Transcription

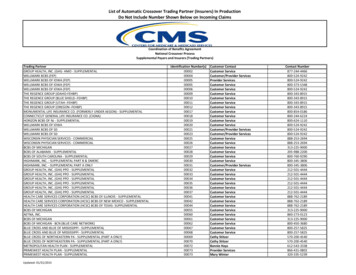

M ary l a ndTeachers and State EmployeesSupplementa lRetirement PlansThe Basics457(b) 401(k) 403(b) 401(a) match planTax-deferred (pre-tax) and Roth (post-tax) accounts

Maryland Teachers and State EmployeesSupplemental Retirement PlansGetting started is easy once you’vemade these four decisions:1 Choose the plan(s) that will work best foryou. See the Plans comparison charts onpages 10 and 11 to help you decide.2 Decide to contribute before or after taxes.Understand the differences between thetwo by reviewing some facts about taxes onpages 8 and 9, and by consulting the Planscomparison charts on pages 10 and 11.3 Decide how much to contribute per pay.4 Choose your investment options. Refer to page 5for an overview of MSRP’s investment options.Once your decisions are made, simplyrecord them on the Participation Agreementform included inside this booklet.You can also enroll online on MarylandDC.comor by calling Team MSRP at 800-545-4730.

WelcomeGet ready for your retirement through one or more of the three Maryland SupplementalRetirement Plans (MSRP). All employees of the State of Maryland, including contractualemployees, are eligible to participate in the 457(b) and 401(k) plans. State employees whowork within a State educational institution are also eligible to participate in the 403(b)plan. Take your pick:1 The 457(b) Deferred Compensation Plan– pre-tax (tax-deferred) option– after-tax Roth option2 The 401(k) Savings and Investment Plan– pre-tax (tax-deferred) option– after-tax Roth option3 The 403(b) Tax-Deferred Annuity Plan foremployees in educational institutionsEven though your pension and Social Securitywill provide income in retirement, they maynot provide enough to maintain your currentstandard of living. MSRP lets you save and investon your own and participation is voluntary.22 78 K78%Probability of outlivingretirement savingsRetirees in the state of MDSource: Ernst & Young LLP for Americans for Secure Retirement. 2009.Who is eligible?All employees of the State of Maryland, includingcontractual employees, are eligible to participatein the 457(b) and 401(k) plans. State employeeswho work within a State educational institutionare also eligible to participate in the 403(b) plan.1

Plans with you in mind457(b)401(k)403(b)401(a)match planThe MSRP includes three supplemental retirement plans1 — the 457(b), 401(k), 403(b) and 401(a) MatchPlan. Employees may participate in more than one plan. All the plans offer you the following advantages:yy Competitive plan feesyy Diversified investment optionsyy Flexible payout optionsyy Easy online account access1yy People who help you —Team MSRP RetirementSpecialists during employmentand Personal RetirementConsultants when you’rewithin five years fromretirement or in retirement.Refer to the Plans comparison charts on pages 10-11 for details about each plan.2 Maryland Teachers and State Employees Supplemental Retirement PlansInformation from RetirementSpecialists or PersonalRetirement Consultants isfor educational purposesonly and should not beconsidered investment advice.

The 401(a) match planThe State of Maryland provides a match to most employeecontributions to MSRP accounts. To be eligible, you mustbe a full-or part-time State employee and a member of theState Employees’ Alternate Contributory Pension Plan.If you qualify, the State will contribute a dollar to match eachdollar you contribute to your MSRP account, up to a maximum of 600 per fiscal year. That’s only 24 per pay period! The match willautomatically begin as soon as you enroll in MSRP, and a new 600maximum limit starts with each fiscal year (July 1 to June 30).NOTE: The amount of the match may change from yearto year or be suspended through legislative action, andis suspended for the fiscal year ending 6/30/2014.Simplify life with a single retirement accountYou may be able to transfer assets from outsideretirement accounts into your MSRP account.yyDoing so may make managing retirement assetseasier, especially when it comes to investment and taxdiversification as well as paperwork, user names andpasswords, and other aspects of account management.yyMSRP doesn’t charge sales commissions, so therearen’t any up-front fees to transfer your funds.yyUse the State of Maryland — MSRP Direct Rollover / Transfer Requestform included in the center of this booklet to get started.We want you to know that assets rolled over from anotherqualified plan may be subject to both surrender charges fromthe original plan and a 10% penalty tax if withdrawn beforeage 59½. However, because MSRP offers so many plan types, itmay be easier to transfer outside assets into your MSRP accountwithout triggering concerns about mixing asset types —e.g., rolling outside 401(k) funds into a 457(b) account.Please keep in mind that MSRP participation involves investing,and investing involves market risk, including possible loss ofprincipal. No investment strategy, including asset allocationand diversification, can avoid loss, especially in a down market.Nationwide Retirement Specialists and Personal RetirementConsultants cannot offer investment, tax or legal advice. For theseservices, you should consult your own advisor. We can help youunderstand market risk and other risks you may face, and strategiesthat may help you deal with them through participation in MSRP.3

Get startedChoose the plan(s) that willwork best for you2 — 457(b),401(k), or (only for educationalinstitution employees) 403(b).Decide whether to contributebefore taxes (pre-tax) orafter taxes (Roth)2 or acombination of both.Decide how many dollarsper pay to contribute.ETEDMPLRMFOTO:sCOlutionFAXt SoORemenRetir Road0ite 40nwide rmickNatio McCo za 1, Su 10311350 utive PlaMD 21 30Exec Valley, 545-4755 rHunt e: 800- 6-9403agedePhon 443-88der s or olFax:if unarSENDple eMTaT sdss a n T pla nherTeac ireMena nd l r eTrylTaaenM leMsuppesoyemForentollmEnrZEPlan 55 ye7(b) an ifNS 45 1(k) PlTIORUC 40INSTPNTMSRMEtheOLLll inginenrod beENRt toy anI wan m todaraing:Progdributdperiocontpayperioperpay 25per willionONTIduct we PriceAstRMZipoll deRoFOpayr the T. nd close . IxINtaeinto ent Fu age 65 nALA pr estedSONbegiStateturntiremwillbe inv ed Re which IPERoneetrrals ys fromk PhreTarg year in at defeWoreOthe30 da d by th thisthNamealto th tanddateiversractuyearpay is rece ceipt of meessperContunde e nextredsrmAddrtyonfowelcorsiperioon th te my that up ogram y time.payUniveddaer ofCity, an ive a Pr e at anrthegulareadNumbramOthe: RecelPhonbe mProg I will reswer)tySocia .cane anHomersis/besrmurrclgeesfowillUnivedatee yope (ci/AddrChanw. Iovid re, andll Tyll bekit.ralEmailbeloI wito prtuPayroCentthiledcase:sure r, signaes orof Birdetaichchangswer)se be mbewhonsDatee anmakeNuPlear, inde:nditican(circlrityen Ioldecy Cod comemySecuMaleleFemaint)se pr(pleaorofes whs an55tioncationthe timtermntlylimitnt allo contribu t thethecurrethawhichestme of myread I amrulesthe inv cation derstandssDatehaveposesnt and nt allo ice. I ununleat Ice imm.meamoue thplanServi Progration the invest of my choledg7(b)thevenueentribule.n(s)an.e 45al Re als fromknowmy co o chang n optio irrevocab) plI ac into thInternalsngeThe e withdrawmay er-tax pla option isd401(ky chaIellemaIce.aftnreceiv):in thenrotime, nt balan -tax orth plaupondeathlledAt any t accou the pre er-tax Roonlyion orenrothaftgram1(k))pyminatcurren r or boin ann 40g terhee a cothe Proinvest7(b))sectioto eitcludinfroml includ ent Kitturen 45IRCion tofundsent (inich wil Enrollmdecissectioed byerIRCploymSignahdrawkit wh g anddefinNumby witm emed bylcome rstandin below:NShip (asyI madefince froa wedeedl Securitl hardsor myITIOverancy (asmailed m of Un s outlin)anciaof meND1) Seergenl bedu401(kSociaere finnefitCOu wil moran provisionle Embesevle foryo0D)AeabForm73m,, Methelusive2)eseANavailab for 457(bquest nce.-545-4ent for ary Form ation onUnforthe excOnlyvisionut Re severaMSrollm1-800ilableyed.3) Anst forofn proPayos en , Benefici led informlingavaplotruTERloathimentlyof a ificationnsl emrmt oftaiby cal. OnRP inretireeiptve orif stilsed,re deible4) Pla disabilityion Foreceipby MSer rec yer’s verployedr positi ns.evenalproces t form.l eman eligUpon Cancellat let with moheld591/2eithe ibutiogin aft emploif stilor tote,agey be5) Totms are rollmenwill bemyuld be my controf the s Bookevenseparaainingals ma t andan IRAlancent comy for d the ensicn701/2theer tointainforent basagehdraw ploymenor Ba6) Attaccou less thaneucebelovoumafilewitingsig,n,myroluldl red nt prorthges.tIaintioonform emMy acc aries.uiredt wilI sho shortaing worticipa date tha7) Attficit req nce froreturnands thaestme found oneligibleh noe of lance bebeneings , financialeramy pa m thet.y bebent fee in the invugratensavsevcelmahofromebacanymentntysAlt ing mys, the ountipatedy cannage founds(es)accou m emploationI ma seven daaccretirem unanticbesesor maincludspectufroy,ermfluctu ult in myin myspectuenses enses canand prowithinrketlong-t day-to-dafunds severanceres)sis forthe proestmenting exp se expTheon ma could(02/13tioncoverprofileuponderlyReaderinvBased . Thise un on on theestmentD-MD.3planrticipa funds to730. fund’s and othtivepahav99Matigay5-4ysnemaencorms). Invlize myNRW-2100-54 der the ins thiI rea le emergomments ults. Inf ctus(eg 1-8 lly consi s contaInvest ment res prospe andDC.ccallinctuavailabveryld by ing, carefu prospementinvest respecti te at Madtaineinvestbe ob fore invest . The funor the ns websiule ofcanirementsesBeschedIts Ret ncial &the Plactuses esting. d expenfor aNRS.605prospe e invalf of FSC and Finaes an3-5behentC.Fund lly befor chargon-54emices RA, SIPks,.1-800endorscarefu tives, rispor t servmber FINationhaveialRP atormting sup C), mewide”) -Financ .m MSobjec nt infommarke n (FSrta“Nation Fighterscall Teaies.on and poratiotively of Fire w.nrsforu.cimponitalwayseducati urities Cory (collec ociation at wwcan opportuy provideof FSC Sec or NISC. ce Compantional Ass nd onlineYouranNRSrna be fouationLLC ma tiveseducvices, representa with MSRP, e Life Insuand the Inte s mayshipwids,lty Seredl & Rea registered affiliat and Nationof Countie ent relationFinancia ants ares, LLC are notutions ociation orsemrved.Consult Ser vice irement Sol ional Ass ut the endresetsRealty wide Ret h the Natrmation aboAll righutions.Nation ships witMore infoent Solrelation ation.e RetiremCorporionwid3 Nat 201NaAgennterll CePayroFill in your personalinformation, check a fewboxes, sign and you’redone with Option Aand EZ enrollment!24 Maryland Teachers and State Employees Supplemental Retirement PlansRefer to the Plans comparison charts on pages 10-11 to helpmake your selection(s).

Enrolling is easy once you’ve made these four decisions:Choose your investment options. You can invest in a Targeted RetirementFund (Option A) — and/or choose your own individual funds (Option B).It all depends on how involved you want to be as an investor.This page offers a brief overview of the investment options available throughMSRP. Our Spectrum of Investment Options details these options, and is available online atMarylandDC.com, from your Retirement Specialist, or by calling Team MSRP at 800-545-4730.Remember, you’re not on your own. Retirement Specialists can answer questions,explain how investing works and implement your informed decisions.—and/or—Option A:Targeted Retirement FundsOption B:Traditional investment approachTargeted Retirement Funds offered by T. RowePrice, also known as target date funds, are assetallocation funds that are based on the date aninvestor plans to begin withdrawing money.Choose your own asset allocation mix of MSRPinvestment options. Review your investments andgradually change your overall strategy as you nearretirement, and/or use an asset allocation modelselected based on your own risk tolerance.These funds use a strategy that reallocates equityexposure to a higher percentage of fixed investmentsover time. As a result, the funds become moreconservative over time as you approach retirement.It’s important to remember that no strategy canassure a profit or prevent a loss in a decliningmarket. The principal value of the fund(s) is notguaranteed at any time, including at the target date.See the Spectrum of Investment Optionsfor details about these funds.Targeted Retirement Funds are managed by T. Rowe Priceand are composed of other T. Rowe Price mutual funds.There are many considerations when planning for retirement. Yourretirement needs, expenses, sources of income, and available assetsare some important factors for you to consider in addition to theRetirement Funds. Before investing in one of these funds, also be sureto weigh your objectives, time horizon, and risk tolerance. All fundsare subject to market risk, including the possible loss of principal.Actively managed funds have managers chooseinvestments to attempt to achieve a goal, likeoutperforming an index or balancing risks withreturns. Because of the management activity,these funds tend to have higher costs thanpassively managed funds. Passively managedfunds normally carry lower-than-averagefees and track the markets per their selectedindices to create a diversified portfolio.We can help you automatically rebalance yourasset allocation quarterly when you call or goonline to sign up for automatic re-balancing.The use of asset allocation does not guarantee returns or insulateyou from potential losses. Asset allocation is a rational strategy forinvestment selection. Simply put, it is the process of diversifyingyour investment dollars across different asset classes. It helps youmaximize your return potential while helping to reduce your risk.Please consider the fund’s investment objectives, risks, andcharges and expenses carefully before investing. The prospectuscontains this and other important information about theinvestment company. Prospectuses are available by calling800-545-4730. Read the prospectus carefully before investing.5

It’s never too late to start but . the sooner you begin investing, the better opportunity you have to grow your MSRP accountto help meet your needs for additional retirement income. Will you have enough money inretirement to live the life you want?Consider how longyou’ll need incomeConsider how muchwaiting can costToday’s 65 year old can expect to live another 20years. But the average retirement age for publicworkers is 60; for a public school teacher, 59. Policeand firefighters often retire at even earlier ages.3The point is: You need to financially prepare fora retirement that may last 30 years or more.Meet Ben and John, two State employees.The cost of living will probably increaseconsiderably. Your other resources may not meetall your needs for retirement income. That’swhere investing through MSRP can help.Ben237 564 202 237 564 160 Invested 2,000per year(or 20,000)10 yearsJohnBen started investing for retirement at age 30 andinvested 2,000 a year for only 10 years, and thenhe stopped making contributions. John waiteduntil age 40 to start investing for retirement andinvested 2,000 for 25 years. Because he startedearly, Ben will have more for retirement eventhough he contributed less than John. Imaginewhat he’d have if he’d continued his contributionsuntil retirement! Start early. Start now!No contributionsNo contributions25 yearsInvested 2,000 per year (or 50,000) 160,474Balance at age 65 135,353This illustration is a hypothetical compounding calculation assuming an 7% annual rate of return. It is not intended toserve as a projection or prediction of the investment results of any specific investment. Investments are not guaranteed.Depending on your underlying investments, your return may be higher or lower. Interest compounded annually based onbeginning-year contributions. No taxes or fees are reflected in this example, which would lower the results displayed.Source: Hewitt Associates, 2008.3How old is old? Is 80 the new 65? Weldon Cooper Center for Public Service, -80-the-new-65/, accessed 02/07/2013; Average retirement age for publicworkers: 60, Orange County Register, May 11, 2011, e-retirement-age-for-public-workers-60/82705/, accessed 02/07/2013.6 Maryland Teachers and State Employees Supplemental Retirement Plans

State of Maryland – MSRPDirect Rollover/Transfer RequestTo expedite the Rollover/Transfer process, please check to see thatyou have provided us with the following items before your requestis submitted: A completed Direct Rollover/Transfer formPERFORATION LINE A recent statement of account from your previous plan provider Distribution paperwork from your previousprovider, completed and signed The appropriate signature requirements from your previous employerAfter all of the above items are obtained, please mail thecompleted paperwork to the following address:Nationwide Retirement Solutions11350 McCormick RoadExecutive Plaza 1 – Suite 400Hunt Valley, MD 21031or fax to 443-886-9403

Before completing this form, please review the checklist on the back to insure thatyour rollover/transfer is processed in a timely manner.State of Maryland Direct Rollover/Transfer Request (For incoming assets only)Please complete all sections of this form. All information on this document must be completed and returned to Nationwide Retirement Solutions in order to beprocessed. If you require assistance in completing this form or need additional information, please contact us at 1-800-966-6355.Upon completion of this form, please return the signed document to:Nationwide Retirement Solutions11350 McCormick Road, Executive Plaza 1 – Suite 400Hunt Valley, MD 21031SECTION I: Participant InformationLastFirstCurrent AddressNumber and StreetStateState Agency:()Work Phone Number (Include Area Code)Zip Code()E-mail Address:Work Location:SECTION II: Rollover/Transfer Funds From:Money Source: Home Phone Number (Include Area Code)Apt./SuiteCityPlan Type:Social Security NumberMiddle 457 plan 401(k) plan Salary Reduction (Pre-Tax)Amount to Rollover/Transfer: 403(b) plan Roth Total account balance 401(a) plan Partial dollar amount Traditional IRA Other Carrier/Custodian NameAccount NumberAddressContact NameNumber and StreetCityStateTelephone NumberZip CodeSECTION III: Rollover/Transfer Funds To:Plan Type: 457 plan 401(k) plan 403(b) planMake check payable to: Nationwide Retirement Solutions, FBO (Participant Name, SS#)Mail check to:Nationwide Retirement Solutions, 11350 McCormick Road, Executive Plaza 1 – Suite 400, Hunt Valley, MD 21031NOTE: For Roth contributions provide the date of the first contribution and cost basis amount.SECTION IV: Investment Direction Credit my rollover/transfer according to the current allocation on file-OR- Credit my rollover/transfer as listed below (must total 100%):FIXED INCOME OPTIONSMALL CAP%T. Rowe Price Small Cap. Stock Fund%Investment Contract Pool%Vanguard Small Cap Growth Index(457(b) & 401(k) only)%Vanguard Small Cap Value Index (Institutional Shares)%Vanguard Prime Money Market Fund (403(b) only)INTERNATIONALBONDS%American Funds – EuroPacific Growth Fund (R6 Shares)%PIMCO Total Return Fund (Institutional Shares)%Vanguard Total International Index Fund (Class A)%Vanguard Total Bond Market Index Fund(Institutional Shares)TARGETED RETIREMENT FUNDSBALANCED%Retirement Income Fund (for those born in 1937 or before)%Fidelity Puritan Fund%Retirement 2005 Fund (designed for those born between1938-1942)LARGE CAP%Retirement 2010 Fund (designed for those born between1943-1947)%American Century Equity Growth Fund%Retirement 2015 Fund (designed for those born between1948-1952)(Institutional Shares)%Retirement 2020 Fund (designed for those born between1953-1957)%American Funds – The Growth Fund of America%Retirement 2025 Fund (designed for those born between1958-1962)(R6 Shares)%Retirement 2030 Fund (designed for those born between1963-1967)%Goldman Sachs Large Cap Value Fund%Retirement 2035 Fund (designed for those born between1968-1972)%Retirement 2040 Fund (designed for those born between1973-1977)(Institutional Class)Retirement 2045 Fund (designed for those born between1978-1982)%Parnassus Equity Income Fund (Institutional Shares) %%Retirement 2050 Fund (designed for those born between1983-1987)%Vanguard Institutional Index Fund%Retirement 2055 Fund (designed for those born in 1988 or after)%Vanguard Value Index Fund (Institutional Shares)MID CAP%T. Rowe Price Mid-Cap Value Fund%Morgan Stanley Institutional Fund Trust –Mid Cap Growth Portfolio - (Class I)%Vanguard Mid Cap Index Fund (Institutional Plus Shares)SECTION V: AuthorizationPlease be aware that due to Internal Revenue Service regulations, if you take a distribution prior to age nttheremaymaybe abe a10% penalty imposed. I acknowledge that I have received and read the fund prospectuses for the investment options I have elected above. I understandthat my direct rollover will become subject to the terms and conditions of the plan. I certify that I satisfy the requirements for making a tax-freerollover/transfer into an eligible retirement plan. Nationwide Retirement Solutions is entitled to rely fully on my certification. I expressly assumeresponsibility for tax consequences relating to this rollover/transfer, and I agree that Nationwide Retirement Solutions shall not be responsible for thosetax consequences. Upon receipt, I hereby request my funds to be invested as directed on this form.I understand that failure to complete this form accurately will result in processing delays. Some mutual funds may impose a short-term trade fee. Pleaseread the underlying prospectus carefully.Participant SignatureDateRegistered Representative NameRegisteredRepresentativeNumberRegistered Principal SignatureOriginal & Copy 1 to NRSCopy 2 - ParticipantDateDC-3679-1212PERFORATION LINEName

Folded and tucked in behind staples“Participation Agreement”and “EZ Enrollment Form”Blank PageOPF

PERORATION LINEMailing Envelopewith return mailing labelto be folded in here.Moisten and seal envelope tabPERFORATION LINEOPF

How much can you invest?You may contribute up to 17,500 to a 457(b) plan and 17,500 to either a 401(k) or 403(b) plan.In addition, you may qualify for one but not both of the Catch-up provisions outlined below.Maximumdeferral limitYEAR 2013If you’re less than age50 this year, you maydefer as much as If you’re at least age50 this year, you maydefer as much as Special 457(b) Catch-updeferral limitIf you have three yearsuntil you retire, youmay be eligible todefer as much as 457(b), Roth 457(b) plan 17,500 23,000 35,000401(k), Roth 401(k)403(b) plan4 17,500 23,000 23,000 (use Age50 Catch Up)TOTAL 35,000 46,000 58,00050 and Over Catch-upEmployees age 50 and over whocontribute the maximum deferralamount allowed each year mayalso make catch-up contributionsup to 5,500 to that plan.4Deferral limit plusAge 50 Catch-upThe UniformedService Employment &Reemployment Rights Act(USERRA)USERRA allows military personnelwho leave their employer forservice in the U.S. military tomake up the missed contributionswhen returning to their formeremployer. Please contact TeamMSRP at 800-545-4730 fordetails regarding this law.Special 457(b) Catch-upIn the three years prior to —but not including — the yearyou plan to retire, you may beable to contribute up to doublethe maximum deferral limit ineffect for each year affected.This provision assumes youhave deferred less than themaximum amount to the457(b) plan in previous years.Let Team MSRP help. Call yourPersonal Retirement Consultanttoll-free at 800-966-6355.Individuals participating in both the 401(k) and 403(b) plans, combined annual contributions to the plans may not exceed 17,500.7

The MSRP tax advantageYou are unique. That’s why MSRP offers both pretax [traditional 401(k), 457(b) and 403(b)] plans andafter-tax [Roth 457(b) and Roth 401(k)] plans to helpyou choose the most advantageous type of planfor your situation now and in the future. Whetheryou choose to pay income taxes now or later, bothkinds of plans offer these convenient features:yyIt’s easy to invest — contributions areautomatically deducted from your payyyChoose your investment amountand change it at any timeyyMoney can stay tax-deferred until payout —even after you separate from State serviceWhat’s the difference?2013 contribution limit2013 catch-up contribution limit — for those age 50 and olderContribution taxable in year contributedContribution taxable in year distributedContribution earnings taxable in year distributedTraditional (pre-tax)Roth (after-tax)457(b) or 401(k)457(b) or 401(k)Combined 17,500Combined 5,500NoYesYesNoYesNo5Is a Roth right for you?You may want to consider making Roth contributions if you:yy Believe that taxes will be raised beforeyou retire and you want to take advantageof the potential tax-free withdrawalsprovided for with a Roth account.yy Expect to be in a higher taxbracket upon retirementyy Are younger, with many workingyears ahead of youyy Are unable to contribute to a RothIRA because of your incomeyy Are looking for an estate-planningtool to leave assets tax-free to heirsNeither Nationwide nor its representatives may offer tax or legal advice. Consult with your own counsel before making any decisions aboutcontributing or converting your Plan assets to Roth.5Contribution earnings are not taxable in the year distributed assuming all contributions have been held in the Roth account for five consecutive years after the first Roth contribution is made AND thedistribution is made after age 59½; or for death, disability, first-time home purchase, or a Roth IRA.8 Maryland Teachers and State Employees Supplemental Retirement Plans

Pre-tax Plan featuresyyContributions are pre-tax — so federaltaxable income is reduced by the amountof money contributed to your planyyContributions and any earningsgrow tax-deferred until you makewithdrawals. Withdrawals are thentaxed as ordinary income.The paycheck advantage 100210 40 430 70 850 150 As shown in the example below, you get ajump start on your traditional 401(k), 403(b) or457(b) investment through payroll deductionversus investing after income taxes are taken.Here’s an example of the paycheckadvantage for a married individualgrossing 38,000 per year whoinvests in a pre-tax plan. 85Amount invested ina pre-tax plan 50Take-home pay isreduced to about 43 25 21Example assumes a tax bracket of 15% and biweekly pay periods.Take-home figures are rounded for reporting purposes.After-tax Plan featuresIn a Roth 401(k) or a Roth 457(b) account, investments occur after income taxes are taken. Additionally,any earnings accounts may receive are not subject to income tax at all. Income taxes for a Roth 401(k)account are paid up front at current tax rates instead of being subject to income taxes at retirement. 10,000 invested in a Traditional vs. a Roth for 20 years304 578 258 742 288 654 198 567 10,000 29,023Traditional 457(b) or 401(k) 8,500 32,892Roth 15% tax bracket 7,500 29,023Roth 25% tax bracket 6,500Roth 35% tax bracket 25,153Net total contributionNet distributionThese examples are hypothetical in natureand assume a 25% tax bracket at distribution.It also assumes that the retirement plan’svalue earns an average total return of 7%compounded annually. Investment return isnot guaranteed and will vary depending uponthe investments and market experience.A single contribution of 10,000 will beworth the same amount in 20 years ifthe tax bracket remains the same.However, if the future tax rate is greater, theamount distributed from the Roth account willbe greater than the post-tax amount distributedfrom the traditional 457(b) or 401(k) account.9

Pre-tax Plans comparison chartTraditional 401(k)Traditional 457(b)Deferred Compensation PlanWho’s eligible to participate?All regular and contractual State employeesWho’s eligible for the State match?403(b)Savings & Investment PlanTax-Deferred Annuity PlanState educational institution employeesAll State employees in the State Employees’ Alternate Contributory Pension PlanAre payroll deductions pre-tax?Yes (after FICA deduction)What’s the minimum I may contribute? 5 per biweekly payWhat’s the maximum I may contribute? 17,500 effective Calendar Year 2013 (may be adjusted in future years for inflation)4May I “catch-up” in a later year?May I contribute to more thanone Plan at the same time?How often may I change mycontribution amount?Age 50 or older bonus: 5,500 effectiveCalendar Year 2013. Special 457(b)Catch-up provision available within 3Age 50 or older bonus: 5,500 deferral effective Calendar Year 2013years of retirement. These two provisionsmay not be used in the same year.6 17,500 457(b) and/or Roth 457 (b) 17,500 401(k) and/or Roth 401(k) 35,000/yr6Yes – but with the6following limitations: 17,500 457(b) and/or Roth 457 (b) 17,500 403(b) 35,000/yr 17,500 457(b) and/or Roth 457 (b) combination of 403(b) & 401(k)/Roth 401(k) not to exceed 17,500 35,000/yr6UnlimitedWhat are the costs to participate?0.14% of your account value a year, no more than 2,000, and 50 cents per month per account.7Investment Contract PoolMutual FundsTargeted Retirement FundsWhat are the current investment options?May I roll over money from otherretirement accounts into my MarylandSupplemental Retirement account?8May I roll over my supplementalretirement account to another typeof retirement account, like an IRA?May I withdraw money from myaccount while employed?When may I begin withdrawals frommy account without a penalty?9May I change my withdrawal option,amount or frequency once I start payout?Must I elect my payout date whenI leave State employment?Is there a loan provision and ahardship/emergency provision?Vanguard Money MarketMutual FundsTargeted Retirement FundsYes – from a 457(b), 401(k), 403(b), thrift savings plan or IRA into your supplemental retirement accountYes – to a 457(b), 403(b), 401(k) orIR

2 Maryland Teachers and State Employees Supplemental Retirement Plans Plans with you in mind The MSRP includes three supplemental retirement plans1 — the 457(b), 401(k), 403(b) and 401(a) Match Plan. Employees may participate in more than one plan. All the plans offer you the following advantages: