Transcription

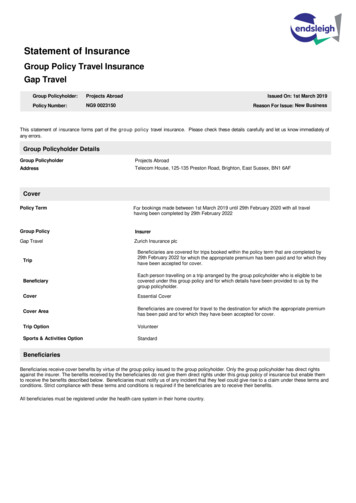

Statement of InsuranceGroup Policy Travel InsuranceGap TravelGroup Policyholder:Projects AbroadPolicy Number:NG9 0023150Issued On: 1st March 2019Reason For Issue: New BusinessThis statement of insurance forms part of the group policy travel insurance. Please check these details carefully and let us know immediately ofany errors.Group Policyholder DetailsGroup PolicyholderProjects AbroadAddressTelecom House, 125-135 Preston Road, Brighton, East Sussex, BN1 6AFCoverPolicy TermFor bookings made between 1st March 2019 until 29th February 2020 with all travelhaving been completed by 29th February 2022Group PolicyInsurerGap TravelZurich Insurance plcTripBeneficiaries are covered for trips booked within the policy term that are completed by29th February 2022 for which the appropriate premium has been paid and for which theyhave been accepted for cover.BeneficiaryEach person travelling on a trip arranged by the group policyholder who is eligible to becovered under this group policy and for which details have been provided to us by thegroup policyholder.CoverEssential CoverCover AreaBeneficiaries are covered for travel to the destination for which the appropriate premiumhas been paid and for which they have been accepted for cover.Trip OptionVolunteerSports & Activities OptionStandardBeneficiariesBeneficiaries receive cover benefits by virtue of the group policy issued to the group policyholder. Only the group policyholder has direct rightsagainst the insurer. The benefits received by the beneficiaries do not give them direct rights under this group policy of insurance but enable themto receive the benefits described below. Beneficiaries must notify us of any incident that they feel could give rise to a claim under these terms andconditions. Strict compliance with these terms and conditions is required if the beneficiaries are to receive their benefits.All beneficiaries must be registered under the health care system in their home country.

Cover - More DetailsTable of BenefitsThe following table is a summary of cover only and the group policy is subject to terms, conditions, limits and exclusions. Please refer to the applicablesections of the group policy wording. The benefits set out below are the maximum amount we will pay under each section per beneficiary per tripunless otherwise noted in the group policy wording.SectionEssential Benefits1Cancellation or curtailment charges2Emergency medical & other expensesExcursionsEmergency dental treatmentSearch and rescue3Hospital benefit4Personal accident5Excess 2,000 100 250 2,000,000 250 200no cover-no cover 0i. Death benefit (aged under 16) 1,000Death benefit (aged 16 to 64) 15,000Death benefit (aged 65 and over) 1,000ii. Loss of limbs or sight (aged under 65) 15,000iii. Permanent total disablement (aged under 65) 15,000BaggageBaggage (Including valuables)a) Single article, pair or set limitb) Valuables limit in totalBaggage delay6Maximum Amount 2,000 500no coverPersonal money, passport & documents1. a) Currency, notes and coins 100 200b) Currency, notes and coins (aged under 16) 50c) Other personal money and documents 2002. Passport or visa 100 500 2507Personal liability 1,000,000 1008Delayed departureno cover-9Missed departure 250 10010Hijack and hostageno cover-11Catastrophes and natural disastersno cover-12Air rageno cover-13Incarcerationno cover-14Overseas legal expenses & assistance 10,000 0Aggregate limit15Extended kennel and/or cattery fees 10,000no cover 0Endsleigh Insurance Services Limited is authorised and regulated by the Financial Conduct Authority. This can be checked on the Financial Services Register by visiting their website at https://register.fca.org.uk/. EndsleighInsurance Services Limited. Company No. 856706 registered in England at Shurdington Road, Cheltenham Spa, Gloucestershire GL51 4UE

Sports and activities coveredPlease refer to the general exclusions in the group policy wording with reference to participation in or practice of sports and activities.No cover under section 7 – Personal liability for pursuit of any business, trade, profession or occupation.The following list details the sports and activities that this group policy will cover in addition to those listed in the group policy wording.Supplementary sports and activitiesPlease note that cover under section 7 – Personal liability is excluded where a beneficiary is participating in any sport or activity marked with *. abseiling activity centre holidaysathleticsbungee jumping (within professional organiser’s guidelinesand wearing appropriate safety equipment)canoeing (up to grade 3 rivers)* casual work (including manual work)cycle touring (wearing a helmet)farm holidaysfootball (amateur only and main purpose of the trip)frisbeehockey (field only)ice skatingkayaking (up to grade 3 rivers)lacrossemarathon / triathlon* moped riding (wearing a crash helmet and maximum 50cc)* motorcycle casual riding (wearing a crash helmet andmaximum 50cc)outward-boundparasailing (behind a boat)parascending (behind motorised vehicle)power boating (as a passenger)regular sportsrugbysailboardingscrambling scuba diving to max depth 30 metres below sea level - ifappropriate PADI or BSAC qualified or other divingrecognised International Authoritative or Affiliate qualifiedand provided you are diving under the direction and/orinstruction of an accredited/qualified instructor.The Beneficiary will not be covered under this policy if theytravel by air within 24 hours of participating in scuba diving. scuba diving - If appropriate PADI or BSAC qualified or otherdiving recognised International Authoritative or Affiliatequalified and without the direction and/or instruction of anaccredited/qualified instructor, depth limited to: - PADI Open Water to max depth 18 metres below sea levelonly.- PADI Advanced Open Water to max depth 30 metres belowsea level only.- BSAC Ocean Diver to max depth 20 metres below sea levelonly.- BSAC Sports Diver to max depth 20 metres below sea levelonly.- BSAC Dive Leader to max depth 30 metres below sea levelonly.- Maximum depth of any other recognised divingqualification.The Beneficiary will not be covered under this policy if theytravel by air within 24 hours of participating in scuba diving.skin divingsolo sailing (inshore waters)trekking up to 5,400 metres altitudeweightliftingwhite water rafting up to level 4 (within organisers guidelines)yachting (in territorial waters)zip climbingzip wiringVolunteer sports and activitiesThe volunteer trip option has been selected:All volunteering work must be organised by a professional organisation operating from the United Kingdom offering support and advice to theBeneficiary. Please note that cover under section 7 - Personal liability is excluded for each of these activities.caring / nursing (excluding the administering of drugs or medicine), classroom teacher, child care, counselling or mentoring youngsters, farm work(but not including the use of plant or power tools and machinery), field work, fruit or vegetable picking, general classroom duties, manual work (butnot including the use of plant or power tools and machinery), orphanage work (excluding the administering of drugs or medicine), occasional lightmanual work (but not including the use of plant or power tools and machinery), ranch work (but not including the use of plant or power tools andmachinery), retail trade including manual work (but not including the use of plant or power tools and machinery), sports coach (general sportsincluding: football, netball, athletics, basketball, swimming, cricket, volleyball, rugby, tennis), superintendence of manual work, supervisedconstruction duties (but not including the use of plant or power tools, and machinery), working with animals and wildlife (excluding hunting and directcontact with snakes, crocodiles, alligators, sharks, hippos, elephants and lions) under the constant supervision of the conservation staff in acontrolled environment and working within the guidelines of the organisation that the beneficiary is working with.Group Policy EndorsementsDetails of the changes to the group policy are shown below. The sections shown replace or change those of the same name in the group policywording, statement of insurance or any previously issued endorsements. This should be read in conjunction with the group policy.Top Up CoverThere is an additional premium for this endorsement and cover is only applicable if the appropriate premium has been paid.a. Section 5 – Baggagea) the single article limit; andb) the valuables limitare each increased to 1,000 in respect of the Beneficiary’s computers and computer equipment (including iPads, tablets, PDAs, personal organisers,laptops, notebooks, netbooks and the like) provided that the total for all Valuables does not exceed 1,000.Any conditions, limitations and exclusions under Section 5 – Baggage apply to this endorsement.b. Excess – any excess amount stated in the table of benefits is reduced to 50 which will be the first amount of each and every claim that eachBeneficiary will be responsible for paying under each section for which an excess applies.General conditions and general exclusions apply to the whole of the group policy and all levels of cover.Endsleigh Insurance Services Limited is authorised and regulated by the Financial Conduct Authority. This can be checked on the Financial Services Register by visiting their website at https://register.fca.org.uk/. EndsleighInsurance Services Limited. Company No. 856706 registered in England at Shurdington Road, Cheltenham Spa, Gloucestershire GL51 4UE

ObligationsIt is important that the group policyholder checks that the information given in the statement of insurance is, to the best of their knowledge and belief,complete and correct as this forms the basis of the insurance contract.Each beneficiary must tell the group policyholder immediately on finding that any information in relation to their cover under this group policy haschanged. The group policyholder must tell us immediately if at any time any of the information is incorrect or changes. Failure to do so may resultin the insurance no longer being valid and claims not being met or not being met in full. If in doubt about any change please contact us as soon aspossible.All beneficiaries should refer to the conditions in the group policy wording for details of how any changes in circumstances may affect their cover under thisinsurance.Excesses And Special Terms And Conditions Applicable To The Whole Group PolicyEach beneficiary is responsible for paying the first amount of each and every claim under each section for which an excess applies. The standardexcesses payable in the event of a claim are shown in the table of benefits.Declarations MadeThe group policyholder declares that to the best of their knowledge all the information provided in connection with this proposal is correct and complete.Beneficiaries agree to the important conditions in relation to health shown within the group policy wording document.Beneficiaries are:Registered under the health care system in their home countryTravelling from and returning to their home countryHow To Report An Incident Or Make A ClaimYour claim will be handled by your insurer, Endsleigh or other agents acting on behalf of your insurer.Travel Insurance 44(0) 1202 038 946Mon-Fri: 8am to 8pmwww.endsleigh.co.uk/claim-centreSat: 8am to 4pmMedical Assistance 44(0) 1243 621 05824 hoursLegal Expenses 44(0) 1179 045 831Mon-Fri: 9am to 5pmEndsleigh Insurance Services Limited is authorised and regulated by the Financial Conduct Authority. This can be checked on the Financial Services Register by visiting their website at https://register.fca.org.uk/. EndsleighInsurance Services Limited. Company No. 856706 registered in England at Shurdington Road, Cheltenham Spa, Gloucestershire GL51 4UE

How To Make A ComplaintIf the group policyholder and/or a beneficiary wish to make a complaint, in the first instance, please contact the person who originally dealt with theenquiry. They will aim to resolve the complaint on the same day. Alternatively the group policyholder and/or a beneficiary can contact us:by postCustomer Experience DepartmentEndsleigh Insurance Services Ltd.Shurdington Road,CheltenhamGL51 4UEby phone0800 085 8698If the group policyholder’s and/or beneficiary’s complaint is not resolved to their satisfaction they have the right to ask the Financial OmbudsmanService to review their case if they are any one of the following:1) a consumer;2) a micro-enterprise (employing fewer than 10 persons; with a turnover or annual balance sheet that does not exceed 2 million) at the time thecomplaint is referred to Endsleigh (or its representative such as an AR);3) a charity which has an annual income of less than 1 million at the time the complaint is referred to Endsleigh (or its representative such as anAR);4) a trustee of a trust which has a net asset value of less than 1 million at the time the complaint is referred to Endsleigh;5) a Consumer Buy To Let consumer (where the complaint is about a Consumer Buy to Let Mortgage or service)Contacting the Ombudsman will not affect your rights to take legal action against us.If you do not fall within the categories above and your complaint has not been resolved to your satisfaction, you have the right to take legal actionagainst us.Financial Services Compensation SchemeWe are covered by the Financial Services Compensation Scheme (FSCS). The group policyholder and/or a beneficiary may be entitled tocompensation from the scheme if we cannot meet our obligations. Further information about compensation scheme arrangements can be obtainedfrom the FSCS at www.fscs.org.uk or by contacting the FSCS directly on 0800 678 1100.How To CancelCancellation: It is IMPORTANT to know that there will not be a refund of premium if there has been a claim on this group policy which the insurerwill have to settle. This group policy may be cancelled by the group policyholder sending notice to the address shown on the statement of insurance.In the event of cancellation of this group policy, the group policyholder must notify beneficiaries of such cancellation.Fees and Charges: If the group policyholder wishes to cancel this group policy at any time a charge will be made for any period for which coverapplied, unless a beneficiary has travelled or a claim or an incident likely to give rise to a claim has occurred, in which case no refund will be due.We will also charge a cancellation fee of 20.00.Endsleigh Insurance Services Limited is authorised and regulated by the Financial Conduct Authority. This can be checked on the Financial Services Register by visiting their website at https://register.fca.org.uk/. EndsleighInsurance Services Limited. Company No. 856706 registered in England at Shurdington Road, Cheltenham Spa, Gloucestershire GL51 4UE

Status DisclosureAbout The InsurersZurich Insurance plc *FCA Register No: 203093Zurich House, Ballsbridge Park, Dublin 4, IrelandZurich Insurance plc, is authorised by the Central Bank of Ireland and authorised and subject to limited regulation by the Financial ConductAuthority. Details about the extent of our regulation by the Financial Conduct Authority are available from us on request.The group policyholder’s rights under the Financial Services Compensation Scheme are not affected by this.* Endsleigh has a risk transfer agreement with these insurers and the following statement applies: When you send us your premium monies ("money"), we will hold it, owing to the insurer listedas an agent for that insurer. Endsleigh will hold monies ("money") paid by the insurer for cancellations, owing to you, as an agent for that insurer.About Our ServicesEndsleigh Insurance Services Limited is an insurance intermediary acting on behalf of the insurer. We are authorised and regulated by the FinancialConduct Authority. Our Financial Services Register number is 304295. You can check this on the Financial Services Register by visiting the FCA'sweb site https://fca.org.uk/register. Our principal place of business is at Shurdington Road, Cheltenham, GL51 4UE. Endsleigh Insurance ServicesLimited is owned by Endsleigh Limited which is a member of the A-Plan group of companies. National Union of Students (United Kingdom) also hasan interest in Endsleigh Limited.This insurance meets the demands and needs of those persons travelling away from home. By purchasing this policy you confirm that this is a fairdescription of your insurance demands and needs.Any information we provide to the group policyholder does not constitute advice or a personal recommendation and the group policyholder agreesto make their own choice about how to proceed. We may ask questions to narrow down the selection of products that we will provide informationon. We only offer group policy travel insurance products from a single insurer, Zurich Insurance plc.When we sell you a policy we retain a percentage commission from the total annual premium. If the type of policy we sell reaches specific profittargets the insurer also pays us an additional amount.It's important the information we have is correct as inaccurate information may result in an increased premium, you not being covered or a claim notbeing paid in full.The parties to a contract of insurance covering a risk situated in the United Kingdom are permitted to choose the law applicable to the contract. Thisgroup travel insurance policy is governed by English law. English law will also apply prior to the conclusion of the group policyholder’s contract ofinsurance.Endsleigh Insurance Services Limited is authorised and regulated by the Financial Conduct Authority. This can be checked on the Financial Services Register by visiting their website at https://register.fca.org.uk/. EndsleighInsurance Services Limited. Company No. 856706 registered in England at Shurdington Road, Cheltenham Spa, Gloucestershire GL51 4UE

Gap Year Travel EssentialInsurance Product Information DocumentEndsleigh Insurance Services Limited (firm ref: 304295) is authorised and regulated bythe Financial Conduct Authority. Registered in England at Shurdington Road, CheltenhamSpa, Gloucestershire. GL51 4UEThis document provides a summary of the key information relating to your insurance policy. Complete pre-contractual andcontractual information for the product is provided in the full policy documentation.This summary does not form part of your contract of insurance and is for information only.What is this type of insurance?This insurance meets the demands and needs of persons travelling away from home.What is insured?Cancelling or cutting short a tripWe will pay you up to 2,000 for unused andirrecoverable costs if you have to cancel or cut shortyour trip as a result of an insured eventMedical emergency and other expensesShould you be injured or become unwell whilst on atrip, we will pay up to 2,000,000 for your hospital,ambulance and medical repatriation costs, includingup to 200 for emergency dental treatmentBaggageWe will cover you if your personal belongings are lost,damaged or stolen up to 2,000 per person. Thefollowing limits also apply: Up to 500 for any one article Up to 500 for the total for all valuablesPersonal money and passportWe will cover you if your personal money is lost,damaged or stolen. The following limits apply: Up to 200 for cash Up to 50 for cash if under the age of 16 Up to 200 for all other personal money anddocumentsWe will also pay up to 250 for additionalaccommodation and transport costs to obtain areplacement passport if yours is lost, stolen ordamagedMissed DepartureWe will pay your additional transport costs up to 250if you miss your public transport from or to your homecountry as a result of an insured eventWhat is not insured?The excess for each claim made by each personunder each cover section where an excess is payableLoss or theft of baggage or valuables which have beenleft unattended or in the care of a carrierAny event which you were aware of at the time oftaking this insurance or booking your trip that couldgive rise to a claimAny trip which has already begun when you take outthis insuranceAny pre-existing medical condition relating to anyreason set out under ‘Important conditions relating tohealth’ in your policy bookletAny optional additional cover unless the appropriateadditional premium has been paidParticipation in any professional sports orentertainmentThere is no cover for manual work unless listed withinthe policy document as acceptableYour travel to any country or specified area or eventwhen the Foreign and Commonwealth Office or theWorld Health Organisation has advised against travelYour own unlawful action or any criminal proceedingsagainst youYour inability to travel due to your failure to hold, obtainor produce a valid passport or any required visa intime for the booked tripAny claims arising from the use of drugs (other thanprescribed treatments), drinking too much alcohol oralcohol abuseAny amount recoverable from any other source suchas your airline, accommodation provider, ATOL bondor debit/credit card providerAre there any restrictions oncover?This cover is only available to those who are registeredwith a GP in their home countryThis policy is not available to anyone aged 66 or over atthe time of departure

Where am I covered?You are covered for travel to the destination for which the appropriate premium has been paid and for which you havebeen accepted for cover provided you are not travelling against the advice of the Foreign and Commonwealth Office orthe World Health OrganisationWhat are my obligations? Please take a few minutes to check all the details you have provided are correctYou should disclose any information or fact which is likely to affect the acceptance of this insuranceIf you are in doubt whether the information will affect the acceptance of this risk you should disclose it anywayIf you fail to disclose information or knowingly give false information all cover under this policy may be cancelledIf any details change after purchase of this insurance please contact usYou must take reasonable steps to prevent loss, theft or damage to your propertyYou must not travel against the advice of a medical practitioner or your public transport providerYou must not travel with the intention of receiving medical treatmentYou must take all reasonable precautions and practical steps to avoid injury, illness or diseaseIn the event of a serious illness or accident which may lead to inpatient treatment you must contact the EmergencyAssistance Services who will then assist youIf you need to make a claim on your policy, you must provide us with the evidence needed to substantiate your lossWhen and how do I pay?Payment can be made by debit or credit card. Full payment is required at the time of taking the insurance.When does the cover start and end?Cover for cancellation starts as soon as you have paid for the policy. All other cover starts when you leave your home tobegin your trip. The policy ceases at the end of the declared period of insurance or when you return home, whichever isthe earlier.How do I cancel the contract?You can cancel your policy by contacting the Group Policyholder at the address shown on your statement of insurance.

.Endsleigh Insurance Services Limited is authorised and regulated by the Financial Conduct AuthorityThis can be checked on the Financial Services Register by visiting their website at https://register.fca.org.ukEndsleigh Insurance Services Limited, Company No. 856706 registered in England at Shurdington Road, Cheltenham Spa, Gloucestershire GL51 4UENG9 0023150

This Group Policy travel insurance has been arranged by Endsleigh onbehalf of the Group Policyholder for the benefit of the GroupPolicyholder and the Beneficiaries. It contains details of the cover,conditions and exclusions applicable and is the basis on which all claimswill be settled.In return for having accepted the premium We will provide cover to theGroup Policyholder and Beneficiaries in accordance with the operativesections of this Group Policy as referred to in the Statement ofInsurance.The Statement of Insurance issued together with this Group Policywording and any endorsements, shows which benefits the GroupPolicyholder has chosen, who is covered under this Group Policy andwhen and where cover applies. The Group Policyholder and theBeneficiaries should take the time to read this Group Policy carefully toensure that it meets their needs.This Group Policy wording, the Statement of Insurance and anyendorsements all form part of the Group Policy. This is a contractbetween the Group Policyholder and Us. The Group Policy and allcommunications before and during the Policy Term will be provided inEnglish.ResidencyThis policy is only available to the Beneficiary if the Beneficiary isregistered under the health care system in their Home Country.The Law applicable to this policyWe and the Group Policyholder are free to choose the laws applicable tothis Group Policy. We propose to apply the laws of England and Walesand by purchasing this Group Policy the Group Policyholder has agreedto this.Age eligibilityCover under this Group Policy is not available to any Beneficiary aged66 or over at the time of departure. Some benefits and Excess may besubject to age limitations as stated in the Statement of Insurance.Group Policy excessUnder most sections of this Group Policy, claims will be subject to anExcess. This means that each Beneficiary will be responsible for payingthe first part of each and every claim under each section for which anExcess applies.Group Policy information or adviceThe Group Policyholder must give a copy of this Group Policy wording,Statement of Insurance and any endorsements to each Beneficiary at the timethey are accepted for cover under this Group Policy. If the Group Policyholderwould like more information or feel that this insurance may not meet their needs,please contact your Endsleigh representative.If you are a traveller covered under this Group Policy (a Beneficiary), and wouldlike more information or feel that this insurance may not meet your needs, contactthe Group Policyholder at the address shown in the Statement of Insurance.The InsurerThis Group Policy is underwritten by Zurich Insurance plc, which is authorisedby the Central Bank of Ireland and authorised and subject to limited regulation bythe Financial Conduct Authority. Details about the extent of Our authorisation bythe Financial Conduct Authority are available from Us on request. Our FCAFirm Reference Number is 203093Data ProtectionEndsleigh is committed to being transparent about how we handle your data andprotect your privacy. Full details can be found within our privacy policy atwww.endsleigh.co.uk/privacy.1

IntroductionDefinitionsGeneral conditions applicable to the whole policyClaims conditionsImportant conditions relating to healthGeneral exclusions applicable to all sections of the policySports and activities coveredEmergency and medical serviceReciprocal health agreementsEU, EEA or SwitzerlandAustraliaGroup Policy coverSection 1 - Cancellation or curtailment chargesSection 2 – Emergency medical and other expensesSection 3 – Hospital benefitSection 4 – Personal accidentSection 5 - BaggageSection 6 – Personal money, passport and documentsSection 7 – Personal liabilitySection 8 – Delayed departureSection 9 – Missed ction 10 – Hijack and hostageSection 11 – Catastrophes and natural disastersSection 12 – Air rageSection 13 - IncarcerationSection 14 – Overseas legal expenses and assistanceSection 15 – Extended kennel and/or cattery feesSection 16 – Ski equipmentSection 17 – Hire of ski equipmentSection 18 – Ski packSection 19 – Piste closureSection 20 – Avalanche coverComplaints procedure282930313234353637383940

Any word or expression to which a specific meaning has been attached will bear the same meaning throughout this Group Policy. For ease of reading thedefinitions are highlighted by the use of bold print and will start with a capital letter.Baggage – means luggage, clothing, personal effects, Valuables and other articles which belong to the Beneficiary (or for which the Beneficiary is legallyresponsible) which are worn, used or carried by the Beneficiary during any Trip but excluding Personal Money and documents of any kind.Beneficiary/Beneficiaries –means each person travelling on a Trip arranged by the Group Policyholder who is eligible to be covered under this GroupPolicy and for which details have been provided to Us by the Group Policyholder. A Beneficiary is not party to this contract which is solely between theGroup Policyholder and Us.Bodily Injury – means an identifiable physical injury sustained by the Beneficiary caused by sudden, unexpected, external and visible means. Injury as aresult of the Beneficiary’s unavoidable exposure to the elements shall be deemed to have been caused by Bodily Injury.Close Business Associate – means any person whose absence from business for one or more complete days at the same time as the Beneficiary’s absenceprevents the proper continuation of that business.Close Relative – means mother, father, sister, brother, wife, husband, daughter, son, grandparent, grandchild, parent-in-law, son-in-law, daughter-in-law,sister-in-law, brother-in-law, step parent, step child, step sister, step brother, foster child, legal guardian, partner, civil partner or fiancé/fiancée or aunt/uncle.Curtailment/Curtail – means either:a) abandoning or cutting short the Trip by immediate return to the Beneficiary’s Home Country, in which case claims will be calculated from the day theBeneficiary returned to their Home Country and based on the number of complete days of the Beneficiary’s Trip they have not used, orb) by attending a hospital abroad as an in

Sports & Activities Option Standard Beneficiaries Beneficiaries receive cover benefits by virtue of the group policy issued to the group policyholder. Only the group policyholder has direct rights against the insurer. The benefits received by the beneficiaries do not give them direct rights under this group policy of insurance but enable them