwork)Lab Work – No ChargeRadiology – 20%Coinsurance40% CoinsuranceImaging (CT/PET scans, MRIs)20% Coinsurance40% CoinsuranceIf you have a testIf you need drugs totreat your illness orconditionTo find more informationabout prescription drugcoverage or to locate anetwork pharmacy log intowww.myCBS.org/healthand click on MyPrescription Drugs or callExpress Scripts at800-718-6601.If you have outpatientsurgeryIf you need immediatemedical attentionGeneric drugsPreferred drugsNon-Preferred drugsSpecialty drugsFacility fee (e.g., ambulatorysurgery center)Physician/surgeon feesEmergency room servicesEmergency medicaltransportation 10 / prescription (retail); 25 / prescription (mailorder) 35 / prescription (retail); 90 / prescription (mailorder) 60 / prescription (retail); 150 / prescription (mailorder)Deductible waived for Lab Work. Limitedto services performed outside physician’soffice. Payment may differ based on placeof service.Limited to services performed outsidephysician’s office. Payment may differbased on place of service. Precertificationis required. A 25% penalty up to 300 mayapply.Same as In-Network 20% coinsurance penaltyCovers up to 30-day supply retailprescription; 90-day supply mail orderprescription.Same as In-Network 20% coinsurance penaltyRetail purchases for maintenanceprescriptions are limited to an initial fill andtwo subsequent refills. Members whocontinue to use retail will pay the maildelivery copayment, however, only up to a30-day supply will be dispensed.Same as In-Network 20% coinsurance penaltyAs categorized above20% CoinsuranceLimitations & Exceptions40% CoinsuranceSee your policy or plan document foradditional information.None.20% Coinsurance40% Coinsurance20% Coinsurance after 100 CopaymentNone.Copayment is waived if admitted.20% CoinsuranceNone.Questions: Call 1-800-807-0400 or visit us at www.myCBS.org/health or email at hbscustomerservice@cbservices.org. If you aren’t clear about any of theunderlined terms used in this form, see the Glossary. You can view the Glossary at www.myCBS.org/health or call 1-800-807-0400 to request a copy.Page 3 of 8

Christian Brothers Employee Benefit Trust Plan Option: MP 5127 – RX 1300Summary of Benefits and Coverage: What this Plan Covers & What it CostsCommonMedical EventServices You May NeedIf you are pregnantCoverage for: Individual Family Plan Type: PPOYour Cost If You Use anOut-of-Network ProviderPrimary Care – 40%CoinsuranceFree Standing Clinic –40% CoinsuranceEmergency Room – 20%Coinsurance after 100CopaymentFacility fee (e.g., hospital room)20% Coinsurance40% CoinsurancePhysician/surgeon fee20% CoinsuranceSpecialist – 50Copayment / visitOutpatient Facility –20% Coinsurance40% CoinsuranceSpecialist – 40%Coinsurance / visitOutpatient Facility – 40%Coinsurance20% Coinsurance40% CoinsuranceSpecialist – 50Copayment / visitOutpatient Facility –20% CoinsuranceSpecialist – 40%Coinsurance / visitOutpatient Facility – 40%Coinsurance20% Coinsurance40% Coinsurance 25 Copayment / visit40% Coinsurance20% Coinsurance40% CoinsuranceMental/Behavioral healthoutpatient servicesIf you have mentalhealth, behavioralhealth, or substanceabuse needsPlan Year 1/1-12/31 Coverage Period: 7/1/15-12/31/15In-Network ProviderPrimary Care – 25CopaymentFree Standing Clinic –20% CoinsuranceEmergency Room – 20%Coinsurance after 100CopaymentUrgent careIf you have a hospitalstaySBC 127 5 1300 20150414Mental/Behavioral healthinpatient servicesSubstance use disorderoutpatient servicesSubstance use disorderinpatient servicesRoutine prenatal and postnatalcareDelivery and all inpatientservicesLimitations & ExceptionsPayment may differ based on place ofservice. This applies to emergency roomor urgent care services.Precertification is required. A 25% penaltyup to 2,000 may apply.None.Payment may differ based on place ofservice.Precertification is required. A 25% penaltyup to 2,000 may apply.Payment may differ based on place ofservice.Precertification is required. A 25% penaltyup to 2,000 may apply.Copayment applies to initial prenatal visitonly (per pregnancy).None.Questions: Call 1-800-807-0400 or visit us at www.myCBS.org/health or email at hbscustomerservice@cbservices.org. If you aren’t clear about any of theunderlined terms used in this form, see the Glossary. You can view the Glossary at www.myCBS.org/health or call 1-800-807-0400 to request a copy.Page 4 of 8

Christian Brothers Employee Benefit Trust Plan Option: MP 5127 – RX 1300Summary of Benefits and Coverage: What this Plan Covers & What it CostsCommonMedical EventServices You May NeedPlan Year 1/1-12/31 Coverage Period: 7/1/15-12/31/15In-Network ProviderOut-of-Network Provider20% Coinsurance40% CoinsuranceRehabilitation services20% Coinsurance40% CoinsuranceDurable medical equipmentHospice serviceEye examGlassesDental check-upCoverage for: Individual Family Plan Type: PPOYour Cost If You Use anHome health careHabilitation servicesIf you need helprecovering or have otherspecial health needsSkilled nursing careIf your child needsdental or eye careSBC 127 5 1300 20150414Not covered20% Coinsurance40% Coinsurance20% Coinsurance20% Coinsurance40% Coinsurance40% CoinsuranceNot coveredNot coveredNot coveredLimitations & ExceptionsLimited to 100 visits per year maximum.Payment may differ based on place ofservice.Not covered.Limited to 120 day maximum for allconfinements resulting from the same or arelated illness or injury.Check your plan document for limitations.Limited to 180 day per year maximum.Unless covered by your vision plan.Unless covered by your vision plan.Unless covered by your dental plan.Excluded Services & Other Covered Services:Services Your Plan Does NOT Cover (This isn’t a complete list. Check your policy or plan document for other excluded services.) Bariatric surgery Habilitation services Routine eye care (Adult) Cosmetic surgery Hearing aids Routine foot care Dental care (Adult) Infertility treatment (except initial diagnosis) Weight loss programs Dental check-up (Child) Long-term care Contraceptives Eye exam / Glasses (Child) Private-duty nursing Sterilization or AbortionOther Covered Services (This isn’t a complete list. Check your policy or plan document for other covered services and your costs for these services.) Non-emergency care when traveling outside the U.S. (only when on assignment by ER) TMJ (Temporomandibular Joint Disorder) limited to 2,500 maximum benefit per lifetime.Questions: Call 1-800-807-0400 or visit us at www.myCBS.org/health or email at hbscustomerservice@cbservices.org. If you aren’t clear about any of theunderlined terms used in this form, see the Glossary. You can view the Glossary at www.myCBS.org/health or call 1-800-807-0400 to request a copy.Page 5 of 8

Christian Brothers Employee Benefit Trust Plan Option: MP 5127 – RX 1300Summary of Benefits and Coverage: What this Plan Covers & What it CostsSBC 127 5 1300 20150414Plan Year 1/1-12/31 Coverage Period: 7/1/15-12/31/15Coverage for: Individual Family Plan Type: PPOYour Rights to Continue Coverage:If you lose coverage under the plan, then, depending upon the circumstances, Federal and State laws may provide protections that allow you to keep health coverage.Any such rights may be limited in duration and will require you to pay a premium, which may be significantly higher than the premium you pay while covered underthe plan. Other limitations on your rights to continue coverage may also apply. For more information on your rights to continue coverage, contact the plan at 1-800807-0400. You may also contact your state insurance department, the U.S. Department of Labor, Employee Benefits Security Administration at 1-866-444-3272 orwww.dol.gov/ebsa, or the U.S. Department of Health and Human Services at 1-877-267-2323 x61565 or www.cciio.cms.gov.Your Grievance and Appeals Rights:If you have a complaint or are dissatisfied with a denial of coverage for claims under your plan, you may be able to appeal or file a grievance. For questions aboutyour rights, this notice, or assistance, you can contact: the Plan at 1-800-807-0400. You can also contact the Department of Labor’s Employee Benefits SecurityAdministration at 1-866-444-EBSA (3272) or www.dol.gov/ebsa/healthreform.Does this Coverage Provide Minimum Essential Coverage?The Affordable Care Act requires most people to have health care coverage that qualifies as “minimum essential coverage.” This plan or policy does provideminimum essential coverage.Does this Coverage Meet the Minimum Value Standard?The Affordable Care Act establishes a minimum value standard of benefits of a health plan. The minimum value standard is 60% (actuarial value). This healthcoverage does meet the minimum value standard for the benefits it provides.Language Access Services:Para obtener asistencia en Español, llame al 1-800-807-0400.Kung kailangan ninyo ang tulong sa Tagalog tumawag sa 1-800-807-0400.(中文): � 1-800-807-0400.Dinek'ehgo shika at'ohwol ninisingo, kwiijigo holne' �––––––––––To see examples of how this plan might cover costs for a sample medical situation, see the next –––––––Questions: Call 1-800-807-0400 or visit us at www.myCBS.org/health or email at hbscustomerservice@cbservices.org. If you aren’t clear about any of theunderlined terms used in this form, see the Glossary. You can view the Glossary at www.myCBS.org/health or call 1-800-807-0400 to request a copy.Page 6 of 8

Christian Brothers Employee Benefit Trust Plan Option: MP 5127 – RX 1300Coverage ExamplesAbout these CoverageExamples:These examples show how this plan might covermedical care in given situations. Use theseexamples to see, in general, how much financialprotection a sample patient might get if they arecovered under different plans.This isnot a costestimator.Don’t use these examples toestimate your actual costsunder this plan. The actualcare you receive will bedifferent from these examples,and the cost of that care willalso be different.See the next page forimportant information aboutthese examples.Coverage for: Individual Family Plan Type: PPO(routine maintenance ofa well-controlled condition)(normal delivery) Amount owed to providers: 7,540 Plan pays 5,420 Patient pays 2,120 Amount owed to providers: 5,400 Plan pays 2,320 Patient pays 3,080Sample care costs:Hospital charges (mother)Routine obstetric careHospital charges (baby) 2,700 2,100AnesthesiaLaboratory testsPrescriptionsRadiologyVaccines, other preventiveTotal 900 500 200 200 40 7,540Patient pays:DeductiblesCopaysCoinsuranceLimits or exclusionsTotalPlan Year 1/1-12/31 Coverage Period: 7/1/15-12/31/15Managing type 2 diabetesHaving a babycharges considered under dependent coverageSBC 127 5 1300 20150414 900 750 0 1,220 150 2,120Sample care costs:PrescriptionsMedical Equipment and SuppliesOffice Visits and ProceduresEducationLaboratory testsVaccines, other preventiveTotal 2,900 1,300 700 300 100 100 5,400Patient pays:DeductiblesCopaysCoinsuranceLimits or exclusionsTotal 750 220 2,030 80 3,080Questions: Call 1-800-807-0400 or visit us at www.myCBS.org/health or email at hbscustomerservice@cbservices.org. If you aren’t clear about any of theunderlined terms used in this form, see the Glossary. You can view the Glossary at www.myCBS.org/health or call 1-800-807-0400 to request a copy.Page 7 of 8

Christian Brothers Employee Benefit Trust Plan Option: MP 5127 – RX 1300Coverage ExamplesSBC 127 5 1300 20150414Plan Year 1/1-12/31 Coverage Period: 7/1/15-12/31/15Coverage for: Individual Family Plan Type: PPOQuestions and answers about the Coverage Examples:What are some of the assumptionsbehind the Coverage Examples? Costs don’t include premiums.Sample care costs are based on nationalaverages supplied by the U.S. Departmentof Health and Human Services, and aren’tspecific to a particular geographic area orhealth plan.All services and treatments started andended in the same coverage period.There are no other medical expenses forany member covered under this plan.Out-of-pocket expenses are based only ontreating the condition in the example.The patient received all care from innetwork providers. If the patient hadreceived care from out-of-networkproviders, costs would have been higher.What does a Coverage Example show?For each treatment situation, the CoverageExample helps you see how deductibles,copayments, and coinsurance can add up. Italso helps you see what expenses might be leftup to you to pay because the service ortreatment isn’t covered or payment is limited.Does the Coverage Example predict myown care needs? No. Treatments shown are just examples.The care you would receive for this conditioncould be different based on your doctor’sadvice, your age, how serious your conditionis, and many other factors.Does the Coverage Example predict myfuture expenses? No. Coverage Examples are not costestimators. You can’t use the examples toestimate costs for an actual condition. Theyare for comparative purposes only. Your owncosts will be different depending on the careyou receive, the prices your providerscharge, and the reimbursement your healthplan allows.Can I use Coverage Examples tocompare plans? Yes. When you look at the Summary ofBenefits and Coverage for other plans, you’llfind the same Coverage Examples. When youcompare plans, check the “Patient Pays” boxin each example. The smaller that number,the more coverage the plan provides.Are there other costs I should considerwhen comparing plans? Yes. An important cost is the premium youpay. Generally, the lower your premium, themore you’ll pay in out-of-pocket costs, such ascopayments, deductibles, andcoinsurance. You should also considercontributions to accounts such as healthsavings accounts (HSAs), flexible spendingarrangements (FSAs) or healthreimbursement accounts (HRAs) that help youpay out-of-pocket expense.Questions: Call 1-800-807-0400 or visit us at www.myCBS.org/health or email at hbscustomerservice@cbservices.org. If you aren’t clear about any of theunderlined terms used in this form, see the Glossary. You can view the Glossary at www.myCBS.org/health or call 1-800-807-0400 to request a copy.Page 8 of 8

Christian Brothers Employee Benefit Trust Plan Option: MP 5127 - RX 1300 Plan Year 1/1-12/31 Coverage Period: 7/1/15-12/31/15 Summary of Benefits and Coverage: What this Plan Covers & What it Costs Coverage for: Individual Family Plan Type: PPO