Transcription

December 2009/January 2010 Volume 6 Issue 6A newNHLSalary ModelThe manyStages of RiskFind out which stage of riskwe are inDoors of OpportunityStrengthening ERM footholds innonfinancial industries

An Enterprising Approach to Risk.Learn more about the CERA credential atwww.ceranalyst.org/The Actuary

24The Actuary is published bi-monthly (February,April, June, August, October, December) by theSociety of Actuaries, 475 N. Martingale Rd., Suite600, Schaumburg, IL 60173-2226. Periodicals postage paid at Schaumburg, IL, and additional mailingoffices. USPS #022-627.This publication is provided for informationaland educational purposes only. The Society ofActuaries makes no representation or guaranteewith regard to its content, and disclaims anyresponsibility or liability in connection with theuse or misuse of any information provided herein. This publication should not be construed asprofessional or financial advice. Statements offact and opinions expressed herein are those ofthe individual authors and are not necessarilythose of the Society of Actuaries or its officers,directors, staff or representatives. The Society ofActuaries does not endorse or make any guarantee with regard to any products, services orprocedures mentioned or advertised herein.The Actuary is free to members of the Society ofActuaries. Nonmember subscriptions: students, 23; others, 43. Please send subscription requeststo: Society of Actuaries, P.O. Box 95668, Chicago,IL 60694.The Actuary welcomes both solicited and unsolicited submissions. The editors reserve the right toaccept, reject or request changes to solicited andunsolicited submissions, as well as edit articlesfor length, basic syntax, grammar, spelling andpunctuation. The Actuary is copyedited according to Associated Press (AP) style.For more information about submitting an article, please contact Sam Phillips, associate editor,at (847) 706-3521, sphillips@soa.org or Societyof Actuaries, 475 N. Martingale Rd., Suite 600,Schaumburg, IL 60173-2226. 2009 Society of Actuaries. All rights reserved.No part of this publication may be reproduced inany form without the express written permissionof the Society of Actuaries.POSTMASTER: Send address changesto the SOA, c/o CommunicationsDepartment, 475 N. Martingale Rd., Suite600, Schaumburg, IL 60173-2226.XX%Cert no. XXX-XXX-XXXXContributing EditorsSteven W. Easson, FSAsteve.easson@rbc.comRonald Poon-Affat, FSArpoonaffat@munichre.comSusan M. Reitz, FSAsmreitz@illinoismutual.comMax Rudolph, FSAmax.rudolph@rudolphfinancialconsulting.comSudha Shenoy, FSAshenoys@aetna.comCover Story1818 A new NHL Salary modelRead about a new and interestingmethod of using actuarial skills todetermine NHL players’ salaries.Luc BerlinguetteFeatures14 The Many Stages of riskHere’s an explanation of thedifferent stages of risk.Dave IngramTyree Wooldridge, FSAty.wooldridge@genworth.comSOA PresidentMike McLaughlin, FSAmmclaughlin@soa.orgSociety Staff ContactsLisamarie LukasDirector of Communicationsllukas@soa.org24 Doors of opportunityerm in the broadereconomic sectorThe final installment of a series onthe evolution of risk management.Robert Wolf14Karen PerryPublications Managerkperry@soa.orgJacque KirkwoodSenior Communications Associatejkirkwood@soa.orgSam PhillipsCommunications Associatesphillips@soa.orgDepartments7 Editorial8 Letter From ThePresidentErin PierceGraphic Designerepierce@soa.org11 Book ReviewDecember 2009/January 201032 The SOA at Workissue of The Actuary13 Society of Actuaries30 Interview

EditorialThrough TheSilence And NoiseSue ReitzBy Sue ReitzThose of you who are parents know this isReally, I mean it. We tend to focus on the fail-of any of the actuarial issues of the time. I wastrue. Kids rarely tell you what you want to knowures of communication, the times when it leadsdisappointed, but did enjoy the forum as a placewhen you want to know it. There are times, ofto conflict or misguided actions. But think aboutto hang out and socialize.course, when it works out, when they tell youthe number of times each day when you eithermeaningful things: all the stuff that made todaygive or receive information and realize that theOver the years, through lack of time, I’vea great day, or their fears about a friendshipvast majority of the time we manage to do itbecome more of a bystander than a participant,that seems to be falling apart, or their opinions“good enough.”in the online actuarial community. However, I’dstill like to make an observation.about god, politics or the Green Bay Packers.But that really doesn’t happen as often as mostMost remarkably, we keep inventing new waysof us would like. When you want to hear aboutto share information with each other. Face-Discussion forums may not be a perfect com-their day, they’ll tell you it was “fine” and thento-face communication just isn’t enough formunication medium—I can understand the res-they’ll wander off. When you want to relax withhumanity. Starting with the invention of theervations of those who are unwilling to spenda glass of wine and a good book, they wantalphabet and going on through the printingtime there. But what I’m seeing is that mixed inyou to listen to a play-by-play analysis of thepress, the newspaper, the telegraph, the tele-amongst the silence of the nonparticipants andvideo game they just finished playing. Whenphone, the radio, the television, the Internet andthe noise of the participants we’re seeing mean-you desperately want to know if their weekendtext messaging we keep coming up with faster,ingful discussions on the issues, challenges andplans include anything unsupervised or illegal,more efficient ways of adding complexity to theopportunities facing our profession. Athey’re desperately trying to convince you thatwhole communication cycle.the friend’s parents you can’t seem to get holdSue Reitz, FSA, MAAA, is assistant vice president forof really will be around to monitor some cookieI remember, years ago, when I was an actuarialIllinois Mutual Life Insurance Co. She can be contacted atbaking and Bambi videos.student, how eager I was to sign up for the newsmreitz@illinoismutual.com.actuarial forum on CompuServe. I worked at aWhen you think about it, communication isvery small company, so I had high hopes thattricky. It’s hard to believe it’s possible to findthis new medium was going to allow me tomeaningful information among all the silencelearn from and absorb the wisdom of the vastand noise and deception flowing around you.actuarial community. What I found was that theAnd that’s just what we’re getting from our kids.online community was anything but vast andWhen you add on all the other relationships wethat the actuaries who were online seemed toall have in our lives, with their varying levels ofwant to talk about anything except actuarialimportance and closeness and trust, it shouldstuff. There were lengthy discussions on beer,be overwhelming. But we’re social beings and,politics, sports and religion. But there was virtu-actually, we’re quite good at communication.ally no discussion on merits or lack of meritsDecember 2009/January 2010 The Actuary 07

Letter From The PresidentOpportunity is EverywhereBy Mike MclaughlinThe Following is adapted from the acceptance speech Mike McLaughlin, the SOA’s2009 – 2010 president, gave at the 2009 SOAAnnual Meeting.I’d like to begin by thanking Cecil forhis leadership over the past year. He willbe moving on to become president-elect ofthe International Actuarial Association. Cecil,now actuaries worldwide will benefit fromyour wise guidance. We wish you the best.I would also like to welcome Don Segal aspresident-elect of the SOA. Don has servedon our Board for several years, and I look forward to working with him in the year to come.08They sent me commutation tables and formulas, and while coding, I discovered and fixedan error in the formulas that they provided.That impressed my bosses, who suggested Ishould take the actuarial exams if I liked thatkind of work. And that is the short version ofhow I joined the profession.My lovely wife, Mary, encouraged me throughthe long series of exams. She is here today,along with Rachel, one of my two wonderfuldaughters. There is also a strong contingentof actuaries from the Caribbean ActuarialAssociation (CAA) attending this meeting.The CAA has been a great source of supportand friendship for me over the years, and I amvery pleased to see them here in Boston!For those of you who don’t know me, I’ll tellyou a little bit about myself. I was born inJamaica, went to university in Canada, lived inthe Bahamas, and moved to Dallas. I currentlylive in Chicago where I am a principal withDeloitte Consulting. I consider Chicago to bea fantastic city, in spite of the dramatic difference in climates from the Caribbean!OpportunityOver my career, I’ve benefited greatly fromour profession, which brings me to why I’mhere today. I’m here to talk about opportunity. I see opportunity everywhere! Opportunityfor the profession as a whole, and for each ofus as individuals.I learned about the profession while I was abright, young computer programmer at BritishAmerican Insurance Company in Kingston,Jamaica. There was a project in which theactuaries needed premiums and reserves fora new ‘rate book,’ as we called it back then. Iwas the only person at the company who knewFortran programming, so I got the assignment.You’ve all seen the changes taking place in thetraditional markets we serve. In the pensionarea, we are all aware of the shift from definedbenefit to defined contribution plans. This hasspurred us to take a new look at funding retirement in the future. In the life insurance industry, capital is scarce, competition is intense,and actuaries need to be ever more creative. The Actuary December 2009/January 2010Health care in the United States is still underdebate. The focus on health reform is a greatopportunity for actuaries to contribute to thediscussion.In addition, the financial turmoil of the lastyear or so has driven governments, privatesector businesses and institutions to take adeeper look at their financial risks.These are challenges, yes. But these arethe very challenges that we, as actuaries,are equipped to manage. These challengespresent a great opportunity for our profession. In fact, the opportunity is so great,actuaries may be in danger of being overwhelmed by it.Many other professionals are getting involvedin finding risk management solutions—andthey’re doing a good job! We face competition!We are a relatively small profession, withapproximately 48,000 actuaries worldwide,of which there are 21,000 SOA and approximately 5,000 Casualty Actuarial Society(CAS) members. To put our size in perspective, the AICPA, a professional organizationof accountants in the United States, has340,000 members. There are also more than96,000 CFAs, which is an increase of 47 percent in the past five years. Obviously, thesearen’t apples-to-apples comparisons, but youget the idea.The Need For GrowthAs a profession, we need to grow to meet theopportunity. At the same time, there must beno compromise of our rigorous standards. Youmay ask, “If more actuaries are part of the pie,doesn’t that leave a smaller piece for me?” Andothers may say, “Things are good. I have a goodjob. I’m well compensated. Why should wechange anything?” I like to think of the adage,“Growth is the only evidence of life.” I don’tbelieve our opportunities are fixed in size, orstatic in nature. And change is all around us.Our profession can and should grow. The business world needs our training in mathematics,financial economics, model construction andrisk management. I firmly believe our actuarialskills and knowledge are underutilized. Thereare broader uses for these skills outside ourtraditional areas of pensions and insurance.We must expand our influence in broaderfinancial services, work more with other disciplines, and reach across geographic boundaries. There are lessons to be learned from othercountries. In Australia and South Africa, forexample, actuaries are working for banks andasset managers, with financial product pricingand management.We should also look at how we can applyactuarial skills to solve problems in otherareas such as manufacturing, technologyand transportation. For example, you knowhow complex airfares can be—that could bea great area to apply actuarial pricing skills.Technology products, too, require sophisticated pricing and management techniques.If we can demonstrate the value of our skills,employers will require a greater supply ofactuaries to fill those roles.For another example, consider enterprise riskmanagement (ERM). With ERM, our profession has the opportunity—perhaps the duty—to apply our skills much more broadly thanever before. ERM is a logical extension of traditional actuarial methods and training. We willmanage a wider range of risks, and considertheir interactions across an organization inmany scenarios. I believe it is the future of ourprofession. It is important for us now to thinkof ourselves as actuaries and risk managers.How are we as actuaries equipped to be leaders in ERM? With our CERA credential. TheCERA embodies the set of skills employers andclients need to execute enterprise risk management. And this is true for life, health, pensionand property/casualty actuaries. It’s true in theUnited States, in Canada, and around the world.The SOA led the way with the CERA credentialand now actuaries worldwide are recognizingits value. This is a huge endorsement of theSOA’s leadership and ERM for actuaries.Global CERACecil mentioned yesterday that we areworking toward offering the CERA as theglobal ERM credential. This is an ambitiousproject. We’re working with 13 other actuarial organizations.One of the biggest challenges has been figuring out how to maintain consistency acrossborders, while upholding the high quality,consistency and rigor of the credential. A credential that varies by country in these important characteristics is not a global credential.We will have a rigorous quality assuranceprocess. There will be no negative impact. Infact, the global CERA will boost the image ofactuaries as risk managers. Most of the detailshave been addressed, and we’re close tosigning an agreement. Our profession is trulyblazing a trail—I haven’t yet seen anothercredential offered by multiple organizationsworking collaboratively.CollaborationAs I talk to members, one question I hear con-sistently is, “Why do weneed so many actuarialorganizations?” Peoplehave mentioned the ideaof forming one largeactuarial organization. Mike McLaughlinThis isn’t practical. And,in my opinion, isn’t necessary. But rather thanmaintain the status quo, we could reshapehow we manage the profession. I would liketo discuss that for a moment. Let me givesome examples.The SOA and CAS already administer certainexams jointly. We have a profession-wideImage Advisory Group, and we work togetheron the Marketing and Market DevelopmentPlan. We also collaborate with the CasualtyActuarial Society and the Canadian Institute ofActuaries on the Climate Change Committee.But we can do more. We must clearly identifythe mission of the profession as a whole, andthe appropriate role for each organization.Recently we formed the Actuarial CollaborationTask Force, ACTF, composed of the currentpresidents of the five U.S.-based organizations. We have defined roles for each bodymore clearly and will also recommend variousorganizational changes to reduce overlap andmake better use of volunteer resources. Wehave made great strides, and I know we willbe working even better together in the future.The FutureObviously, we can’t discuss the future of theprofession without talking about the FutureEducation Methods (FEM) concept. We knowFEM has been a hot topic among members.I’ve been viewed by some as an FEM supporter. Perhaps that’s because I have beenin favor of exploring the concept. I’ve alsobeen told I’m not a strong supporter becauseI’ve suggested ways to change the concept.December 2009/January 2010 The Actuary 09

Book ReviewLet me say right now, I do not support FEMin its present form. On the other hand, somenew and different ideas have surfaced thatdeserve consideration.The Board had a lively discussion of this,at the meeting that concluded on Sunday.After considering your comments, the Boardhas acknowledged your concerns, and hasdecided not to proceed with FEM in its present form. The Transfer Knowledge StrategicTeam will communicate education strategyto the Joint Steering Committee, which hasbeen asked to identify possible alternatives tomeet our educational goals, without university course exemptions, as currently proposed.We’re asking them to report back to the Boardin February 2010. I will also appoint a taskforce to communicate with our members andemployers specifically on this issue. We haveheard your voices.CommunicationAlthough it has been controversial, onebenefit of the FEM discussion is that it hasemphasized the importance of good member communication. Communicating withmembers has always been of prime importance to the SOA.The Board and SOA staff are looking atseveral ways of obtaining feedback. One ofthe first was the ‘Conversation with the 2010President’ that took place earlier this morning. It was great to have a group of you attendthis discussion.Some other ideas: Our friends at the CAS usea member advisory panel, and I think that’sa great idea worth exploring. We are alsoconsidering more frequent communicationsfrom SOA leadership, and using a blog, orTwitter. I want you to know that you are freeto contact your Board, Section leaders andme with any ideas, comments and suggestions you may have.ConClusionIn conclusion, I look forward to an excitingyear of improved collaboration, growth—including broader influence in ERM—andopportunity for the actuarial profession.Remember that we are actuaries and riskmanagers. We must look outward together, inorder to expand our horizons.I’d like to conclude with a quote from GeneralDouglas MacArthur, who once said, “There isno security on this earth. Only opportunity.”Thank you. AMike McLaughlin, FSA, CERA, MAAA, FIA, is presidentNEWof the SOA. He can be contacted at mmclaughlin@soa.org.Life and AnnuitySympoSiumNew DecaDe. New DirectioNS.may 17-18, 2010m Ar r i o t t tAm pA wAt e r S i d etA m pA, f Lw i t h L i f e A n d A n n u i t y S e m i nA r S o n mAy 1 9 .First there was the Life Spring Meeting.Then there was the Product Development Symposium.Now the SOA is combining these two valuable meetings to bring youthe best of both including:nnBe there. m ay 1 7 , 1 8 aN D 1 9 . ta m pa.more details will be available soon at www.soa.org.nnnTwo full days of offeringsExtended session lengthsIn-depth coverage of important topicsMore networking opportunitiesAn optional third day with seminarsA Comprehensive Guide to Measuring and Managing Life Insurance Company Expensesby Sam Gutterman, FSAReviewed by Douglas C. Borton, FSAPricing methodologies vary by company. Cost-based pricing is intended torecover expected costs plus a profit.Conditions may result in cost overruns,requiring active expense management. Market-based pricing sets the price onthe basis of market conditions. Activeexpense management then determines the level of cost control thatmust be utilized. External constraints such as pricesdictated by regulators may force aninsurer to decide whether or not toparticipate in the market. In other casesrules may limit the use of certainexpense categories in setting rates.Although expense management is a keycontrollable component of life insurancecompany profitability, until now the subjecthas been largely ignored in actuarialliterature. Therefore, this landmark publication fills an important void for actuaries andother professionals involved in designingand administering insurance products.The 450-plus page textbook was publishedby the Society of Actuaries in 2007. It had itsbeginnings with “Expense and Pricing,”which was written in 1997 by Sam Gutterman in response to a call for papers. Overthe next decade the original paper wasexpanded sixfold in size with the assistanceof dedicated volunteer editors includingMike Eckman, FSA; Tim Harris, FSA; TomHerget, FSA; Paul Strong, FSA; and SteveSorrentino, FSA.Although designed primarily as a referencebook, the first five chapters provide avaluable overview for readers who are notfamiliar with the subject or who want tobrush up on their knowledge.Expense management and analysis play arole in a variety of life insurance companyfunctions including measuring performance,establishing benchmarks, communicatingfinancial results, estimating future costs andmaking business decisions.There is no best way to derive expenseassumptions, allocations or projections thatapply in every circumstance. However, theremay be an optimal approach to implementa particular business strategy. Thus, theauthor describes the pros and cons ofvarious techniques.The business of insurance consists ofdeveloping products and services to meetcustomer and policyholder needs,creating an infrastructure to attract clients,and establishing processes to servicethese products. The long-range andintangible nature of these offerings makesthe insurance business unique.Every entity has a strategic plan, even if itdoesn’t realize it. The plan must beexecuted through tactical and operational planning and quantified by abudget. A recent study indicates that theultimate goal of recouping all expensesis achieved by only 42 percent to 67percent of insurance companies. Theothers recover less than 60 percent oftheir total expenses.These situations require accurate andtimely expense information.The insurance industry is at the forefront oftechnological development. New technologyis always introduced with the promise thatcosts will be reduced. As a practical matter,anticipated savings are often not realized,because the new equipment is used toperform additional tasks that are notnecessary.The book covers a broad spectrum of theconcepts involved in analyzing and controlling insurance company expenses. It isenhanced by a four-page list of acronyms, aglossary of pertinent terms and an exhaustive bibliography. The readable text is supplemented by informative graphs and tables.A Comprehensive Guide to Measuring andManaging Insurance Company Expenses is avaluable resource for everyone involved inthis important area. ADecember 2009/January 2010 The Actuary 11

Society of ActuariesSOA celebrates 60th anniversarywith donationCecil Bykerk, SOA president at time of photoCheck presentation to Rev. Gregory Groover,Chairman, Boston School CommitteeGreg Heidrich, SOA executive directorAs a part of the SOA’s 60th anniver-Then current SOA President Cecil Bykerk anddrives making it easier for them to effectively man-sary celebration and in keeping with theExecutive Director Greg Heidrich visited Bostonage important papers—like math homework.SOA’s mission of education, the SOA donatedLatin Academy to present the donation to BPS,BPS administrators were very excited and grate- 25,000 to the Boston Public Schools (BPS) onmeet with school administrators and visit withful to receive the donation. BPS plans to useFriday, Oct. 23 to help BPS enhance its mathstudents. Boston Latin Academy is one of BPS’the donation in several ways. It will be used toprograms. These programs will help studentsadvanced learning schools with a rigorous cur-improve technology, which will allow studentsthroughout BPS to continue to grow their mathriculum and has been recognized by numerousto participate in certain math education pro-skills and be successful at higher math levels.scholarship and awards programs.grams. BPS also plans to increase student accessIn addition, The Actuarial Foundation donated its“These students and their ability to excel in mathBuilding Your Future financial literacy packets toare the key to the actuarial profession’s futurethe Boston Latin Academy, with plans to expandsuccess,” said Bykerk. “We sincerely hope that“The SOA is proud to share its anniversary cel-the donation to include other schools in thethe SOA’s contribution will help the Bostonebration in a way that truly represents an impor-system. Building Your Future is designed to helpPublic Schools’ math programs and, ultimately,tant part of the mission we’ve been pursuing forhigh school students easily grasp the essentialsits students reach new heights.”the last 60 years—education,” stated Bykerk. Ato online math programs and train more teachers in a variety of top-notch math programs.of personal finance and to master the knowledgeica registration ad paths .indd 120/10/2009 4:04:36 PMand practical skills needed to live financiallyIn addition, the SOA provided all of the more thanhealthy lives.1,700 students at Boston Latin Academy with flashDecember 2009/January 2010 The Actuary 13

the manyofBy Dave IngramThe author of this article likens the stages of risk to a sinewave. Read on to find out the definition of each stage.Modelers usually work with onemodel of the world and from thatmodel we try to infer the amountof risk. This practice has been looking moreand more suspect with the frequency of theevents that are either totally outside of themodels or at best at a very, very low frequency.better capture the increased volatility thatseems to occur during some periods of time.That has increased the ability of the modelsto stay within 10 standard deviations of reality. It would be even better if there was a wayof thinking that could also keep managementthat close to the real risk environment.But if there is a major difference betweenthe world and the model, what should youdo? Some react to that by making totallyoutrageous comments about how unlikelythe event that just happened was. “We wereseeing things that were 25-standard deviationmoves, several days in a row,” David Viniar,Goldman’s chief financial officer, said to theFinancial Times.Discussions of the financial crisis have alsofavored the two-stage approach to the world.In those discussions the two stages are Normaland Dreadful. All of the activity of adjustingregulations is focused upon the idea of making the Dreadful stage much less likely.Some modelers have been using a two-stagemodel, called a regime-switching model, toBut there is an operational problem with trying to fix things with that two-stage view. Itpaints the risk as a cliff situation. Once youpass the edge, there is nothing that you cando. So keeping away from the edge is the fullextent of preparation. After some time, the edgeseems less and less dangerous to approach andfirms find that there are more and more profitsoperating closer and closer to the edge.Firms that use this two-stage view of theirrisks tend not to do anything active in riskmanagement, other than the “be cautious.”But in fact, many people refer to the financialsystem as going through cycles. Cycles canbe broadly represented by sine waves. Anda sine wave has four stages: a bottom, top,upward slope and downslope. Now withfinancial cycles, the duration and amplitudeof each of these stages is unknown, but thereare four stages.In macro terms, the environment for any riskcan be seen to have four main stages:December 2009/January 2010 The Actuary 15

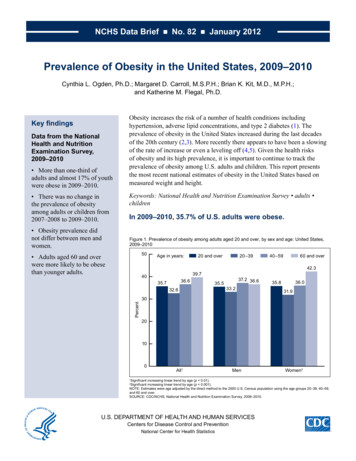

Stages of RiskPrice-to-Rent Ratio, Q1 1997 1.0National Case-Shiller Home Price Index and Owner Equivalent Rent1.81.7Stage 21.6Stage 0Price-to-Rent ratio1.5phes or sudden major shiftsin markets might be triggers.Capacity that during Stage1 was seen as a perpetualresource now suddenlyseems like it may or maynot be sufficient. Suddenlypeople are extremely concerned with how risks are(and were) managed.1.4Stage 3 – High LossEnvironment. Many ofthoserisks have turned1.2intoLOSSES.Survival of theStage 1Stage 31.1institution (and potentiallythe entire financial system)1.0is uncertain. The marketsenses that many previous0.9ly respected firms will notmake it through this period0.8and that suspicion lly slows business activhttp://calculatedrisk.blogspot.com/ity. Risk management focusneeds to be on helping callyfind the course of actionStage 0 – Low Risk Environment. It doesthat will save the firm. For the firms that fail,not seem to matter how much risk is taken on ment. Volatility is in the normal range, sorisk management efforts shift to workout.during this stage. Every decision to take an hedging and reinsurance programs have theexpectedimpact.Riskmanagementseemstoadditional risk pays off handsomely. Over andThe graph above gives a good picture of howover again the naked, unhedged position beats be designed for this environment—becausethe stages work. Stage 1 was in effect for 15out the carefully hedged position; the unin- it is. Capacity for risk taking is carefullyyears. There were moderate swings up andsured risk beats the insured risk. During this matched up to risks, but taking risks up todown during Stage 1, but nothing severe.environment, people slowly drift away from capacity is usually seen to be the best courseinthisenvironment.CapacityisusuallyThen, the market came to think that therebeing concerned about risk and risk managewas almost no risk and entered into Stage 0ment because they are looking at others who defined in terms of something like a oneduring 2002. This ramping up of risk takingare not concerned with risk who are making a in-200-year loss, but no one really expectstoexperiencealossofthatsize.Thatjustled to a Stage 2 Environment during 2005.lot of money. Capacity for risk taking does notThen in 2007, that transitioned into Stage 3seem to be an issue and some will take much wouldn’t be normal.1.3more risk than could possibly be prudent inany other environment.Stage 1 – Normal Risk Environment.This is when the long-term averages seem tohold up well. Investors and insurers experience mostly gains, but with enou

antee with regard to any products, services or procedures mentioned or advertised herein. The Actuary is free to members of the Society of Actuaries. Nonmember subscriptions: students, 23; others, 43. Please send subscription requests to: Society of Actuaries, P.O. Box 95668, Chicago, IL 60694. The Actuary welcomes both solicited and unsolic-