Transcription

Perspective on incomeLincoln Lifetime Income SM Advantage 2.0 and i4LIFE Advantage GIBLINCOLN ANNUITIESNot a depositNot FDIC-insured May go down in valueNot insured by any federal government agencyNot guaranteed by any bank or savings associationInsurance products issued by:The Lincoln National Life Insurance CompanyLincoln Life & Annuity Company of New York1175644Lincoln ChoicePlus Assurance SMvariable annuityClient Guide

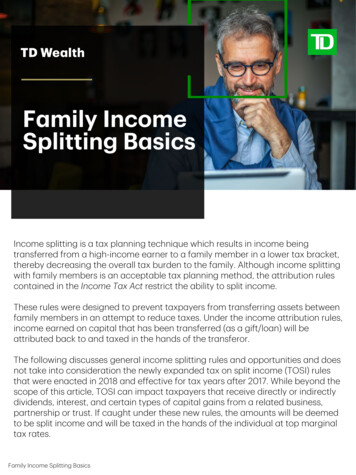

Planning forand protectingyour retirementincomePlanning for your financial future takes more than balancingsavings and expenses — especially when it comes to income.Traditional sources of income, such as pensions and SocialSecurity, may not be enough to protect your lifestyle. Today,most Americans are expected to fund a large part of their ownretirement. Meeting your goals in today’s environment can beintimidating as you face the challenges of outliving your savings,rising taxes and healthcare costs, market volatility, and inflation.These challenges can lead to financial risk and future uncertainty.The good news is that you can take charge to help plan for andprotect your income with strategies from Lincoln Financial.

CHALLENGES & STRATEGIESToday’s challengesTo understand the challenges affecting your financial future, here are some facts worth considering:TaxesT axes are too often overlooked or miscalculated when creating a retirement income plan. Becausetaxes top the list of expenses paid in retirement, it is essential to address this issue.31%16%6%TaxesHome or mortgageLeisure and travelHousehold expenses(utilities and food) Health and healthcare Other The average amount paid in taxes*13%17%18%* Reflects retired households with income over 100K and includes federal, real estate,state, capital gains, and personal property taxes. Source: Spectrem Group survey,“2013 — Expense Challenges of Age 62 – 75 Retirees.”Long-term health costs What may be even more sobering than the increasing need for long-term care are the costsassociated with it.1 Just consider the national average costs for the following types of care: 95,707 49,669One year in a private roomat a skilled nursing facilityA one-bedroom unitin an assisted living facilityfor one year 21.86 per hourAssistance froma home health aideMany Americans are at risk of having long-term care needs that could make a significant impact on their family’spersonal wealth.60%of Americans age 40 orolder believe they may needlong-term care someday.2LTCG, “2013 Cost of Care Survey.” For a printed copy of the survey, call 877-ASK-LINCOLN.12The Associated Press-NORC Center for Public Affairs Research, “Long-term Care in America: Expectations and Reality,” May 2014.3

Today’s challenges, cont’d.Longevity Americans are healthier and living longer than ever. And while a longer life expectancy is a good thing,it also means that you will need to fund a longer retirement.Retirees should plan for living longere of one spouse survivinge of one spouse survivingMale age 658550% chance of one spouse surviving25% chance of one spouse surviving92Male age 65Female age 6588Female age 65Individuals 65 years of age have asignificant chance of living well intotheir 90s. Consider how long you willneed your retirement income as youOne out of a couple (bothare developing your strategy.94One out of a couple (both age 65)92ty 2000 Mortality Table,uaries.Figures assume aood health.97020406080100Source: Annuity 2000 Mortality Table,Datasource:2000 Annuity Tables,Societyaof Actuaries.Societyof Actuaries.Figuresassumeperson is in good health.0Inflation Over time, inflation can erode the value of your retirement savings. Even a relatively low inflation rate canhave a significant impact on your purchasing power.Decline in purchasing power over timeToday5 yearsYears from retirement start date10 years15 years20 years25 yearsIncome to maintain present lifestyle 60,000 50,000 50,000 40,000 30,477 30,000 20,0002% inflation3% inflation4% inflation 23,880 18,756 10,000 0Source: Morningstar.All numbers were calculated based on hypothetical rates of inflation of 2%, 3%, and 4% (historical average from 1926 to 2012 was 3%) to show the effectsof inflation over time. Actual inflation rates may be more or less, and will vary.42040

CHALLENGES & STRATEGIESMarket risk A s you approach retirement, market swings can be difficult to overcome. But over the long term,equities may offer the growth potential needed to fund a longer retirement.Staying invested is a long-term strategy20,00019841989199419992004200920141999DOW reaches 10,00015,000Value2000Internet bubble bursts10,0001995Netscape IPO1987Market crash5,0002002Bear market hitslowest point2008Financial crisis2009Current bullmarket begins0Dow Jones Industrial Average (DJIA) is a price-weighted average of 30 significant stocks traded on the New York Stock Exchange. It is not possible to invest directlyin an index. Past performance does not guarantee future results.Source: Morningstar 2015.Whether you’re just starting to plan your strategy, working to accumulate assets or gettingready to enjoy retirement, Lincoln’s comprehensive approach can help you address thesechallenges. Take the next step in planning for and protecting your retirement income withgrowth and income strategies.5

The big pictureRetirement planning has two sides:the time before and after you starttaking income.Your retirement income should protect your lifestyle,have the potential to grow, and last the rest of yourlife. The key to a successful retirement is to addressand prepare for challenges you’ll face in both thegrowth and income phases.The two sides of a variableAccumulation phaseis the time to let money in an annuity growtax-deferred (also called growth phase ordeferral period).A variable annuity can be a valuable tool to helpprotect and grow your wealth. Variable annuities aredesigned to provide tax-deferred growth and a lifetimeincome stream. With a Lincoln variable annuity, you cancustomize your contract through investment allocation,optional living benefits, and wealth transfer strategies.Account valueThis is directly connectedto the performance ofyour investment choices.3–10 yearsVariable annuities are long-term investment productsthat offer a lifetime income stream, access to leadinginvestment managers, options for guaranteed growthand income (available for an additional charge), taxdeferred growth, and death benefit protection forloved ones.To decide if a variable annuity is right for you,consider that its value will fluctuate with themarket, it is subject to investment risk and possibleloss of principal, it has various costs, and allguarantees, including those for optional features,are subject to the claims-paying ability of theissuer. Limitations and conditions apply. There arefees and charges associated with investing in avariable annuity such as mortality and expense,administrative and advisory fees. Optional featuresare available for an additional cost.65Optional features, available for an additional%Guaranteed growthLifetime withdrawalsGuaranteed growth during the accumulationphase and guaranteed withdrawals for life withLincoln Lifetime IncomeSM Advantage 2.0, basedon the Income Base beginning at age 65 forsingle life contracts and 75 for joint life contracts.1 Lincoln Lifetime Income Advantage 2.0 is available for an additionalannual charge of 1.05%, or 1.25% for joint coverage, abovestandard contract expenses (maximum annual charge of 2.00%).1

CHALLENGES & STRATEGIESannuityIncome phasestarts when you begin taking income from the annuity (also called payout, distribution ordecumulation period).Based on your total principal payments and onany gains in the subaccounts you have selected.If the contract value is reduced to zero, the annuityenters the guaranteed phase. It is when money neededto continue funding the income payments comes fromthe insurance company if a guarantee is purchased.Income payments20–30 yearsThis chart is for illustrative purposes only and does not reflect the performance of any particular product.Options for growth and incomecharge with a Lincoln variable annuity, can help protect and grow your wealth in every phase of retirement.10%Nursing homeenhancementThe nursing home enhancement increaseswithdrawals to 10% for qualified nursing homeexpenses at age 70.2In order to qualify for the nursing home enhancement, you must be70, you cannot be in a nursing home the year prior to rider electionor for five years after, you must have a minimum 90-consecutive-daystay, and your account value must be greater than zero. With joint life,the first person to qualify and file will receive the enhancement. Notavailable in all states.2 i4LIFEi4LIFE AdvantageGuaranteed IncomeBenefit (GIB)A patented lifetime income distribution method designedto help protect and grow income, while maintaining controland access to your money.3This feature is available for an additional annual charge of 1.05% for single life, or1.25% for joint life, above standard contract expenses (maximum annual charge forGIB is 2.00%).3 7

Prepare for tomorrow with Lincoln Lifetime Income SM Advantage 2.0Lincoln Lifetime Income Advantage 2.0 is an optional living benefit rideravailable for an additional cost that provides: Guaranteed growth for income — 5% compounded step-ups or market step-ups Guaranteed lifetime income — 5% withdrawals starting at age 65 (age 75 for joint life) Protection for you and your family via a dollar-for-dollar Guarantee of Principal death benefit 10% nursing home enhancement Optional coverage for your spouse No minimum issue ageLincoln Lifetime Income Advantage 2.0 age bandsGuaranteed annual incomeSingleAge55 – 59½59½ – 6465 Joint%3.50%4.00%5.00%Age55 – 59½59½ – 6465 – 7475 %3.50%4.00%4.50%5.00%L incoln Lifetime Income Advantage 2.0 is available for an additional annual charge of 1.05%, or1.25% for joint coverage, above standard contract expenses (maximum annual charge of 2.00%).As your Income Base increases, your cost will increase proportionately. The Income Base is nota cash or surrender value, nor is it available as a lump sum. The 5% compounded growth willcontinue for the earlier of 10 years or through age 85 and is not available in any year a withdrawaloccurs. Withdrawals in excess of the guaranteed annual income amount will adversely impactlifetime income. Investment requirements apply.8

Lincoln Lifetime Income SM Advantage 2.05% compoundedgrowthLock in growth when the market is upeven when themarket is down10%5%Yr 1Yr 2Yr 3IncomeYr 4Yr 5Income increases ifyour account valuereaches a new highYr 6Yr 7Growth phaseIncome BaseYr 8Yr 9Yr 10NursingHomeYr 11Yr 12Income phaseAccount valueIncomeThis hypothetical example does not reflect a specific investment. Past performance does not guarantee future results.More than one way to take incomeWhen you’re ready to take income, you can start a guaranteed lifetime income fromLincoln Lifetime Income Advantage 2.0, or you have the option to transition to i4LIFE Advantage Guaranteed Income Benefit (GIB). If transitioning to i4LIFE Advantage, theinitial GIB amount equals a percentage of the account value or the Income Base (lessallowable withdrawals), whichever is greater. See page 12 for more details.9

Growth phaseIn this example, a 60-year-old male invested 500,000 of after-tax money in a Lincoln ChoicePlus AssuranceSM variable annuitywith Lincoln Lifetime IncomeSM Advantage 2.0 to potentially grow his future income.This illustration shows how the performance of the underlying investment accounts could affect the policy cash value and deathbenefit. This may not be used to project or predict investment results. The five investment options that these illustrations useare listed with their performance on page 22 and were chosen based on the funds’ assets under management and investmentrequirements.AgePeriodendingat issueAccountvalueAnnualreturns 500,000IncomeBase*Guaranteedannual income*Deathbenefit 500,000 20,000 500,000 612,844 24,514 612,844 666,639 26,666 666,6396012/03 612,84422.57%6112/04 666,6398.78%6212/05 681,5512.24% 699,971 27,999 681,5516312/06 742,5538.95% 742,553 29,702 742,5536412/07 776,7994.61% 779,680 38,984 776,7996512/08 543,815–29.99% 818,664 40,933 543,8156612/09 664,61322.21% 859,598 42,980 664,6136712/10 733,12610.31% 902,578 45,129 733,1266812/11 717,710–2.10% 947,706 47,385 717,7106912/12 796,01410.91% 995,092 49,755 796,0147012/13 884,75411.15% 1,044,846 52,242 884,7547112/14 897,6681.46% 1,097,089 54,854 897,66812Cumulative: 5.00%1Locked-in market growth25% compounded enhancements*Income available subsequent year. The Income Base is used to calculate the guaranteed withdrawals or Guaranteed Income Benefit (GIB) if you elect i4LIFE Advantage. It is notavailable as a lump sum withdrawal or a death benefit. The Income Base equals the contract value at election; however, while the contract value fluctuates with the market, theIncome Base grows with annual lock-in opportunities and is reduced by excess withdrawals.This table is for illustrative purposes only. Past performance does not guarantee future results. The cumulative returns represent the cumulative annualized returnfor the illustration period. The annual returns shown reflect the deduction of all applicable contract fees and charges. This includes a maximum 1.30% mortality and expense riskcharge and administrative fee, and a 1.05% charge for Lincoln Lifetime Income SM Advantage 2.0. There are also investment management fees and expenses as well as a 12b-1distribution fee. It does not reflect any state premium tax deducted upon surrender. Specific fees and expenses can be found in the prospectus.10

Lincoln Lifetime Income SM Advantage 2.0Income phaseYou may choose to take income from Lincoln Lifetime IncomeSM Advantage 2.0 because it is both an accumulationbenefit and an income benefit.In this scenario, a 70-year-old male invested 500,000 of after-tax money in a Lincoln ChoicePlus AssuranceSM variableannuity with Lincoln Lifetime Income Advantage 2.0 to begin taking lifetime income.This illustration shows how the performance of the underlying investment accounts could affect the policy cash valueand death benefit. This may not be used to project or predict investment results.AgePeriodendingat issueAccountvalueAnnualreturns 500,000IncomeBase*Guaranteedannual income* 500,000 25,000Nursing homeenhancement*Deathbenefit 500,0007012/03 583,77322.34% 583,773 29,189n/a 583,7737112/04 603,5198.61% 603,519 30,176n/a 603,5197212/05 585,7772.12% 603,519 30,176n/a 585,7777312/06 606,1868.88% 606,186 30,309n/a 606,1867412/07 603,3304.65% 606,186 30,309 60,619 603,3307512/08 397,996–29.87% 606,186 30,309 60,619 397,9967612/09 450,27121.62% 606,186 30,309 60,619 450,2717712/10 463,1269.94% 606,186 30,309 60,619 463,1267812/11 423,456–2.10% 606,186 30,309 60,619 423,4567912/12 437,36510.86% 606,186 30,309 60,619 437,3658012/13 453,09710.93% 606,186 30,309 60,619 453,0978112/14 428,3181.27% 606,186 30,309 60,619 428,318Cumulative: 5.19%5Guaranteed withdrawals for% life starting at 65, based onthe Income Base regardlessincome of account value (age 75 forjoint life). 387,322Total income received,and withdrawals will lastfor life.10% The nursing homenursinghomeenhancement increaseswithdrawals to 10% atage 70.†*Income available for the subsequent year.† In order to qualify for the nursing home enhancement, you cannot be in a nursing home the year prior to rider election or for five years after, you must have a minimum90-consecutive-day stay, and your account value must be greater than zero. With joint life, the first person to qualify and file will receive the enhancement. Notavailable in all states.This optional feature is available with a Lincoln variable annuity for an additional annual charge of 1.05%, or 1.25% for joint coverage, above standard contractexpenses (maximum annual charge of 2.00%). Investment requirements apply.11

Maximize income potentialwith i4LIFE Advantage GIBi4LIFE Advantage Guaranteed Income Benefit (GIB) is an optional living benefit rider available for anadditional cost that provides: Guaranteed lifetime income Control of investment options Guaranteed minimum payment (GIB) Tax-efficient income Growth potential of the market andopportunities for rising income Joint life options Access to your money A dollar-for-dollar Guarantee of Principaldeath benefitThe five investment options used in this illustration are listed with their performance on page 22 and werechosen based on the funds’ assets under management and investment requirements. This illustration showshow the performance of the underlying investment accounts could affect the policy cash value and deathbenefit. This may not be used to project or predict investment results.Ageat issue70Protected incomeThe GIB guarantees you a minimumpayment. Future i4LIFE Advantagepayments will never be less than yourfirst protected payment (provided youdo not take additional withdrawals).71i4LIFE Advantage GIB age bandsPercentage of account value for initial GIBSingleJoint7273Age%Age%Under 402.50%Under 402.50%40 – 543.00%40 – 543.00%55 – 59½3.50%55 – 59½3.50%59½ – 644.00%59½ – 694.00%65 – 694.50%70 – 744.50%70 – 795.00%75 – 795.00%7880 5.50%80 5.50%79When the total income reaches a new high in subsequent years,your GIB payment (as long as it exceeds the current GIB) willautomatically step up to 75% of that amount.747576778081TotalThis optional feature is available with a Lincoln variable annuity for an additional annual charge of 1.05%, or 1.25% for joint coverage, above standard contract expenses(maximum annual charge of 2.00% for GIB). Additional withdrawals taken before age 59½ may subject current and prior taxable distributions to an additional 10% federaltax. Investment requirements apply for the GIB. Please see the prospectus for details.If transitioning from Lincoln Lifetime Income SM Advantage 2.0 to i4LIFE Advantage, the initial GIB amount equals a percentage of the account value or the Income Base (lessallowable withdrawals), whichever is greater.12

i4LIFE Advantage GIBi4LIFE Advantage payments will increase if the return exceeds 4% net ofthe annuity fees and expenses.Pay to theorder ofForPeriodendingMr. InvestorYou can opt to have yourprotected income andadditional income splitinto two checks.Protected income: 25,000The appropriateLincoln issuing companyProtected incomeAccountvalueAnnualreturns 500,0001Pay to theorder ofForMr. InvestorAdditional income: 5,822The appropriateLincoln issuing companyAdditional incomeProtected income(GIB)*Additional income(over GIB)*Annualincome*Nontaxableincome†Deathbenefit 25,000 5,822 30,822 22,500 500,000 27,289 9,097 36,386 22,500 576,69012/03 576,69022.22%12/04 588,0448.57% 28,524 9,508 38,032 22,500 588,04412/05 562,0342.12% 28,524 8,799 37,323 22,500 562,03412/06 572,8758.89% 29,349 9,783 39,132 22,50012/07 559,4834.66% 29,543 9,847 39,390 22,500 559,48312/08 361,011–29.62% 29,543— 29,543 22,500 361,01112/09 408,12522.19% 29,543 1,193 30,736 22,500 408,12512/10 417,83310.32% 29,543 3,130 32,673 22,500 417,83312/11 378,397–1.69% 29,543 1,276 30,819 22,500 378,39712/12 388,49211.30% 29,543 3,526 33,069 22,500 388,49212/13 397,48711.34% 29,543 5,959 35,502 22,500 397,48712/14 368,2921.67% 29,543 5,128 34,671 22,500 368,292Cumulative: 5.53% 375,030 73,0682Total income 448,0983 572,8754 292,5001234Guaranteed lifetime incomeGrowth potentialNontaxable incomeLegacy planningThis table is for illustrative purposes only. Past performance does not guarantee future results. The cumulative returns represent the cumulative annualizedreturn for the illustration period. The annual returns shown reflect the deduction of all applicable contract fees and charges. The assumed Access Period is 20 years.This includes a maximum 1.30% mortality and expense risk charge and administrative fee, and a 1.05% charge for i4LIFE Advantage GIB. There are also investmentmanagement fees and expenses as well as a 12b-1 distribution fee. It does not reflect any state premium tax deducted upon surrender. Specific fees and expenses can befound in the prospectus.At certain broker-dealers, annuitization for nonqualified and standalone qualified contracts must occur by the annuitant’s age 95.*Income available for the subsequent year. In some states payment may be slightly lower due to payout rates.†Nontaxable amount applies if investment is nonqualified.13

Income and flexibilitywith i4LIFE Advantage GIBThe way you take income can affect the amount you pay in taxes. With i4LIFE, if you’ve invested with nonqualified money,you can save a portion of your income from taxes.Our patented distribution methodWhen it’s time for income, Lincoln variable annuities offer a patented income distribution method, i4LIFE Advantage GIB,which is available for an additional charge. You can either elect i4LIFE directly or transition from Lincoln Lifetime IncomeSMAdvantage 2.0.Tax-efficient income — For nonqualified contracts, i4LIFE offers tax advantages through an exclusionratio. Each i4LIFE payment returns a portion of the original investment (or cost basis) together with aportion of the gains, reducing the overall tax burden.Systematic withdrawalsIf there are gains inthe contract, systematicwithdrawals start withfully taxable gains beingpaid out first, resultingin less current income.Gainsi4LIFE Advantage paymentsGainsPrincipalPrincipalIf there are gains inthe contract, i4LIFEincludes a portion of thenontaxable principal alongwith the gains in eachpayment — saving youmoney in taxes.For systematic withdrawals, if there are no gains, all withdrawals are considered principal and are not taxed. Fori4LIFE, if the contract experiences no gains or is down, a portion of your payment is treated as a taxable gain anda portion is treated as principal. Once the principal has been paid out, each payment is fully taxable.Control and flexibility — Control of investment options and access to account value continue throughthe Access Period.1 Additional withdrawals receive favorable tax treatment because a portion of eachwithdrawal is excludible from taxes as long as there is cost basis remaining in the contract.21Y ou choose the length of the Access Period. The minimum Access Period with the GIB is the greater of 20 years or until age 90 (15 years or age 85 if waiting at least five yearsafter electing Lincoln Lifetime Income SM Advantage 2.0). You may also extend it further, up to age 115 (100 for qualified contracts). Additional withdrawals reduce the cost basis,account value, death benefit, GIB amount and future income payments proportionately. After the Access Period ends, payments will continue on a lifetime basis, but you will nolonger have access to your assets or a death benefit.Additional withdrawals are subject to ordinary income tax to the extent of the gain. Withdrawals will reduce the account value, death benefit, GIB amount and income paymentsproportionally.2 14

i4LIFE Advantage GIBComparing taxable incomeWhen it’s time to convert accumulated retirement savings into a reliable stream of income, consider not onlyyour retirement income strategy but also your tax strategy. This case study illustrates how taxation can impacttwo different income strategies.Case study: A 60-year-old male invested 500,000 in a variable annuity with no living benefit elected. Over10 years, his annuity grew to 800,000. He is now ready to draw income from his retirement savings. He hastwo options: systematic withdrawals or income from i4LIFE Advantage.The table below compares the taxable income of the initial guaranteed i4LIFE payment against the taxable incomeof a typical systematic withdrawal. Four tax brackets are shown for comparative purposes. The initial i4LIFE paymentis based on age and amount of the initial investment. Future i4LIFE payments will vary based on performance of theinvestment options chosen in the product.Age70707070 800,000 800,000 800,000 800,00028%33%35%39.6%5% systematic withdrawals 40,000 40,000 40,000 40,0005% withdrawals after taxes 28,800 26,800 26,000 24,1606.16%6.16%6.16%6.16%i4LIFE withdrawal amount 49,316 49,316 49,316 49,316Nontaxable percentage*45.62%45.62%45.62%45.62%Nontaxable amount 22,500 22,500 22,500 22,500Taxable amount 26,816 26,816 26,816 26,816Total tax paid 7,508 8,849 9,386 10,619i4LIFE after tax 41,808 40,467 39,930 38,69745%51%54%60%Account valueTax ratei4LIFE withdrawal percentagePercentage increase with i4LIFEThe nontaxable return of the principal portion of your payment increases with the age you starttaking income, giving you a greater percentage increase with i4LIFE when compared to typicalsystematic withdrawals. This is shown in the “Percentage increase with i4LIFE” row.*Excludable amount determined by IRS.This table is for illustrative purposes only. Past performance does not guarantee future results.The initial payments shown reflect the deduction of all applicable contract fees and charges. This includes a maximum 1.30% mortality and expense risk chargeand administrative fee, and a 1.05% charge for i4LIFE Advantage GIB. There are also investment management fees and expenses as well as a 12b-1 distributionfee. It does not reflect any state premium tax deducted upon surrender. Specific fees and expenses can be found in the prospectus.15

The Lincoln Risk Managed StrategiesThe Lincoln Risk Managed Strategies seek to deliver long-term appreciation over afull market cycle while stabilizing volatility. A stock market cycle is a time period thatencompasses a full range of environments, from a bull (rising) market to a bear (falling)market and back again. The available risk-managed strategies include both the LVIPManaged Volatility Funds and the LVIP Managed Risk Funds.The strategies are designed to stabilize volatility in all market environments through acombination of asset allocation and ongoing volatility management. In periods of highvolatility, the strategies reduce the portfolio’s exposure to equities to lessen the impactof potential bear markets without adjusting the actual portfolio allocation. In periods oflow volatility, equity exposure can increase — giving you the potential to participate inrising markets.Strategy strengths Enables diversification across equities and fixed income Designed to manage the volatility of the portfolio Lower equity exposure during periods of high volatility Seeks more consistent returns over a full market cycleStrategy limitations May not protect against sudden market shocks or during smallmarket pullbacks May not capture all of the upside of a prolonged equity rallyNeither asset allocation nor diversification can ensure a profit or protect against loss.The risk-managed strategies are not guaranteed, may not perform as expected, and contractowners may experience loss.16

LVIP Managed Volatility FundsSelect from the investment choices below to build your own portfolio. Investment restrictions apply, and you must invest a maximum of 80%into equity and a minimum of 20% into fixed income options unless you select one of the 100% asset allocation options. Lincoln InvestmentAdvisors Corporation serves as the investment adviser to the LVIP Managed Volatility Funds.Equity optionsU.S.International/globalLarge cap LVIPBlackRock Equity Dividend Managed Volatility FundL VIP ClearBridge Variable Appreciation ManagedVolatility Fund L VIP ClearBridge Large Cap Managed Volatility Fund L VIP Dimensional U.S. Core Equity 2 ManagedVolatility Fund* L VIP Franklin Mutual Shares VIP Managed Volatility Fund L VIP Invesco Diversified Equity-Income ManagedVolatility Fund* L VIP Invesco V.I. Comstock Managed Volatility Fund L VIP SSgA Large Cap Managed Volatility Fund L VIP UBS Large Cap Growth Managed Volatility Fund L VIP VIP Contrafund Managed Volatility Portfolio L VIP American Century VP Mid Cap Value ManagedVolatility Fund L VIP BlackRock U.S. Opportunities ManagedVolatility Fund L VIP Ivy Mid Cap Growth Managed Volatility Fund L VIP JPMorgan Mid Cap Value Managed Volatility Fund L VIP VIP Mid Cap Managed Volatility Portfolio* L VIP Dimensional International Core Equity ManagedVolatility Fund* L VIP MFS International Growth Managed Volatility Fund L VIP Multi-Manager Global Equity ManagedVolatility Fund* L VIP SSgA International Managed Volatility Fund L VIP Templeton Growth Managed Volatility Fund80% 1L VIP BlackRock Emerging Markets ManagedVolatility Fund (up to 10% can be invested into this fund)Mid cap Small cap L VIP SSgA Small-Cap Managed Volatility FundAssetallocationoptions L VIP BlackRock Global Allocation V.I. Managed Volatility Fund*L VIP SSgA Global Tactical Allocation Managed Volatility Fund*Fixed incomeoptionsHigh quality Short duration100%or 80% 1Medium/low quality elaware VIP Limited-Term Diversified Income SeriesDL VIP Delaware Diversified Floating Rate Fund L VIP PIMCO Low Duration Bond Fund Intermediate/long durationL VIP BlackRock Inflation Protected Bond Fund L VIP Delaware Bond Fund L VIP Dimensional/Vanguard Total Bond Fund* L VIP Global Income Fund L VIP SSgA Bond Index Fund Each fund has been assigned to a style box by Lincoln based on its investment focusand portfolio composition. The funds’ portfolios are subject to change and may notalways reflect the characteristics of their assigned box.Market cap: Large-cap companies (L) have a market capitalization ranging fromgreater than 5 billion to greater than 9.1 billion, depending on fund managerinvestment classifications. Mid-cap companies (M) have a market capitalizationranging from between 1– 5 billion to between 1.3– 9.1 billion, depending onfund manager investment classifications. Small-cap companies (S) have a marketcapitalization ranging from less than 1 billion to less than 1.3 billion, dependingon fund manager investment classifications.Duration: Short-range maturity (S) is up to 3.5 years. Intermediate-range maturity (I)is 3.5 years to 6 years

occurs. Withdrawals in excess of the guaranteed annual income amount will adversely impact lifetime income. Investment requirements apply. Prepare for tomorrow Lincoln Lifetime Income Advantage 2.0 age bands Guaranteed annual income Single Joint Age % Age % 55 - 59½ 3.50% 55 - 59½ 3.50% 59½ - 64 4.00% 59½ - 64 4.00% 65 5.00% 65 .