Transcription

Benefit Plan SummariesFor groups with 2 to 50 employeesEffective January 1, 2017Last Updated: November 15, 2016

Network optionsUPMC Health Plan offers the following network options for our2-50 market portfolio.UPMC Standard NetworkOnly employer groups domiciled within the 28 counties in our service area are able to purchase plans that includethe UPMC Standard Network.The UPMC Standard Network includes all UPMC-owned hospitals, providers, and facilities in addition to othercommunity-based hospitals, providers, and facilities. Members will be covered for services when they seek carefrom participating providers within the UPMC Standard hamptonLancasterYorkChesterPhiladelphiaDelaware

UPMC Premium NetworkOnly employer groups domiciled within the 29 counties in our service area are able to purchase plans that include theUPMC Premium Network.The UPMC Premium Network includes all UPMC-owned hospitals, providers, and facilities in addition to othercommunity-based hospitals, providers, and facilities. Members will be covered for services when they seek care fromparticipating providers within the UPMC Premium radfordLancasterYorkChesterPhiladelphiaDelaware

Medical plan descriptionsWe understand that employers of all sizes want to control health care costswhile keeping their employees healthy.UPMC Small Business AdvantageUPMC MyCare AdvantageWith that in mind, we created UPMC Small BusinessAdvantage, a unique portfolio of medical plan options forcompanies with less than 50 employees. UPMC SmallBusiness Advantage comes standard with every small groupplan. This unique plan design gives smaller businessesthe opportunity to offer their employees a robust benefitpackage that addresses their total health and well-being.UPMC MyCare Advantage is a tiered benefit plan thatfocuses on patient-centered care to improve the healthoutcomes of its members. It offers the same type ofcoverage as other UPMC Health Plan products, butmaximizes in-network savings with lower cost sharing whenmembers receive care from level 1 providers, which includesall UPMC-owned facilities and practices. Level 1 providersalso include these valued community-based partners: ExcelaHealth — Frick, Latrobe, Westmoreland; Grove City MedicalCenter; Heritage Valley Health System — Beaver andSewickley; Jameson Hospital; Monongahela Valley Hospital;St. Clair Hospital; and Washington Health System Greeneand Washington Hospital.LifeSolutions employee assistance program is included withUPMC Small Business Advantage plans. Your employees canhave three over-the-phone sessions per issue, and managerscan receive consulting services. All employees are grantedaccess to the WorkLife resource center, which contains onlinematerials on a variety of topics.UPMC Small Business Advantage plans also come withvision and dental discounts, including discounts on LASIKprocedures and hearing aids.UPMC Small Business Advantage plans can include theUPMC Standard Network or UPMC Premium Network.UPMC Small Business Advantage is available in EPO, PPO,and HMO plan types.Employers with two or more employees in these countiesare eligible: Allegheny, Beaver, Bedford, Blair, Butler,Erie, Lawrence, Mercer, Venango, Washington, andWestmoreland. UPMC MyCare Advantage is available in thePPO plan type.

UPMC HealthyUHere are descriptions of each plan type:UPMC HealthyU is an innovative plan that rewards membersfor making healthy choices. By completing healthy activities,members earn reward dollars in a health incentive account(HIA) that helps pay for their health care expenses. UPMCHealthyU recommends healthy activities that are uniquelycustomized to the individual, each with a reward dollarvalue to help encourage members to focus on what’smost important in understanding and improving theirown health. UPMC Health Plan deposits reward dollarsinto the member’s HIA every time he or she completes arecommended activity. The reward dollars then help payfor out-of-pocket medical expenses, such as deductible,coinsurance, and pharmacy copayments. UPMC HealthyU isavailable in the PPO plan type.EPOWith UPMC Health Plan’s EPO (exclusive providerorganization) health benefit plan, members mustreceive care from network physicians and facilities(except in the case of emergency services). Preventivecare is always covered at 100 percent, and membersdo not need a referral to see a specialist.UPMC Consumer AdvantageHMOWith UPMC Health Plan’s HMO (health maintenanceorganization) health benefit plan, members must receivecare from network physicians and facilities (except inthe case of emergency services). Members must select aprimary care physician (PCP) to help coordinate their care.A PCP referral is required for most specialty care. Preventivecare is always covered at 100 percent.UPMC Consumer Advantage offers many plan optionsfor groups looking to add a qualified high-deductiblehealth plan (QHDHP) to their medical plan offerings.A QHDHP qualifies members for a health savings accountor flexible spending account. These accounts help thempay for current and future health care expenses. Dependingon the account selected, the employer and employee maycontribute to the account, and employees may be able totake the funds with them at retirement or when they changeemployers. UPMC Consumer Advantage is available inthe PPO plan type.PPOUPMC Health Plan’s PPO (preferred provider organization)health benefit plan allows members to go out of the networkto receive care; however, out-of-pocket expenses maybe lower if they receive care from a network physician orfacility. Preventive care is always covered at 100 percent,and members do not need a referral to see a specialist.

Plan detailsAll plans are SHOP Marketplace eligible.UPMC Small Business AdvantagePlan mum(Individual/Family)NetworkCoinsurancePCP Visit 0/ 0 1,250/ 2,500Premium 0 10 500/ 1,000 1,000/ 2,000Premium 02 20Gold EPO 1,000 20/ 45 1,000/ 2,000 3,500/ 7,000Premium 02 20Gold EPO 1,500 10/ 40 1,500/ 3,000 3,500/ 7,000Premium 02 10Gold EPO 2,000 20/ 40 2,000/ 4,000 3,000/ 6,000Premium 02 20Silver EPO 3,000 20/ 50 3,000/ 6,000 7,150/ 14,300Premium 02 20Bronze EPO 6,850 6,850/ 13,700 7,150/ 14,300Premium 0 02† 0/ 0 1,250/ 2,500Premium 0 10 500/ 1,000 1,000/ 2,000Premium 02 20Gold PPO 1,000 20/ 45 1,000/ 2,000 3,500/ 7,000Premium 02 20Gold PPO 1,500 10/ 40 1,500/ 3,000 3,500/ 7,000Premium 02 10Gold PPO 2,000 20/ 40 2,000/ 4,000 3,000/ 6,000Premium 02 20Silver PPO 3,000 20/ 50 3,000/ 6,000 7,150/ 14,300Premium 02 20Bronze PPO 6,850 6,850/ 13,700 7,150/ 14,300Premium 0 02 † 0/ 0 1,250/ 2,500Standard 0 10 500/ 1,000 1,000/ 2,000Standard 02 20Gold HMO 1,000 20/ 45 1,000/ 2,000 3,500/ 7,000Standard 02 20Gold HMO 1,500 10/ 40 1,500/ 3,000 3,500/ 7,000Standard 02 10Gold HMO 2,000 20/ 40 2,000/ 4,000 3,000/ 6,000Standard 02 20Silver HMO 3,000 20/ 50 3,000/ 6,000 7,150/ 14,300Standard 02 20Bronze HMO 6,850 6,850/ 13,700 7,150/ 14,300Standard 02 02†Plan NamePlatinum EPO 10/ 25EPOPlatinum EPO 500 20/ 40Platinum PPO 10/ 25PPOPlatinum PPO 500 20/ 40Platinum HMO 10/ 25HMOPlatinum HMO 500 20/ 40Waived if admittedAfter deductible3After deductible, copay waived if admitted4Aggregate/Aggregate† First three PCP visits are 35 copayment per visit, not subject to deductible12This document is meant to assist in comparing benefit plans. It is not a contract.If differences exist between this summary and a group’s contract or a member’sCertificate of Coverage, the contract or Certificate of Coverage will prevail.22

SpecialistVisitUPMCAnywhereCare Visit(PCP/Specialist)Urgent CareFacilityEmergencyDepartmentInpatientHospital CareAdvanced Imaging(PET, MRI, etc.)Other Imaging(x-ray, etc.)Lab andOther Services 25 5/ 25 25 1751 0 150 25 25 40 10/ 40 40 1001 0 125 20 20 45 10/ 45 45 1751 40 5/ 40 40 502 0 0 45 45 401 175 0 0 40 40 10/ 40 40 100 0 0 40 40 10/ 50 50 2003 3002 3002 50 50 0 0 / 0 0 0 0 02 0 02 25 5/ 25 25 1751 0 150 25 25 40 10/ 40 40 1001 0 125 20 20 45 10/ 45 45 1751 0 0 45 45 40 5/ 40 40 175 40 10/ 40 40 1001 50 10/ 50 50 0 0 / 0 2522222221222222222 02 0 40 40 02 02 40 40 2003 3002 3002 50 50 0 0 0 02 0 02 5/ 25 25 1751 0 150 25 25 40 10/ 40 40 1001 0 125 20 2012222122222 45 10/ 45 45 175 0 0 45 45 40 5/ 40 40 1751 02 02 40 40 40 10/ 40 40 1001 02 40 40 50 10/ 50 50 200 300 300 50 50 0 0 / 0 0 0 0 0 0 022222322 02222222Note: All standard medical plans offered within this document are embedded, unless marked aggregate.What do aggregate and embedded mean?Aggregate Deductible means that for family coverage,the entire family deductible must be met by one or acombination of the covered family members before coveredservices are paid for any member on the plan.Aggregate Out-of-Pocket Limit means that for familycoverage, the entire family out-of-pocket limit must be metby one or a combination of the covered family membersbefore the plan pays at 100 percent for covered services forthe remainder of the benefit period.Embedded Deductible means the plan pays for coveredservices in these two scenarios (whichever comes first):1. When an individual within a family reaches his or herindividual deductible. At this point, only that person on theplan is considered to have met the deductible; OR2. When a combination of family members' expensesreaches the family deductible. At this point, all coveredfamily members are considered to have met thedeductible.Embedded Out-of-Pocket Limit means the out-of-pocketlimit is satisfied in one of two ways (whichever comes first):1. When an individual within a family reaches the out-ofpocket limit. At this point, only that person will havecovered services paid at 100 percent for the remainder ofthe benefit period; OR2. When a combination of family members' expensesreaches the family out-of-pocket limit. At this point, allcovered family members are considered to have met theout-of-pocket limit and will have covered services paidat 100 percent for the remainder of the benefit period.

UPMC Consumer AdvantagePlan mumNetworkCoinsurancePCP VisitSpecialist Visit(Individual/Family)Gold HSA PPO 1,350/10%4 1,350/ 2,700 3,425/ 6,850Premium10%210%210%2Gold HSA PPO 2,0004 2,000/ 4,000 3,425/ 6,850Premium 02 02 02Silver HSA PPO 3,250 3,250/ 6,500 6,450/ 12,900Premium 02 02 02Platinum HIA PPO 1,350/10% 1,350/ 2,700 2,000/ 4,000Premium10%210%210%2Gold HIA PPO 2,500/10% 2,500/ 5,000 3,425/ 6,850Premium210%10%10%2 250/ 500 1,000/ 2,000Premium 02 20 40 500/ 1,000 1,000/ 2,000Premium35%2 40 80Gold PPO 1,250 20/ 40 1,250/ 2,500 3,500/ 7,000Premium 02 20 40Tier 2 2,500/ 5,000 3,500/ 7,000Premium35% 40 80Silver PPO 3,000 25/ 55 3,000/ 6,000 7,150/ 14,300Premium 0 25 55Tier 2 6,600/ 13,200 7,150/ 14,300Premium35% 50 110Silver PPO 5,000 20/ 40 5,000/ 10,000 6,500/ 13,000Premium 02 20 40Tier 2 6,350/ 12,700 6,500/ 13,000Premium35%2 40 80UPMC HealthyU2UPMC MyCare AdvantagePlatinum PPO 250 20/ 40Tier 2Waived if admittedAfter deductible3After deductible, copay waived if admitted4Aggregate/Aggregate† First three PCP visits are 35 copayment per visit, not subject to deductible12This document is meant to assist in comparing benefit plans. It is not a contract.If differences exist between this summary and a group’s contract or a member’sCertificate of Coverage, the contract or Certificate of Coverage will prevail.222

UPMCAnywhereCare Visit(PCP/Specialist)Urgent CareFacilityEmergencyDepartmentInpatientHospital CareAdvanced Imaging(PET, MRI, etc.)Other Imaging(x-ray, etc.)Lab and Other Services10%2/10%210%210%210%210%210%210%2 02/ 02 02 02 02 02 02 02 02/ 02 02 02 02 02 02 0210%2/10%210%210%210%210%210%210%210% /10%10%210%10%10%10%10%2 10/ 40 40 1751 02 02 30 30 10/ 80 80 17535%235%235%235%2 10/ 40 40 1751 02 02 35 35 10/ 80 80 17535% 13/ 55 55 1753 02 13/ 110 110 175335%35%35%35%2 10/ 40 40 1751 02 02 30 30 10/ 80 80 175135%235%235%235%22222222235%35%35%2 02 55 552222

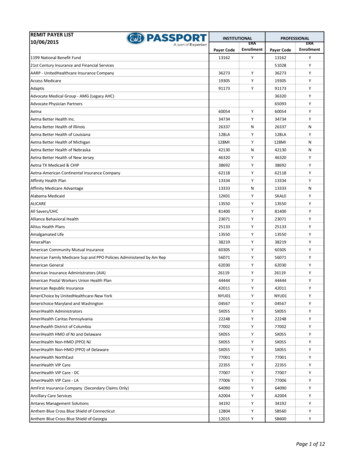

PharmacyUPMC Health Plan’s pharmacy network includes more than 30,000pharmacies nationwide, including Giant Eagle, Kmart, Rite Aid, Target,CVS, Walmart, Sam’s Club, and Wegmans (Erie locations).UPMC Health Plan produces the Advantage Choice formulary for our small market groups. We offer this formulary athttp://upmchp.us/pharmacybenefits or in searchable format at http://upmchp.us/medication.UPMC Health Plan contracts with Express Scripts Inc. to provide convenient home delivery of certain maintenancemedications. With home delivery, members can: Receive up to a 90-day supply of most drugs, plus refills. Enjoy strict quality and safety controls on all prescriptions.UPMC Small Business Advantage and UPMC MyCare Advantage OptionsDuring deductible period and after the deductible has been metGenericPreferred BrandNon-Preferred BrandSpecialty 10 40 75 95Copayment (generic/preferred/non-preferred/and/or specialty)Retail (30-day supply)Mail Order (90-day supply) 10/ 40/ 75/ 95 20/ 80/ 150UPMC HealthyU and UPMC Consumer Advantage Options: IntegratedDuring deductible periodActual Drug CostAfter the deductible has been metGenericPreferred BrandNon-Preferred BrandSpecialty 10 40 75 95Copayment (generic/preferred/non-preferred/and/or specialty)Retail (30-day supply)Mail Order (90-day supply) 10/ 40/ 75/ 95 20/ 80/ 150For more information, visit http://upmchp.us/pharmacybenefits.

UPMC Vision CareBy offering UPMC Vision Care to your employees, you allow them to receivemore integrated services from UPMC Health Plan.UPMC Vision Care, administered by National VisionAdministrators (NVA), offers Exam Only, Classic, Deluxe,Prime, Premier, and Elite plan models, with both copay andno copay options, plus a national network of vision providers.Features: Discounts through the NVA EYEESSENTIAL Plan Mail-order contact lens service Fixed copayments for lens add-ons Discounts on LASIK procedures at UPMC Eye Center,QualSight, TLC Vision, and LASIK Centers of AmericaProductFrequencyCopaymentExam Only24 months 0Exam Only 224 months 15Classic24 months 0Classic 224 months 15Deluxe*24 months 0Deluxe 2*24 months 15Prime12 months 0Prime 212 months 15Premier12 months 0Premier 212 months 15Elite12 months 0Elite 212 months 15*For dependents through age 18, frequency for exams and lenses is12 months.For further lens selections, request the "Additional Lens Options"document from your account representative.Out-of-network reimbursement is based on usual, customary, and reasonablerates as determined by UPMC Vision Care.Pediatric Vision Services are covered as required under the Affordable Care Act(ACA) for members enrolled in ACA-compliant group plans. Employees can findeligibility and benefit details in their Pediatric Vision Certificate of Insuranceand Pediatric Vision Schedule of Benefits on MyHealth OnLine, or they can callMember Services once enrolled.

Vision Essential Health Benefits Schedule of Benefits for members under age orkReimbursement2Children UnderAge 19100% 3012 monthsLenses (for glasses)3 – All lenses must be provided by anNVA-contracted laboratory.Single Vision100% 2512 monthsBifocal100% 3512 monthsTrifocal100% 4512 00% 30Covered12 months12 monthsContact Lenses – If deemed medically necessary. Prior authorizationis required.Contact lens fitting and follow-up reimbursement are separate fromcontact lens material.Contact LensFitting andFollow-up100%Contact LensMaterial100%In-network reimbursement is based on the percentage of providerreimbursement. Participating vision providers are not permitted to billthe member for the difference for any services unless otherwise stated.Participating vision providers may charge a member a copayment foroptional lenses and treatments listed below.1Out-of-network reimbursement is based on usual, customary, andreasonable rates as determined by UPMC Vision Care.2Lens reimbursement includes reimbursements for polycarbonate lenses.3Provider may make available non-collection frames. Non-collection framesare frames that are any amount over the retail allowance for collectionframes. If non-collection frames are chosen, members are responsible forthe difference in cost between the retail allowance amount for collectionframes and the retail price of the frame, less a 20 percent discount.4Members are eligible for additional lens options at a fixed fee, in-networkonly. If members choose extra options, they are responsible for the additionalcost of the options paid directly to the vision provider. For additional lensoptions, refer to the chart. Members receive a 20 percent courtesy discounton lens options not listed below.Optional Lensand TreatmentFixed FeeOptional Lensand TreatmentFixed Fee 8Progressives(Tier 1) 50Anti-ReflectiveCoating (Tier 1) 40Progressives(Tier 2) 80Hi-Index Plastic1.53-1.60/Trivex 40Polarized(Tier 1) 65Hi-Index Plastic1.66/1.67 71Transitions VII 70Hi-Index Plastic1.70 and above 80Plastic Dyes - Solid 22512 months12 months

UPMC Dental AdvantageUPMC Dental Advantage offers Basic, Standard, and Premium plan models,plus a vast network of dentists.Our plans encourage regular preventive care and foster open communication between members and dentists regardingtreatment plans.Features: Prior authorization is not required for major services. Enhanced benefits include:– One additional cleaning for members who are pregnant, during the course of the pregnancy.– Increased coverage for nonsurgical periodontal treatment, including topical application of fluoride for adults with ahistory of surgical periodontal treatment.– Coverage for microbial tests and brush biopsies.Plan In-NetworkCovered AmountClass I/Class II/Class IIIDeductible/Plan Year MaximumOrtho Lifetime MaximumServiceClassAnnualMaximumDeductibleClass Class ClassIIIIII 0 50 75 1,000 etimeMaximumOut-ofNetworkCoverage 2,000YesNo 80/0/080/0/0BasicBasic 100/0/0/ 01Basic 100/0/0/ 501Basic 100/0/0/ 751StandardStandard 100/50/50/ 0/ 1,500/No OrthoStandard 100/50/50/ 0/ 1,500/Ortho/ 1,000Standard 100/50/50/ 75/ 2,000/No OrthoPremiumPremium 100/80/50/ 0/ 1,500/No OrthoPremium 100/80/50/ 0/ 1,500/Ortho/ 1,000Premium 100/70/50/ 0/ 1,000/No OrthoPremium 100/70/50/ 50/ 1,000/No OrthoPremium 100/70/50/ 0/ 1,500/No OrthoPremium 100/70/50/ 50/ 1,500/No OrthoPremium 100/80/50/ 50/ 1,000/No OrthoPremium 100/80/50/ 50/ 1,500/No 333—3——3——3—100/80/5020% discount applies to Class II & III services when visiting participating providers.See plan documents for additional information.

UPMC Dental Advantage Discount PlanUPMC Dental Advantage offers a Discount Dental Plan to all new and currentemployers, either as a standalone plan option or as an added benefit to theexisting Basic plan offerings.Members who choose to enroll in the standalone DiscountDental Plan will receive a 20 percent discount on all eligibleClass I, II, and III services when visiting a participatingprovider. Members enrolled in a UPMC Dental AdvantageBasic plan may receive a 20 percent discount on eligibleClass II and Class III services received by a participatingprovider. Members should review their plan documents foradditional information.Features: 20 percent discount is applied to the provider’susual and customary charges. Claims do not need to be submitted for thediscount plan. ID cards are not required.The Discount Dental Plan may not be used in conjunctionwith other insurance, including other UPMC DentalAdvantage plans.The discount does not apply to orthodontic orcosmetic services.

Dental Essential Health Benefits Schedule of Benefits for membersunder age 19UPMC Dental Advantage will cover the services set forth below, which are related to the dental benefits provided withUPMC Dental Advantage policies and procedures. If the terms and conditions set forth in other dental benefit materialsyour employees have been provided conflict with those set forth in this plan document, the terms and conditions of thisplan document control.Plan Year Deductible: Class I (Out-of-Network Only), ClassII, and Class III ServicesClass I: Diagnostic/PreventiveExams and ProphylaxisIn-NetworkOut-of-Network1 50 Individual/ 150 EligibleDependents (2 Children) 75 Individual/ 200 EligibleDependents (2 Children)100%90%Payable for 2 services in a Benefit PeriodBitewingsPayable for 2 services in a Benefit Period up to age 14; 1 service in a BenefitPeriod for 14 yearsComplete Series and Panoramic FilmsPayable for 1 service in a 36-month period and is not covered for membersunder the age of 5Topical FluoridePayable to age 19 for 2 services in a Benefit PeriodPeriodontal Scaling and Root PlaningPayable for 1 service every 24 monthsSealantsPayable to age 14 for 1 service per tooth (molar) every 36 monthsSpace MaintainersPayable to age 19Class II: Basic Services70%60%Amalgam and Composite FillingsPayablePulpal Therapy/Anterior and PosteriorPayableEndodontic Therapy (including treatment plan, clinicalprocedures, and follow-up care)PayableExtractions and Oral SurgeryPayableClass III: Major Services50%40%Crowns and BridgesPayable for 1 service per tooth in a 60-month periodInlay/Onlay – Metallic/Porcelain/Resin up to 4 SurfacesPayable for 1 service per tooth in a 60-month periodImplantsPayable for 1 service per tooth per lifetimeDentures Complete and PartialPayable for 1 service in a 60-month periodPrefabricated Stainless Steel Crown/Primary ToothOrthodontics: Subject to Medical Deductible2Payable for 1 service per tooth in a 60-month period50%Not Covered1Out-of-network reimbursement is based on usual, customary, andreasonable charges as determined by UPMC Dental Advantage.The member is responsible for the difference between those chargesand the provider’s fee.Copayments, coinsurance, and deductibles for dental benefits applytoward satisfaction of the combined out-of-pocket maximum specifiedin the member’s Medical Schedule of Benefits. Services are covered at100 percent after the out-of-pocket maximum is satisfied.Orthodontic coverage is subject to the Medical Deductible, which can befound in the Medical Schedule of Benefits. Orthodontic services are payableonly when deemed medically necessary by the plan.This Pediatric Dental Schedule of Benefits may expand or restrict thebenefits set forth in the member’s UPMC Dental Advantage PediatricDental Certificate of Insurance. You may advise your employees to seethe Pediatric Dental Certificate of Insurance for the details of the termsof coverage for their health benefit plan. In the event that the terms ofthe Pediatric Dental Certificate of Insurance conflict with this PediatricDental Schedule of Benefits, the terms of this Pediatric Dental Scheduleof Benefits control.2The services above are not all-inclusive — they include only themost common dental procedures in a class or service grouping.UPMC Dental Advantage encourages, but does not require, members toseek predetermination for major services, such as crowns and bridges,to obtain the most accurate payment estimate. Coverage for members isadministered in accordance with policies and procedures in effect on thedate of service. Additional plan information can be found in the PediatricDental Certificate of Insurance.

Value-added benefits and servicesUPMC Small Business AdvantageUPMC Health Plan offers a robust benefit package for valueadded benefits and services that focus on the total healthand well-being of your employees. All UPMC Small BusinessAdvantage medical plans come standard with this uniquebenefit package. The value-added benefits and services ofUPMC Small Business Advantage include:LifeSolutions employee assistance programWorkplace, personal, and family issues can be distracting,resulting in lost productivity and missed work. LifeSolutions offers a host of resources to help our members feel betterand stay focused and to help managers with workplaceissues. Benefits include coaching and counseling over thephone and numerous online resources, such as financialcalculators and self-assessments. Employees and managersdo not need to be enrolled in a medical plan to receiveemployee assistance program (EAP) services. Also, EAPservices are available to all members of the employee'sand manager's household.Employees receive: Three confidential telephone sessions with a licensedprofessional per issue. Access to the WorkLife online resource website withinformation on a variety of topics, such as personalrelationships, child care, elder care, adoption, legalmatters, financial concerns, etc.Employers receive: Unlimited managerial telephone counselingsessions with a licensed professional on topicssuch as improving effectiveness at work, addressingsensitive employee issues, and dealing withworkplace stress concerns. Online education and training.Other value-added benefitsand servicesAssist AmericaThe nation's largest provider of emergency medicalservices for travelers comes free of charge with UPMCHealth Plan coverage. Members have access to care24/7 — anytime, anywhere.

Health coachingWe offer lifestyle improvement and condition managementprograms at no cost to our members. Members workone-on-one with a health coach over the phone. Programsinclude nutrition, weight loss, physical activity, tobaccocessation, and stress reduction.MyHealth OnLineMyHealth OnLine is a secure website where members canpersonalize their goals and needs. Here, they can take theMyHealth Questionnaire to find out their health risks. Inreturn, they get a list of activities recommended just forthem to reduce their risk for chronic disease, feel better, andmeet their goals. They can also research health conditions,access treatment cost and comparison tools, see their claimsand coverage information, and more.UPMC AnywhereCareWith UPMC AnywhereCare, members can get treatmentfor colds and flu, strep throat, and other nonemergencyconditions with an e-visit — anytime, day or night. Thecost is less than or the same as a visit with their primarycare physician.UPMC Health Plan members located in Pennsylvania at thetime of service will have a virtual visit with a UPMC-employedprovider. If a member is located outside Pennsylvania, service willbe delivered by a separate provider group – Online Care Group(OCG). UPMC AnywhereCare is currently not available inTexas or Arkansas.UPMC eDermatologyMembers can also connect with leading dermatologistsand get treatment for skin conditions and disorders. Theseservices are available 24/7.Member must be in Pennsylvania during the eDermatology visit.UPMC MyHealth 24/7 Nurse LineMembers can speak to a registered nurse anytime, day ornight, when they have a health question or medical concernby calling the UPMC 24/7 MyHealth Nurse Line.UPMC Consumer Advantagespending accountsFlexible spending accountsFlexible spending accounts (FSAs) from UPMC ConsumerAdvantage help members save money using pretax dollars.We offer health care, dependent care, and limited purposeFSAs as well as commuter transportation accounts.Health savings accountsHealth savings accounts (HSAs) from UPMC ConsumerAdvantage help members pay for out-of-pocket health careexpenses. An HSA must be paired with a qualified highdeductible health plan. Both the employer and employeecan contribute. The balance can be carried over from year toyear. The employee owns the account and can take it whenhe or she changes employers.Health reimbursement arrangementsHealth reimbursement arrangements (HRAs) from UPMCConsumer Advantage are employee spending accounts thatemployers fund. Your employees can use their HRAs to payfor health care deductible expenses. Funds that the employercontributes to the HRA are not considered wages and arenot subject to income taxes, FICA (Social Security andMedicare), or workers’ compensation.Qualified transportation accountsQualified transportation accounts from UPMC ConsumerAdvantage are member spending accounts that employeesfund with pretax contributions. Funds can be used for eligibletransit and parking expenses related to their commute toand from work.Ancillary servicesUPMC COBRA AdvantageMember must be in Pennsylvania, West Virginia, or Ohio whencalling the UPMC MyHealth 24/7 Nurse Line.We administer monthly billing and collection fromthe COBRA or Mini-COBRA participant, monitornonpayment, and provide late payment notices. Wealso handle open enrollment mailing, carrier updates,and other vital communications.Health Care ConciergeRetiree billingMembers receive fast, personal service from our UPMCHealth Plan Health Care Concierge team. Our outstandingcustomer service team strives to resolve questions andconcerns in one phone call or online chat session.Our web-based system allows you to coordinate enrollment,billing, and reimbursement of retiree benefits. Electronicpayment of monthly premiums eliminates the need to

vision and dental discounts, including discounts on LASIK procedures and hearing aids. UPMC Small Business Advantage plans can include the UPMC Standard Network or UPMC Premium Network. UPMC Small Business Advantage is available in EPO, PPO, and HMO plan types. UPMC MyCare Advantage UPMC MyCare Advantage is a tiered benefit plan that