Transcription

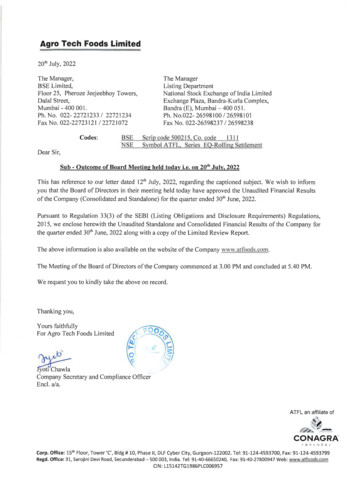

A9ro Tech Foods Limited20 th July, 2022The Manager,BSE Limited,Floor 25, Pheroze Jeejeebhoy Towers,Dalal Street,Mumbai - 400001.Ph. No. 022- 22721233/ 22721234Fax No. 022-22723121 /22721072Codes:BSENSEThe ManagerListing DepartmentNational Stock Exchange of India LimitedExchange Plaza, Bandra-Kurla Complex,Bandra (E), Mumbai - 400051.Ph. No.022- 26598100 / 26598101Fax No. 022-26598237/26598238Scrip code 500215 . Co. code1311Symbol ATFL. Series EO-Ro lling SettlementDear Sir,Su b - Outcome of Board Meeting held today i.e. on 20 th July, 2022This has reference to our letter dated 12th July, 2022, regarding the captioned subject. We wish to informyou that the Board of Directors in their meeting held today have approved the Unaudited Financial Resultsof the Company (Consolidated and Standalone) for the quarter ended 30 th June, 2022.Pursuant to Regulation 33(3) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations,2015, we enclose herewith the Unaudited Standalone and Consolidated Financial Results of the Company forthe quarter ended 30th June, 2022 along with a copy of the Limited Review Report.The above information is also available on the website of the Company\ \IVY \ . atfoods .co m.The Meeting ofthe Board of Directors of the Company commenced at 3.00 PM and concluded at 5.40 PM .We request you to kindly take the above on record.Thanking you,Yours faithfullyFor Agro Tech Foods Limited'yotl ChawlaCompany Secretary and Compliance OfficerEnc\. ala.ATFL an affiliate of . . .CONAGRACorp. Office: 15 th Floor, Tower 'C', Bldg # 10, Phase II, DLF Cyber City, Gurgaon-122002. Tel: 91-124-4593700, Fax: 91-124-4593799Regd. Office: 31, 5arojini Devi Road, 5ecunderabad - 500 003, India. Tel: 91-40-66650240, Fax: 91-40-27800947 Web: www .atfoods.comCIN: L15142TG1986PLC006957

Agro Tech Foods LimitedRegd. Office: 31, Sarojini I)evi Road, Secunderabad - 500003CIN LI5142TGI986PLCU06957, Ph: 040-6665024U Fax: 040-278UU947Statement of Unaudited Standalone and Consolidated financial results for the quarter ended June 311, 21122( 3U-U6-2022UnauditedParticularsARevenue from operationsSale ofprodu"tsOther operating revenoeTotal revenue from operationsOth\!f incomeTot 1BincomeExpensesCost of IlHiteriais cons umedPurchase ufstock-in-tradeChanges in invcntolics of finished goods and stock-ill-hadeEmployee benefits expenseFinance costsDepreciation ami i:tl11ortisaliun t:xpt;nseAdvcrtisl!lll!.:nt and sales promution cxpcnscCDEFGHIJOthe,' expensesTotal expensesProfit before exceptional items and tax (A-B)ExccptiQJJaJ items (Refer note 6)Profit before tax (C D)Tax expenseCurrent laxIncome-tu x in respect ofcarlicl' Yl.!alSI 20,622152U.63714.20713,6546458M1,IHO5I51012,322( 1.51811,140725084543.72918.592444410Deferred lu x dla" el (eredil)Total tax expenseProfit after tax IE-FlNon-controllinu interestNct profit aftcr taxes "nd non eontrollin!! jntcrest (G-H)Other comprebensive income(0 items that lI'ill nul be rf!dw'sUied subs(!(/ueJllly tv (he .,·lulel1lefl( ufpru/il lIlili luss:- RcmciisurcmclH oflbe net defined benefit obligatiun- Incume-lax I'elating to thust: itt:msStandaloneQuarter ended31-U3-202230-06-2021Refer Note 84293.16519.5881.0491.04991.4X311591,59 27742.608-4(I)-4(I)prq!iI and loss:Exchangc- difterence:-o in translating the tinancial statements or fore ignsubsidial itsKTotal comprehensive income /(1oss) before non-controlling interest (J J)LNon-controlling interestMTotal comprehensive income 1(loss) arter non-controlling interest (K-L)NPaid up equity share capital (face value0Other quityPEarnings pcr share (ofi( 10 each) (ror the period - notannualised):31Basic ( )Dilllted( ) I 0 per equity sha, .67446171.396515276313.72120.621651201H5212J 531,6462281,50260514429U7219.6041.U345X.I775,706( 189)5.9472422,1012, 233( 6 421.2721,034-2q22X9162.585--632755-2.742.72Page 1 of 23.263 ?410.9710.91700( 743.5770.130.13Veur 9573-in Iii) Items Ihut 11'i/l he l'f!cICl. ijied .mh.veClllf!l1t v to fhe .vtllfemelJI ITotal olher comprehensiw income /(Ioss), nel of lax30-06-2022Unaudited6 138(14)96220652-240Vear ended31-U3-2U22AuditedConsolidatedQuarter ended31-03-2U2230-U6-2U21l!naudltedKef. Note 543,7740.Q92.653.1 0.09' 643. 1710.X7IO.SIVV

Agro Tech Foods LimitedRegd. Office: 31, Sarojini Oevi Roud, Secunderabad - 500 003CIN LI5142TCI986PLC006957, Ph: 040-66650240 Fax: 040-27800947Notes:These financial results were reviewed and recOin mended by the Audit Committee and approved by the Board of Directors at their meetings held on July 10, 2022.2These results have been prepared in accordance with Indian Accounting Standards (Ind AS) prescribed under Section 133 of the Companies Act, 2013, read with the relevant rules issuedthereunder and are as per Regulation 33 orthe SEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended . The statutory auditors have carried out a limited reviewof these results for the quarter ended June 30, 1022 and have issued an unmodified report on these results.3The consolidated fin ancial results include the results of Agro Tech Foods Limited ("Parent Company") and its wholly-owned subsidiaries (i) Sundrop Foods India Private Limited; India (ii)Agro Tech Foods (Bangladesh) Pvt. Ltd .; Bangladesh and (iii) Sundrop Foods Lanka (Private) Limited; Sri Lanka (together referred to as "the Group").4In the context of Indian Accounting Standard (Ind AS) lOX Operating Segments, "foods" is considered as the operating segment of the Company since the "Chief Operating Decision Maker'(CODM) reviews business performance at an overall Company level as one segment.5The figures for the quarter ended March 31 , 2022 are balancing figures between thethird quarter ended December 31, 2021.6During the previous year, the Parent Company had received the settlement in respect of the insurance claim made by it in relution to the fire incident at one of the manufacturing facilities of theParent Company which had caused dumage to the Parent Compuny's property, plant and equipment alid inventory during the year ended Murch 31, 2019. The Parent Company had recorded aloss arising from such incident for the year ended March 31 , 2019 and had also recognised a minimum insurance claim receivable for an equivalent amount. The Parent Company had adjustedthe insurance proceeds against the net claims rec ivable balance and presented 20 I lakhs as exceptional income in the financial results for the quarter and year elld March 31, 2022.audit dfigures of the full financial yearDate: July 20, 2022Place: GurugrumVisit our website at: www.atfoods.comPage 2 of 2 ndedMarch 31, 2022 and the published year to date figures upto

DeloitteHaskins. Sells LLPChartered Ac:c:ountantsKRBTowersPlot No.f to 4 & 4A1st. 2nd & 3rd FloorJubilee Enclave, MadhapurHyderabad-500 081Telangana, IndiaTel: 91 407125 3600Fax:40 7125 3601 9,INDEPENDENT AUDITOR'S REVIEW REPORT ON REVIEW OF INTERIM STANDALONEFINANCIAL RESULTSTO THE BOARD OF DIRECTORS OFAGRO TECH FOODS LIMITED1.We have reviewed the accompanying Standalone Unaudited Financial Results ofAgro Tech Foods Limited ("the Company"), for the quarter ended June 30, 2022("Results") included in the accompanying Statement of Unaudited Standalone andConsolidated Financial Results for the quarter ended June 30, 2022 ("the Statement"),being submitted by the Company pursuant to the requirement of Regulation 33 of theSEBI (Listing Obligations and Disclosure Requirements) Regulations, 2015, as amended.2. The Results included in the Statement, which is the responsibility of the Company'sManagement and approved by the Company's Board of Directors, have been prepared inaccordance with the recognition and measurement principles laid down in the IndianAccounting Standard 34 "lnterim'Financial Reporting" ("Ind AS 34"), prescribed underSection 133 of the Companies Act, 2013 read with relevant rules issued thereunder andother accounting principles generally accepted in India. Our responsibility is to expressa conclusion on the Results included in the Statement based on our review.3 . We conducted our review of the Results included in the Statement in accordance withthe Standard on Review Engagements (SRE) 2410 'Review of Interim FinancialInformation Performed by the Independent Auditor of the Entity', issued by the Instituteof Chartered Accountants of India (ICAI). A review of interim financial informationconsists of making inquiries, primarily of the Company's personnel responsible forfinancial and accounting matters and applying analytical and other review proced ures. Areview is substantially less in scope than an audit conducted in accordance withStandards on Auditing specified under Section 143(10) of the Companies Act, 2013 andconsequently does not enable us to obtain assurance that we would become aware of allsignificant matters that might be identified in an audit. Accordingly, we do not expressan audit opinion.4.Based on our review conducted as stated in paragraph 3 above, nothing has come to ourattention that causes us to believe that the Results included in the accompanyingStatement, prepared in accordance with the recognition and measurement principles laiddown in the aforesaid Indian Accounting Standard and other accounting principlesgenerally accepted in India, has not disclosed the information required to be disclosed interms of Regulation 33 of the SEBI (Listing Obligations and Disclosure Requirements)Regulations, 2015, as amended, including the manner in which it is to be disclosed, orthat it contains any material misstatement.For DELOITTE HASKINS & SELLS LLPChartered Accountants(F.R.N: 117366W/W-100018) . '-Place: GurugramDate: July 20, 2022tSumit TrivediPartnerMembership No. 209354 DIN: 42 'l?,SltANC,TLr.;l ObRegd. Office: One International Center. Tower 3, 32nd Floor. Senapati 8apat Marg, Elphinslone Road (West). Mumbai·400 013. Maharashtra. India.(LLP Identlflcation No. MB-873 7)

DeloitteHaskins & Sells LLPChartered AccountantsKRB TowersPlot No 1 to 4 &4A1st, 2nd & 3rd FloorJubilee Enclave, MadhapurHyderabad-SOO OS1Telangana, IndiaTel: 91 4071253600Fax: 91 4071253601INDEPENDENT AUDITOR'S REVIEW REPORT ON REVIEW OF INTERIM CONSOLIDATEDFINANCIAL RESULTSTO THE BOARD OF DIRECTORS OFAGRO TECH FOODS LIMITED1.We have reviewed the accompanying Consolidated Unaudited Financial Results ofAgro Tech Foods Limited ("the Parent") and its subsidiaries (the parent and its subsidiariestogether referred to as "the Group") ; for the quarter ended June 30, 2022 ("ConsolidatedResults") included in the accompanying Statement of Unaudited Standalone and ConsolidatedFinancial Results for the quarter ended June 30, 2022 ("the Statement"), being submitted bythe Parent pursuant to the requirement of Regulation 33 of the SEBI (Listing Obligations andDisclosure Requirements) Regulations, 2015, as amended.2.This Consolidated Results included in the Statement, which is the responsibility of the Parent'sManagement and approved by the Parent's Board of Directors, have been prepared inaccordance with the recognition and measurement principles laid down in the Indian AccountingStandard 34 "Interim Financial Reporting" ("Ind AS 34"), prescribed under Section 133 of theCompanies Act, 2013 read with relevant rules issued thereunder and other accounting principlesgenerally accepted in India. Our re ponsibility is to express a conclusion on the ConsolidatedResults in the Statement based on our review.3.We conducted our review of the Consolidated Results included in the Statement in accordancewith the Standard on Review Engagements (SRE) 2410 "Review of Interim Financial InformationPerformed by the Independent Auditor of the Entity", issued by the Institute of CharteredAccountants of India (ICAI). A review of interim financial information consists of makinginquiries, primarily of Parent's personnel responsible for financial and accounting matters, andapplying analytical and other review procedures. A review is substantially less in scope than anaudit conducted in accordance with Standards on Auditing specified under Section 143(10) ofthe Companies Act, 2013 and consequently does not enable us to obtain assurance that wewould become aware of all significant matters that might be identified in an audit. Accordingly,we do not express an audit opinion.We also performed procedures in accordance with the circular issued by the SEBI underRegulation 33(8) of the SEBI (Listing Obligations and Disclosure Requirements) Regulations,2015, as amended, to the extent applicable.4.The Consolidated Results included in the Statement includes the results of the following entities:(a) Agro Tech Foods Limited; India (Parent)(b) Sundrop Foods India Private Limited; India [wholly owned subsidiary of (a) above](c) Agro Tech Foods (Bangladesh) Pvt. Ltd; Bangladesh [wholly owned subsidiary of (a)above](d) Sundrop Foods Lanka (Private) Limited; Sri Lanka [wholly owned subsidiary of (a) above]5.Based on our review conducted and procedures performed as stated in paragraph 3 above,nothing has come to our attention that causes us to believe that the Consolidated Resultsincluded in the accompanying Statement, prepared in accordance with the recognition andmeasurement principles laid down in the aforesaid Indian Accounting Standard and otheraccounting principles generally accepted in India, has not disclosed the information required tobe disclosed in terms of Regulation 33 of the SEBI (Listing Obligations and DisclosureRequirements) Regulations, 2015, as amended, including the manner in which it is to bedisclosed, or that it contains any material misstatement'tRegd Office: One International Center, Tower 3. 32nd Floor, Senapati 8apat Marg, Elphinstone Road (West). Mumbai-400 013, Maharashtra.lndia.(LlP Identifi,ation No. MB-8737)

DeloilleHaskins. Sells LLP6.The Consolidated Results includes the interim financial information of three wholly-ownedsubsidiaries which have not been reviewed by their auditors, whose interim financialinformation reflect total revenue of 400.59 lakhs, total loss after tax of 12.65 lakhs andtotal comprehensive loss of 12.65 lakhs for the quarter ended June 30, 2022, as consideredin the Consolidated Results included in the Statement. According to the information andexplanations given to us by the Management, these interim financial information are notmaterial to the Group.Our conclusion on the Consolidated Results included in the Statement is not modified in respectof our reliance on the interim financial information certified by the Management.For Deloitte Haskins & Sells LLPChartered Accountants(F.R.N: 117366WjW-100018) H '----- -----:--t-[.,Place: GurugramDate: July 20, 2022Sumit TrivediPartnerMembership No. 209354UDIN: ,2,::I.t,09aSltA"'C; TN I( 86.aS"

Scrip code 500215. Co. code 1311 Symbol ATFL. Series EO-Rolling Settlement . Tot 1 income t8.636 21.267 2U.637 91.866 IH.639 21.272 20.63H 91.899 . The Parent Company had adjusted the insurance proceeds against the net claims rec ivable balance and presented 20 I lakhs as exceptional income in the financial results for the quarter and .