Transcription

Making Home AffordableWorking Together to Help HomeownersNovember 2010 l Making Home Affordable

Response to the CrisisMHA is part ofAdministrationapproach topromotingstability forhousing market,homeowners. Homeowner Affordability and Stability Planboosts affordability and reduces foreclosures.MHA is key. Supported the 8,000 Homebuyer Tax Credit,which helped 2.5M families purchase homes. Provided almost 7B in support ofNeighborhood Stabilization Program topurchase, rehabilitate, sell, and rent foreclosedand vacant properties. Created 7.6B HFA Hardest Hit Fund forinnovative foreclosure prevention programs innation’s hardest hit housing markets.November 2010 l Making Home Affordable2

Making Home Affordable Offers HelpMHA and otherprograms worktogether tohelphomeownersavoidforeclosure andrevitalizehousing. Home Affordable Refinance Program (HARP) FHA Refinance for Homeowners with Negative Equity(FHA Short Refinance) Treasury/FHA Second Lien Program (FHA2LP) Home Affordable Modification Program (HAMP)– Home Affordable Unemployment Program (UP)– Principal Reduction Alternative (PRA) Second Lien Modification Program (2MP) Home Affordable Foreclosure Alternatives (HAFA) Options for mortgages insured, guaranteed, or held byfederal government agencies:– FHA (FHA‐HAMP), USDA’s RHS Special Loan Servicing(RD‐HAMP), and VA (VA‐HAMP) Housing Finance Agency Innovation Fund for the HardestHit Housing Markets (HHF)November 2010 l Making Home Affordable3

HARP OverviewHomeAffordableRefinanceProgram(HARP) Helps homeowners unable to refinance due todeclining property values. Makes payments more affordable or morestable.–Replace ARM, Option ARM etc. with fixed‐ratemortgage.–Reduce amortization term in order to buildequity. Extended through June 30, 2011.November 2010 l Making Home Affordable4

HARP Eligibility CriteriaHomeowner: Is current on themortgage Is owner‐occupant of a 1‐4 unit property Has reasonable ability topay the new mortgagepaymentLoan: Owned or guaranteed by FannieMae or Freddie Mac First mortgage cannot exceed125% of property’s currentmarket value Refinance must improveaffordability or sustainabilityNovember 2010 l Making Home Affordable5

Steps to HARP RefinanceHomeownercontacts lenderto apply forHARP. Homeowner determines basic eligibility atMakingHomeAffordable.gov. Homeowner owing more than 105% and up to125% of home’s current market value contactscurrent lender to apply for HARP refinance. Homeowner owing 105% or less of home’scurrent market value contacts any GSE‐approvedmortgage lender to apply for HARP refinance.November 2010 l Making Home Affordable6

FHA Short Refinance OverviewProvidesadditionalrefinancingoption forunderwaterhomeowners. Provides homeowner who owes more than homevalue chance to refinance into FHA loan at nomore than 97.75% of home value. Lender writes down unpaid principal balance of1st lien by at least 10%. Treasury provides incentives to participatingservicers, investors who extinguish all or part of2nd lien. Effective September 7, 2010 ‐ December 31,2012.November 2010 l Making Home Affordable7

Scenarios of HAMP ModificationsProgramenhancementsare designed toaddress avariety ofscenarios.What if thehomeowner isstruggling to makethe mortgagepayment?Home AffordableModificationProgram (HAMP)What if the homeowner isunemployed?Unemployment Program (UP)What if the homeowner owesmore than the home is worth?Principal Reduction Alternative(PRA)November 2010 l Making Home Affordable8

HAMP OverviewHomeAffordableModificationProgram(HAMP) Modifies 1st liens for eligible homeowners toachieve more affordable or more stablepayments.– Helps homeowners keep their homes.– Reduces impact of foreclosure oncommunities. Ends December 31, 2012.November 2010 l Making Home Affordable9

HAMP Eligibility CriteriaHomeowner:Loan: Has financial hardship and isdelinquent or at risk ofdefault Is owner‐occupant of 1‐4unit property Has sufficient, documentedincome to support themodified payment Amount owed on firstmortgage equal to or lessthan 729,750 Mortgage originated on orbefore January 1, 2009 First mortgage payment (PITI homeowner association/condo fees) is greater than31% of homeowner’s monthlygross incomeWhat if thehomeowner isunemployed?Try UP.November 2010 l Making Home Affordable10

UP OverviewHomeAffordableUnemploymentProgram (UP) Any unemployed homeowner who requestsassistance under HAMP must first beconsidered for UP. UP provides temporary assistance tohomeowner with hardship related tounemployment. Assistance grants homeowners a forbearancewhere payments are reduced or suspended. Effective August 1, 2010.November 2010 l Making Home Affordable11

UP Eligibility CriteriaBorrower:Loan: Is owner‐occupant of 1‐4 unitproperty. Makes request before seriouslydelinquent (three months due,unpaid). Is unemployed at time ofrequest and eligible forunemployment benefits. Has not previously received UPforbearance. Amount owed on firstmortgage equal to or less than 729,750. Mortgage originated on orbefore January 1, 2009. Is delinquent or default isforeseeable. Loan has not been previouslymodified under HAMP.November 2010 l Making Home Affordable12

From UP to HAMP od. Minimum forbearance is 3 months, but may beextended at servicer discretion. Homeowner’s payment must be reduced to nomore than 31% of gross income. Servicer may suspend homeowner’s mortgagepayment in full. UP Forbearance Plan Notice provides theeffective date and other details about theForbearance Plan.November 2010 l Making Home Affordable13

From UP to HAMP ModificationServicerevaluateseligiblehomeowner forHAMP. At least 30 days before forbearance expiration,servicer required to evaluate whether extensionwill be provided. Servicer provides Initial Package to homeownerat re‐employment or 30 days before UPforbearance expiration. Homeowner submits Initial Package for servicerevaluation for HAMP.November 2010 l Making Home Affordable14

Steps to HAMP ModificationStep #1for everyone!Homeownersubmits InitialPackage forevaluation.What if thehomeowner isunderwater?Try PRA. Homeowner proactively seeks help from serviceror responds to servicer solicitation letter. Homeowner submits Initial Package:–Request for Modification & Affidavit (RMA)–Signed and dated 4506T‐EZ–Evidence of income–Certification that homeowner not convictedof felony larceny, theft, fraud or forgery;money laundering; or tax evasion over last 10years. Servicer evaluates income, debt, and hardshipagainst eligibility criteria.November 2010 l Making Home Affordable15

PRA OverviewPrincipalReductionAlternative(PRA) PRA was designed to help homeowners whosehomes are worth significantly less than theyowe (LTV 115% ) by encouraging servicers andinvestors to offer principal reduction relief. Principal reduction may lower re‐default risk forsome loans. HAMP‐participating servicers required toevaluate homeowners for PRA. Each servicer required to develop guidelinesaround application of principal reduction. Effective October 1, 2010 ‐ December 31, 2012.November 2010 l Making Home Affordable16

HAMP Steps to ModificationServicercalculatestarget modifiedpayment.Servicer applies the standard modificationwaterfall to reduce monthly mortgage paymentto 31% of gross (pre‐tax) income.1. Capitalize outstanding interest, escrowadvances, out‐of‐pocket servicing expenses(no late fees).2. Cut interest rate to as low as 2%.3. Extend loan term up to 40 years.4. Defer portion of principal, interest‐free, untilloan is paid off.November 2010 l Making Home Affordable17

PRA Alternative Modification WaterfallServicercalculatestarget modifiedpayment.If servicerforgives 5% : Interest ratemay exceed 2%. Step 3 mayprecede Step 2.For underwater homeowner (LTV 115% ), servicermust ALSO apply the alternative modificationwaterfall to reduce monthly mortgage payment to31% of gross (pre‐tax) income.1. Capitalize outstanding interest, escrowadvances, out‐of‐pocket servicing expenses(no late fees). Servicer reduces UPB to reach LTV of 115% ortarget monthly mortgage payment at 31%.2. Cut interest rate to as low as 2%.3. Extend loan term up to 40 years.4. Defer portion of principal, interest‐free, untilloan is paid off.November 2010 l Making Home Affordable18

PRA NPV TestServicerApplies NetPresent Value(NPV) Test NPV test is complex, nonlinear mathematicalmodel to analyze cost/benefit of investmentdecisions. If NPV test is positive on standard modificationwaterfall, servicer must modify loan. If NPV test is negative, servicer may modify loanin accordance with investor guidelines. If NPV test is positive on alternativemodification waterfall, servicer may reduceprincipal with HAMP modification. Homeowner can request review of NPV values ifdenied because of negative NPV test.November 2010 l Making Home Affordable19

Steps to HAMP ModificationQualifiedhomeownerenters HAMPTrial Period. Servicer offers 3‐month trial modification (4months if in imminent default at start). Trial Period Plan Notice details terms and neednot be signed by homeowner. Homeowner must make payment each monthduring trial period. Homeowner eligible for permanent modificationafter successful trial period.November 2010 l Making Home Affordable20

PRA Application of Principal ReductionPRA reducesprincipal overthree years. Servicer must initially treat principal reduction asnon‐interest bearing principal forbearance. Homeowner in good standing receives principalreduction in thirds: one‐third per year for 3 years. Homeowner in good standing who sells home orpays off loan 30 days after permanentmodification is effective receives total reduction. Servicer may retroactively forgive any amount ofprincipal for any loan permanently modified or ina trial period plan prior to October 1, 2010.November 2010 l Making Home Affordable21

PRA Homeowner NotificationServicerprovideshomeownerdetails ofprincipalreduction.Servicer must provide the following informationto the homeowner: How deferred principal reduction will beapplied to the loan. That principal reduction will be reported to IRSin year curtailment is applied. That homeowner should seek advice from taxprofessional. How homeowner may elect to decline theprincipal reduction.November 2010 l Making Home Affordable22

HAMP Modification Pays for PerformanceHAMP reducesprincipal forresponsiblehomeowners. Homeowner who makes timely paymentsreceives principal reduction of up to 5,000: 1,000 per year for 5 years.November 2010 l Making Home Affordable23

HAMP Protections Against ForeclosureDesigned toprotectresponsiblehomeownersfromunnecessaryand costlyforeclosureactions. Servicers may not refer homeowner toforeclosure until homeowner is determinedineligible for HAMP, or contact efforts failed. Servicer may not proceed with foreclosure saleuntil homeowner determined ineligible,declines HAMP, or contact efforts have failed. Servicer’s attorney or trustee cannot conduct aforeclosure sale without written certificationthat a homeowner is not HAMP‐eligible. In most cases, if not approved, homeownerbenefits from 30‐day waiting period beforeforeclosure sale.November 2010 l Making Home Affordable24

HAMP Help for Homeowners in BankruptcyDesigned toexpandmodificationopportunitiesforhomeowners inbankruptcy. Servicers must consider homeowners in activebankruptcy for HAMP if request is received fromhomeowner, homeowner’s counsel, orbankruptcy trustee. Homeowners in trial period plans whosubsequently file for bankruptcy may not bedenied HAMP modification because ofbankruptcy filing.November 2010 l Making Home Affordable25

2MP OverviewSecond LienModificationProgram (2MP) Designed to work in tandem with HAMP,providing a comprehensive solution forhomeowner with 2nd lien. When 1st lien is modified, participating 2MPservicer must offer to modify 2nd lien. Available through servicers participating in2MP. Effective through December 31, 2012.November 2010 l Making Home Affordable26

2MP Coordination with HAMP2MP works intandem withHAMP. When there is principal forbearance orreduction on 1st lien, participating 2MP servicermust forbear or forgive on 2nd lien in at leastsame proportion. If principal reduction is offered retroactively on a1st lien, 2MP servicer may forgive principalretroactively on 2nd lien.November 2010 l Making Home Affordable27

2MP Modification Pays for Performance2MP reducesprincipal forresponsiblehomeowners. Homeowner who makes timely paymentsreceives principal reduction of up to 1,250: 250 per year for 5 years.November 2010 l Making Home Affordable28

HAFA ) Provides alternatives—Short Sale (SS) andDeed‐in‐Lieu of foreclosure (DIL)—when homeretention options are exhausted. Standardized process offers graceful exit toproactive homeowners:–Releases homeowner from future liability.–Provides 3,000 relocation assistance.–Encourages cooperation from subordinatelien holders. Effective April 5, 2010 – Dec. 31, 2012.November 2010 l Making Home Affordable29

HAFA Eligibility CriteriaHomeowner:Loan: Is owner‐occupant Property may be vacant 90days if homeowner requiredto relocate 100 miles forwork Amount owed on 1stmortgage equal to or lessthan 729,750 Mortgage originated on orbefore January 1, 2009 First mortgage payment (PITI homeowner association/condo fees) is greater than31% of homeowner’s monthlygross incomeNovember 2010 l Making Home Affordable30

HAFA Short SaleHAFA ShortSale releaseshomeownerfrom futureliability fordebt Servicer allows homeowner to sell propertyfor less than full amount due on mortgage. Servicer accepts payoff in full satisfaction ofmortgage. Servicer approves short sale terms prior tolisting using standard forms and specifictimeframes. Alternatively, servicer may approve short saleat homeowner request for property alreadyon the market.November 2010 l Making Home Affordable31

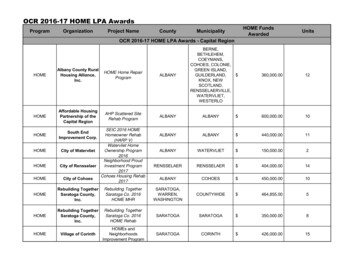

HAFA Pre‐Approved Short Sale ProcessTriggereventoccursServicer has30 calendardays to offerconsiderationunder HAFA(or HAMP).Homeownerhas 14calendar daysto respondwith requestforconsiderationfor HAFA (orHAMP).30 DAYS14 DAYSServicer hasreasonableamount oftime todetermineminimumacceptablesale amountand to offerSSA tohomeowner.REASONABLETIMEHomeownerhas 14calendardays toreturn SSAto servicer.Homeownerand/orlisting agenthasminimum of120 calendardays tomarketproperty.Homeownerand/orlisting agenthas threebusinessdays tosubmit offerwith RASS orARASS toservicer.Servicerhas 10businessdays toapprovetheoffer.Servicerschedulesclosing forno less than45 calendardays. Uponclosing,homeownerreceives 3,000relocationassistance.14 DAYS120 DAYS3 DAYS10 DAYS45 DAYSHomeowner Does not qualify for a Trial Period Plan Does not successfully complete a Trial Period Plan Is delinquent on a HAMP modification Requests a short sale or DILNovember 2010 l Making Home Affordable32

HAFA Deed‐in‐Lieu of ForeclosureHAFA DILreleaseshomeownerfrom futureliability fordebt. Homeowner voluntarily transfers ownership ofmortgaged property to servicer in fullsatisfaction of the total amount due. Servicer may require homeowner to list andmarket property before agreeing to DIL. Homeowner provides marketable title, freeand clear of other mortgages, liens, andencumbrances. HAFA incentives also available on Deed‐to‐Lease options.November 2010 l Making Home Affordable33

HHF OverviewHousingFinance AgencyInnovationFund for theHardest HitHousingMarkets (HHF) HHF supports innovative HFA programs thatstabilize housing and help families avoidforeclosure. Programs may include assistance to unemployedhomeowners, principal reduction, funding toextinguish 2nd liens, and facilitation of SS, DIL. Designed to complement MHA or reachhomeowners ineligible for MHA. Eighteen states plus DC have funds available: AL,AZ, CA, FL, GA, IL, IN, KY, MI, MS, NJ, NV, NC, OH,OR, RI, SC, and TN. und.htmlNovember 2010 l Making Home Affordable34

HHF Rules of EngagementHHF programsare intended tocomplementassistanceprovidedthrough MHA.A servicer may not Deny or delay HAMP consideration pendingacceptance of a borrower into an HHF program. Require that homeowners first request HFAprogram assistance. Solicit the homeowner for participation in anHHF program without written consent from theHFA.A servicer may Contact the HFA for authorization to notifyhomeowner of potential participation in HHF.November 2010 l Making Home Affordable35

HHF Interactions ‐ Unemployment AssistanceHHF programsoffer additionalassistance tounemployedhomeowners. May precede, run concurrently with, orextend UP forbearance. If HHF assistance precedes UP, servicerreceiving payments greater than 31% ofhomeowner’s gross monthly income mustoffer qualified homeowner UP forbearance (atleast 3 months in length) after HHF assistanceends and prior to evaluating the borrower forHAMP.November 2010 l Making Home Affordable36

HHF Interactions ‐ Principal ReductionHHF programsare designed toassisthomeownerswhose homesaresignificantlyunderwater. HHF programs can contribute funds towardprincipal reduction to enable modification totake place. HHF programs can be used to pay escrowshortages and reduce arrearages. If suchamounts have been capitalized, thepayments are a principal reduction. HHF programs can be used to makemodifications NPV positive by providingupfront principal reduction.November 2010 l Making Home Affordable37

HHF Interactions ‐ Funding for 2nd LiensHHF programsmay includefunding toextinguish 2ndliens. 2nd lien may be modified or extinguishedunder HHF program if 1st lien not in TrialPeriod Plan, not modified by HAMP. 2nd lien may be modified or extinguishedunder HHF program if servicer does notparticipate in 2MP. If corresponding 1st lien subsequentlymodified under HAMP, 2MP servicer mustmodify 2nd lien per 2MP guidance.November 2010 l Making Home Affordable38

HHF Interactions ‐ Short Sales, DILsAn HHFprogram canhelp ahomeownermake agraceful exit.HHF programs may Assist homeowner with monthly paymentsduring Short Sale marketing period. Provide additional relocation assistancefollowing successful Short Sale or DIL.HHF programs may not Provide additional compensation to extinguishsubordinate liens in a HAFA transaction.November 2010 l Making Home Affordable39

HHF Interactions ‐ Government‐Insured LoansHHF programswork with theservicer andinsurer todetermine themost effectiveuse ofresources.HHF programs may be used to facilitate FHAmodifications in the following ways: Payment of arrearages Reduction of forborne amounts Settlement of other debtNovember 2010 l Making Home Affordable40

Find Program InfoMakingHomeAffordable.govHomeownershave easyaccess to MHAinformationand tools.Find the list of participating servicersatwww.MakingHomeAffordable.gov/contact servicer.html.November 2010 l Making Home Affordable41

Fight ScamsLoanScamAlert.orgSpread theword. Identifyand reportscams.Information is available inmultiple languages.Homeowners learn to identifyscams. Enforcement is keypart of campaign.Partner Toolkit providesresources for localparticipation and promotion.November 2010 l Making Home Affordable42

Resources for Trusted AdvisorsResources arein place to helpadvisors helphomeowners. HAMP Solution Center: 1‐866‐939‐4469,support@HMPadmin.com Escalate cases to escalations@HMPadmin.com. FannieMae.com, (800)7Fannie, KnowYourOptions.com FreddieMac.com, (800)Freddie,Borrower Outreach@FreddieMac.com Follow MHA progress at FinancialStability.gov. For assistance with FHA loans, contact the FHA NationalServicing Center at (877)622‐8525 orHUD.gov/offices/hsg/sfh/nsc/nschome.cfm. For assistance with VA loans, call (877)827‐3702 or visitHomeLoans.va.gov. For help with RHS loans, contact the Centralized ServicingCenter at (800)414‐1226.November 2010 l Making Home Affordable43

Access Program InformationTrustedadvisors haveeasy access toMHAinformationand tools.HMPAdmin.comResources for Counselorsand Trusted Advisors FAQs Presentations Escalation process detailsHomeowner Outreach Homeowner presentations Consumer brochures. Fact Sheets in English, Spanish,Portuguese, Chinese, Korean,Hmong, Tagalog andVietnamese Web‐ready banner adsNovember 2010 l Making Home Affordable44

Trusted Advisors Escalate Tough CasesHAMP SolutionCenter helpstrusted advisorswith cases thatare difficult toresolve.Visit the HAMP Solution Center atHMPadmin.com.November 2010 l Making Home Affordable45

Discussion/QuestionsThank YouNovember 2010 l Making Home Affordable46

November 2010 l Making Home Affordable 6 Homeowner contacts lender to apply for HARP. Steps to HARP Refinance Homeowner determines basic eligibility at MakingHomeAffordable.gov. Homeowner owing more than 105% and up to 125% of home's current market value contacts